By: Michael Moe, CFA, Owen Ritz, Joe Murdy, Catherine Merrick

“Weather forecast for tonight: dark.” — George Carlin

“If life were predictable it would cease to be life, and without flavor.” — Eleanor Roosevelt

“The best way to predict the future is to create it.” — Abraham Lincoln

January 1, 2024

As we close the books on 2023, the lesson we’ve relearned is the future isn’t the present extrapolated. Moreover, taking the other side of conventional wisdom is where the opportunity lies.

If we were writing this from London in 1900 which was at the time, the capital of the world, we could have easily assumed that “the Sun would never set” on the English empire and the British Pound was the “coin of the realm” for the world…forever.

When the New York Times pondered whether space travel would be possible in the future on January 13th, 1920, it wrote “That (rocket pioneer Robert) Goddard…does not know the relation of action the reaction, and the need to have something better than a vacuum against which to react — — to say that would be absurd. Of course he only seems to lack the knowledge ladled out daily in high schools. ”Nearly fifty years later, on July 17th 1969 when the Apollo 11 crew was on the way to the Moon, the New York Times printed a correction saying simply “the Times regrets the error”.

If we were writing from New York City on New Year’s 2000, we might have been surprised that the world hadn’t disintegrated, as many predicted that it would from “Y2K,” but we would have probably have felt safe from foreign enemies as “Island America” had historically been.

By January 2020, everybody wanted to be in Silicon Valley or China, because that’s where the action was and Big Tech was becoming more powerful than governments.

Wars happen, bubbles burst, terrorists attack, pandemics spread, arrogance infects etc… all of which change the course of history.

Entering the “Year of the Rabbit”, the general forecast was to batten down the hatches, get your fresh water and canned goods stored away, and stay away from the flying debris. Keeping sharp objects locked up was also advised. Most Wall Street strategists and business leaders alike warned of the upcoming recession (apparently oblivious to the recession that started 6 months before), relentless inflation and a Fed who was going to pound the economy into submission whether we liked it or not.

By January of 2023, there already had been nearly 100K tech workers in the United States let go and globally, that number had reached 150K. This seemed to make a lot of sense given the tech laden NASDAQ was down 33% in 2022 and the market always accurately forecasts the future.

War was raging in Europe and the Mad Man Putin was likely to hit the button on Kiev or even London at any moment and if that didn’t happen, the lack of access to affordable energy was going to freeze to death the cold parts of Europe.

China, the world’s second largest economy and largest population, was thought to be in disarray after being in a “Zero Covid” mode for three years but gave up the ghost after wide-scale public protest. China had gone from being widely lauded for how it had handled the pandemic to widely criticized, so after opening things up with the corresponding infection increase, the media was a little tongue tied in their reporting. Conventional wisdom was that China was “uninvestable.”

The United States continued to have a bit of an identity crisis and appeared to many as trying to commit suicide. Love her or hate her, the United States continued to be the most relevant Country on earth. Four percent of the earth’s people, but 25% of global GDP. People all around the World want to know what is going on in the U.S…and as the Border Crisis shows, people are still desperate to find a way to America which is still perceived as the “land of opportunity.”

The United States has been criticized for unequal access to basic needs such as healthcare and education but if you are sick, you want to be in America and the U.S. Higher Education System remained the envy of the world. Yes, 38 million people in the United States are in poverty, which is horrible, but none of them will die of hunger, while nearly 10 million people around the world died of hunger in 2023.

One of America’s and the West’s greatest assets was the rule of law, property rights and freedom of speech. Effectively, the U.S. has funded its trade and budget deficits by having wealthy residents in poor countries buy homes, properties and our bonds to effectively diversity assets into what was thought to be a safe haven. Actions by government actors over the past couple years has dramatically undermined the confidence in the system.

Elon Musk went from being a universal hero to a Hated by the Left zero with his Twitter rescue…but gave some hope to people seeing free speech as foundational for a great society.

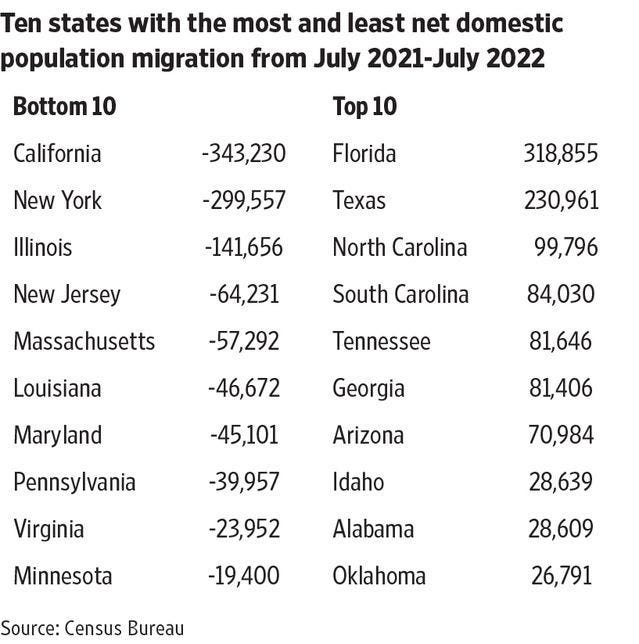

The migration away from “Blue” States to “Red” States accelerated in 2023 with a new “Mason Dixon” line created, bookended by California and New York. “Texodus” is showing network effects with the Dallas region projected to be larger than Chicago by the decades end. Miami, which had become the de-facto capital of Latin America, has a tech scene that is BOOMING.

Over three trillion with a “t” was lost in the Crypto meltdown. Every crime needs a criminal and boy was one found in the likes of Sam Bankman-Fried. Maybe it should have been a clue that something was amiss when SBF interviewed former heads of state in shorts, flip flops, and a dirty t-shirt, or when he was pitching institutional investors while playing “League of Legends”…but none-the-less, defrauding people out of billions of dollars is likely to send him to the “Greybar Hotel” for an extended stay.

The silly, speculative, and foreseeable phase of Web3/Metaverse/Crypto was officially over with the malfeasance of FTX, but the mania had melted well before the documentary.

Over 21,000 cryptocurrencies versus 180 fiat currencies in hindsight might have been a clue to the madness, or the absurd instant wealth that was created by people who here-to-fore had trouble fogging a mirror.

But, the excitement that got the frenzy going in the first place was driven by the transformative next chapter of the Internet…and it’s BIG. The Metaverse is the natural evolution of blurring your physical and digital world with two key features…community and ownership. Apple’s AR glasses changed how people see the Metaverse — literally.

Two illustrations of this in 2023 were Starbucks Odyssey and Nike .Swoosh, which are building the next generation of customer loyalty programs. In 2023, companies realized that community is their biggest customer…and a Web3 wallet is the most valuable tool for consumer engagement since the email address. Vatom and Forum3 were examples of platforms that partnered with enterprises to help them thrive in the Brave New (integrated) World.

Giving credibility to the now-mocked crypto exchanges, Nasdaq bought a crypto exchange, quickly followed by the NYSE. Additionally, Bitcoin, left for dead, was resurrected to higher levels in 2023, as did ETH.

It was expected that the world’s best and brightest engineers would take their talents from South Beach back to the South Bay… and then something funny happened…they stayed. While being at an office came back with some modifications, where those offices were had shifted permanently.

Some of the things that happened in 2023 were predictable….there was a surge in M&A activity with companies that were out of cash looking for a home, and/or products that were looking for a company. As the COO of Notion Ashkay Kothari put it, “the next big thing in 2023 will be small teams building billion dollar businesses.”

A blockbuster deal that occurred which was originally forecasted by Prof G was Disney acquiring Roblox and its 60 million daily active (young) users for $22 billion. Bob Iger made true on his promise to come out of retirement to do major deals, and Disney’s content found a new home in the Metaverse.

Microsoft’s Maestro Satya Nadella stunned everyone with his purchase of Zoom, making him an instant hero with all of us who groaned seeing a Teams link in our calendar. Effectively, this became lights out for Slack and along with a sizable investment in OpenAI, catapulted Microsoft to be the largest market cap in the World. More good news for MSFT was the $69 billion of Activision prevailed.

The Empire (tried to) Strike Back Last year and get some of its innovator mojo back. While some hedged against Google due to the threat of ChatGPT, the company returned to its roots as the world’s strongest product-led growth business, expanding YouTube Courses, launching its own AI chabot competitor, and rolling out handwriting to text for education.

While it was foreshadowed by the Biden Administration banning TikTok from government phones for security concerns, over 100 million U.S. Gen Z’ers and Millennial’s went into meltdown mode after it was outlawed. The combination of TikTok being suspected as spying for the CCP and it being “digital fentanyl” by mental health experts, were reasons given to make the unpopular ruling.

Speaking of fentanyl, in 2023 there finally was a movement to do something about the Opioid Crisis which has killed hundreds of thousands of young people in the past couple years. As is often the case, art was on the forefront of this change, with My Pet Dragon, a dangerous new musical about addiction becoming want “Rent” did for the Aids Epidemic.

The pandemic pause in student loan payments became indefinite as Biden’s Student Loan Forgiveness plan remained in legal limbo. Only 1.2% of borrowers continued paying off their loans during the pause in 2022, and that number approached 0% during 2023. The consumer has essentially forgotten about loan obligations, and the stakes became clear for both “Hire Ed” and Higher Ed.

For “Hire Ed,” it became clear that student loans were not going to resume, and employers started to view student loan debt as a tax-advantaged compensation and a benefit. Employers can pay up to $5250/year/employee without paying payroll tax and with no income tax for the employee.

When it came to Higher Ed, widespread student debt relief created a moral hazard where every student has come to expect debt forgiveness in the future. This movie has been seen before, with debt without consequences not having a happy ending.

The gigantic accelerant of the digital learning space catalyzed by Covid resulted in a “boom and bust” for leaders in the space. Shooting first and asking questions later happened in middle of 2021 as this group turned over, but the fundamental strength of the opportunity overwhelmed the haters in 2023. Leaders such as Coursera, 2U and Chegg had strong performances.

The big story that few expected in 2023 was how the re-opening of China after three years of being hermetically sealed off from the rest of the world was a catalyst for global growth. While Covid infections initially went through the roof, deaths were way below expectations and the matriculation into the global community was rapid. Chinese stocks, at a thirty year low on a valuation basis, absolutely ripped. Tencent, Alibaba, Pinduoduo, Meituan, and JD.com went from must avoid to must own.

The fundamentals of India remained strong with a rising middle class, hyper-prioritization of education and strong entrepreneurship culture all contributing to the the growth story. But the FOMO investors had from China being back on the scene saw a first half of 2023 asset re-allocation from Bangalore to Beijing.

While Big Tech and Silicon Valley continued to feel lost and unloved, innovation was alive and well in the booming Global Silicon Valley.

The Middle East’s IPO market had another record year in both proceeds and pricing activity, as it reached to $40 billion and 100 IPOs. Abu Dhabi was no longer just the “Capital of Capital” but with its twin sister Dubai, became a major hub for the entire region…..India (2.5 hour flight to Mumbai), Israel (3.5 hour flight), and Nigeria (3 hour flight to Lagos) were all part of the emerging “Falcon Economy.”

Capital is fungible, and flows to the best risk-adjusted opportunity and growth. Accordingly, other VCHIIPS continued to prosper, including Vietnam, Indonesia, the Phillippines, and Singapore.

Tesla has been a monster stock corresponding with its amazing product and huge growth. The market value had gone from $2.9B in 2011 to $1.1T in 2021 making Elon Musk the richest man in the World. TSLA stock was off 69% in 2022, so revision to the mean was a reasonable expectation. The problem with that thesis was that Tesla shares started the year still selling at a 7X higher P/E multiple then its comps.

Electric car sales are supposed to go from 1 million out of the 8 million cars sold a year to 4 million by 2030, virtually all the car companies now have competitive products to Tesla and the Tesla models have become long in the tooth. Porsche’s electric car Taycan had heads turning and its stock (WKN: PAG911, $101.69), which in January sold at approximately 3X earnings and 30% of sales, was a big winner for the year.

Not “green” environmentally but “green” economically, Formula One became a darling stock for growth investors. Becoming one of Liberty Media’s (NASDAQ: LSXMA, $39.31) projects in 2019, Formula One has become a truly global phenomenon with its race on the Las Vegas Strip creating one of the greatest shows on earth.

Investors showed an insatiable appetite for sports assets with the Washington Commanders sold to an investor group led by Jeff Bezos and Jay Z for $7 billion…this was over $2 billion more than the Denver Broncos had been sold for a year earlier for.

Most people felt FAANG would rebound after a disastrous 2022 which saw the group down -44%. While the group had a better year, they never returned to their status that they held from 2009–2021.

Bear markets provide a transition to new leaders, and 2023 was the year where those leaders started to emerge. While Tom Brady and Aaron Rodgers were the superstars in the past (and might be OK for a few more seasons), the future will be Patrick Mahomes, Josh Allen, and Jalen Hurts (and maybe Bryce Young), so we’re looking for the stock equivalents.

Disruptive companies in AI, Web3 and the Metaverse, mixed reality, and wellness went from the stars of tomorrow to the stars of today. The “starting gun” of this race was a series of hot IPOs in 2023.

By 2030, we’ll look back at 2023 as a seminal turning point for all of these technologies. While they’ve been around the corner for the past decade, we can actually see the headlights this time around.

Whereas most investors’ playbook was to be in a “risk off” mode throughout the year, Central Banks got tamer in the spring and public growth stocks started to show life again. The IPO Market had been in hibernation for over a year, but suddenly new exciting companies were anxious to provide investors the oxygen they were looking for.

Additionally, generative AI, which originally looked like a job destroyer, not only unleashed innovation in unforeseen ways but also, was a major productivity enhancement for businesses of all sorts, and reducer of cost. Essentially, every knowledge worker got a highly intelligent summer intern that can do tasks, research, and rough drafts – instantly and for free.

The net result was companies across the board accelerated growth and lowered cost, providing more juice for investors.

As we cling our glass to 2024, the road ahead will continue to have twists and turns, but that’s what makes the race so fun and rewarding.

Motivation for the New Year

A Christmas Miracle

As many of you know, we moved from Silicon Valley to Dallas a year ago. We live on Turtle Creek which is aptly named because it is full of Turtles. I’ve become obsessed by turtles and now have many turtle mementos throughout our house.

It is with that backdrop that I share my Christmas Miracle where “Cliffe” the Turtle showed up in our Koi Pond with no explainable means of getting there including how he got over the wall around our house. But what a great gift!

Market Performance

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…. EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM