EIEIO... 2026 in Review

The Russell Romps, AI Stomps, Love Trumps

GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

January 1, 2027

As has become expected, 2026 was a year of the unexpected.

Heading into January, many on the Left feared our 250 year old Republic celebrated on July 4th wouldn’t survive another year under the Trump Presidency and many on the Right predicted NYC would become a the People’s Republic of Gotham under Mayor Mamdani.

Neither occurred.

What continued was President Trump’s domination of the news thru his Truths, tariffs, transactions and transitions.

Despite conventional wisdom that America was facing headwinds, the economy ripped in 2026 fueled by $500 billion in tax cuts that were part of the “Big Beautiful Bill” and augmented by the aforementioned tariffs which: 1) started to level the global trading playing field 2) brought in hundreds of billions of dollars to the U.S. Treasury 3). Catalyzed major investment in the United States from domestic and international enterprises.

Contrary to Wall Street strategists projecting persisting inflation, the CPI for the year was 2%. This allowed the surprise new Fed Chairman Scott Bessent to lower the Fed Funds rate to 2.5% by mid-year. GDP growth came in at a roaring 4%.

Add this all up and the stock market proxied by the S & P 500 defied probabilities and to some degree valuations, advanced for the fourth year in a row. The Magnificent 7 (Nvidia, Microsoft, Alphabet, Meta, Amazon, Apple and Tesla) which represent approximately 35% of the S & P had been leading the charge during the BULL run took a bit of a breather as the Market breadth broadened. Going into the year, the Mag 7 was expected to grow their collective earnings by a healthy 20% versus expected EPS growth for the S & P 500 of 15%.

In fact, both the Mag 7 and the S & P results exceeded forecast but the forward P/E of 29X for the Mag created a bit of a ceiling. Not coincidentally, the small cap Russell 2000 was the top performing stock index in 2026 increasing more than 20% which got the double whammy benefit of high earnings growth and an expanding P/E multiple.

In kind, the IPO Market in the United States had a good year with approximately 250 Companies going public versus 202 in 2025. Key new issues included the largest IPO in history SpaceX with a Market Value exceeding $1 trillion, Stripe, Canva, Anthropic and Kraken. Notable for those in the investment World, innovative Boston based VC General Catalyst became the first venture capital firm to ever go public following it acquiring growth manager Janus Henderson.

Building on the momentum of 2025 where $4.5 trillion of mergers and acquisitions were completed globally, 2026 was a record year in M & A. The megatrend of mega mergers continued, with Warner Brothers being acquired by Paramount for $90 billion and Electronic Arts going private with Silver Lake for $55 billion as prime examples. Lower interest rates and more friendly regulatory environment contributed to the fertile landscape for deals.

Clearly, the “animal spirits” that John Maynard Keynes described were alive and well in 2026.

Since the Civil War, the Party in Power with Presidency has lost congressional seats 90% of the time. Accordingly, that historical reality coupled with bad electoral showing for Republicans in 2025 made it a “given” the Republicans were going to give up the House if not the Senate, too.

It didn’t. The strong economy, robust stock market, increased global peace along with an equally disliked opposition Party kept the Republicans controlling both the House and the Senate.

The AI Bubble that the smart guys said was about to burst never happened… as it rarely does when everybody is expecting it. Instead, the $450 billion that was invested in AI infrastructure into the “hyperscalers” accelerated the AI Revolution.

Rapidly, AI went from a cool “magic trick” to impress your friends and neighbors to a measurable return on investment for both money and time. In 2026, AI was like air, it was invisible, it was ubiquitous and you needed it to live.

OpenAI, the poster boy for the AI Revolution with insatiable appetite for capital (its raised $60 billion to date), got hit hard on two fronts.

First, the Empire Struck back with Gemini leveraging all its advantages from Android, Chrome and Search surpassing ChatGPT in DAU’s, MAU’s and mindshare. Some historians had deja vu comparing OpenAI to Netscape from the Browser War days.

Second, Elon Musk’s suit alleging OpenAI violated its fiduciary responsibility by abandoning its original mission of being open source and not for profit started to have traction.

This put the brakes on what was anticipated to be one of the hottest IPO’s of 2026 and one of the largest of all time. OpenAI’s record shattering compensation per employee of $1.5 million helped keep the “Yankees of AI” players in tact for the time being.

While most of the attention was directed at the massive investments that were made in AI LLM’s, infrastructure, chips and the energy to power it all, the return juice was in the companies that were enabled by AI or leveraging it for competitive advantage. The success of Coca Cola was made possible by electricity… similarly, AI is catalyzing completely new business models. Key areas of opportunity were in sectors such as health care, manufacturing, financial services and education.

Perhaps the biggest change in people’s daily lives was how autonomous everything became front and center. Autonomous cars have been bandied about for years but seemed more science fiction than real World. In 2026, driverless cars were everywhere. Waymo (owned by Alphabet) went from 4 million rides in 2024, and 14 million rides in 2025, to over 40 million rides last year. Tesla’s Robotaxi also finally got out of the gates and instantly seemed ubiquitous.

Speaking of which, another part of Elon’s empire, the Boring Company, was the talk of the town in Las Vegas and Nashville where autonomous Tesla’s were transporting people underground from point A to point B at a fraction of the accustomed time. Boring could burrow a tunnel at a $10 million a mile in six weeks versus something like the Big Dig in Boston which cost $2 billion a mile and took sixteen years. New projects in Dallas, Austin and Dubai couldn’t come fast enough to relieve the soul sucking gridlock in those booming hubs.

Trends forecaster Faith Popcorn coined the term “Cocooning” in 1981 to describe the social shift of people doing more and more in their home. This forty year megatrend accelerated during Covid where one’s home became their operating system for life…where you worked, where you learned, where you were entertained, etc. The autonomous home became in vogue in 2026 with AI invisibly, intelligently and intuitively having your home do what you want it to do without needing a computer science degree. Hi Solutions (disclosure, I’m Chairman and an investor) was a leader in this emerging space.

AI capabilities advanced on an exponential curve with one of the results being the technology replaced the technologist. No code software meant an Arts History major could “vibe code” their way to a technology start up. Accordingly, innovation flourished and many of the unemployed software programmers became start up entrepreneurs creating an even bigger wave of transformation. Where it used to be standard to spend 60% or more of salaries on engineers for a start up, that shifted to sales in marketing in 2026. The World’s first one person “unicorn” was created by an out of work MIT graduate.

With 25% of Americans 60 years or older, wellness and especially longevity continued to be a major theme. In the United States, $2 trillion was spent on wellness in 2026 and globally, $80 billion was spent on longevity. Wellness in all variations is expected to grow around 8% annually with longevity growing closer to 12% reaching $180 billion by 2034. Function Health, founded by longevity guru Dr. Mark Hyman, achieved a valuation above $2.5 billion in less than five years and wellness centers such as Fountain Life and Alive and Well continued to boom.

A Negatrend spotted in 2026 was people were getting worn out on wearables. Oura and Whoop which had become status symbols if not fashion glam, were in search of a now what? The answer to that, in part, came roaring with the emergence of Frequency Exchange (disclosure, I’m an investor) a.k.a. “Freak Tech” which didn’t monitor how much sleep you got but helped you get better sleep. Ditto relieving pain, allergies and even Lyme Disease. Exposure to Freak Tech on the Superhuman 2 documentary created soaring demand.

Sports continued to be a hot category for investment with private equity and sovereign funds scouring the planet to get involved. Football remained King with 85 of the 100 most watched programs being the NFL and 98 being sports overall. The Winter Olympics in Italy was a must watch with 41 year old downhill racer Lindsey Vonn becoming the oldest person ever to win a Gold Medal. Spain won the World Cup with its Superstar Lamine Yamal becoming a global favorite.

Not wishing to miss out in all the fun, the original Barbarian at the Gate KKR purchased sport focused private equity firm Arctos for $5.5 billion. Pro Athlete Community (disclosure, GSV is an investor) became the platform that current and former professional athletes got connected to opportunities.

The University of Utah rumored to having received $125 million for 35% interest in its athletic program at the end of 2025, and subsequent $500 million investment in the Big 12 by CAS (College Athletic Solutions) turned out to be the tip of the iceberg for the re-organization of college sports. The transfer portal and related NIL which brought Indiana its first National Football Championship ever changed the game where either you had to pony up to participate or get left behind. Models such as Vestible partnered with Universities to get them up front capital for a percentage of the athletic departments revenue became the rage.

The Experiential Economy thought to be enjoying a cyclical boom post Covid, turned out to be a secular trend. Overloaded with always on digital connectivity, people couldn’t get enough of live events. Super premium bolt on experiences to events such as the World Economic Forum, the Milken Conference and ASU GSV Summit were coveted.

Live Music continued to surge with new age venues such as the Sphere in Las Vegas transforming the entertainment experience. Riding the wave of live, Broadway and the West End both had record years with Titanique and Dolly battling each other for Tony’s. My Pet Dragon continued to gain critical and commercial praise as this generation’s version of Rent.

Powering the AI Revolution was an obvious investment theme with leaders such as GE Vernova and Constellation having strong tailwinds.

Fusion is a different type of energy that became THE transformative force of 2026.

Fusion is the power created by the combination of two seemingly unrelated objects. Different than a mere combination, fusion changes the equation itself… 1+1=11

The World in 2026 changed at an unprecedented pace with Artificial Intelligence putting gas on what already seemed like an out of control fire. Driverless cars, no code software, gene editing, digital twins, commercial space travel, drone warfare…all unimaginable even a decade ago.

Many experts predicted that the disruption that was taking place made humankind obsolete effectively checkmated by technology. Education, acquiring knowledge to apply against future opportunity, seemed futile as the “intelligence” of Large Language Models (LLM’s) was crossing the Singularity.

We had a different, more optimistic view of the road ahead and how perpetual learning will be at the core of a limitless future which played out in spades in 2026.

Our belief is that people are wired to work and be productive. Moreover, human potential is only capped by our lack of imagination. The North Star that will continue to drive civilization forward is the relentless search for meaning and purpose.

Artificial Intelligence won’t replace the human race, it will enhance our ability to run faster and farther. And learn at the speed of light.

Historically, we faced a reality there is a finite amount of time in a day and a week. AI manufactures time and how we apply that time dividend available to all of us will determine whether AI is a force for good or not.

Initially, the separation between what machines do exceptionally well and what only people can do creates a modern division of labor. We call this “multiplication by division” this resulted in an explosion of innovation.

The Industrial Model of schools with its batch processing was upended with students progressing (or not) based on competency, not the calendar. One size fits all education was replaced by AI enabled individualized learning.

School choice, charter schools, ESA’s, Home-School, micro-schools, continued to have overwhelming support and momentum. 75% of adults were in favor of alternative school options. The entrenched status quo said “give us more time and more money”. The good news was the American public said, “250 years is long enough, we need change today!”.

It’s not Man versus Machine….its the fusion between them that creates a positive force of change that transforms society as we know it. AI is unbeatable for complicated problems like math where humans are designed to solve complex issues like relationships.

Fusion is a potent Megatrend that revolutionizes nearly every aspect of life and is especially powerful in education.

The fusion between learning and earning. No longer are these activities siloed but merged thru apprenticeships, internships and entrepreneurship.

The fusion between learning and playing. You can’t learn if you aren’t engaged. Students today spend more time on average playing games than they do in the classroom. Through “invisible learning,” fun activities that have the benefit of acquiring knowledge and skills are fundamental to the future.

The fusion between physical and virtual learning. Lifelong learning means everybody is student and will be learning without distinction between the real world and online.

The fusion of the teacher with a robot teacher assistant or digital twin will provide an always on and personalized learning environment for students and the opportunity for teachers to be more of a coach.

The fusion of smarts and hearts will power the great enterprises of tomorrow. Along with fusion of purpose and profits….the great businesses in the future will have the ambition of a for profit and the heart of not for profit.

When the Apple iPhone was introduced not even twenty years ago, the magic was the fusion between mobile computing, the cloud, GPS and the App Store business model. This fusion resulted in catalyzing game changing start-ups such as Uber, Instagram, AirBNB and TikTok…last year alone, over $1.3 trillion of business was done over the iPhone platform.

There was an even more powerful platform that emerged on the horizon…love.

The fusion between love and education is World changing. If we love our neighbors children as we love our own, we create a society where no child is left behind. We will be living in a World where people have the education, knowledge and skills to fully participate in a future that is limitless.

This fusion is human flourishing. Here’s to an amazing 2027!

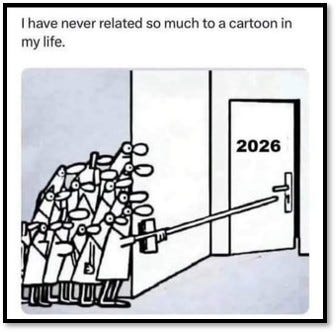

Toon for the New Year

Year-end-Review Rap

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM

From your Substack to God’s ear…I may just get a good night’s sleep enjoying 2026.