By: Michael Moe, CFA, Owen Ritz

“The future of humanity will be defined by Asia’s youth.” — Parag Khanna

“It’s not India’s decade, it’s India’s Century.” — Bob Sternfels, McKinsey CEO

“India is the one land that all men desire to see and having seen once, by even a glimpse, would not give that glimpse for all the shows of the rest of the Globe combined.” — Mark Twain

“India is a place where color is doubly bright. Pinks that scald your eyes, blues you could drown in.” — Kiran Millwood Hargrave

“India lives in several centuries at the same time.” — Arundhati Roy

The Long Arc of History

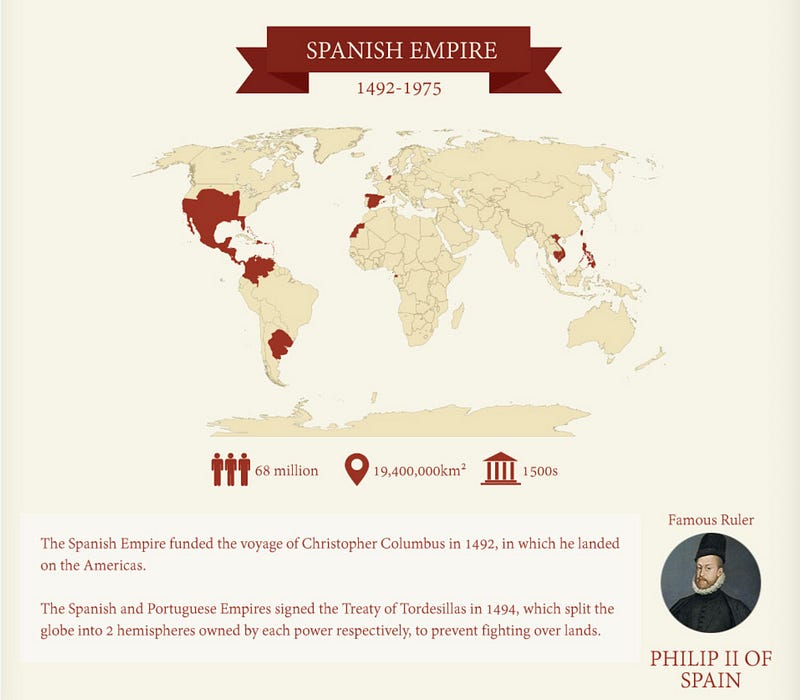

Throughout history, great nations developed based on their access physical resources or their ability to surmount physical barriers. England and Spain crossed oceans. Germany turned coal and iron into steel, and the United States exploited a wealth of agricultural and industrial resources to become the World’s breadbasket and an industrial superpower.

Jared Diamond’s Guns, Germs, and Steel famously drove this point home, arguing that Europe and its descendants dominated human society for centuries because of their geographic advantage, not a genetic one.

Diamond’s thesis was simple: areas with favorable geography were able to develop stable agricultural societies, which gave them immunity to deadly diseases and allowed them to develop powerful, organized societies and revolutionary technologies (see Appendix for more on this concept).

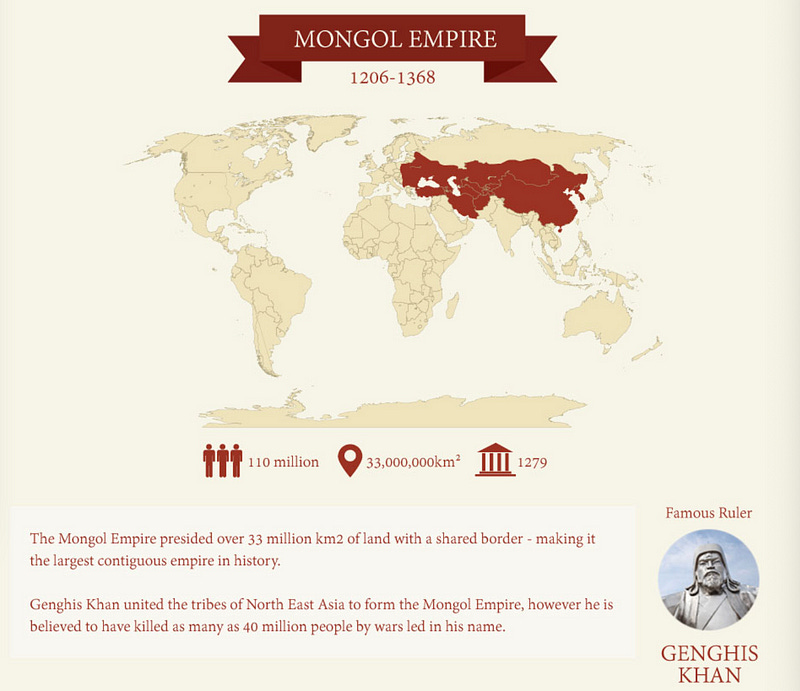

These initial advantages compounded over centuries to help form the great empires of history, from Ancient Egypt to the British Empire (see our Appendix for some data on each of these empires).

However, the advent of the PC, the Internet and digital delivery of information has transformed the World from a physically based, manufacturing economy whereas the resources were coal, oil and steel… the resources of the knowledge based economy are brain power and the ability to acquire, process and deliver information effectively.

As Larry Summers said, “If investment in factories were the most important investment in the Industrial Age, the most important investments in the Information Age are surely investments in the human brain.”

The most successful countries in a Knowledge Economy invest in the namesake of this newsletter — EIEIO. Entrepreneurship, Innovation, Education, Impact, and Opportunity are the best tools to develop the brain power that powers a Knowledge Economy… and there’s no better case study that illustrates the power of EIEIO than the rise of Singapore.

The Rise of Singapore

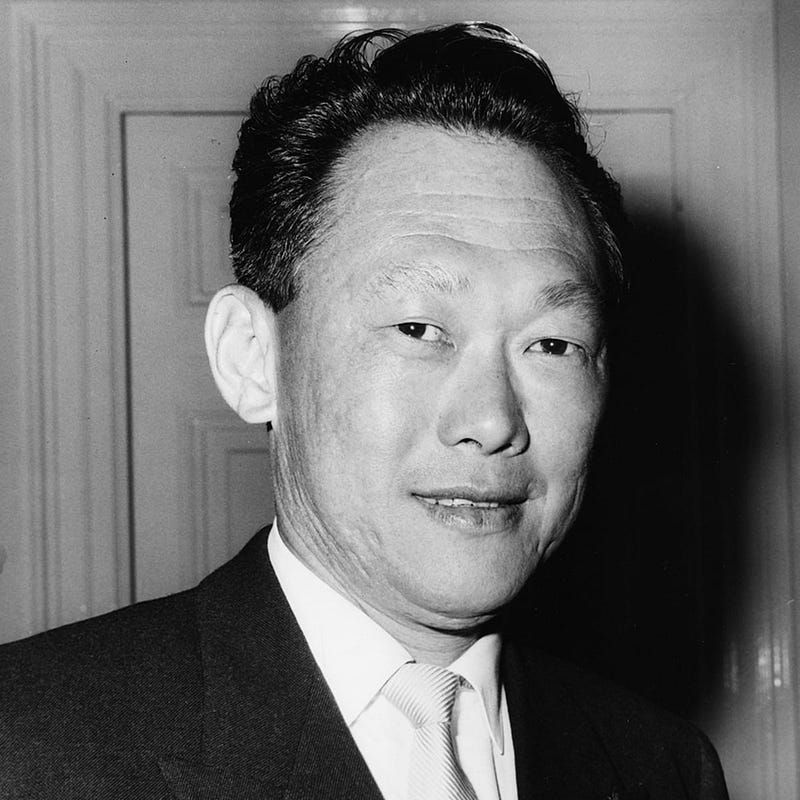

Singapore has rigorously applied common sense and creativity to a variety of economic, urban development, and social policy challenges over the past half-century. Spurred by the visionary leadership of its first Prime Minister, Lee Kuan Yew (LKY), who dreamed of creating a “City in a Garden”, Singapore has catapulted from Third World to First… planning and executing relentlessly along the way.

In many respects, Singapore shouldn’t exist at all. It has no energy deposits, forests, or farms. For many years, Singapore had to import drinking water from neighboring Malaysia. When it gained independence from British colonial rule in 1959, Singapore’s economy had limited assets beyond a deepwater port and its GDP per capita, a proxy for quality of life, was less than a quarter of the level of the United States. They were an unlikely candidate to become a global economic powerhouse. Looking back, the data on Singapore’s rise is astounding:

GDP per capita has surpassed the United States

Population has nearly quadrupled since 1960

The first country in the world to be fully covered by standalone 5G

City streets are monitored by a network of sensors, cameras and GPS devices, predicting future congestion and alerting drivers to alternate routes

Water management systems are among the world’s most advanced

“Green City” policies are becoming a model for the world; “Supertree” structures, which house a concentrated variety of plant-life, are being interspersed throughout the city to collect rainwater, act as ventilation ducts and generate solar power

Chan Heng Chee, the Former Ambassador to the United States, once remarked that “Singapore is not a natural country… For Singapore to survive, we have to be extraordinary… If we were ordinary, we would just disappear.”

Above all else, Singapore’s innovative human capital strategy has propelled the country’s transformation. This strategy has been executed across three core phases:

Phase 1 (1959–1978): Survival

At the time of independence, most of Singapore’s population of two million were illiterate and 70% of GDP derived from port and warehousing activities (Source: OECD). The government’s initial focus was on expanding basic education for all ages to enable diversification to a variety of manufacturing functions. Schools were built rapidly, teachers were recruited at scale, and the government aggressively courted foreign manufacturers to hire their emerging talent.

Phase 2 (1979–1996): Efficiency

As Singapore sought to evolve from a labor-intensive economy to a capital and skill- intensive country, including sophisticated technology development (e.g. silicon wafers, computers, etc.) they evolved their education strategy. In January 1979, Singapore moved away from its standardized approach to schooling and created multiple learning pathways for students in order produce the more technically-skilled labor force needed to achieve their new economic goals. Intent on raising the social status of skilled manufacturing jobs, in 1992 Singapore invested significantly to develop the state-of- the-art Institute for Technical Education. Facilities rivaled the best universities in the United States and Western Europe.

Phase 3 (1997-Present): Knowledge

Singapore believed that the emergence of the global Knowledge Economy required a paradigm shift in education, so their focus moved from technical skills cultivation to innovation, creativity and research. At the school level, Singapore created a new strategic plan titled, “Thinking Schools, Learning Nation.” This major milestone in Singapore’s human capital transformation epitomized Prime Minister Goh Chok Tong’s belief that “A nation’s wealth in the 21st century will depend on the capacity of its people to learn.”

Singapore’s success inspired its peers throughout the region. In 1976, LKY met Mao for the first time. LKY would go on to visit China 33 times over the following four decades.

A few years later, LKY met Deng Xiaoping, which signaled the start of a close relationship between the two statesmen.

China’s leaders embraced a “learn from Singapore” slogan as they tried to develop their own “managed democracy” and Knowledge Economy. The rise of Singapore offered China an opportunity to modernize its economy from the Silk Road to the “Silicon Road.”

Chindia

For much of World history, the two dominant geographies were what is now China and India. Connected by the Silk Road, these regions produced great empires — from the Hans to the Mughals and the Mongols — driving global commerce and culture for centuries.

Finding a faster route to the Far East inspired fortune-seekers and explorers like Marco Polo and Christopher Columbus. Opportunistic investors from the west have long been enamored with these markets. There’s a famous saying that “India conquered and dominated China culturally for 20 centuries without ever having to send a single soldier across her border.”

While most of the 20th century saw China and India in decline — China under the communist regime of Chairman Mao, India under the colonial British Empire — this has been a blip in the broader sweep of history.

Beginning around the time of the fall of the wall in Berlin, we saw Chindia roar back to life. By 1990, China had emerged as the World’s manufacturing champion. Later, India emerged as a key exporter of services, ranging from back office work, to call centers and R&D.

While China has been the lead actor, India has played the part of the understudy. China was recognized as an economic powerhouse and served as an original member of the UN Security Council. Today, China is considered the United States’ biggest geopolitical rival since the Cold War.

China went from imitator to innovator by following Singapore’s “EIEIO Playbook.” In 2022, 338 Chinese universities made the U.S. News & World Report’s World’s Best Universities list, compared to 280 American universities — the first time China outnumbered the U.S. China’s enrollment ratio in tertiary education grew from 3.4% in 1990 to 57.8% in 2021.

At the same time, the World bracketed India with Pakistan as a more complicated region and opportunity. In the 1990s, India and Pakistan both required massive assistance from the IMF and World Bank.

However, over the past 30 years, India has gone from under-the-radar understudy to the spotlight: FDI Inflows nearly tripled over the past decade.

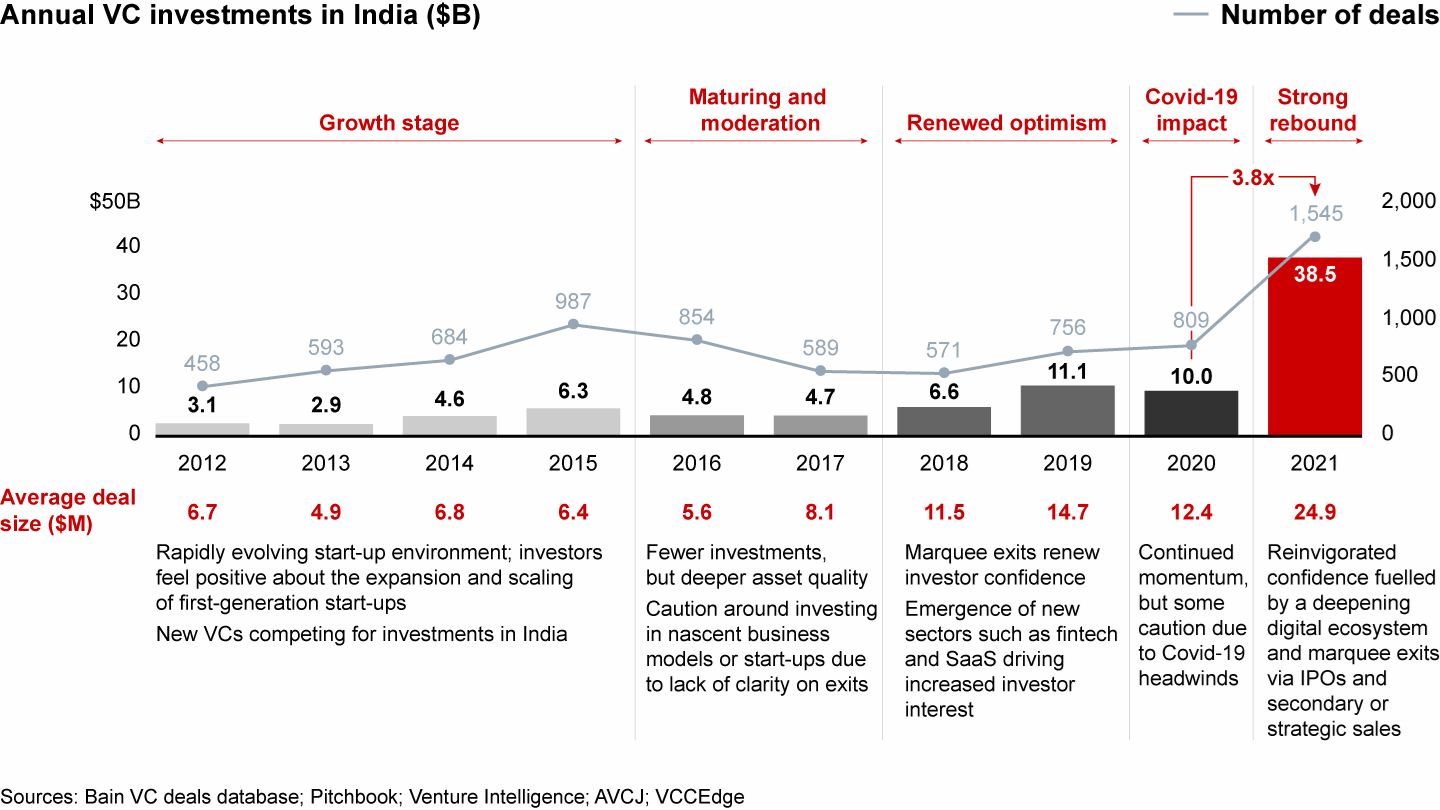

Meanwhile, annual VC investment grew from $3.1B in 2012 to $38B in 2021. Even in the bull market of 2021, VC investment grew 2x as fast in India as the rest of the world, while the number of participants in Indian markets has more than tripled since the start of 2022.

While India’s “top-line growth” is astounding, it’s worth taking a closer look at the drivers behind the country’s rise (or demise). While we refer to “India” as if it’s one place, it’s really a combination of many different countries, cultures, and languages.

As the saying goes, “India is a country divided by many local languages and united by a single foreign language.” India has 28 states, 8 union territories, 21 modern languages, and a caste system that remains entrenched, over 75 years after independence.

A few years ago, a friend explained that there are really “Three India’s” — India #1 (Europe), India #2 (Brazil), and India #3 (Sub-Saharan Africa)… as he put it, the joke is that “if someone asks for a dirty cloth to clean something, you are in India.”

Regardless of how you divide or define India, it’s crucial to understand the country’s past, present, and future. Next week, we’ll do a deep dive on all things India, but here’s a preview of what’s to come…

A Fork In The Road: Adani’s or Adonis?

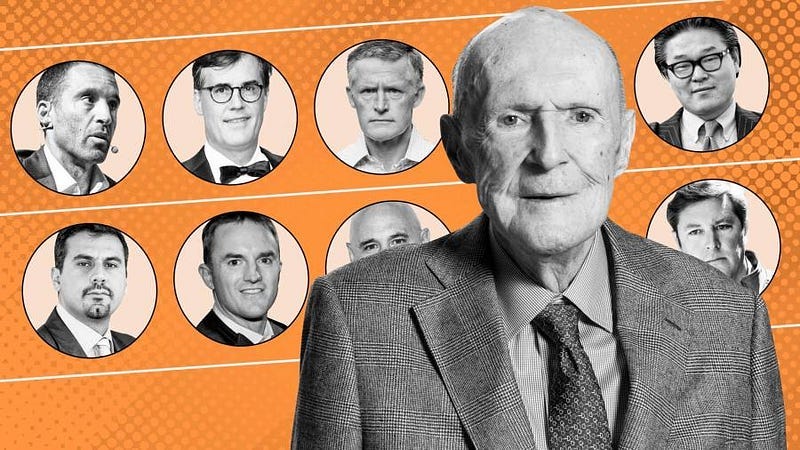

Legendary investor Julian Robertson, who died last Fall at age 90, was great at spotting a company at its inflection point. He famously had the biggest Bull and Bear go to his office and make their case. Robertson thought that vigorous debate was the best way to create high performance.

We see India at this massive infleciton point. It could be as McKinsey’s CEO Bob Sternfels predicts — that this will be “India’s Century — or it could fall far from its potential. The same exercise for India will be insightful for both innovators and investors as they seek to understand the opportunities and challenges of India…India is a country where everyone is in a hurry, but no one is ever on time.

The Bear case starts with one name that should be familiar after this week: Adani. This past week, Gautam Adani’s Adani Group was hit with a scathing short report by Hindenburg Research. Until this week, Adani was the richest man in Asia and the 3rd richest man in the World; over a 48 hour span this week, his collection of companies lost $51 Billion.

What’s the big deal? From January to August last year, 80% of the increase in India’s stock market capitalization came from the Adani conglomerate, while Gautam Adani added $40 billion to his net worth.

Adani’s rise has been in lockstep with Prime Minister Modi, earning him the nickname “Modi’s Rockefeller.” For example, during COVID, the Adani Group became India’s 2nd largest airport operator out of nowhere.

As Edwin Dorsey shares, Hindenburg alleged that dubious offshore funds tied to the Adani Group are the largest non-management shareholders of the Adani companies. For example, Adani Transmission Limited is 74.19% owned by its management group, right below the 75% limit imposed by Indian regulators. Hindenburg also found that at least 10% of the company’s stock is also held by “suspect holders” that may be funded by the Adani Group.

This leaves an increasingly small public float that can be manipulated to inflate the Adani Group’s value. Hindenburg wrote that the Adani Group companies “have 85% downside purely on a fundamental basis owing to sky-high valuations” largely due to huge share price increases over the last few years.

While we’ll continue to watch how the Adani vs. Hindenburg battle play out, one thing is for sure. Wealth and power are much more concentrated than most people understand, and not all “democracies” are created equal.

While many investors assumed India would be a home run for emerging markets, a big concern is whether India’s corporate governance is like a Western democracy or more like Russia. Obviously, it would be problematic if Prime Minster Modi and Adani’s relationship turned out to be more like Putin and his pals. An interesting fact is that India has bought 33x more oil from Russia than this time last year.

If the Adani case is a one-off case of corporate negligence, then everything might be OK. If not, there are lots of larger questions that the world needs to understand (and answer) a lot of questions before going “All In on India.”

The Bull case sees the glass half full with all its potential energy and youth. As the saying goes, “In India, success is relative. More success, more relatives.” This is India the Adonis: a handsome youth destined for greatness. India’s future is powered by massive demographic tailwinds, growing startup ecosystem, and emphasis on education — Singapore 2.0 at the scale of 1.4 billion people.

The median age is 28, a decade younger than China. India is home to 1/5th of Gen Z and 20% of the world’s working inhabitants by 2047. India produces 1.5 million engineers annually, while 80% of households will be middle income by 2030. There’s a truism that “India is a country where people first become engineers, and then figure out what they want to become.”

We’ve heard this story before…and it transformed China from one of the poorest countries in the world to the US’s greatest geopolitical threat. India’s at an inflection point. It has the opportunity to be the future…or a false hope. Next week, we’ll share which direction we think it will take and why.

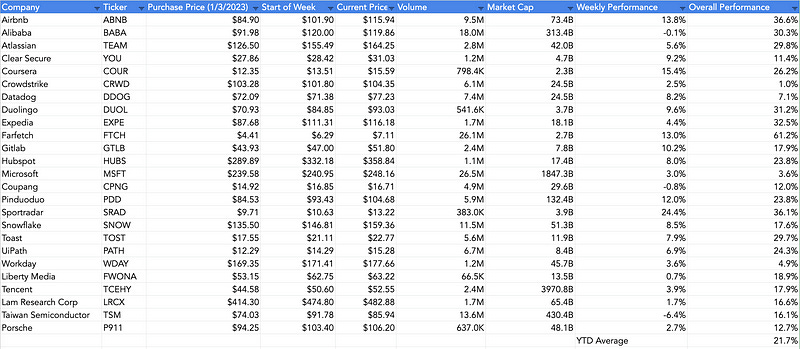

Market Performance

In a plot twist not suspected by many going into the year, growth stocks continued to rip last week with NASDAQ advancing 4.3%, followed by the S&P 500 rising 2.5% and the Dow up 1.8%. YTD, the NASDAQ is over 11%.

What’s changed is inflation has come down for six months in a row and it appears the Fed might lighten up on the gas for raising interest rates…expectations are now for the Fed to increase just 25 bips versus the 75 bips previously.

On individual stocks, Microsoft beat the quarterly estimates but warned about a future slowdown, Tesla missed numbers but said its future demand was strong. Intel missed significantly which was only surprise if you haven’t been paying attention to PC sales recently.

In another surprise confounding conventional wisdom, China has roared back with Chinese stocks up 50% in the past three months.

EIEIO…Broken China?

Zigging while others are zagging.medium.com

Even with the recent rise, the MSCI sells at only 12X this years projected earnings while growth is expected to be 14%. Contrast this with the S & P 500 at a 18x P/E and 4% earnings growth and it appears opportunities remain West of LA and East of London.

China's Comeback Is Getting Started. How to Play It.

Talk about a comeback. As China abandons policies that stifled economic growth for three years, its stocks have staged…www.barrons.com

We remain constructive on the Market and in particular, high growth businesses. We believe a slow growth environment with inflation being contained bodes well for companies that are growing fast and are selling at materially discounted prices. Our GSV Growth Portfolio is up 21.7% YTD.

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed this past week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: Yardeni

#2: IPO Market

One quiet but mighty IPO this week was QuantaSing (NASDAQ: QSG), which raised $40 million. QuantaSing is China’s largest online service provider for personal interest courses for adults. QuantaSing has 75M registered users, $403M revenue growing 68% last year, and an 88% gross margin.

Source: Renaissance Capital

#3: Interest Rates

The Fed will meet this coming week, with expectations that rate hikes will slow. If so, it’s another good sign for market performance this coming year.

Source: Edward Jones

#4: Inflation

This week, Stanley Druckenmiller shared this week that “betting on a soft landing is a real long shot…what history says is that once inflation goes above 5%, it has never come back down without the Fed Funds Rate exceeding the CPI.” We’ll see if that’s the case this time around…

Charts of the Week

Articles of the Week

TikTok is a New Type of Superweapon

For thousands of years, humans sought to subjugate their enemies by inflicting pain, misery, and terror. They did this…gurwinder.substack.com

“The first indication that the Chinese Communist Party is aware of TikTok’s malign influence on kids is that it’s forbidden access of the app to Chinese kids. The American tech ethicist Tristan Harris pointed out that the Chinese version of TikTok, Douyin, is a “spinach” version where kids don’t see twerkers and toilet-lickers but science experiments and educational videos. Furthermore, Douyin is only accessible to kids for 40 minutes per day, and it cannot be accessed between 10pm and 6am.

Has the CCP enforced such rules to protect its people from what it intends to inflict on the West? When one examines the philosophical doctrines behind the rules, it becomes clear that the CCP doesn’t just believe that apps like TikTok make people stupid, but that they destroy civilizations.”

ChatGPT: Everything you need to know

ChatGPT is free for now, but investors are convinced the technology will become the basis of many new companies and…link.wired.com

“In November, artificial intelligence startup OpenAI launched a chatbot named ChatGPT. The future of education, the internet, and the tech industry have felt somewhat uncertain since.”

Legendary Investor Bill Gurley on Investing Rules, Finding Outliers, Insights from Jeff Bezos and…

"The minute you set a very hard rule, you might be setting yourself up for a mistake. And venture, I have found, is a…tim.blog

“It’s very easy to get into a trap in venture where getting no right feels like a win. And it’s just not that, I mean obviously you can’t do every deal, you can’t do every investment, you go broke. But getting overly jazzed about correctly identifying a negative or a no, it’s just not that big a deal. It’s not the job. The job is to find the outliers.”

Opinion | One of the Strangest Friendships in Washington

Send any friend a story As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share…www.nytimes.com

Great article on our friend and advisor Anurima Bhargava….just because you don’t agree on everything doesn’t mean you can’t agree on important things…and be friends.

Chuckle of the Week

EIEIO…Fast Facts

Entrepreneurship: 1.7 million — new business applications in the US in 2022, up 28% from pre-pandemic levels (Source)

Innovation: 12,000 — articles written about Generative AI, up from 152 in June (Source)

Education: 70% — percent of people that have career regret (Source)

Impact: 6.3% — decrease in San Fransisco’s population from 2019 – 2021, a decline larger than any two-year period in Detroit’s history (Source)

Opportunity: 37% — percent of the world that has never been online (Source)

Appendix

Connecting the Dots & EIEIO

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…. EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM