GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: 95% – The claimed accuracy rate of Crunchbase's AI system in predicting startup fundraising events through backtesting. (VentureBeat)

Innovation: 4% – The percentage of SaaS companies that reach $1 million in revenue. .04% make it to $10 million. (VentureBeat)

Education: 90% – The percentage of schools that reported having “major difficulties” transporting students in 2024. (Harper’s)

Impact: 7.1 million – The number of kids and adolescents in the U.S. received an ADHD diagnosis in 2022, one million more than in 2016. (NPR)

Opportunity: 20 years – The amount of time it will take Boston to build “West Station” on the MBTA Commuter Rail Framingham/Worcester Line. It took six years to build the Transcontinental Railroad from Omaha to Sacramento. (Crémieux)

“Some men see things as they are and say why. I see things that never were and say why not.” – George Bernard Shaw

”How come you never see a headline like ‘psychic wins lottery’?” – Jay Leno

“Thinking is the hardest work there is, which is probably the reason why so few people engage in it.” – Henry Ford

It was Thanksgiving evening after another amazing dinner at the Smith family home. The highlight of the meal was always Granny Smith’s ham which as one of the traditions, always had the end cut off.

After a few post dinner libations, one of the grandkids home from college started to ask why it was that the end of the ham was always cut off. Nobody around the table knew, or even had a thesis.

So finally, they got Granny Smith out of the kitchen and asked her, what was the secret behind cutting off the end of the ham?

She said, “When I first got married to your Grandpa, we couldn’t fit the full ham in the oven so we cut the end off.”

Traditions often start with a purpose that made sense at the time. Same with societal conventions and programs.

When I was a kid, I used to drive my family crazy because I always asked, “How come?”

How come I have to go to bed? How come I have to eat my broccoli? How come I can’t go to your office? How come I can’t play with the older kids? How come I have to go to school?

When Horace Mann, the newly appointed Secretary of Education for Massachusetts, introduced universal K-12 education in 1837, 80% of the population was engaged in farming. Not a coincidence, the school year was created around the agrarian calendar and the school model resembled a factory which had revolutionized manufacturing.

Over the past nearly 200 years, not only has farming become less than 2% of workers but the economy has shifted to a service and knowledge economy. Moreover, the “modern” school system was created before we had telephones, automobiles, planes, computers, software, the Internet, the Cloud, and AI…just to name a few of the transformative changes that impacted basically everything.

The number of college students globally has gone from a grand total of 500,000 in 1900 to 250 million today, reflecting the traditional ROI that students have received from a higher education degree. With college cost soaring and the future of work being upended by AI and shifts in the economy, society has shifted from saying “College for all!” to “College at all?”

In other words, how come I have to go to college?

It’s not a function that people can be ignorant and thrive in life but it’s the definition of being educated that is changing.

It used to be that being educated meant that you had a certain amount of formal education, the more the better, which also directly correlated with income. Moreover, the brand equity of ones degree also made a material difference in opportunities that a person was able to get access to. The admissions director at Harvard was the de facto hiring director at Google.

We are now at a time and place where the historic definition and conventions around education need to be reexamined to meet the reality of tomorrow.

Being educated isn’t about the artifact provided upon completion of a program—a.k.a. “a degree”—but the knowledge, skills, capabilities, and/or know-how a person has that can be applied against an opportunity. Some of that “currency” may be gained from formal school programs, but a lot of one’s “knowledge currencies” in their bank account will come from a variety of other places. And AI is going to be a major enabler.

Human capabilities have been growing at a linear rate for centuries and technology is on an exponential curve. Artificial intelligence is going to help human intelligence be accelerated and knowledge, skills and capabilities will grow in ways that, heretofore, were unimaginable.

We truly are going to be learning at the speed of light.

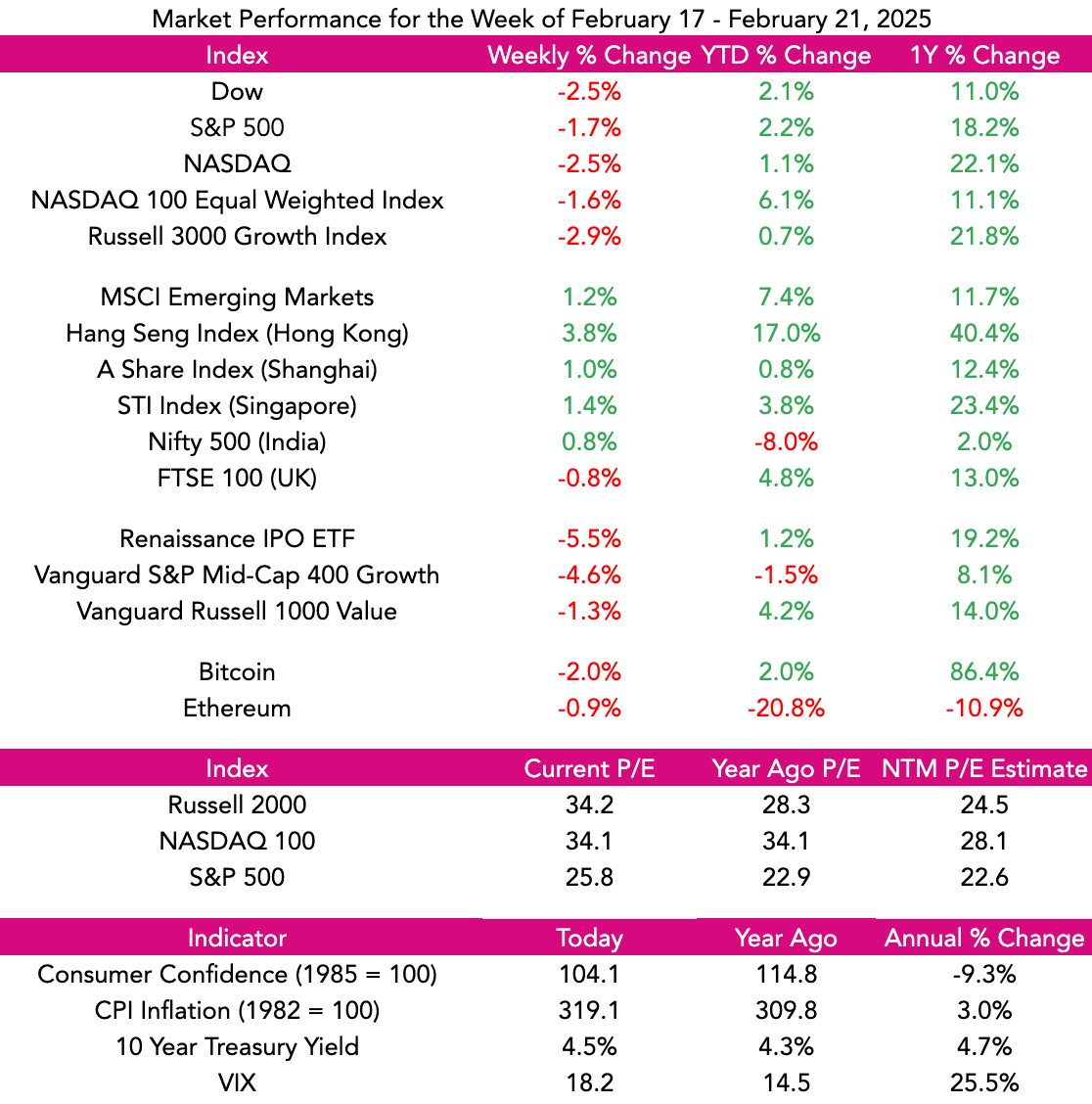

Market Performance

Market Commentary

A slower economic outlook and inflation fears put the brakes on the market last week.

While the S&P hit all time highs on Wednesday, it ended Friday, being off 1.7% for the week, with NASDAQ and the Dow both falling 2.5%.

The so called “Magnificent 7” have lagged this year, not unexpectedly do to their overall extended valuations, but high growth, high multiple stocks were hit last week as well. Palantir was down 15%, Cava fell 18%, and Reddit slid 15% after being off 12% the week before.

Berkshire Hathaway, led by 94 year old Warren Buffett, reported operating income up a stunning 71% to $14.3 billion. Berkshire Hathaway also reported it had $374 billion of cash at its disposal.

In an interesting twist, China’s President Xi Jinping held a meeting with leading tech entrepreneurs in Beijing including formerly exiled Jack Ma and the DeepSeek crew. China stocks are acting very positively and additionally, the MSCI index is up 5% YTD.

This week NVIDIA, Snowflake, and Salesforce will report earnings. DOGE will continue to make news with findings of misused taxpayer money which we believe is positive for the fundamentals of the overall economy.

We remain BULLISH for the intermediate term outlook for growth stocks but also are also believe it’s healthy to see a bit of a pause in the highest flyers. Our thesis for a broadening of participation in stocks moving upward coupled with anticipated robust IPO Market keeps us optimistic for opportunities.

Need to Know

WATCH: ACQ2: Building Web Apps with Just English and AI (with Vercel CEO Guillermo Rauch) | Acquired

READ: 0-$5M: How to Nail Founder-Led Sales | First Round Review

LISTEN: Microsoft Unveils First Quantum Computing Chip | Bloomberg Technology

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

#3: Interest Rates

#4: Inflation

Chart of the Week

Maggie Moe’s GSV Weekly Rap

Chuckles of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM