“Teach your children well…and feed them on your dreams…Don’t ever ask them why. If they told you, you would cry. So just look at them and sigh and know they love you.” — Graham Nash

“Intellectual growth should commence at birth and only cease at death.” — Albert Einstein

“All of the sudden, we’ve lost a lot of control. We can’t turn off our Internet; we can’t turn off our smartphones; we can’t turn off our computers. You used to ask smart person a question. Now, who do you ask? It starts with G-O, and it’s not God…” — Steve Wozniak

Turning Tiny Tykes to Titans

I’m very baby focused these days as my youngest daughter Caroline just had her first child Raegan in October. (yes, that makes me a grandfather!).😳

With all the turmoil in the world, it gives pause to reflect on what this gorgeous little girl is going to be facing in her lifetime. While it’s easy to be pessimistic, I’m hopeful it’s going to be the most exciting and progressive hundred years of human history, just as the last hundred years were.

This week on Tuesday, it’s projected that a baby will be born somewhere on Planet Earth that brings the population to 8 billion people. Notably, the global population reached 7 billion people just eleven years ago. When I was born, in 1962, there was 3 billion people, and the United States had a population of 180 million versus roughly 335 million today.

The combination of people living longer and 140 million new babies coming on line every year creates an expectation that there will be 11 billion people in the World by 2100. Climate change, nuclear war, society killing itself thru drugs, etc. could all change the demographic destiny but as things look today, it’s likely that there will be over 5X as many people living on Earth at the turn of the next century as there was at the beginning of the previous century.

A tremendous change occurred with the Industrial Revolution whereas, it had taken all of human history up to the year 1800 for the World population to reach 1 billion, the second billion was achieved in only 130 years (1930) and the third billion 30 years (1960).

Five hundred years ago, you lived, worked, and died within five miles of where you were born. Your parents past was essentially your future. If your father was a farmer, you were a farmer. If your mother was royalty, you were royalty.

One of the great ideas that the United States brought was that of “the American Dream.” First articulated by James Truslow Adams in 1931, it was a carry forward from the Declaration of Independence, that stated that all men were created equal and had the right to “life, liberty and the pursuit of happiness”.

The American Dream was that “life should be better and richer and fuller for everyone with opportunity for each according to ability or achievement,” regardless of social class or circumstances at birth.

The American Dream was such a powerful concept that people from around the world came to the United States to have purposeful and better life. It didn’t matter if you were born rich or poor or who your parents were: if you hustled, worked hard, and kept your nose to the grindstone, the sky was the limit.

As we moved from an Industrial Economy to a Knowledge Economy, where your future in a large part was determined by the education you had, access to quality learning was a major obstacle to the American Dream.

In 2000, four states in America had over 50% of the households with school age children below the poverty level. It’s stunning that in the world’s most prosperous country, there would be any states where over 50% of the households were poor.

By 2022, it has grown to 21 states.

If you are born into a poor family, studies have shown that you will have a 30 million word gap by the age of 4 compared to a child that is born into a professional family.

52% of poor children enter kindergarten unprepared. If you start from behind, it’s hard to catch up.

In fact, poor children are 5X more likely to drop out of school and 8X more likely to go to prison. In fact, 80% of the prison population is made up of high school dropouts. (We need to make prisons prep schools but that’s for an EIEIO another day).

When you look at the SAT test, the gateway to access the most competitive colleges, there is a direct correlation between a family’s household income and their child’s test score. So what the SAT does the best job of predicting is how wealthy your family is.

Studying enrollment of the most competitive schools, 75% of the students come from the top quartile household incomes. If you come from a bottom quartile family income household, you have only a 15% chance of graduating from any university. (The semi-good news is that’s up from 8% ten years ago.).

Add it all up, and if you are born poor today, you have a 70% chance of remaining poor. The concept of the American Dream in America has been shattered.

Effectively, we’ve gone back five hundred years, which means that your future is determined by how well you selected your parents.

There are many, many issues that contribute to creating inequality in society but access to quality education from birth to the return to earth is foundational.

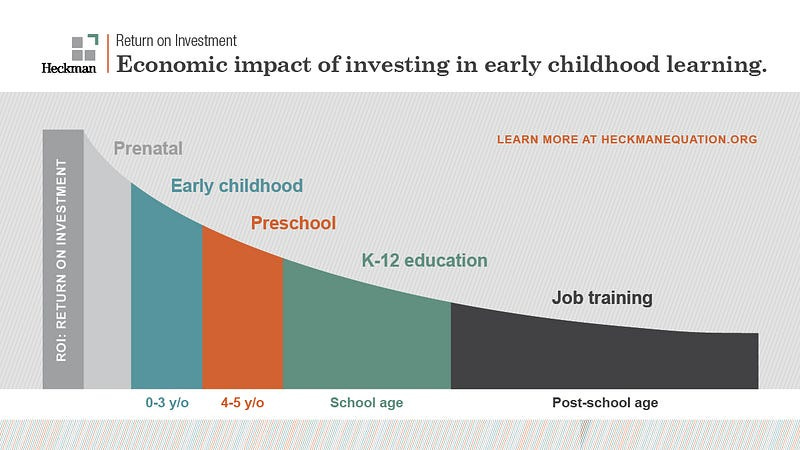

What we know from Nobel Laureate Economist James Heckman out of the University of Chicago is that $1 invested in early childhood education produces a $7 return in economic gain. Moreover, while investment in education produces a compelling return at all stages, the earlier you invest in education, the higher the return.

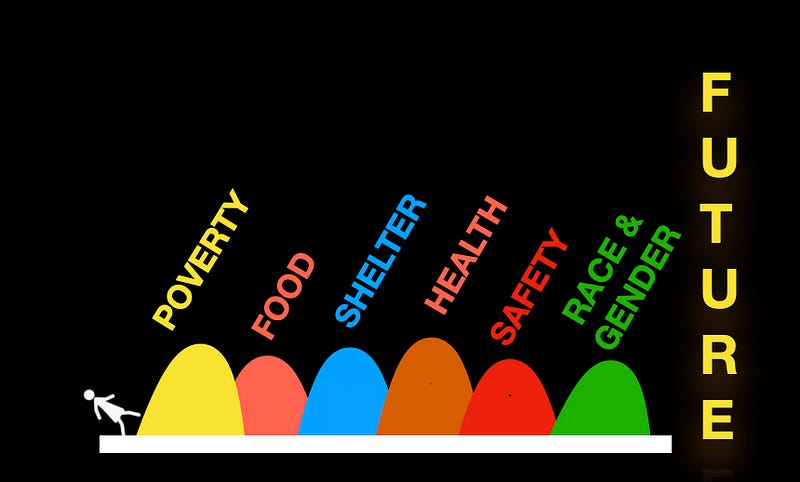

While it’s obvious and common sense that finding ways to give all children access to quality education is imperative, the problem is complex. It’s a bit of a whack-o-mole that you nail one issue and two more pop up.

We look at the impediments that prevent us from achieving our goal of giving everybody an equal opportunity to participate in the future, and as we’ve pointed out, poverty is a big one, but geography, access to technology, family structure, gender, and race, all create friction to our objective. The United Nations listed its 17 problems to solve for a more sustainable planet, and many of them get back to early child education.

Despite the compelling needs for quality early childhood education, the U.S. spends less than most Western countries and from an individual standpoint, we pay child care workers less on average than we pay pet care workers.

Problems create investment opportunities, with venture investment in Pre-K companies growing from $170 million in 2017 to $814 million last year. That’s the good news. The bad news is that’s only 4% of the overall VC investment in education in 2021 despite the clear needs and data that shows that the earlier the investment, the higher the return for society.

Some of the structural changes that have taken place in society that need to be taken into account is the combination of women in college and dual income families. Today, approximately 60% of college students in the U.S. are female… accordingly, in a Knowledge Economy, it’s pretty clear who will be running the future. Dual income families have gone from 49% in 1970 to 66% currently.

“Education as a Benefit” is a theme that GSV has focused on for some time, as employers looking to obtain, train, and retain key employees increasingly are adding education a core benefit. As a family benefit to employees with small children, Bright Horizons has created a fantastic offering now with 1,350 employers around the world and has earned a $4.4B market cap.

Alternative models for delivering high quality and lower cost childcare and pre-school include companies such as Wonderschool, WeeCare and Otter.

One of the tricks, of course, for young children to learn is how to keep them engaged. “Hollywood meets Harvard” is another theme we’re focusing on which has huge opportunity for Pre-K learning. You can’t learn if you aren’t paying attention and Hollywood does a great job of creating engagement thru storytelling, music and characters. Sesame Street, which is celebrating its 50th anniversary, is an amazing example of creating a fun but highly efficacious learning platform.

New “Hollywood Meets Harvard” Pre-K companies include Lovevery which offers high-end, Montessori-inspired toy subscription boxes. We mentioned Dreamscape Learn in a previous EIEIO but we think VR in general, and Dreamscape Learn in particular, have tremendous potential for accelerating learning for young people.

A sister concept to Hollywood Meets Harvard is “Invisible Learning,” which is learning things while doing something that you are doing because you enjoy it. Games are a great example of that with Legos being the original baby bootcamp for engineers. Roblox and ClassDojo are helping kids learn by creating and playing games in the Metaverse. A stunning fact, kids under 13 spend more time on Roblox than YouTube, Netflix, and Facebook….combined.

“Robo-Ed” is the GSV theme which incorporates Artificial Intelligence to have a personalized learning experience. If you have had a chance to watch a very young child interact with technology, it’s natural, intuitive and game changing. Miko and Moxie are two interesting examples of the Robo-Ed theme that have shown material impact.

It might seem overwhelming, if not impossible on how we can help all people get the education they need to participate in the future and especially in Pre-K. As the late, great philosopher and boxer Muhammad Ali said “impossible is just an opinion.” Moreover, there is a Silver Bullet to how we make this happen. If we love our neighbors as ourselves…and our own children…we will find a way to help all children have the future they deserve.

Market Performance

Catalyzed by inflation that was “only” 7.7% year over year, stocks ripped last week with NASDAQ advancing 8.1%, the Dow up 4.1% and the S & P 500 lifting 5.9%. NASDAQ is still off 27.6% for the year.

Earnings, both now and projected future, weren’t the reason for stocks going up. With 90% of the S & P having reported 3Q numbers, the average EPS “beat” was just 3% and the aggregate growth y-o-y was 2%. Moreover, over the past six months, 2023 projections have come down 15% and Goldman Sachs last week projected that 2023 earnings overall will be flat. All this comes with a forward P/E on the S & P 500 of 16.4X which is still above the historical average of 15X.

The big news last week, of course, was the collapse of the second largest crypto exchange FTX. It looks when all is recovered from the ashes, it will be a case study for the ages. Not a coincidence, Ethereum and Bitcoin were both down nearly 20% last week and off approximately 65% for the year. Fortune might not favor the brave this time.

In my favorite news for the week, Zoom announced that it will be integrated into Tesla so soon I won’t have to be doing the homebrew version of holding my phone up while I’m driving.

Hot or Not

GSV’s Four I’s of Investor Sentiment

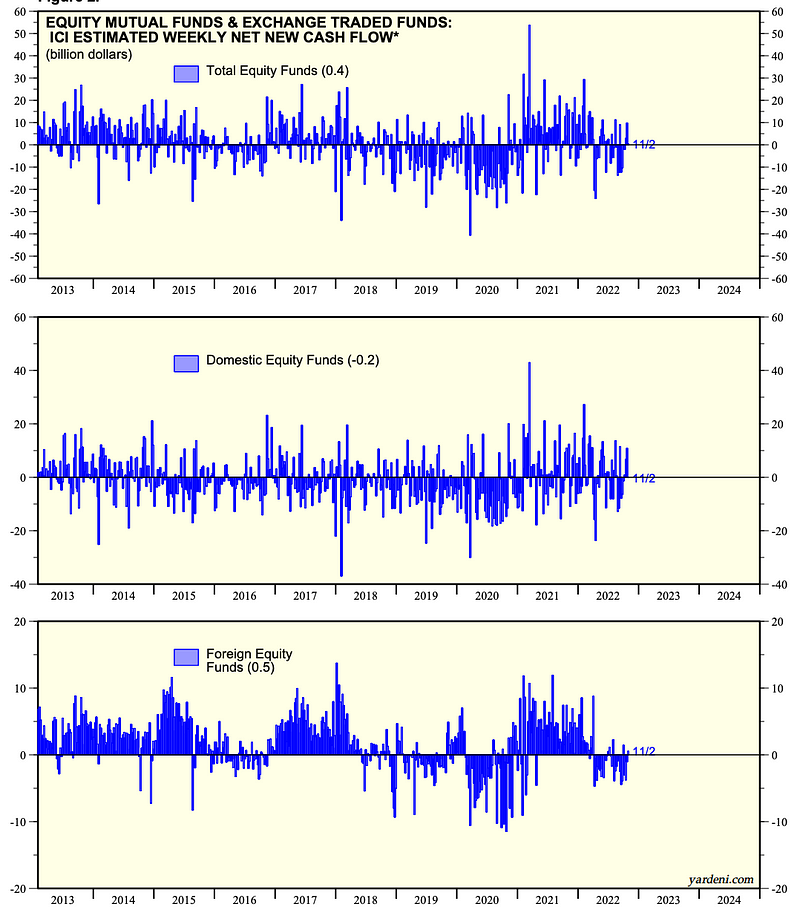

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed this past week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Total Equity Funds went from (9.9) to (0.4) from 10/26 to 11/2. Investors were spooked after Chair Powell’s comments last week that tougher times could still be ahead.

#2: IPO Market

The IPO market remains quiet, but one recent bright spot is Mobileye. The company raised almost $900M, is up 11%, and is trading at 14.7 x P/S while growing 35%. We’re hoping that more exceptional growth companies will come out of hibernation soon.

#3: Interest Rates

The Fed delivered another 75-basis-point rate hike at its meeting last week. Chair Powell said that the Fed “may move to higher levels than we thought” on raising rates, causing widespread worry that rate hikes are not ending anytime soon.

#4: Inflation

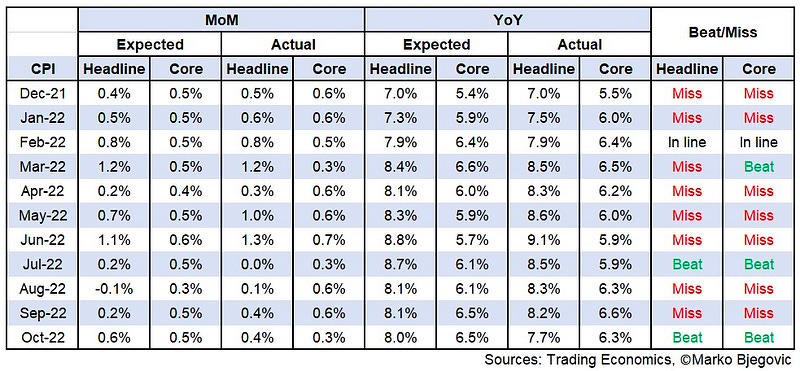

The CPI came in lower than expected — this is only the 2nd beat on the headline and the 3rd beat on the core CPI this year. While this surprise is exciting, we agree with Larry Summers in cautioning against making judgements against a single number.

Chuckles of the Week

Chart of the Week

California, Massachusetts, and New York are still the “big three,” but is the Sunbelt becoming the next Silicon Valley? It’s starting to look that way…

Videos of the Week

https://www.youtube.com/watch?app=desktop&v=uymLJoKFlW8

https://www.youtube.com/watch?app=desktop&v=BH5-rSxilxo

Too Soon?

The GSV Big 10

This fall, we launched The GSV Big 10, synthesizing the news to bring you the top 10 stories and insights in learning and skilling. In case you missed it, here are some of this week’s top stories:

#1 Visualized: The Top Feeder Schools into Silicon Valley

If Silicon Valley is the big leagues for tech talent, then Carnegie Mellon is “Tech’s Dominican Republic.” Funny enough, no Ivy League schools made the top 10 (and Stanford snuck in at #10).

#2 Why School Board Seats May Be the Hottest Races on Your Midterm Ballot

The midterms determine more than who serves in Congress, they also decide who controls the classroom. Tuesday was a mixed bag for school boards, but it’s no longer a one-horse race. Finally, Florida and Governor DeSantis figured out that a small number of people have tremendous influence.

#3 California’s largest teachers union has more on its mind than education

To make it painfully clear (once again), the teachers union is about helping adults, not helping students. Key issues for Tuesday’s election for the 310,000-member California Teachers Association included abortion rights and vape juice. Whether you’re for it or not, they’re clearly not about reading, writing, and arithmetic.

… for more insights on the news, subscribe to N2K and The Big 10.

EIEIO: FAST FACTS

Entrepreneurship…

94% — loss in Sam Bankman-Fried’s net worth on Tuesday, November 8… the biggest single-day drop in a billionaire’s fortune compared to their total net worth (Source)

$2 billion — amount of venture investment in FTX, most recently at a $32 billion valuation (Source)

0 — amount of outside board directors at FTX (Source)

$19 billion — amount of investment made by Tiger Global Management in private tech companies in the past 19 months (Source)

45% — amount of surveyed eBay sellers that identify as “accidental entrepreneurs” (Source)

Innovation…

52 — amount of web3 companies funded by a16z made from July 2021 — June 2022 (Source)

2 — amount of web3 companies funded by Benchmark since 2018 (Source)

12 — amount of Twitter employees in India, down from 200 last week (Source)

$24 billion — Shein’s projected revenue for 2022 (Source)

$22 billion — 2021 combined revenue for Calvin Klein, Tommy Hilfiger, Ralph Lauren, Abercrombie & Fitch, and American Eagle (Source)

Education…

8.7% — percentage of eligible voters that participated in the local school board election in Los Angeles County in 2019 (Source)

130 — number of times Tucker Carlson mentioned “Critical Race Theory” between May 2020 and November 2021 (Source)

26 — number of times Tucker Carlson has mentioned “Critical Race Theory” in 2022 (Source)

75% — percentage of college graduates who vote during presidential elections (Source)

52% — percentage of high school graduates who vote during presidential elections (Source)

Impact…

14.5% — amount of anthropogenic greenhouse gas emissions generated by livestock (Source)

3.5% — amount of anthropogenic greenhouse gas emissions generated by aviation (Source)

3% — improvement on the United Nations’ Sustainable Development Goals since 2014 (Source)

30.1% — median FY 2021 return for higher education endowments (Source)

-10.2% — median FY 2022 return for higher education endowments (Source)

Opportunity…

1.6 years — average skill development in a one-year academic cycle at LEAD School (Source)

23% — percentage of Congress members over 70 in 2022 (Source)

8% — percentage of Congress members over 70 in 2002 (Source)

1,356 — amount of Carnegie Mellon alumni employed as engineers in Silicon Valley (Source)

661 — amount of Stanford alumni employed as engineers in Silicon Valley (Source)