By: Michael Moe, CFA, Owen Ritz

“The optimist sees the opportunity in every difficulty.” — Winston Churchill

“Victory comes from finding opportunities in problems.” — Sun Tzu

“Bad news is an investor’s best friend.” — Warren Buffett

“As Oil was to the Industrial Economy, Education is for the Knowledge Economy” — MM

As we shared last week in Fork In The Road, we see India at a massive inflection point. The next decade could be the start of “India’s Century” as McKinsey’s CEO Bob Sternfels predicted. That said, India wouldn’t be the first country on the verge of stardom, but instead step in it.

On one hand, there are success stories such as Singapore. But modern history is also full of countries who failed to live up to their potential, despite their best efforts to invest in EIEIO.

For example, there was the “United Arab Republic” — Egypt and Syria’s short-lived politician union — which promised to unite the two Arab countries into an international power. It was conceived in 1958…and buried in 1961.

Meanwhile, Chile’s development under the “Chicago Boys’’ was once lauded by fellow “Chicago Boy” Milton Friedman as an “economic miracle”…but it has turned out to be more of an EIEIO misfire.

The Chilean government commits just 0.5% of GDP on higher education, the average university course costs 41% of the average income, and the country has a 50% dropout rate — all of which put Chile at the back of the pack in the OECD.

India is at a similar inflection point. The question is will India follow Singapore’s playbook or Chile’s? Will it make the most of the coming century, or will it miss its opportunity?

We’ll be looking at India from the perspective of both a Bear and a Bull. No matter how rose-tinted your glasses are, India faces a series of challenges over the coming years. However, we think that many of these challenges are opportunities in disguise…and that India is uniquely positioned to take advantage of them.

The Bear Case

India’s challenges start with the fact that there’s not really one “India.” Instead, there are really “Three India’s” — India #1 (Europe), India #2 (Brazil), and India #3 (Sub-Saharan Africa).

While India’s GDP per capita is roughly $2,000, if you drop India’s wealthiest 30 million people, per capita income GDP drops to ~$700… that would be roughly equivalent with Somalia for the rest of the 1.37 billion people in India.

India’s caste system has existed for at least 3,000 years, but it’s not a historical artifact yet. Today, nearly all Indians identify with a caste, regardless of their religion. While 82% of Indians say they have not personally faced discrimination based on their caste over the past year, 24% of Indians say that all their close friends are from their caste.

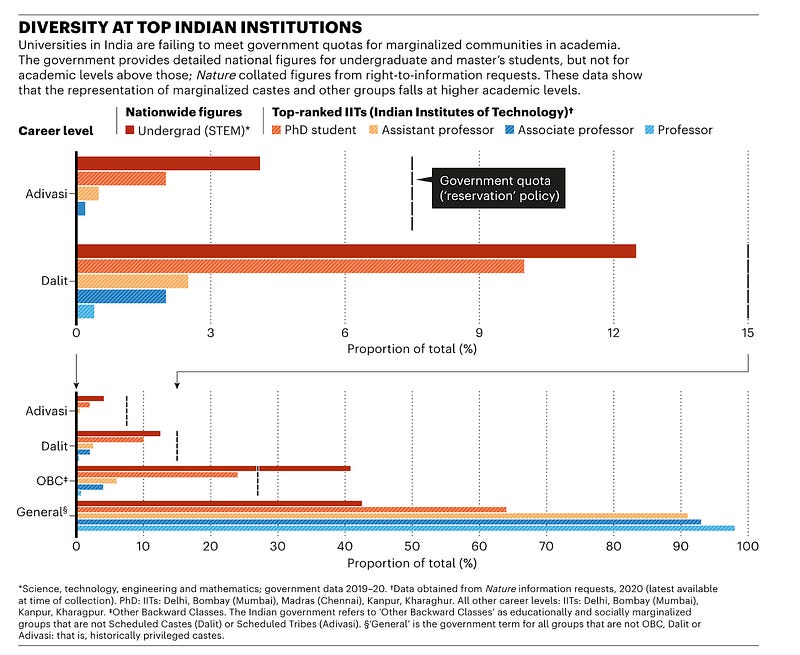

India’s caste system doesn’t just have implications for your friends and partners; it also has implications for India’s ability to invest in EIEIO. 1% of Indians own more than 40% of the country’s total wealth. Additionally, Brahmins are only 4% of India’s population, but they’ve been 45% of all Prime Ministers, 30% of all Presidents, and 47% of all Supreme Court Chief Justices since Independence.

A child’s future should not be determined by how well they select their parents…and America’s not perfect either. While the Ivy League is a meritocracy on paper, it’s driven by lineage too — Harvard’s acceptance rate for legacies is 34% vs. 5.9% for ordinary students. 3% of universities produce 90% of unicorns and 36% of US Presidents are Ivy League grads.

Meanwhile, India’s venture-backed entrepreneurial ecosystem is still in its early teenage years — a lot of excitement, but still gaining experience. While India has 108 unicorns, they only have 8 “Centaurs” — SaaS companies generating greater than $100M ARR. While Centaurs are 7x more rare than unicorns worldwide, Centaurs are 11x more rare than unicorns in India.

On the public markets side, the Indian market has undergone a seismic shift over the past month. Through the end of 2022, Indian stocks were up 4% in local-currency terms, while global stocks were down 20%. At the end of the year, Indian stock markets were trading at a Forward P/E of 22x, which was the same Forward P/E as the Nasdaq 100. Meanwhile, China’s Forward P/E was 10x, while Brazil’s P/E was 7x.

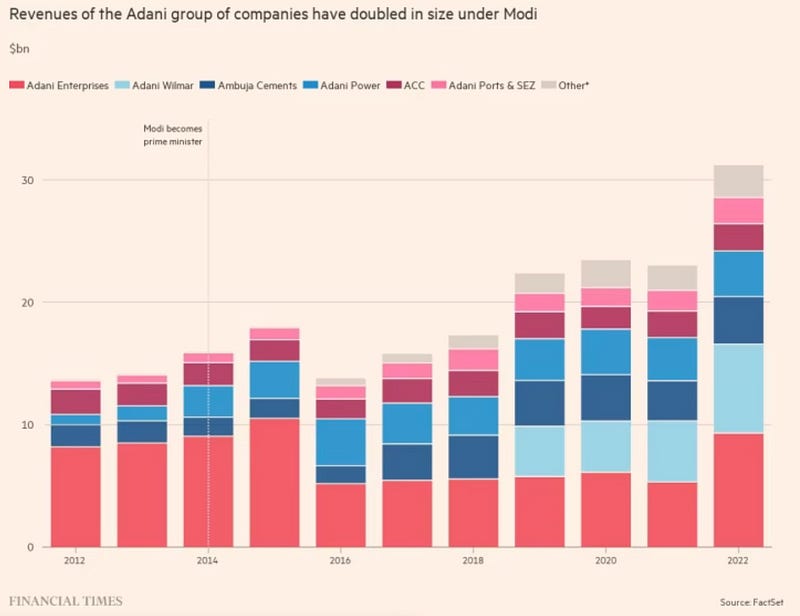

Additionally, the Sensex vs. S&P 500 was trading at the highest level in over a decade, while retail buyers spent $36 billion on stocks, a massive increase from 2019. One interesting note is that 80% of stock market cap gains from January to August last year came from the Adani conglomerate.

That momentum quickly came to a halt on January 24, 2023 when Hindenburg Research released their short report on Adani Group. Since then, Adani Group has lost $108 billion in volume, while Adani’s net worth has dropped by $52 billion.

Bloomberg reflected that “Adani’s downfall defies just about every historical comparison,” while Charlie Robertson of Renaissance Capital described the Adani accusations as a “cold shower” for domestic and foreign investors.

The Adani affair reveals two larger challenges facing India: questions surrounding corporate governance and the state’s development model. If India wants to catch up to China, it needs to invest heavily in manufacturing…so far, the results are mixed.

While China has pursued a series of private-public partnerships to develop its infrastructure, India has essentially outsourced industrial development from the government to a few ultra-wealthy individuals nicknamed the ‘Bollygarch’ tycoons (most notably Adani).

Both Modi and Adani come from the Indian state Gujarat, Modi flew in an Adani private jet after he was elected Prime Minister in 2014, and revenues of the Adani Group have doubled since Modi took over.

Modi and Adani’s opponents don’t think this is a coincidence; instead, they view it as a sign that crony capitalism is the dominant force in Indian politics and society. As Rahul Gandhi, a leader of the opposition Congress party, put it, “whatever happens in India, Adani-ji is found everywhere.”

Aside from Adani, India has other lingering challenges from its caste system. While the Indian government has set quotas for Adivasis and Dalits (‘Scheduled Tribes’ and ‘Scheduled Castes’), the historically privileged castes still dominate India’s elite universities. Less than 1% of professors come from these marginalized groups at the IITs.

Perhaps the biggest challenge and opportunity facing India is how little women are represented in India’s economic activity. Less than 7% of India’s urban female population has independent financial income, while in China this number is 90%+. The overall female labor participation is 21%; the female to male workforce participation rate ratio in India is 27.6, while the global average is 63.5.

The literacy rate for Indian women is 65% (15% below the global average), while only 64% of women attend secondary schools. 102 million women are married before the age of 15, while only 4% of males are married by the age of 18. All financial products are bought by men, and men spend more money on fashion than women (in other markets, women spend 5–7x more than men).

On the other hand, women are starting to break through to bigger opportunties, and unleashing the potential of half of India’s population could be a gigantic catalyst to India entering the world stage.

While India’s education ecosystem is booming (more on that later), there’s still a massive need for finishing schools. While India graduates 1.5 million engineering students annually, but only 7% can handle core engineering tasks.

One thing that many people are unaware of is that India has actually been “neutral” in the Russia-Ukraine war. Like China, Saudi Arabia, and the UAE, India hasn’t technically picked a side. Interestingly, India has bought 33x more oil from Russia than this time last year, while 70% of India’s existing arsenal is Russian-made.

India is the world’s largest democracy, but it’s certainly not the world’s most predictable one. It’s led by a strong leader who has a bold vision for national prosperity…this worked in Singapore, but it’s flopped in other countries. We’ll see how it unfolds…but we’re betting India will become the next Singapore, not the next Somalia.

The Bull Case

The Bull case focuses on all of India’s potential energy and youth. India’s future is powered by massive demographic tailwinds, growing startup ecosystem, and emphasis on education — Singapore 2.0 at the scale of 1.4 billion people. If you’re 1 in a million…you’re 1 in 1400 in India.

Education is the driver of the Knowledge Economy…and there’s no more important education market in the world than India. To understand the importance of education for the 1.4 billion population (600 million of which are school age), top teachers and students have headline articles written about them in newspapers.

A perfect example of India’s education mania is a recent episode of Shark Tank India. While Shark Tank US features companies selling toys and trinkets that will end up sitting in your garage, Shark Tank India features 18-year-olds hoping to build billion-dollar education companies.

The stats are staggering: by 2030, India will have 90 million people joining the workforce, 2x as many students attending higher education, and 2x as many people in high income and middle-income segments.

India’s also shifted from an exporter to an importer of technology talent …and from an imitator to innovator. Tech and startup jobs are quickly becoming the most attractive jobs in India, and Indian startups will need $800 billion of capital by 2030. Companies used to export jobs to India; now, India is exporting its companies to the world.

In 2011, India had less than $1 billion of total venture capital; by 2021, India had nearly $40 billion. 2021 was a banner year for venture capital in India. VC investment grew nearly 4x in 2020, 2x as fast as global growth and nearly 3x as fast as growth in China.

Additionally, Seed funding has grown 2.5x since 2017, with the average Seed round growing nearly 3x.

The success of the Indian diaspora has spilled over across the Atlantic. Of the 407,000 H1-B visas issued by the US in 2021, 74% were secured by Indians. Indian-origin people account for ~1% of the US population, but they account for 6% of Silicon Valley’s workforce. 33% of the immigrant startup founders in the US since 2006 are Indians.

The Indian diaspora isn’t just shining at startups; they’re leading Fortune 500 companies and even governments. When Parag Agrawal took over at Twitter, he became the 12th Indian CEO to lead a public technology company.

There’s a truism that “India is a country where people first become engineers, and then figure out what they want to become,” but that’s no longer the case. Since 2008, a South Asian American child has been named a champion at every Scripps National Spelling Bee.

Indian-origin politicians are also playing a crucial role in world politics. Rishi Sunak became the UK’s first Indian Prime Minister last year, while Kamala Harris and Nikki Haley could face off for POTUS in 2024.

The upshot is this: success is contagious, and India’s rise is starting to have a massive influence around the World. The combination of ambition without aggression, investing in education and innovation, and strong political leadership will all drive India’s ascent.

The way this is heading is Singapore 2.0. Singapore was amazing, but it was done at the scale of a small island. India is much more complex because of its size and diversity…but done right, the biggest country in history making a massive investment in EIEIO will have a tremendous impact.

Market Performance

Keeping with its being the mirror opposite of 2022, growth stocks continued to lead last week with NASDAQ advancing 3.3%, and the GSV Portfolio up 4.2%. It’s definitely been a “risk on” environment with NASDAQ being up nearly 15% YTD versus the S&P 500 advancing nearly 8% and the Dow below 3%.

We felt pretty good that the GSV portfolio has increased over 24% until we saw that Cathy Wood’s Ark Fund has increased 42% YTD. More evidence of investors appetite for futures, Bitcoin and Ethereum are both up over 35% since January 1st.

Some of the positive Market vibes were expressed by Fed Chairman Powell who said “the disinflationary period has started” coinciding with the modest 25 basis increase of the Fed Funds rate Wednesday morning. This was two days before the job numbers came in 2X the forecast to 517K and unemployment being at the lowest level since we put a Man on the Moon in 1969.

It was also nearly two years after Powell said inflation was “transitory” and the same week that a spy balloon went across the United States without much of plan…so our confidence in the Government is a little muted.

We continue to be very constructive on the Market environment for growth companies….the re-opening of China, inflation seemingly getting in check, persistent pessimism particularly in Technology land, and hordes of cash on the sideline keep us BULLISH.

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed this past week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: Yardeni

#2: IPO Market

While the IPO market continues to remain quiet, rumors are swirling that banks are starting to book build for companies looking to go public.

Source: Renaissance Capital

#3: Interest Rates

Stocks are rallying this year, while interest rates are coming down. It seems that the current phase of rate hikes could be coming to close to an end.

Source: Edward Jones

#4: Inflation

While inflation still seems high at the grocery store, the reality is that overall inflation has started to decline from its peak last year. Oil is down 40% from its peak last year, while used-car prices are coming back to earth.

Source: FxMacro

Chart of the Week

EIEIO…Fast Facts

Entrepreneurship: 80% — amount of early-stage companies that have fewer than 12 months of runway (Source)

Innovation: 1% — percent of US GDP from VC investment; VC-backed companies account for 57% of total market cap and 82% of R&D Spend (Source)

Education: 72% — percent of parents that support school choice, including 68% of Democrats, 82% of Republicans, and 67% of Independents (Source)

Impact: 85 million — estimated shortage of tech workers by 2030 (Source)

Opportunity: 11% — nominal GDP growth in Vietnam the next 5 years (Source)

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…. EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM

I really enjoyed how this piece offers clarity and inspiration throughout. The writing feels genuine and accessible, creating a welcoming space for readers to explore ideas. Such thoughtful content makes learning enjoyable and encourages continued curiosity. When travelers from Colombia begin planning their Egyptian getaway, an essential question to address is Can Colombian citizens apply for an Egypt eVisa online? since digital services can simplify the preparation phase significantly. Many people now prefer handling their travel tasks from home rather than navigating complex paperwork. Colombian tourists can benefit from having instant access to applications and submission tools online. These systems are often designed to be user-friendly and informative, ensuring nothing gets missed. With faster processing and helpful guidance, travelers can start their adventures with peace of mind. The online route encourages greater independence and planning flexibility. For more information: https://evisa-to-egypt.info/egypt-visa-for-Colombia-citizens/