GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

“India is the cradle of the human race, the birthplace of human speech, the mother of history, the grandmother of legend and the great-grandmother of tradition.” – Mark Twain

“India is eternal…Her culture is ageless and is as relevant to this present 20th century as it was to the 20th century before Christ.” – Nani Ardeshir Palkhiwala

“Being one in a million in India means that there are 1,400 Indians just like you.” – Unknown

“In India, success is relative. More success, more relatives.” – Unknown

We are on the cusp of the Golden Age of India (AKA “Amrit Kaal”), where it will take center stage in the global marketplace and lead the future.

While it may seem like a recent phenomenon, from a historical perspective, both India and have been megapowers for most of human history. That said, if you go back 50 years, India and China were effectively in the same place from a GDP per capita perspective…and that wasn’t good.

10 years before that, Singapore became an independent country under the leadership of Lee Kwan Yew. When Lee Kwan Yew took over, Singapore was a poor, isolated island with a GDP per capita ($500) that was essentially the same as Jamaica ($553) while they both became independent within a few years.

How was Lee Kwan Yew able to transform the country? The formula of EIEIO…Entrepreneurship, Innovation, Education, Impact and Equal Opportunity. Today, Singapore’s GDP per capita is $72.7K, compared to the US at $70.2K, $46.5K for the UK. In contrast, Jamaica’s GDP is $5.2K.

As Pablo Picasso said, “good artists copy, great artists steal.” In China, Deng Xiaoping took the Singapore EIEIO playbook 50 years ago and applied it to his own country.

In 1974, just 1% of Chinese students went to college; it’s now a remarkable 60%. China’s GDP per capita increased 80X from $160 to $12.6K today.

Leaders create change. Major figures in history have transformed the world as we know it. It’s always about a person, an idea, and execution.

President Xi came into power in March 2013 and while he shared some of the philosophies of the previous leaders, he brought his new brand in. A Chinese mix between capitalism and communism under the leadership of a strongman.

Meanwhile, President Modi came into power in May 2014, and he’s been a transformational leader thanks to the “Modi Magic.”

Within months of starting their terms, both leaders made two big bets.

President Xi’s bet was on physical infrastructure, effectively recreating Marco Polo’s trade routes with his Belt and Road initiative.

President Modi also doubled down on India’s internal physical infrastructure, tripling investment in roads, airports, and railroads. But his game-changing bet was India’s Digital Public Infrastructure, DPI (aka the India Stack), which enables the government to run the country on digital rails. DPI has allowed India to leapfrog other countries and is now planning on exporting it.

What’s enabled this is the combination of the top-down force of the Modi Magic and the bottom-up adoption of digital technology. Smartphone adoption and internet access is up from 15% and 18% in 2014 to 66% and 47% in 2024.

Increasing Smartphone Growth, Decreasing Data Costs

India has also turned Brain Drain into Brain Gain. Historically, India’s best and brightest went to pursue opportunities in places like the United States and Silicon Valley. But the percentage of IIT grads (India’s MIT) taking international jobs has gone from 80% in 2001 to just 33% last year.

Decrease in India’s Poverty Rate Since Modi

These changes are creating opportunities for hundreds of millions of Indians to reach the middle class. India’s poverty rate has gone from 55% in 2014 to 16% in 2024, and India has added over 200M people to the middle class over the last decade.

Today, there are 432M middle-class Indians…for context, the European Union’s population is 450M. Over the next two decades, India will have an additional 570M people join the middle class over the next 20 years.

In riding the Megatrend of the Global Silicon Valley, India is at the front seat. Human capital and investment capital flow to opportunity. Investors have embraced the opportunity to power India’s growth, from startups to the public markets.

Venture Capital investment has increased 14X over the past decade from $2B in all of India in 2014 to $28B in 2024. The number of startups in India has increased from 350 in 2014 to 110,000 in 2024, and the number of unicorns is up 25X from 4 in 2014 to 111 in 2024. The growth of startups shows the engagement of young, talented, ambitious people who historically would have worked for the Government and now are becoming entrepreneurs.

Bangalore AKA Bengaluru is India’s Unicorn Hub

Importantly, India has a robust capital market that offers liquidity to entrepreneurs and investors and increases confidence in supporting the innovation ecosystem. The number of IPOs in India has increased from 47 in 2014 to 149 in 2022.

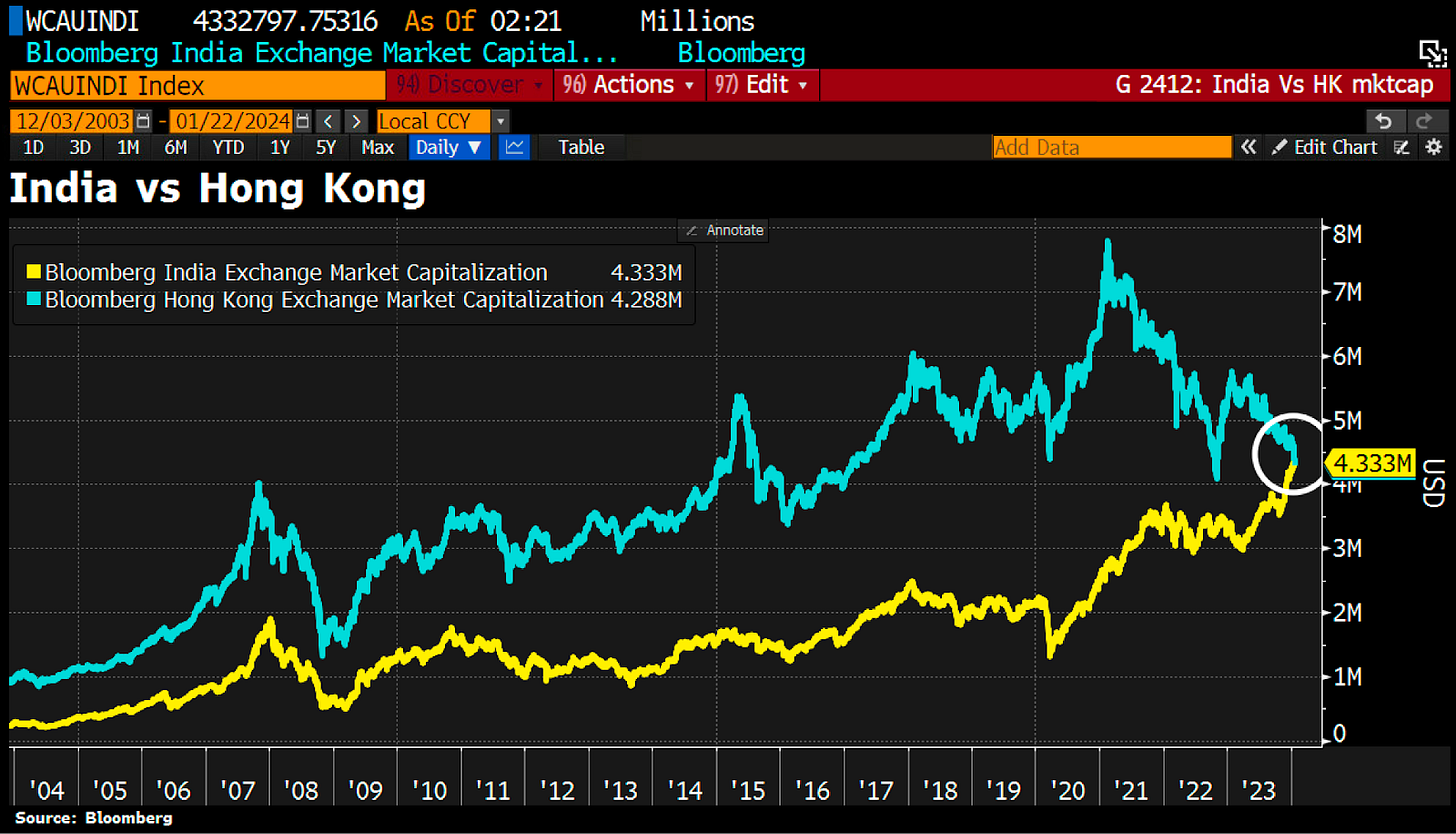

Earlier in January, India surpassed Hong Kong as the 4th largest stock market in the world. A decade ago, the Hong Kong exchange was $3T vs. $1.3T for India. Today, they’re both just above $4.3T.

India Overtakes Hong Kong as 4th Largest Stock Market

Looking at P/E multiples for the two exchanges helps gauge investor sentiment and expectations for future growth. The Indian exchange trades at 24X while the Hong Kong exchange trades at just 8X, reflecting investor optimism in India’s prospects.

India vs. China Since COVID…A Tale of Two Markets

What are the areas India needs to focus on in order to achieve its full potential? Three key indicators are college enrollment (gross enrollment ratio), R&D as % of GDP, and female labor-force participation rate.

While India’s college enrollment has increased 6X over the past 50 years to 31%, it still lags China at 72% and Israel at 59%.

India’s R&D as a % of GDP, a proxy for investment in innovation, has remained flat at less than 1% of GDP, while China spends 2.6%, the US spends 3.4%, and Israel spends 5.4%.

Last but certainly not least, India’s female labor force participation rate lags at 33% vs. 55% for Israel, 57% for the United States, and 61% for China. This needs to change dramatically for India to achieve its full potential.

One leading indicator of economic development for all is women opening bank accounts, and that has risen dramatically under President Modi from 39% to 79%.

Taken together, these factors have driven the growth of India’s GDP per capita at a 5% CAGR over the past decade, growing from $1.4K in 2014 to $2.6K today.

India’s GDP Per Capita Growth Since 1987

There’s one more key ingredient that will determine India’s ascent onto the world stage…a cultural shift towards embracing the failure that is required to create great entrepreneurs.

Every day in India, 80 new startups are formed…and every day, 80 startups fail. In 2023, just 9 VC-backed technology companies went public, and there’s a 20% chance a company survives its first 3 years.

Entrepreneurs are 80% more likely to have a heart attack, 2X more likely to get divorced, and 3X more likely to go bankrupt. So what type of pioneer would start a business?

Let’s play a game…Name that Pioneer.

This pioneer dropped out of the cheapest college he could afford in Mumbai, moved to London to study law, and then came home to find out that his mother died. He then tried and failed to establish a law practice in Mumbai and quit his next job as a litigator.

With his back against the wall, he moved to South Africa for a total salary of £105 (~$4,000 in 2023). When he got there, he was not allowed to sit with European passengers on trains and was then beaten for refusing to move seats. He ended up spending a total of 6 years in his life in prison.

So who’s that pioneer? Mahatma Gandhi (aka Bapu).

The next pioneer moved to Mumbai to become a movie star, was rejected because he was too tall and too ugly, and then rejected as a Radio DJ because his voice was too deep. He finally got a chance in a movie and then it flopped…as did his next 9 movies.

He finally got his big break in Movie Zanjeer which made him a massive star, but he ended up going bankrupt in 2000. Left with nothing, he got a second chance to host a game show…only to resurrect his career and his reputation.

Who’s that pioneer? One of India’s top movie stars Amitabh Bachchan (aka Big B).

The next pioneer graduated college at 16 but started as an entrepreneur selling fritters on the street. He then moved to Yemen to work at a gas station to make ends meet. He moved back to India with $600 to start a textile trading company, but then traders refused to buy his textiles from him…so he sold them directly on the street.

Who was that pioneer? The Father of the $100B+ Ambani Fortune…Dhirubhai Ambani.

The last pioneer started as a research assistant for his college professor before getting inspired to start a company, but his first startup failed in 18 months. He then traveled to Communist Bulgaria where he was arrested and expelled from a train. He was left in solitary confinement without food or water for five days.

Instead of being disheartened, he left convinced of the power of capitalism and inspired to start one more company even though he only had $250. That business? Infosys…and the pioneer was N.R. Naryana Murthy, the father of India’s IT sector.

As G20 Sherpa Amitabh Kant said in a recent interview, “In India, every child is an entrepreneur…we need to accept failures. Without failing you can’t succeed. Indian mothers do not want their child to fail. All parents must know that their child must fail once or twice.”

We’re as bullish as ever that Indian Edtech companies will power the Global Knowledge Economy…and empower the Indian economy. So as we think about the future, one thing we need to know is things change. And over time things could change a lot.

We’re excited to explore those opportunities at the 2nd Annual ASU+GSV & Emeritus Summit which kicks off tomorrow in Gurgaon.

While the last 50 years were about China, the next 50 years will be about India. The Sun Rises In The East…and the path towards Amrit Kaal is underway!

Top Investors and Companies to Watch in Indian EdTech

Market Performance

The markets stayed hot for the fifth straight week with the Nasdaq up 2.3%, the S&P up 1.4%, and the Dow roughly flat.

Earnings season continued to roll on, with the biggest winner of the week being chipmaker Arm, who shot up 60% this week due to the double play of accelerating revenue growth and investor enthusiasm around the “picks and shovels” of the AI revolution. Cloudflare rallied 33% off a 3% revenue beat and beat their FCF guide by 32%.

Laggards included Snap suffered a 35% drawdown as revenue missed expectations and ad sales slowed behind their peers. PayPal had a lukewarm earnings print after new CEO Alex Chriss declared they would

“shock the world” earlier this year.

It continues to be a “tail of two markets” in the technology sector, as the AI-induced bull market roars while the rest of tech continues to take the medicine after the COVID hangover. 2024 has already seen over 100,000 layoffs, with Twitch laying off 35% of its workforce, Spotify at 17%, Qualtrics at 14%, and Wayfair at 13%.

Our thesis has been that we would start to see a broadening of participation in Market performance which would also correspond with a wakening up of the IPO Market. We continue to be positive on the outlook for high quality, emerging growth companies and believe an opening of the IPO Market will bring some much needed, fresh oxygen for investors. We remain BULLISH.

Maggie Moe’s GSV Weekly Rap

GSV Model Portfolio

Need to Know

READ: Primecap Interview – Morningstar

LISTEN: Chuck Akre - The Three Legged Stool

WATCH: Higher Ed Crisis: Ask Us Anything!

READ: 48 Hours With Vision Pro: Our Thesis on Spatial Computing | Deepwater Asset Management

LISTEN: Sanjay Ayer – Think Different and Get Better at WCM

WATCH: Hedge Fund Leaders Expose 2024's Biggest Trends

READ: China Is Pressing Women to Have More Babies. Many Are Saying No. - WSJ

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: FT

#2: IPO Market

#3: Interest Rates

Source: Kobeissi Letter

#4: Inflation

Source: Charlie Bilello

Chart of the Week

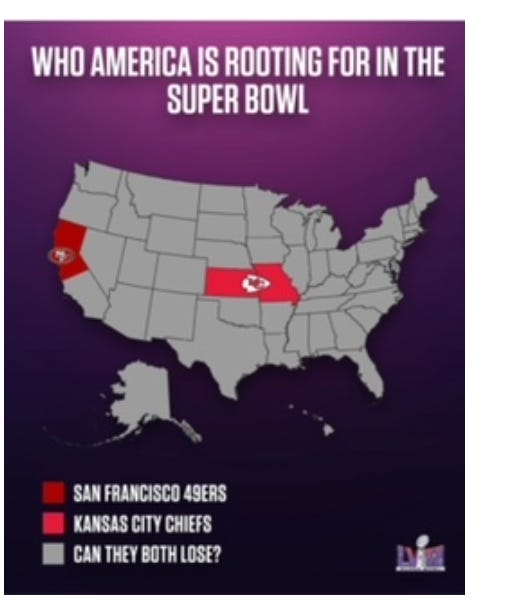

Chuckle of the Week

EIEIO…Fast Facts

Entrepreneurship: >5x – increase in Stripe Atlas incorporations in January 2024 vs. January 2019 (Patrick Collison)

Innovation: 1 million – patents granted in the U.S. in 2023, an all-time record high (USPTO)

Education: 250,000 – students enrolled in AI and machine learning university courses in 2023, doubled since 2020 (HolonIQ)

Impact: 88% – percent of countries that have set net-zero emissions targets (UN)

Opportunity: 17% – percent of Americans who say that the American dream is “out of reach” for their family (Pew)

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup….EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM