EIEIO...Announcing the Mission Summit Schedule

We’re one week closer to the inaugural SMU+GSV Mission Summit, coming to Dallas, TX on May 22 – 24.

We’re extremely excited to gather leaders to promote powerful ideas to help accelerate the “Mission Movement”…Changing the World for Good!

Linked here are a couple articles on the event from Fort Worth Inc., Dallas Innovates, and SMU.

Check out the schedule for the Summit below!

If you want to join us in Dallas or virtually, sign up below!

Market Performance

Stocks more or less took one step forward and one step backward last week with the Dow and S & P off .3% and the NASDAQ up .4%.

Inflation proxied by the Consumer Price Index (CPI) was .4% or an annual 4.9% which encouraging on a relative basis and awful on an absolute basis. The University of Michigan’s Consumer Sentiment Index fell to a six month low at 57.7.

Probably more of a sign CEO’s are being cautious than business being robust, of the 420 S & P 500 reporting, the average EPS beat was 7.2% versus the typical 4% upside “surprise”.

Uncertainty is the mood of the moment which makes it uncomfortable to take bold action. Probably not the time to be a hero, a Nero (fiddling while Rome burned), or a Zero….time to carefully put some points on the board.

Need to Know

READ: China’s new “Top Gun” normalises war with America | The Economist

LISTEN: Honestly with Bari Weiss: America Needs a Self-Help Book. Tim Urban's Got One.

READ: Microsoft just made a huge, far-from-certain bet on nuclear fusion - The Verge

WATCH: Discussing Founders, Seriousness, and American Dynamism - Moment of Zen Podcast

READ: The AI Startup Litmus Test - NfX Blog

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: Yardeni

#2: IPO Market

So far in 2023, only two U.S. venture-backed companies (LanzaTech and Intuitive Machines) have listed above $1 billion on the public markets, and both are down more than 40% since going public. Conventional wisdom is that the IPO market will reopen for business in 2024.

Source: Renaissance Capital

#3: Interest Rates

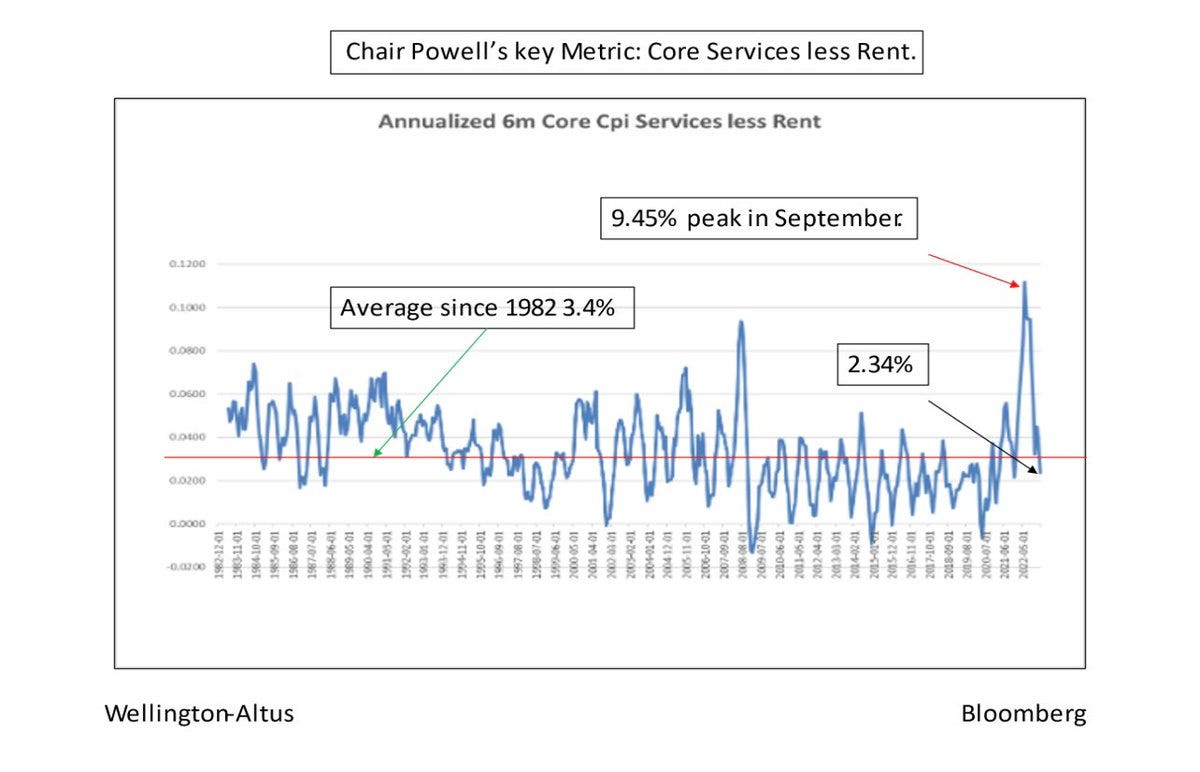

Markets are pricing in a 98% chance of the Fed standing pat in its June meeting, but they’ve also started to price in deep cuts in rates by the end of the year. However, Michelle Bowman said that recent reports “have not provided consistent evidence that inflation is on a downward path,” suggesting further rate increases could be in the cards.

Source: Edward Jones

#4: Inflation

This week’s inflation print showed that inflation eased to 4.9% in April, slightly less than the estimate. While inflation has slowed for 10 straight months, inflation remains sticky enough for the Fed to remain on track to keep rates high for the rest of the year.

Source: James E. Thorne

Charts of the Week

Chuckles of the Week

EIEIO…Fast Facts

Entrepreneurship: 5% – percent of GDP that Israel invests in R&D, twice the OECD average (Source)

Innovation: 74% – China’s share of the world’s battery production by gigawatt-hours (Source)

Education: 850 – number of school districts that have adopted 4-day school weeks (Source)

Impact: 77% – percent of AI voice scam victims that lose money (Source)

Opportunity: 17% – percent of BART riders who say they feel safe on the trains (Source)

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…. EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM