“In anything we do, any endeavor, it’s not what you do, it’s why we do it.” – Howard Schultz

"Any analysis of capital structure should recognize that most balance sheets are dramatically inaccurate because (with the exception of professional sports franchises) they fail to include the value of human capital." – Mike Milken

“It's not a faith in technology. It's faith in people.” - Steve Jobs

Adam Smith’s invisible hand might be sprained, but it’s not broken.

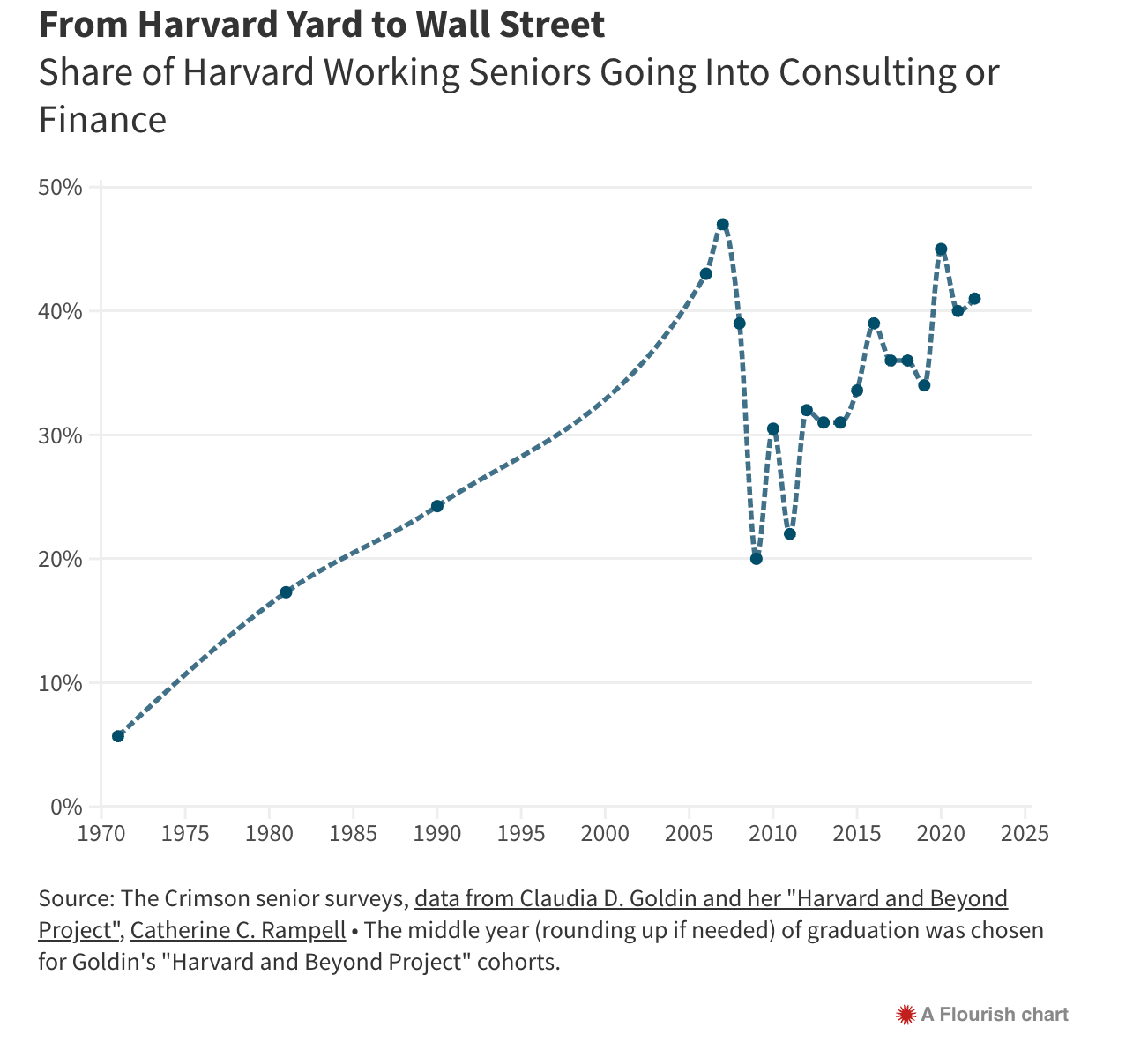

Capital flows where it has the highest risk-adjusted return. The same is true of human capital. Human capital flowed to Investment Banking in the 1980s, Hedge Funds and Private Equity in the 1990s, Venture Capital in the 2000s, and Big Tech in the 2010s.

There isn’t just a pattern of Harvard grads going from Harvard Yard to Wall Street (and Market Street)...there’s a pipeline. 41% of Harvard’s Class of 2022 are working in Consulting or Banking, up from 18% in 1980.

There’s a reason why so many Harvard grads go into consulting or banking…and it’s not because they dreamed of working for McKinsey or Morgan Stanley as children (at least we hope not).

Instead, these jobs offer the best risk-adjusted return for students looking to launch their careers. As John Luttig puts it, these jobs are a byproduct of the “index mindset.” They offer a basket of potential career opportunities without committing to one, and the projects across these industries span a variety of firms and disciplines.

Over the past decade, “Big Tech” and entrepreneurship have started to take the reins from consulting and finance as the most attractive space for young graduates. Companies like Google, Microsoft, and Meta offered eye-watering compensation for 22 year old software engineers, with entry-level salaries of $175k, juicy stock options, and plenty of time to chill in the cafeteria.

Meanwhile, Y Combinator has become the de facto signal of being a young, credible founder. Even if your startup fails, you still have the legitimacy (and connections) that come with having YC on your LinkedIn profile.

Historically, the smartest VCs followed the best and brightest people. In 2013, Chris Dixon penned an essay titled “What the smartest people do on the weekend is what everyone else will do during the week in ten years.”

Dixon’s insight was that many breakthrough technologies – the PC, the web, blogs, and open source software – were hatched by hobbyists in garages and dorm rooms.

His investment thesis was to seed these people to help them turn their present-day passions into future industries. His 2013 essay mentioned touch-free human computer interfaces, NoSQL databases, and most notably, math-based currencies like Bitcoin. 9 years later, he created a16z’s Crypto Franchise and topped Forbes’ Midas List as the World’s #1 VC.

Dixon’s thesis on the value of human capital isn’t just relevant for identifying the stars of tomorrow…it's essential for every company today, from startups to the S&P 500.

Fifty years ago, Book Value was the most important metric to value a company. The five largest companies in the US – GM, Exxon, Ford, GE, and Chrysler – lived and died by the physical assets on their balance sheet.

Price to Book was the de facto standard for calculating enterprise value. In fact, legendary investor Ben Graham used Book Value to develop the magic “Graham number” to calculate the intrinsic value of a stock.

While the “Graham number” produced outsized results for its time, Book Value is no longer the magic number it used to be. According to a survey conducted by the Association for Financial Professionals in 2020, just 13% of respondents use Price to Book as their top valuation metric (our question is what planet do these 13% live on?)

While every firm still needs to know the value on its balance sheet and the match (or mismatch) between assets and liabilities, the reality is that most of the value in the modern enterprise is not captured on the balance sheet (banks are a notable exception, as we all learned the past few months).

Today, book value has been replaced by brain value – the human capital, intellectual property, and proprietary data that a firm has. Accountants refer to these as “intangible assets,” it’s become quite tangible that they are the key drivers of enterprise value in a Knowledge Economy. We call this the New Balance Sheet.

Information is widely accessible and software tools are wildly affordable – companies no longer gain an edge from these things. It’s in the “human layer” where the difference is made - so hire wisely. Intellectual property (IP) generated by talented individuals who effectively leverage information and software tools is what drives business success.

The proof is in the data. Apple generates $2.5 million of revenue per employee, over 2x as much as its Big Tech peers.

Meanwhile, Goldman Sachs compensation ratio hit a decade high in January at 35% of revenue. Why? Competition for the best and brighter grads is fiercer than ever. Why endure two years of 100 hour weeks and “inhumane” working conditions when you can get paid $200k a year to enjoy catered lunches, in-office cocktails, and eucalyptus towels?

Perks aside, the reality is that there has been an irreversible shift in what drives enterprise value. The old balance sheet has been replaced by the new balance sheet.

Take my friend Mike Abbott, who just joined General Motors as Executive Vice President of Software. GM didn’t recruit Mike from Toyota, Honda, or even Tesla…they recruited him from Apple, where he was the Vice President of Engineering. Mike is leading a newly created software unit for the automaker. GM has a goal of doubling its revenue to $280 billion by 2030. The most important investment to achieve that goal is hiring leaders like Mike.

The new balance sheet won’t just change the way companies are valued; it has implications for how companies obtain, train, and retain the best talent in the world. Companies that recognize the importance of the new balance sheet will require a new type of employee. We call this the New Renaissance Person.

A hundred years ago, the org chart of the World’s largest companies looked like a very narrow pyramid: industrial visionary at the top, a few trusted lieutenants below him (it was always a him back then), and thousands of factory workers.

Today, those org charts look very different…and a lot flatter. They have a flatter (and arguably fatter) top, with pods of people working in interconnected hubs. While we agree with Zuck that managers shouldn’t just be managing managers, it’s undeniable that the modern organization looks a lot more like a basketball team (generalists rotating roles in real time) than a football team (one clear position per person).

Even the US military – what used to be the epitome of a hierarchical organization – has moved to a networked organization. In 2016, General Stanley McChrystal shared at the ASU GSV Summit that the US military has evolved from the “general and infantry model” to a team of strategic contributors.

That trend has only accelerated today. This March, I served as a judge for the Air Force’s Spark Tank, along with new Joint Chiefs Chairman Charles Q. Brown Jr. Spark Tank is the Air Force’s capstone innovation campaign and startup competition.

While there were many compelling finalists, my favorite pitch was “Accelerated Development of Multi-Capable Airmen and Guardians.” The problem this addressed is that for most career fields, airmen receive minimal or no outside training beyond their narrow focus. The pitch was to develop a program to train Airmen in a more efficient and dynamic way.

The companies of the past relied on just in case learning – learn something just in case you can apply it in your job. The companies of the future use just in time learning – learn what you need, when you need it, and where you need it on a real time basis.

We’re seeing this shift play out in the market real time. Platforms such as iLearningEngines and Glean unlock the value of enterprise data by offering “ChatGPT for the Enterprise.” Meanwhile, Snowflake acquired Neeva to help accelerate search in the Data Cloud through generative AI (aka helping customers find and use their data faster and cheaper).

The takeaway is clear. A new kind of organization needs a new type of talent and training. At GSV, we always talk about the 5Ps Framework, with the first P, People, being the most important. The challenge (and opportunity) is how do we systematically quantify the impact of the people that help organizations win.

LiveData Technologies is tackling this problem. LiveData tracks real-time job change data from ~100M (and growing) individuals using its patented Search Engine Response Page (SERP) technology to get the most up-to-date signals from the open web. The company is changing the way investment firms, go-to-market teams, and data vendors are able to leverage human capital data. Check out their blog post on GSV here.

What LiveData is bringing to the enterprise already exists in sports. There’s a clear scorecard of how much value a player contributes on the field (off the field is a little tougher to measure, but it’s just as important).

Superstars are so valuable in the NBA that teams throw away their entire season just to have a chance to draft the next Lebron or MJ. The NBA has “Supermax” contracts, which goes to only the top .1% of players in the league.

This year, the Celtics’ Jayson Tatum and Jaylen Brown are eligible for $613 million in supermax contracts. Yet they were just beaten by the Miami Heat, who’s most important player is arguably Udonis Haslem, the oldest active NBA player this season.

Haslem does not get a lot of playing time anymore, but he is famous for being the founding father of “Heat Culture,” the mindset that it’s the TEAM that comes first, no matter what. That method has taken years to develop…while the Celtics needed a game of Topgolf to get their chemistry back as a team after going down 3-0 to Miami.

What’s the upshot? The last thirty years was the “Revenge of the Nerds” – the next thirty will be “Back to the Future.” 10x engineers will still be coveted hires, but they will eventually be commoditized by AI. Software and the web made information cheap and accessible, so this is not where companies’ gain an edge.

Instead, it’s the “human layer” where the difference is made. The most important hires will be well-rounded, adaptable Renaissance Men (and Women) who know how to leverage technology to drive the insights that really matter. How can companies (and countries for that matter) develop their own superstars?

It comes back to the 7 C’s – Critical Thinking, Creativity, Communication, Cultural Fluency, Civic Engagement, Collaboration, Character. Notably, Coding and College are not on that list for a reason…they’re indicators of talent, but they do not guarantee smarts or success on their own.

For more on this, check out my recent keynotes at the ASU+GSV Summit and the inaugural SMU+GSV Mission Summit.

Market Performance

U.S. stocks acted positively last week catalyzed by bipartisan debt ceiling agreement and a robust jobs reports. For the Week, the Dow and NASDAQ were up 2% and the S & P 500 advanced 1.8%.

By casually looking at the averages, one could easily assume it’s “Happy Days” again with the S & P and NASDAQ up X and Y, respectively. Taking a closer look, given the market cap weighted structure of both indices, if you removed Apple (+36% ytd), Microsoft (+37%), Alphabet (+39%), Amazon (+44%), NVIDIA (+159%), META (+120%), and Tesla (66%), both indices would actually be down for the year.

AI continues to be the dominant topic of conversation, with leading chip maker for the AI Gigatrend NVIDIA joining the Trillion Dollar Market Cap Club last week. On a sobering note, the Center for AI Safety which is made of leaders from groups such as Google, Microsoft and OpenAI came out with a statement saying “mitigating the risk of extinction from AI should be a Global priority alongside other societal scale risk such as pandemics and nuclear war.” Wow.

We continue to be constructive on growth opportunities where fear remains high, valuations remain relatively low and fundamentals remain strong.

Need to Know

READ: From $1 to $100m revenue: Scaling VC backed SaaS with Notion Capital

LISTEN: The Pursuit of Forever with Dr. Peter Attia

READ: How success coaches ‘dig deeper’ to anticipate Dallas College students’ obstacles

WATCH: VC Contagion: Is Venture Capital Killing Itself? | The Newcomer Podcast

READ: Big Tech’s Biggest Bets (Or What It Takes to Build a Billion-User Platform)

WATCH: Mohnish Pabrai's Presentation and Q&A at the University of Nebraska, Omaha on May 5 2023

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: Yardeni

#2: IPO Market

While the US IPO market continues to stay quiet, the world’s largest IPO market has shifted to China. Companies in mainland China have secured more than $25 billion across over 100 billion deals year-to-date, 4x more than the US IPO market. Meanwhile, Abu Dhabi’s Adnoc Logistics jumped 50% over its IPO price in its debut.

Source: Renaissance Capital

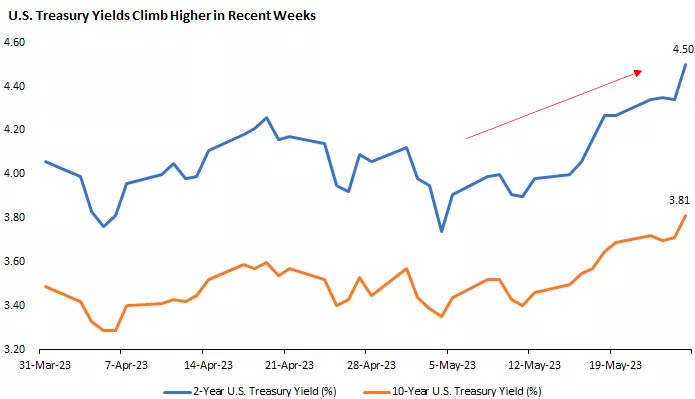

#3: Interest Rates

Fed Fund Futures show that there’s a 69% chance that the central bank forgoes an interest-rate hike this month, leaving rates at between 5% and 5.25%. However, investors see a 50% chance that rates will be hiked again in July.

Source: Edward Jones

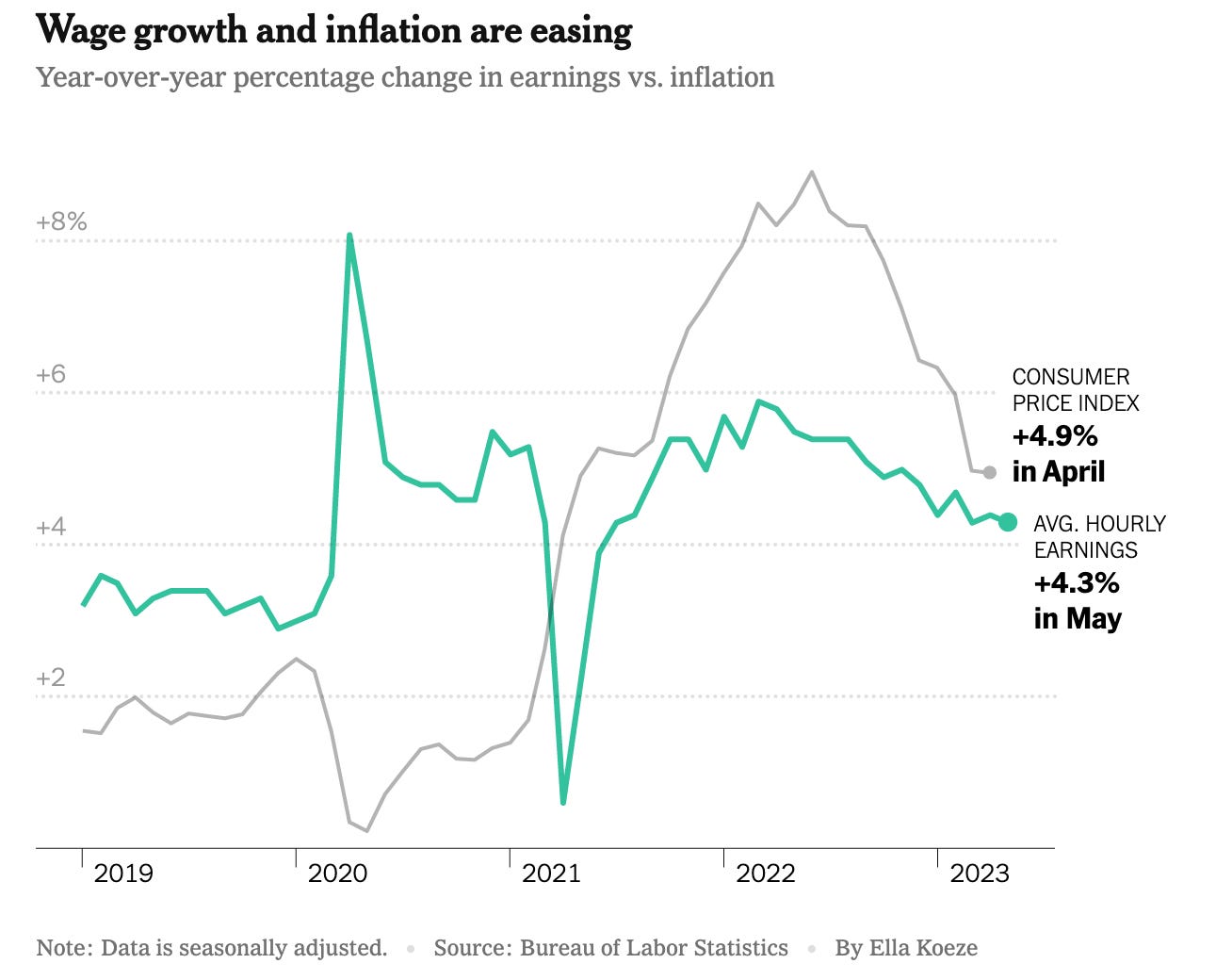

#4: Inflation

Inflation is below 5%, less than a year after peaking at 9%. The challenge is going from 5% to 2%...but that’s not a prerequisite for finding great companies. As Ron Baron puts it, “in my lifetime, inflation has averaged about 4-5% a year. That means prices approximately double every 14 or 15 years. The stock market doubles roughly every 10 or 12 years, or about 7-8% per year.”

Source: NYT

Charts of the Week

Chuckle of the Week

EIEIO…Fast Facts

Entrepreneurship: 51 – public companies that sustained 20%+ annual growth since 2010 off a revenue base of at least $100 million (Source)

Innovation: 80% – percent of the world’s data that resides behind firewalls, not on the public web (Source)

Education: 60% – percent of US working families that spend 20% of their income on daycare (Source)

Impact: 29% – decrease since 2009 of Canadian women aged 15-30 reporting excellent or very good mental health (Source)

Opportunity: 17% – decrease in New York’s personal income tax revenue since 2019 (Source)

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…. EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM