EIEIO...Dancing in the Dark

By: Michael Moe, CFA, Brent Peus, Owen Ritz, Catherine Merrick

GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

“Volatility is the friend of the long-term investor.” – Warren Buffett

"Don't confuse brains with a bull market" - Humphrey B. Neill

“The order is rapidly fadin' \ And the first one now \ Will later be last \ For the times they are a-changin'” – Bob Dylan

Two hundred years ago, the United States was essentially the East Coast less Florida.

Back then, traveling from the East Coast to the West Coast would take a generation and you’d lose half of your travel party. Today, flying from NYC to San Francisco takes six hours and if your Wi-Fi doesn’t work, you’re pissed off.

One hundred years ago, it was thought that cigarette smoking enhanced your athletic performance.

In 1920, Detroit, Michigan was the Silicon Valley of its day, the automobile was the era’s disruptive technology, and Henry Ford was Elon Musk. The young and ambitious flocked to Detroit because it was where you could make your mark.

In 1923, there were 103 automobile manufacturers in the United States along with thousands of complimentary businesses that were part of the industrial ecosystem.

One hundred years ago, Silicon Valley was made up of apricot and apple orchards, and “The Farm” was a 38-year-old university that few people East of the Mississippi had ever heard of.

Fast forward to today and Detroit is a shadow of its former self and Silicon Valley is home to many of the game-changing businesses such as Apple, Alphabet, NVIDIA, and OpenAI (speaking of change).

In 1965, Intel co-founder Gordon Moore predicted that computing power would double approximately every two years. What’s so interesting about what is now called “Moore’s Law” is that it wasn’t scientific or physical law, it was essentially Moore imposing his will on the semiconductor industry which not only transformed that industry but the World as we know it.

If the automobile industry had shown the same progress, a Ford Taurus that cost $20K in 1990 would be less than $1 today and you’d throw it away after your ride.

Change is not only constant – it’s happening faster and faster.

Technology adoption timelines have been compressed dramatically. It took 68 years from the Wright brothers’ first flight for airlines to reach 50 million passengers. The telephone took 46 years to hit 50 million users. The internet, just 7 years. Facebook, 3 years. Twitter, 2 years. ChatGPT reached 100 million users in 2 months.

The Moore’s Law tailwind has been further propelled by forty years of declining interest rates, globalization, and a rising middle class.

From 1981 to 2022, interest rates fell from 20% to 0%. Basic economics – as rates fall, the value of future cash flows increases.

Growth stocks had an unfair advantage in this environment and while there were inevitable “rain delays” that caused pauses in the action, the multiple trillion-dollar businesses were growth machines.

Zero cost of capital can result in some very bad decisions and by 2021, the capital-drunk investors were paying prices for growth that would only make sense if conditions stayed the same or got even better.

The average high-growth (>30%) public software company was trading at 32X EV/Revenue in 2023, while Series B & C companies were raising at 100X ARR.

When post-pandemic inflation reared its ugly head, somehow surprising our appointed financial maestros, it became clear that the waiters needed to stop serving champagne immediately, and the chaos that ensued was both predictable and painful.

The public markets are always the first to react, with IPOs falling shortly thereafter. The private markets tend to initially ignore that the music has changed and lag to respond to the new genre for weeks or months.

Public stocks act as an early indicator that a new shift is underway when the sun begins to rise again in the market. A lively IPO market signals to private players that opportunities are arising and that there may be light at the end of the tunnel.

After a rough and tumble two years, public stocks have woken up. It is also telling that more speculative assets such as Bitcoin have rocketed.

Nobody can predict the future with certainty, but what we do know with 100% confidence is that over time, growth correlates with enterprise value creation. As legendary investor Peter Lynch said, “People may bet on the hourly wiggles of the Market, but it’s the earnings that waggle the wiggles long term.”

Peter is one of my heroes and mentors, but I have a slight amendment to his quote. I actually think revenue growth is the biggest driver of enterprise value. Yes, it’s ultimately cash flow by which companies are valued, but high, sustainable revenue growth is the oxygen.

The study below shows that in the short term, multiples are the number one driver of returns. However, in the long term, revenue growth is the most important driver of shareholder returns.

As growth investors, volatility is the price you pay for long-term performance. Below are the long-term historical volatility of major asset classes and their corresponding annualized returns.

Over the past few years, multiples have changed, but fundamentals have not. Revenue growth is still the number one driver of returns for the strongest businesses in the world. That’s true throughout the lifecycle of a company, whether it’s private or public.

The future belongs to those who see the next big wave before it crests. We’re on a mission to identify breakout stars that have the potential to be growth machines in the years to come.

Market Performance

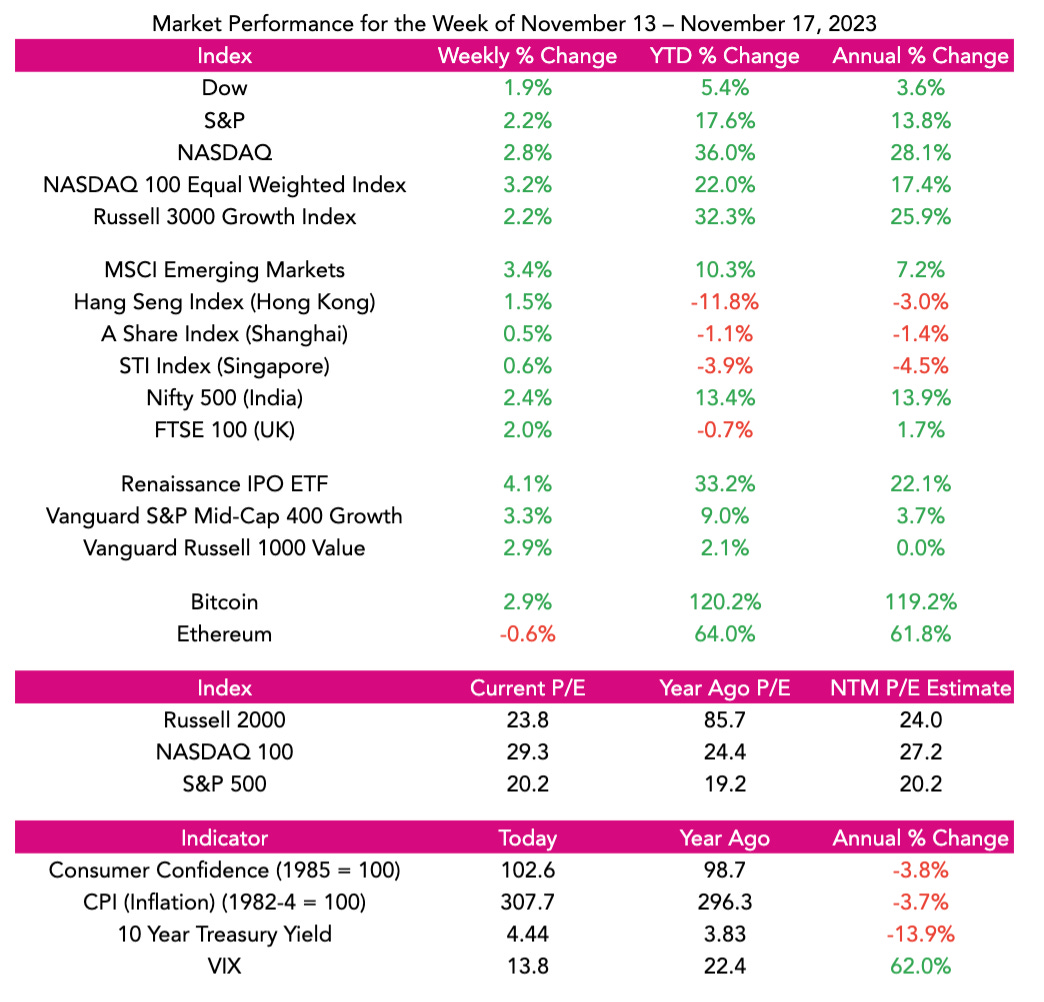

Stocks, as are their nature, continue to rise as most remain worried about all the issues surrounding them. For the Week, NASDAQ rose 2.4%, the S&P 500 was up 2.2% and the Dow increased 1.9%. Over the past three weeks, NASDAQ is up 11.7%.

The biggest news of the week was the Friday afternoon bombshell that Sam Altman was fired by OpenAI’s board, only to be reportedly in discussions to return to the company as of Sunday afternoon.

President Biden and Xi Jinping’s meeting in San Francisco was successful, despite President Biden referring to Xi as a “dictator.” Xi received a standing ovation at a dinner on Wednesday night that hosted US executives from Apple, Blackstone, Pfizer, FedEx, and Boeing.

On the macro front, the October inflation report came in stronger than expected, as CPI was unchanged from September compared to an expected rise of 0.1%. Crude oil prices continued to fall, hitting $75 by Friday, down from $90 in September.

On the company front, Amazon announced it will allow U.S. auto dealers to sell on its platform, Alibaba scrapped its plans to spin off its cloud business, and Microsoft released its first in-house AI chips. Airbnb purchased former Siri co-founder Adam Cheyer’s stealth AI startup GamePlanner.AI for $200 million, its first public M&A .

Maggie Moe’s GSV Weekly Rap

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

Need to Know

READ: Tech is Going to Get Much Bigger

WATCH: A Deep Dive into Thrive Capital's Investment Strategy

LISTEN: FedEx: Anytime, Anywhere

READ: Move Over, New York. These Fast-Growing Cities Are the New Economic Powerhouses.

LISTEN: Invest Like the Best: Brad Jacobs - Think Big and Move Fast

WATCH: The Long Game: Andrew Luck & Condoleezza Rice on the Future of College Sports | Uncommon Knowledge

READ: Lessons from History: The Rise and Fall of the Telecom Bubble

Special Announcement

In case you missed it…

Dash Media has a new podcast! This week we launched Ed on the Edge, where we cover the "who" and the "how" of driving change in the global education landscape.

Episode 1 is with Jon Hage, the Founder & CEO of Charter Schools USA.

Check it out here ⬇️

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Equity funds just saw the second-largest inflow (+$23.5bn) of 2023.

Source: Michael Hartnett, BofA

#2: IPO Market

Just when the IPO window seems to have closed yet again, rumors emerged that Starlink could spin off from SpaceX and pursue a potential IPO in 2024.

Source: Renaissance Capital

#3: Interest Rates

Fed Chair Powell warned again this week that the US Central Bank risks being “misled” by good data on prices and that the return to the 2% inflation target still has a long way to go.

Source: Atlanta Fed

#4: Inflation

Wednesday’s inflation report came in softer than expected, with consumer prices unchanged in October and core inflation rising at the slowest pace since September 2021.

Source: Koyfin

Chart of the Week

Hedge fund positioning in the Magnificent Seven hit record highs in Q3 2023.

Source: Zerohedge

Chuckle of the Week

EIEIO…Fast Facts

Entrepreneurship: 50% – percent of Gen Z that wants to start their own business (CNBC)

Innovation: <4% – percent of the total US equity market that are small caps (Jefferies)

Education: 6% – Black ACT test takers rated ready for college-level courses in English, Math, Science, and Reading (JBHE)

Impact: 48% – Gen Z and Millennials that are likely to purchase an electric vehicle (Pew)

Opportunity: 36% –New Yorkers that are foreign-born (Rockefeller Institute)

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…. EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM

Thanks. I read your newsletters regularly as they are best combo of story and stats, with superb insights. One point, the focus on revenue growth, deserves a cautionary addenda. The pursuit of top line growth by company management or by investors, can lead to the "growth trap", if I may coin a phrase. We see this in some early stage companies going public with high, but unprofitable growth. While Tesla pulled it off, many don't. When mature companies pursue growth by acquisition, two pitfalls await them. First is dilution either by increasing share count or impairing the balance sheet. More worrisome is loss of cultural coherence. The very top level becomes a portfolio manager. One level down, it's feudalism. HP and Intel fell victim to this 'death by a thousand acquisitions'.