EIEIO...Dog Days of Summer

Wags to Riches

GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: $100k – The size of the Thiel Fellowship Grant that Dylan Field used to get started building Figma at age 21. (AInvest)

Innovation: +985% – The percentage increase in job postings related to agentic AI from 2023-2024. (McKinsey)

Education: 68% – The percentage of school districts that experienced declining enrollments between the 2019-20 and 2023-24 school years. (K-12 Dive)

Impact: $67,000 – The estimated annual amount that a U.S. household needed to earn to afford a median-priced home in 2019, compared to $114,000 today. (Realtor)

Opportunity: 1 in 13 – Chance that a recently graduated U.S. computer-engineering major is unemployed, compared to 1 in 33 for Art History majors. (Harper’s)

“If you want a friend, get a dog.” – Gordon Gekko

“A dog is the only thing on earth that loves you more than he loves himself.” – Josh Billings

“Be the person your dog thinks you are.” – C.J. Frisk

“Scratch a dog and you find a permanent job.” – Franklin Jones

“Wanna know who loves you more? Put your spouse and your dog in the trunk of your car and drive around for an hour. When you open the trunk who’s happy to see you?” – Anonymous

Pets are people, too.

It’s an investment theme I’ve had for some time. It became clear to me in our household when our beloved beagle Bruiser had a knack for finding his way into our neighbor’s rat poison.

Four blood transfusions later and Bruiser was still following his nose where ever it took him. As expensive as it was, I didn’t think twice about getting him the emergency care he needed…Bruiser was a Moe.

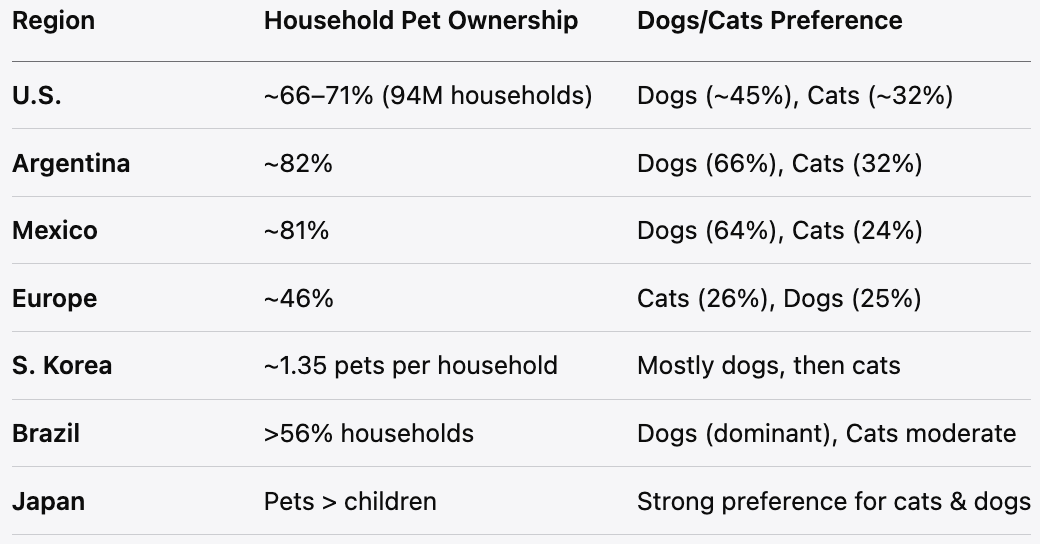

I’m not alone in my feelings. 88.7% of dog owners and 84.7% of cat owners consider their pets “part of their family”. 70% of U.S. households have a pet versus just 39% than have a child.

It’s the “Dog Days” of Summer in Dallas right now with temperatures over 100 degrees. Our youngest daughter has a rambunctious French Bulldog and unfortunately, Frenchies have narrow nostrils and elongated soft palates which makes it really difficult to breath in the extreme heat.

In what was a Friday night trauma, “Arthur” got heatstroke and had to be rushed to the emergency vet where he received IV, oxygen and a variety of other treatments to help him recover. The operation was AMAZING…and compared to some human emergency rooms I’ve been to, night and day in terms of cleanliness, friendliness, and orderliness.

In my brain was ringing Rahm Emmanuel’s quote, “don’t let a crisis go to waste” along with Peter Lynch’s philosophy of investing in what you know, I went to work researching Arthur’s urgent care facility, Veterinary Emergency Group.

What I found didn’t surprise me but was a little bit of a let down. Veterinary Emergency Group wasn’t an undiscovered gem as I had hoped, it has raised $150 million of private capital from the likes of Fidelity, D1, Sequoia, Summit and Durable. It also has over 100 centers across the United States and it’s doing an estimated $500 million in revenue.

While I wish I had been on VEG earlier, even with 100+ centers, it seems this opportunity has legs. For quick context, there are roughly 7,000 human hospitals in the United States and 15,000 urgent care centers. Between my house and Veterinary Emergency Group (which is about mile), there are two other vet emergency clinics, and three coffee shops. There are no hospitals or urgent cares in that mile radius.

Pets are People is a Megatrend. Since 2018, the number of pets receiving a birthday party has increased 250%, with 75% of pet owners now having a celebration for their animal. In the past twelve months, mentions of “pet birthdays” has increased 260%.

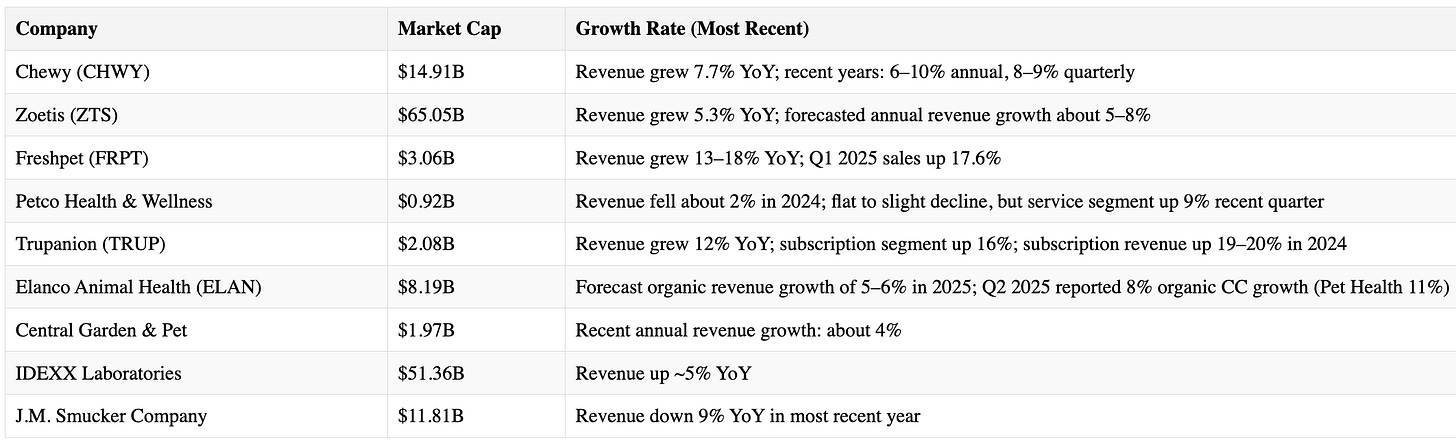

Organic pet food has grown from $22.1 billion in 2022 to $27 billion this year and expected to grow to $41.6 billion by 2032. FreshPet is the rapidly growing leader in category but major food companies such as Nestle (Purina), General Mills, JM Smuckers, and Mars are all in the game.

A few private companies in the Pets space to watch know…

Pet Insurance has gone from just over $1 billion ten years ago to $21.4 billion this year. Leaders include Trupanion and Lemonade.

The pet wearables market is the fastest growing segment with the global market going from $4 billion this year to $11 billion in 2029. You can’t make this up, one of top players is FitBark, and Garmin is also into pet tracking.

Historically, when I was asked by an entrepreneur if I could give them one bit of advice, I responded “get a dog”. Being an entrepreneur is tough. There are days when everybody hates you—your co-workers, your investors, your wife, your kids, sometimes even yourself…but your dog will always be wagging his tail when you walk in the door.

Today, I’d add an addendum to my counsel. Not only should entrepreneurs get dogs, but they should start a companies in the dog business, too.

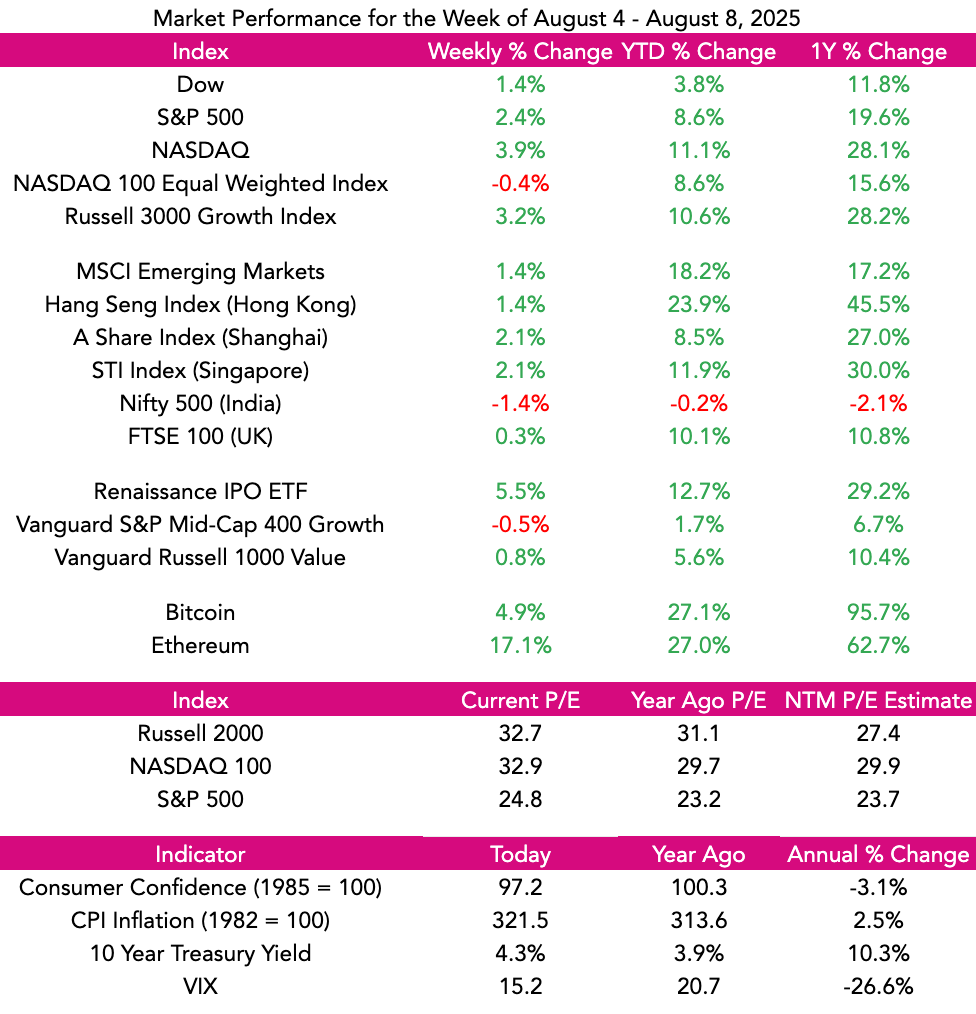

Market Performance

Market Commentary

One of the Wall Street sayings is to “Sell in May and go away.” The conventional wisdom is that people are at the beach in the summer, so it’s best to get out of the market by Memorial Day and get back in after Labor Day.

Sounds sensible; however, it’s almost always better to be zigging when others are zagging. To that point, if you were out of stocks since June, you would have missed over a 20% increase in the NASDAQ. If you were out since April, when commentators told you the world was coming to an end, you’d have missed over a 40% increase.

Moreover, in the true “Dog Days of Summer,” when NOBODY is supposed to be in the office (like last week), you’d have blown off the best week in the NASDAQ since 2021, with it up 3.9% and the S&P advancing 2.4%. Also, you’d have skipped the seminal FIGMA IPO, which has advanced 130% from its $33 new issue price. Year to date, the NASDAQ has increased 11.1%, with the S&P up 8.6%.

While headline numbers for growth stocks were strong—with leaders such as Palantir rocketing another 20% after reporting the fifth quarter in a row of accelerating results and 48% revenue growth—performance was mixed. Specifically, a number of semiconductor stocks dropped after President Trump said they would be excluded from a 100% tariff if they invested in the United States. Taiwan Semiconductor, which is building a FAB in Arizona, was seen as a big beneficiary of that news, and the stock responded in kind. Astera Labs surged over 36% with massive growth of 150% in revenue and 238% in EPS growth.

Other good results delivered last week included Uber, which had EPS rise 34%, and DoorDash, which had accelerating revenue growth of 25%. Shopify reported 34% EPS growth and 31% revenue growth, and its share price increased over 26%.

This Tuesday, inflation numbers come out with an expected increase in CPI of 0.3%, or an annualized 2.7%. Also, a bunch of Chinese companies report, including TenCent, VIPshop, JD.com, Weibo, and Netease, which will give a window into what’s going on in the Middle Kingdom.

I continue to be positive on the outlook for high-growth enterprises. I’m particularly looking forward to fast-growing new issues expected this fall. Accordingly, I remain BULLISH. 🐂

Need to Know

READ: How AI, Healthcare, and Labubu Became the American Economy | Kyla’s Newsletter

WATCH: Introducing GPT-5 | OpenAI

LISTEN: GPT-5 and Agents Breakdown – w/ OpenAI Researchers Isa Fulford & Christina Kim | a16z Podcast

GSV’s Four I’s of Investor Sentiment

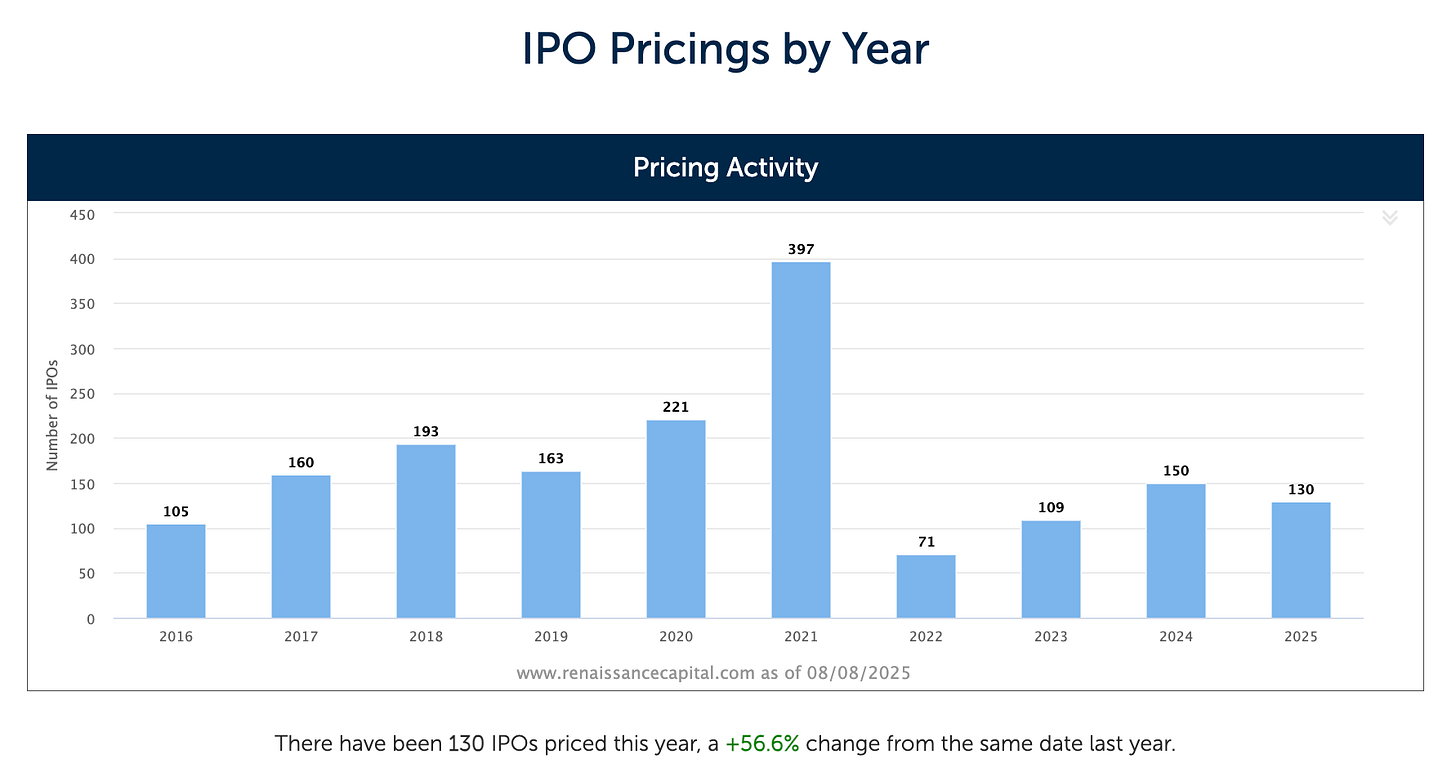

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

#3: Interest Rates

#4: Inflation

Chart of the Week

Maggie Moe’s GSV Weekly Rap

Chuckles of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM