GSV’s weekly insights on the global growth economy. Join 22,000+ readers getting a window to the future by subscribing here:

“Number one rule of Wall Street: Nobody - I don't care if you're Warren Buffett or Jimmy Buffett - nobody knows if the stock's going to go up, down, sideways, or in circles, least of all stockbrokers.” – Matthew McConaughey in The Wolf of Wall Street

“The difference between baseball and business, however, is that baseball has a truncated outcome distribution. When you swing, no matter how well you connect with the ball, the most runs you can get is four. In business, every once in a while, when you step up to the plate, you can score 1,000 runs. This long-tailed distribution of returns is why it’s important to be bold. Big winners pay for so many experiments.” – Jeff Bezos

In the short run, the market is a voting machine but in the long run, it’s a weighing machine.” – Benjamin Graham

Geniuses make complex things simple. Mediocre people make complex things more complex.

Warren Buffett, easily the GOAT investor, shared his philosophy in his folksy but brilliant Berkshire Hathaway Annual Reports (which was my MBA) and for those fortunate enough to make the pilgrimage to Omaha, at his shareholder meetings with sidekick Charlie Munger.

Some Buffett gems:

“Be fearful when others are greedy and greedy when others are fearful”.

“If you aren’t prepared to own a stock for 10 years, don’t even think about owning it for 10 minutes”.

“If past history was all that was needed to play the game of money, the richest people would be librarians.”

“It takes 20 years to build a reputation. It takes 5 minutes to lose it.”

“Predicting rain doesn’t count. Building an Ark does.”

And of course….”Rule #1 of investing…don’t lose money. Rule #2 of investing…don’t forget rule #1.

Buffett famously compared his investing philosophy to a punch card. The punch card approach means that you should approach your investing career as though you were holding a single ticket with 20 slots for each investment. Picking too many businesses to invest in (or selling too soon) is the biggest mistake you can make.

Julian Robertson, the patriarch of Tiger and its Cubs, said they were looking to invest in the 200 best companies in the World and short the 200 worst companies, that’s it.

Peter Lynch of Fidelity showed how a companies stock over time was essentially 100% correlated with its growth. Accordingly, the secret to success is focusing on investing in companies with the highest earnings growth for the longest time.

Apple Price vs. Normalized Diluted EPS (Annual)

Tesla Price vs. Normalized Diluted EPS (Annual)

Monster Price vs. Normalized Diluted EPS (Annual)

Ron Baron, who over 50 years has outperformed 99.9% of investors bets on people he thinks are extraordinary and holds on for the ride. He literally did this with TESLA because of his view on Elon Musk, and while he had to fasten his seatbelt, he’s made over $6 billion on that investment.

Making complex simple works beyond investing as well. Coach Holtz took a terrible University of Minnesota football team that had the worst record but the most sophisticated offense in America to a winner with a handful of plays and a no audible rule.

Ronald Reagan, like Walmart, said America would make more money in tax revenue by lowering the tax rate dramatically…and voila, tax revenues increased nearly 3X during his Presidency because business and people were invented to prosper. “Mr. Gorbachev, tear down this Wall” and 45 years of Communism came tumbling down without a shot fired.

With this in mind, we did our annual top performing stock analysis, looking for a simple recipe for spectacular success. These 25 companies had the highest total return from January 1st, 2013 thru December 31st, 2022.

What’s interesting isn’t who made the list, in hindsight you could probably guess many of them…but what’s interesting is how they got there.

The median stock of the Top 25 list appreciated 34% during that 10 year period, which isn’t so surprising as having that type of performance is how you are an All Star with over 4000 Companies.

That does mean with the Rule of 72 that the stock prices of this list nearly doubled every two years.

The median revenue growth was 25% which is both lower than what I’d expect based on prior years analysis and the median Price to Sales was 3.3X which is also lower.

The ending Price to Sales was 9.6X which contributed to the outperformance which was a combination of interest rates falling to zero (making future growth more valuable and a handful of companies being reevaluated by the Market for its future growth prospects i.e. NVIDIA and Lattice Semiconductor).

The median market cap of $619 million at the beginning of the period is consistent with what we’d expect and past analysis.

2012 to 2022 Top Performers - Median Statistics

2012 Market Cap: $619M

2022 Market Cap: $18B

Stock Return: 1711%

Stock Return CAGR: 34%

Revenue CAGR: 25%

2012 P/S: 3.3X

2022 P/S: 9.6X

Individually, TESLA stock CAGR was 49% but its revenue CAGR was even higher at 68% growth. Its Price to Sales went down from 9.3X at the beginning of the period to 5.2X.

Netflix stock appreciated at 36%, doubling every couple years. While its revenue growth was “only” 24%, its EPS growth was a 76% CAGR.

Diabetes hero Dexcom stock grew at 42% corresponding with it’s 40% revenue growth.

Our conclusion is that if we want to pick the winners 10 years from now:

We should identify companies we think can have the highest revenue growth for the longest time.

We should focus on smaller cap companies as over time, size forges an anchor to growth.

We know that over a long period of time, return and growth come together, almost by definition. Moreover, from an investment philosophy standpoint, there’s two key fundamentals….Growth + Time = Big Winners.

We’ll call this the Einstein Rule – not because of the Theory of Relativity, but because of Einstein’s love of Compound Interest.

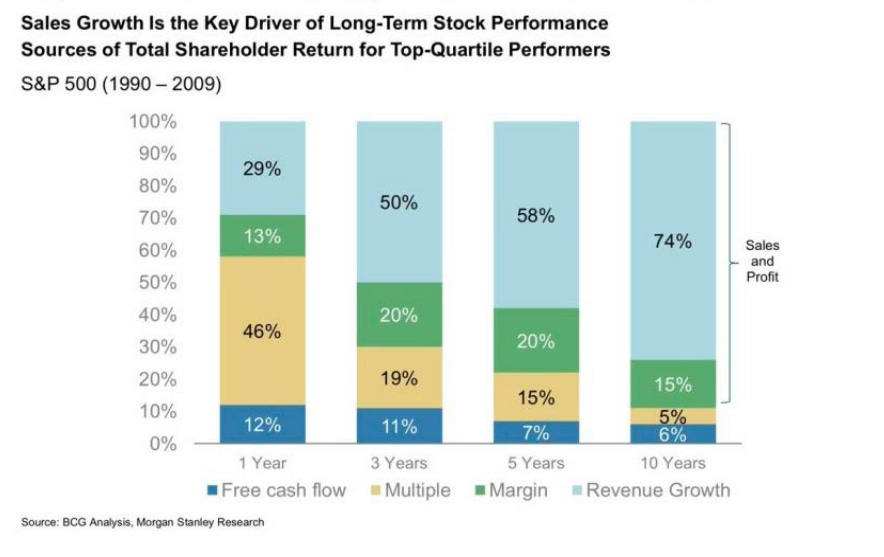

The first fundamental is hyper-growth, as we want to focus on companies that can consistently compound at a significant rate for decades, not merely quarters. In 10 years, topline growth accounts for nearly 75% of long-term stock performance.

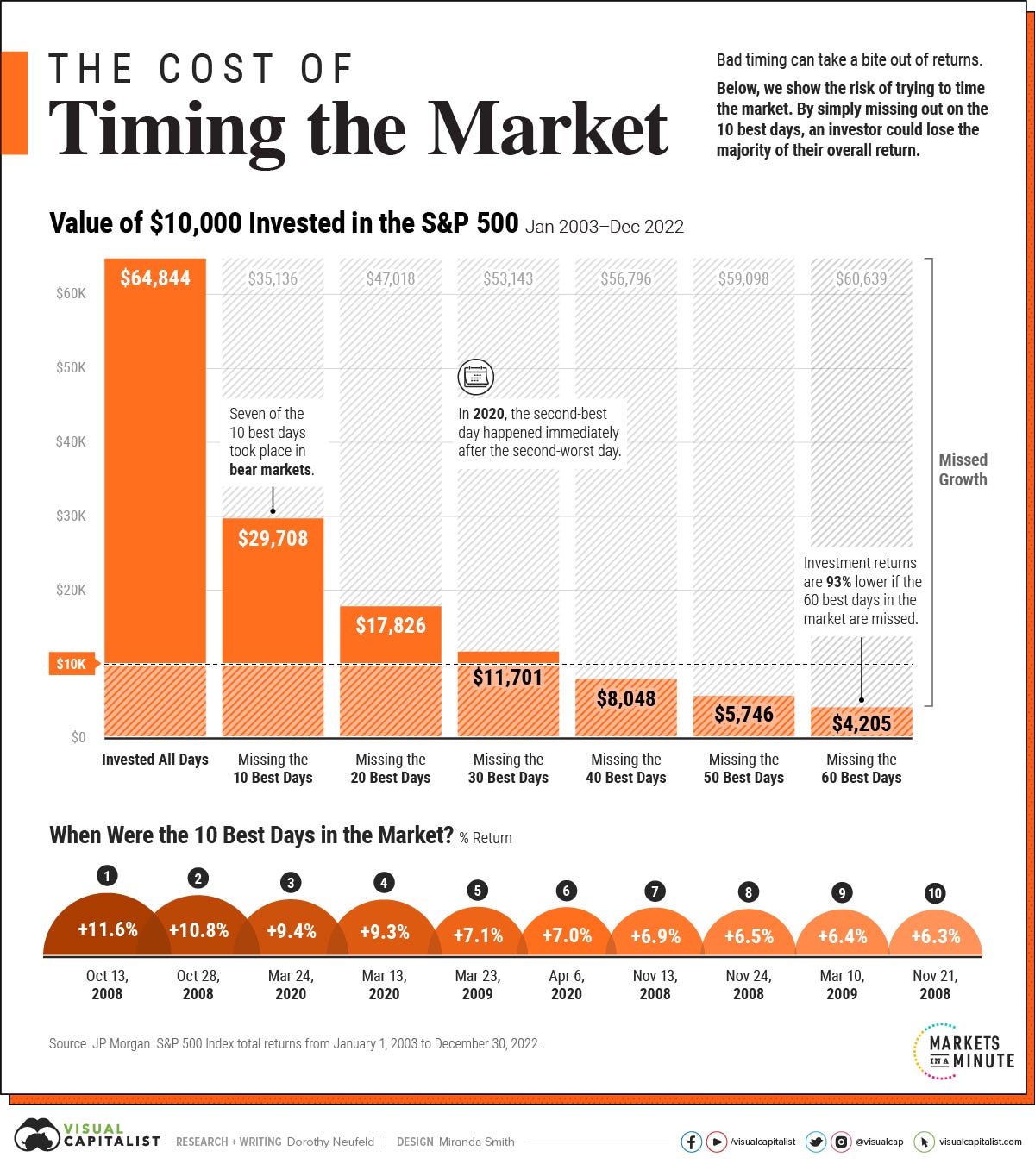

The second fundamental is time, not timing …aka staying out of the way as we let compounding do its magic. Having a positive return on any given month or quarter is essentially a coin flip. But the longer the holding period, the more likely you are to have a positive return.

The success of the Einstein Rule comes down to simple math. If you invest $1 in the S&P 500 ( 8% annual revenue growth) versus a compounder (30% revenue growth) for 20 years, your dollar is worth $4.66 vs. $190.05.

All of this sounds simple, but it’s easier said than done. The combination of the Internet and free trading commissions via platforms like Robinhood have reduced the average holding over the past 50 years from 5 years to 10 months…and blurred the lines between investing and gambling.

We zig while others zag, and while the world becomes increasingly short term, we’re doubling down on finding long-term winners. Over the past forty years, the variance in the S&P 500 over one year is nearly 100% (from -43% to 61%). But over time, this decreases to 5%, right between the long-term return of 10%.

The one investment that most Americans do “buy and hold” is their home. There’s a lot more friction to selling real estate vs. a stock…you don’t have an up-to-the minute appraisal tracker for your house. The average holding period is 12 years for a house vs. <12 months for a stock.

Dow 1,000,000

Earlier this summer, Ron Baron shared on CNBC that he thinks the Dow will hit 900,000 in 50 years. That may sound hard to believe given the Dow is at 34,500 as of today.

But when you break it down, Dow 900,000 is maintaining growth at 7% or higher (aka doubling every decade). Going back 50 years, it seemed outlandish to say Dow 34,500….because it was 925 in 1973.

We’ll one up Ron and go with Dow 1,000,000 by 2073.…7% growth for 50 years.

There’s no doubt that there will be wars, panics, pandemics, and inflation along the way, but in the long term, things will continue to be up and to the right…and correlated with the growth of the world’s best companies.

So what will Dow 1,000,000 in 2073 look like? Tune in next week for our History of the Future…

Market Performance

Unlike most of the Country, stocks have cooled off over the past month. Last week, the Dow was down 2.2%, the S & P 500 2.1% and NASDAQ declined 2.6%.

Pundits point to rising interest and mortgage rates, problems in China and the bloom coming off the generative AI rose. Moreover, the ever popular FAANG stocks are down 11% in the past month. Our view is that it’s healthy and probably needed to take a bit of Summer break with NASDAQ being up nearly 40% by the end of July.

In trends we continue to monitor, more data came out last week from LinkedIn saying that recruiters were 5X more likely to hire somebody based on their skills than the level of their degree. Microsoft and Google are two of the latest former degree snobs who have done away with that requirement.

Lot’s of action in the electronic vehicle arena. GM’s EV Cruise was recommended to reduce its fleet by 50% in San Francisco after one of its vehicles crashed into a Fire Truck. The CEO of Ford Jim Farley said they needed a “reality check” following his ill fated Route 66 trip with the F150 Lightening pickup that only could give him a 40% charge after 45 minutes.

On the other side of the mountain, CATL said it had a breakthrough with its battery technology which results in getting a 250 charge in 10 minutes…good news for TESLA which announced it was lowering the price $10K on its popular S model. And defying SPAC gravity, Vietnamese EV Maker VinFast IPO popped 255% giving it a market cap larger than Ford and GM combined.

Our view remains cautiously optimistic and hyper focused on hyper growth and sustainability of that growth overtime. Giddy up!

The Weekly Rap

Need to Know

READ: Head of the Class | No Mercy / No Malice

LISTEN: Transcript: Ted Seides - The Big Picture

WATCH: PandoMonthly: Fireside Chat With Spotify CEO Daniel Ek

READ: The Majority of Top Performing IPOs Were Never Unicorns

WATCH: A Fireside Chat with Benchmark General Partner Peter Fenton

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: Yardeni

#2: IPO Market

Cava backed up its hot IPO with a strong earnings season debut. Net sales soared 62% to $172 million while traffic grew 10%. Cava plans to open between 65 to 70 new locations next year. Meanwhile, Vietnamese EV Maker VinFast IPO popped 255% in its debut, giving it a market cap larger than Ford and GM combined.

Source: Renaissance Capital

#3: Interest Rates

Fed officials see “upside risks” to inflation possibly leading to more rate hikes, with Fed September Rate hike bets raising to 39%, up from 10% before the FOMC meeting.

Source: Atlanta Fed

#4: Inflation

Inflation ticked up to 3.2%, up from 3% in June. The monthly figures for both headline and core inflation were in line with Wall Street expectations.

Source: Koyfin

Chart of the Week

Chuckles of the Week

EIEIO…Fast Facts

Entrepreneurship: 24 – number of IPOs in the last 2 years with >50% gain (Sam Lessin)

Innovation: $6.7M – average sales per Chick-fil-A store (QSR Magazine)

Education: 43% – percent of full-time college students that work while enrolled in college (Fortune)

Impact: 80% – percent of school-aged Afghan girls that are out of school (UNESCO)

Opportunity: 15 – number of billionaires in the US 40 years ago (Forbes)

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…. EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM