GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: 1 in 10 – of all small businesses in the US are in the state of Texas. (USA Today)

Innovation: $160 billion – what SoftBank's NVIDIA shares would be worth today if it still held them instead of selling its entire position for $3.6 billion in 2019. (Fortune)

Education: 2 per month – the rate at which private colleges are closing nationwide. (AP)

Impact: 100 years - the amount of time for which the energy in U.S. nuclear waste could power the entire country with clean energy. (CNBC)

Opportunity: 0.6 milliseconds - the latency per prompt token for on-device inference on iPhone 15 Pro. (Apple Machine Learning Research)

“First mover advantage doesn’t go to the company that starts up…it goes to the company that scales up.” – Reid Hoffman

“Being too early is the same as being wrong.” – Yours truly

“Pioneers take the arrows. Settlers take the land.” – Duncan Clark

Silicon Valley circa 2000 was a very different place than it is today. The dot-com bubble had burst but few people had realized it yet.

Steve Jobs had come back for his second tour as Apple’s CEO and while iconic, its market cap was only around $5 billion, vs. $3 trillion today. Few people had heard of Google, and it certainly wasn’t a verb yet.

Tesla was only a twinkle in Elon Musk’s eye and Mark Zuckerberg was in 10th grade. San Francisco was beautiful, but basically uninhabited by start-ups…the real technology businesses were in Santa Clara.

I was lucky to have moved south next to Palo Alto so my oldest daughter Maggie could be closer to her school. Soon after our move, I received an email inviting my daughter and me to attend a San Francisco Giants baseball game with other Sacred Heart dads and daughters.

I showed up at the Catholic school at 10 AM on Sunday and before I got on the bus, a dad with an Old Pro baseball cap flipped open a Bud Light and handed it to me, shaking my hand and introducing himself.

”Hi, I’m Bill Campbell.”

We sat next to each other on the way to the game and Bill asked me what I did for a living. I puffed my chest out and said “I’m the CEO of this new investment bank in San Francisco…blah, blah, blah.”

In turn, I asked him what he did. He said, “I’m retired.”

Well, then, what did you do?

“I worked in the software industry.”

Really, who did you work for?

“Intuit.”

What did you do there?

“I was the CEO.”

With each answer, I slumped further and further into my chair.

As we walked into the game, everybody at the stadium knew this guy. The person taking the tickets, the hot dog salesman, the President of the Giants…everybody.

Thus began a fifteen-year friendship with the man later dubbed “The Coach of Silicon Valley.” A book was later written about Bill called Trillion Dollar Coach.

Bill earned these nicknames because he was the coach of the who’s who of Silicon Valley…Steve Jobs, Eric Schmidt, Jeff Bezos, Larry Page, Marc Andreessen, and so on. Earlier in life, Bill had been the head football coach at Columbia University. That turned out to be not such a great gig (the Lions aren’t particularly known for their dominance on the gridiron), and when his wife told him it was time to get a real job, he moved west to work in Silicon Valley.

Bill had a thousand best friends, but his closest friend was a native San Franciscan named Mike Homer. Mike was a true visionary and the most fun guy you could ever be around.

Mike and Bill worked at Apple together in the early days where Mike’s job was to make sure Bill could get his Mac to work. Mike was also the technology advisor to Apple’s CEO John Scully.

In the early 90s, Bill and Mike were Batman and Robin at a hot startup called “Go Corp” which was bleeding edge technology but while the leader, it was too early. Coach used to call that episode “Going, going, gone.”

Mike was then brought into the early days of Netscape as VP of Marketing and was responsible for creating the business plan. The Netscape Navigator made it easy for mere mortals to access the World Wide Web and a year after the company was launched, it went public with a $3 billion market cap.

At the time of the IPO in August 1995, Netscape had a 90% market share of the Internet browser market. Bill Gates famously downplayed the potential of the Internet in his 1995 book “The Road Ahead” and Internet Explorer wasn’t even incorporated into Windows 95.

Gates had an “Oh shit” moment that caused him to quickly about-face and go all in on “the Browser Wars”. Microsoft used its desktop franchise and superior resources (including being able to provide Explorer for free) to take the oxygen out of the room. By 2001, Microsoft’s browser market share was over 90%.

Mike was an advisor and investor in TiVo – the pioneer in digital recording of TV programs. To combat this wildly disruptive idea, cable companies quickly developed their own TiVo killers, resulting in TiVo being left in the dust.

Mike came into my office at ThinkEquity in the early 2000s with his new video platform, Kontiki. We were early adopters of Kontiki and loved the vision of how we could publish our research and management presentations on video over the Internet. At the time, the maximum length of a video was a couple of minutes, and even that was challenged.

YouTube launched in the spring of 2005 and Kontiki was sold in 2006 for $62 million. Today, it’s estimated that YouTube is worth $400 billion.

Tragically, Mike died at the age of 50 of a rare brain disease called Creutzfeldt-Jakob in 2009 and Bill Campbell died of cancer in 2016.

Before Facebook, there was Friendster and MySpace. Friendster's user base unexpectedly shifted to the Philippines before the platform's eventual demise and MySpace was bought by Rupert Murdoch for $580 million. Facebook (Meta) is worth $1.3 trillion today.

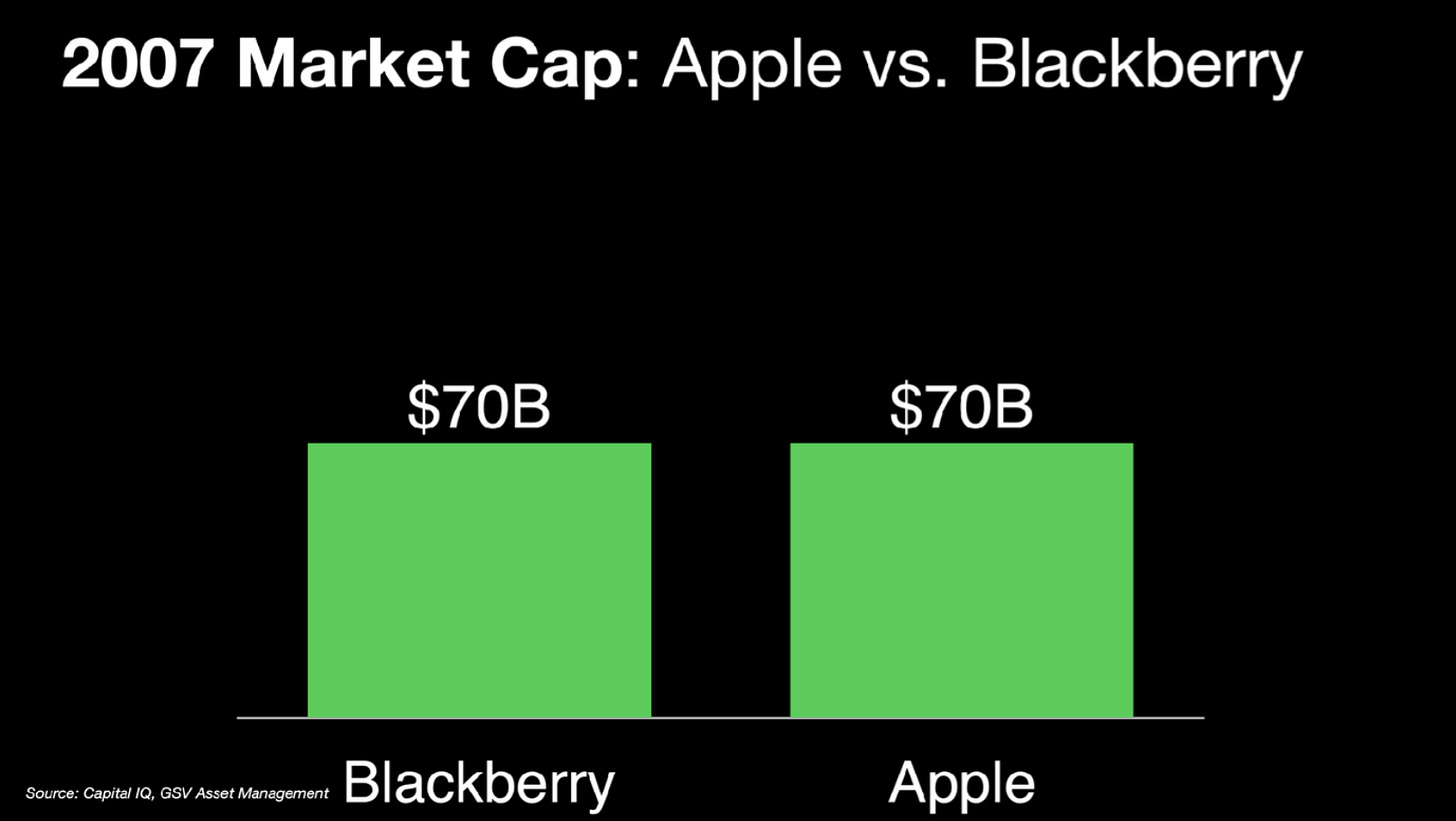

Apple didn’t make the first smartphone, there were many before it. When the iPhone was introduced in April 2007, Apple and BlackBerry had the same market cap of $70 billion. BlackBerries were so popular its users referred to them as “Crackberries.” Today, Apple’s market cap is $3.2 trillion, and BlackBerry’s is $1.4 billion.

In the world of Search, Yahoo, Lycos, AltaVista, and Excite all came years before “BackRub” a.k.a. Google was started in Ester Wojcicki’s Palo Alto garage in 1998. Today, Google has over a 90% market share in Search.

Like the Internet, Artificial Intelligence has been around far longer than most people recognize. In 1950, Alan Turing introduced the 'Turing Test' to evaluate a machine's ability to exhibit intelligent behavior indistinguishable from that of a human. John McCarthy coined the term “Artificial Intelligence” in 1956. At GSV, we’ve invested in a number of AI enterprises over the past 15 years including Palantir, Dreambox, and Photomath. We were writing about generative AI five years ago.

It wasn’t until OpenAI introduced the general public to ChatGPT on November 30th, 2022 that people started to understand that we weren’t in Kansas anymore. The now famous adoption curve shows that ChatGPT reached 100 million users faster than any technology in history…in a mere 8 weeks.

ChatGPT was a magic trick that nobody had seen before, and it changed everything overnight. Over the 18 months that followed, OpenAI raised tens of billions and soared to a valuation of almost $90 billion.

The gold rush was on, with generative AI companies raising $22 billion in 2023.

In tandem, market values swelled. As of the end of April, there were 37 generative AI unicorns globally.

We have views on how AI will impact the future and key themes we’ve developed but we’ll share that in future EIEIOs.

Today, we want to share our general map of the AI pyramid and where we think the greatest risk-adjusted returns will be found.

Heretofore, most of the capital and excitement has been focused on the foundation layer of the Large Language Models (LLMs) and below.

There is a reason why NVIDIA has become one of the three largest market cap companies in the world in the past couple of years, seemingly from nowhere, due to its 80% market share position in data centers and producing the GPUs necessary to power the AI models.

While it’s hard to be sure who will win the LLM Wars, one thing I do know is that there will be a lot of money made and a lot of money lost…and there will be a disproportionate gain to the winners.

We think the best investment opportunities will lie on the top of the pyramid at the apps and services layers – which also have the lowest capital requirement.

We will continue to utilize our “5P” framework of people, product, potential, predictability, and purpose as we look to identify and invest in who we believe will be the “Stars of tomorrow.”

As much as things are changing faster than ever, the fundamentals that make winning businesses will endure.

Our Foundational Themes for AI Businesses

Best Data Wins: Advantaged collection of high-value data.

Moneyball Everything: Real-time analysis that optimizes tasks and decision-making.

Time Dividend: Time compression and productivity unlock.

Merging of Worlds: Seamless toggle between physical and digital life.

Human Capital Unleashed: Learning and earning, optimized.

Problem Predictor: Identification of future issues + prescriptive solutions.

Personalize It: Education, wellness, finance, relationships.

Friction-Free: Removing the time, space, and cost associated with how we work and live.

Market Performance

Market Commentary

Stocks rose for the third week in a row with the Dow advancing 1.5%, the S&P 500 up .6%, and the NASDAQ flat.

We continue to look for a broadening of the market, of which we have seen glimmers, but despite the S&P 500 increasing nearly 15% this year, it’s still driven by a small number of AI plays.

Specifically, NVIDIA, Apple, and Microsoft have increased more in value in June than the other 497 companies combined in the S&P. Only 198 of the 500 are up in value despite 11 of the 13 days of the month having been positive. NVIDIA, which briefly became the highest-valued company in the World, has advanced 40% since reporting its blowout numbers a month ago.

India has clearly been the hot global market and has increased 110% since 2019. This contrasts with China stocks being down 30% in that same period and U.S. tech stocks up roughly 100%. While India’s stock market sells at a rich 23X forward earnings vs. China’s market selling below 10X earnings, EPS growth for Indian companies this year is 17%.

In other notable news, 77% of Tesla’s shareholders voted to pay the $46 billion his contract said he was supposed to get based on his performance. Last week also saw Tesla’s once-rival Fisker file for bankruptcy.

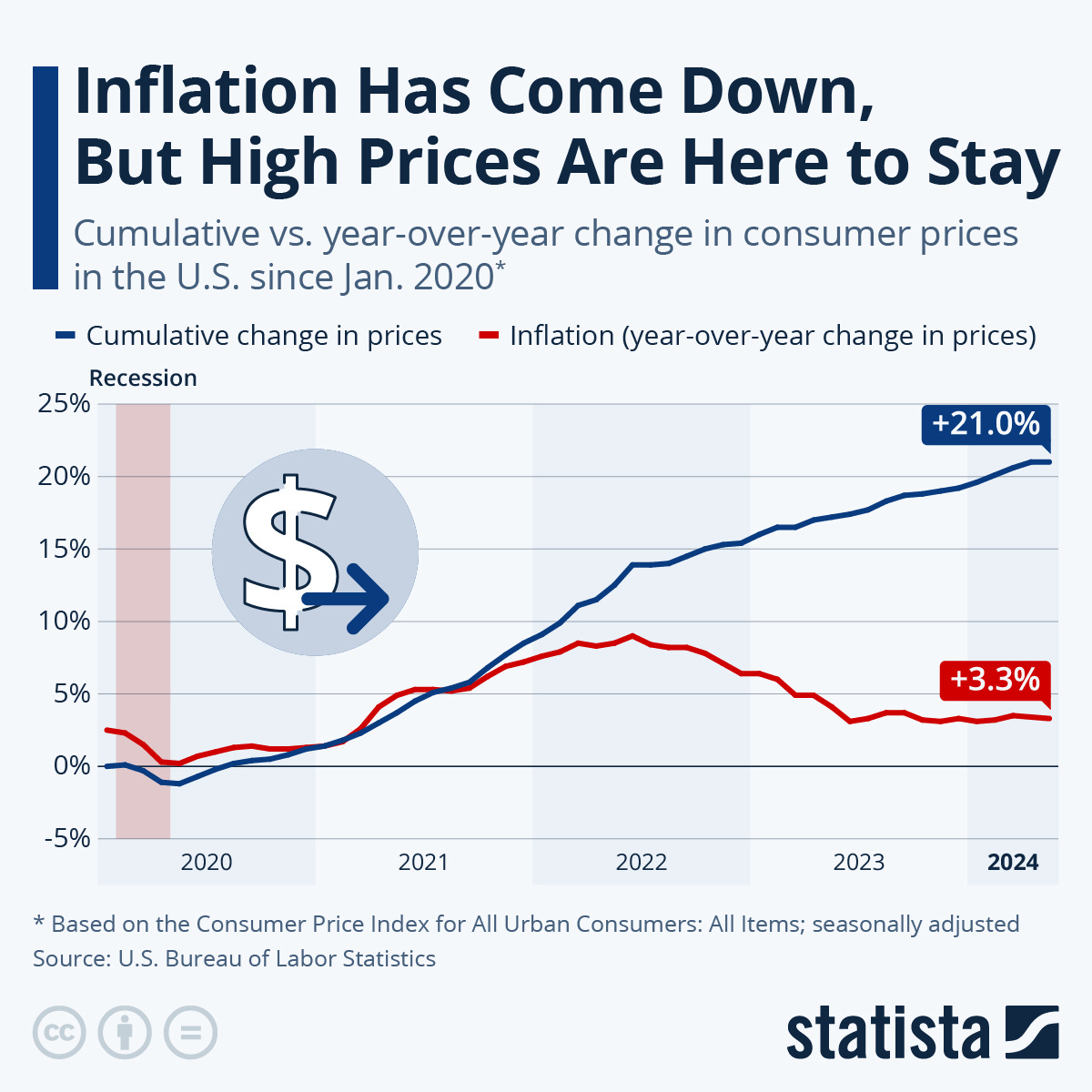

We continue to be BULLISH on growth stocks based on positive fundamentals and an inflationary environment that looks increasingly in check.

Maggie Moe’s GSV Weekly Rap

Need to Know

READ: U.S. Senate passes bill to support advanced nuclear energy deployment | Reuters

LISTEN: Pat Grady (Sequoia) - Relentless Application of Force | Invest Like The Best

READ: Surgeon general calls for warning labels on social media platforms | Axios

WATCH: In Conversation with President Trump | The All-In Podcast

READ: Anthropic has a fast new AI model — and a clever new way to interact with chatbots | The Verge

WATCH: Ep11. Coatue Conference Recap, Tesla & ISS Controversy | BG2 with Bill Gurley & Brad Gerstner

READ: AI Laundromat | No Mercy / No Malice

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

#3: Interest Rates

#4: Inflation

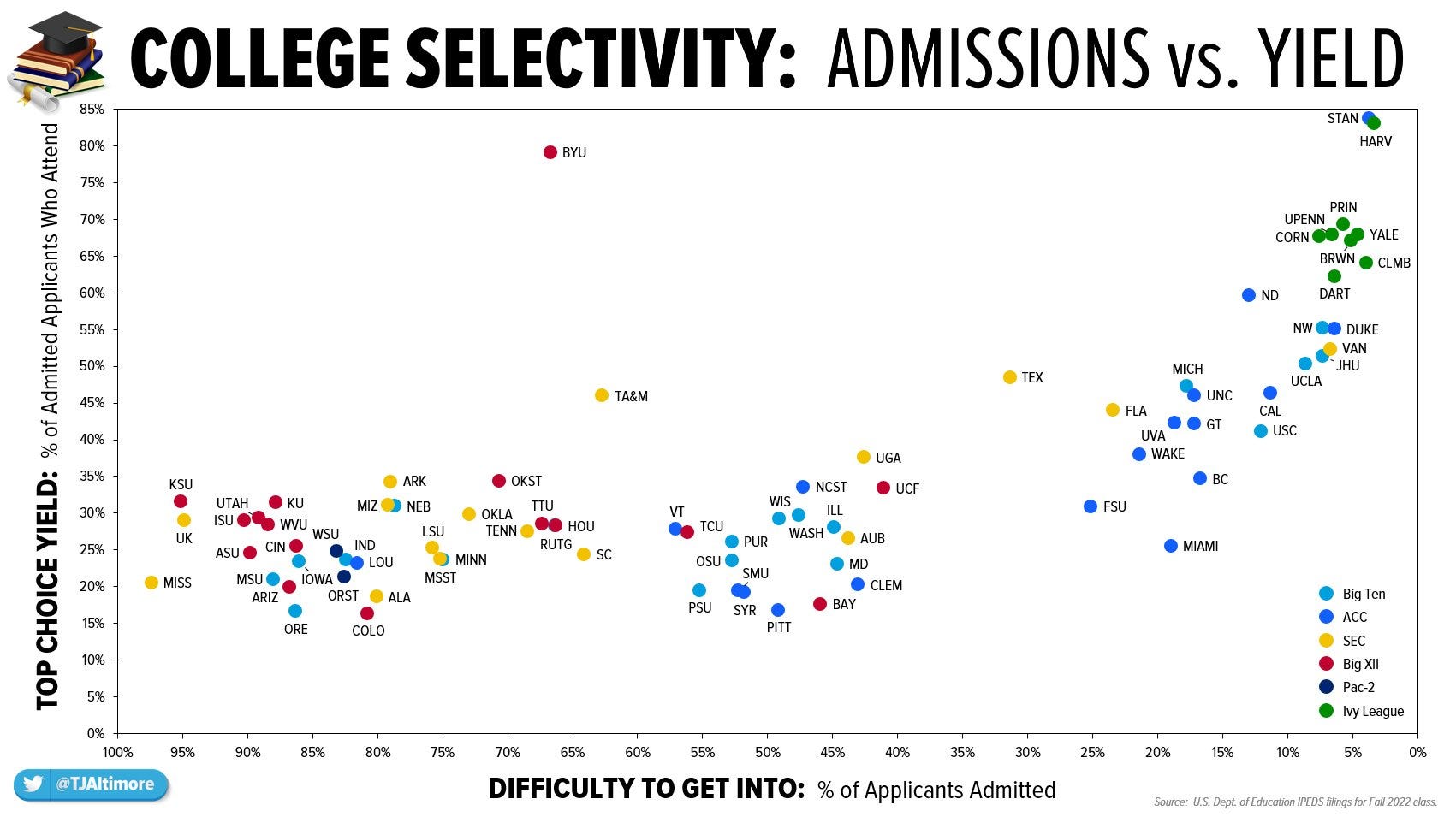

Chart of the Week

Chuckles of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup….EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM