GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: 65% – The percentage of Americans who had a “Great deal/Quite a lot” of confidence in Small Business in 2023, contrasting with a record-low 14% for Big Business. (Gallup)

Innovation: 77.8% – The percentage of programmers who believe AI code generators will improve code quality. (9vc9)

Education: 30% – The percentage of microschool founders who are neither currently nor formerly certified educators. (The 74 Million)

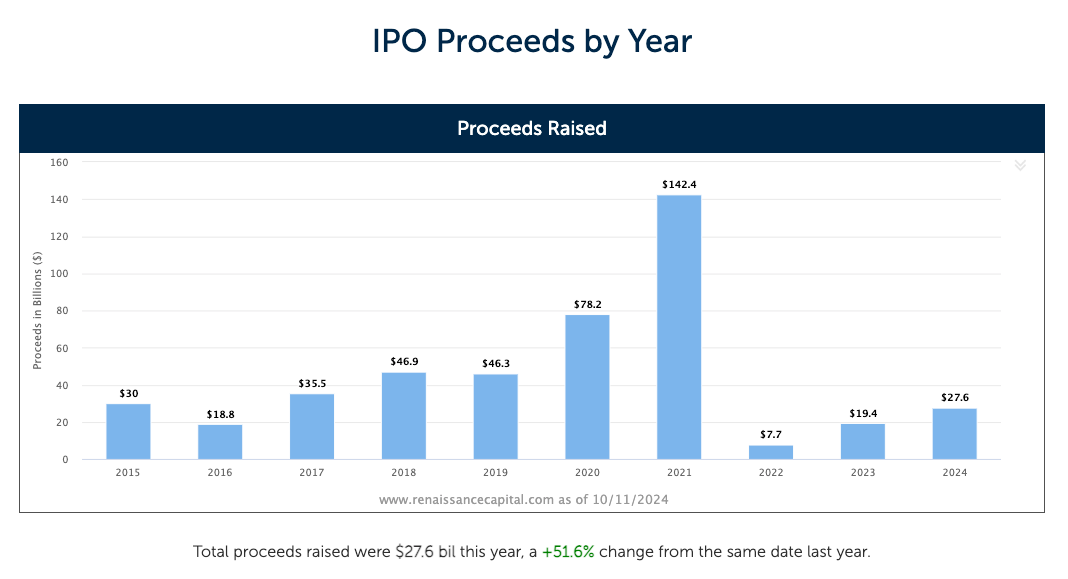

Impact: 8 – The US technology IPO count for 2022 & 2023, compared to 229 for 2020 & 2021. (Coatue)

Opportunity: 8 in 10 – The portion of people on Earth who will live in Africa and Asia by 2100. (Washington Post)

“A year spent in artificial intelligence is enough to make one believe in God.” – Alan Perlis

“It’s not the light we need but the fire. It’s not the gentle shower but the thunder. We need the storm, the whirlwind, the earthquake.” – Fredrick Douglas

“I am telling you, the world’s trillionaires are going to come from somebody who masters AI and all its derivatives and applies it in ways we never thought of.” – Mark Cuban

This iconic moment:

…Gave way to this iconic moment:

Stay with me.

Electricity was a discovery and innovation of seismic proportions. I don’t need to explain the myriad ways it changed life, but for one, we were able to stop relying on whale-based candlelight to illuminate our lives.

The entire utilities sector was born out of this invention. Many of today’s largest providers were launched in the late 19th and early 20th centuries, including Centerpoint Energy in 1882, Duke Energy in 1904, and Nextera in 1925.

These companies capitalized on this epic technological shift and became the foundation layer for the now-electrified world.

That said, the creation of the grid was the merely the tip of the spear for the innovations that would follow.

Electric air conditioning (invented in Willis Carrier in 1902) and the electric refrigerator (invented in 1913 by Fred W. Wolf Jr.) transformed the way we live, work, eat, and travel. Entire hubs were created as a result of climate control…do you think Vegas would be the tourist attraction it is today without AC?

Presently, the two largest US utilities providers, Nextera Energy and Southern Company, have a combined market cap of ~$265 billion.

Coca-Cola, a company that leveraged electric refrigeration to build its global kingdom, has a market cap of ~$300 billion.

The revolutionary technology always gets all the buzz, but it's the entrepreneurs who envision what’s now possible—things that were previously unimaginable—who drive the real action.

Earthquake-level innovations trigger aftershocks—creating entirely new sectors and markets. These ripples allow incredible value to accrue across emerging businesses in these nascent domains.

Earthquake:

ChatGPT 🤖 (2022)

When you see OpenAI raise a $6.6 billion round at a $157 billion valuation, that’ll catch your attention…but it’s what these foundations enable that should get you excited.

For comparative purposes, Google raised a total of $1.7 billion at the time of its IPO valuing the company at $25 billion just twenty years ago. Apple’s IPO brought in $100 million of equity and valued the company at $1.8 billion after its first trading day.

When OpenAI introduced ChatGPT to the outside world November 30th, 2022, the investment public thought that fire, the wheel and electricity were all made inconsequential in comparison. This “overnight” sensation was 70+ years in the making but the capital that has poured into large language models over the past 22 months is jaw-dropping.

While the unprecedented investments in LLMs, infrastructure, and chips may or may not prove to be wise long-term choices, I am confident that the AI tracks currently being laid will provide huge opportunities for entrepreneurs.

The $64K question – or maybe the $64 trillion question – is what can be built today that couldn’t have been built five years ago?

Market Performance

Market Commentary

Celebrating the anniversary of the two-year-old Bull Market, stocks moved higher last week for the fifth week in a row. The Dow led the way and was up 1.2% last week, the S&P 500 and NASDAQ both advanced 1.1%, and the small-cap Russell 2000 was up 1%. Over the past two years, the Market is 60% higher.

Earnings season has begun with JP Morgan and Wells Fargo pleasing investors with their results. Uber gapped up over 16% for the week, and Tesla dropped nearly 13%.

Stock action is very strong with 75% of the S&P 500 trading above their respective 200-day moving averages. But with the S&P trading at 22X forward earnings projections versus an average of 17.7X, upward moves from here will be mainly driven by earnings growth.

We remain BULLISH encouraged by good growth fundamentals, an improving economic backdrop, and a broadening of participation in the upward momentum of emerging growth stocks.

Need to Know

READ: It’s the creators’ economy, stupid | Hamish McKenzie

WATCH: How Couples Met (1930 - 2024) | James Eagle

LISTEN: #68: Google’s Antitrust Saga Continues… | More or Less

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

#3: Interest Rates

#4: Inflation

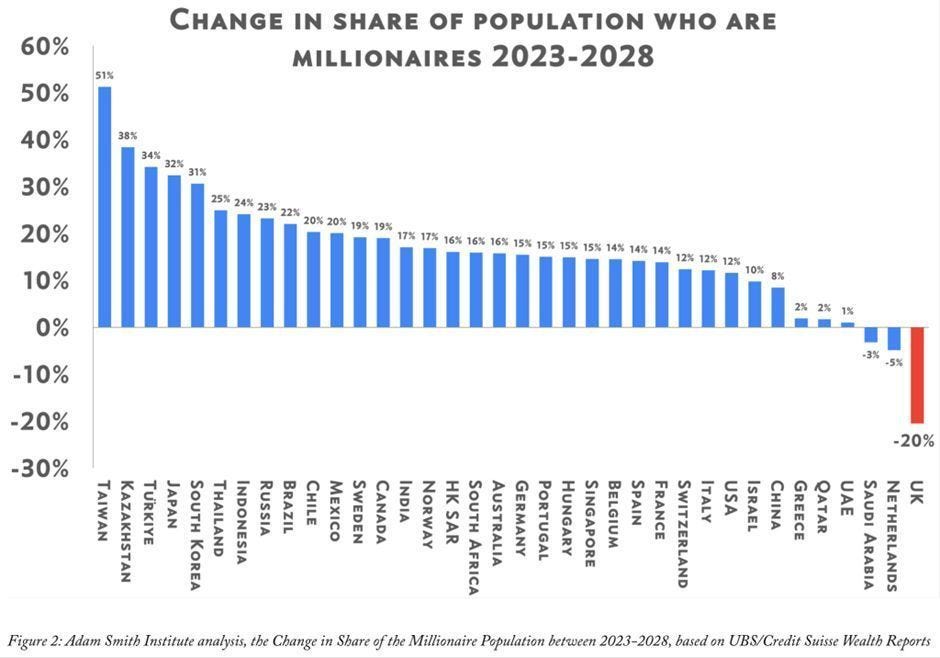

Charts of the Week

Maggie Moe’s GSV Weekly Rap

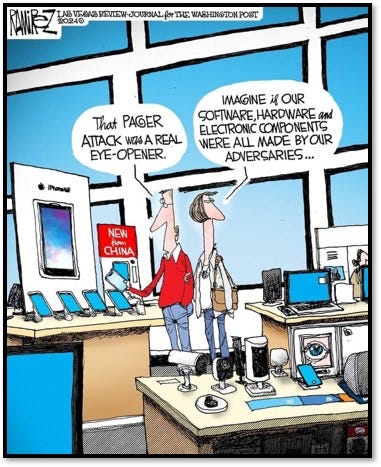

Chuckles of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup….EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM