GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: Nearly 1 in 3 – The portion of U.S. workers who are considering quitting their full-time jobs to pursue a side hustle. (Forbes)

Innovation: 68,656 – The number of records from the National Archives’ JFK Assassination Records Collection reviewed by Hebbia's Matrix product to pull evidence for and against conspiracy theories. (Hebbia)

Education: $200,000 - The annual family income below which Harvard will now provide free tuition to students. (AP)

Impact: $1.2 billion – The upfront payment Chicago received in 2008 for leasing its parking meters to private UAE-based investors, a deal that forfeits ~$150 million/year in parking revenue until 2083. Chicago currently faces a nearly $1 billion budget deficit. (The TRiiBE)

Opportunity: 56% – The percentage of U.S. engineers with Ph.D.s who were born abroad (Harper’s)

”I feel the need. The need for speed.” — Maverick from Top Gun

“Have you ever noticed that anybody driving slower than you is an idiot and anybody driving faster is a maniac?” — George Carlin

“Nothing travels faster than the speed of light with the possible exception of bad news, which obeys its own special laws.” – Douglas Adams

Last Tuesday, America celebrated as stranded NASA astronauts Suni Williams and Butch Wilmore safely splashed into the Florida Gulf following a nearly ten month extended stay in space. Unlike the S.S. Minnow whose “3 hour tour” turned into six seasons of Gilligan’s escapades along with his castaways due to a storm, Boeing’s Starliner problems were due to mechanical (man made) issues.

Humans have dreamed of going to space for centuries and it’s been part of mythology and literature such as Daedalus and Icarus. StarTrek and Star Wars inspired generations “To boldly go where no man has gone before”.

It wasn’t until rocket technology was able to develop powerful enough engines that could overcome Earth’s gravity that space travel became more than a figment of fantasizers’ imagination.

In other words, scientists needed to figure out a way to make rockets go faster.

The Starliner traveled at top speed of 17,500 mph. Comparatively, the fastest manned plane ever was the North American X-15 which was able to travel at Mach 6.7 or 4,520 mph. (In Top Gun Maverick, Tom Cruise got his plane up Mach 10.2 or about 7,680 mph which I chose to believe happened but experts say that would surely kill a person).

The need for speed has been true in almost every endeavor where throughout human history—nobody has ever demanded slower.

The fastest thing in the universe is the speed of light which is 671 million miles per hour. That’s nearly one million times faster than the speed of sound.

It takes light approximately 12 minutes to go from Earth to Mars. Today, the fastest a rocket can make it to Mars is 7 months. Elon is hoping with more advanced nuclear rocket propulsion, SpaceX can reduce it to as little as 80 days.

Cheetahs reach 75 mph when chasing dinner. Falcons can dive at over 200 mph when they spots their prey.

Elephants are 10-20x stronger than humans. An unarmed human stands virtually no chance of surviving a confrontation with a tiger.

We are amazed how smart chimpanzees and dolphins are but it’s estimated their IQ is around 25…about 1/4 the smarts of an average human.

Humans have become masters of the universe (as we know it) not because they are stronger, faster or more athletic than anything else, but because humans are smarter.

It’s an overused comparison but it’s still worth noting that the cell phone in your pocket is more powerful than the computers that first landed astronauts on the Moon 56 years ago. In fact, with the “brains” of the computer doubling every couple years, computing power is 1 trillion times greater today than it was in 1966 when Gordon Moore first made his prediction.

If Moore’s Law just continues for the next 10 years, computing power will increase 40X by 2035 (As an aside, it seems pretty crazy that 100% of the brains of the computer are manufactured 80 miles off the Chinese coast).

As we’ve noted in the past, we’re already at the point where technology is replacing the technologist. Artificial intelligence is going to disrupt every aspect of business as we know it.

A pessimist would say, “We are done, we are about to be conquered by the new king of the jungle: AI. Unemployment is going to skyrocket like it did in the Great Depression with at least 25% of the workforce wiped out. Thank God for Universal Basic Income because otherwise, we will all be starving with AI being our new masters.”

That’s one scenario.

My view is we are entering the most exciting time of human history with innovation and entrepreneurship accelerating at an unimaginable pace.

The AI Revolution is going to create a “time dividend” that individuals, enterprises and governments can use to advance humankind to new heights. “Multiplication by Division” will take Adam Smith’s concept of division of labor, aligned with “Man and Machine” partnering to create hyper-productivity.

Key to my optimistic vision is that we utilize AI to learn faster, cheaper and better…both changing the trajectory of acquiring knowledge and increase the access to it. To the cynics who say my optimistic view isn’t realistic, I say neither was putting people in space.

Moreover, the human spirit seeks purpose which comes from education and meaning through work. People rise to the occasion and opportunity.

Superman was faster than a speeding bullet, stronger than a locomotive, and could leap tall buildings in a single bound. We are about to enter the era of super humans which will be driven by learning at the speed of light, piggybacking off the magic of artificial intelligence, and realizing one’s God given potential.

Market Performance

Market Commentary

After four weeks of negative performance, stocks moved higher as the Fed left rates unchanged.

For the week, the Dow advanced 1.2%, the S&P 500 was up .5% and NASDAQ inched .2% higher. YTD, NASDAQ is down nearly 8%. Gold, the refuge in times of turmoil, rose above $3,000 for the first time in history.

It’s interesting but not surprising, the anchor on the market was the propellant over the past couple years…A.K.A…large cap tech…A.A.K.A…the “Magnificent 7”. Since January 1st, NVIDIA is off 12%, Google is down 13%, Microsoft has declined 7%, Amazon is down 10%, Apple is off 13%, and TESLA has collapsed—down nearly 40%. Only META is up for the year but just barely having increased its share price 2%. That’s a lot of market cap weighing down the market cap-weighted NASDAQ and S&P 500.

The battle front in the AI Revolution is focused on the AI Assistant with the major armies being built by OpenAI’s ChatGPT, xAI’s Grok, DeepSeek, Anthropic’s Claude, Google’s Gemini, Perplexity, and META’s Llama. Palantir (which is up 20% in 2025 after advancing 340% last year) Snowflake (which is flat YTD) and Databricks are helping companies with using their proprietary data and to build their own AI models.

While TESLA has suffered from consumers’ and countries’ protests of Elon’s DOGE activities, Chinese leading electronic car maker BYD hit new highs last week announcing that its cars can now be fully charged in 5 minutes. Another Chinese technology company XIAOMI (best known for making smartphones) now earns nearly 10% of its revenues from electric cars.

Private equity continues to find its way into sports with the San Francisco Giants selling 10% of the franchise to Sixth Street and the Boston Celtics being sold to group led by Bill Chisholm of Symphony Technologies but also included Sixth Street. The private equity + college sports tidal wave is coming.

In its biggest acquisition ever, Google announced it’s purchase of cyber security Wiz for $32 billion. Notably, two of Wiz’s big customers include Google Cloud rivals Azure and AWS. We are also closely following the expected IPO of NVIDIA-backed CoreWeave which rents NVIDIA GPU-equipped servers. Showing some investor hesitation, expected proceeds have gone from $4 billion to $2.5 billion.

We have been on BULL run for over 2.5 years, so the recent softness in the market is natural and healthy. Long term growth investors should view declines in leading companies as an opportunity to be able to BUY quality on “SALE”. How long we’ll be in a dead to down market is anybody’s guess. Signals we will look for include an emergence of new market leaders along with an IPO market that is robust with strong aftermarket performance.

Need to Know

WATCH: Inside the AI lab revolutionizing smell | ft. Alex Wiltschko

READ: The Implications of the Wiz/Google Deal | Tomasz Tunguz

LISTEN: E82: Fundraising in Bear Markets: How Nichole Wischoff Closed $50M | Turpentine VC

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

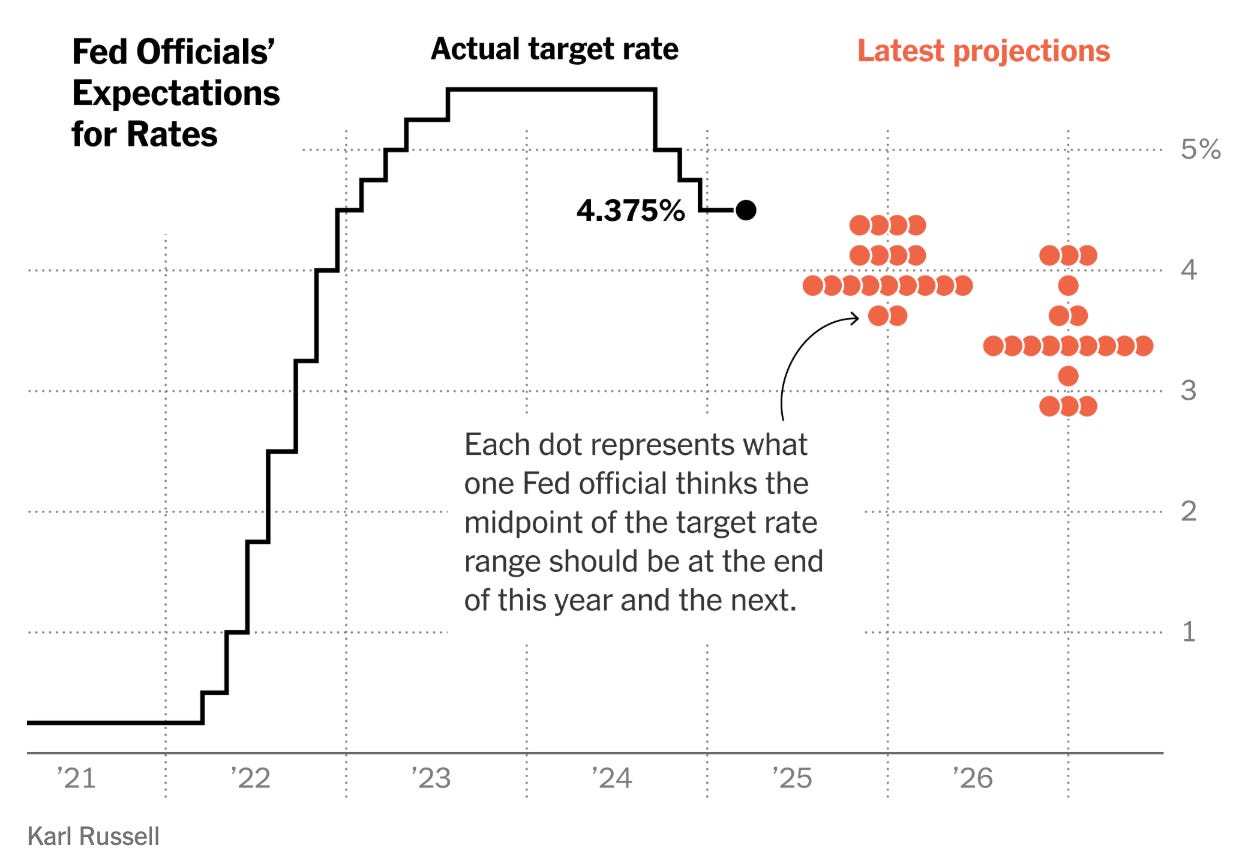

#3: Interest Rates

#4: Inflation

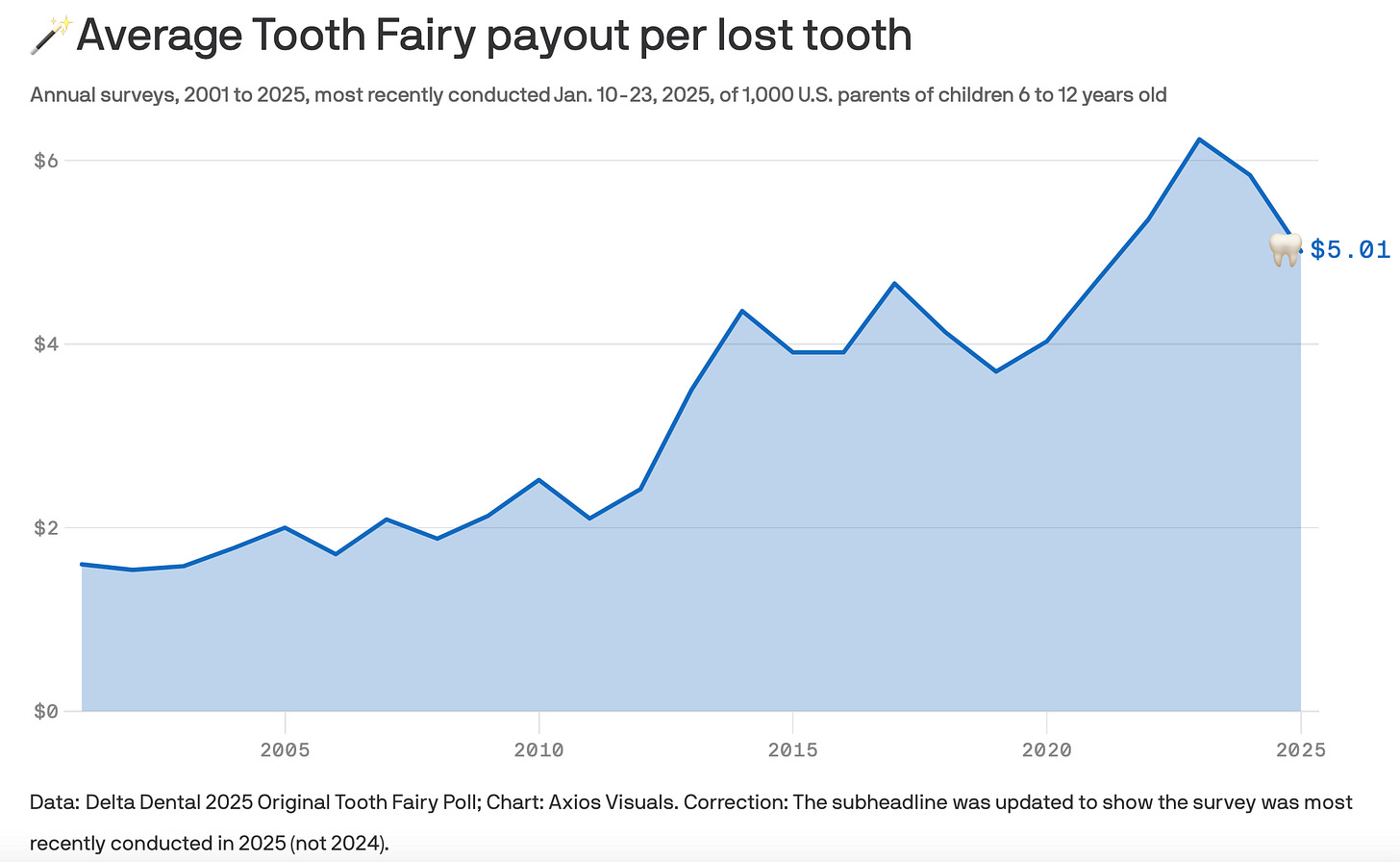

Chart of the Week

Maggie Moe’s GSV Weekly Rap

Chuckles of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM