EIEIO...Follow the Leader

Holtz, Schultz and Campbell

GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

“Where there is no vision, the people parish.” Proverbs 29:18

“A leader is one who knows the way, goes the way and shows the way.” John C. Maxwell

“You can get everything in your life you want, if you help enough other people get what they want.” Zig Ziglar

Three stories from my life…all of which have affected me profoundly.

Vignette #1.

It was the dead of winter 1984 in Minneapolis, and things were looking bleak. The formerly mighty Golden Gophers football team, of which I was a member, had just finished a season where we were the worst Division I football team in the country. Rice beat us. Northwestern whupped us. Nebraska destroyed us 84–13, and it wasn’t that close. Worse, the squad was in complete disarray. Fingers were pointed everywhere except inward. Fights would routinely break out amongst ourselves. White players ate with other white players. Black players ate with other black players. Nobody went to class. Drugs were everywhere.

Then, with a miraculous intervention, Lou Holtz was hired to be the head coach. He said when he was recruited to take the job, supersalesman Minnesota alumnus Harvey “Swim With Sharks” Mackay told him that the Gophers only lost to national champion Nebraska by 11… nobody told him it was 11 touchdowns!

We were all called to a meeting to introduce Coach Holtz, and as he walked into the room, people had their feet up on the desk, hats on backward, and were basically oblivious to the hurricane they were about to experience. Immediately, Holtz told people to sit up straight, take their hats off inside a room, and that being on time meant whenever he decided to start, which was usually five minutes early… instantly, the clock speed turned up for everything.

The first thing he asked us was, “How many people in the room think we can have a winning season next year?”

Remember, this was a team that was truly awful and got smoked by nearly everybody. So it wasn’t a huge surprise that, while most hands went up, not everybody’s did. The next question he asked was, “How many people think we can win the Big Ten Championship next year?” Maybe a third of us kept our hands up. Then, he asked, “How many believe we can win the Rose Bowl?” Maybe ten hands were still raised. Lastly, he asked, “How many think we can win the National Championship?” Two hands remained, and one of them wasn’t mine.

Coach then made a declarative statement: “If your goal isn’t to win a National Championship next year, you should leave now.” All of a sudden, somebody was in charge with a vision, an expectation of excellence, and a plan to get there. Yes, Coach Holtz was a phenomenal recruiter and said, “The heart and soul of the team needs to come from Minnesota, but the arms and legs need to come from somewhere else.”

Coach Holtz set seemingly impossible goals but had a very simple, clear philosophy we lived by:

Do what’s right

Do your best

Show people you care

Included in that simple framework was that everybody was expected to go to class and participate, and in fact, we had to have a signed sheet from our professor every week saying we were at class and we were involved. What did that have to do with winning football games? Nothing and everything. We had random drug tests. We had rules for our conduct, which included that you could go to a bar but you couldn’t wear anything with Minnesota Football on it. Our playbook went from the most sophisticated offense imaginable to basically six plays. But we were expected to run those six plays flawlessly.

What was the result? The team that was the laughingstock of college football, in two short years with basically the same cast of misfits, competed for a Big Ten Championship and won a bowl game.

The lesson? Leadership is everything, and little things make the big difference.

Vignette #2.

It was 1992, and I was a wet-behind-the-ears research analyst covering everything that moved between Minneapolis and Seattle. I was visiting companies in the Emerald City, and the last meeting I had for the day was this little coffee company off of Interstate 5. I was tired after a busy week and seriously contemplated canceling my meeting with Starbucks because the concept sounded ridiculous to me, and getting home early was alluring. Ultimately, I figured the company was on the way to the airport, and I’d make it quick.

The minute I walked in the door, I could feel something was different. The receptionist treated me like a best friend from high school. The energy in the building was off the charts. Then I met 38-year-old Howard Schultz, who had braces on his teeth but articulated this powerful vision of not only how Starbucks was going to have more units than McDonald’s, but how he was going to change the world one cup of coffee at a time.

It wasn’t about the coffee… it was about the community. One of the key ingredients of creating the “third place” was the people who worked there. Contrary to conventional wisdom, Howard’s philosophy was to put the employee first. Why? If they were happy, that would be reflected in how they interacted with customers. Schultz almost created a revolt on his board when he proposed giving even part-time employees health care because of the added cost. He showed that even if the added benefit reduced turnover by 15%, it would pay for itself. Starbucks’ employee turnover went from 150% to 50% and, at the same time, resulted in not just a monetary return on investment; he showed his people he cared, and in turn, customers received a superior experience.

There were maybe 50 Starbucks then, and few had heard of the company outside the Puget Sound area. Today, there are nearly 40,000 Starbucks, and it is a global iconic brand with roughly a $100 billion market cap.

The lesson? Leadership is caring about other people and having them thrive.

Vignette #3.

It was September 2002, and my oldest daughter, Maggie, had just started going to Sacred Heart in Atherton. I received an email from a father of one of Maggie’s new classmates saying that “dads and daughters” were going to a Giants baseball game to get to know each other. I show up at the Catholic school parking lot Sunday morning at 10 a.m., where a bus awaited to bring us to the game. A guy with blue jeans and an “Old Pro” baseball cap greets me, flips open a Bud Light, shakes my hand, and says, “I’m Bill Campbell, what’s your name?”

We sit on the bus next to each other on our way up to the game, and he asked me what I did for a living. I puffed out my chest and said, “I’m the CEO of this new investment bank in San Francisco… ThinkEquity Partners.” I then asked him what he did. He said, “I’m retired.” Well then, I asked him, what business were you in? Bill said, “I was in the software industry.” I then asked who he worked for. He replied, “Intuit.” What was your position? “I was the CEO.”

I’m now slumping in my seat, embarrassed by what a big shot I thought I was and not knowing I was sitting next to somebody who actually was important. We then get to the game, and everybody from the person taking tickets to the president of the Giants is giving Bill a hug.

Bill later became known as “the Trillion Dollar Coach” because he was the CEO whisperer to everybody from Steve Jobs to Eric Schmidt, Jeff Bezos, Larry Page, and Marc Andreessen. They called Bill “the Coach” because, before he became a Silicon Valley executive, he was the head football coach at Columbia. Not being a great gig, and with a young family, his wife told him to get a real job, and he ended up at Apple selling computers. The rest, as they say, is history.

We became friends from our shared passion for football and entrepreneurship, and I had the privilege of coaching 8th-grade boys’ and girls’ flag football with Bill for 12 seasons. Bill was arguably the most in-demand person in Silicon Valley, but from 4:30 p.m. to 6:00 p.m. in the fall and spring, he was over at Sacred Heart coaching kids. In a weak moment, Bill agreed to join my board at GSV Capital, which was humbling, for sure.

The magic behind Bill Campbell was he cared about people and didn’t care if you were the groundskeeper at the school or the CEO of a gazillion-dollar business. People loved him because he loved them, and he made you want to be a better person. Bill had a weekly “TGIF” at the sports bar he owned in Palo Alto called the Old Pro. The rules were you couldn’t talk business, you couldn’t talk politics, and you couldn’t be a “jagoff”… just enjoy each other. Bill had his rules for business and was very systematic in his approach to management, but what he did was motivate people to want to be their very best. He knew when to hug you after you made a mistake and when to kick you in the tail when you were getting too full of yourself.

The lesson? Leadership is truly caring about people, whether they can do anything for you or not.

For many years, I’ve had my formula for investing in the most dynamic growth companies in the world (the Stars of Tomorrow), which I call the “5 P’s”… People, Product, Potential, Predictability, and Purpose. While all the P’s are important, the paramount fundamental is People, and with People, it’s all about leadership. To find and invest in the Stars of Tomorrow, follow the leader.

Market Commentary

With NASDAQ up over 40% since the market low on April 8, and the S&P 500 up 30%, it’s natural and healthy to take a breath. Accordingly, last week stocks mainly took a step back, with NASDAQ off 0.7%, the S&P down 0.3%, and the Dow Jones Industrial Average fractionally off 0.1%.

The big news last week was NVIDIA’s announcement that it was investing up to $100 billion into OpenAI. On the surface, the $100 billion seemed outrageous because: 1) that’s a lot of money, and 2) at quick glance, NVIDIA has “only” $57 billion of cash on its balance sheet.

Upon deeper analysis, NVIDIA has actually generated $112 billion of free cash in the past six quarters and has also bought back $58 billion of stock. Bears say the deal is simply vendor financing and circular. Bulls say the investment could generate up to $500 billion in revenue for NVIDIA. NVIDIA’s track record looks good, with its investment in CoreWeave a grand slam home run.

Memory chip maker Micron delivered huge results driven by AI data growth. For the quarter, revenues were up 44% and EPS surged 157%. President Trump signed an executive order to allow a group led by Oracle to buy TikTok from its Chinese parent, ByteDance. Also rumored to be included in the deal are Andreessen Horowitz, Abu Dhabi’s MGX, and Silver Lake.

Amazon was ordered to pay $2.5 billion for using deceptive methods to secure Prime memberships. Electronic Arts was rumored to be going private at a $50 billion takeout price.

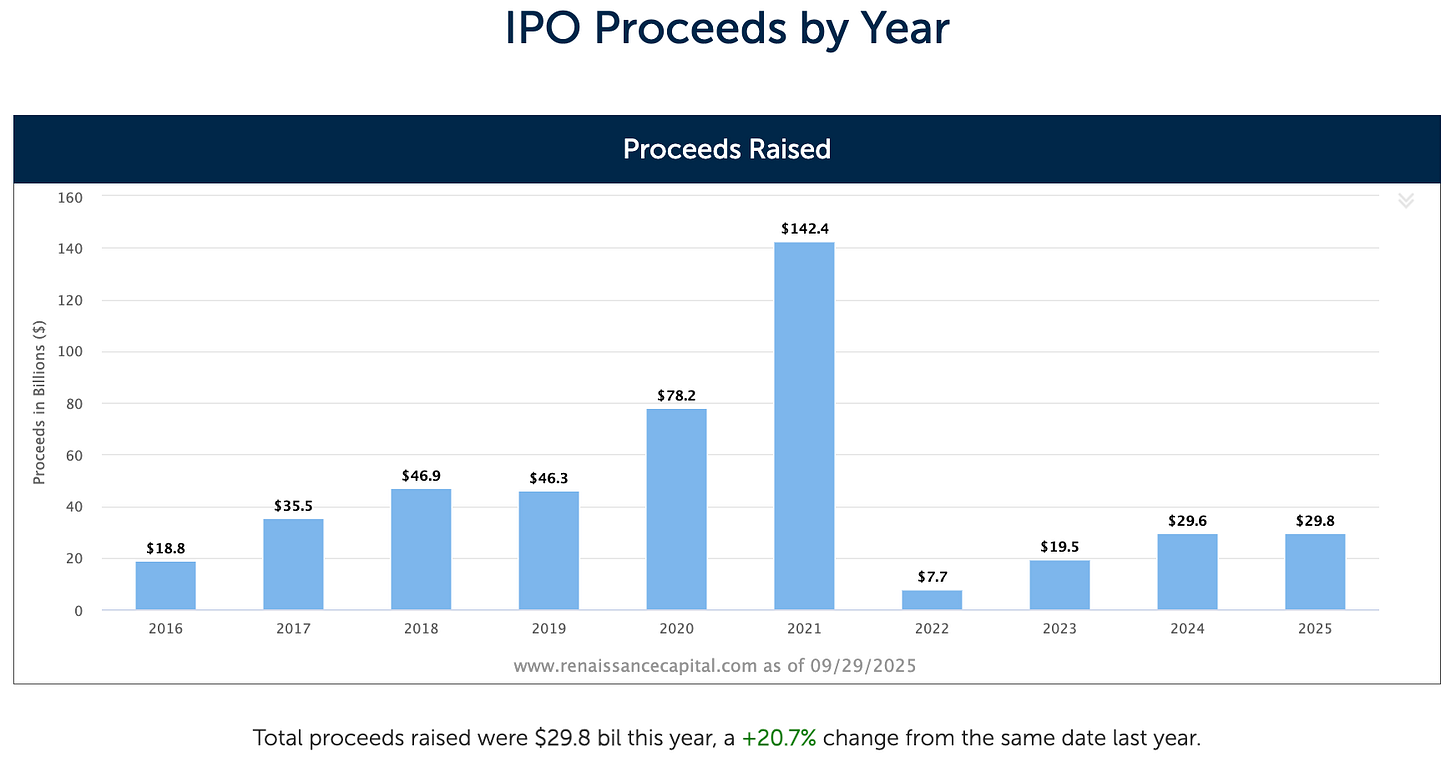

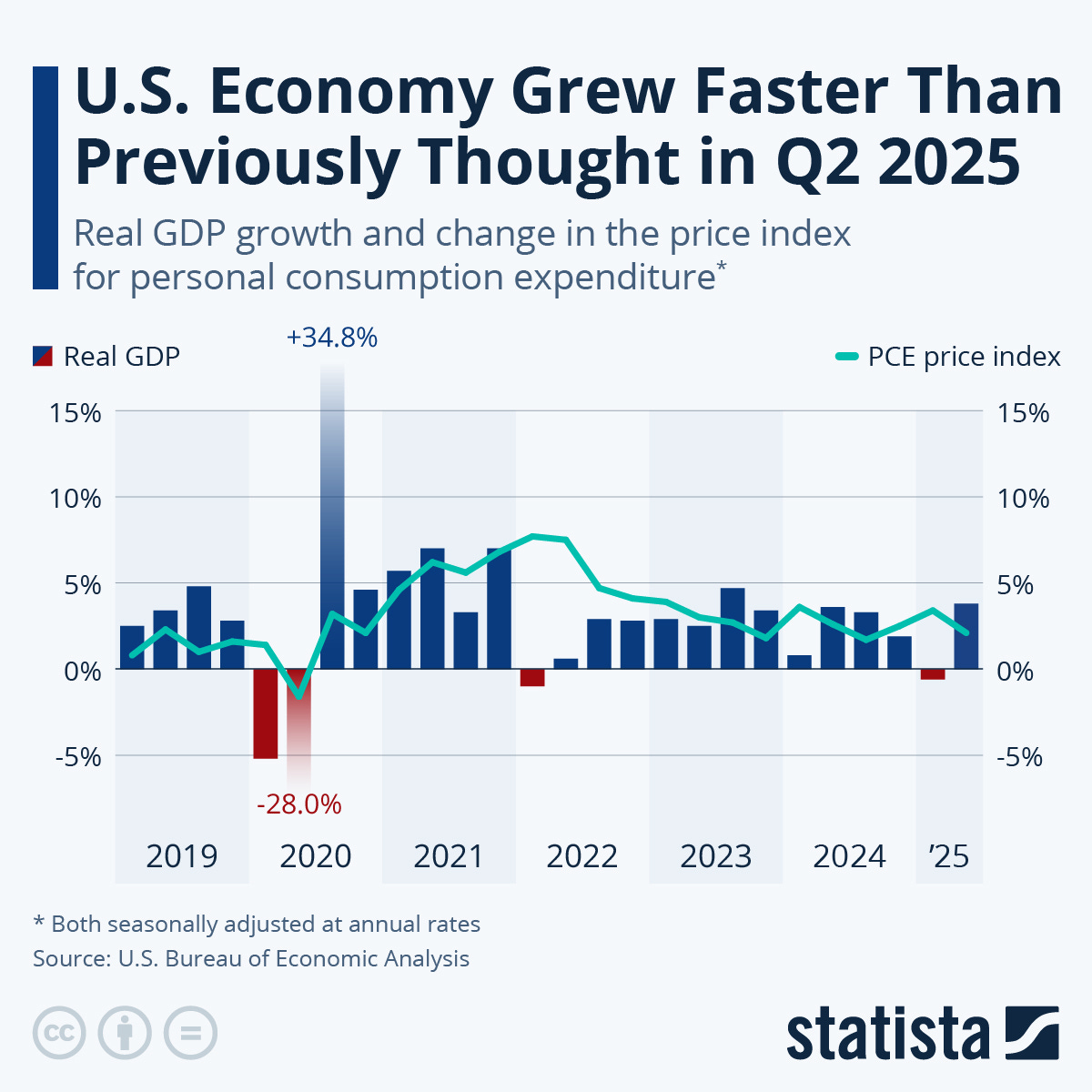

Economic growth led by consumers appears to be strong, with tame inflation giving us a backdrop that we think continues to be favorable for growth companies. We also expect to see a robust IPO market that provides fresh names for investors. Accordingly, we remain BULLISH. 🐂

Need to Know

READ: Opportunities Live Between Fields of Expertise | David Haber

WATCH: How Successful Entrepreneurs Manage Time | Kevin O’Leary

LISTEN:

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

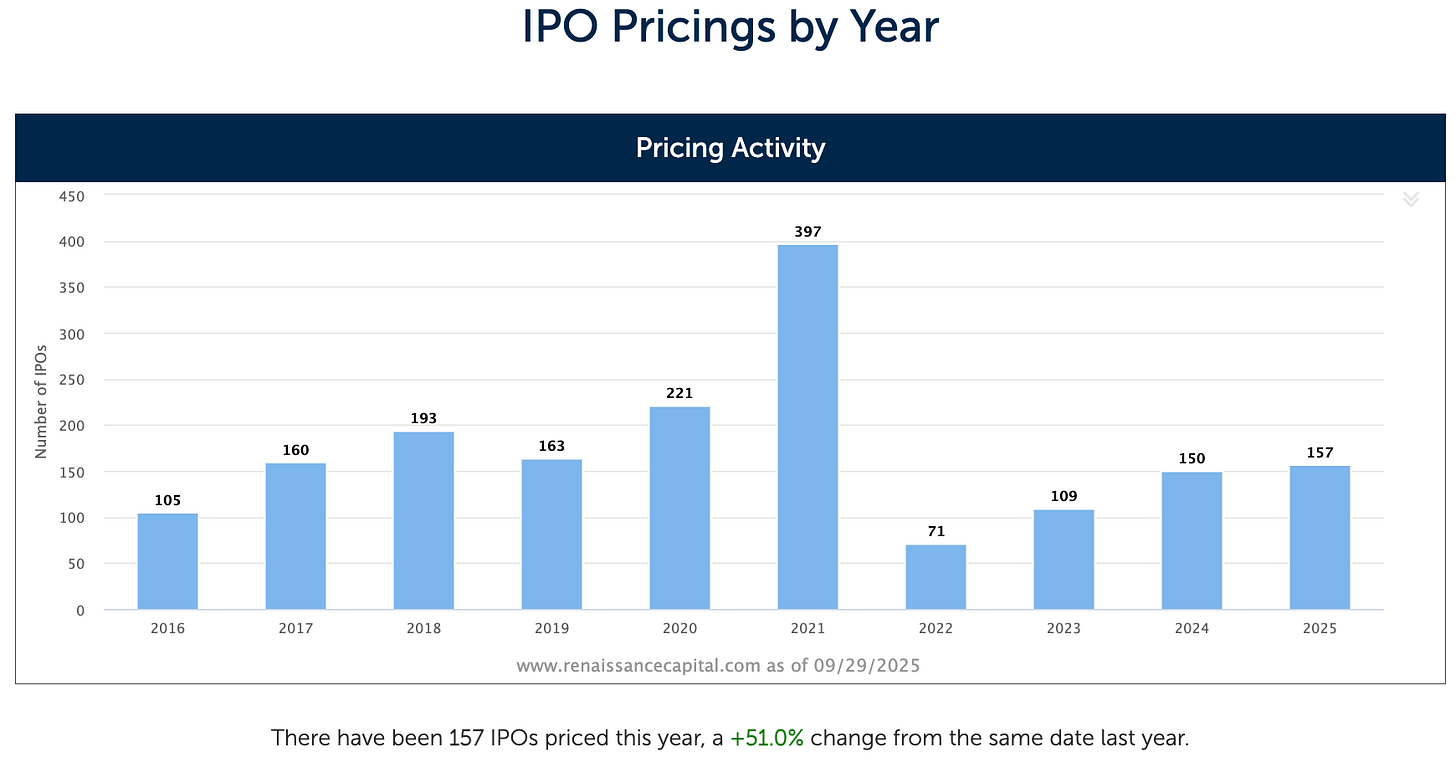

#2: IPO Market

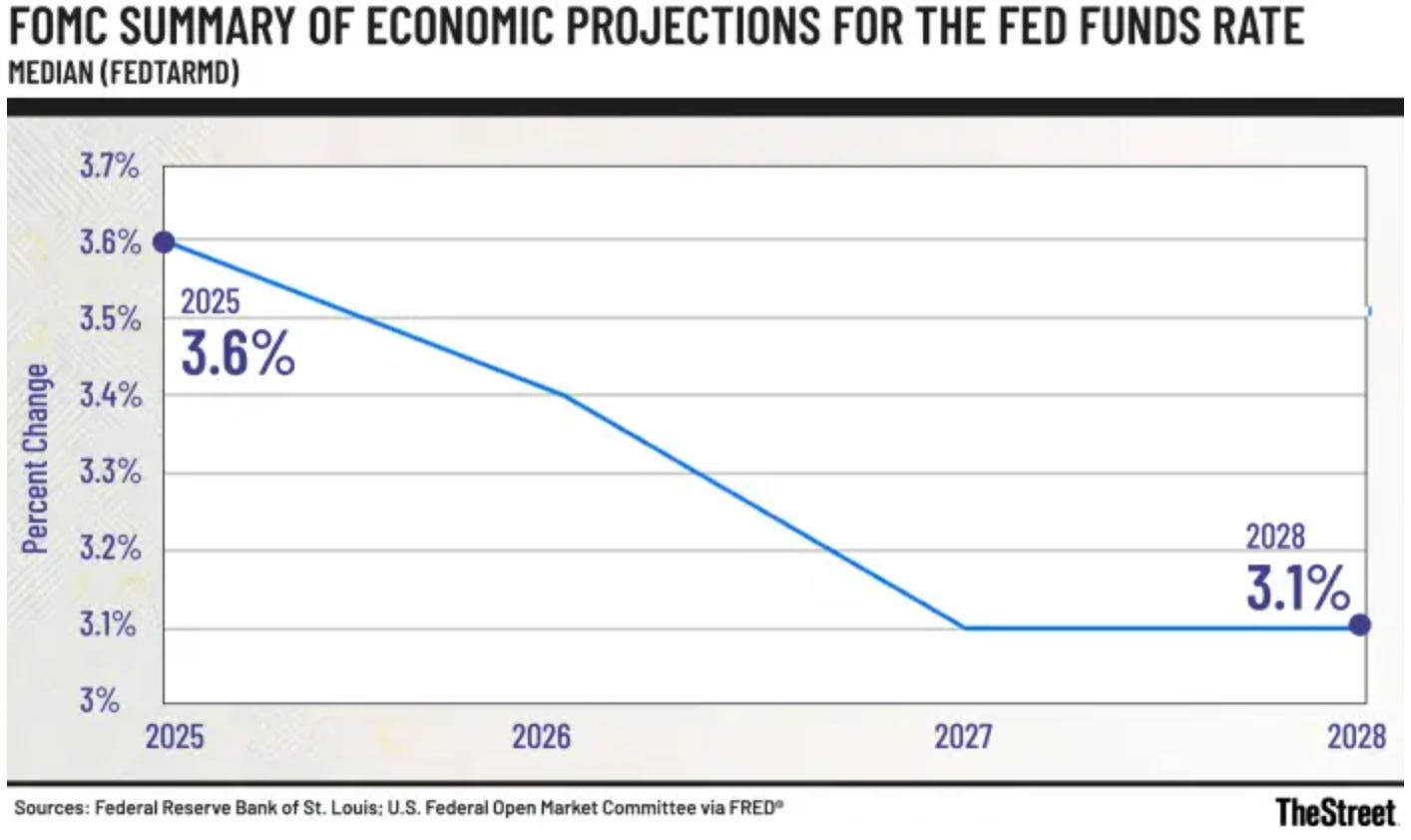

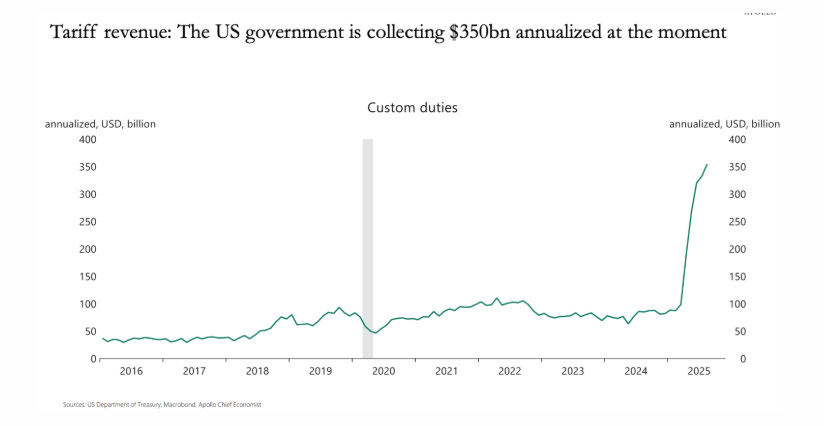

#3: Interest Rates

#4: Inflation

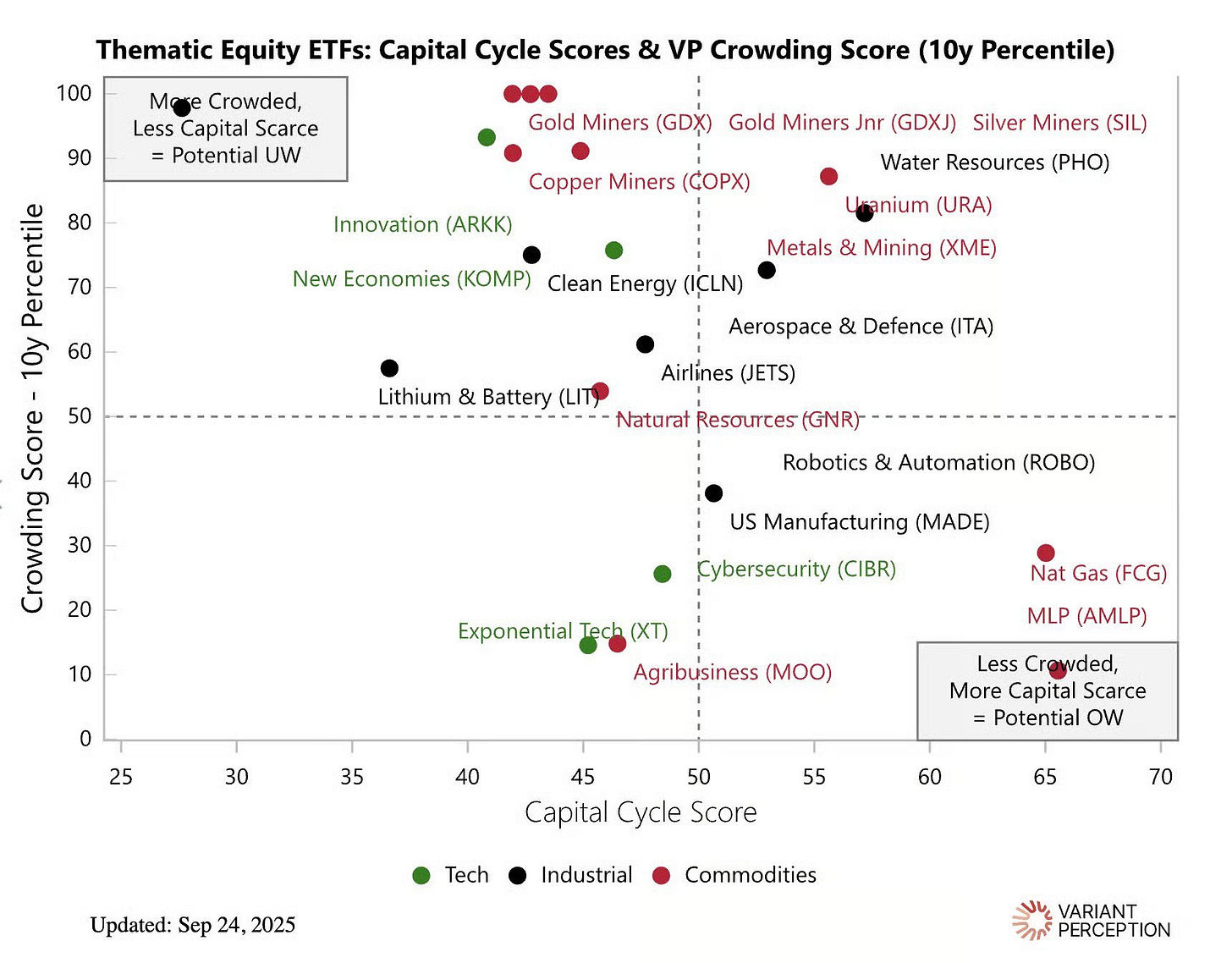

Chart of the Week

Maggie Moe’s GSV Weekly Rap

Chuckles of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM

Eclectic