GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: $9 billion – The valuation at which former OpenAI CTO Mira Murati’s start up, Thinking Machines Lab, aims to raise $1 billion. Murati departed OpenAI in September. (Crunchbase News)

Innovation: 59% – The percentage of people aged 18-64 in the United States who report having used linear TV in the past 12 months. (Statista)

Education: #1 – K-12 schools have become the single most-targeted industry for ransomware attacks, with recovery costs averaging over $3.7 million. (The 74 Million)

Impact: 15.3% – The percentage of members of Gen Z who have maxed-out credit cards, compared to 4.8% of Baby Boomers. (Federal Reserve Bank of New York)

Opportunity: ~$1.6 trillion – The total amount Americans owed in student loans as of June 2024 – 42% more than what they owed a decade earlier. (Pew Research Center)

“A man who stands for nothing will fall for anything.” – Malcolm X

“Thus, man will like on their backs, talking about the fall of man, but never make an effort to get up.” – Henry David Thoreau

“Boys will be boys, so will a lot middle aged men.” – Kin Hubbard

Kick boxing champion and social media bad boy Andrew Tate arrived in Ft. Lauderdale Thursday in a private jet to jeers and some cheers.

The Tampa Bay Young Republicans extended an invitation to Tate and his brother Tristan under the pretext of being “free speech absolutist.”

Florida old Republican Governor Ron Desantis said the Tate’s are “not welcome” in the Sunshine State.

I’ve been paying attention to Andrew Tate for several years as I found it remarkable that anybody who has said the reprehensible things he proudly takes credit for, let alone the very serious allegations of human trafficking and rape, had the type of following he had especially with young men. To wit, he has 10 million followers on X.

When things don’t compute, I want to understand why.

How can Luigi Mangione who on video (allegedly) savagely murdered United Health Care CEO Brian Thompson become a folk hero with fans sending him so many photos and letters he had to tell them to stop?

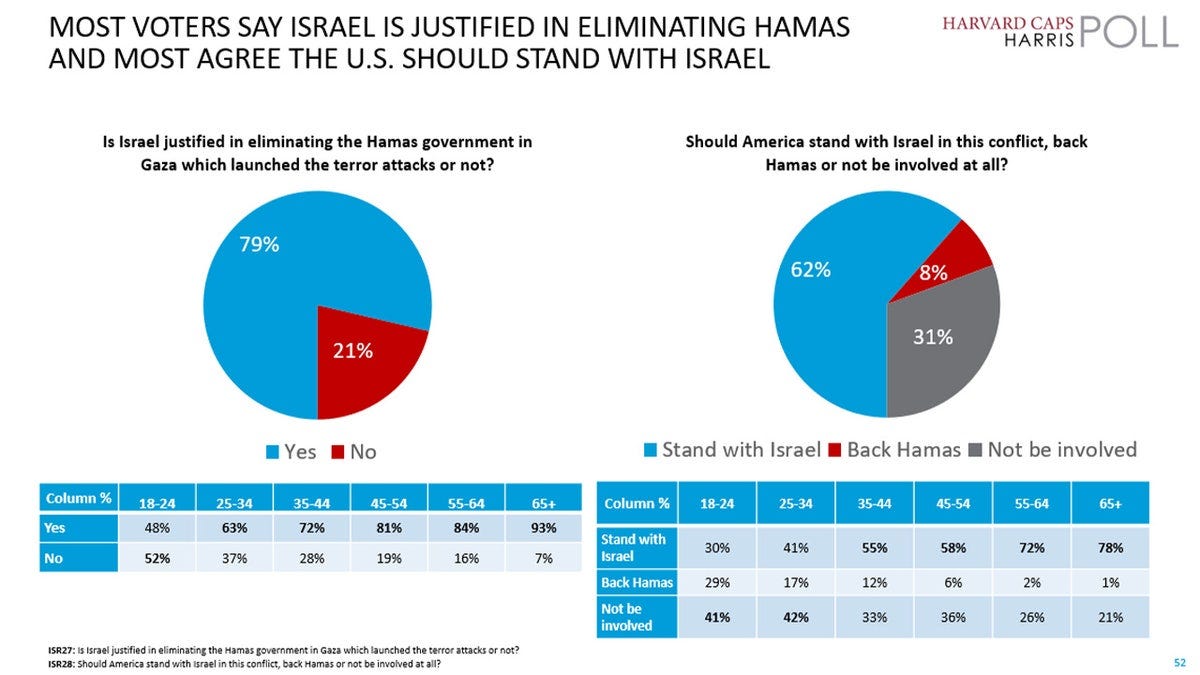

How could it be that 50% of college students supported Hamas—not the Palestinian people—Hamas(!) in the Israeli/Palestinian conflict?

With Andrew Tate, what in the World is going on with young men that they could see him as a role model? It’s clearly a symptom of something much bigger.

The fact of the matter is that young men are in crisis. It shows up in mental health, employment data and societal roles. Young men are falling behind and it’s starting to be extreme.

Today, for every male graduate from college, there are two female graduates. That’s a flip flop from fifty years ago. In that college graduates make double in lifetime income to high school graduates, the future impact is profound.

7 out of 10 high school Valedictorians are female.

33% of men under the age of 35 live at home with their parents.

One in seven Generation Z men report they have “no friends”.

Over 75% of the drug overdoses and suicides are men.

Men are 14X more likely to be incarcerated. 98% of mass shooters are men.

The adult male participation rate in the labor force is 68% down from 80% in 1970.

You might say “so what?”

Well, the U.S. Economy is about $30 trillion with 156 million people working…or about $200K per worker. Thus, every 1% of additional labor equates to approximately $500 billion in GDP, so just having the male labor force participation being up to 1970 levels would add an additional $6 trillion to our economy…(Canada’s GDP is $2.1 trillion)

With two daughters I’m very proud of, and having highlighted the investment theme of “POW…Power of Women” for decades, nobody is happier for the advancement of women than I am. Obviously, I’m not arguing for a regression to the mean or to lift men up by bringing women down.

What I am stridently saying is we need to get men back in the game, starting in school and evolving into work. Having positive role models for young men to be looking up to from all facets of society is a key place to start.

Gentleman, start your engines!

Market Performance

Market Commentary

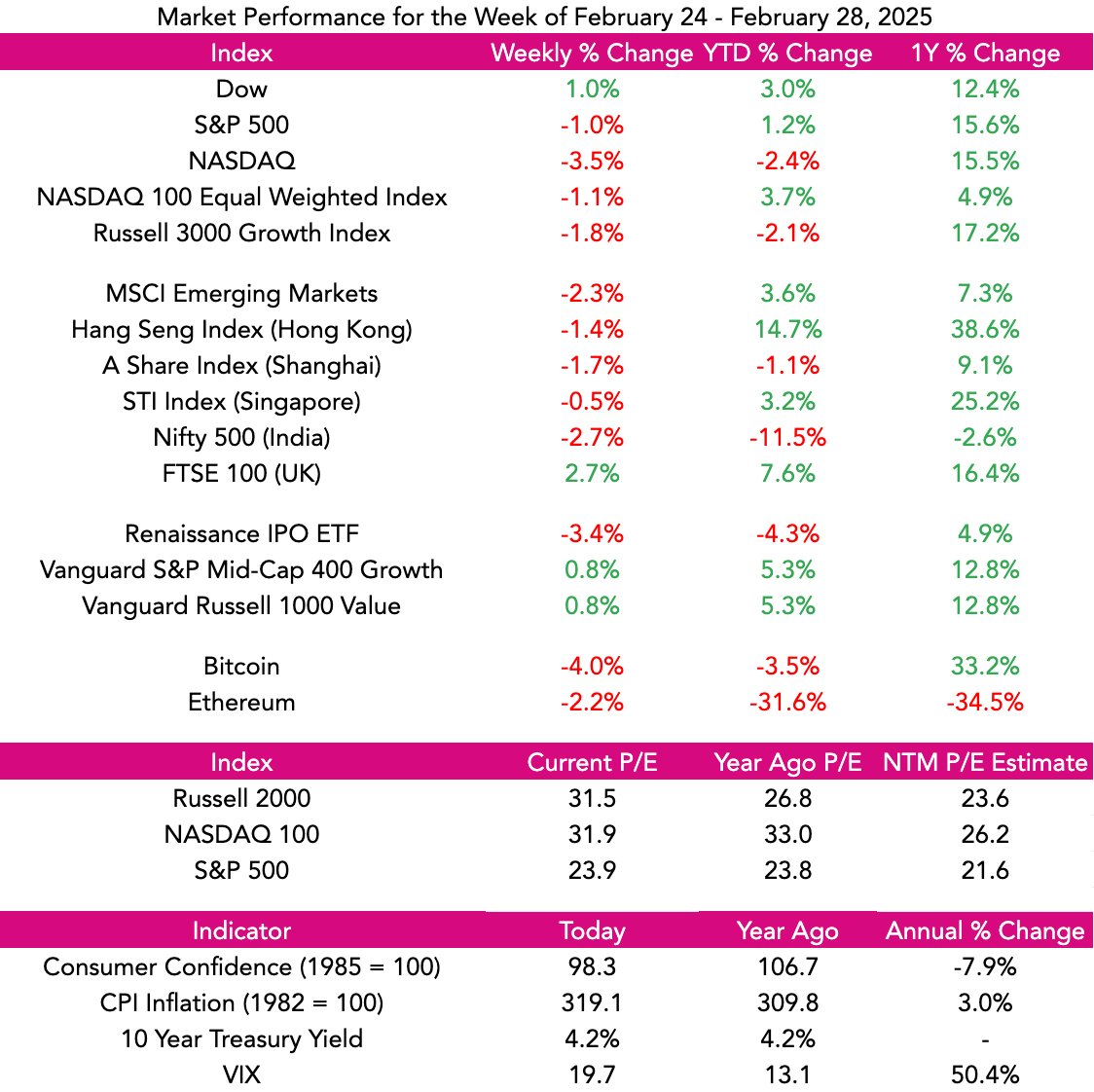

Stocks were mixed last week with the momentum clearly being negative. The Dow moved up 1% while the S&P 500 was off 1% and NASDAQ decreased 3.5%

As was predictable, what was the driver of stock performance, the so-called Magnificent 7 has been the anchor with the M7 down 10% from peak levels. On the other side of the barbell, the small cap Russell 2000 has been lagging and is off 10% from its high. As another proxy for investors appetite for risk, Bitcoin was off 25% from its high earlier this year, but today surged 10% on news its coins will be included in the strategic reserve.

NVIDIA, the most magnificent of the 7, reported revenue growth of 78% for the Fourth Quarter up to $39.3 billion. For perspective, NVDIA’s entire revenue in 2023 was $27 billion. Nonetheless, NVIDIA stock fell nearly 10% last week both due to guidance that projected “only” 65% revenue growth in 2025 and a still sky high valuation of 28X price to sales.

Other interesting “tech” news last week was Amazon paying $1 billion for the rights to the James Bond franchise. Also, Apple said they were going to spend $500 billion (with a “b”!) on new facilities in the United States and hiring another 20,000 people.

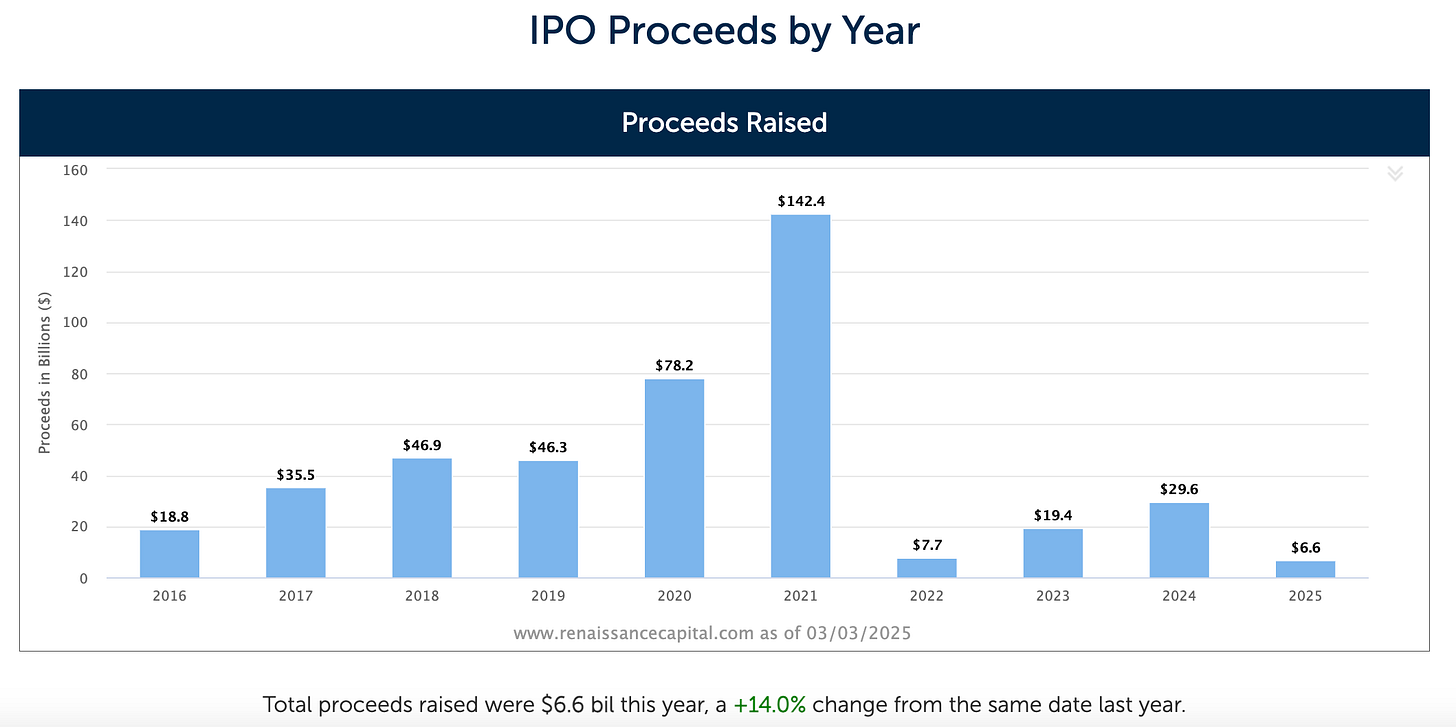

In IPO news, it’s rumored that General Catalyst is looking to go public, which would make it the first VC firm ever to do so. Also, the scooter company Lime is mentioned as getting ready to do IPO which would be a remarkable comeback following near death during Covid.

While the market has cooled noticeably from what we have grown accustomed to over the past couple years, we view that as natural and healthy. We continue to be very BULLISH on the intermediate and long term outlook for growth stocks and would look at dips in the highest quality names as buying opportunities.

Need to Know

WATCH: Now at $2B Valuation: Mercor CEO On How They Started | Turpentine VC

READ: Marrying Up and Marrying Down | No Mercy / No Malice

READ: What Happened to My Traffic? | Tomasz Tunguz

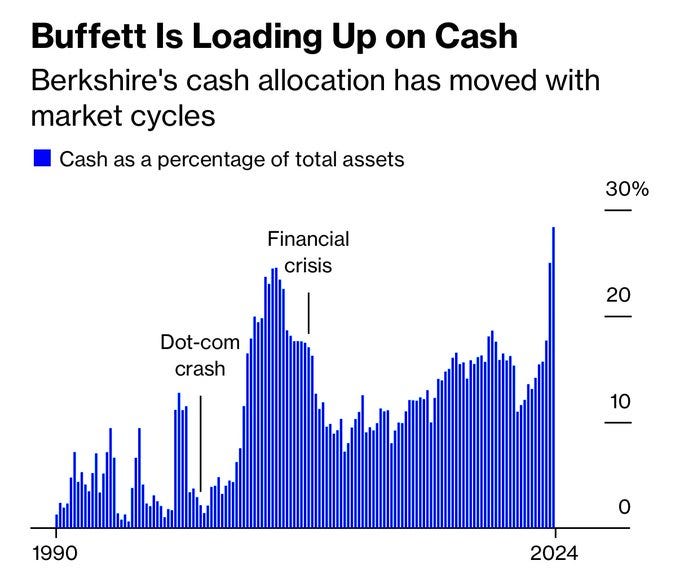

LISTEN: #380 Four Hundred Pages of Warren Buffett and Charlie Munger In Their own words | Founders

GSV’s Four I’s of Investor Sentiment

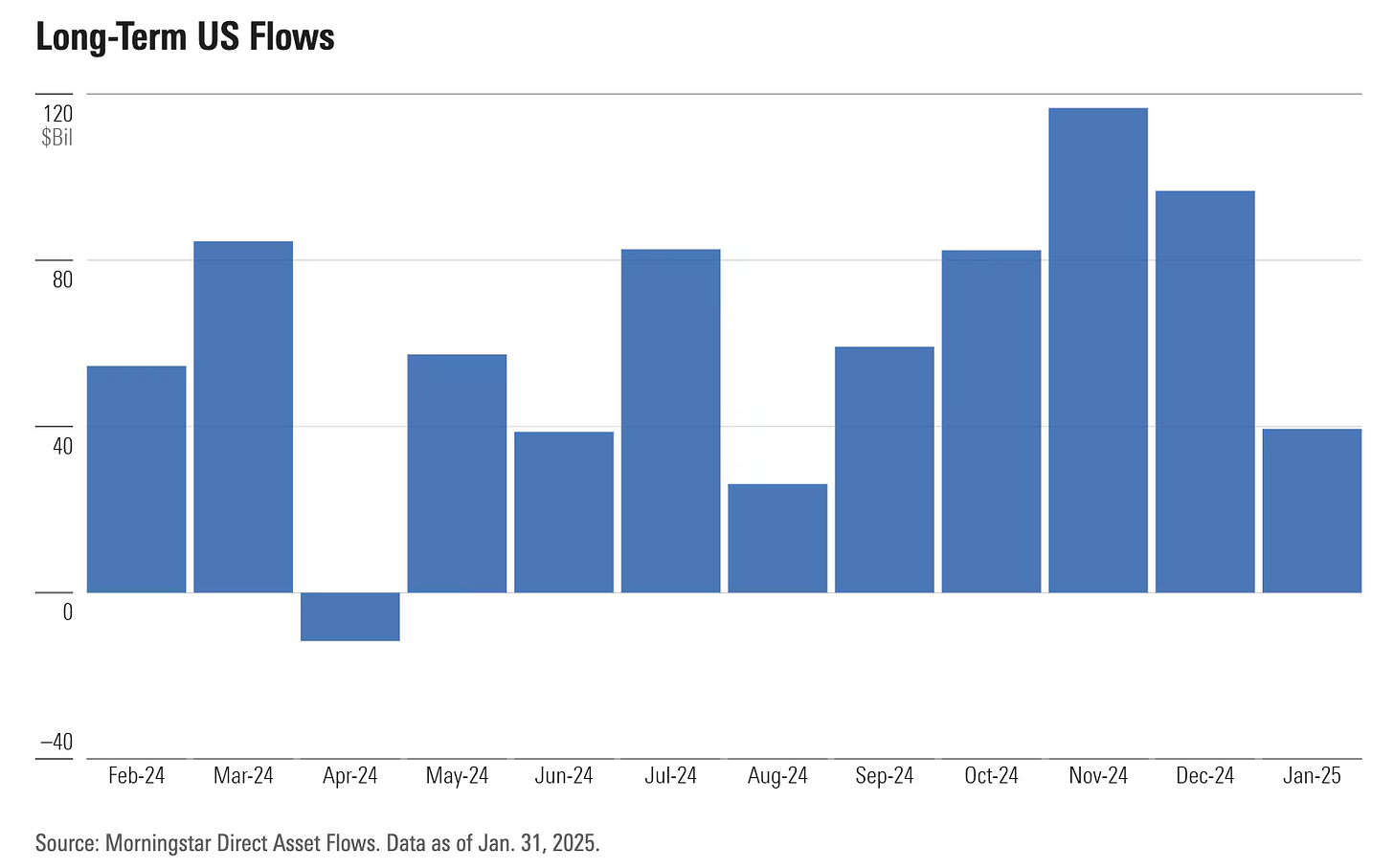

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

#3: Interest Rates

#4: Inflation

Chart of the Week

Maggie Moe’s GSV Weekly Rap

Chuckles of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM