GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

“If what you did yesterday seems big, you haven't done anything today.” – Lou Holtz

“Whether you think you can or you think you can't, you're right.” – Henry Ford

“The two most important days in your life are the day you are born and the day you find out why.” – Mark Twain

On Monday night, I delivered my keynote speech at the 15th annual ASU+GSV Summit. We covered a lot in 40 minutes and nearly 300 slides…I hope you enjoy it.

This past week, we hosted our 15th annual ASU+GSV Summit in beautiful San Diego, California. 7,200+ people attended, 900+ startups participated, and 143 countries were represented. The night before the conference I said to my wife, “Did you ever imagine in your wildest dreams that I would be speaking in front of thousands of people from over 100 countries?” She said, “Honey, you're not in my wildest dreams.”

Our partner, Arizona State University, is the largest public university in the United States with over 180,000 students. ASU has been ranked the most innovative university in the United States for the past nine years in a row – not bad for a party school, huh? Thanks to this great partnership, we've been fortunate to get some positive recognition for the Summit, with Forbes calling it the “Davos of Education.”

Our venture fund, GSV Ventures, invests in education technology businesses and we've invested in roughly half the unicorns that are in the Edtech space.

We’re lucky to be in an industry that has very positive fundamentals to it and for society there's a direct correlation between level of education attainment and GDP per capita.

It’s also been a growth market. In 1900 there were 500,000 students globally in higher education. By 2010, it was 160 million ad right now there are 245 million. By 2030, there'll be 414 million students in higher ed around the world.

One of the reasons the Summit has been successful is we've been able to provide a Window to the Future and be able to see things here before they actually were well known in the marketplace.

At the first Summit 15 years ago we were talking about Artificial Intelligence and how it was going to transform education. we were talking about the Power of Women (POW!) and showed how women were going to have increasing influence in positions of leadership. We covered Invisible Learning – the concept that people are going to learn by doing things they already like to do like playing games. We coined Hollywood Meets Harvard: Hollywood does an amazing job of telling stories and getting people engaged, and engagement is the most important component of learning.

These were just a few examples, and we've been fortunate to be in front of a number of these big waves that have happened.

My football coach in college, Lou Holtz, said “If what you did yesterday seems big, you haven't done anything today.” And that's very much the way that we feel here so as much as we're proud of what we've accomplished in the last 15 years we're just getting going.

In our research, we think about megatrends and seek to connect dots to best understand what changes are taking place. Recognizing these shifts and some of the patterns that consistently emerge allows us to see the most creative innovation that is currently taking place as well as what’s around the corner. The key to this is to take complex things and make them simple.

There are only three primary colors, but Michelangelo was able to create the Sistine Chapel with those three primary colors.

There are seven musical notes, but Beethoven was able to create the Fifth Symphony with those seven musical notes.

There are 10 numbers and look how creative Bernie Madoff was able to be with those 10 numbers.

The bigger the problem, the greater the opportunity. If you look at the UN’s 17 Sustainability Goals, they seek to address everything from poverty to health and well-being, to gender equality, etc. Every single one of these problems has one thing in common, and it’s that education is the foundation for solving each and every one of them.

We know there are some very powerful tailwinds behind what we’re doing here, and yet we also recognize and appreciate that things change, and over time they can change pretty dramatically.

We're in an environment today where things are changing faster than ever before. Taking a look back, 200 years ago the United States was basically the East Coast without Florida, and to go from the East Coast to the West Coast would take a generation and you'd lose half your travel party. Now, when you go from New York to San Francisco it takes six hours if your Wi-Fi doesn't work, you're pissed off.

Take a close look at this picture:

This is the Tour to France 100 years ago, when it was thought that cigarette smoking actually enhanced your athletic performance.

This is Henry Ford. He was the Elon Musk of his day and Detroit, Michigan was the Silicon Valley of its time. It was the palace where ambitious people were trying to change the world. On the flip side, 100 years ago Silicon Valley was made up of apricot fields and apple orchards and “The Farm” – Stanford University – was little known by anybody east of the Mississippi. Obviously, today Silicon Valley is the home of many of the game changing businesses that are transforming the world as we know it…from Google, to Apple, to Intel, to Facebook, and many many others.

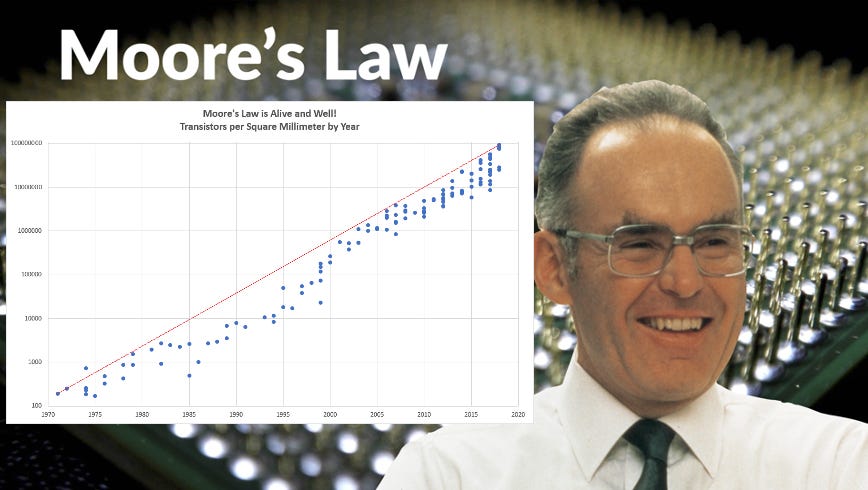

This is Gordon Moore.

He had this idea just about 60 years ago that computing power will double every couple of years. What's so interesting about what ultimately became known as Moore’s Law is that it wasn't actually a scientific law or physical law…it was basically Gordon Moore imposing his will upon an industry and not only transforming technology but also transforming the world as we know in the process. Take a look at the impact of Moore’s Law just since 2000. The cost of computing has gone down 99%, and the cost of storage is now basically free with virtually infinite capacity.

If the automobile industry would have had that same type of progress, a Ford Taurus that cost $20,000 in 1990 would cost less than a dollar today and you would throw it away after you used it.

In 2007, the market capitalization of Blackberry and Apple were nearly the exact same. Some of you will remember Blackberry – people loved these things so much they called them “Crackberries.” 2007 was also the year the iPhone was introduced by Apple. Today, Apple’s Market Cap is $2.7 trillion and Blackberry’s is less than $2 billion.

Take a look at this picture of St Peter’s Square at the Vatican in 2005.

This is what it looks like today.

In the last 19 years everybody has become a photographer with their smartphones. What’s so interesting is during that same period, Kodak, which was synonymous with photography went bankrupt (2011).

If you want to see the future, study demographics. From a geographic standpoint, it's fascinating that seven of the 10 fastest growing countries in the world last year were in Africa. If you look at Africa's population 1.1 billion people, of that 41% are under the age of 15 years old. The Nigerian birth rate is 5.3 births per woman – compare that to the United States’ ~1.7 Europe was 1.4. In East Asia, it's even less than that. If you fast forward to 2050, Lagos is expected to have 40 million people.

Today, the three largest cities in the world are in Asia (Tokyo, Dehi, and Shanghai). However, when you look at Japan for instance, for every birth they’re having two deaths. Societies like these are literally vanishing. By 2100 the three largest cities in the world are going to be in Africa (Lagos, Kinshasa, Dar es Salaam). If you want to find a way to participate in and benefit from this growth pattern, you need to get to Abu Dhabi & Dubai - what we call they Capital of Capital. These places serve as a Window to the Future and is a central hub with short flights to Africa, India, and of course other cities in the Middle East like Tel Aviv and Riyadh.

If you really want to see the future you study young people. Right now, Gen Z is age 12 to 27. So what does this generation look like in terms of their outlook and behaviors?

Well, 40% of 12th graders think “It's hard to have hope in the world.” 57% of Gen Z constantly take prescription medication. The percentage of teens who feel lonely has more than doubled to 40% in the last 30 years. Adolescent suicide numbers have tripled. The number of teens taking antidepressants has exploded – teen antidepressant use basically did not exist in 1992, and now 37% of teenagers take them. In that period of time, Eli Lily's Market Cap has grown by more than $700 billion by selling a lot of Prozac.

One theme we have around Gen Z is what we call OverDoped. This has to do with this generation’s extremely volatile levels of dopamine. Consider how plugged in this generation is…there are now seven billion smartphones on Earth - almost one for every man woman child in the world. You now have 5.4 billion people on the internet vs. 361 million in 2000. 91% of all teenagers play video games, and the global spending on video games has gone up 8x in the last 13 years to $260 billion. The New York Times has more subscribers to their games today than to their news.

In 2010, screen time was 13 hours a week. Now, it’s 13 hours a day. From kindergarten through 12th grade students will spend more time playing games than they actually spend in the classroom. Here’s an illustrative statistic: 39% of all Gen Z’s listen to podcasts at faster than normal speed compared to just 1.5% of the overall population. One of many second-order effects of all this: 20 years ago, the average American tension span was 150 seconds. Today, it’s 8 seconds – 1 second less than a goldfish.

Another theme we’ve been analyzing is the concept that Influencers Are The New Institutions. The middleman has been eliminated, and many case studies prove it. If you look at the number one sports channel on YouTube, it's Dude Perfect with 60 million subscribers. The number one business and finance podcast is All-In – no young person is going to watch CNBC, they’ll listen to the Besties instead. Look at Tucker Carlson’s move - when he was on Fox News he had 3.1 million viewers per night, and now he gets hundreds of millions of eyeballs on X. Our friend Bari Weiss left the New York Times to go direct with The Free Press less than two years ago and has since created the number one SubStack publication in the world.

Mr. Beast had 2.5 billion views in a month last fall - do you think Nickelodeon or Cartoon Network can compete with that? Notably, he's monetized that distribution in a number of ways, including taking a candy bar company (Feastables) from $0 to $200 million in sales in two years.

These influencers are causing platform shifts of seismic proportions.YouTube is now estimated to have a market value of ~$400 billion - bigger than Comcast and Disney combined.

A third theme that we’re examining is that Everyone Is An Entrepreneur. 72% of high school students say they want to be an entrepreneur and 65% of college students say they want to be an entrepreneur or work at a startup. The great news is, it's never been easier to get a business off the ground. Jensen Huang recently said “Everybody in the world is now a programmer. This is the miracle of artificial intelligence.” AI is going to replace the perspiration economy in many ways - the days of slogging away at endless Excel spreadsheets or writing pages of marketing copy are coming to a close.

Interestingly, it’s already the case that 58% of all unicorns have co-founders who do not have computer science degrees. Just 15 years ago, this was thought to be a non-negotiable prerequisite.

In 2010, when we started the ASU+GSV Summit, there was $500 million of venture capital in education technology. We thought that was amazing because if you added up all the VC dollars that had flowed into education technology before that, it wouldn't have added up to $500 million. During the next 11 years, it grew at 40% CAGR, reaching $20.8 billion in 2021. Over the same period, we saw a big shift into this true Global Silicon Valley…in 2010, 75% of all venture capital was United States, and today three-quarters of the venture activity is happening outside the US.

While things change, patterns repeat…particularly when it comes to human nature.

Good times create weak people…

…and weak people create hard times.

The past couple of ears have been a tough environment, particularly in the education technology space. Some extremely painful mistakes were made and the consequences have been significant.

In the past few years, we went from that 40% CAGR to an 86% decline in Edtech funding globally, 99% and 91% declines in China and India, respectively.

M&A deal value dropped 53% from 2022 to 2023, there 122 startups with ≥$10 million in funding were forced to shut down. In short, it has felt like a long winter out there, and a lot of people hibernate during winter, but it's hard times that create strong people.

Remember, 50% of the Fortune 500 was created during a recession or bear market.

Thankfully, strong people create good times.

Another striking shift that we’re experiencing is the collapsing trust in institutions. Confidence in Congress, organized religion, newspapers, and higher education is in shambles.

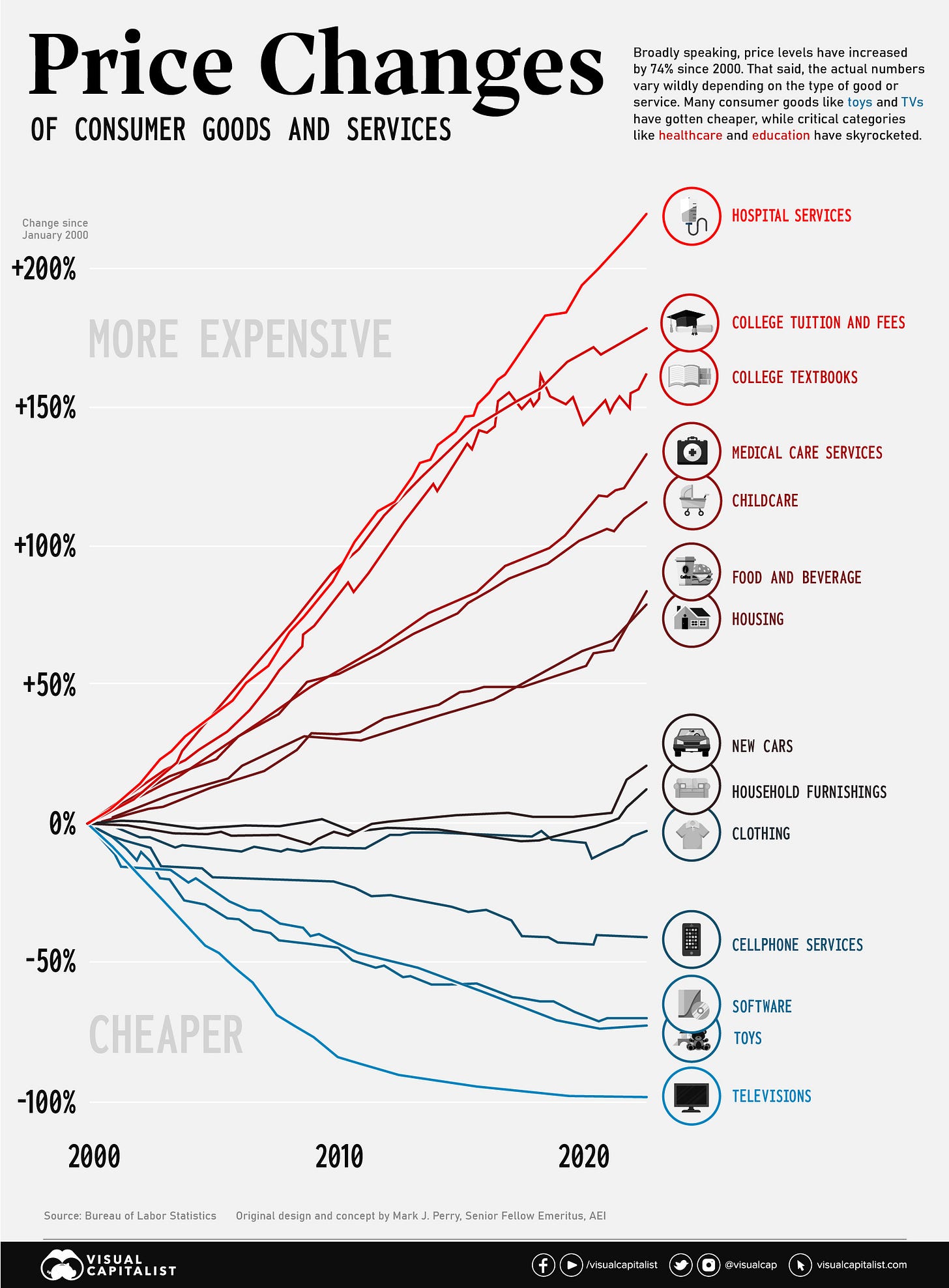

In 2008, President Obama talked about “College For All”, and the good news is we've seen a continued increase in the number of adults with a college degree, reaching 38% in 2023. However, in that same period where we had drop in prices of many consumer products like televisions (down 98% since 2000) and software (down 72% since 2000), textbooks have increased 154% and college Tuition has increased 185%.

If you look at the current four-year total cost of higher ed, it's $220,000 for a private university, $105,000 for a public institution, and $340,000 for the Ivy League. Not coincidentally, there is now $1.7 trillion of student debt (more than credit card debt), and we now have 74% of Gen Z second-guessing traditional college education.

Fueling these doubts are the facts that more than half the people who graduate from college don't use their degree at all, 78% of Americans hate their jobs, and we have 11 million open jobs and 7.2 million working-age male “NILFs” (Not In Labor Force). Earlier this month the Wall Street Journal published an article about how Gen Z may be becoming the “tool belt generation.”

Employers are recognizing these trends, too. 72% of them now prioritize skills and experience over diplomas, and 55% of employers eliminated degree requirements during 2023. According to ZipRecruiter, jobs requiring a bachelor's degree fell to 14% last year (from 18% in 2022).

The market is clearly telling us that it’s about knowledge, not college. This revelation is striking because as long as I can remember, a primary pro-college argument was that there is a lifetime earnings delta of $1.2 million between high school and college graduates. That sounded pretty good when college cost a lot less money than it does today.

However, when you remind a rational person that investing that $200k into the stock market (and expected a 10% annual return) would earn them $23.5 million over 50 years, they can’t help but reconsider their thinking.

So, the real question is: does college really have product-market fit?

Let’s consider a few stats.

40% of college students have a full-time job. 25% of college students have children. 73% of all college students are “non-traditional.”

The problem is that most universities are set up for 18 to 22-year—olds, with classes during the day offered twice a year, dormitories, a football team, a marching band, and rec centers with swimming pools. All of these things are irrelevant to almost three quarters of the student population. Reminder - the University of Kentucky spent a million dollars per day building facilities over the past decade.

Across the United States, there are 4,500 universities. Roughly one hundred of them have endowments of $1 billion or more. The 20 most elite universities have ~1% of the students but 45% of the endowment dollars - that's $333 billion. When it comes to athletics, the power two conferences (Big 10 and SEC) have $13 billion in media rights. This goes far past just the TV and the fans and the stands – it greatly impacts the school overall. Just look at the Coach Prime Effect…the University of Colorado has experienced a 50% increase in applications since he became the head football coach. During Nick Saban’s tenure at at Alabama, their student population went up 50% (many of whom were out-of-state enrollees), which meant hundreds of millions of dollars to the University of Alabama every year.

This begs the question: what will happen to the 4,000 universities without massive endowments or big time sports?

A case study of this type of school is Gustavus Adolphus College. Few people outside of my home state of Minnesota have heard of this school, and yet it has been able to raise its tuition at 3.5x inflation for the past 40 years. What happens when the music stops and people refuse to go along with the steady increase in cost with limited marginal gain from the diploma? There may be a very ugly end to this game of musical chairs – in 2018, Clayton Christensen predicted that 50% of the colleges would be bankrupt by 2028.

But, obstacles create opportunities.

A model I like to think about is the music industry before Spotify, where basically all the power was with the record label. If you wanted to listen to a song, you had to buy the whole album. Now, with Spotify’s subscription model, users can pick and choose from the world’s music library however they please. Another analogous model is that of Tesla. With how quickly things have been changing in the past two decades in particular, the value of the degree started to depreciate the farther out from graduation you got – similar to what happens when you drive a new car out of the lot. With its software updates, Tesla is able to upgrade its cars and maintain (if not increase) the value of the vehicle over time.

There are a number of shifts that are going to have to take place across our institutions in the future, including:

4 Year Degree → 40 Year Degree

Cost Per Credit → Subscriptions

Physical campus → Blended Model

Degree → Knowledge Currency

Closed System → Open System

Learning → Earning

Prix Fixe → All You Can Eat

Single Menu → Endless Feast

Office Hours → Co-Pilot

Just In Case Learning → Just In Time Learning

Random Walk → Hero’s Journey

Together, these shifts will put the community back in college.

To predict the future, we examine the past. A case study is to look at the academic journey of one of the most successful people in the world, Warren Buffett. It started somewhat traditionally, with undergraduate schooling at the University of Nebraska followed by a business degree from Columbia Business School.

However, he says that the most important degree he has is the $100 Dale Carnegie speaking course he took when he was young. Buffett says he gained early business understanding through a paper route he started as a kid, and his entrepreneurial journey began when he refurbished pinball machines and sold them to barber shops.

His first investment in Geico in 1951 came on a walkabout where stumbled into an office and started talking to the person who was working there on Saturday - after hearing what the man had to say about Geico he decided he liked the business and decided to invest. Buffett also benefited from lifelong mentors like Benjamin Graham, Philip Fisher, and LeFevre Dodd who helped show him the way. He even had significant experiential learning experiences - when he bought Berkshire Hathaway, it was a terrible investment in the textile industry. He summed up his takeaway with the comment, “When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.”

Warren Buffett is now over 90 years old and he still reads five hours a day - a shining example of a lifelong learner.

On to K-12. A Nation At Risk 40 years ago and author Terence Bell (then the Secretary of Education) said that if a foreign ad adversary were to impose our education system on us, we'd view it as an act of war.

Devastatingly, 40 years later in 2023, we had the lowest math scores in the history of the PISA test which began in 2003.

At the same time, the high school graduation rate has gone up to 87% – that's the good news, right? The bad news is the percentage of high school grads who can't read proficiently has grown to 19%.

And the issues certainly do not end there.

When it comes to spending, there is now $16,000 spent per kid in the United States every year on average, and in NYC, it’s more than double that at $38,000. Take that $38,000 and multiply it by 20 students which gets to $760,000 per classroom. Assuming the average teacher makes $80,000 and you generously assume that books, supplies, technology, etc. costs $80,000, then where does that other $600,000 go?

The basic answer is that it’s simply consumed by the bureaucracy.

I can't think of another service industry that exists in the world where over 50% of every dollar is spent outside of where the service is being rendered unless the government supports it.

Consider parents’ views on education. 64% of parents aren't satisfied with the US education system, yet the irony is 76% of parents historically said they were completely satisfied with their own child's education. But that was all Before Corona (B.C.), and now we’ve had 1.6 billion students thrown into the deep end of the online learning pool and told to sink or swim. Some sank, some got out and decided they were never going back in, and many flailed around before getting used to it. The reality is, the genie’s not going back in the bottle.

During that period of online school during COVID, many parents had the chance to look over their child's shoulder into the zoom school and didn't like what they were seeing. When the masks came on, the mask came off. Couple this with commentary from figures like Terry MCauliffe (“I don’t think parents should be telling schools what they should teach.”), and the school choice revolution started its engine.

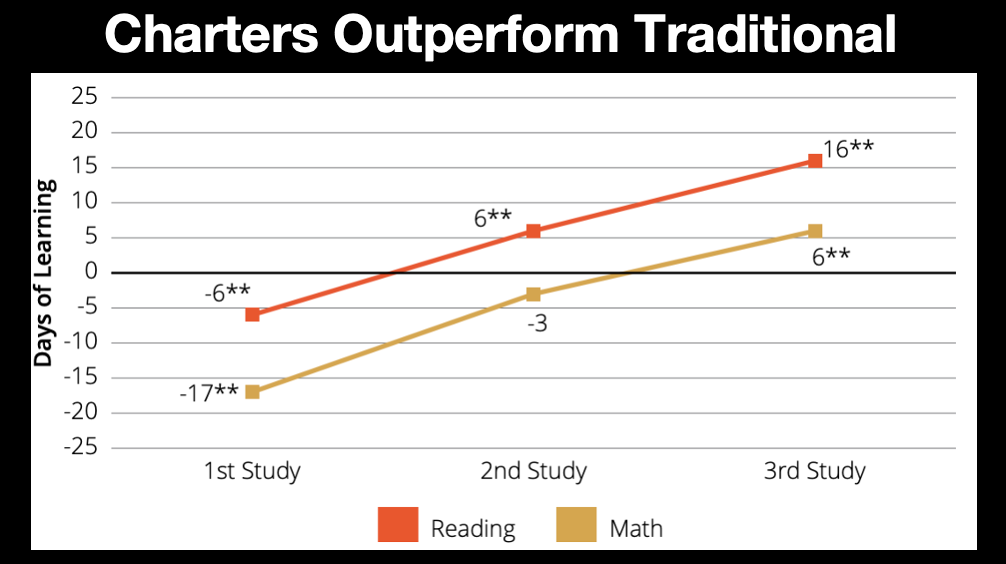

In a country where we can't agree what day of the week it is, we now have approximately 75% of all Americans - Republicans and Democrats - who support school choice. 75% supports Charter Schools, 75% support ESAs, partially because people simply want alternative options, and partially because the data supports it.

Education truly is the civil rights issue of our time and 2023 was the year of choice.

The first charter school was in St. Paul, Minnesota in 1991. Then the movie Waiting for Superman came out 20 years later and added awareness of many of the inequities of what was going on in public schools. So as Steve Jobs said, these “overnight successes take one hell of a long time” and now we have 36% of all K12 students enrolled in non-traditional, non-local schools, 8,000 Charter Schools in the US with 3.7 million students and 691 virtual Charter Schools with 483,000 students. This is thanks in huge part to some very inspiring charter networks that are being operated and created around the country.

Further, we have 2.2 million students in micro-schools and again a number of interesting entrepreneurial companies that are supporting that wave. 33 States now have ESAs or vouchers, there are 72 ESA/Voucher programs, and remarkably there are now 3.6 million students now in home schools. Here's a homeschool story that is well worth the watch:

As Edison’s friend Henry Ford said, “Whether you think you can or you think you can't, you're right.”

AI is going to transform not just education, but the World. We’re very proud of the of the AIR Show that we had at the front end of the conference, which had over 15,000 registrants in its inaugural year.

We call it the AIR Show for two reasons - one is that AIR = AI Revolution, but we also say that AI is like air because it's invisible, it's ubiquitous, and you're going to need it to live.

In terms of opportunity, a 5% capture of the $8 trillion education market equates to $400 billion.

As Bill Gates said, “Most people overestimate what they can do in one year and underestimate what they can do in ten years.”

A well-established repetitive cycle is known as the Gartner Hype Cycle, which features a new disruptive technology trigger, followed by a peak of inflated expectations, followed by the trough of disillusionment, followed by the slope of enlightenment, and finally the plateau of productivity.

I like to remind entrepreneurs that the early bird gets the turd. Often times people think they need to have the first mover advantage, and Google is just one of many, many examples where that was not the case.

We think AI is going to be incredible in the classroom and every teacher going to have their own teaching assistant and every student is going to be able to have a great digital tutor in their pocket. Digital Twin technology will be hugely disruptive and offer people the ability “borrow the brains” of many of the greatest leaders and thinkers on the planet.

Beyond specific tools, AI is revolutionary because it creates time.

Mark Andreessen said that he personally feels AirPods are the biggest technological invention in his lifetime because they enable him to learn constantly while doing other things - he can listen to a lecture while he works out, or to a podcast while drives.

AI has gone from informing life to transforming life.

Historically, it was only the ultra-rich that could get “time dividends” by paying for things like butlers, private planes, and landscapers. I don't think Elon Musk has made a dinner reservation in a long time.

We can sum up what we see coming: Time Dividend * Knowledge Proliferation = Innovation Explosion.

This transformation of society is going to be like nothing we've ever seen before.

In closing, what will be extremely important is the combination of the aforementioned AI wave and the encompassing way that Gen Z is wired.

Adam Smith wrote the Wealth of Nations in 1776 and in it he talked about the invisible hand – the idea that when economic incentives are matched with business objectives, the invisible hand guided behavior towards positive outcomes. This was really the birth of capitalism, which caused the greatest improvement in peoples’ circumstances in history. Also in 1776, Thomas Jefferson wrote the Declaration of Independence and in it he stated that everybody deserves the rights to life, liberty, and the pursuit of happiness.

A lot of people don't know that in George Washington’s inaugural address in 1789 he wrote about a different type of invisible hand and that was one of providence and of meaning. He argued that what people were really seeking was to have meaning and purpose in their life.

Consider what ‘s happening now – 54% of Gen Z a negative view of capitalism, 51% actually have a positive view of socialism, and a staggering 67% of young Brits want socialism.

This isn't because young people are stupid. It’s because of what has happened and what they’ve experienced; a system that hasn't worked and seems unfair.

What’s the answer if Adam Smith’s invisible hand is clearly broken?

Well, I believe the fix lies in Adam Smith's invisible hand merging with George Washington's message of providence and together you get what we call the Mission Movement. My friend Mike Carter and I wrote a book on this topic called The Mission Corporation that talks about the combination of purpose and profits.

We believe that the great businesses of tomorrow are going to have the ambition of a for-profit and the heart of a not for-profit. We feel so strongly about this shift that we actually added a fifth “P” to our (formerly) 4 Ps formula that we used to evaluate potential investments for many years. In addition to People, Product, Potential, and Predictability, we’ve now added Purpose because we think great businesses need that purpose really to achieve their desired significance.

Everyone knows there are growth investors and value investors, but we think of ourselves as values investors. We’re looking for companies that can combine purpose with profits while also investing in smarts and hearts, which is important because you can't tell anything about skin color, gender, religion, etc. when you judge them by their brain and their heart.

We’re seeking to create meaning through learning and purpose through work. As Mark Twain said, “The two most important days of your life for the day you were born and the day you find out why.”

So when we think about how complex all these issues are in education all of the dynamics that we have covered, it’s easy to say that there is no Silver Bullet to solving this deluge of problems. But I really do think there is a Silver Bullet, and that’s love. If we love our neighbor as we love ourselves, I really believe that we can change the world for good and that can start right now.

As we always say, make your dash count!

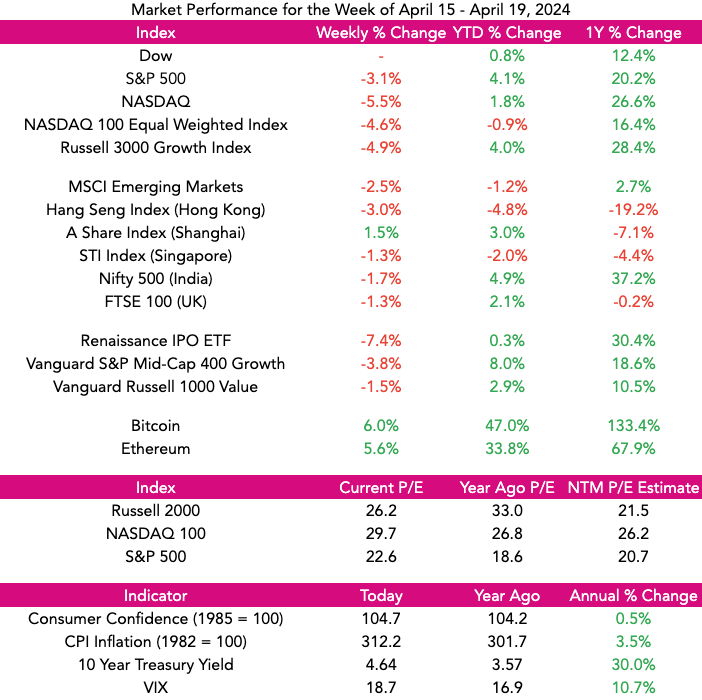

Market Performance

Market Commentary

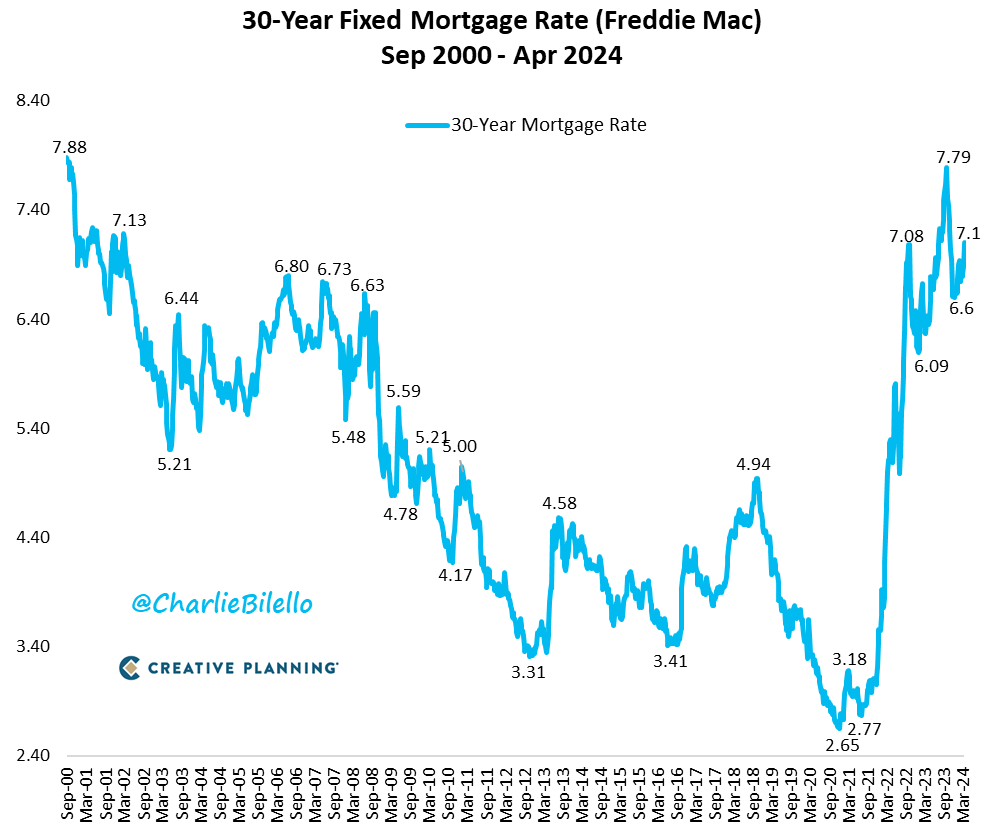

Stocks continue to retrace the gains they’ve seen since last October with the S&P 500 off for the third week in a row and NASDAQ being down for the fourth week. Numerically, the S&P fell 3% and NASDAQ declined 5.5%. The 30 member Dow Jones Industrial Index managed to be flat for the week.

NVIDIA which has been an upward bound freight train dropped 10% on Friday following its server supplier Super Micro reporting disappointing numbers, which fell 23%. Netflix, reported huge subscriber gains of nearly 10 million for the quarter, double the expectation, but revenues came in a smidgen below analyst expectations and future forecast weren’t inspiring.

Why the pause in the Market overall?

Four Main reasons:

With inflation concerns reemerging, it’s now expected the Fed will only lower rates once in 2024.

While 1Q earnings have been pretty good, future guidance has been tepid.

Bombs going off everywhere makes investors (and everybody else) nervous.

Stocks are like people and need to take a breath before they continue to climb.

This week, we will be getting quarterly reports from Microsoft, Alphabet (Google), Meta (Facebook) and Tesla…among others.

Our view remains that we are in a constructive environment for growth companies and would look at the decline in high quality names as a buying opportunity for long term investors. We appreciate that stocks are one of the few things people buy less of when they go on “sale” but we’ve always believed in buying swim suits in January.

Maggie Moe’s GSV Weekly Rap

GSV Model Portfolio

Need to Know

READ: Whiteboard Notes | Whiteboard Advisors

LISTEN: How a Legendary NFL Receiver Became a Wall Street Player | The Deal with Alex Rodriguez and Jason Kelly

WATCH: Ep6. AI Demand / Supply - Models, Agents, the $2T Compute Build Out, Need for More Nuclear & More | BG2Pod with Brad Gerstner and Bill Gurley

READ: AI 50: Companies of the Future | Sequoia

WATCH: Sam Altman & Brad Lightcap: Which Companies Will be Steamrolled by Open AI? | 20VC with Harry Stebbings

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: Fidelity

#2: IPO Market

Source: Renaissance Capital

#3: Interest Rates

Source: X

#4: Inflation

Source: Charlie Bilello

Chart of the Week

Chuckles of the Week

EIEIO…Fast Facts

Entrepreneurship: 70% - The percentage of Y Combinator’s Winter 2024 batch that were AI startups, up from 32% in YC W23 (Drake Dukes)

Innovation: 2 years – The amount of time before AI businesses run out of harvestable “high quality-data” (Wikipedia entries, scientific papers, etc.) on the internet (Morning Brew)

Education: 7% – The percentage of US students who are “high performers” in math (Hechinger Report)

Impact: $101 million – The size of the award the XPRIZE will give to any team that can restore 20 years worth of muscle, brain, and immune function in older adults (MIT Technology Review)

Opportunity: 16% – Share of US home listings that are “affordable” on a median income, down from 45% in 2020 (Visual Capitalist)

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup….EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM