EIEIO...Hooray for Hollywood!

Entrepreneurship, Innovation, Education, Impact, and Opportunity

GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: 50% – the percentage of 16 to 25-year-olds who want to start their own businesses (Samsung / Morning Consult)

Innovation: $23 billion – the price of Google’s potential acquisition of Wiz, an AI cybersecurity company founded less than 5 years ago (Fortune)

Education: 17% – the estimated percentage of Johns Hopkins University’s funding in the past decade that came from tuition and fees, compared to 19% from the Department of Defense (Harper’s)

Impact: 48 years – the amount of time since the US has had a presidential election without a Biden, Clinton, or Bush (Bruce Mehlman on X)

Opportunity: 70% – the percentage of global investment in longevity clinics that happens in the U.S. (WSJ)

“I do not like broccoli. And I haven’t liked it since I was a little kid. And I’m President of the United States and I’m not going to eat any more broccoli.” – George H.W. Bush

“Every time I go to the movies it’s magic, no matter what the movie is about.” – Steven Spielberg

“Conjunction Junction, what's your function?

Hooking up words, phrases and clauses” – Schoolhouse Rock“I am not throwin’ away my shot.” – Lin Manuel Miranda as Alexander Hamilton

“A spoonful of sugar makes the medicine go down.” – Mary Poppins

People love the movies.

The average person in the United States saw 3.5 movies last year on the big screen.

Increasingly more notable, Netflix has 277 million subscribers with the average person watching over an hour a day on its streaming service. YouTube’s even more popular with 2.5 billion monthly active users.

Hollywood does an amazing job of engaging audiences with storytelling, making stars of the actors, and achieving low cost and high quality through scale.

As we move towards a new frontier catalyzed by the AI Revolution, acquiring knowledge has never been more vital. Moreover, we will utilize AI to learn at the speed of light. However, no longer are you going to fill up your knowledge tank to age 25 and drive off through life….you will need to be continually “fueling up”, or risk getting left in the dust.

Importantly, the way we’ve traditionally acquired education needs to be augmented by a variety of other formats that fit into our natural living process. GSV has a daily newsletter named “News to Knowledge”, representing the continuum of how people obtain knowledge on an ongoing basis…news articles, podcasts, TED talks, documentaries, conferences, online courses, all the way to a Master’s degree.

Artificial Intelligence done right will create a “time dividend” for us but we still will do what we want to do versus what we should do…that’s human nature. Weight Watchers is on the brink of bankruptcy because it requires doing hard things to lose weight, while half of Eli Lilly’s revenue now comes from the weight loss drug Zepbound. It’s a lot easier to take a shot than to work out and consume a disciplined diet.

“Invisible Learning” and its cousin “Hollywood meets Harvard” are two mega-themes in the education space as they fit hand in glove with today’s lifelong learning reality. Both put “chocolate on broccoli” so whether it’s playing a game where I’m acquiring a critical skill or watching Hamilton and learning about American history, these are examples of how people will increasingly gain the knowledge they need to thrive.

The Oregon Trail launched in 1971 was the original “Invisible Learning” game that had the “twofer” of both teaching Generation X how to utilize computers and learn history. Today, Duolingo has done a masterful job of teaching users new languages with games. Its $8 billion market cap and 12X forward price to sales multiple reflect its success.

Sesame Street came on the scene in 1969 with Jim Henson’s muppets helping kids learn numbers, letters, literacy and life skills. Schoolhouse Rock began four years later with catchy tunes like “I’m Just a Bill” and “Conjunction Junction”.

Mr. Rogers’ Neighborhood helped with emotional and social skills and Bill Nye the Science Guy became an icon with a generation of kids teaching science through humor and crazy demonstrations.

Colossal hit Hamilton has, in my view, taught more people about American History than all the books and lessons created before it. Legendary growth investor Dick Gilder’s Gilder Lehrman Institute for American History leaned into this and created a Hamilton Program in which 20K students participate each year. Teachers report that 85% of students show a positive improvement in civic engagement and 75% say students now see a connection between the history of the past and events today.

Legally Blonde (both the movie and the musical) was huge for shattering stereotypes and self-empowerment. Ditto to Freedom Writers.

The Social Network was a case study on Silicon Valley entrepreneurship and The Founder about Ray Kroc was a master class on branding, systems, the need for speed, franchising, real estate, persistence, and vision.

The Bible is the greatest-selling book of all time with over 5 billion copies circulated, but I’d argue more people know the content from the Andrew Lloyd Webber musicals Jesus Christ Superstar and Joseph and the Amazing Technicolor Dreamcoat than the good Word itself. Taking Bible education to a whole new level, The Chosen has had over 400 million views, activated studies in over 150 countries, and ignited interest by young people who, heretofore, had been fleeing religion.

As a huge signal for the growing importance of obtaining knowledge through the magic of movies, demand for documentaries is up 142% from 2018 to 2021. Gen Z in particular is drawn to life stories and educational content with the market reaching $11.65 billion in 2022. Streaming platforms such as Netflix, Amazon Prime, and Apple TV have increased the supply with documentaries being the fastest-growing genre and transforming from niche to mainstream.

This brings me to my evening at Joe’s Pub in NYC a week ago where I watched a concert for a groundbreaking new musical My Pet Dragon.

MPD is the story of a young girl who has a chronic illness and is prescribed a “dragon” to cope with the pain she lives with. The “Dragon” is a metaphor for “drugs” and it grows and grows and wreaks havoc on her life.

Full disclosure, the writer of the musical is my daughter and the story is hers. She wrote it because she wanted to help the nearly 50 million people in the United States who are battling substance abuse and to help de-stigmatize addiction to get people the help they need. 100K people died last year alone from an overdose, many of those young people. It’s estimated that two-thirds of society is affected by people close to them with addiction.

So you naturally say, who wants to see a musical about something as depressing as addiction? I’m obviously ridiculously biased, but not only is My Pet Dragon timely and important, but it’s funny, inspiring, and it has great music that you will be humming for days. Spoiler alert, the heroine slays the dragon for a happy ending.

To see for yourself, check it out here.

Market Performance

Market Commentary

It was a bumpy ride last week finishing with the worst stock performance since mid-April.

Tech continued to lose popularity with a noticeable rotation into small-cap and value stocks. Tech-laden NASDAQ fell 3.6% for the week, while the S&P 500 dropped 2%. Countering that, the Dow moved up .7% and the small-cap Russell 2000 Index increased 1.5%.

On the good news side, Fed Chairman Powell remarked that the delicate dance between growth and inflation had a “much better balance”. This, of course, fueled traders’ optimism we might see a rate cut as early as September.

On the holy crap side, in news only to people who were in isolation the past 48 hours, a botched update by security software vendor CrowdStrike crashed the ubiquitous Microsoft Windows operating systems around the World. The result was a “blue screen death” for many airlines, healthcare providers, financial institutions, and energy companies from Seattle to Singapore.

Other issues affecting the technology industry were chip stocks were rocked by the Biden administration’s threat of severe export curves to reduce the end around to supply China.

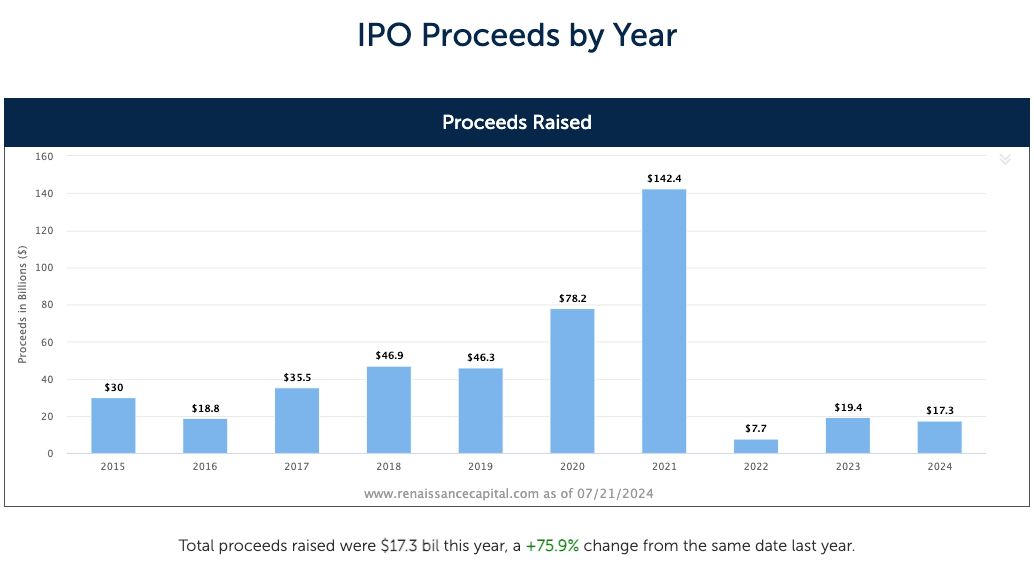

Also notable, and consistent with the de-thawing thesis we put forward early in the year, VC funding reached an eight-quarter high of $55 billion. We continue to expect more IPOs and private financing as the Markets broaden and give investors the message, “Come on in the water is fine”.

We remain BULLISH.

Need to Know

READ: Donald Trump, Elon Musk, and the Portal Into American History | Tablet

READ: Six-Chart Sunday (#26) – Gradually Then Suddenly | Age of Disruption

WATCH: “Good illustration that kinetic energy increases with the *square* of velocity” | Shaun McGuire on X

READ: The top emerging Edtech companies for higher education in 2024 — edtech 20:20 vision | Emerge

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

#3: Interest Rates

#4: Inflation

Chart of the Week

Maggie Moe’s GSV Weekly Rap

Chuckle of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup….EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM