EIEIO...How ‘Bout Them Cowboys!

Drama in the Big D, the Netflix Way, and the Path to Human Flourishing

GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: $36.7 Billion – The total amount of venture capital dollars invested into Bay Area start ups from Q3 of 2024 - Q2 of 2025. (Carta)

Innovation: $4.3 Trillion – The market cap of Nvidia, which is more than the total economies of of the United Kingdom, Canada and Russia. (Unusual Whales)

Education: 84% – The percentage of the top 50 quarterbacks from the high school class of 2021 who transferred at least once in college. (The Athletic)

Impact: $0 – The amount of public funding and tax dollars that will be used to construct the Denver Broncos’ new stadium. Over the last decade, 9 NFL stadiums have been built/are being built and have used $6.5 billion in public funding. (Andrew Petcash)

Opportunity: 52.4 Days – The average wait time for a physician appointment in the Boston metropolitan area. (Digital Native)

“Mammas don’t let your babies grow up to be cowboys.” – Willie Nelson

“You’ve got to know when to hold ‘em. Know when to fold ‘em. Know when to walk away. And know when to run.” – Kenny Rogers (The Gambler)

“AI is the intern who never sleeps…just feed it electricity instead of pizza.” – Adena Friedman.

Who could fire their Head Coach after winning two Super Bowls in a row?

Not since the question of who shot J.R. has the city of Dallas captured the public’s intrigue as now with the Netflix documentary, ”America’s Team…The Gambler and his Cowboys”.

Better than the prime time soap opera which featured an assortment of characters led by the deliciously evil J.R. Ewing, the real life Cowboys had a cast that had the full assortment of idiosyncratic individuals led by the gambler himself, Jerry Jones. Upon buying the team, he immediately fired legendary coach Tom Landry, who was so beloved the city of Dallas had a ticker tape parade to celebrate his career after Jones canned him. He then hired his college buddy Jimmy Johnson, only to fire him after winning the Lombardi Trophy twice.

The drama had it all. Jones began his wheeling and dealing by trading one of the NFL’s top players, Herschel Walker, for a boatload of future picks. QB1 Troy Aikman went from the “good cop” under Johnson to the “bad cop” after wild man Barry Switzer became the head coach (Switzer got arrested for trying to bring a loaded gun on the team plane). Michael Irvin, who faced drug charges, the volatile but talented defensive end Charles Haley, and, of course, "Prime Time" himself, Deion Sanders, all played pivotal roles in the spectacle that turned the Cowboys into “America’s Team.”

While the Cowboys haven’t been to the Super Bowl since the magical time in the ‘90’s when they won three World Championships in four years, the value of the franchise has gone from $140 million when Jones bought the team in 1989 to $10 billion today.

Netflix, which produced both “America’s Team” and the also very entertaining, “America’s Sweethearts: Dallas Cowboys Cheerleaders”, was on the forefront of a revolutionary change in the relationship between employee and employer. The company treated its culture more like what you have in professional sports (See below…Reed Hastings said it himself). Out with the gold watch, in with loading up on stock options.

The goal of Netflix management was to get the best players on the field, valuing performance over loyalty or tenure. “Radical candor”—typical of a coach on the field—was the norm at Netflix under Hastings’ leadership. The Netflix Way has become the model for Silicon Valley and emerging Global Silicon Valley.

When Netflix went public in 2002 its market cap was $300 million. Today, it’s over $500 billion. The Netflix Way has worked and nothing breeds copy cats like success.

The AI Revolution is catalyzing a new shift on the way enterprises are structured and rewarded. Many people are discussing “the future of work,” which is great, but our focus is on what the great organizations of the future will look like and how they align with human flourishing.

Accordingly, we are doing a live GSV TV session tomorrow, Monday September 22nd at 11am EST.

A few ideas we will cover:

Throughout history, doomsayers have predicted how disruptive technology was going to destroy jobs but in every case, the technology always created exponentially more jobs than it destroyed (Industrial Revolution, electricity, automobile, computer, Internet, etc.)…but many people are now saying that the AI Revolution is different…is it? And if so, how/why?

Before Generative AI came on the scene in the Fall of 2022, the half life of skills had gone from 30 years in 1980, to 5 years by 2023 and 2.5 years for technical skills…what does this mean for people, employers and society? Continuous upskilling and reskilling? Learning in embedded in what you do professionally and/or personally? Games?

Already, we’ve seen an elimination of formerly desirable entry level jobs replaced by AI. As an example, unemployment is 2X higher for engineering graduates than Art History majors…How can apprenticeship programs play a role so students can hit the ground running when they enter the workforce? What other pathways are on the horizon?

“Learning on the job” has taken a new meaning, with AI both enabling workers to learn just in time but also align training with the job…how do you see this playing out? Will innovation explode within organizations by embracing Vibe Coding?

Is AI going to “Democratize” education or “Destroy” it? How does this unfold and what are the ways learning will be democratized…increasing access, lowering the cost and improving the quality? Do we see income inequality which is at an all time historical high increasing, decreasing, cause a revolution, make more people have the opportunity for the American Dream?

I’ve talked about the 7C’s as the foundation of the future of learning…Critical thinking, collaboration, communication, creativity, cultural fluency, civics and character…what am I missing? Scott Pulsipher would say competency which I agree with but doesn’t fit nicely into my 7 C’s 😎…what are the other key subjects students will need to know?

How do you see the collaboration between academic institutions, employers and students work in the future. How much is “earning” and “learning” integrated?

Is the degree as valuable, more valuable or less valuable in the age of AI? and how will AI be used to not just accelerate learning but validate what you know? How will it create an ongoing learning journey aligned with interest, aptitude and opportunities?

Is it Man versus Machine or Man and Machine? How do you see the Division of Labor?

Are people going to work less? Or use the “time dividend” to be more productive, innovate and be more competitive? Is it “multiplication by division” for employers analogous to the Adam Smith pin factory with a gigantic increase of productivity? Or are we all going to be on Universal Basic Income, taxing the machines with people eating grapes and drinking wine all day?

With the World moving so fast, how does an organization hire the right people for the future, and know what types of skills will be required? How will AI be used to do a current origination skills/competency diagnosis, prescribe how to fill knowledge/skill gaps with rapidly moving target?

What does the successful enterprise look like in the future? Hollywood Studio Model? Tours of Duty? Revenue per person goes up by factor of 10X? How will they obtain, train and retain the talent they need? HR? Chief People Officer? Chief Productivity Officer? Role of the CEO?

People find purpose through learning and meaning through work…How can academic and corporations provide the right model to promote human flourishing?

In the 1967 movie “The Graduate” with Dustin Hoffman, “Mr. McGuire” advised Hoffman to go into “Plastics” because that was the future…what would be your advice to a graduate in 2025?

Besides your own company, who is best positioned for what you see as the future of work? And/or promoting human flourishing? And why? And what academic institution are you most impressed by?

Please tune in live to be part of dynamic conversation—register HERE!

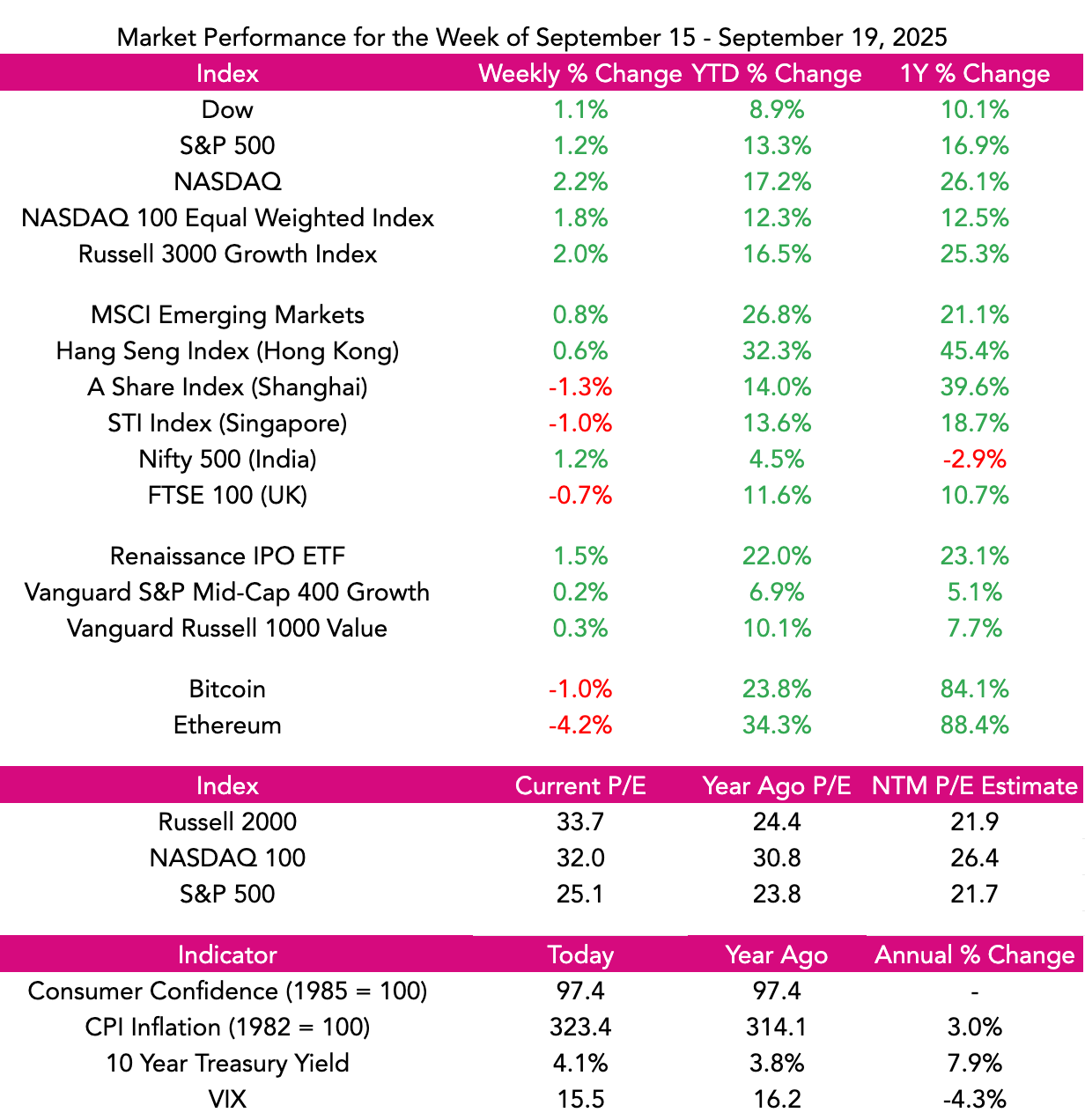

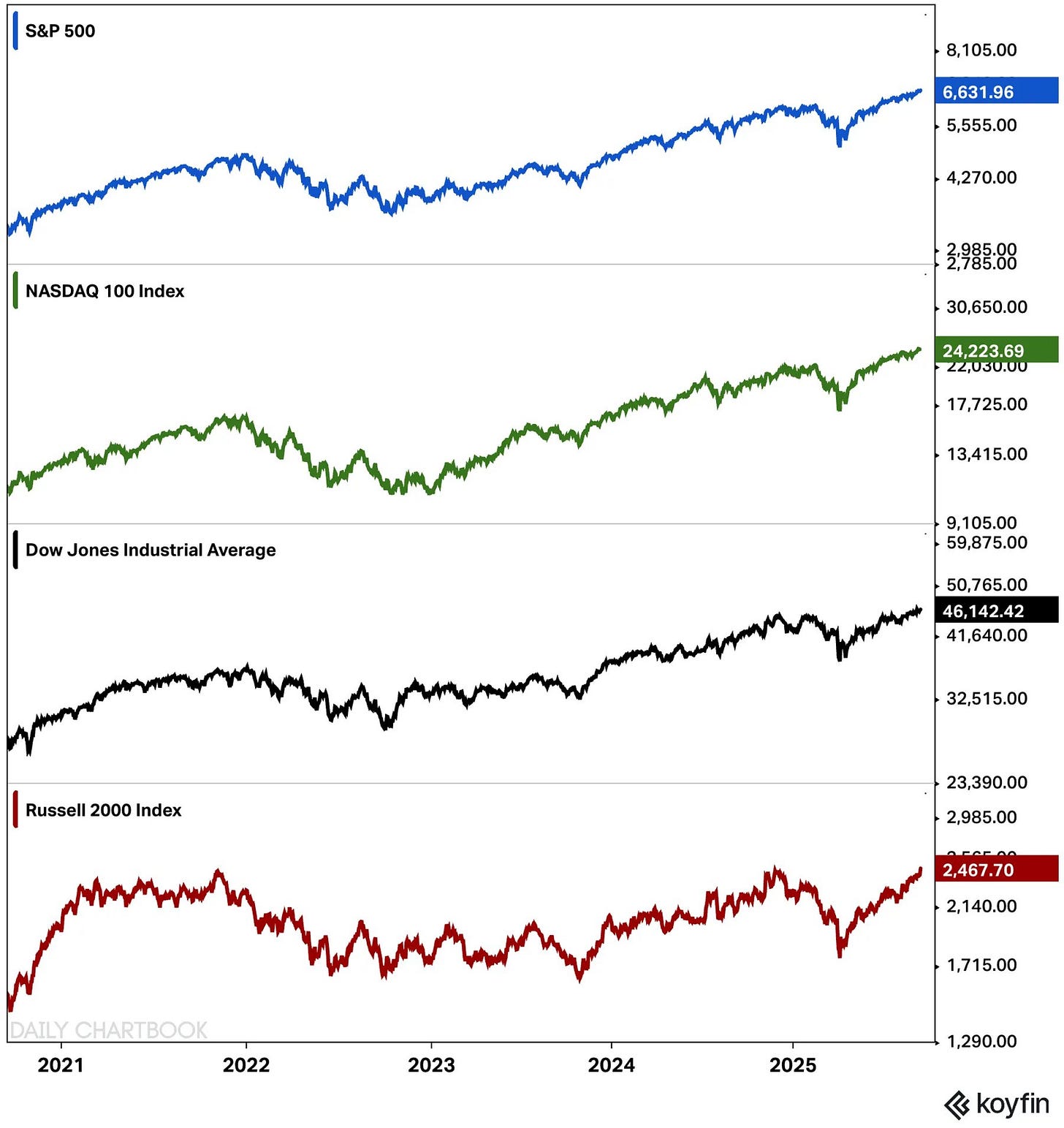

Market Performance

Market Commentary

Indexes closed at record highs, catalyzed by the Federal Reserve finally cutting rates by a quarter point on Wednesday.

For the week, the NASDAQ was up 2.2% and has now advanced 17.2% for the year. The S&P 500 rose 1.2%, the Dow was up 1.1%, and the Russell 2000 increased 2.2%. In a not-encouraging sign, advancers trailed decliners 2 to 1.

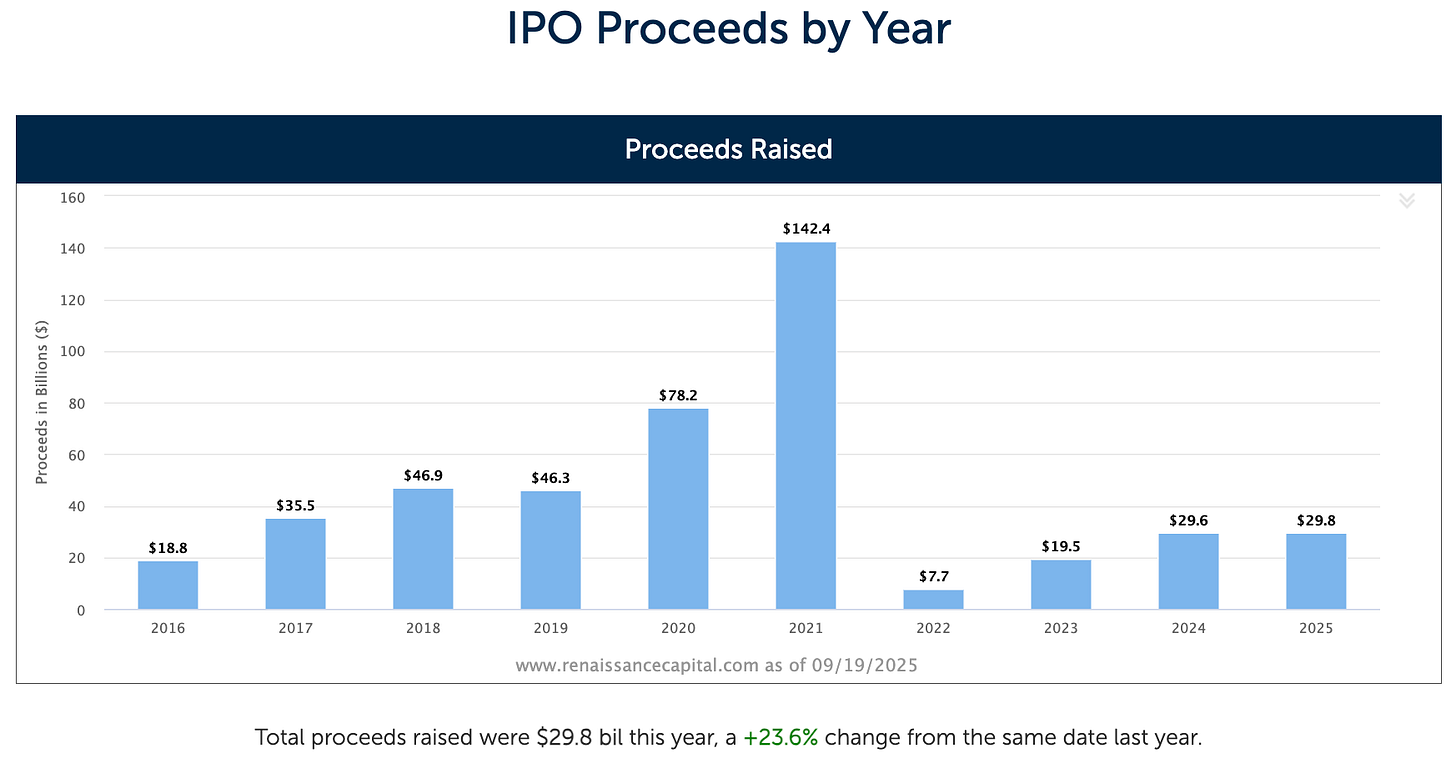

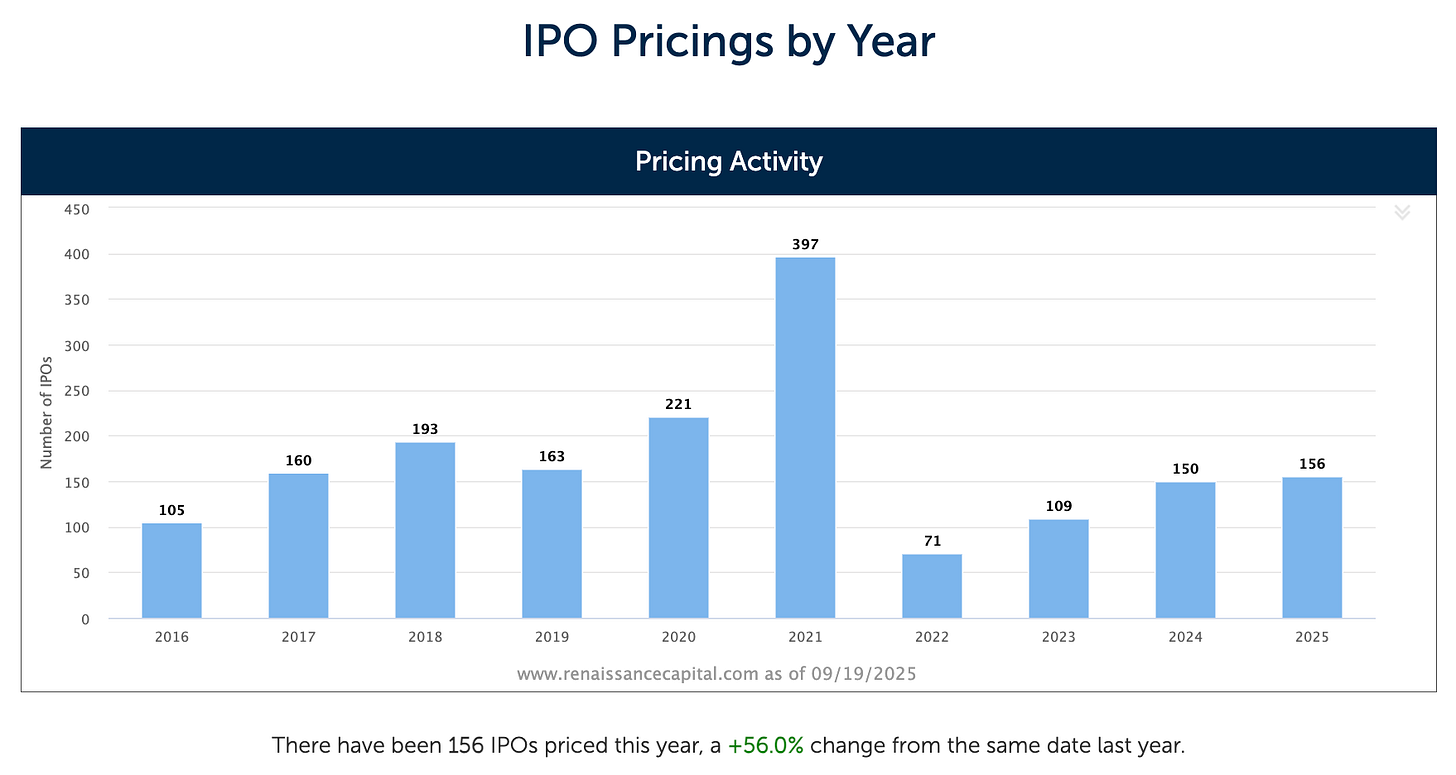

As we saw coming, the IPO market has picked up materially, with 153 new issues year to date versus 99 at this point last year and 76 in 2023. Importantly, the average first-day “pop” has been 26%, which encourages active participation from investors and encourages private companies and their masters to come in the water. Circle Internet, Figma, Newsmax, and CoreWeave are prime examples of the new crop of high-flying companies entering the public market.

Other interesting market news included Alphabet surpassing the $3 trillion market cap level, Elon Musk announcing he had bought $1 billion of Tesla stock, and NVIDIA buying $5 billion of Intel to top off the $9 billion Uncle Sam had invested previously.

Some other data points of note included that nearly 50% of all consumer spending came from the top 10% of income earners, which was the highest since 1989. Also, whispers that there was a deal between President Trump and President Xi for TikTok, with Oracle, Andreessen Horowitz, and Silver Lake as the investors buying it out from ByteDance.

Gold, cryptocurrencies, and stocks are all at all-time highs, which causes us to pause and reflect on whether our continued optimism for growth stocks needs a break. In actuality, we see an environment where rates should continue to fall—making future earnings more valuable—an IPO market that has come to life, which provides fresh oxygen to the market, and hyper-growth companies starting to outperform.

Accordingly, we remain BULLISH. 🐂

Need to Know

READ: The New Status Game: Longevity | New Internet

WATCH: #117 TikTok’s New Owner and Hiring a US CEO? | More or Less Podcast

WATCH: The Legacy of Charlie Kirk | The White House

LISTEN: Keith Rabois: Lessons from PayPal Mafia, $OPEN, & Investing | Sourcery

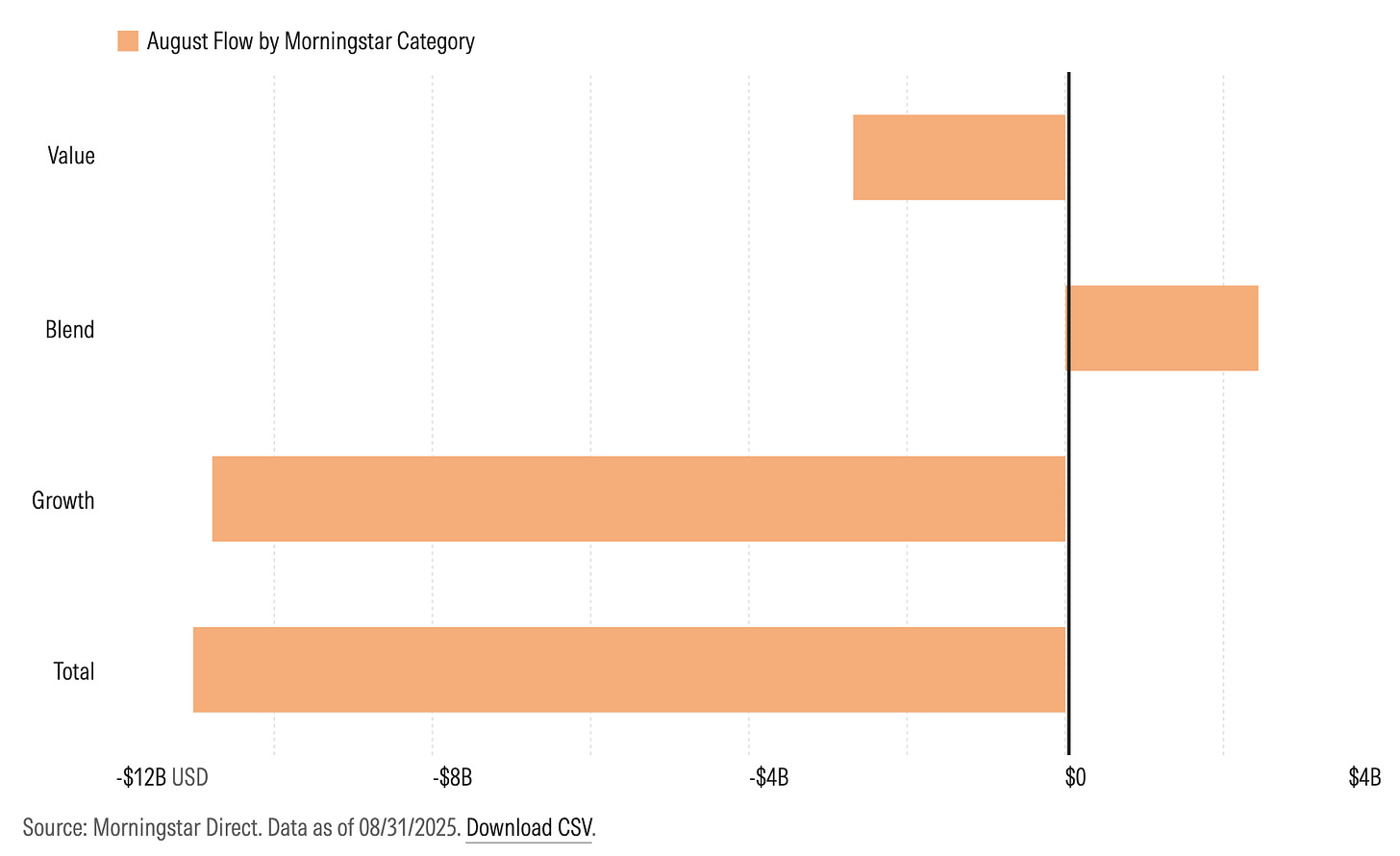

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

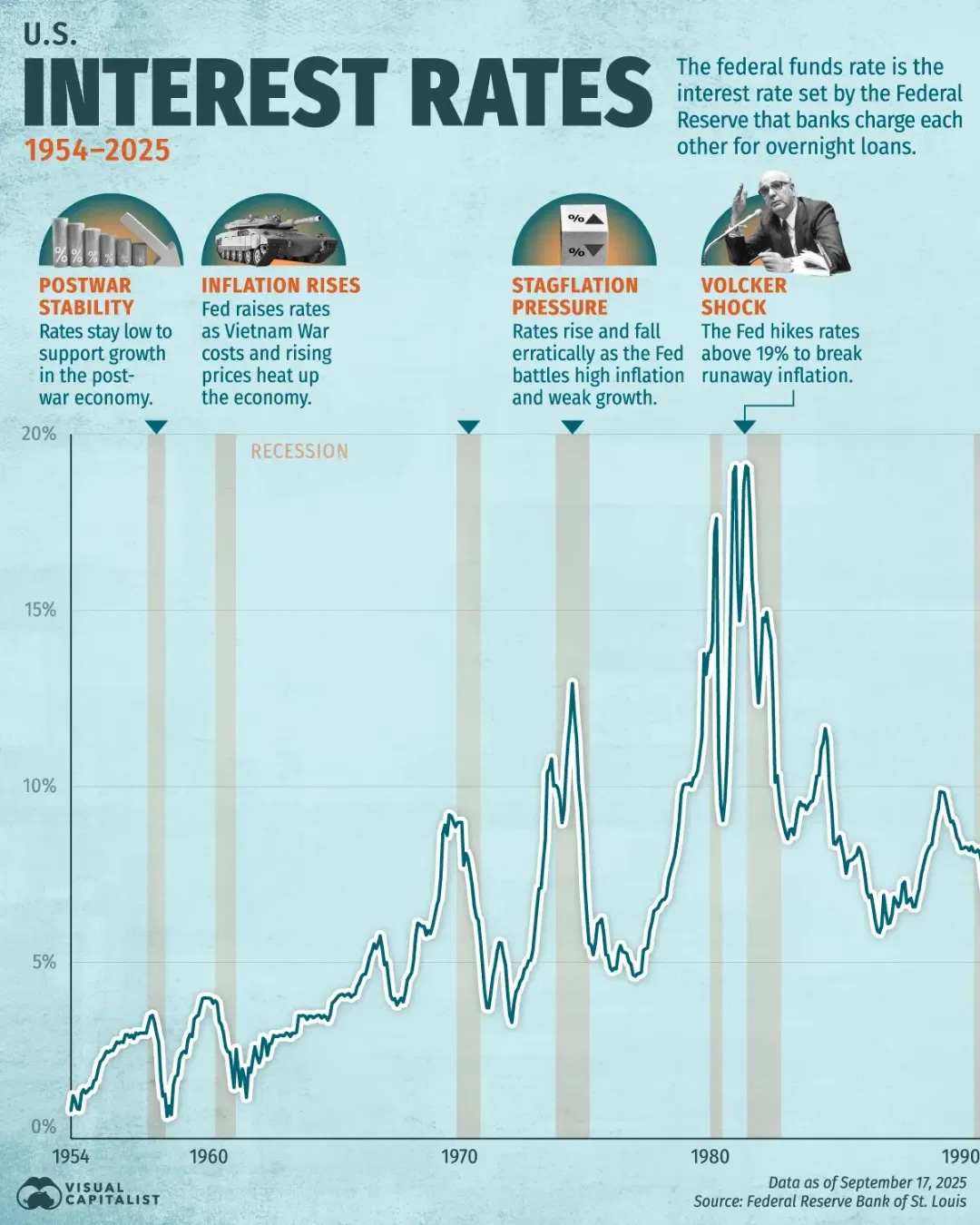

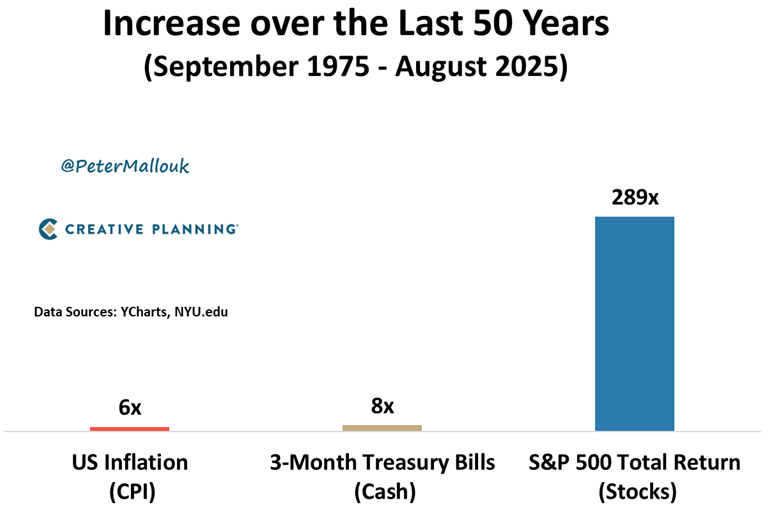

#3: Interest Rates

#4: Inflation

Chart of the Week

Maggie Moe’s GSV Weekly Rap

Chuckles of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM