GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: $42 billion – Total venture dollars invested into AI-related startups in Q4 of 2024, a record (and ~3.5x the amount invested in Q4 2023). (Crunchbase News)

Innovation: $46 billion – Total data center-related spending by Microsoft from January through August 2024. (Voroni)

Education: 95% – The percentage growth in “Administrative Staff” in US Public Schools since 2000, compared to 10% in teachers, and 5% in students. (America)

Impact: ~50% – The portion of FEMA’s disaster budget that was spent in the first 8 days of FY25. (Politico)

Opportunity: 78% – The percentage of NVIDIA employees who are now millionaires. (Special Situations Research)

“The Pioneers get all the arrows…but the ones that survive get all the land.” – Yours Truly

“In God we trust, all others bring data.” – W. Edwards Deming

“Data is the new oil.” – Clive Humby

The inauguration is still a week away but the incoming President has already been a provocateur with some of his musings. For a real estate guy, land is always on his mind so floating a purchase of Greenland, making Canada our 51st state, and/or taking back the Panama Canal should not seem remotely out of character.

After all, acquiring dirt has always been part of America’s superpower playbook. In 1789, the United States was comprised of the East Coast less Florida.

In a bold move, and inconsistent with his limited Federal Government philosophy, Thomas Jefferson bought the territory of Louisiana from France in 1803 for $15 million, doubling the number of states to 26.

The Treaty of Guadalupe Hidalgo of 1848 ceded California to the United States from Mexico in exchange for ending the War and paying them $15 million. Timing in life is everything with the California Gold Rush happening in the next year.

Alaska, barren but rich with oil and minerals, was bought from Russia in 1867. The annexation of Hawaii occurred in 1898 with the overthrow of the Hawaiian monarchy.

And so on.

As to whether President Trump is serious about making this Greenland acquisition (from Denmark) a priority, it’s not insane…and as Mark Twain recommended, “Buy land, they’re not making at anymore.” Moreover, while the population of “Land of the Midnight Sun” is roughly the same as Palo Alto, it’s strategically situated – vital for defense and surveillance of China and Russia.

The Panama Canal, which we gave to Panama in 1999, plays an immense strategic role in global trade, national security, and geopolitical influence. 6% of Global Maritime trade goes through the Canal, and 40% of U.S. containers rely on it. Recent Chinese activities have caused a heightening realization of the Panama Canal’s significance.

When the Internet was commercialized with the release of the Netscape Navigator in 1994, it became a “land grab” to get as many “eyeballs” as possible to engage with your product or service.

The key fundamental to creating a successful “Internet Company” was to get “Network Effects”…the phenomenon where every new node to your platform added exponential value. To wit, if you had one phone in the world, it wouldn’t have much value, but if you added another one, the value increases significantly, and when you add a third, the value compounds.

Hence, there was a mad rush to maximize nodes on your platform to achieve these powerful Network Effects. Another reality of Internet Economics is that the leader gets disproportionate value, largely due to these Network Effects.

One of the best strategies to remove “friction” to achieve massive scale quickly was to make your offering free. “Freemium” models were key for wildly successful businesses such as Google, Facebook, Twitter, Spotify, and Reddit to build their Network Effects rapidly. I’d argue vigorously that nobody would have ever heard of Google if the company had charged even a penny per search.

In the virtual world of the Internet, land grabs were as important as they were in the physical world.

In the AI Revolution, the maniacal focus on creating Network Effects has taken a backseat to acquiring the most, best, and – importantly – proprietary data. Data is to AI what oil is to energy.

Foundational Large Language Models (LLMs) lack inherent Network Effects since user interaction is independent. That said, proprietary data collection eventually creates a feedback loop, which could help create Network Effects. Further, AI-enabled platforms could foster Network Effects through developers and users like an Apple App Store.

In the Internet Era, it was about acquiring as many eyeballs as fast as you could. In the AI Revolution, it’s a Land Grab for data. OpenAI is doing partnerships with groups such as the Associated Press for data on journalistic information. OpenAI has partnered with Arizona State to get data that can be transformed into knowledge.

In drug discovery, 23andMe had a highly innovative approach to get rich databases to accelerate cures for diseases. Sanofi and BioNtech are using AI to accelerate R&D and radically speed up the creation of game-changing drugs.

The AI Revolution is going to be won by the enterprises that are the best and most effective and turning Data into AI gold. It’s a Land Grab.

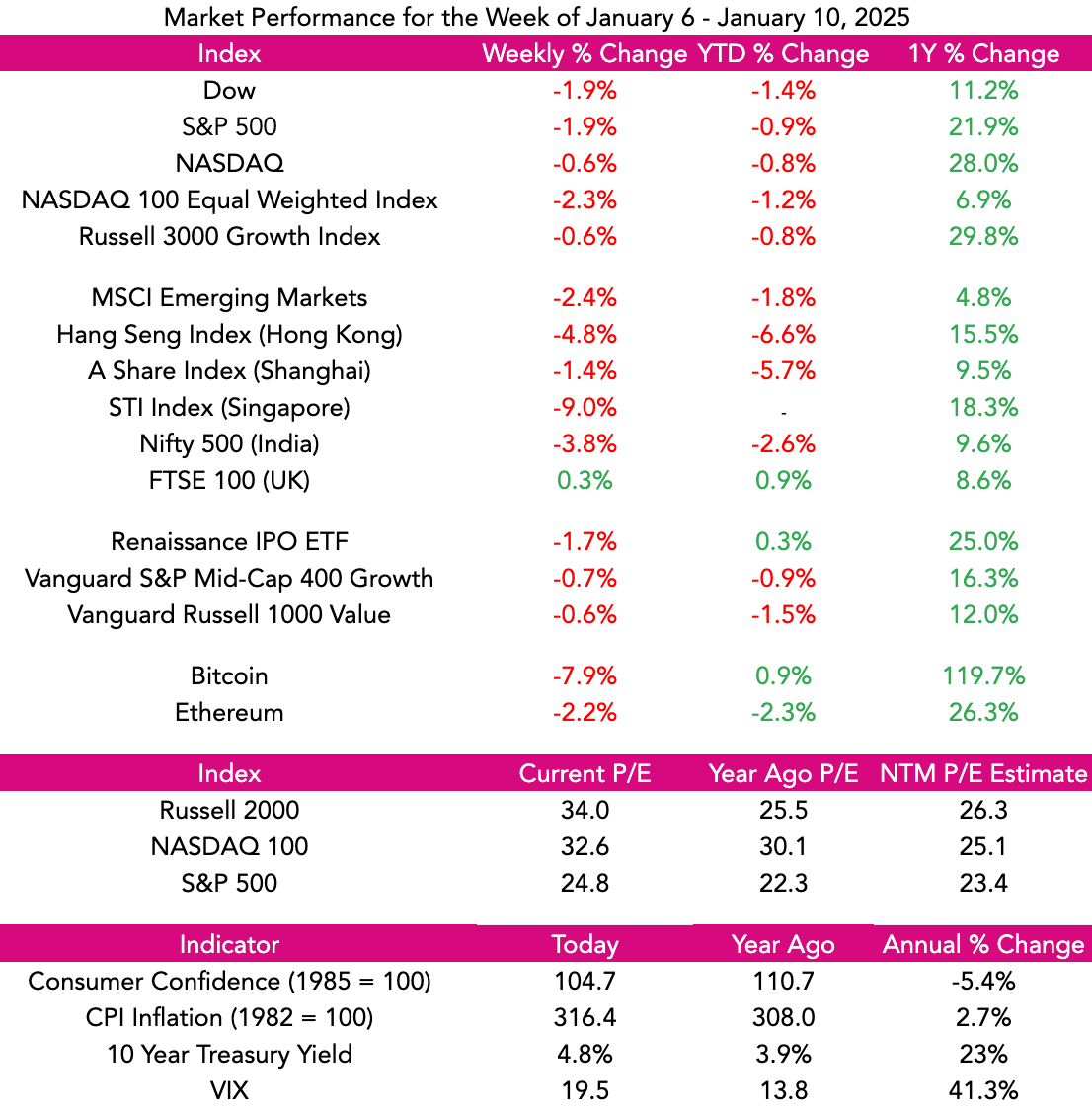

Market Performance

Market Commentary

Fittingly, the 140K attendee Consumer Electronic Show in Las Vegas featured AI everywhere but also nowhere. Unlike the cool TVs, next-generation computers, and gadgets of yesteryear, AI is invisible. But AI was in everything with the AI Revolution disrupting everything from cars, to homes, to fitness, medicine, and even food.

Despite the positive MOJO at CES and the momentum from 2024 which saw NASDAQ rise 30%, stocks were down in the first real trading week of the year. Probably the biggest vibe shift was investors embracing a “friendly Fed” to not wanting to “Fight the Fed.”

For the week, NASDAQ was off 2.3%, and the S&P 500 and Dow were both down 1.9%.

As is typical with the Market, “good news” was treated as “bad news” with non-farm payrolls increasing to 256K new jobs and unemployment falling to 4.1%. Of course, the fear investors had was that we were going to have a resurgence of inflation, and yields reflected this with the 10 10-year note reaching a 5% yield.

While we remain optimistic about the outlook for growth stocks for 2025, given the strong two-year+ performance for stocks, we expect some healthy pauses that allow fundamentals to catch up with valuations. We are BULLISH but believe it’s time to focus on “the Stars of Tomorrow” as some of the large leaders of the past seem a bit tired.

Need to Know

WATCH: NVIDIA CEO Jensen Huang Keynote at CES 2025

READ: 25 Predictions for 2025 | Digital Native

LISTEN: Mike Maples: How to do a 10x Seed Fund in 2025 | 20vc

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

#3: Interest Rates

#4: Inflation

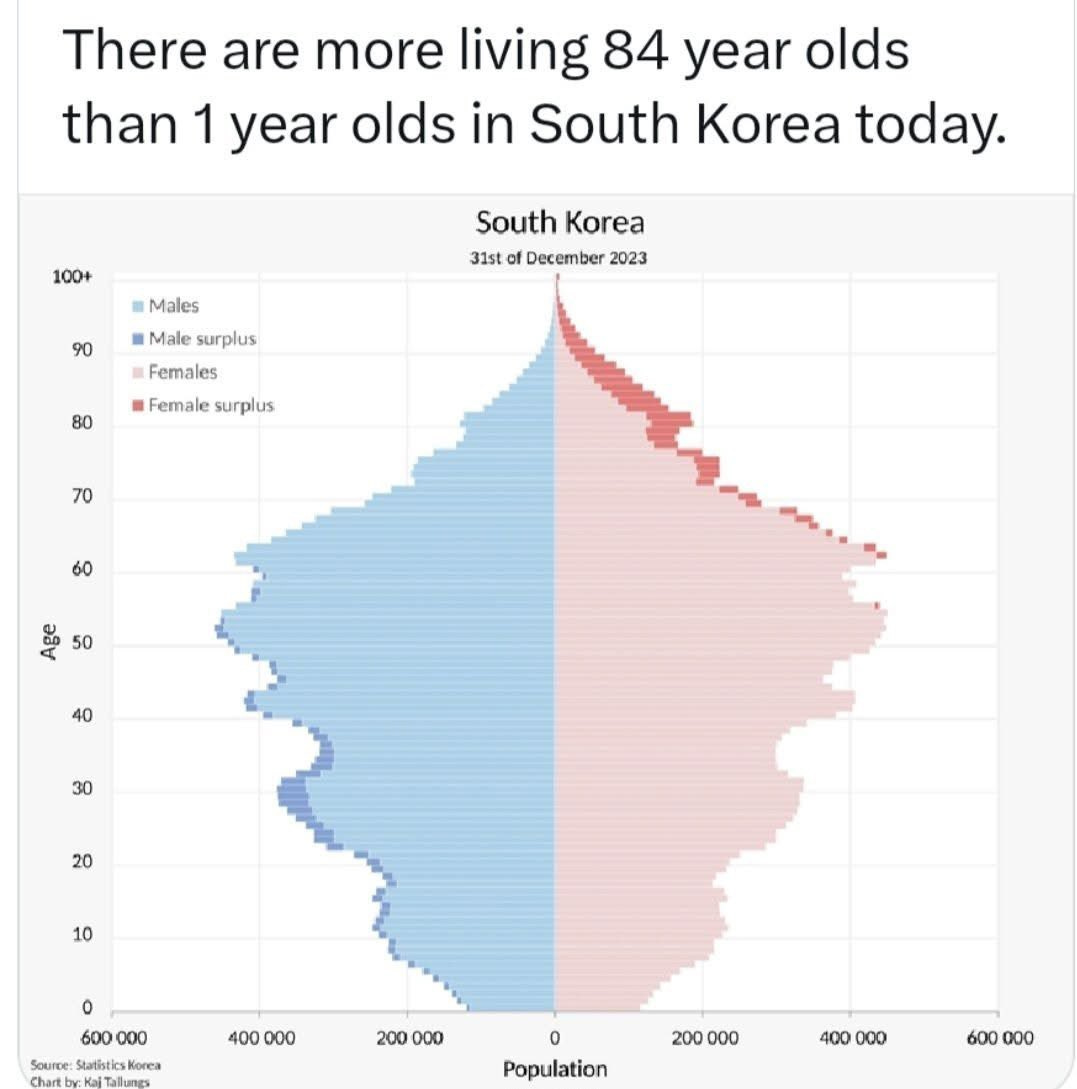

Chart of the Week

Maggie Moe’s GSV Weekly Rap

Chuckles of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM

Hello