EIEIO...Land of Opportunity

Entrepreneurship, Innovation, Education, Impact, and Opportunity

GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

"Ability is nothing without opportunity." – Napoleon Bonaparte

"Following the light of the Sun we left the Old World." – Christopher Columbus

"America is the Land of Opportunity and don't ever forget it." – Will Rogers

Nearly 30 years ago, I moved my family from the bustle of Manhattan to the boom of Silicon Valley.

I had grown up in Minneapolis and thought I’d never leave, but I was recruited by Lehman Brothers in the Big Apple as the “Small Cap Growth” analyst, and the allure was too large to pass up. My Mom was so proud of me. She could tell her friends her son was THE First Vice President at the legendary Wall Street firm Lehman Brothers.

A couple of years later when I called her to tell her I was leaving to go to San Francisco to work at Montgomery Securities, a firm that she (and most other people) had never heard of, she was despondent. “What happened?”

What happened was I got the break of my life to be part of an extraordinary moment in time when the City By the Bay was becoming the place where it all was happening. The talent, the ideas, and the capital were like this gigantic gravitational force where it seemed that everything that mattered was between the 50 miles that separated San Francisco and San Jose.

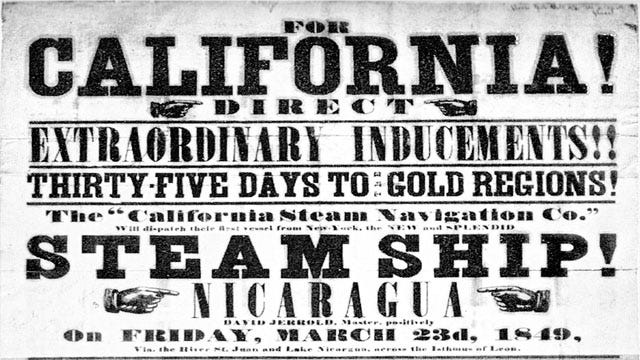

Since 1849, California had been the place where the young and ambitious looked to make their mark, but the technology revolution made it THE place you had to be.

California always had great bones…stunning beauty, perfect weather, and natural resources. It combined that with leading public schools, top-flight universities, and being a leader in key industries such as entertainment and aerospace.

It was no mystery why California’s population grew from under 2 million in 1900 to 40 million by 2020.

Importantly, if you were an entrepreneur with a big idea, you had to move to Silicon Valley, because that’s where the ecosystem was built to make you a success.

When we founded Global Silicon Valley (GSV) in 2011, part of our thesis was that innovation was rapidly being democratized around the World. Challenges emerging in Silicon Valley—rising costs, a supply and demand imbalance for talent, and regulatory hurdles, among others—combined with advancements in technology made it possible and desirable to build a business from virtually anywhere.

So, we named our firm after the Megatrend we saw emerging….the Global Silicon Valley. We wanted to connect Silicon Valley to the innovation that was beginning to sprout up around the World…from Austin to Boston, Chicago to Sao Paulo, from Mumbai to Shanghai to Dubai.

In 2011, 92% of Venture Capital was in the United States, and over 50% of it was in California. Last year, 55% of Venture Capital was outside of the United States.

While Silicon Valley remains the King of the Venture Capital Mountain, cities around the United States are rapidly developing robust innovation ecosystems of their own.

While I was excited to see entrepreneurial opportunities spread throughout the World, I had no notion that I was ever going to live anywhere but Silicon Valley – it had been my home for 25 years. SFO was my friend, and I could get basically anywhere on a direct flight so all was good…kind of.

March of 2020 began to shine a light on some cracks that had developed in the Golden State, and after a year of comparing and contrasting what was going on in other places, my wife and I became part of the Texodus movement in the Summer of 2021.

Like a lot of trends, COVID accelerated change that was already in place. Sure, some of the massive shift that was underway in the South was because of the business-friendly policies that attract companies and talent.

Major corporations, wealthy elites, and millions of Americans have moved South, drawn by low taxes, fewer regulations, and incentives. 2.2 million people and $100 billion of wealth moved to the Southeast in just over two years…that’s roughly the population of Houston.

But it’s much more than that. People are drawn to where they can be all that they can be. This isn’t just about taxes and regulation…it’s about quality of life: family values, country values, and community. As an example, in Texas, the four most important things are the Four F’s…Faith, Family, The Flag and Football.

People are voting with their feet. The Dallas-Irving-Plano area topped all U.S. markets for the greatest job gains in the last five years. Despite DFW making up 2% of the nation’s population, the area has scored 10% of the net jobs created in the U.S. since February 2020.

Why the sudden shift? When California was rocking and rolling, it was like paying a high P/E for a premier Growth company…it was worth it. But when the fundamentals change (due to crime, homelessness, and quality of living) and the valuation doesn’t, it’s time step back and reevaluate.

In the case of the Bay Area, even the Giants are struggling to attract talent via free agency because players don’t want to live there, and the Oakland A’s are headed to Las Vegas.

Regardless, the Bay Area today is still undeniably the capital of startups (and especially AI startups). However, these are lagging indicators rather than leading indicators. It’s interesting to note that already, the Bay Area is not the leading geography for four key industries of the future: Energy, Education, Fintech, and Gaming.

Warm weather, low taxes, and vibrant economies attract lots of talent. But it’s a mistake to think its just the Texas Triangle (between Texas, Tennessee, and Florida) that’s booming.

The past decade has found huge gains over the past decade in venture capital investment in places like Salt Lake City (410%), Denver (480%), and Phoenix (700%).

Why are these hubs growing? A series of intersecting trends.

First, every industry is becoming a technology industry. This means that traditional industrial hubs will quickly become technology hubs, and thus require the corresponding innovation and investment. Our friend Steve Case calls this Internet 3.0…when the Internet meets the real world. By the way, it will soon become apparent that every company needs to become an AI company.

Second…COVID didn’t kill the office as many predicted, but it changed where the offices are. People want to be on a TEAM (and a TEAM that wins), but the best talent doesn’t necessarily want to live in the Bay Area, Boston, or New York City. The best founders and investors are contrarian by nature…and that often means living far from the herd. Like it or not (editorial comment: I don’t), hybrid is the future.

Third…and what we’d say is most important, is the question of purpose. Young people want to work for high-growth, high-energy companies, but they also want to have a big impact. Most young people would rather work for a company that’s genuinely changing the World instead of building another B2B SaaS product for the next “platform shift” or making an app 10% more addictive.

Talent (another word for people) wants to feel like their life makes a difference and make their dash count. People are motivated by where they want to work, where they want to live, and where they shop from people aligned with their values.

Ultimately, the best entrepreneurs and employees vote with their feet. Cities that leverage the Innovation Flywheel can become leading industry hubs on a global scale…just like Silicon Valley did 50 years ago.

10 US Boom Towns We’re Watching

Below is our framework for identifying the cities that will become the Stars of Tomorrow. Check out the full 2023 Global Silicon Valley Handbook for more on the cities of the future.

Miami - Wall Street South

Miami has long been a hub for culture and the de facto capital of Latin America…now it’s a hub for innovation. The Miami Tech scene is booming, with Founders Fund and a16z opening offices there over the past few years. Serious capital is coming to the party too, with many top hedge funds including Ken Griffin’s Citadel moving to Miami.

Notable Residents: Keith Rabois (Founders Fund), Jeff Bezos (Amazon, Blue Origin), Katherine Boyle (a16z), Ken Griffin (Citadel)

Dallas - The Big D

Dallas is the capital of Texas’ diversified economy, with 24 Fortune 500 companies HQ’d in the DFW and over 65,000 businesses. Dallas is home to a world-class dining scene (nicknamed the “New Dubai” by the NYT), four major league sports teams, and one of the best and busiest airports in the World, DFW…which is larger than the island of Manhattan.

Notable Residents: Mark Cuban (Mark Cuban Companies), Dave Clark (Amazon), Nirav Tolia (Nextdoor), Michael Abramson (Newlands)

Nashville - Music City USA

Nashville is one of the fastest-growing cities (added 100 new residents per day in 2022) in the fastest-growing state in the country, Tennessee. It boasts a world-class music scene, leading corporations such as AllianceBernstein and Bridgestone, and no state income tax. Adam Neumann’s new venture Flow has been investing aggressively in Nashville apartments.

Notable Residents: Clark Landry (Hawke Ventures), Al Gore (Generation Investment Management)

Raleigh - The Research Triangle

Raleigh and the rest of North Carolina’s Research Triangle have all the ingredients for a budding VC ecosystem. 26% of the population is 18-34, Apple is building a $550 million campus, and Charlotte is the 2nd largest banking center in the country by total assets. Raleigh is known for its booming biotech industry, advanced manufacturing, and Cleantech.

Notable Residents: Scot Wingo (Triangle Tweener Fund), Arthur Tew (Sherpa Collaborative), Bill Spruill (2ndF)

Salt Lake City - Silicon Slopes

Salt Lake City has become the heart of the Silicon Slopes, the area between Salt Lake City and Provo. Key industries include PropTech, FinTech, and life sciences. The regionis known for its low cost of living, unique R&D tax credit system, and world-class skiing in Park City.

Notable Residents: David Blake (Degreed), Mike Levinthal (Levinthal Capital), Ryan Smith (Qualtrics)

Denver - The Mile High City

Denver (and its little brother Boulder) is becoming an innovation hub, as Tech giants like Google, Facebook and Salesforce all have offices in the state, as do private companies like Gusto and Robinhood. Palantir recently moved its headquarters from Palo Alto, California, to Denver. The area is known for its access to outdoor life, with some of the World’s best skiing just a few hours away.

Notable Residents: Matthew Witheiler (Wellington Management), Brad Feld (Foundry Group), Eric Resnick (KSL Capital Partners)

Phoenix - The Valley of the Sun

Phoenix is emerging as a massive hub for innovation, led by Arizona State University. The CHIPS Act is bringing the semiconductor industry to its new home in Arizona, Ohio, and Texas. One massive winner is Arizona State University, which is launching a $270 million semiconductor facility with Applied Materials and partnering with TSMC to build a global semiconductor hub.

Notable Residents: Howard Lindzon (Social Capital) and Jack Selby (Thiel Capital & AZ-VC).

Austin - Bat City

Austin has emerged as a major tech hub and startup city. It boasts a thriving music scene, the SXSXW Conference & Festival, great BBQ, and no state-income tax. Austin is home to 20 unicorns and secondary offices of many of the World’s largest tech companies, including Google, Apple, Oracle, Amazon, and Meta.

Notable Residents: Elon Musk (Tesla), Joe Lonsdale (8VC), Bill Gurley (Benchmark)

Tampa + St. Petersburg – Champa Bay

The Tampa Bay Area famously became a Sports Capital over the past few years, led by Tom Brady and the Tampa Bay Lightning’s back-to-back Stanley Cup titles. It’s also quietly become a hub for financial services, with firms like BlackRock and AQR opening major outposts there. Next door in St. Pete is Cathie Wood and her firm ARK Invest, and the just-completed Ark Innovation Center.

Notable Residents: Cathie Wood (Ark Invest), David Seldin (Anzu Partners)

Las Vegas - Sin City

Las Vegas is becoming a major innovation hub, with major firms like Amazon and Google opening large offices, taking advantage of the global sports, entertainment, and lifestyle that the city offers.

Notable Residents: Ben Horowitz (a16z), Jeff Saling (StartUpNV)

10 Hot Global Cities to Watch

Abu Dubai (Abu Dhabi + Dubai)

London

Riyadh

Tokyo

Tel Aviv

Mexico City

Mumbai

Ho Chi Minh City

Seoul

*Shanghai + Shenzhen…China will be Hot again

Market Performance

The party celebrating the extraordinary stock performance of 2023 led by NASDAQ's 45% rise led to a 4 Advil hangover for the start of 2024. Stock and bonds had the worst first week in nearly 20 years, with NASDAQ down 3.2%, the S & P off 1.5% and the Dow declining .6%, with the 10 Year Yield increasing to 4.1%.

While pundits pointed to a number of culprits for poor out of the gate performance, nothing weighed heavier on the indices than the downgrade of the $3 trillion market value Apple, which shed nearly 6% for the week.

To quantify that a little more, that's approximately $175 billion of decline in market value. For context, there are only 50 Companies in the World with $175 billion or more of market value. Slow down in iPhones and Macs caused the investor concerns with the end of week having a NY Times article saying the Justice Department was at the late stages of anti-trust investigation of Apple.

Also causing angst is the skirmishes in the Red Sea prompted by the Iranian sponsored Houthi militants. Approximately 30% of global containers go thru the Suez Canal which links the Red Sea and Mediterranean Sea.

The December jobs report significantly exceeded analyst expectations with 216K new jobs created. The unemployment rate remained at 3.7%.

Notable, bankruptcies jumped 72% in 2023 with surging interest rates being a major factor. Amongst companies going bankrupt included 21 former SPACS.

Our thesis for 2024 is that there will be a broadening of participation in stock performance which we started to see towards the end of 2023. We expect with that, the IPO window will open up in the Spring providing some fresh oxygen for growth investors.

In Case You Missed It….

EIEIO…2024 In Review

The GSV Big 10…Shake It Up, Shake It Up!

Maggie Moe’s GSV Weekly Rap

Need to Know

READ: At The Money: Contrarian Investing - The Big Picture

READ: 2024: The Year of AI-Powered Stock Picking | Deepwater Asset Management

LISTEN: Erik Serrano - Investing in Investment Firms

WATCH: Cathie Wood on Bitcoin Holdings, Tesla, AI, 2024 Outlook

WATCH: Redefining Partnership with Adam Neumann

WATCH: Tech Market Breakdown with Bill Gurley, Brad Gerstner, and Jason Calacanis

WATCH: The Future of Longevity with Tony Robbins

GSV’s Four I’s of Investor Sentiment

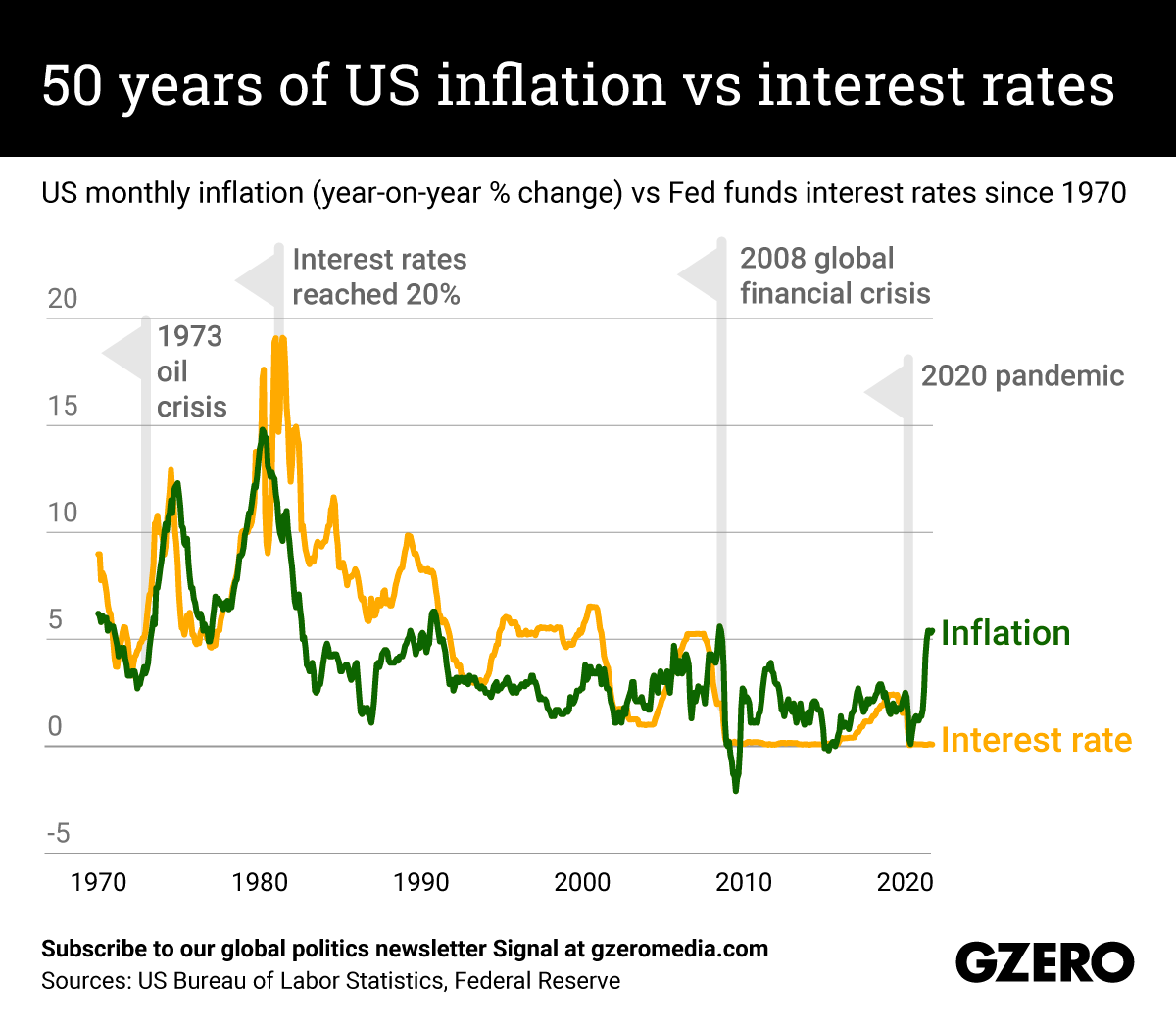

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

December fund flows into the S&P 500 ETF $SPY was the strongest monthly inflow in a decade at $39.4 billion.

Source: X

#2: IPO Market

Amer Sports, which owns brands such as Wilson, Salomon, Arc’teryx, and Louisville Slugger, filed for a US IPO this week. Amer Sports is owned by China’s Anta Sports Products.

Source: Axios

#3: Interest Rates

The chances of a rate cut by March plummeted on Friday after a better-than-expected jobs report. The odds of a rate cut have been steadily decreasing since Tuesday - from 67% to 33%.

Source: Kalshi

#4: Inflation

Source: GZERO

Chart of the Week

Chuckle of the Week

EIEIO…Fast Facts

Entrepreneurship: 79% – GDP in India that comes from family firms (The Economist)

Innovation: 38% – Global population that still hasn't used the internet (Zippia)

Education: 67% – Americans aged 18-24 agree that "Jews as a class are oppressors and should be treated as oppressors” (Harris Poll)

Impact: 25% – Americans aged 40 who have never been married, up from 6% in 1980 (Pew)

Opportunity: 38% – increase in revenue for companies with higher diversity vs. lower diversity in management (BCG)

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup….EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM