GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: >5 million – The number of businesses that actively use TikTok. (BusinessDasher)

Innovation: 90% – The percentage of medical cases that ChatGPT accurately diagnoses on the basis of a list of symptoms, compared to 74% by doctors, on average. (Harper’s)

Education: 28 - The number of closures of degree-granting U.S. institutions in 2024. (The Hechinger Report)

Impact: ~20% – The percentage of Americans who use marijuana every month. (Auren Hoffman)

Opportunity: >70% – The percentage of inmates in America’s prisons who cannot read above a fourth-grade level. (Governor’s Early Literacy Foundation)

“Success is best when it’s shared.” — Howard Schultz

“Care more than others think wise.” — Howard Schultz

“Risk more than others think safe.” — Howard Schultz

“Expect more than others think possible.” — Howard Schultz

“If you are an entrepreneur, you’ve got to dream big and then dream bigger.” —Howard Schultz

“The most powerful and enduring brands are built from the heart.” — Howard Schultz

It was a Thursday afternoon after a long week on the road visiting companies. I was in Seattle with one meeting to go before I flew home. My friends told me about this coffee company named after a Moby-Dick character with a cult following.

I almost canceled my meeting because I was tired and the company sounded ridiculous.

Maybe people in Seattle would embrace a coffee house as a great business but I couldn’t imagine the concept of traveling beyond the Puget Sound. At the time, I didn’t even drink coffee! But, Starbucks headquarters was just off Interstate 5 on the way to the airport and I figured, “Why not, I’ll make it quick.”

The minute I walked into the reception area, I knew something special was going on there. The receptionist made me feel like we had been friends for 100 years. The level of energy in the air was electric.

When I sat down with the CEO, Howard Schultz, who at the time had braces, he crystallized how Starbucks would become the most important coffee company on the planet. He talked about the importance of employees and how he was creating a partnership with them. He was passionate about the quality of the product and customer experience. Moreover, he painted a picture of how Starbucks was going to develop a universally known, widely respected, marquee brand. And maybe even more grandiose, how Starbucks was going to change the World for good, one cup of coffee at a time.

After meeting Howard at that first meeting, I was convinced that Starbucks was indeed creating a World-changing business. I started to drink coffee!

That was in 1992.

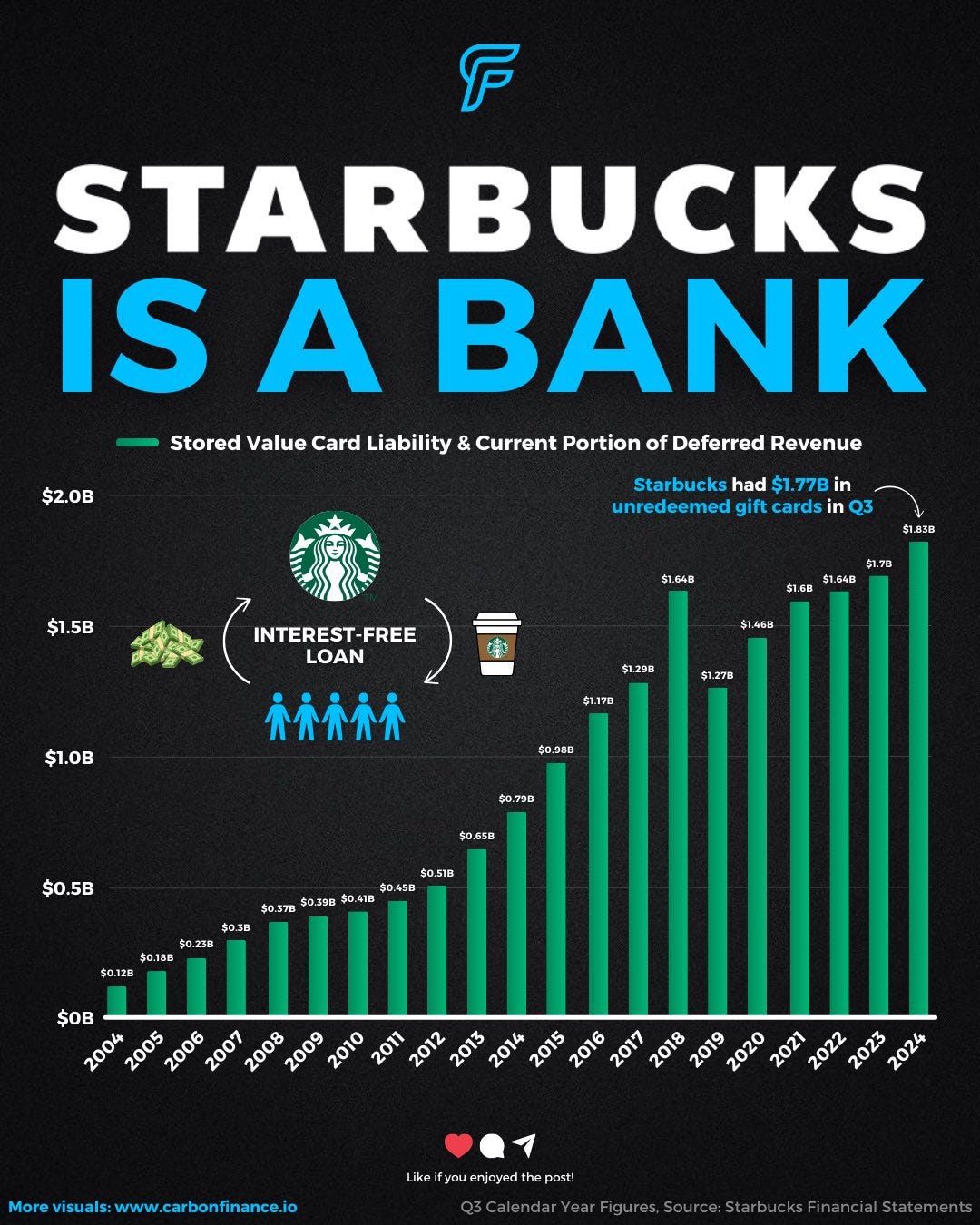

Today, Starbucks has over 40,000 stores in 85 countries and a $100 billion market cap. In the United States alone, the company has 17,000 units and serves 5 million cups of coffee a day. One particularly mind-blowing statistic: the business has almost $2 billion dollars on deposit from unredeemed gift cards.

The lessons I learned from Howard and Starbucks over thirty years ago influence me to this day.

The “5P’s” came from my Starbucks experience. Namely, to identify and invest in “the Stars of Tomorrow”, I was looking for companies with great PEOPLE; a leading PRODUCT, huge POTENTIAL, strong PREDICTABILITY and a sense of PURPOSE.

Most importantly, I found religion on the importance of the people within an organization…and it starts at the top. Clearly, Howard Schultz was a very, very special leader, but he surrounded himself with exceptional people who brought different experiences and skill sets. Orin Smith was a great finance person who helped instill rigor to this dynamic, young business. Howard Behar was the other Howard’s alter ego. Dave Olsen was the coffee guy who scoured the globe to find the best beans and develop relationships with farmers from Ethiopia to Sumatra.

It’s a given in retail that the “customer is always right”, and staff should do anything to make the customer happy. Starbucks’ philosophy was instead to treat their employees like royalty, with the belief that this would translate into stellar customer experiences.

Despite the views of its private investors, Starbucks gave even part-time employees full health care benefits and stock options in the company through its “Bean Stock” program.

Why?

Because it was the right thing to do, and Howard had been heavily influenced by his family’s struggles and losing healthcare benefits when it mattered most. But he was able to make the economic case to his investors that if he was able to have employee turnover go down from 150% (the industry standard) to 130%, it would pay for itself.

Turnover plummeted to 65%. Employees were thrilled and loyal which translated into thrilled and loyal customers. Using that same logic and commitment to its people, Starbucks partnered with Arizona State to create “education as a benefit” for its workers with over 12,000 graduates. The results have been impressive with the average Starbucks employee in the program staying with the company 50% longer and getting 3X the number of promotions.

The Starbucks Bean Stock Program

“Go to College, On Us” ASU+Starbucks: Starbucks College Achievement Plan

Another seemingly small thing that paid cumulative dividends is that Starbucks stores always opened 10 minutes earlier and closed 10 minutes later than published store hours. Their Net Promoter Score (NPS) has always been far above average and continues to this day with an NPS of 77 versus the fast-food industry average of 30.

Starbucks was always fanatical about delivering a product that was #1. There were hard and fast rules to be followed…no flavored coffee, no franchising, no compromising on quality (Howard Schultz equated franchising to a communicable disease as he thought it to be antithetical to what he believed in for the brand).

Howard wasn’t afraid to take risks even though he had a killer core product, and there were definite whiffs along the way (Remember “Joe Magazine”?). But creating that delicate dance between keeping your eye on the prize and pushing the envelope Starbucks was the master of. And a belief that you get better or worse, you don’t say the same….you grow, or you die.

AUGUST 2002: Starbucks Expands Internet Program | The Los Angeles Times

Flashback to 1999 – Starbucks Creates Joe Magazine and it Tanks | StarbucksMelody

Starbucks created its own music label Blue Note that curated an experience for its faithful. While it seems obvious today, Starbucks was the first restaurant of note that provided free WiFi in its stores which I’ll admit, I didn’t get when they did it.

Predictability of growth is always challenging for young, fast-growing companies, and it’s notoriously difficult for a restaurant. Actually, Starbucks had strong visibility because its average customer visited 22 times a month. This began my love for businesses that are addictive and don’t cause cancer.

In the early days, the top revenue store in the Starbucks system was on Robson Street in Vancouver. Counterintuitively, at least to me, Starbucks opened another store across the street, and instead of cannibalizing its top performer, supply induced demand and instantly created two of the top-performing stores in the entire Starbucks system.

Even though Starbucks’ growth in the United States was far from saturated, Howard saw the potential in China and opened the first store in Beijing in 1999. This was after going there every quarter for several years before (and then for years after) recognizing early how big the Chinese market could be. Today, there are over 7,500 stores in the Middle Kingdom.

Perhaps two of the most enduring lessons I learned from Starbucks were the importance of a brand and having a purpose beyond making money.

Brands aren’t about marketing or a fancy logo. Brands are a promise to your constituents and the consistency in delivering against that promise. You can’t say you are one thing, but your actions say you are something else. Great brands are authentic and from the heart. Brand equity has enormous value and must be protected like a valuable treasure.

There was a belief infused by Howard Schultz that the mission of Starbucks was to change the World, one cup of coffee at a time. It was caring about people. It was creating a place where communities could gather and friendships could be made. The success of Starbucks was directly correlated with the number of people whose lives they could improve.

In the relentless pursuit of Finding the Next Starbucks, I’ll always go back to the playbook of why the original Starbucks achieved its stunning success.

Market Performance

Market Commentary

Here we go!

On his first day in office, President Trump signed 26 Executive Orders. The areas of action could be put into four buckets: energy, immigration reform, tariffs, and technology.

In a major announcement with OpenAI, Oracle, and SoftBank, President Trump declared he wanted to “Make America the World Capital of Artificial Intelligence.” Project “Stargate” promises to invest as much as $500 billion to build data centers and infrastructure. Oracle was up 14% last week. Key Trump advisor Elon Musk dissed Stargate saying they didn’t have the money…but unsaid by Elon was the initiative did involve his nemesis: OpenAI’s Sam Altman.

Excitement around the new administration and good early earnings results lifted stocks higher last week with the Dow advancing 2.3% and the NASDAQ and S&P both up 1.7%.

Netflix had an especially strong week reporting nearly 20 million new subscribers to go over 300 million Globally. It was also announced that Netflix had the most Academy Award nominations with 16 up for Oscars…it seems that its $17 billion investment in production is yielding significant ROI. NFLX stock was up 10% last week and is up 100% in the past year.

This week, Meta, Tesla, Microsoft, and Apple will all be reporting. It’s a good thing they didn’t report last week because all the CEOs were in Washington.

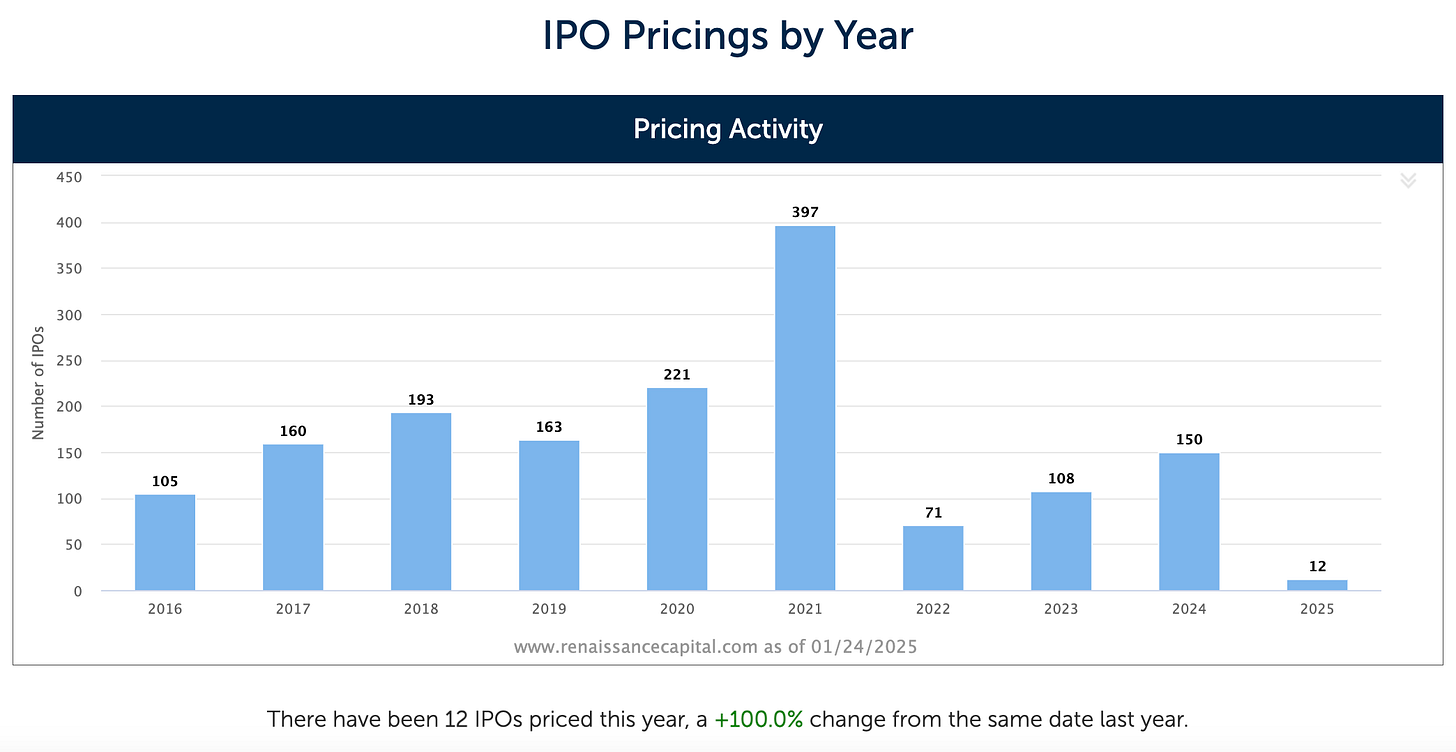

One data point consistent with our thesis of continued strong performance for growth companies is that KPMG stated last week that 150 to 250 companies had done “quiet” filings with the SEC to do IPOs. The market needs “fresh blood” to continue to go higher, and IPOs act as a great source.

We remain BULLISH.

Need to Know

READ: AI vs. AI: The New Frontline in the Billion-Threat Cyber War | BCV

WATCH: Stargate, Executive Orders, TikTok, DOGE, Public Valuations | BG2 w/ Bill Gurley & Brad Gerstner

LISTEN: Michael Lewis: Arenas of American Ambition | Glue Guys Ep. 22

GSV’s Four I’s of Investor Sentiment

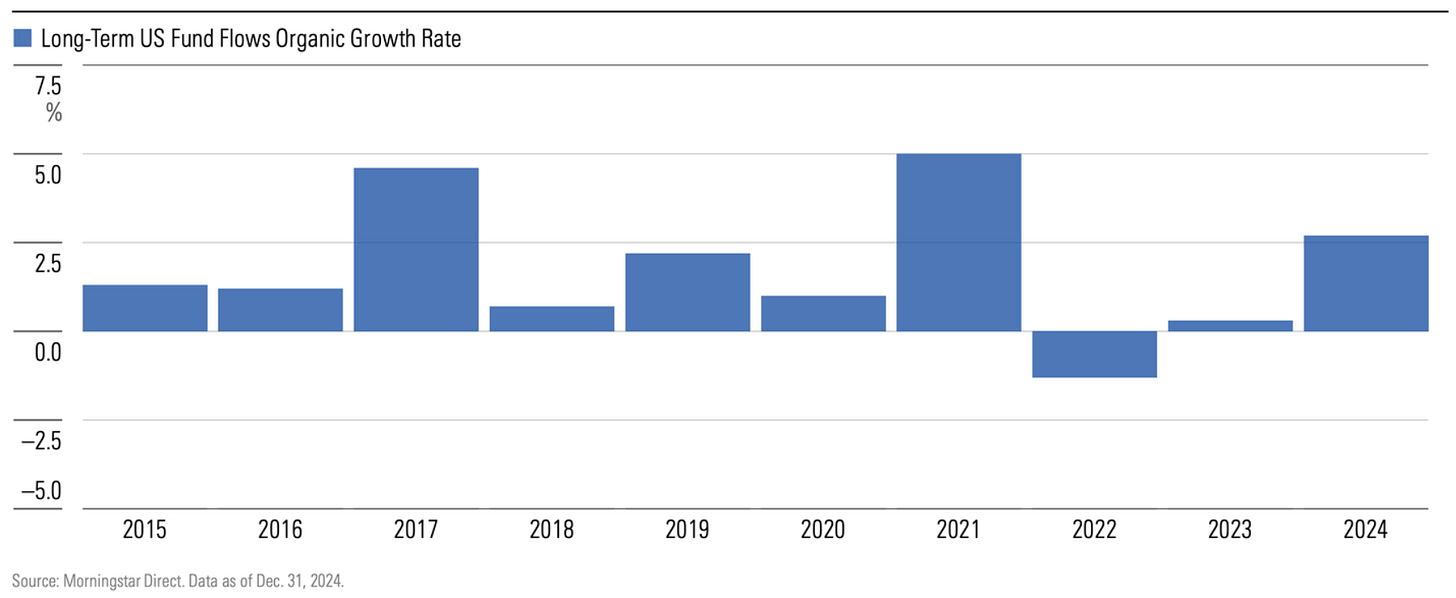

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

#3: Interest Rates

#4: Inflation

Chart of the Week

Maggie Moe’s GSV Weekly Rap

Chuckles of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM