EIEIO...Lyin' Eyes

Getting Personal...Preventative, Personalized, Precise

GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: $1.1 Billion – Substack’s new valuation after last week’s $100 million series C raise, led by Bond Capital and The Chernin Group. (Reuters)

Innovation: 32.9 million – The number of worldwide iPhone App Store downloads of TikTok, Facebook, Instagram, and X combined during a 28-day period this spring. ChatGPT had 29.6 million downloads over the same stretch. (SimilarWeb)

Education: 20% – The percentage of voters who say that race, gender, or ethnicity should be taken into account when universities are choosing which students to admit or teachers to hire. (The Free Press)

Impact: 10 – The number of permanent night club closures per month in the UK between June 2020 and June 2024. (NTIA)

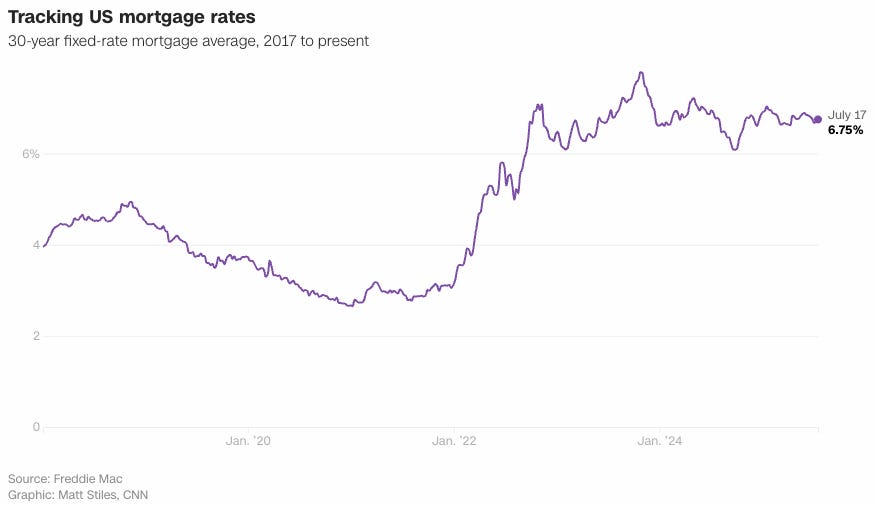

Opportunity: 24% – The percentage share of home purchases made up by first-time home buyers in 2024, compared to 50% in 2010. (NAR)

“The future depends on what you do today.” – Mahatma Gandhi

“Some people make things happen. Some people watch things happen. Some people say, ‘What happened?’“ - Mary Kay Ash

“Your eyes lie to you all the time.” – Dr. Marcus Elliott, Founder of P3

In July 2002, I received a phone call from Sandy Robertson telling me I should hire a young banker named Pat Kratus who worked at Robertson Stephen’s which was being shut down by its acquirer, Banc of Boston.

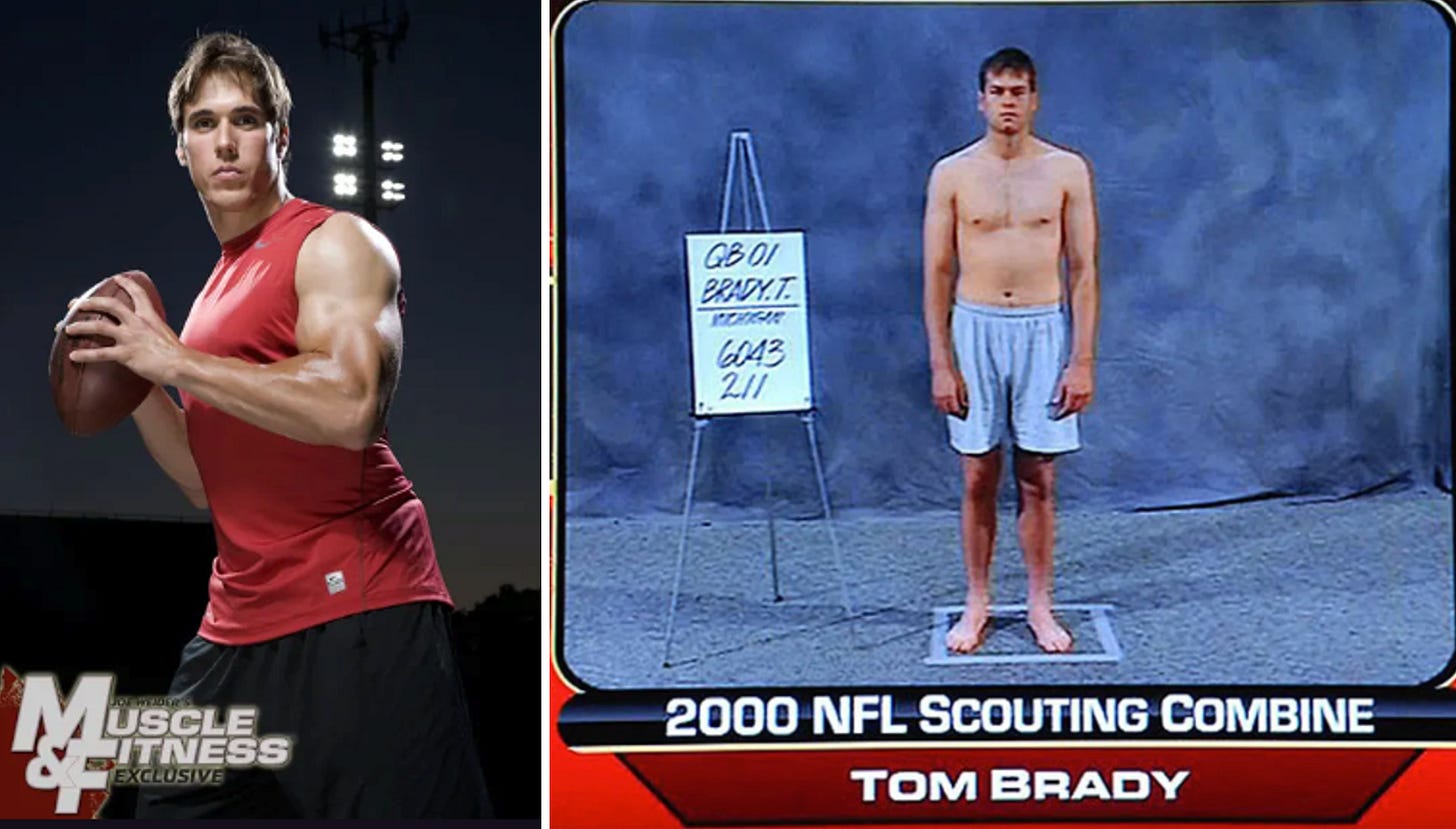

My respect for Sandy was so extreme, I didn’t give it another thought and hired Pat immediately. Pat, it turns out, played center at the University of Michigan (Sandy’s Alma mater) and his best friend was Tom Brady. As a kind of side benefit of Pat for ThinkEquity, Tom would occasionally stop by our office in the offseason to hang out with his former teammate.

Years later I was having lunch with Pat to catch up and I asked him, “Do you still see Tom much?”

Pat replied, “Sure, when he comes to town, we’ll hang out. But it’s not like the old days.”

“Why?” I asked.

Pat said “When we used to go out, we’d go to a bar and have a beer or two. Tom really doesn’t drink any more. So I asked him, is it hard for you not to drink? And Tom said, ‘Pat let me ask you this…If I paid you $40 million a year not to drink beer, would that be hard for you?!’”

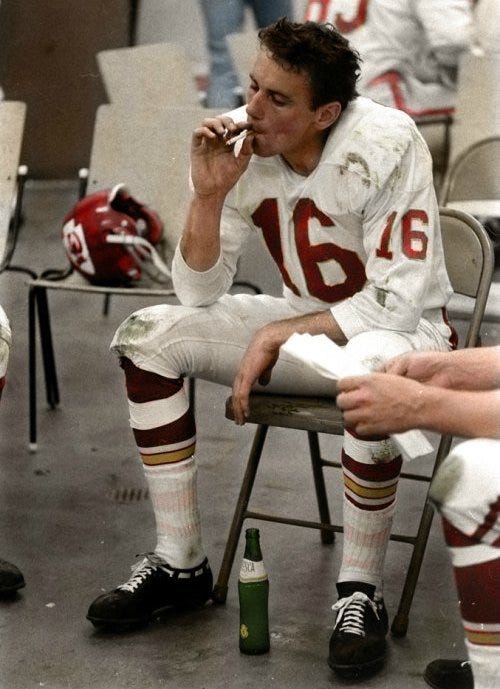

Athletes haven’t always been so health conscious.

Babe Ruth was legendary not only for swatting home runs but swigging beer (and crushing hot dogs). Joe Namath was called “Broadway Joe” due his late night habits and fondness for Johnnie Walker Red. Green Bay Packers wide receiver Max McGee famously stayed out drinking until 6AM the day of the Super Bowl and went on to play a starring role in the game.

Oh and by the way, Ruth’s entire 22-year career earnings are equal to what LA phenom Shohei Ohtani makes in two games.

Ruth’s salary was a fraction of today’s players when he made a whopping $80,000 in his highest income season. ($5,000 more than President Hoover made the same year. When Ruth was asked if it was fair that he made more than the President, Ruth replied, “I had a better year.”)

Joe Namath made $162,000 per year at his peak. Today, the average starting QB salary in the NFL is >$34,000,000.

As Tom Brady illustrated in his conversation with Pat, that type of money will motivate an athlete to take care of his or her body (did anyone else see Kirk Cousins visiting Antigua for stem cell therapy in season 2 of Quarterback?). When it comes to health, wellness, fitness, longevity, and the pursuit of ever-extending our healthspan, we’re entering a new chapter.

This is the era of the 3 Ps: preventative, personalized, and precise.

Modern medicine is remarkably good at putting something broken back together again. Remember when we used to hear that an athlete “Had so much potential, but then he blew out his knee.”? Athletes don’t “blow out their knees” anymore. They tear their ACL, receive surgery and rehab, and return to play (in many cases) with a stronger ACL than they had before. Remarkable, but reactive.

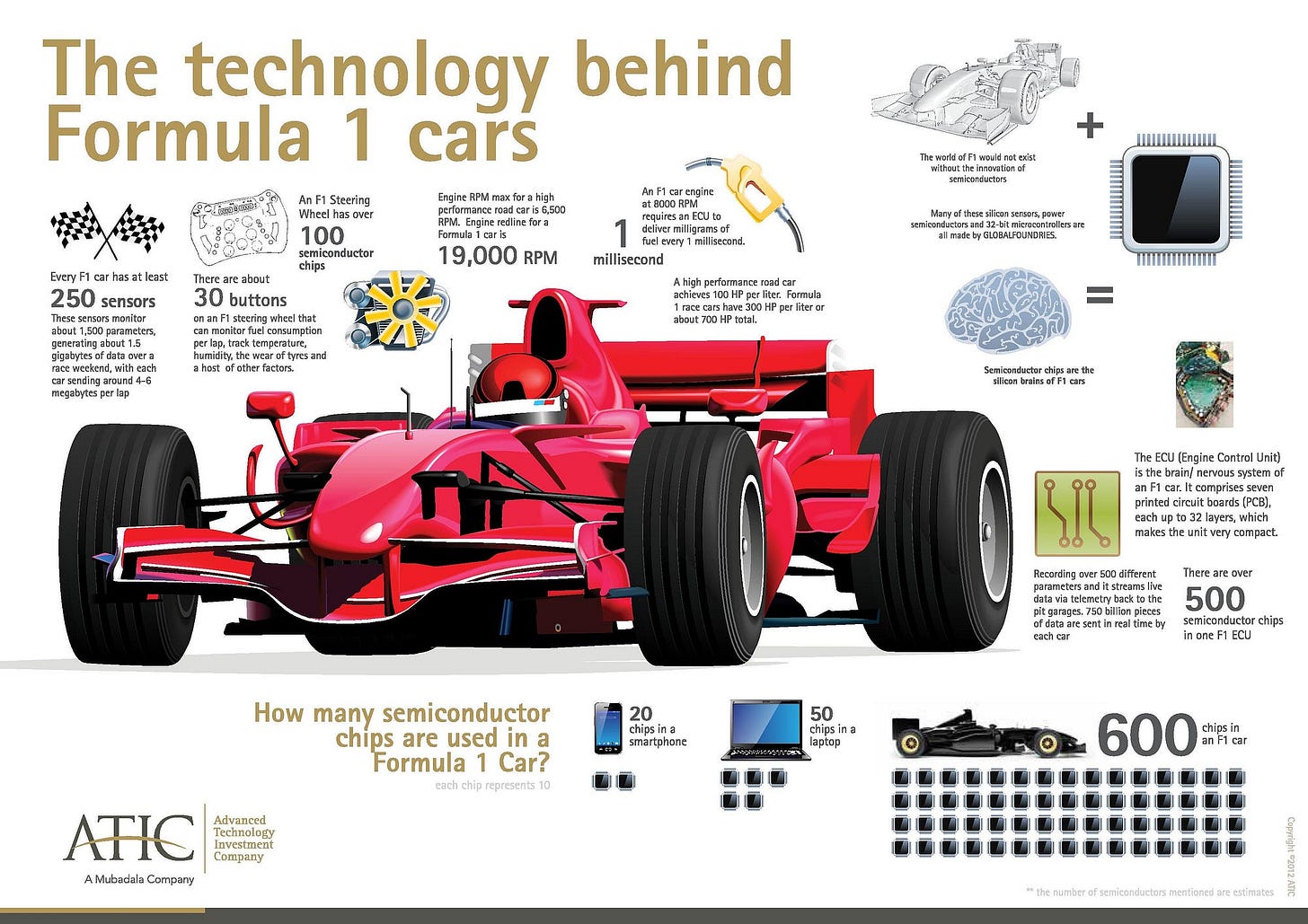

But the tide is turning. Predictive analytics, already ubiquitous in preventing damage to or destruction of valuable assets like race cars, military aircraft, and oil wells, are now finally being leveraged for the most valuable asset of all—our bodies.

Going to the hospital when you're already sick or injured is like hauling your car to the auto body shop after the crash. But what if we had a Formula 1 pit crew for our bodies instead? They monitor every system in real-time, know exactly how your specific engine performs, and make micro-adjustments lap by lap to prevent failure. That's the shift happening now—from reactive repairs to preventative, personalized, and precise optimization of our bodies.

Instead of shooting with a shotgun, hoping to hit something, we’re starting to shoot with a rifle—making targeted, specific interventions based on data. Yet bizarrely, much of our medical history is still retroactive, reacting to problems after they’ve already occurred.

Successful change making all comes back to robust data—collected via wearables, motion-capture technology, and in some cases, in-ground force plates. Assigning an athlete a risk score for an injury that has yet to happen is mighty valuable…to both the athlete who wants to stick around the league and the organization paying him that wants to get its money’s worth.

Another huge wave is arriving ashore…blood work and genetic testing are coming online through businesses like Function and Superpower. These companies track hundreds of biomarkers to offer insights into disease risk, enabling more preventative care.

Compared to disease prevention, the human movement category has had little disruption. Chronic pain still affects one in four adults in America—a testament to how little most people understand about their own bodies. We spend our days sitting in desk chairs, with only a vague awareness of problems: “I have a bad back,” or “knee problems.”

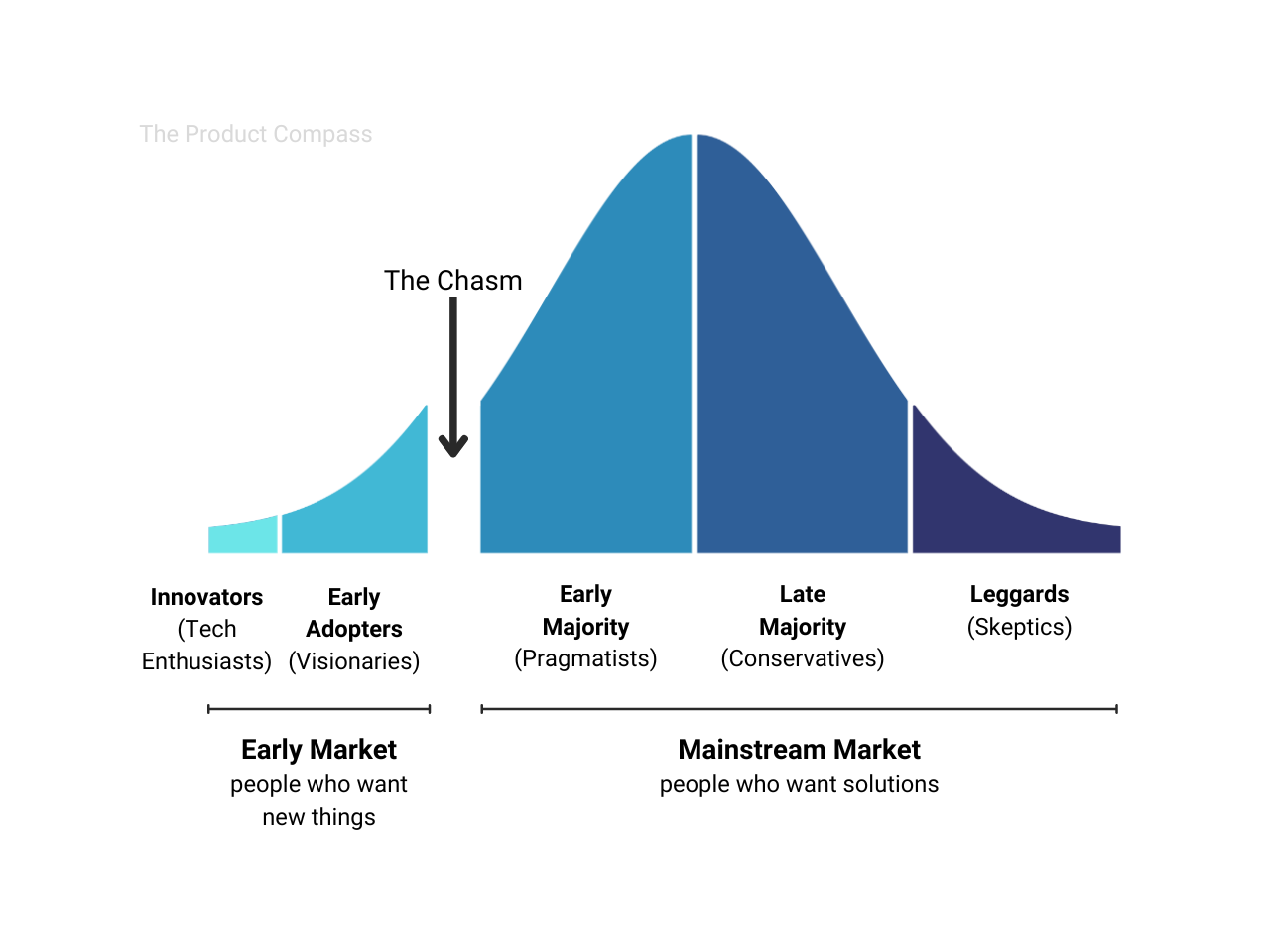

Unsurprisingly, the earliest adopters of this 3 Ps era are those whose bodies are their work—professional athletes. Other visionaries in this domain are Silicon Valley leaders who are also pushing boundaries, adopting extreme regimens to extend their own lifespans.

The concept of “healthspan” (which we first wrote about 2 years ago) is coming to the forefront; the pursuit of not just living longer but healthy aging. Living to 105 is not very appealing if one’s final 30 years are filled with pain and the inability to move freely. Luckily, mass adoption of this highly preventative, personalized, and precise world is coming.

Back to our pit crew analogy. In elite sports, a “bad Car Fax” (a poor injury history, or bad indications of future injury risk) can cost an athlete tens of millions in future earnings. Zion Williamson has missed more games than he has played in during his first five seasons in the NBA. He’s a freak of nature, but he has not been able to prevent breakdowns.

Athletes in today’s era must thoroughly, quantitatively understand their bodies, and they need to start early. No one wants to be the owner of a jumbo jet that has an 80% chance of crashing over the Atlantic.

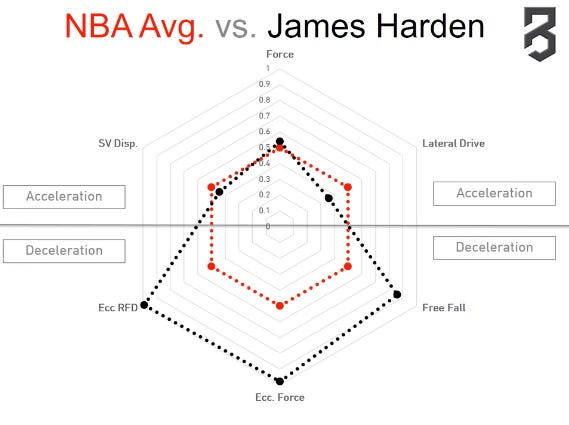

NBA scouts doubted Luka Doncic because he didn’t look fast or explosive on film. But the data told a very different story. As a teenager, Luka underwent a full biomechanical assessment at P3 (The Peak Performance Project, founded by Dr. Marcus Elliott) in Santa Barbara.

Using their state of the art equipment and team of brilliant data scientists, P3 measured and analyzed Doncic’s movement patterns in granular detail. The result? They found that Luka decelerated as well as any NBA player P3 had ever assessed—a key, it turns out, to his game.

This is particularly incredible given P3’s large sample size—70% of actively rostered players in the NBA today have been assessed at P3. While scouts were concerned about his lack of get-up-and-go, the real key was his ability to stop.

The conversation around braking started with James Harden, whose 99th percentile deceleration at P3 matched his signature step-back three-pointer. Coincidence?

Our eyes lie to us. We love the look of athletes like Tim Tebow and Brady Quinn, but often underrate players like Tom Brady or Drew Brees.

To make a comparison to software engineering, this is a question of front end vs. back end…what’s on the outside vs. what’s under the hood. The data driven evaluators love these athletes—the Luka’s, Harden’s, Brady’s, and Brees’s of the world—because of how they move. They are efficient in specific ways…ways that one’s game can be built around.

Marcus said it best in his interview with Brent.

“We tend to we carry on these historical paradigms and we tend to overly rely on our eyes. If you're a young baseball pitcher who’s 6'4”, wide shoulders, and you're throwing 78 miles an hour people call you projectable. They think that that body is going to throw really hard. If you're throwing 5 miles per hour faster and you're 5'10" that that's just not projectable, right?

But, there are plenty of guys below six feet that throw bullets. But our eyes want [to see] somebody who’s bigger, long arms, strapping. As a business of sports have gotten as big as they as they have, we're going to have to discard a lot of these old paradigms. There is so much slack in those systems.”

In a world where data is the new oil, P3’s human movement data base—built up over 19 years and counting with the world’s greatest athletes—is a gusher. The future of predictive healthcare, longevity, and injury prevention is here. And for those willing to look past what the eyes see, a new era of healthspan optimization is just beginning.

Companies to Know in Functional Health

Headquarters: Austin, Texas

Notable Investors: Morrison Seger

Headquarters: Meridian, Idaho

Notable Investors: Kainos Capital

Headquarters: New York, NY

Headquarters: New York, NY

Notable Investors: Khosla Ventures, Founders Fund, 8VC, General Catalyst

Headquarters: Orlando, FL

Notable Investors: Tony Robbins, Peter Diamandis

Headquarters: Vancouver, Canada

Market Cap: ~12.5M CAD

Headquarters: Austin, TX

Notable Investors: a16z, Wisdom VC, Kevin Hart, Matt Damon, Zac Efron, Pedro Pascal, Jay Shetty, Ari Emanuel

Valuation: $2.5B

Headquarters: Los Angeles, CA

Notable Investors: Headline, Plus Capital, Anna Kendrick, Shaun White, Dak Prescott, Klay Thompson

Valuation: $500M

Headquarters: Hamburg, Germany

Headquarters: United Kingdom

Notable Investors: Jim Mellon, Greg Bailey, Mike West

Headquarters: New York, NY

Notable Investors: a16z, Long Journey Ventures, TriplePoint Ventures

Headquarters: Stockholm, Sweden

Started by Spotify founder Daniel Ek

Notable Investors: Lightspeed, General Catalyst, Atomico

Headquarters: New York, NY

Notable Investors: Resolute Ventures

Headquarters: Oulu, Finland; San Francisco, CA

Notable Investors: TCG, Temasek, Forerunner Ventures, Fidelity, Dexcom, Alumni Ventures, Michael Dell, Apolo Ohno, Shaquille O’Neal, Will Smith

Valuation: $5.2B

Headquarters: Santa Barbara, CA

Headquarters: Redwood City, CA

Notable Investors: Felicis, Left Lane, Forerunner Ventures, Anne Wojcicki, Cindy Crawford, Tony Fadell

Headquarters: San Francisco, CA

Notable Investors: Sequoia, Madrone Capital, DST, TCV

Headquarters: Los Angeles, CA

Notable Investors: Forerunner, Susa Ventures, Long Journey Ventures, Steve Aoki, Vanessa Hudgens, Giannis Antetokounmpo

Headquarters: New York, NY

Notable Investors: Forerunner Ventures, L Catterton

Headquarters: Boulder, CO

Notable Investors: Forerunner Ventures, Imaginary Ventures

Headquarters: Boston, MA

Notable Investors: SoftBank Vision Fund 2, IVP, Kevin Durant, Patrick Mahomes, Rory McIlroy

Valuation: $3.6B

Leading Names to Know in Functional Health

Founder, P3

Founder, Foundmyfitness

Physician, researcher, author

Orthopedic surgeon, Stanford

Geneticist, professor, and author of Lifespan

Neuroscientist, professor, host of Huberman Lab

Entrepreneur, author, venture capitalist, founder of Blueprint, leader of the ‘Don’t Die’ movement

Founder, UltraWellness Center and the Cleveland Clinic Center for Functional Medicine, Co-founder and Chief Medical Officer of Function Health

Co-founder and Deputy Chairman of Juvenescence

Engineer, physician, entrepreneur, founder of XPRIZE

CEO of Tally Health

Founder, WHOOP

Motivational speaker, author, investor

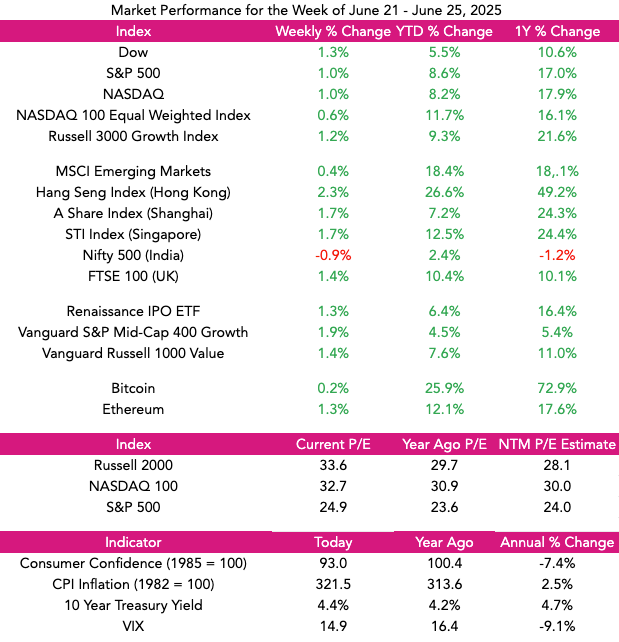

Market Performance

Market Commentary

For the fifth week in a row, the S&P 500 made new highs, advancing 1% and is now up nearly 9% for the year. The tech-heavy NASDAQ increased 1%, and the Dow gained 1.3%.

Earnings season is in full swing, with 82% of the 169 companies reporting so far beating analyst estimates. Alphabet and Verizon were two big names that beat forecasts, with Google’s cloud business growing 32% for the quarter. Google and Verizon advanced 4% and 5%, respectively.

Tesla had disappointing results, with EPS dropping 23% and revenues falling 12%. Elon Musk warned that TSLA “could have a couple of rough quarters” ahead. On a more fun and futuristic note, Tesla opened up its Tesla Diner in West Hollywood, with Elon serving up French fries himself. Features of the retro-futuristic offering include charging stations, big video screens, and a lot of robotics.

This coming week, four of the “Magnificent 7” report, with META, Apple, Microsoft, and Amazon announcing 2nd quarter results. Expect Microsoft and Amazon to announce strong growth with their cloud businesses and lots of investment in the AI Revolution.

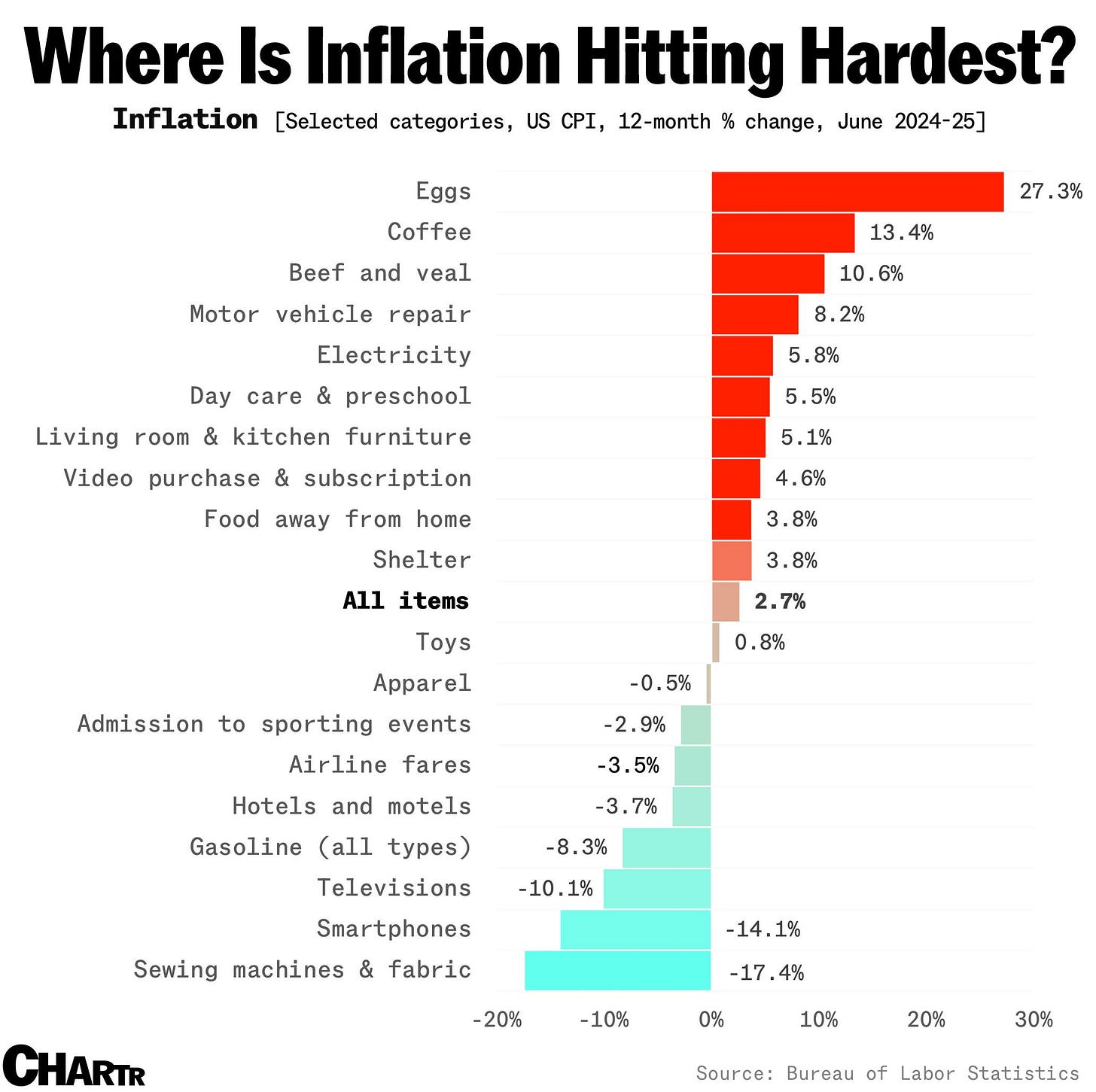

The backdrop for strong equity performance continues… inflation is below 3% and falling, interest rates are stable and likely to go down, and earnings are picking up steam. We continue to be BULLISH on the market and especially fast-growing technology companies.

Need to Know

READ: Where is Consumer AI, Unsaid Reasons We Use Products, & Uncommon Practices for Innovating in Big Companies | Implications by Scott Belsky

WATCH: Marc Andreessen on Top Universities’ '“DEI for White People” | Sheel Mohnot on X

LISTEN: How I Use ChatGPT to Run My $30 Billion Company | My First Million

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

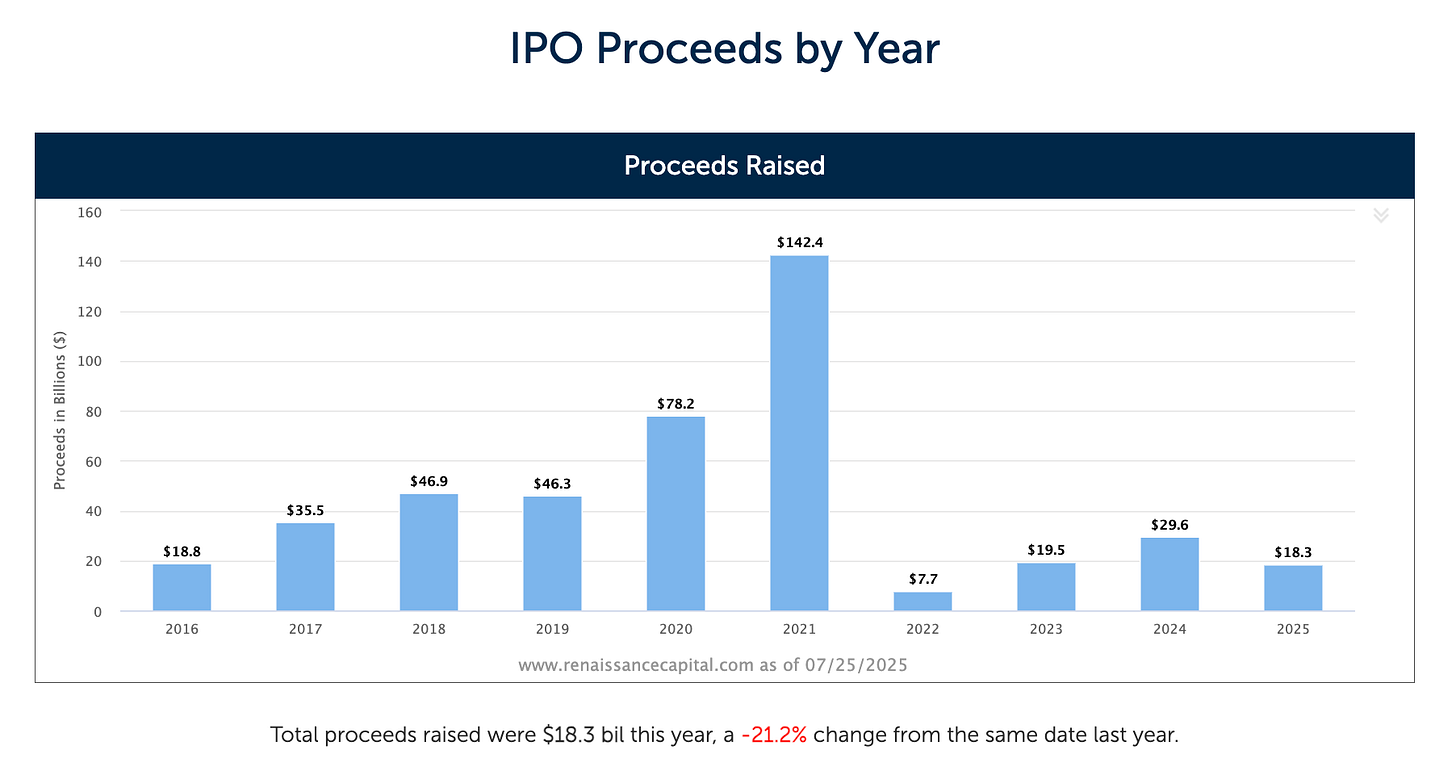

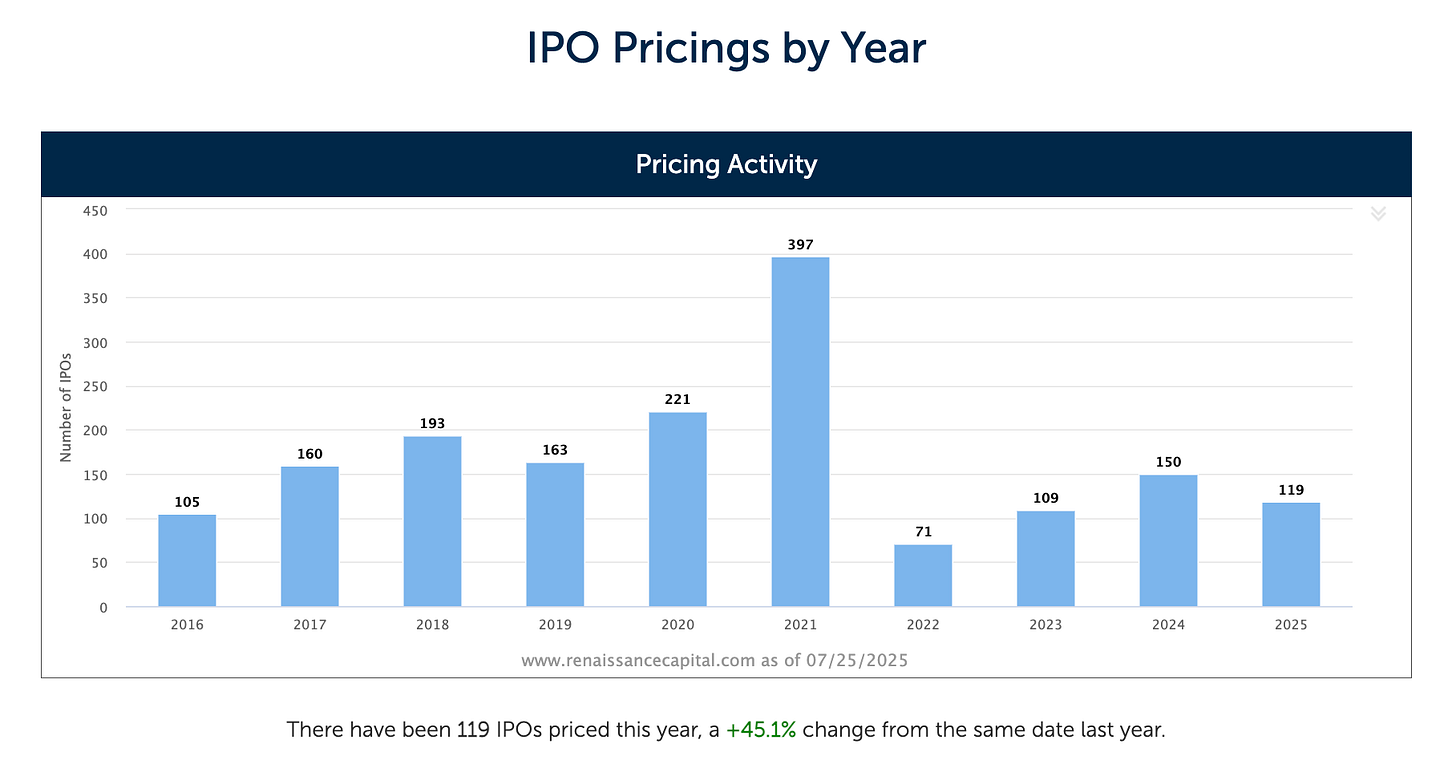

#2: IPO Market

#3: Interest Rates

#4: Inflation

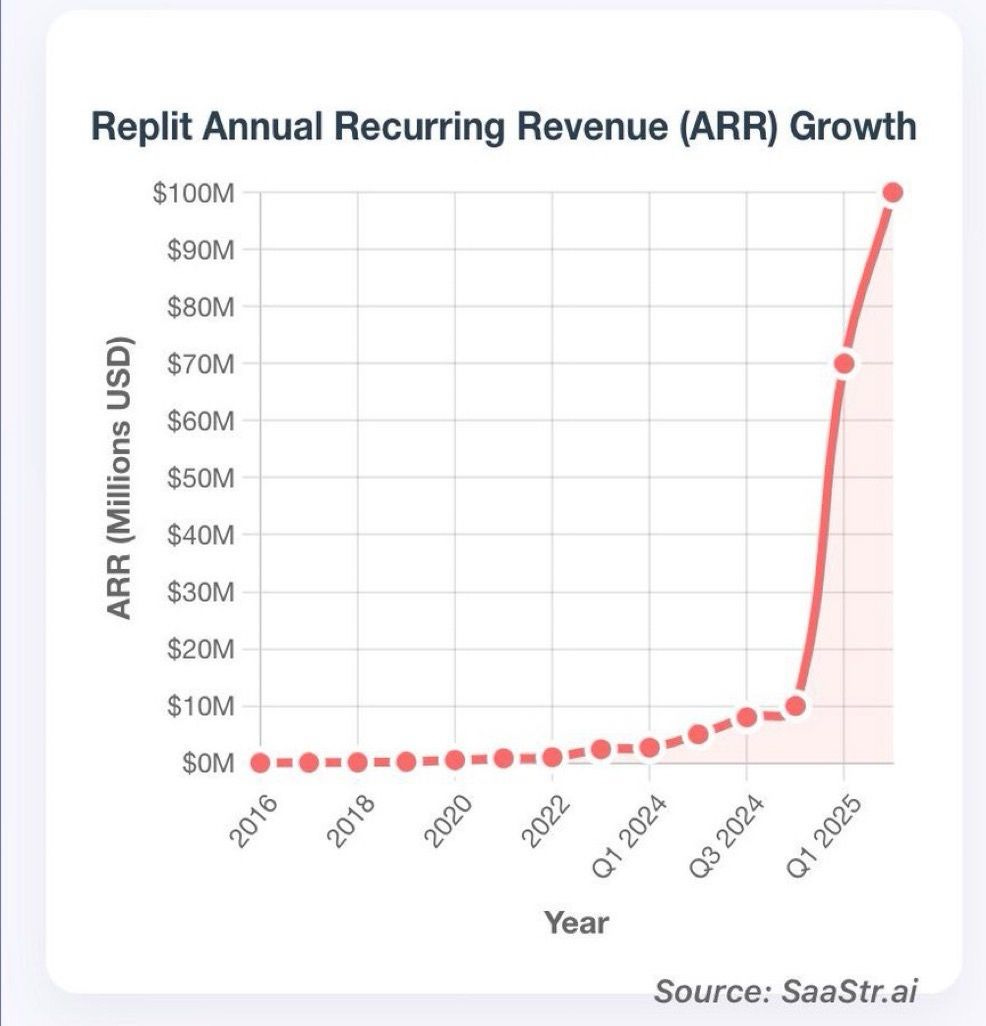

Chart of the Week

H/t CJ Gustafson

Maggie Moe’s GSV Weekly Rap

Chuckles of the Week

Via Astronomer

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM