"Be happy while you're living, for you're a long time dead." - Scottish Proverb

"In the end, it's not the years in your life that count. It's the life in your years." - Abraham Lincoln

“I have not failed, I’ve just found 10,000 ways that won’t work.” - Thomas Edison

The inaugural SMU+GSV Mission Summit was a success, with over 700 participants and ~135 presenters. There was a palpable buzz of energy all event long, from the opening night reception at the beautiful Bush Presidential Library to the closing celebration at the Rustic.

Our speakers and panelists, from Governor of Oklahoma Kevin Stitt, to Kansas City Chiefs Owner and CEO Clark Hunt, to former Dallas Mavericks coach Avery Johnson, to world-famous magician Drummond Money-Coutts, delivered amazing content across a breadth of topics.

The Summit was an incredible learning opportunity for entrepreneurs, investors, and innovators across the Mission Movement. Below are four of the key lessons we learned at the event.

#1 The Mission Movement is Not For The Faint of Heart

Entrepreneurship has become increasingly popular in the past two decades; however, its perceived glamor often overshadows the numerous challenges and struggles faced by entrepreneurs.

One out of every ten startups makes it. The other nine fail – whether they never find product market fit, run out of money, get creatively destroyed, or go out in a blaze of glory – they are forced to close their doors. Founders opt to take on the risk and sign up for the stress when they leave their “regular” job, accept other people's money, and seek to take control of their own destiny.

Founders require a North Star in order to persist through the endless obstacles that they encounter. Without it, leaders are forced to be reactionary - at the mercy of ever-changing corporate environments, markets, and consumer sentiments.

As Daniel Ek of Spotify put in a recent podcast: “it’s an emotional rollercoaster…so your purpose will have outsized impact.”

Daniel Ek at age 16

#2 Integrated Impact, Purpose-Driven Callings

The traditional "two-pocket mindset," where profits and philanthropy were separate entities, is becoming increasingly obsolete. In today's world, companies that seamlessly integrate purpose and profit are more likely to achieve long-lasting success and make a greater impact. Corporate chameleons, who fail to align their actions with their words, risk losing trust and valuable talent.

Speakers emphasized that pursuing a purpose-driven calling, rather than merely a career, can lead to significant value creation and positive change. By focusing on creating outsized impact and addressing critical challenges, such as housing, energy, infrastructure, security, education, mental health, and upskilling, individuals can contribute their full potential and passion to solving the world's most pressing problems.

#3 Fusion, Not Farmville

The rapid rise (and drawdown) in ESG indicated there’s a real interest in using the power of business to tackle the World’s biggest problems. The massive opportunity is designing mission-driven businesses from first principles, rather than slapping a “do good” label on top of a company that’s unrelated to their actual purpose.

Gimmicky products and businesses are not of interest to the biggest thinkers of today and in younger generations. The star employees and entrepreneurs of tomorrow want to work on fusion, not Farmville.

#4 Purpose, Not Perks

The best people want to work at the most ambitious companies. That’s why 3.6 million people have applied to work at Tesla in 2022 alone.

Go to any Stanford career fair and you’ll see students lining up around the block to add their resume to the piles at the booths for companies like SpaceX, Palantir, OpenAI, Anthropic, Nvidia, and Anduril.

Imagine going to any major college campus today and offering students a guaranteed job at a company where they’d get steady pay, benefits, promotions every few years, and decent responsibility but little real decision making power. It would be comfortable, the people would be nice enough.

You tell them that in order to accept your offer, they have to sign a contract to work for this company for 45 years. They will be able to live an upper-middle, to upper-class lifestyle forever. How many would agree to that? Our guess would be nearly zero. It’s not the way this generation is wired.

Instead, Gen Z and Millennials see tech as a force for good. In their lifetimes, they have experienced technology's power to bring entire nations online, facilitate an explosion of global communication, and technology amplify voices that ignite entire revolutions.

For More from the Mission Summit, check out some of our favorite panels below.

Market Performance

This week, the Dow closed up 0.3%, the S&P gained 0.4%, and the NASDAQ was up 0.1%. The S&P 500 officially entered a bull market, closing 20% above last October’s lows and marking the end of the longest such run since 1948.

Despite worries about rate hikes, inflation, lower spending, layoffs, and wars in Europe, bulls have found hope in Big Tech and AI enthusiasm.

The returns from Alphabet, Apple, Amazon, Meta, Tesla, and Nvidia are the largest we’ve seen in the past twenty years, and they make up 28% of the S&P 500’s total value.

In Tech World, Apple unveiled the Vision Pro, its first “spatial computing” device on Monday, which will cost $3,500 and be available next year. Also, Sequoia announced plans to split into three entities — Sequoia Capital in the U.S. and Europe, Peak XV Partners in India and Southeast Asia, and HongShan in China.

Meanwhile, the SEC doubled down on its Crypto Crackdown, filing lawsuits against Finance and Coinbase. Last but not least, PGA and LIV announced a merger in one of the most shocking sports announcements in decades.

Need to Know

READ: Isn’t That Spatial?

LISTEN: The Pushkin Prize for Egregiously Deceptive Self-Promotion

READ: Ultimate Guide to Platforms

LISTEN: Lex Fridman and Mark Zuckerberg

READ: Should you send your children to private school?

READ: 22 Lessons from Advertising Tycoon David Ogilvy

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: Yardeni

#2: IPO Market

Cava and Surf Air filed to go public this week. Cava is raising up to $274 million at a $2.1 billion valuation, while Surf Air is going public via a direct listing. The performance of these listings will be closely watched by their peers currently on the sidelines.

Source: Renaissance Capital

#3: Interest Rates

The Fed is widely expected to leave interest rates alone next week, but the debate is whether it’s a “skip” or a “pause” for rate hikes. Pricing in the futures market points to a 25 basis point interest rate rise by the Fed in July.

Source: Edward Jones

#4: Inflation

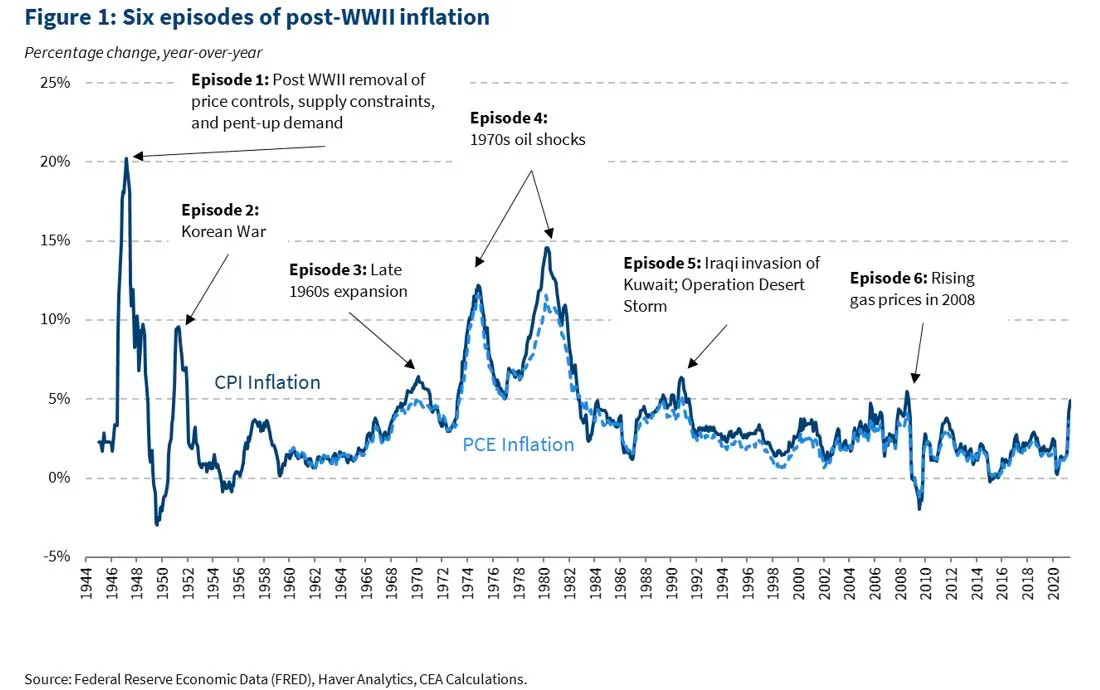

There’s a generational divide on how sticky “Episode 7” of post-WWII inflation will be. 75% of millennial millionaires say inflation will come down to 2% within two years, while 59% of older investors say it will take longer than two years.

Chart of the Week

Chuckle of the Week

EIEIO…Fast Facts

Entrepreneurship: 120 – number of videos that Mr. Beast uploaded to YouTube before breaking 1,000 subscribers (Source)

Innovation: 25x – increase in memory (tokens) of Generative AI models from ChatGPT (Nov 2022) to Anthropic - Claude (May 2023) (Source)

Education: 33% – US adults that approve of colleges considering race and ethnicity to increase diversity at schools (Source)

Impact: $26,320 – cost of a new Tesla Model 3WD in Vermont (Source)

Opportunity: 45% – percent of recruiters on LinkedIn that now search for candidates using skills data (Source)

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…. EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM