EIEIO...Multiplication by Division

AI will ignite human capital, changing learning and earning as we know it.

GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: 12 million – the estimated number of businesses that will be sold in the United States in the next 10-15 years (Score)

Innovation: 16 minutes – the amount of time between Joe Biden’s resignation announcement on X (which has 425 million views) and the first reporting on the event by a legacy media company (Linda Yaccarino)

Education: 32% – the percentage of Americans who report feeling “little or no confidence” in higher education. In 2015, that number was 10%. (Lumina Foundation)

Impact: 50% – the percentage of advanced STEM degree holders working in the US defense industrial base that are foreign-born (IFP)

Opportunity: $8,435 – the average annual health premium for single-employee coverage in the United States in 2024, compared to $2,471 in 2000 (Statista)

“Divide and conquer.” – Julius Caesar

“The greatest improvement in the productive powers of labor and the greater part of the skill, dexterity and judgment with which it is anywhere directed, or applied, seem to have been the effects of the division of labor.” – Adam Smith

“Division of Labor is justification for sloth.” – Leo Tolstoy

“The more the division of labor and application of machinery extend the more the competition extends among the workers, the more do their wages shrink together.” – Karl Marx

“Generative AI won’t replace executives. But executives who use generative AI will replace executives who don’t.” – Erik Brynjolfsson and Andrew McAfee

In Chapter 1 of his treatise on capitalism, The Wealth of Nations, Adam Smith writes about a pin factory and how specialization and division of labor allow for surging productivity.

Smith described how 10 workers specializing in different tasks could produce about 48,000 pins per day, compared to maybe 20 pins if each worked independently.

Part of the magic was specialization where the pin-making process could be divided into 18 distinct tasks. By specializing, workers could become more skilled and efficient at their particular roles.

Not only did the division of labor create time savings and increase output, but by specializing in specific tasks, workers were able to identify improvements and innovations.

Henry Ford disrupted the automobile industry through the division of labor via the assembly line, reducing Model T production time from 12 hours to 93 minutes. At the same time, Ford was able to cut the cost of the vehicle from $900 to under $300 (consumers could have any color they wanted as long as it was “black”). Ford workers were able to be paid more and by 1927, the company had sold 15 million cars – quickly changing the market from niche to anything but. “Fordism” of high-scale production and higher wages were implanted across other industries.

Amazon has been an early adopter of robots in its warehouses, employing over 750,000 to increase productivity and lower costs. This allowed workers to do more complex tasks, saving 9,000 hours and allowing engineers to focus on innovation (while increasing wages).

There are over 100 million “knowledge workers” in the United States and it’s predicted that 80% of them will have at least 10% of their jobs impacted by generative AI. Approximately 20% are expected to have 50% of their current job disrupted.

While this may seem like a scary prospect for human workers, it actually represents an opportunity for dramatic increases in productivity and innovation through a modern division of labor between humans and machines.

The fear of technology’s impact on workers goes back to Queen Elizabeth I in the 1600s who fretted that automated knitting would take jobs from “young maidens”. John Maynard Keynes coined the term “technological unemployment” in the 1930s.

Famous computer scientist and AI pioneer Geoffrey Hinton in 2015 boldly predicted that AI would replace radiologists in five years. Confident as your favorite LLM, Hinton said this was “obvious”.

In fact, the number of radiologists has gone up 7% and now it’s predicted there will be a shortage. AI and machine learning is really great at interpreting imaging which is 1 of the 28 task bundled into a radiologist job.

In an A/B test conducted on a call center by MIT and Stanford, it showed that agents assisted by AI bots increased their productivity 14% in a matter of months. More impressive was that customer satisfaction also increased as did employee fulfillment.

Algorithms need data, and data needs humans to interpret the data. Software IS eating the world…and AI is its teeth…BUT humans are going to decide what to eat.

The freeing up of time and energy for humans to focus on what’s uniquely human is going to unleash the giant within and be a boom for society.

It’s not man vs. machine…it’s man collaborating with machine.

We call this multiplication by division.

The great businesses of tomorrow will strategically leverage AI, assigning tasks to either AI or humans based on their comparative advantages.

Workhelix is a Silicon Valley startup that has looked at 20,000 knowledge-worker jobs and identified 250,000 tasks associated with those roles. Using this data, the company can provide organizations with a detailed map outlining which tasks are better suited for AI and which are better handled by human workers. By creating a division of labor, organizations have the opportunity to be more productive, more efficient, and more innovative.

Companies to Watch in the AI Revolution Human Capital Ecosystem

Cornerstone OnDemand: Cornerstone OnDemand (CSOD) is a cloud-based learning and human capital management software company that helps organizations develop their workforce.

Coursera (NYSE: COUR): Coursera is an online learning platform that offers courses, degrees, and other learning formats from universities and companies around the world.

Degreed: Degreed is a lifelong learning platform used to discover learning content, build skills, and successfully take on new career challenges.

Docemo (NASDAQ: DCBO): Docebo is a learning platform that enables users to drive engagement, productivity, and connections with customers, partners, and employees.

iLearning Engines (NASDAQ: AILE): iLearning Engines is an outcomes driven learning and AI platform that is used by enterprises to deliver firm specific training and drive mission critical outcomes that are embedded into the flow of work.

Lightcast: Lightcast is a global leader in labor market analytics.

Linkedin Learning: LinkedIn Learning is an on-demand library of instructional videos covering the latest business, technology, and creative skills.

Live Data Technologies: Live Data Technologies unlocks the power of real-time job change and human capital data for multiple verticals including investors, AI companies, and data providers.

NovoEd: NovoEd is a capability-building platform that combines social and collaborative learning to unlock human potential at scale and with measurable impact.

Udemy: Udemy is an online learning and teaching marketplace with over 220000 courses and 70 million students.

Workera: Workera is the fastest way to enterprise-scale AI-ready workforces.

Workhelix: Workhelix brings together cutting-edge research and comprehensive data to assess companies' Generative AI opportunities.

The time dividend that is created by AI and the division of labor will not create a lazier society where people sit around and eat cheese and drink wine (don’t get me started on the terrible idea that is UBI), but will instead be a catalyst for human flourishing like we’ve never seen before. Acquiring new knowledge and skills through invisible learning will be a defining aspect of the future, and the advancement of humankind will make it the most exciting era in history.

Learning at the speed of light will be essential as technology grows exponentially. Skills for the future, such as being AI-ready, "Learning How to Learn" (Andrew Ng’s favorite course on Coursera), embracing the 7Cs, and "connecting the dots," will determine individual participation in tomorrow's world.

Adam Smith introduced the concept of the "Invisible Hand," driven by economic incentives, which acts like a force guiding human actions. This concept is complemented by George Washington's reference to another "invisible hand" in his inaugural address, emphasizing our natural pursuit of purpose and meaning through our activities on Earth.

Multiplication by division will be the fundamental that puts human advancement on the same exponential curve as technology…and gives us the opportunity to thrive like never before.

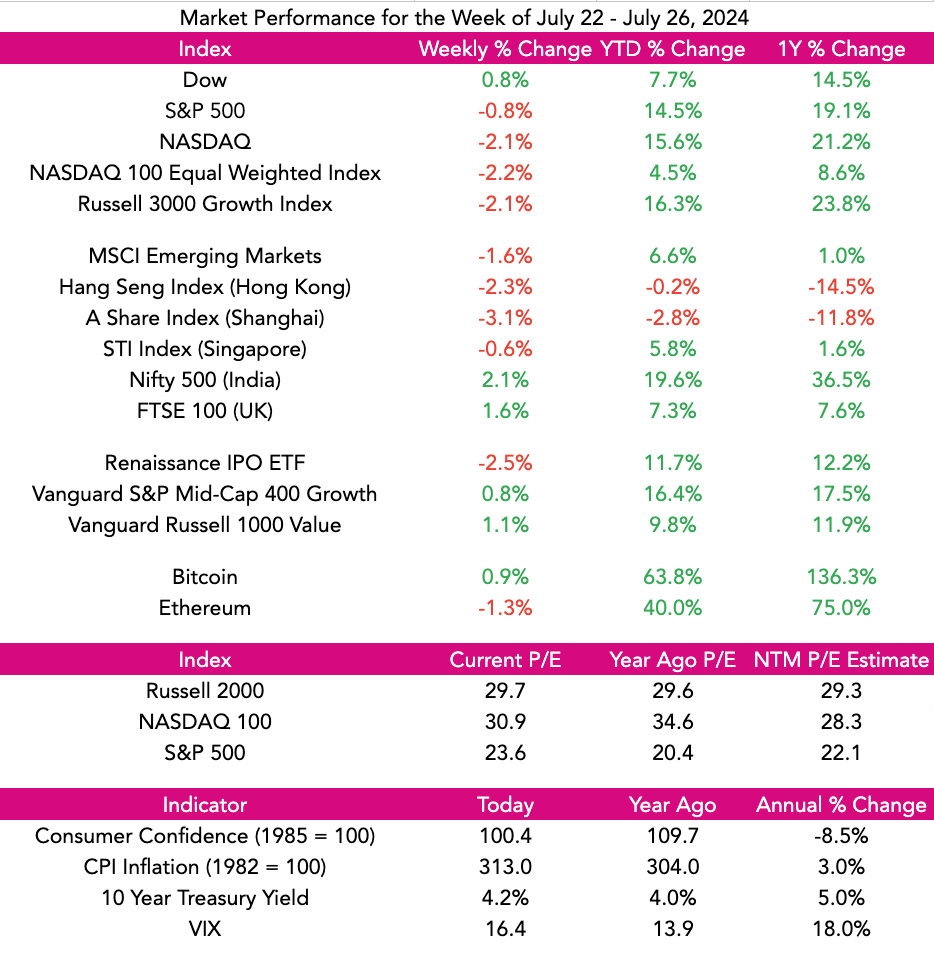

Market Performance

Market Commentary

Last week continued the rotation in stocks and politics. The so-called “Magnificent 7” continued to act heavy with small-cap stocks showing renewed vibrancy.

NASDAQ heavily influenced by large-cap tech stocks was down 2.1% for the week, the S&P 500 was off .8% while the Russell 2000 advanced 3.3% and the Dow was up .8%.

Last week was huge for ed tech. 2U filed for bankruptcy and announced it was going private, Instructure announced that KKR was taking it private and Coursera reported EPS on Friday with its share going up nearly 50%. Ed tech shares have had a post covid hangover but we think last week’s activity is a positive sign. Moreover, the SCOTUS Chevron ruling removed a risk factor for investors worried about the rules of the game-changing every four years.

It’s earnings season and with 41% of the S&P 500 reporting so far, EPS has grown about 10% year over year. This week we will have results from Microsoft, Apple, Amazon, and Meta which should provide a signal to the sustainability of large tech leadership…or not.

Regardless, our thesis from the beginning of 2024 was we would see a broadening of stock participation and a corresponding opening of the IPO Market. Consistent with this, there were 5 IPOs last week raising $6 billion. We believe that the script is playing out according to plan.

We remain BULLISH.

Need to Know

READ: Why Big Tech Wants to Make AI Cost Nothing | DuBlog

LISTEN: Jeremy Giffon – Special Situations in Private Markets | Invest Like The Best

READ: Why The Democrats Lost Tech |

WATCH: Brainstorm Tech 2024: A Roadmap For Converting Technology To Value | Fortune

GSV’s Four I’s of Investor Sentiment

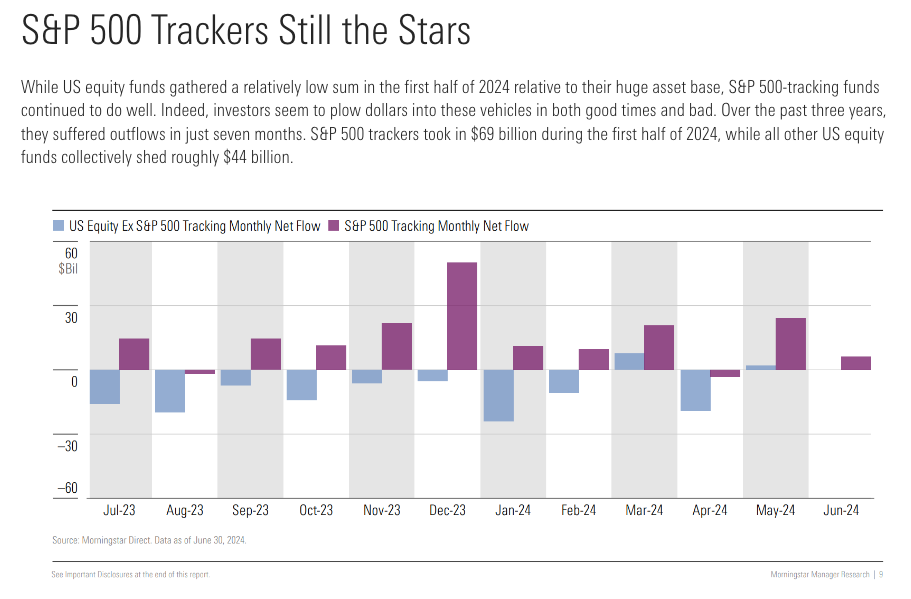

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

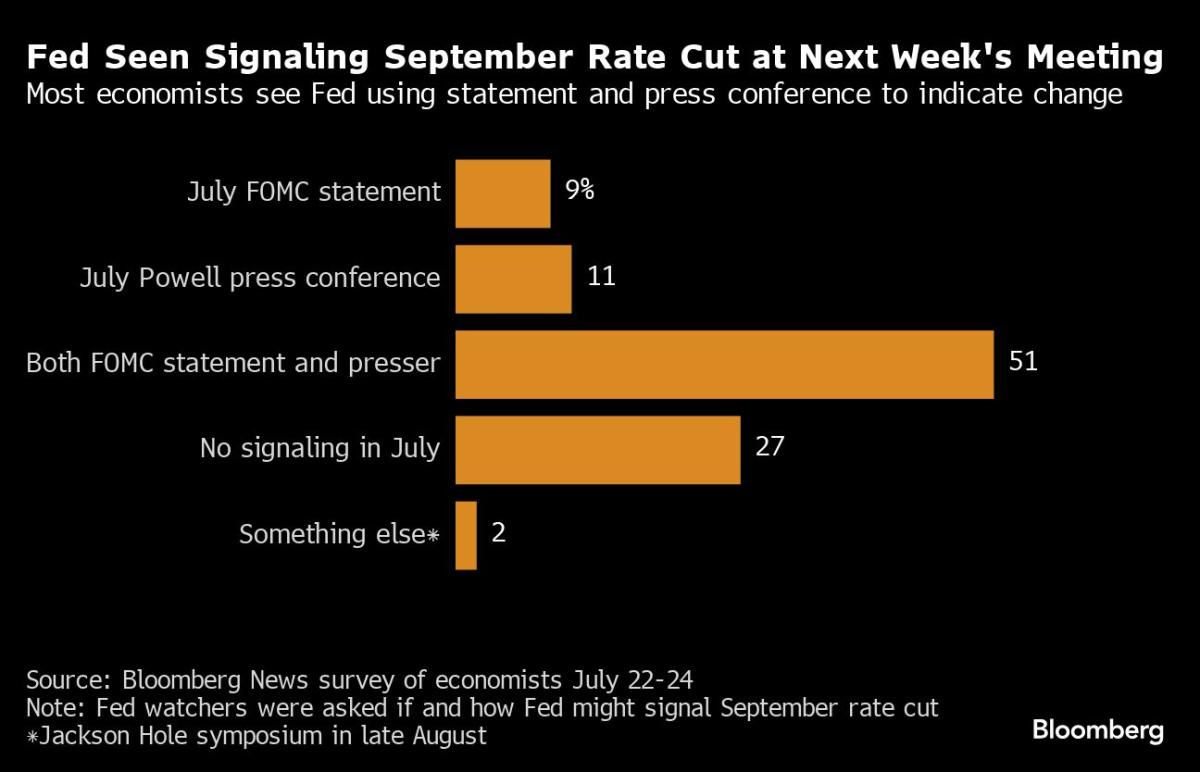

#3: Interest Rates

#4: Inflation

Charts of the Week

Maggie Moe’s GSV Weekly Rap

Chuckle of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup….EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM