EIEIO…Pioneers and Arrows

By: Michael Moe, CFA, Brent Peus, Owen Ritz, Catherine Merrick

GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

“The Pioneers get all the arrows….but those that survive get all the land.” – Amory Lovins

“A camel is a horse built by committee.” – Allan Sherman

“Consensus killed the Quakers.” – Michael M. Carter

Investing in emerging growth companies takes a strong stomach.

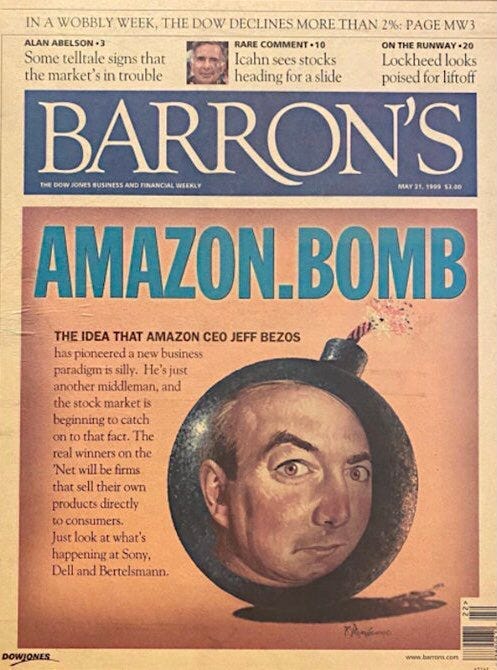

Often, conventional wisdom is against the idea. Moreover, the “smart guys” think the company is ridiculous (Author’s note: for some reason, in the investment world, cynics are thought to be brilliant).

Typical comments include:

“If it’s such a great idea, why hasn’t it been done already?”

“Google (Microsoft, Apple, General Motors, etc.) is going to wipe them out.”

”The valuation has increased 3X in a year, trees don’t grow to the sky.”

And so on.

Furthermore, if you are wrong about a company that the group was skeptical on, the chorus from the “cheap seats” will be unmerciful. The gleeful “I told you so” will be out in full force and other believers will be as quiet as Peter in Jerusalem.

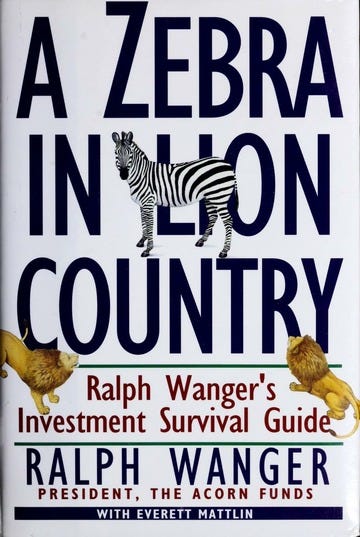

Legendary Chicago investor Ralph Wagner summed up well in his excellent tome “A Zebra in Lion Country.”

Zebras have the same problem as institutional portfolio managers like myself.

First, both have quite specific, often difficult-to-obtain goals. For portfolio managers, above-average performance; for zebras, fresh grass.

Second, both dislike risk. Portfolio managers can get fired; zebras can get eaten by lions.

Third, both move in herds. They look alike, think alike, and stick close together.

If you are a zebra and live in a herd, your key division is where to stand in relation to the rest of the herd.

When you think that conditions are safe, the outside of the herd is the best, for there the grass is fresh, while those in the middle see only grass that is half-eaten or trampled down. The aggressive zebras, on the outside of the herd, eat.

On the other hand—or hoof—there comes a time when lions approach. The outside zebras end up as lion lunch. The skinny zebras in the middle of the pack may eat less well, but they are alive.

A portfolio manager for an institution such as a bank trust department, an insurance company, or a mutual fund cannot afford to be an outside zebra. For him, the optimal strategy is simple: stay in the center of the herd at all times. As long as he buys the popular stocks, he cannot be faulted. On the other hand, he cannot afford to try for the large gains on unfamiliar stocks that would leave him open to criticism if the idea failed.

The term “groupthink” was popularized during the Vietnam Era. Essentially, it describes how smart people, when together, make really dumb decisions.

Groupthink typically occurs when people become preoccupied with what the group consensus is, and that obsession overrides the motivation to assess situations objectively.

Groupthink, while in the same family as conventional wisdom, is driven by group dynamics, whereas conventional wisdom is an aggregate collection of the seemingly obvious.

Accordingly, but no less bizarrely, “risk” isn’t the analysis of return versus potential loss of capital but the loss of your job…or status. As they used to say, “you can’t get fired for hiring IBM” (until you couldn’t).

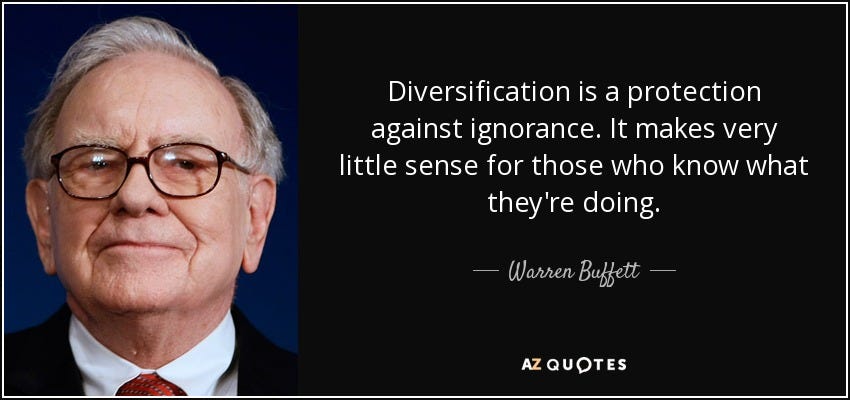

Another example of how Groupthink infects thoughtful judgment is in the area of portfolio diversification. A group generally considers it less risky to own a broad diverse portfolio than to own a relatively small number of stocks that they follow closely and know intimately.

“Don’t put all your eggs in one basket” sounds so wise, but Peter Lynch called this “diworsification” and Warren Buffett said to “keep all your eggs in one basket, but watch that basket closely.”

Great works of art, groundbreaking recipes, exceptional music, or even impressive investment track records are rarely, if ever, produced by a collective group. While I’m very Bullish on the advancement for humanity that generative AI presents, it’s not going to be for its creativity by itself…it’s an Index Fund…..or an aggregator of conventional wisdom.

Opportunity will always be on the edge. Zigging while others zag. There is always a growth market somewhere and big opportunities that are being ignored by the masses.

Market Performance

True to form, as Market Pundits were warning to “batten down the hatches” stocks ripped. For the week, NASDAQ was up a whopping 6.6%, the S&P 500 advanced 5.9% and the Dow Jones Industrial Average increased 5.1%.

The bad news for society that October jobs were weaker than predicted was good news for Wall Street. The reason for the irony is of course it seems possible we are done with rate increases. Reflecting this, the 10 Year Note’s yield fell to 4.57% from touching 5% two weeks ago.

Crypto creep Sam Bankman-Fried was convicted on all 7 counts of fraud and faces decades in prison. Consistent with the theme of opportunities being foreign to conventional wisdom, Bitcoin is up 108% to date and Ethereum is up 51%.

We remain optimistic on the outlook for growth companies and see the strength of the Market despite all the scary news as a good sign for it wanting to go up.

Maggie Moe’s GSV Weekly Rap

Need to Know

READ: JP Morgan Asset Management – Guide To The Markets

WATCH: Robin Hood NYC 2023 Fireside Chat Stan Druckenmiller

LISTEN: Charlie Munger Acquired Interview

READ: Short-Form War | No Mercy / No Malice

LISTEN: Inventing The Future Of Defense

WATCH: Alexandr Wang: 26-Year-Old CEO Powering the AI Industry

READ: Letter #134: Michael Moritz and Robert Lacher (2023)

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

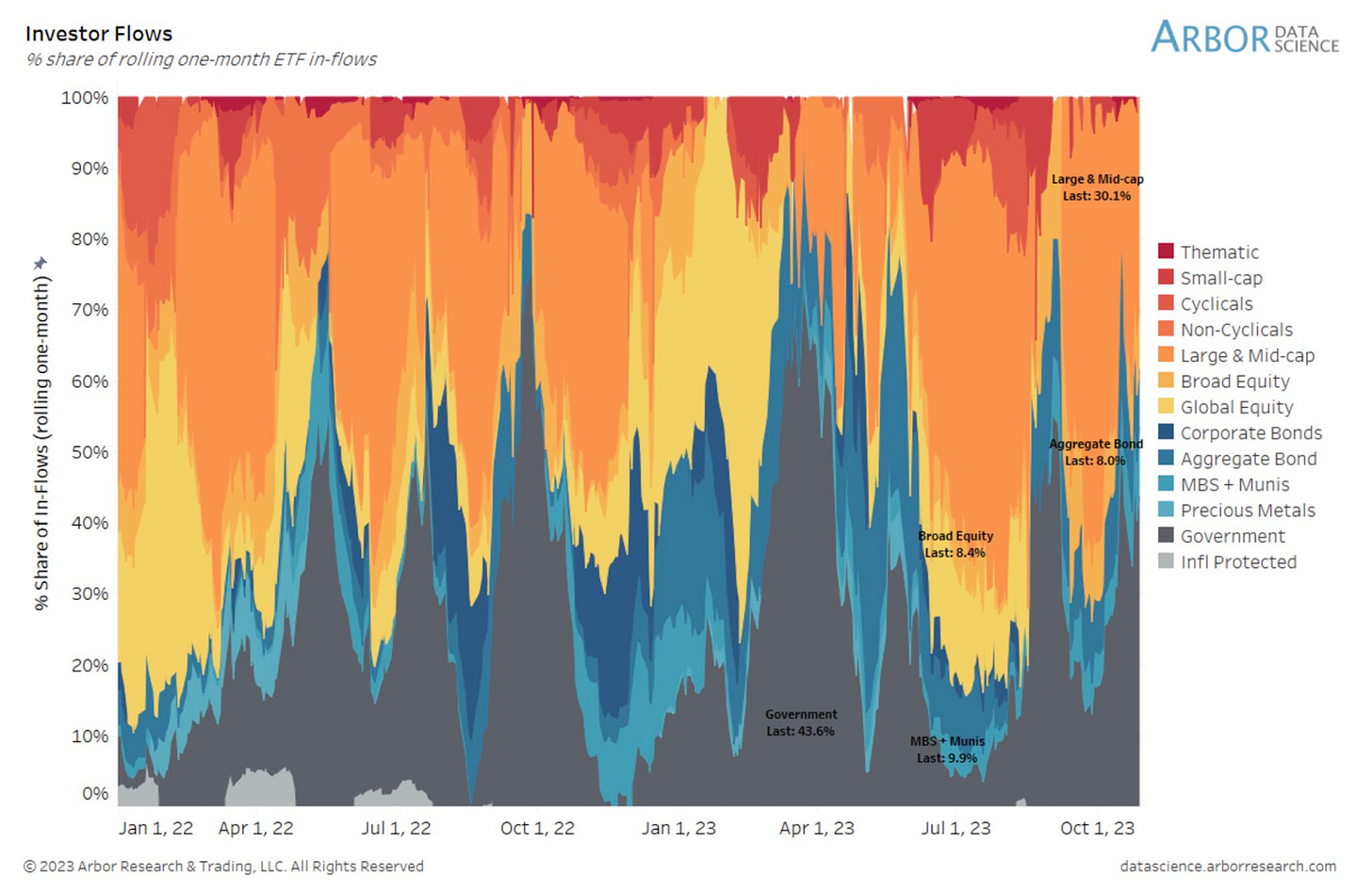

#1: Inflows and Outflows for Mutual Funds & ETFs

Flows into large- and mid-cap equity ETFs continue to ease on rolling one-month basis while government bond ETFs pick up slack...latter had inflows of $5.8 billion (compared to $3.3 billion in prior week).

Source: Liz Ann Sonders

#2: IPO Market

The IPO reopening has lost its momentum, with Birkenstock (up 13%) being the only recent IPO trading up since going out. The IPO slowdown is not just a US phenomenon…public records show 126 companies have canceled or suspended IPO applications on Shanghai’s Star Market so far in 2023, more than in the previous four years combined (Financial Times).

Source: Renaissance Capital

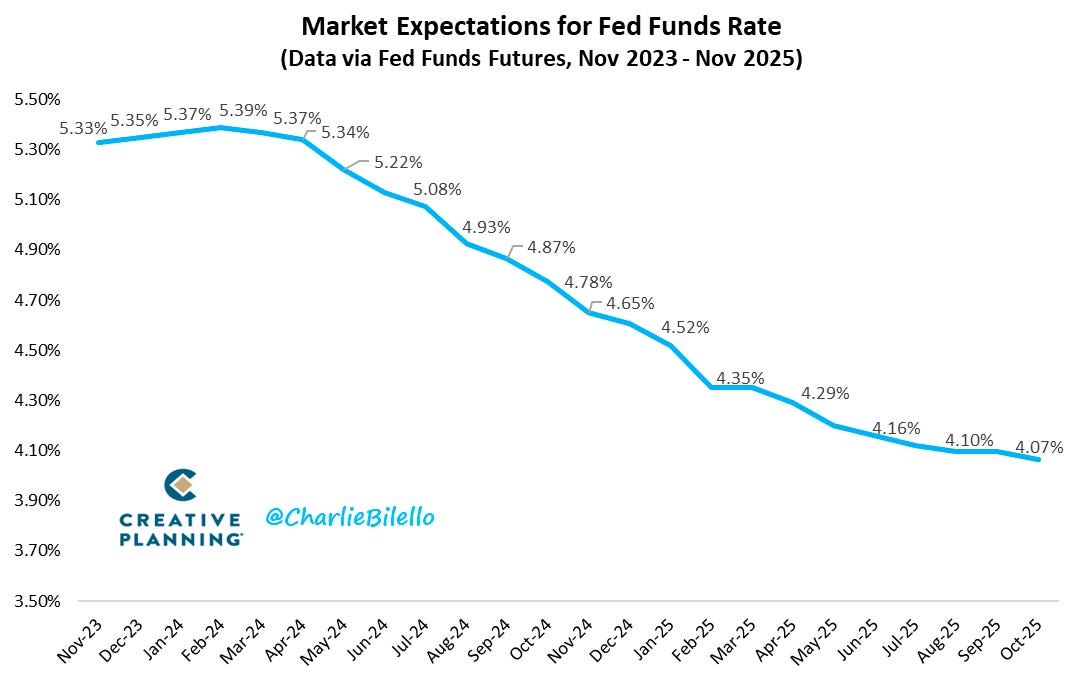

#3: Interest Rates

The Fed held steady on rates for a second-straight time at its November meeting, keeping the federal funds target rate at 5.25% to 5.5%. The Fed also reaffirmed their view that a recession has been removed from their forecast.

Source: Charlie Biello

#4: Inflation

Money market funds have seen over $1T of inflows since the Fed started raising rates in March 2022. This is the fastest ever move into money market funds in recent history.

Source: The Kobeissi Letter

Chart of the Week

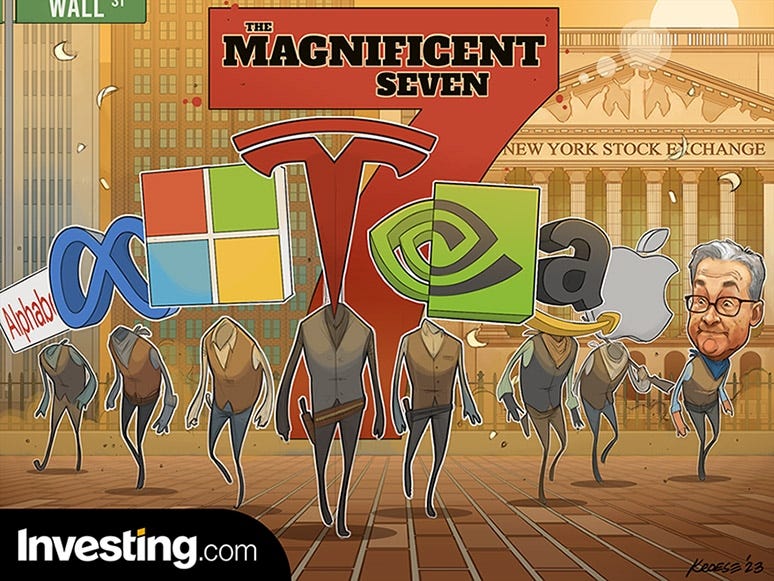

The S&P 500’s cap-weighted index is outperforming its equal-weighted index by 13% YTD, the widest margin of outperformance (through this point in the year) in 30+ years.

Source: Carl Quintanilla

Video of the Week

Motivation for entrepreneurs across the World…Jeff Bezos announced his move from Seattle to Miami this week – take a look at his tour of Amazon’s first office.

Chuckle of the Week

EIEIO…Fast Facts

Entrepreneurship: $7B – difference in net worth between Bill Gates and Steve Ballmer (Pythia Capital)

Innovation: +27% – difference in user base between Pinterest (482 million) and Twitter (368m) (Chartr)

Education: 51% – growth of homeschooling in the US over the past 6 years (Washington Post)

Impact: 75% – percent of women under the age of 30 that aspire to become senior leaders (McKinsey)

Opportunity: 85% – percent of Gen Z who expects they’ll have to make sacrifices in their own lives because of global climate change (Pew Research)

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…. EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM