EIEIO...Quack! Quack!

IPOs back in Season, Circle Soars, and Fresh Oxygen to Climb Higher...

GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: 46% – The percentage of two-person founding teams dividing their equity equally. In 2015, that number was 31.5%. (Carta)

Innovation: 780 million - The number of monthly visitors achieved by ChatGPT in the US, surpassing Wikipedia at 716 million. (Sherwood)

Education: #1 – Ireland’s ranking in the world’s most educated companies. 52.4% of adults have a bachelor’s degree or higher. (Visual Capitalist)

Impact: 36 – The number of companies that accounted for half of global carbon-dioxide emissions in 2023. (Harper’s)

Opportunity: 55.2 billion – The number of visits AI chatbots drew last year, just 2.96% of search engine traffic. (Voroni)

“If you can get an IPO, don’t BUY it. Only BUY IPOs you can’t get.” – Vahan Janjigian

“Buying an IPO is like buying a used car at a new car price.” – Wall Street Proverb

“In investing, what is comfortable is rarely profitable.” – Robert Arnott

Sandy Robertson was a legendary Silicon Valley financier and hero of mine who passed away last August at the age of 93.

Robertson Stephens, the San Francisco firm he founded, was one of the “Four Horsemen” that were known for taking emerging growth companies public. In fact, during its twenty-four year existence, Robertson Stephens had done over 600 IPOs.

Sandy famously said, “When the ducks are quacking, you feed them!”

What he meant by this was when investors were hungry for fast growing, riskier companies, your job was to get them to the market via an IPO.

This wasn’t brain surgery, it was just paying attention to what was going on.

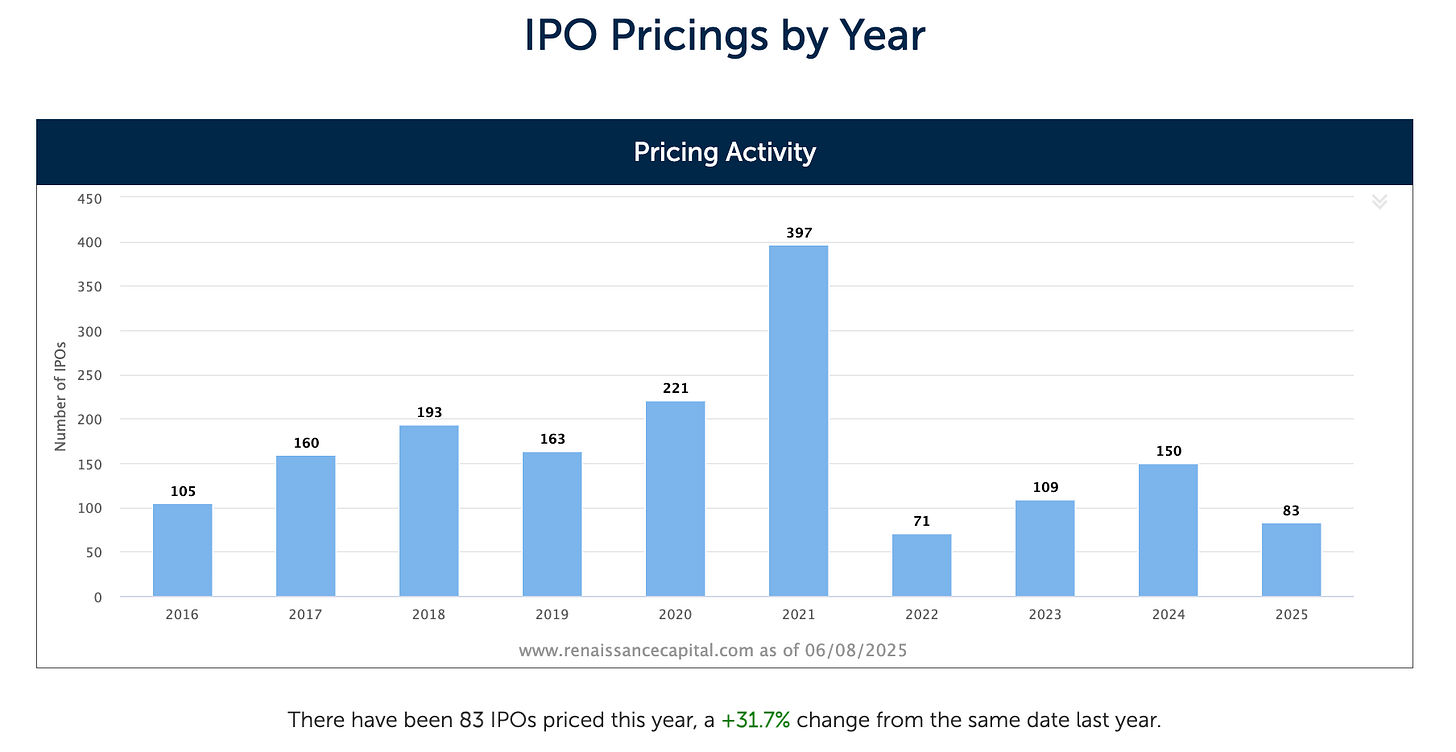

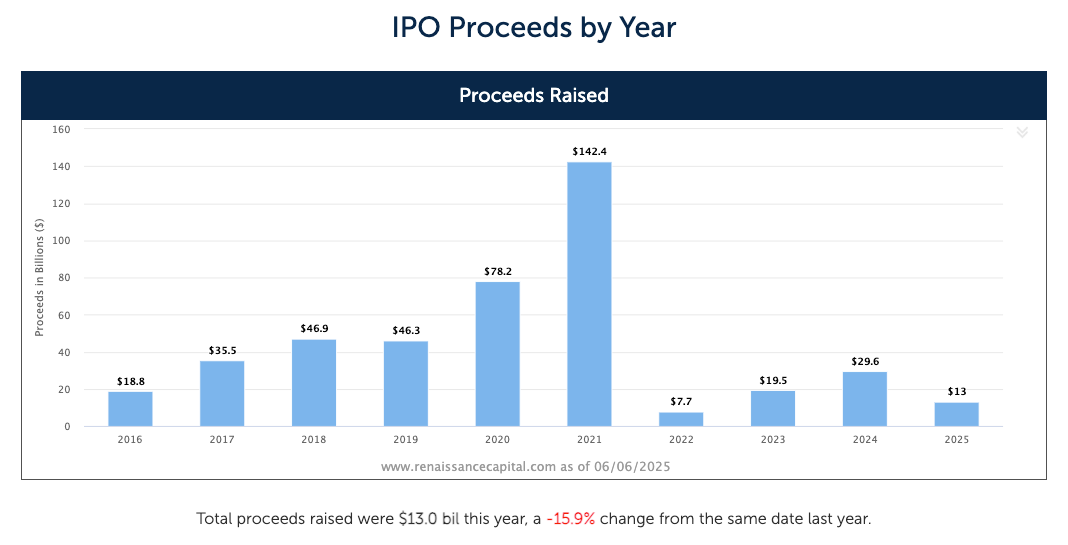

What’s been happening in the past six weeks has been very instructive in terms of where the “ducks” are. Since the April 4th “Liberation Day” lows, NASDAQ has surged approximately 17%. Moreover, the new issue market which has been subdued for much of the past three years has shown signs of waking up.

The alarm bell went off last week with stablecoin provider Circle going public with an offer price of $31 and closing at $83…a 168% IPO “pop”. Circle closed the week at $107, or a 245% gain.

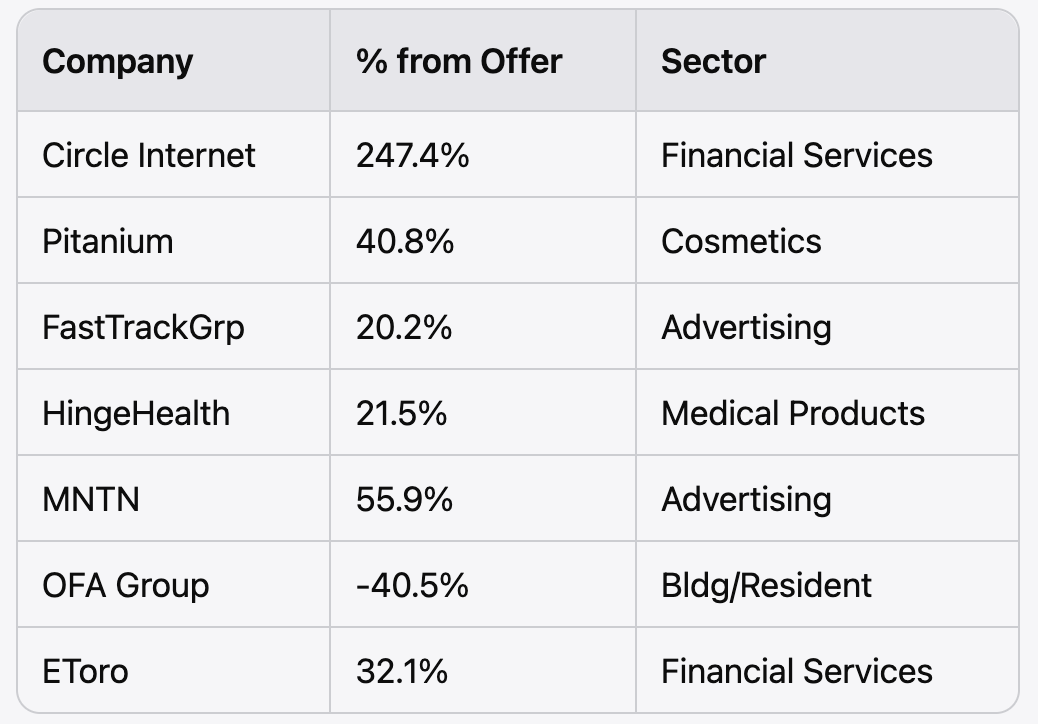

Looking at the last seven companies that have gone public in the past three weeks, the average increase from IPO price is 45.9% with median being 32.1%.

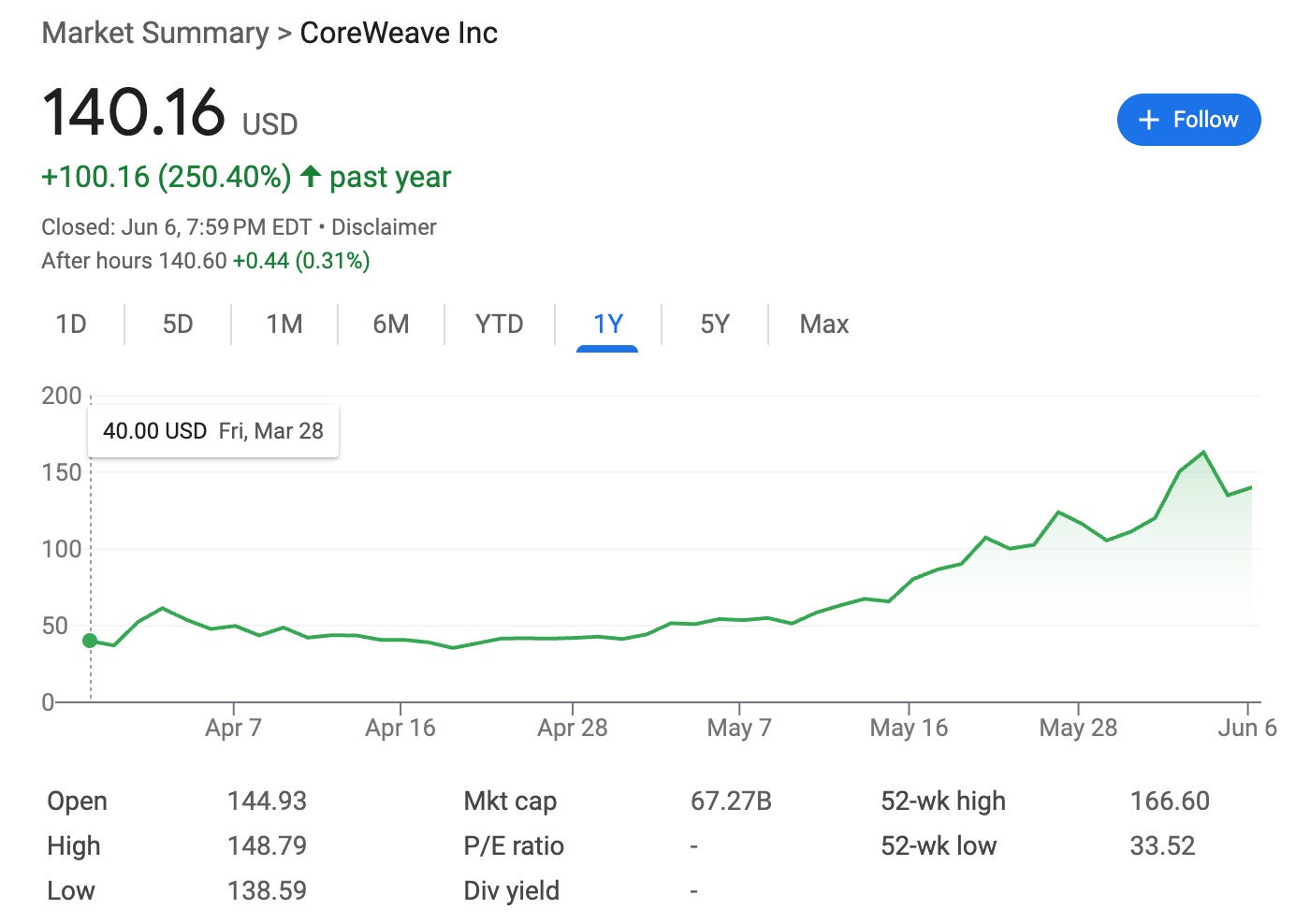

Cloud Infrastructure leader CoreWeave did its IPO March 28th— in the teeth of the market storm—with its IPO trading flat on day one from its offer price at $40 a share. Since then, CoreWeave stock has taken off like a rocket and closed at $140 on Friday which is an increase of 250% in two months. CoreWeave’s market cap is now approximately $70 billion and trades at 13.5X 2025 estimated revenues.

I’ve always felt that IPOs were the best true sentiment indicator because that’s how investors were actually voting with their cash.

When there are a zillion IPOs going out the door, many at questionable quality and they were all pricing and trading to the moon, it serves as a warning bell that things are overheated and investors should be getting more cautious. When there were few IPOs (if any) and they are trading poorly, it’s a sign that the environment might be too pessimistic and accordingly, opportunity was being created.

The not too hot, not too cold environment was when there was a steady stream of high quality companies doing IPOs with the pricing and trading being “just right”. Just right historically meant that the first day IPO “pop” was between 10-15% and the vast majority of new issues were trading above their IPO price after a month.

Also, a “normal” environment was where about 60% of IPOs priced within their filing range, about 20% priced above the filing range and 20% priced below the filing range. So if 80% of the IPO’s were priced above the range, a signal things were getting too hot. If 80% were pricing below the range, an indication things were too cold.

Signature IPOs have historically catalyzed the market often out of a difficult period and messaged the coming of a new era.

Netscape went public in August of 1995 (when everybody was supposed to be at the beach) with its shares being initially repriced from $14 on the original IPO filing to being priced at $28 and closing the first day at $58 with IPO “pop” of 108%. Netscape’s IPO marked the beginning of the Internet wave and NASDAQ was up 35% overall the next twelve months.

eBay went public in September 1998 in the midst of the Russian Ruble crisis and the demise of Long Term Capital with its IPO going from its $18 initial price to $47 the first day, or a 163% change. This let investors know to jump in the market, the water was fine. NASDAQ advanced 65% in the next year.

Snowflake did its IPO in September of 2020 and Airbnb went public three months later in December. The markets were recovering from the initial Covid scare but still in a very uncertain environment. Snowflake and Airbnb both traded up approximately 110% their first day. NASDAQ was up 32% and 27% following the Snowflake and Airbnb IPOs, respectively.

NASDAQ is up nearly 100% from its fall of 2022 lows and needs fresh oxygen beyond the “Magnificent 7” from here to perform. The IPO Market has always been the place where investors have found a boost and with over 1,200 Unicorns globally, there is a robust pipeline to feed the ducks…because they are quacking.

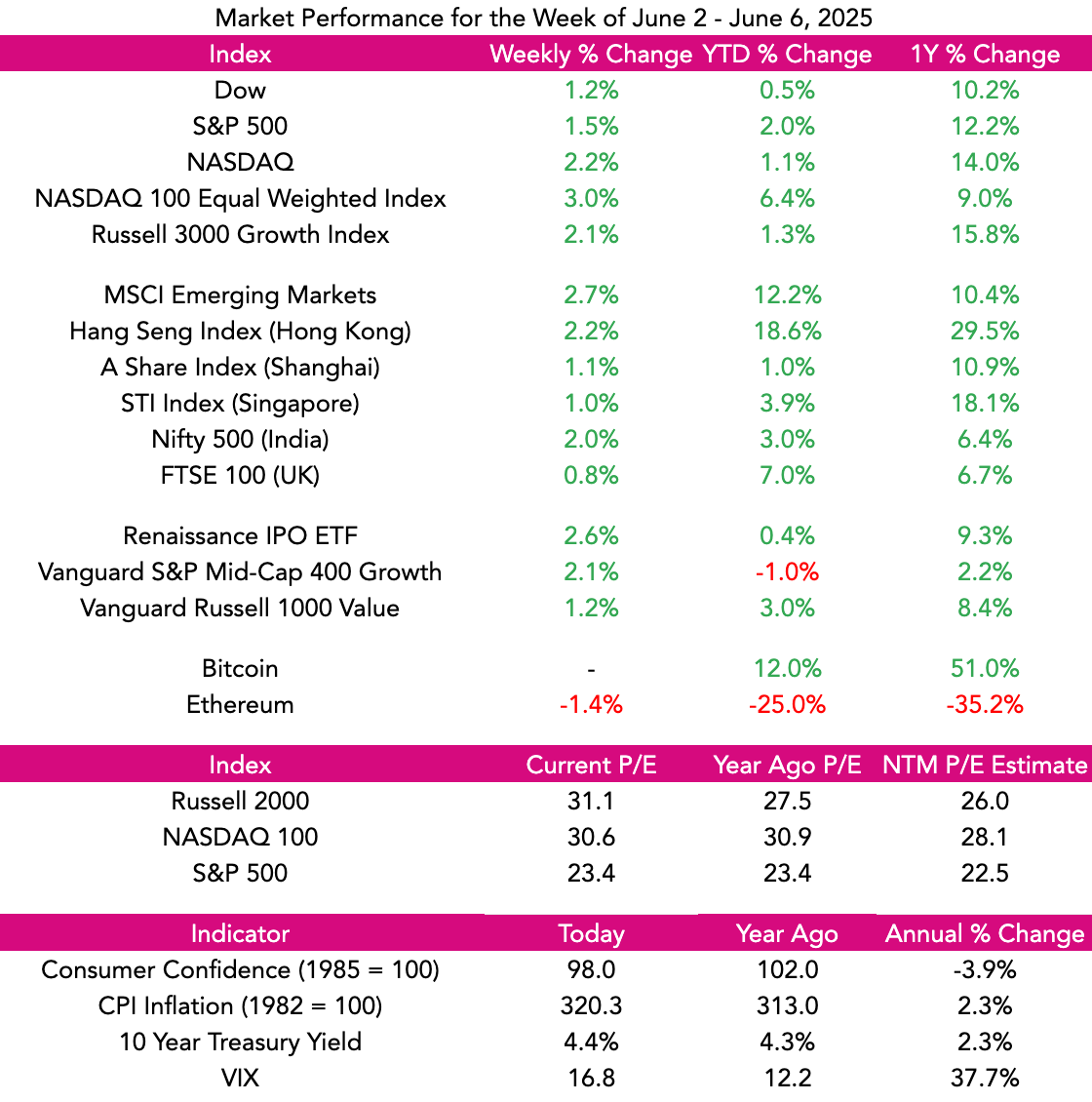

Market Performance

Market Commentary

While the fireworks between the world’s richest man and the world’s most powerful man got much of the mindshare for the week, stocks continued their upward rebound from April lows.

For the week, NASDAQ advanced 2.2%, has climbed 17% from its low and is now in positive territory for the year. The S&P 500 was up 1.5% and Dow increased 1.2%.

With earnings season over, the results were solid with a 12.5% year over year EPS growth in the 1st quarter. This marks three of the past four quarters having double digit growth. Overall, earnings growth for the year is expected to be 8.5% which is down from the previously expected 14.5%, but a re-acceleration in 2026.

Also, the jobs report last week was slightly better than expected with 139K new non-farm payroll jobs created. Unemployment remained at 4.2%.

The AI wars remain intense with Reddit suing Anthropic for allegedly illegally scraping proprietary content off of its communities. Perplexity was close to raising strategic money from Samsung and has been added as feature on its phone. X.ai raised another $5 billion of debt to provide it more much needed ammunition.

Chime Financial and Voyager Technologies are slated to go public this week which will be instructive on how much momentum the IPO market has going for it.

We remain optimistic on the outlook for stocks and emerging growth companies in particular.

Need to Know

READ: The Personalization of Software | Digital Native

WATCH: 🏟️🎙️ Chip Paucek, Co-Founder of Pro Athlete Community (PAC) | S2 E8 | Under The Number

LISTEN: China, AI Immigration, Rare Earths & Chips, Tariffs, Market Check | BG2 w/ Bill Gurley & Brad Gerstner

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

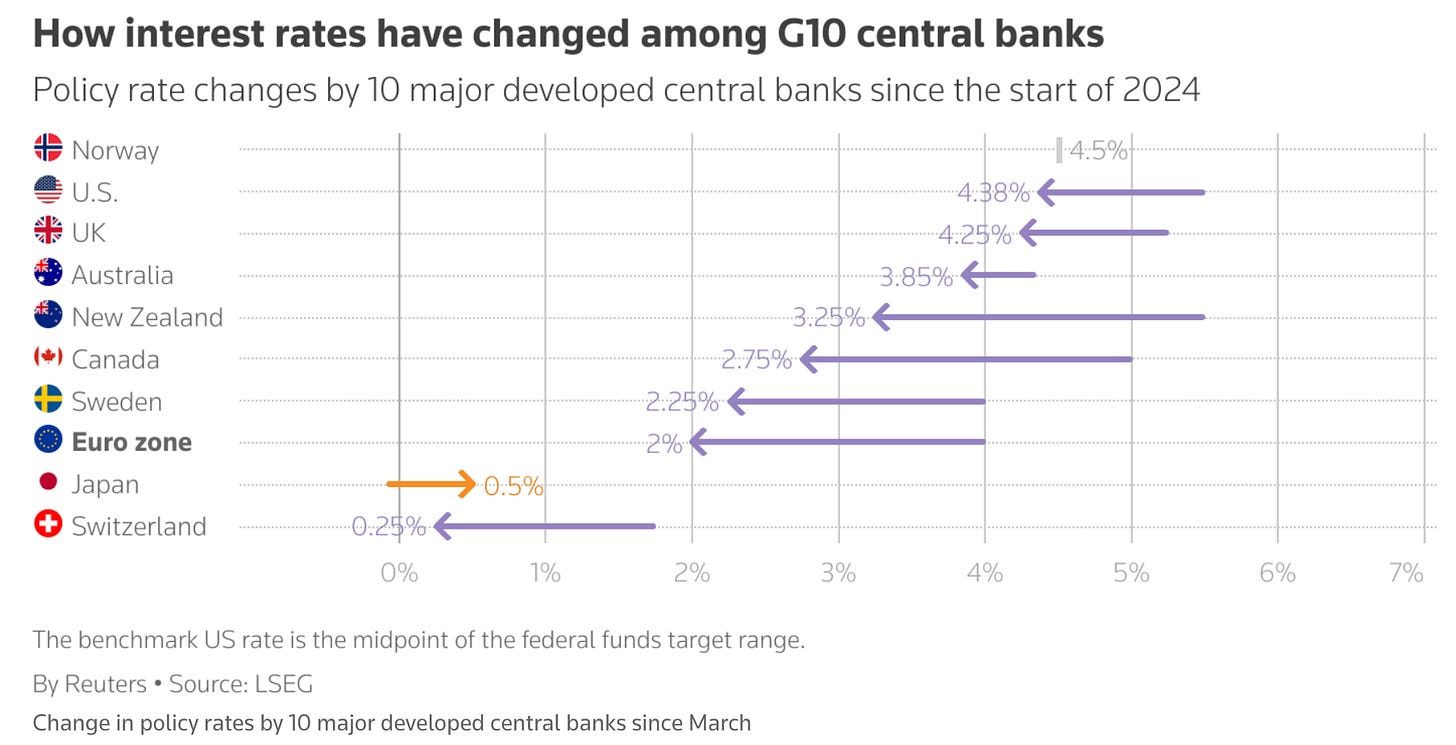

#3: Interest Rates

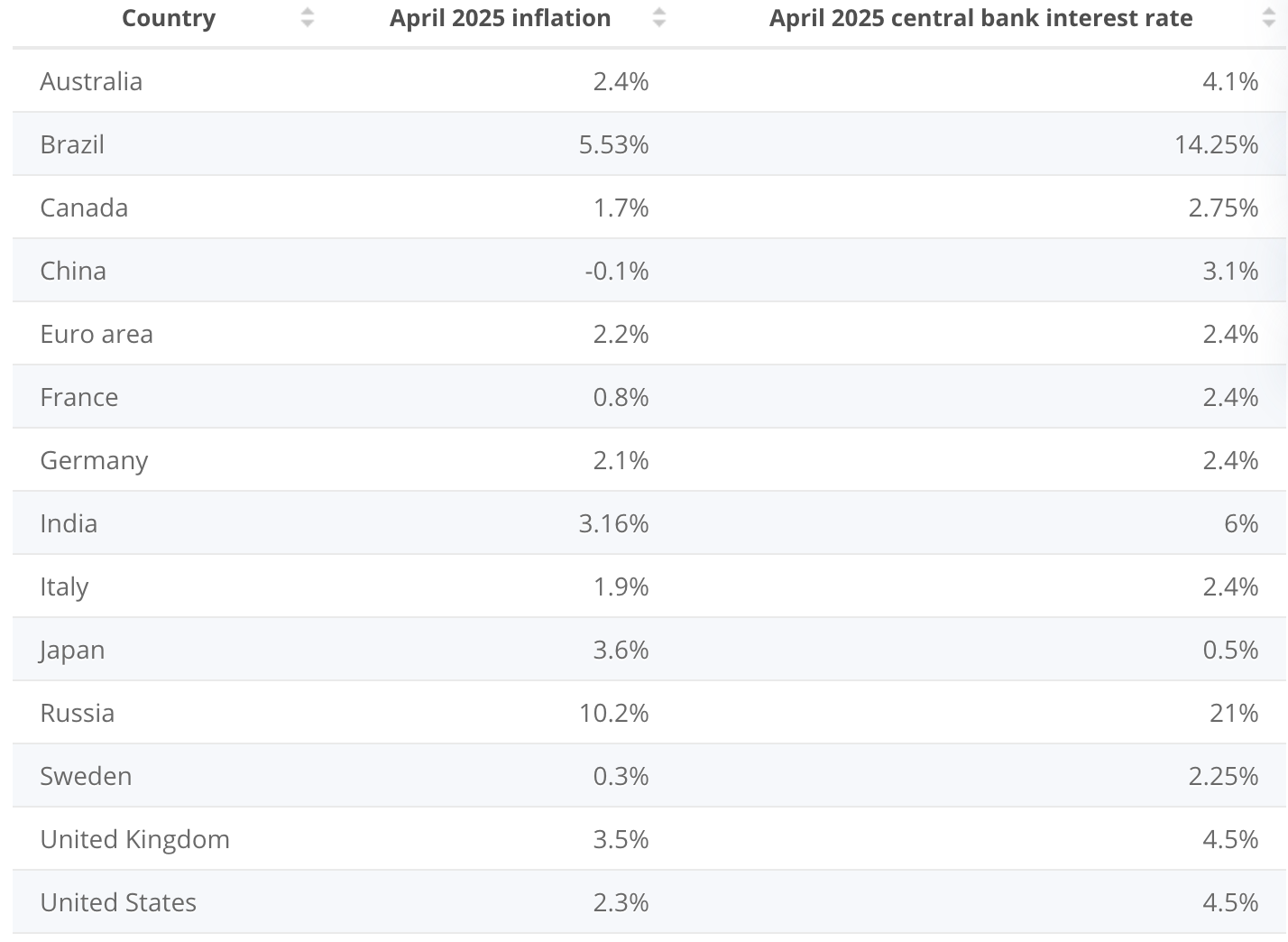

#4: Inflation

Chart of the Week

Maggie Moe’s GSV Weekly Rap

Chuckles of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM