EIEIO...Real Leaders, Real Impact

Dare to be Authentic and Dare to Care

GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: At least 10 – The number of new AI-driven private K-8 campuses that Alpha School plans to open by December 2025. (PR Newswire)

Innovation: $20 Billion – What Tim Draper’s $9 million investment in Baidu became worth, a deal he did in a taxi in 2000. (Tim Draper)

Education: 1,389,000 – The number of job openings in the Education and Health Services sector as of July 2025. (Arbor Data Science)

Impact: ~40% – The percentage of Nvidia's quarterly revenue that came from just two clients. (Futurism)

Opportunity: 61.5% – The proficiency rate in math for black students in New York Charter Schools, compared to 34.3% in district schools. (New York City Charter School Center)

“If past history was all that was needed to play the game of money, the richest people in the World would be librarians.” – Warren Buffett

“The only thing worse than a Coach or CEO who doesn’t care about his people is one who to pretends to care. People spot a phony every time.” – Jimmy Johnson

“A life is not impactful except the impact it has on other lives.” – Jackie Robinson

“You can get everything in your life you want if you help enough other people get what they want.”

ESG is dead. DEI is done.

Long live ESG and DEI!

OK, OK, OK…before I start getting the hate emails from every side, let me explain. My belief is that something like 80% of us care about the concepts of ESG and DEI and think they’re important…but we may have a disagreement on how things were implemented, or how sincere the beliefs were.

The terms ESG (Environmental, Social and Governance) and DEI (Diversity, Equity and Inclusion) have become toxic with organizations running away from them even faster than when they ran to them when they were in fashion.

Yet, over 75% of Gen Z (current 13 to 28 year olds, about 70 million people) say that environmental, social, diversity and fairness issues are important to them when considering an employer, 50% are willing to leave their job if their values don't line up and 33% will pay more for products that align with what matters to them.

The fly in the ointment is that the most important value that Gen Z prioritizes is authenticity so when a company says one thing but does another, it shatters trust. When a company does something because it thinks it makes them look good but doesn't have that sincere of belief, it's smelled out as phony as a $3 dollar bill quickly.

Some think the AI Revolution is going to dehumanize business but I believe the opposite. The big differentiator between enterprises is a company's ability to obtain, train and retain the best and the brightest. AI is obviously a major disruptor and accelerator but the magic will be how people integrate in the mix.

With AI creating a "time dividend" and "multiplication by division", humans will have more time to innovate, create and debate. Software is eating the World. AI is its teeth…but humans will decide what to eat.

Fortune has for 27 years published the 100 Best Companies to Work For. The market performance of these companies is stunning with outperforming the S&P 500 by over 2000%.

Fortune’s Top 10 Best Companies To Work For 2025

The criteria include culture, benefits, innovation, personal growth and caring about the employee as a person. Authentic leadership is core, as is transparency in communication along with values that are shared. The speed of business is the speed of trust with the best companies being able to move faster.

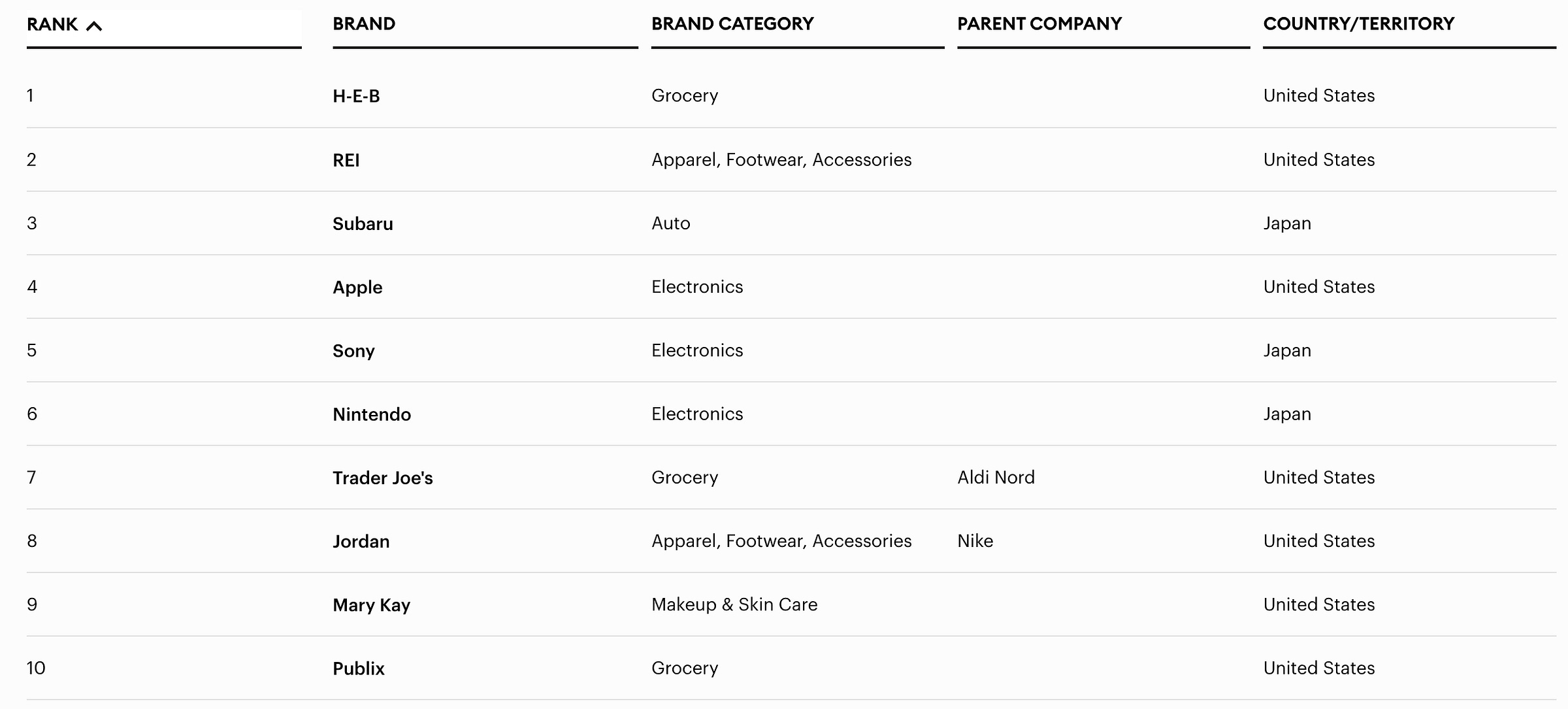

My long time friend Rob Pace founded a business HundredX which is a "listening company". Forbes partnered with HundredX to determine the 100 Best Brands for Impact. The criteria for best brands included trust, integrity, social values, sustainability and community linkage. HundredX took 4 million feedback entries from over 185,000 individuals on 3,200 companies to pick the top 100.

What's really cool about HundredX is 100% of the Cost of Goods Sold (COGS) is paid to charities for the data their members are providing. A gigantic benefit for investors is that HundredX data has an uncanny ability to predict the future performance of companies they are receiving input on.

What's clear is consumers, which is 2/3 of the economy, want to buy from companies that they relate with.

The best companies in the future are going to combine purpose and profit. They will care about leaving the planet better than they found it. They will care about sustainable business practices and having a workforce that is diverse in every sense of the word. They will foster a culture of fairness and helping others.

As we think about who are going to be the "Stars of Tomorrow", the fastest growing, most dynamic companies in the World, it becomes an exercise of identifying real leaders who are going to drive real impact.

The SOT will have the ambition of a for profit with the heart of a not for profit.

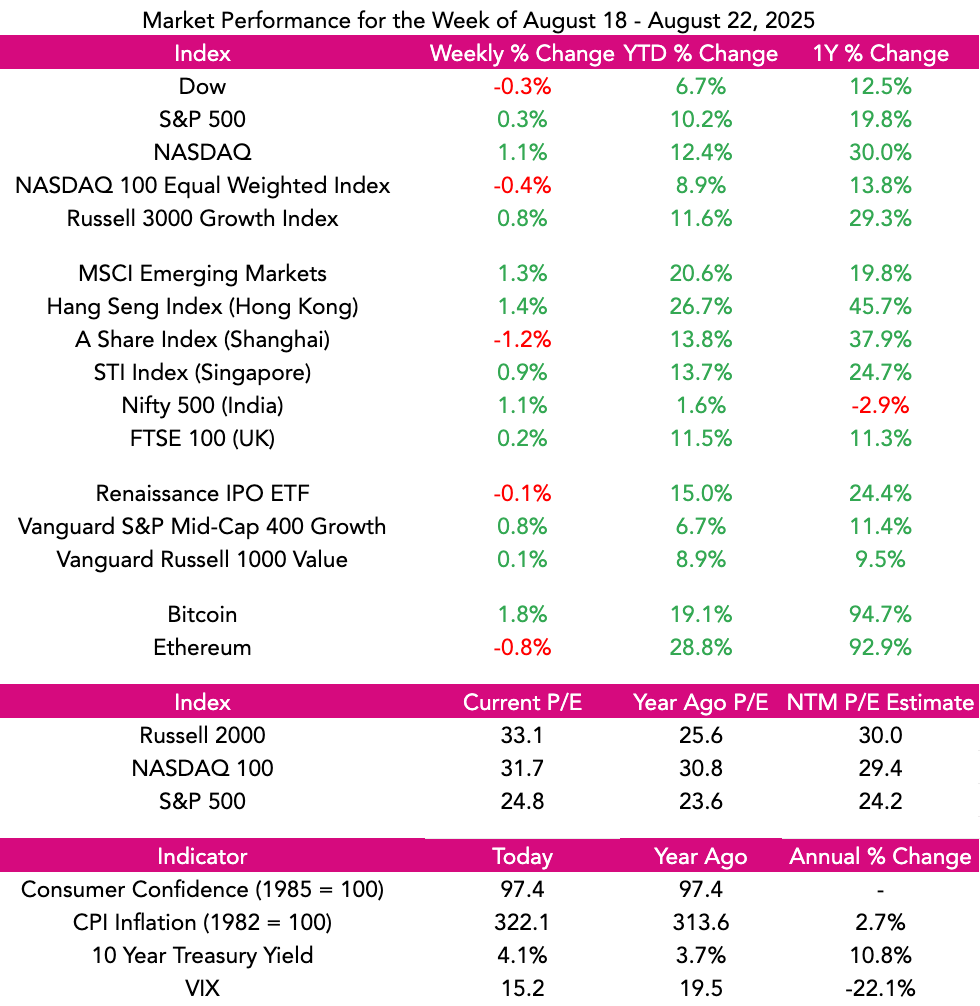

Market Performance

Market Commentary

As the Markets are wont to do, bad news was treated as good news with the 22K new jobs reported in August over 50K below analyst forecast.

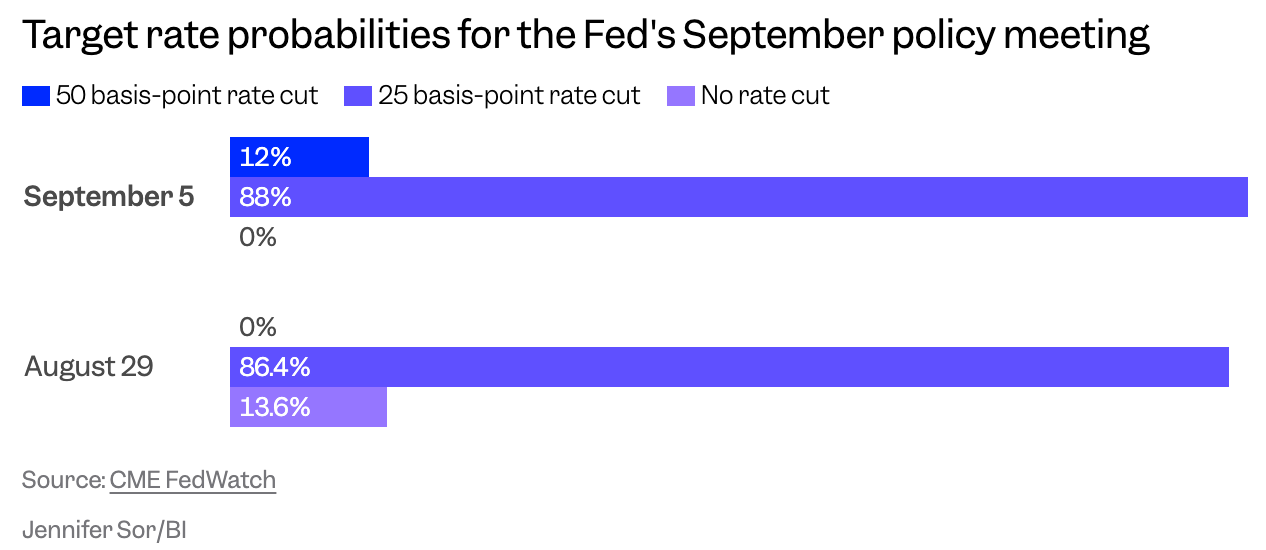

The logic being, weak employment numbers ensured the Fed will be dropping rates this month, which is expected to help the economy.

For the week, the NASDAQ rose 1.1%, the S&P 500 was up .3% and the Dow was down .3%.

Alphabet shares rose as the judge ruled it can keep its Chrome browser. Broadcom reported EPS up 36% with chip revenues increasing 63%…shares of AVGO rose nearly 14% in kind. High speed AI center connectivity enterprise Credo reported revenue increase of 274% and EPS growth of 1200% with its stock also rising approximately 14%.

On the not so happy side, uber-hot Figma cooled off 20% after relaying disappointing guidance going from 41% revenue growth last quarter to under 35% growth. Salesforce also issued soft guidance with its shares falling 2%. Chinese Tesla competitor BYD dropped nearly 8% after announcing deliveries of their EVs would be about 1 million short to 4.6 million vehicles.

Speaking of Tesla, TSLA's board provided a compensation package that could pay him $1 trillion over the next 10 years.

We continue to see the environment for emerging growth companies as very positive. A broadening of Market participation, a declining of interest rates making future growth more valuable, and an IPO Market that is poised to provide more fuel to the fire all contributes to our BULLISH position. 🐂

Need to Know

READ: Weekly Dose of Optimism #160 | Not Boring

WATCH: Palantir co-founder Joe Lonsdale on Pres. Trump's industrial policy, tariff agenda and AI chip sales | CNBC

LISTEN: Robinhood CEO Vlad Tenev | The Iced Coffee Hour

GSV’s Four I’s of Investor Sentiment

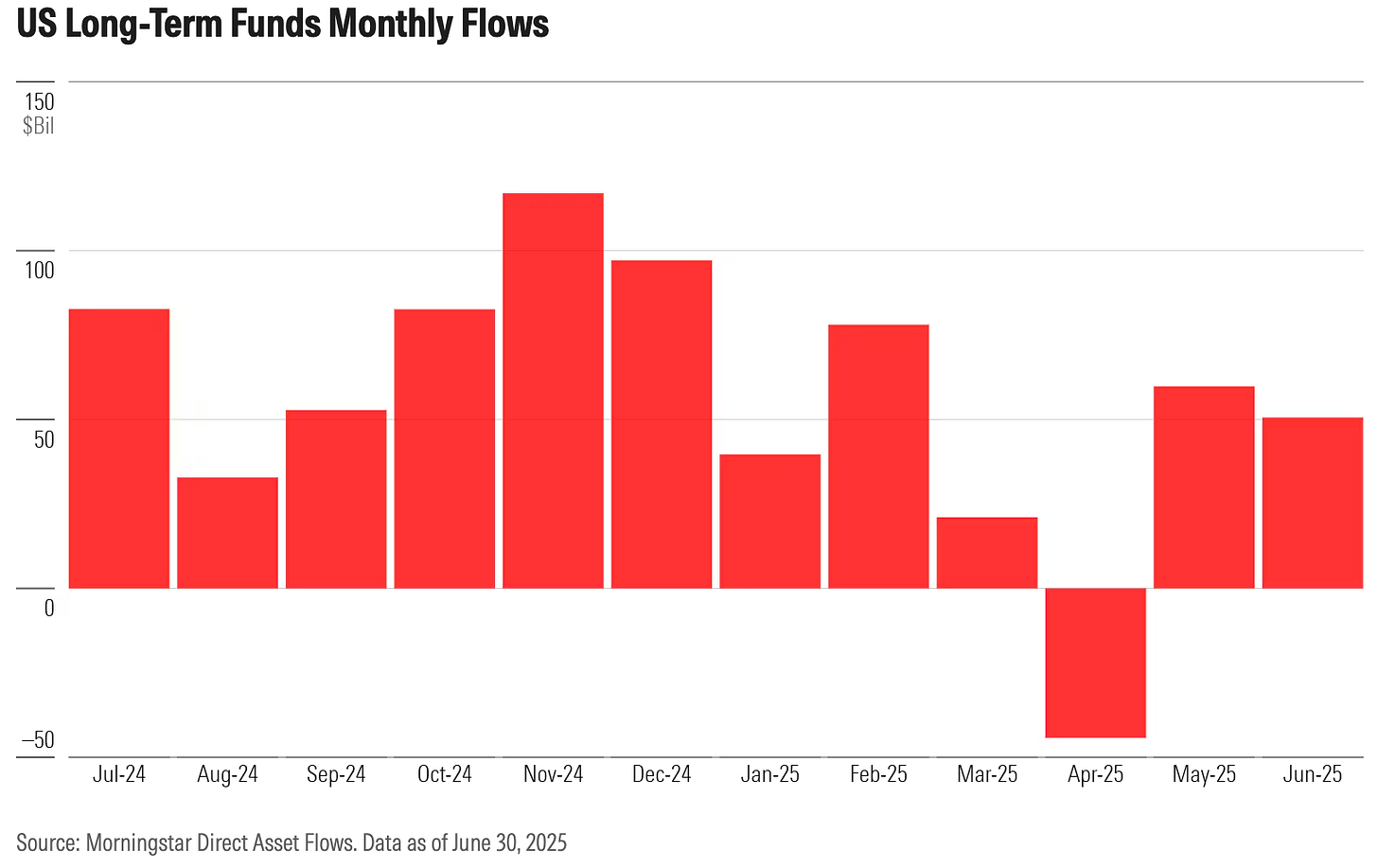

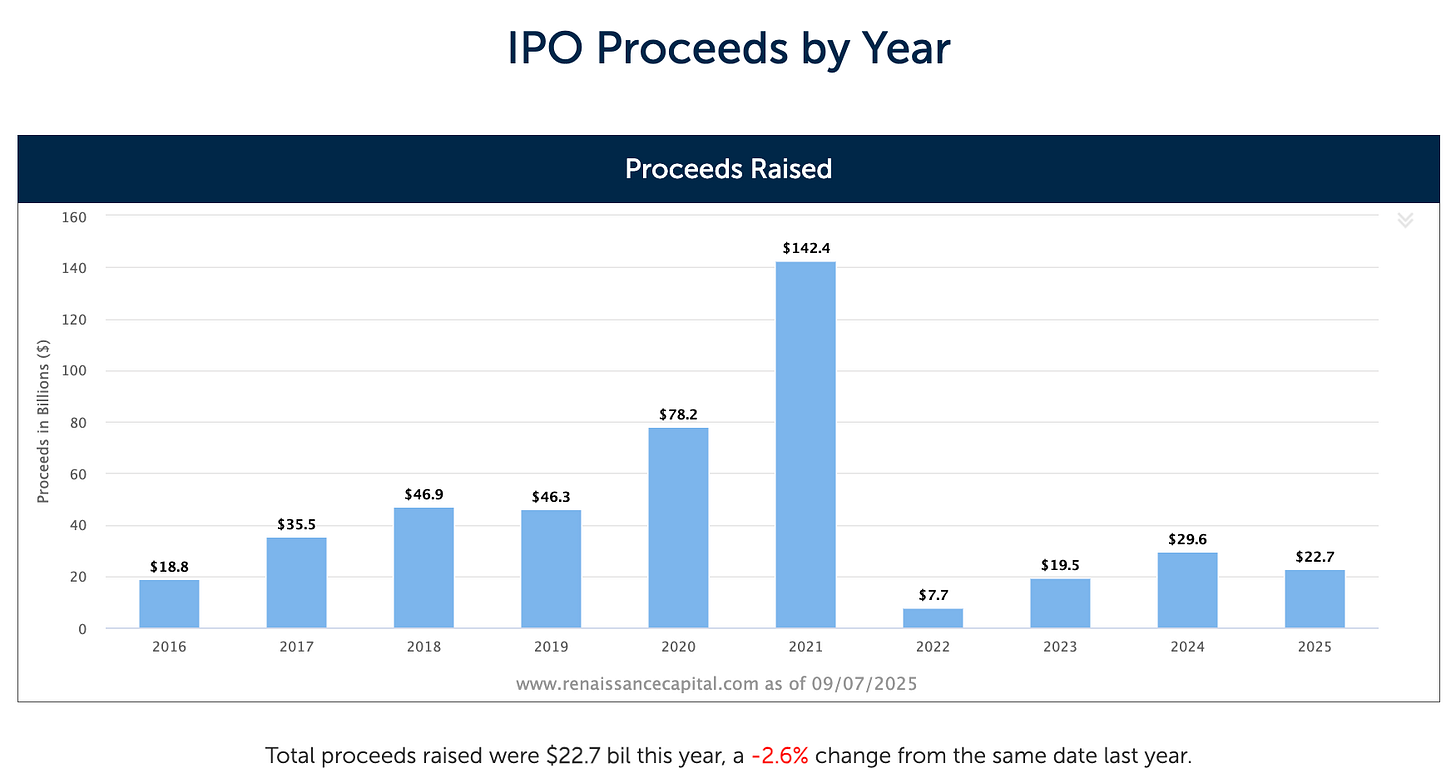

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

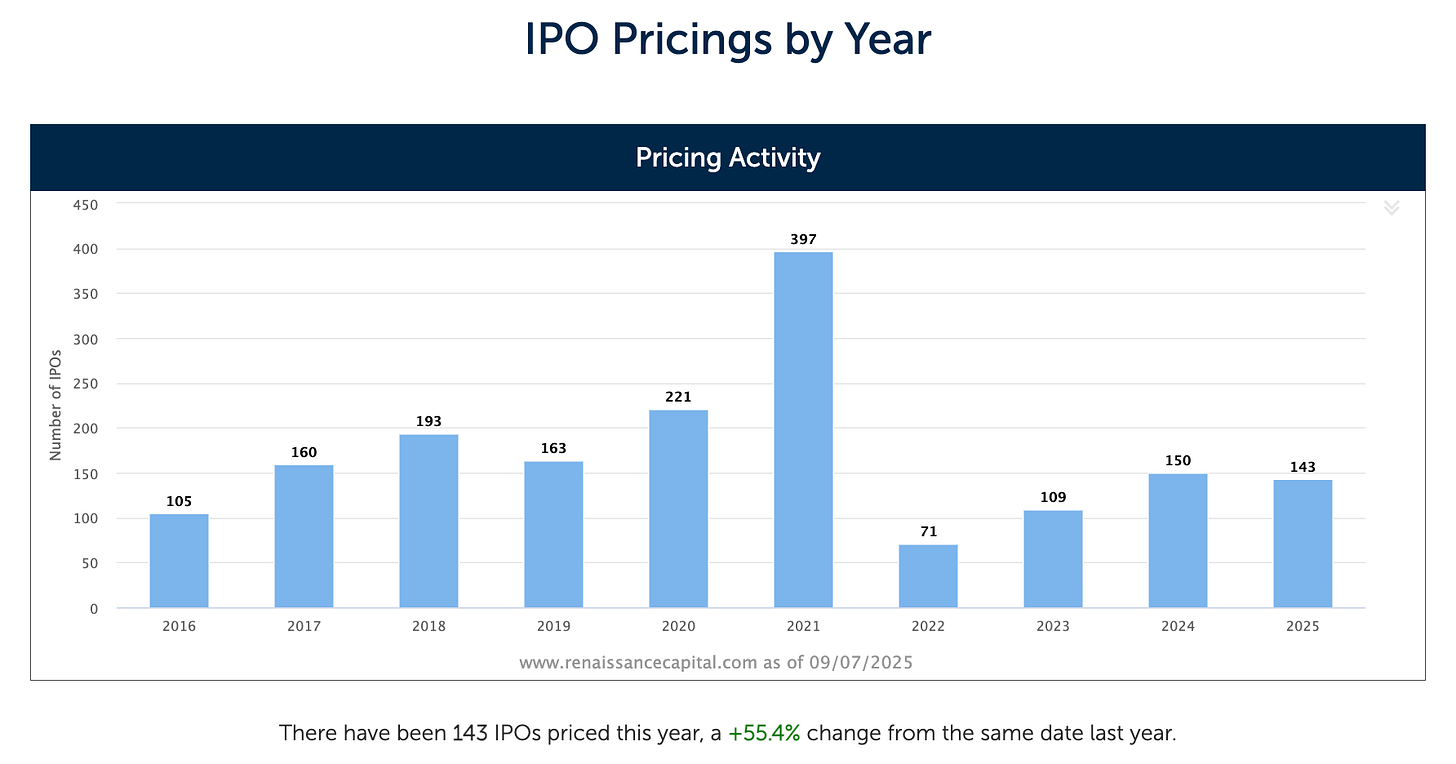

#2: IPO Market

#3: Interest Rates

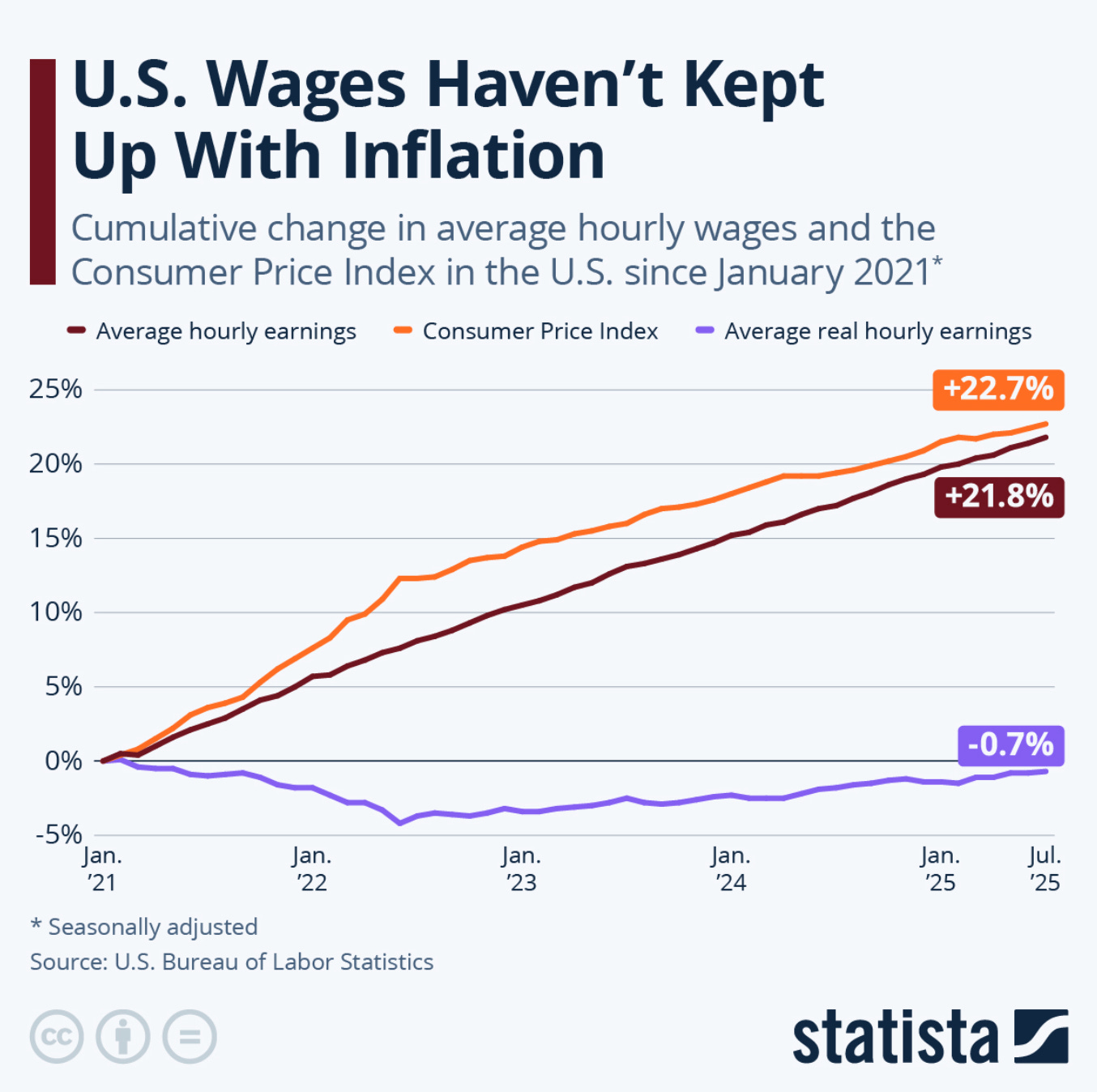

#4: Inflation

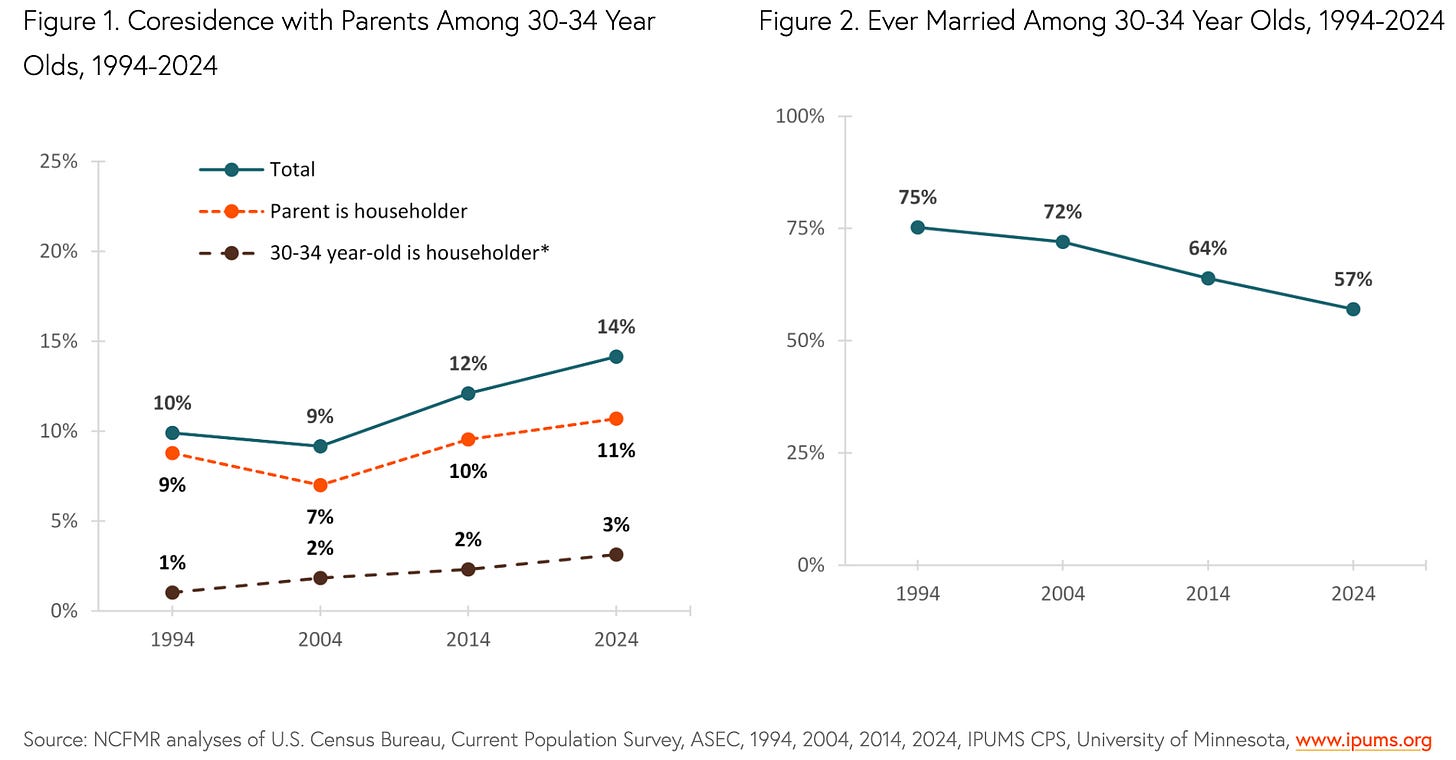

Chart of the Week

Maggie Moe’s GSV Weekly Rap

Chuckles of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM