“An object in motion will stay in motion unless it is acted upon by a force.” – Isaac Newton

“I don’t set trends. I just find what they are and exploit them.” – Dick Clark

“The trend is your friend.” – Martin Zweig

Scorched Earth.

Last week was the hottest seven days in 100,000 years. In Death Valley, a World record was set reaching 130 degrees.

In Phoenix, it was over 110 for two weeks in a row. Del Rio, Texas had 21 days of 100 degree plus weather. In Europe, an all-time heat record was set reaching 120 degrees.

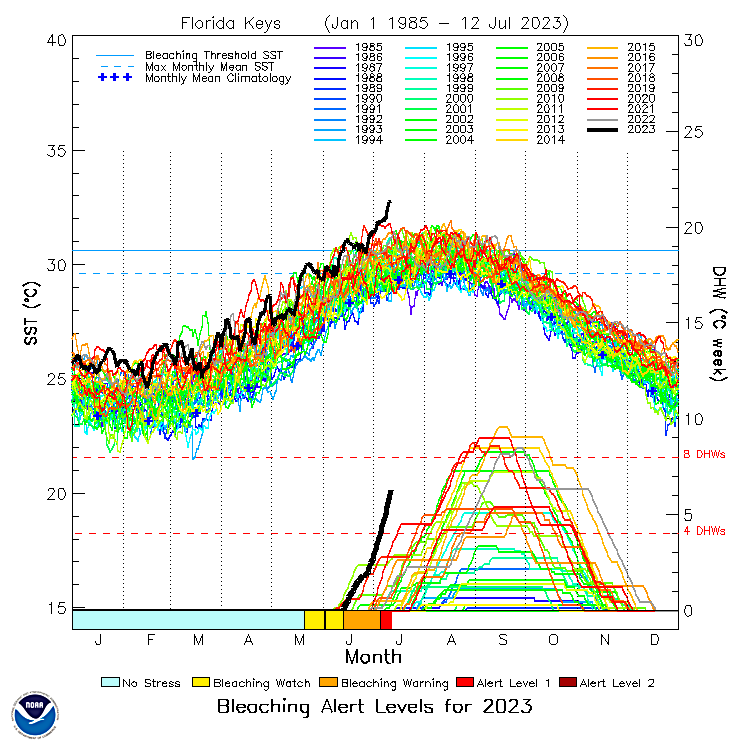

“Boiling the ocean” took on a whole new meaning with the Atlantic temperature reaching 97 degrees off the coast of Miami.

Fires in Canada burning over 22 million acres of forest. Floods up the Hudson Valley and into Vermont. Droughts in Spain wrecking havoc on farmers.

Whether it’s climate change caused by human activity, El Niño or just the way cycles swing….or all of the above….one thing for sure, Mother Nature is nobody to mess with.

“Climate Czar” Kerry gets some heat on his testimony to Congress

As an investment theme, protecting the environment is a huge need and opportunity. It’s imperative that we leave the Earth at least as good as we found it, so clean water, clean air, clean energy, and sustainability squarely fit our Mission theme.

Fred Wilson’s AVC Piece: Flooding

Water doesn’t boil when it’s watched, and the same can be said for growth stocks. This year, while many investors were wringing their hands of the high-flying technology stocks of yore, many ascended to new heights with NASDAQ advancing 34.8% YTD.

It’s always instructive to see what stocks and industries come out the strongest following a correction in the Market. Often, it’s where new leaders are found…ditto and then some with IPO’s.

So what we are seeing suggests “Remember The Titans.” NVIDIA is not only the best performing stock to date, it was also a top stock in 2003 and 2016 (up 93% and 233% respectively). Meta, with its newfound love of AI and launch of Threads, has gotten its Mojo back.

Tesla’s progress in Autopilot and the Charging Wars (Rivian, GM, Ford, and Mercedes-Benz have decided “if you can’t beat them, join them”) has driven the stock back to its October 2021 level. Adobe’s acquisition of Figma and piracy-free generative AI tool Firefly have changed the perception of the business (and the stock).

The private market, almost always lags the public market in terms of activity and valuations but sends major signals in terms of what sectors have the greatest future potential.

So while for the first half of 2023, funding of VC backed companies is down 48% to $173 billion, Artificial Intelligence companies received $40 billion. For a must-watch video on the potential good and bad for AI, watch the 60 Minutes interview with Google CEO Sundar Pichai…

Exploring the human-like side of artificial intelligence at Google

Below is the CB Insights 2023 AI 100. Since 2019, the 2023 AI 100 cohort has raised nearly $22B. The list includes 15 unicorns, 14 industries, and 13 countries.

The biggest potential opportunities are often found where Megatrends intersect growth sectors of the economy. AI is clearly not just a Megatrend but a GIGATREND, and thinking about how that affects areas such as education, health care, longevity, the environment, and Media is where the “stars of tomorrow” will be found.

Actors vs. AI: Strike brings focus to emerging use of advanced tech

With any Megatrends, there are minitrends that develop. Minitrends might be huge in terms of the opportunity but narrow as they relate to impacting all growth sectors.

In addition to Megatrends, and mini-trends, we like to look at Negatrends both in terms of areas to avoid as well as where there are problems to solve.

An exercise we like to do from time to time to keep a pulse of what’s going on is creating our “hot” and “not” list. Both art and science, the value is differentiating between a “trend” and a “fad”.

Market Performance

Buoyed by “cooling” inflation of annual CPI of 3.0%, stocks moved higher last week. The tech laden NASDAQ advanced 3.3%, the S & P 500 was up 2.4% and the Dow increased 2.3%.

2nd Quarter Earnings Season started last week with analyst forecast expecting earnings to decrease by 7.7%. JP Morgan and Wells Fargo came out with good numbers and the Market responded in kind.

We continue to be cautiously optimistic about the outlook for the Market overall and growth stocks in particular. We said in January that it’s wiser to buy a swimsuit in the Winter than in July….we also think its wise that when things are hot outside, you gotta jump in the water!

Need to Know

READ: NYTimes: Inside the White-Hot Center of A.I. Doomerism

LISTEN: Reid Hoffman on the Possibilities of AI - Conversations with Tyler

READ: Filtering The Idea Funnel - by Frederik Gieschen

WATCH: ARK's Cathie Wood: The market is starting to look to the other side of the rate hike cycle

READ: What Would You Pay for Personalized AI?

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: Yardeni

#2: IPO Market

Cosmetics company Oddity has filed terms for a $300 million US IPO, while The Information reported that Liquid Death has hired Goldman Sachs for a spring 2024 IPO.

Wellington’s Matthew Witheiler took a more muted stance on IPO expectations, sharing that the majority of Wellington’s portfolio companies with confidential S-1s out are thinking that Q1 of next year is the first real point they’ll evaluate going public.

Source: Renaissance Capital

#3: Interest Rates

The 3% inflation print this week hinted at the end of the inflation emergency, and thus the end of the Fed’s historic monetary tightening. The Fed is widely expected to hike rates again this month, but that could be the last hike of this cycle.

Source: Bloomberg

#4: Inflation

The 3% inflation print is the lowest in more than two years…and 1 year inflation breakevens have hit their lowest level since 2020.

Source: Twitter

Video of the Week

Charts of the Week

Chuckles of the Week

EIEIO…Fast Facts

Entrepreneurship: 41.9 – average age of an entrepreneur (The Generalist)

Innovation: $800 Billion – decrease from remote work in value office buildings in major cities (Bloomberg)

Education: 31% – US adults 55 and older with a great deal of confidence in higher education (Gallup)

Impact: 36% – percent of podcast listeners who have tried out of a lifestyle change because of a podcast (Pew Research)

Opportunity: 96.5% – growth of labor force aged 75 years and older over the next decade (BLS)

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…. EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM