GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

"In the short term, the Market is a voting machine. In the long term, it's a weighing machine." – Ben Graham

"If past history was all there was to the game, the richest people would be librarians." – Warren Buffett

"People bet on the hourly wiggles of the market but it's the earnings that waggle the wiggles long term." – Peter Lynch

Three legends of investing. Three quotes...all gems. If these quips were the sum total of an investment philosophy, it would be notably superior to most peoples’ strategies.

Let's break it down.

Ben Graham talked about the Market in the short term being very emotional and swayed by the mood of the moment, like what happens when people vote in an election.

Fear and greed dominate the moment-by-moment movements of the stock market. FOMO affects the voting machine. Human nature does not change - everyone is trying to minimize pain and maximize pleasure.

There are always things that tickle the nervous system, for example:

"AI companies are going to the Moon."

"AI companies are going to be legislated away."

"The War is going to make the Economy crash."

"The War is going to make the Economy boom."

In the long term, however, the Market is a "weighing machine" and what it measures is cash flow and earnings growth. Accordingly, to be a long-term winner in the Stock Market, the key is to invest in companies that generate the highest earnings and revenue growth over time.

The Oracle of Omaha gives readers of Berkshire Hathaway's Annual Report an MBA in business and finance, with the point about librarians being that it doesn't count what happened in the past, it's what materializes in the future that matters.

That's not to say the past track record doesn't give some good information about what could happen, but it's the road ahead where the race is won.

The philosophy of Fidelity’s Peter Lynch can be crystallized into a single sentence: Earnings growth drives stock price, and over time, there is essentially a 100% correlation between the two.

To incorporate all three philosophies into one snapshot of the Market, the so-called "Magnificent 7" a.k.a. Apple, Microsoft, Alphabet, Amazon, Facebook, NVIDIA, and Tesla were up on average 111% last year, yet 2023 EPS growth was just 33%.

Why? The "voting machine" was in a dual state frenzy about AI with the M7 viewed as the smart way to play it AND the investors were still scared to invest in riskier companies.

Magnificent 7: 2023 Metrics

With that backdrop, we are publishing our annual list of the top 25 performing public stocks for the past 10 years. The #1 stock was NVIDIA which went from a $9.1 billion market value in 2013 to worth $1.2 trillion in 2023. #3 on the list Tesla increased over 40X in value in the same ten years.

Top 25 Performing Public Stocks, 2013-2023

Top 25 Performing Stocks, Median Metrics

What's interesting isn't so much who made the list – most investors who have been paying attention would have been able to name a number of the 10-Year All-Stars – it's how they got there.

The median stock CAGR from 2013 to 2023 was 32%, which means the average top 25 company was nearly doubling every two years. But that's not so surprising because, after all, that's how you make an All-Star list out of 4,000 other companies.

The average P/E of the top 25 was over 27X earnings at the beginning of the period of outperformance. In other words, these were not exactly "cheap" stocks by historical standards. However, the average revenue growth for the top 25 was 24% and the median EPS growth was 27%. The 10-year stock price increased more than revenue and EPS growth due to the P/E multiples expanding even from the high starting level to finish at 68.5X.

Also notable, the median market cap for the list went from $855 million – small-cap stocks in today’s World – to $21 billion. That’s larger than the largest company from 2013’s list (Tesla) at $18 billion.

So we conclude that if we want to pick the companies that will be on the list 10 years from now, we need to focus on 1) companies that have the highest growth potential, and 2) smaller cap companies because, over time, size forges an anchor.

We've done this study for over 20 years and it always tells us the same thing: growth is the answer. However, there were some interesting anomalies and a few trends that I think may have a reversion.

Looking at the median price-to-sales of 2.9X at the beginning of the period (rather modest for a list of high-growth businesses), 11 of the 25 are either semiconductor companies or computer hardware which have historically lower price-to-sales multiples.

The fact that this group finished the 10 years with a median price to sales of 9.2X reflects 1) investors’ re-evaluation of the sectors 2) a shrinking supply of stocks, and 3) the falling interest rate environment for much of the period.

NVIDIA's stock exploded with a 62% CAGR against 27% revenue growth and 45% EPS growth. The price to sales, however, went from 2.4X in 2013 to 27.5X in 2023. Since going public, NVIDIA's stock has correlated with its earnings growth.

Tesla's stock increased by 38% versus its revenues and earnings growing at 50% and 43%, respectively. How that happened is its price-to-sales multiple went down from 10.3X to 9.2X from 2013 to 2023 (and still is 30X the automobile average price-to-sales multiple).

The 40-year tailwind of falling interest rates made growth companies' future earnings more valuable. However, higher rates have now become a headwind. Accordingly, multiple expansion is less likely to be a performance driver going forward.

Another boost to P/E and P/S multiples has been the shrinking supply of stock. The number of publicly traded companies in the past 10 years has gone from 5,949 to 3,700, driven by mergers and private equity-driven take-privates.

Moreover, while VCs have funded 119,168 companies (Source: Pitchbook) since 2013, there have been only 344 VC-backed IPOs since 2013 (34 per year on average). To give some perspective on how few this is, consider this: my old firm Montgomery Securities took 101 companies public in 1997 alone.

The requirements for going public have become significantly higher and the desirability of being public is significantly lower. As a result, there are over 2,700 VC-funded unicorns that are looking for an exit.

Additionally, there is a huge pent-up demand from public investors who want new, fast-growing companies to provide some fresh oxygen to a Market that is dying for some new blood to keep it going.

The trillion-dollar question is: when will the market be receptive to IPOs, and what are the signs that will signal the growth ecosystem to confidently say, "Come on in, the water is fine"?

Like most things in life, there are repeatable patterns that can be recognized that signal what's going on and where things are heading. In the growth investing world, the public market has patterns that signal what type of mood it's in....risk on, risk off, prudent, bubble, or shut down.

Currently, we are in a prudent Market environment. Growth matters, but so does profitability. When investors start to get more confident, the Market broadens in terms of what companies get attention, and we are starting to see that happen now. NASDAQ's 43% rise in 2023 was very narrow amongst a handful of Megastocks led by the Magnificent 7.

When the Market is in a "risk on" (or bubble) environment, which together is about 50% of the time, it's starving for growth. Growth trumps company size. Growth trumps profitability. This is when IPOs are in popular demand. Our working thesis is that this will start to happen by the Spring.

Typically, investment banks want to bring out the strongest private companies first, and upon the Market receiving them positively (priced well, trade up 15%+), they'll want to bring more. As Sandy Robertson from IPO boutique Robertson Stephens used to say, "When the ducks are quacking, you feed them."

Some of the leading candidates to go public this year include Databricks, Reddit, Rubrik, and Fanatics.

Leading Potential 2024 IPOs

Additionally, a number of rapidly growing smaller companies can complement the IPO shopping list that we are looking at as candidates for our 10-year study concluding in 2033.

2033 Watch List

Speed thrills. We’ll continue to search for the fastest-growing, highest-quality companies in the world. Happy hunting.

Market Performance

Boosted by positive inflation news and GDP growth that was above expectations, the Market had another positive week. The S&P led up 1.1%, NASDAQ increased .9% and the Dow advanced .7%.

Inflation slowed for the 11th month but with GDP coming in at 3.3% for the 4th Quarter after rising almost 5% in Q3, it's unlikely the Fed is going to want to lower interest rates any time soon.

The beginning of earnings season was uninspiring with just 70% of companies thus far beating analyst estimates compared to the typical 80%. Notable disappointments came from Tesla, 3M, and Intel (which is having difficulty getting into the AI game). This week, Amazon, Alphabet, Apple, Microsoft, and AMD are all reporting.

In particular, Tesla has been struggling as of late and its stock has shed $210 billion of market value being off over 26%. Operating margins have been cut in nearly half due to lower-priced cars and substantial investment in R&D. Competition from China and less demand for electric cars in the U.S. have all created headwinds.

We remain constructive on the outlook for growth stocks and expect Market participation to continue to broaden. By Spring, we believe will start to see the beginning of an IPO Market start to open up. Another pattern to keep an eye on is the fact that in an election year like 2024, stocks usually find a way to go up.

Maggie Moe’s GSV Weekly Rap

GSV Model Portfolio

Need to Know

READ: Keeping Up with China for the English-speaking World (UPDATED) - DJY Research

LISTEN: John Reardon - Patek Philippe: Watch Perfection

WATCH: Building a $65B Company: The Thesis and Operating Principals That Built CrowdStrike

READ: Baillie Gifford, The Long View

LISTEN: Jobs of the Future | Andreessen Horowitz

WATCH: BG2 with Bill Gurley & Brad Gerstner | MANG VC Gone Wild, Can You Trust AI Valuations? & More | E01

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

IPO rumors are heating up, with Chipmaker Cerebras Systems and cybersecurity bellwethers Snyk and Cato rumored to be working on IPO filings.

Source: Axios

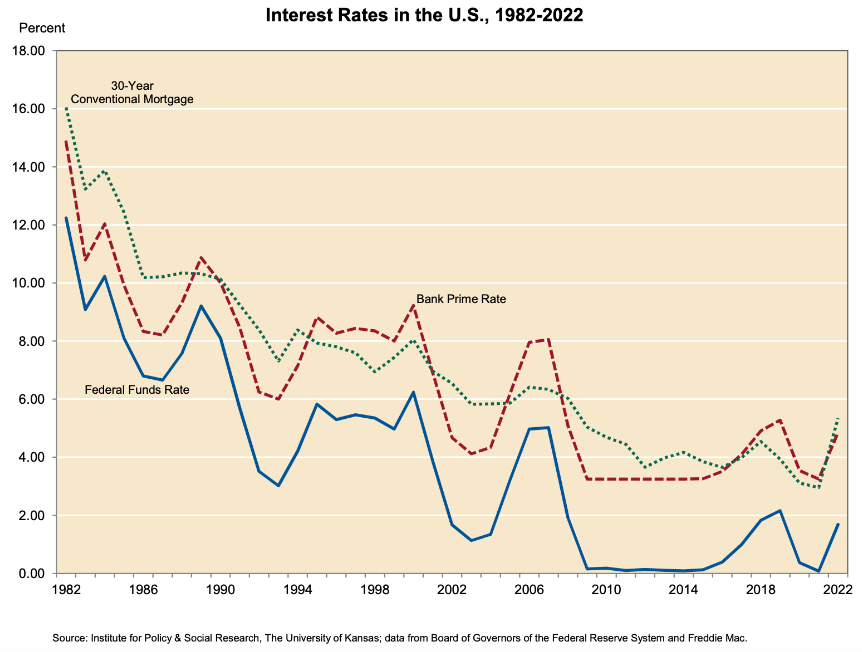

#3: Interest Rates

Source: Charlie Bilello

#4: Inflation

Chart of the Week

Chuckle of the Week

EIEIO…Fast Facts

Entrepreneurship: 40% – the percentage of the 532 U.S. unicorns trading at valuations below $1 billion in the secondary markets (Cowboy Ventures)

Innovation: 199 million – number of hot dog & soda combos sold in 2023 (Quartr)

Education: 31% – the percentage of Americans with graduate degrees who think they will always live paycheck to paycheck (Harper’s)

Impact: 23% – amount of future lifetime earnings that American workers are willing to give up to have a job that was always meaningful (HBR)

Opportunity: 68% – percentage of Americans who think the affirmative action decision in higher education is “mostly a good thing” (The Hill)

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup….EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM

Brilliant writing takes you to the very core of compounding far from all the noise and hustle bustle of the world - keep up the good work - you guys have nailed it ! Quality post