GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

“In the long run, your human capital is your main base of competition.” – Bill Gates

“Train people well enough so they can leave. Treat them well enough so they don’t want to.” – Richard Branson

“The race is not always to the swift, nor the battle to the strong, but that's the way to bet.” – Damon Runyon

I think NIL (Name, Image, and Likeness) and the Transfer Portal are gateway drugs that will ultimately kill college sports. The genie is out of the bottle and it will be impossible to get her back in.

I will give my argument as to why I think it’s so destructive some other time, but the purpose of this missive is to look at the value of human capital, the impact of how it flows, and what it predicts. Athletics are a natural place to start because there is such a clear correlation between talent, outcomes, and economics.

Last week, 1,500 Division 1 Football players entered the transfer portal, and it’s expected that over 20% of FBS players will transfer this offseason. Up until a couple of years ago, there was friction in transfer process – the athlete would have to sit out a year before they would eligible to compete for their new school.

The elimination of that rule has created a tidal wave of transfers which has been exacerbated by NIL. There are many good reasons for transferring schools – 18 year old kids may make bad decisions regarding school fit initially. Or, the coach who recruited the athlete may leave. Students might also realize they could get more playing time at another school – the list goes on.

Alas, the emergence of well-funded alumni 'collectives' means transferring is now less about school fit and more about the highest bidder.

Nebraska Head Coach Matt Rhule recently said that to get a good quarterback, it was going to take $1 to $2 million dollars….this was as much message to his booster club as it was to football public at large.

In this year’s transfer portal dating and mating season, big deals have been consummated with ferocious activity amongst the football elite. For example, former Oklahoma QB Dillon Gabriel flew to Oregon to join the Ducks for a rumored $1.1 million NIL deal.

Top 10 Players in the Transfer Portal

College football works kind of like venture capital – the best schools get a disproportionate number of the best recruits, which generate the highest percentage of wins, that results in the most championships, and produce the most amount of money.

The Flywheel of College Football

The University of Alabama dominates recruiting, has won six National Championships since 2009, has the highest winning percentage of all Division 1 programs, and generates over $120 million from its football program.

While Rice is a great university, its Division 1 football team is mediocre, bringing in just $12.6 million in revenue.

Top 10 Recruiting Classes Over The Past 5 Years

But, the impact of winning extends beyond the win-loss record or the direct revenues generated for the school. It has a multiplier effect that can be remarkably significant. Some think it’s outrageous that Alabama Head Coach Nick Saban makes $12 million a year, but they really shouldn’t be. In addition to the $127 million of revenue his TEAM produces, enrollment at Alabama has doubled from 20,000 students to 40,000 students during his tenure. At $32,000 per student in tuition, that’s a $640 million increase.

In the Knowledge Economy, businesses are no different than sports teams. The success of an enterprise is directly correlated to the ability to obtain, train and retain the best talent.

In the Industrial Economy, human capital was far less valuable. Many workers were more like widgets – though required to operate, they were easily replaceable. It was the return on property, plant, and equipment that generated more significant financial returns.

Accordingly, financial metrics such as book value were essential to understanding a business's value and operating potential.

Fifty years ago, the four largest companies in the world sold at a median book value of 1.6 and a Market Cap Per Employee of $83,391.

Top 4 Companies: Industrial Economy vs. Knowledge Economy

The four largest companies by market cap today sell at a median price to book of 16.4X and a Median Market Value Per Employee of $11.2 million. In other words, the Price to Book is 10X higher, the employee count is 1/2, and the market cap per employee is over 100X higher today vs. 50 years ago.

That’s not because Apple, Microsoft, Alphabet, and Meta are wildly overvalued…it’s because what drives business value has changed.

In the Old Economy - book value was relevant because that’s what generated returns. Today, growth and correlated returns come from human capital.

The Flywheel For Leading Enterprises

In the Knowledge Economy, it is intangible assets – human capital & data – that drive returns. Talent is usually measured as an expense on the income statement, but it should really be an asset on the balance sheet.

Investors often use LinkedIn to track hiring events at companies to understand when something is “going on” at a business. However, this is a lot like tracking the number of new recruits a football team has signed without knowing how skilled the players are.

Moreover, services such as Glassdoor show important metrics such as employee satisfaction and CEO approval rates, but that data is not incorporated anywhere in the financial statements.

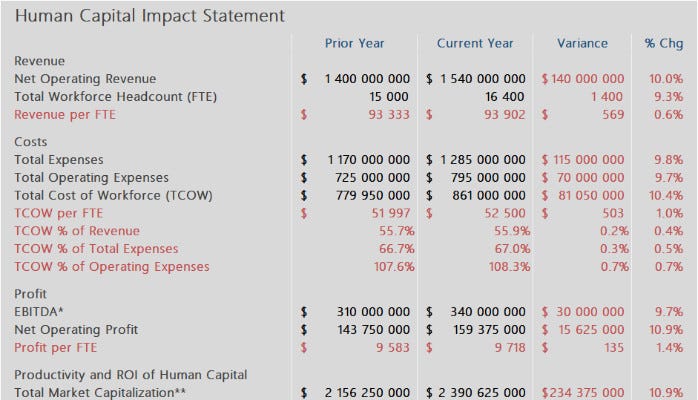

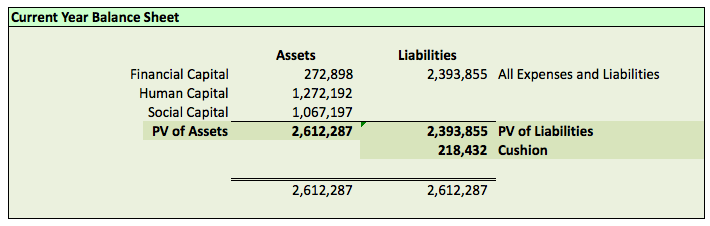

We think in addition to the Income Statement, Balance Sheet, and Cash Flows, a fourth component needs to be incorporated for the Modern Financial Statement…and that’s around enterprises’ Human Capital and Data.

As a leading indicator of future revenues and enterprise value, certain employee metrics deserve integration. These include revenue per employee versus cost, investment in training and development, turnover, and internal advancement versus external hiring, to name a few. We measure R&D spending as an indicator of future growth and sustainability and argue that measuring investment and “return on people” is logical too.

Indian IT giant Infosys has been successful in valuing its own human capital on the balance sheet for over a decade. Infosys values each of its employees based on their earnings potential until retirement, assuming they will stay until they’re 60 years old.

Since adding human capital to their balance sheet, Infosys’ stock has been up 345%, hitting a market cap of $74B as of December 2023.

Ultimately, all companies are valued the same way, with future cash flows discounted back to the present.

Whatever the industry, the most valuable companies will be the ones that are the best at obtaining, training, and retaining people.

P.S. There’s no better resource for this than the leadership playbook of the Trillion Dollar Coach, Bill Campbell.

Bonus: Putting The Human Capital Balance Sheet Into Action With Live Data

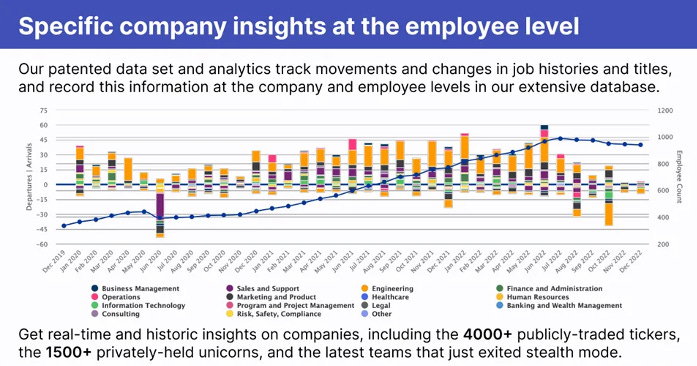

One tool we use at GSV for tracking these indicators is Live Data Technologies. Live Data tracks job change data for over 100M+ US and EU professionals across 4M+ companies.

Live Data is differentiated by the recency or “freshness” of its data, at scale. Live Data quantifies human capital by identifying “all stars” based on tenure, past jobs, promotions, and education.

Two examples of Live Data in action are OpenAI Alumni and Alumni Founders, which track the movement of OpenAI and SpaceX alums in their next acts. Given that these employees have raised over $7B and recruited 5,000+ employees at their next startups, it’s invaluable to know their next move…whether you’re an investor or a competitor.

Below are a few other use cases of the Live Data platform.

Investment Decisions

Deal Sourcing: Find investment opportunities early. Follow key employees and founders to establish relationships for private equity, venture capital, and investment banking deals.

Secondary Markets: Identify the supply side for private company shares. Make the most of the 90-day PTE window, helping both those looking for liquidity and those looking to invest.

Quantitative Trading: Employee movement is a leading indicator of company health and trajectory. Generate alpha by including real-time employee flow in your models.

Fundamental Analysis: Get insights into employee quality, workforce trends, and comparisons among competitors. Human capital is the foundation for long-term company success.

Private Banking: Prospect clients for private banking and investment management. Track job changes and promotions for high net-worth individuals and be the first to congratulate them.

GTM / Enterprise: Job changes are key sales and retention triggers. Follow the people moving in and out of key accounts to understand the best opportunities and the top risks to your GTM efforts.

OEM / Developer: Modern services, products, and applications run on data. Live Data powers leading GTM and recruiting platforms to build with the most up-to-date employment data and job change events.

Data Vendors: The world runs on data. Data is only valuable if it is accurate. Live Data ensures that top people data providers are providing their customers with the freshest and most accurate data across their core offerings.

Higher Education: Where do people go after graduation? From career services to student outcome tracking to alumni relations, Live Data enables leading educational institutions to build strong networks and highlight key outcomes.

Market Performance

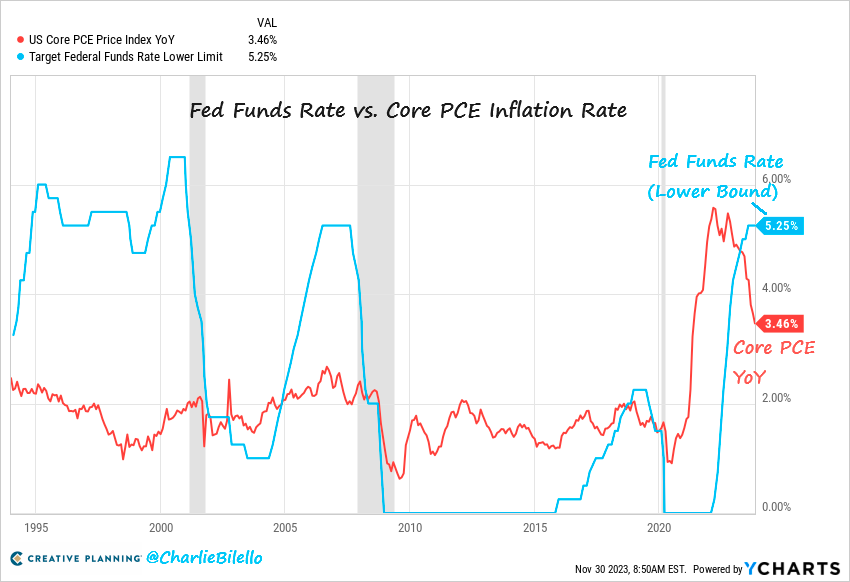

And the beat goes on….for the sixth week in a row, stocks gained catalyzed by a strong jobs report and belief inflation is finally in check. New jobs came in at 199K for November and economists now believe the Fed is done raising rates.

Also encouraging, the University of Michigan Consumer Sentiment Index surged to 69.4 in December up from 61.3 in November and significantly up from expectations of 62.

NASDAQ led the Market charge advancing .7% for the week and is now up 38% for the year. The S&P 500 inched forward, advancing .2% while the Dow was up 0.1%.

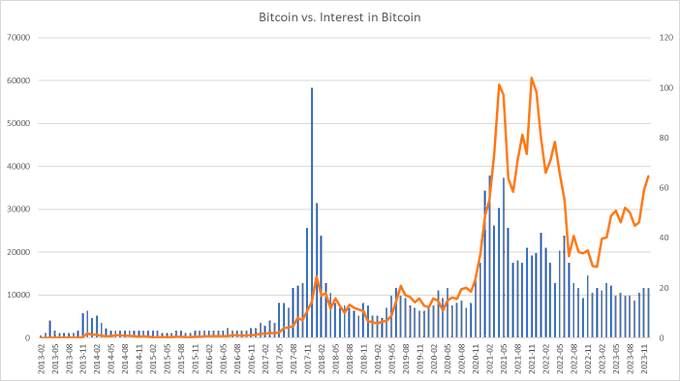

It’s interesting to us that Bitcoin and Gold continued to move higher. Conventional wisdom says Bitcoin is surging because people forgot what happened last year and didn’t listen to Jamie Dimon. Gold is a hedge against all the uncertainties.

My view is that Bitcoin has rocketed because it’s: 1) an alternative of exchange versus fiat currency such as the U.S. Dollar, which has a guarantor with over $33 trillion in debt and can’t seem to get its act together 2) a compliment to the global, ever-growing digital marketplace.

Despite shortages of air traffic controllers and flight attendants, airline traffic is soaring with an expectation of reaching an all-time high of 4.7 billion passengers in 2024. In the meantime, global carriers are expected to make over $23 billion in profit this year.

Some may take the NASDAQ up nearly 40% YTD as a signal that the World has once again gone mad. However, I believe it is more a reflection of the market’s natural instinct to climb the “Wall of Worry”. While growth always trumps non-growth, the delicate dance continues to be between growth and profitability. We expect to continue to be in a great environment for stock pickers and remain cautiously optimistic.

Maggie Moe’s GSV Weekly Rap

Need to Know

READ: Capital Efficient Businesses - by Elad Gil

WATCH: OWN IT! Ron Baron's Keynote Speech at the 30th Annual Baron Investment Conference

LISTEN: A Conversation with Charlie Munger & John Collison

READ: Lux LP Letter - Q3 2023.pdf

WATCH: Charlie Munger's Final Interview With CNBC

LISTEN: Overseeing the Largest Sovereign Wealth Fund - Capital Allocators with Ted Seides

READ: Big Ideas in Tech for 2024 | Andreessen Horowitz

WATCH: Brad Gerstner (Founder of Altimeter) Interview w/ Elad Gil

LISTEN: The All-In Podcast Episode 156

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Investor flows into equities continue to rally since the “October Slump.”

Source: @ volmancapital

#2: IPO Market

The Information published a piece highlighting prospective IPO candidates for the 2024 cycle. The common theme? These startups are significantly older than the average IPO candidate, a “flight to quality” following the high-flying cycle of 2020–2021.

Source: The Information

#3: Interest Rates

Interest rate futures shifted from showing rate cuts beginning in March 2024 to May 2024 after this week’s jobs report. Odds of rate cuts beginning in January 2024 fell from 16% to 6%.

Source: The Kobeissi Letter

#4: Inflation

The Fed's preferred measure of inflation (Core PCE) moved down to 3.5% in October, the lowest since April 2021.

Source: Charlie Bilello

Charts of the Week

Bitcoin hit $44,000 this week, up 166% YTD (which we predicted in EIEIO… 2023 Year In Review). Unlike past bull runs, there has been less major public FOMO so far.

Chuckles of the Week

EIEIO…Fast Facts

Entrepreneurship: 44% – percent of US economic activity that comes from small businesses (SBA)

Innovation: 68% – percent of drivers who are afraid of fully autonomous vehicles (AAA)

Education: 40% – percent of students who are distracted due to their own or someone else’s digital device during class (AFR)

Impact: 40% – increase in workforce retention from purpose-driven companies (Cigna)

Opportunity: 94% – percent of new jobs added in 2021 by members of the S&P Index that went to people of color (WaPo)

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup….EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM