GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: 71% – the percentage of Gen Zers who say they have taken on a side hustle in the past 12 months, along with 68% of millennials (Marketwatch)

Innovation: 80% – The percentage of all private R&D that is conducted by U.S. venture-backed companies (NVCA)

Education: 97% – The percentage of kindergarten and pre-school teachers who are female (Forbes)

Impact: 40% – the percentage of major infrastructure projects in the Inflation Reduction Act that have been delayed or paused indefinitely (Financial Times)

Opportunity: 195% – the percentage increase in the supply of rental housing in Buenos Aires since President Javier Millei's repeal of rent control laws took effect on December 29 (Newsweek) h/t Packy McCormick

“Formula for success: rise early, work hard, strike oil.” – J. Paul Getty

“Boy, that is black gold. Texas Tea.” – Jed Clampett (Beverly Hillbillies)

“Data is the new oil.” – Clive Humby

In 1901, a towering 100-foot drilling structure known as Spindletop unleashed a powerful surge of black crude oil, drenching the surrounding terrain of Beaumont, Texas in a dark, viscous substance. This event represented the first significant oil find in the United States and heralded the onset of the American oil industry.

Today, the world consumes over 100 million barrels of oil per day.

Texas Tea Tycoons

The oil and gas industry employs nearly 10 million people in the United States. These jobs exist across exploration & production (upstream), storage and transport (midstream), and refining and commercialization (downstream).

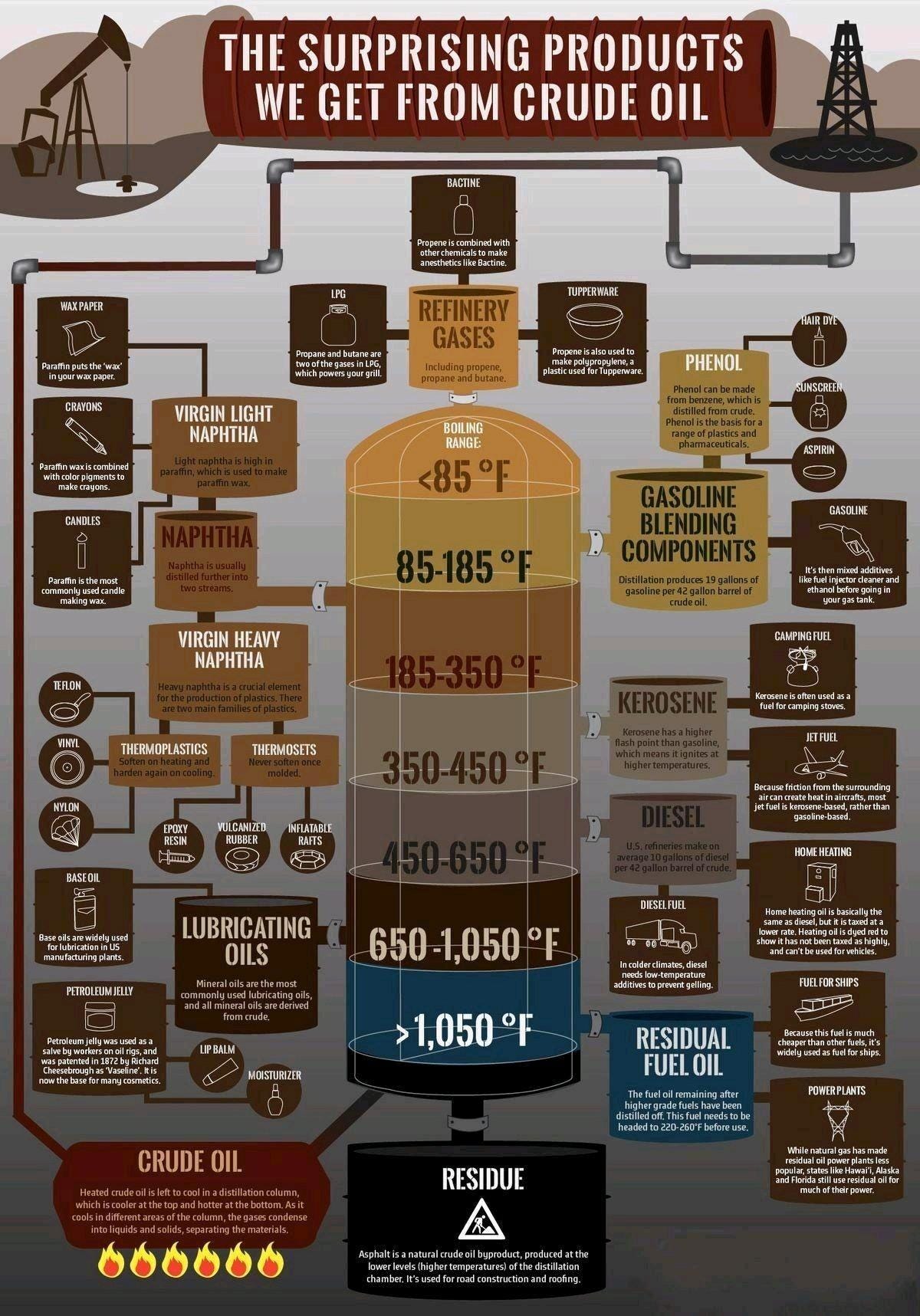

We’re all aware that the gasoline in our cars comes from oil, but it's easy to overlook the myriad other products that also depend on this crucial resource. What about the sunscreen you used at the beach last weekend? The Crayons on your child’s desk? The Tupperware storing what’s left of last night’s dinner? The Patagonia jacket in your closet? The wind turbines on the outskirts of your town? The glasses sitting on your face as you read this?

While the Industrial Revolution of the 18th and 19th centuries relied on coal and wood power for its newfound innovations, oil was the cornerstone that supercharged the continued industrialization in the 20th century.

For anyone who has yet to fully grasp oil’s incredible impact, perhaps this illustration will help.

This is Saudi Arabia in 1937, one year before oil was discovered in the country.

This is Saudi Arabia today.

While Riyadh historically was on few peoples’ bucket lists, go there today and it feels like Manhattan.

1938 began the transformational period in Saudi Arabia that shifted its economy from farming and agriculture to oil and gas production and export. Saudi Aramco (the largest oil company in the world) and its profits have 1) made the Saud family the world’s richest and 2) funded the nation’s more recent investments in the Knowledge Economy, positioning it to be a global leader in the space. The Saudi Public Investment Fund (PIF) backed Masa Son’s Vision Fund to the tune of $45 billion and has plans to create a $40 billion AI-focused fund. These investments are made possible due in large part to the $700+ million in petroleum exports the country does on a daily basis.

Data is the New Oil

In a Knowledge Economy, it’s data, not oil, that fuels the engine of advancement. Companies that possess and continually generate vast, quality quantities find themselves extremely well-positioned to compete in the AI Revolution. There are many structural parallels to be drawn from the oil world to the data & technology world, and a straightforward framework is to think in terms of upstream, midstream, and downstream.

Upstream

In the oil industry, everything starts with the exploration and extraction of oil—finding and tapping what’s hidden beneath the earth's surface. Energy companies involved in upstream include Continental Resources, Chesapeake Energy, and Occidental Petroleum.

Drilling for Data

AI is no good without data.

LLMs like ChatGPT provide answers and insights based on the massive volumes of indexable text and language-based data it has at its disposal. Businesses like Palantir and C3.ai are enterprise AI businesses that sell to Fortune 500 companies and governments, but they are only as effective as the client data they are provided.

This data is collected in a variety of ways. Want to monitor a $25 million drilling rig remotely? Smart IoT (Internet of Things) sensors can be placed on the physical asset to monitor performance and provide alerts when a machine experiences signs of a slowdown. Minimizing asset downtime at scale is serious business.

Companies that collect, maintain, and grow proprietary datasets are paramount in the AI economy. Examples of “upstream” data companies include Flock Safety (law enforcement), Verkada (facility security & management), and Metropolis (parking).

Midstream

The midstream sector of oil & gas involves the transportation, storage, and initial processing of crude oil. This stage serves as a critical link between the upstream production sites and the downstream processing facilities. Midstream operations include the use of pipelines, tanker ships, and rail systems that ensure the efficient and safe delivery of crude oil to refineries. Key players in this sector include companies like Kinder Morgan, Williams, and Enbridge. These firms manage extensive pipeline networks and storage facilities that are essential for handling the large volumes of oil transported daily across vast distances.

Data Transport & Storage

In the realm of data management, companies like Databricks, Confluent, Talend, Snowflake, and Informatica serve functions analogous to the midstream sector in the oil industry. Just as midstream operations are crucial for the transportation, storage, and preliminary processing of crude oil, these tech firms specialize in similar processes for data.

Databricks provides a unified platform for data engineering, collaborative data science, and business analytics, much like a complex network of pipelines facilitating the flow of crude.

Confluent manages real-time data streaming, akin to pipelines delivering oil continuously across vast distances.

Talend focuses on data integration and quality, ensuring that data, like oil, is in a proper state for downstream processing.

Snowflake offers cloud-based data warehousing, similar to storage facilities that hold crude before it’s refined.

Lastly, Informatica enhances data quality and governance, paralleling the initial processing that oil undergoes to ensure its suitability for further refinement.

These companies are essential in ensuring that data is efficiently managed, processed, and prepared, linking the collection of raw data to its ultimate analytical and operational uses.

Downstream

The downstream sector is where crude oil is transformed into usable products such as gasoline, diesel, and various chemical products. This phase encompasses refining, marketing, and distribution. Refineries are where crude oil undergoes complex processes to be broken down and reconstituted into different fuels and lubricants. Think Valero and Phillips 66 (also gas stations, these companies are in the refinery business). Post-refining, the products are distributed via networks of gas stations (i.e., Sunoco) and other retail outlets, making them accessible to consumers and industries. This sector is crucial for creating the direct consumer and industrial products that drive everyday life.

Data-Driven, Dynamic Offerings

The downstream sector is mirrored by the application layer of software. These technologies are designed to transform raw data into actionable insights and tools, similar to how crude oil is refined into various products for everyday use. Just as downstream companies refine oil into gasoline, diesel, plastics, fertilizers, antifreeze, propane, pesticides, pharmaceuticals, asphalt (etc. etc. etc.), tech companies find ways to apply relevant data to industry-specific use cases. Examples of AI companies doing this include Harvey AI in law, Hebbia in financial services, and Truewind in accounting. These businesses leverage and refine vast amounts of raw data to directly support business operations and decision-making.

In sectors ranging from law to finance to healthcare to education, these applications drive innovation and competitiveness.

Fullstream

There are even energy firms that operate across all three phases - (upstream, midstream, and downstream), including Chevron, ExxonMobil, Saudi Aramco, and Royal Dutch Shell. Baker Hughes was the first company to brand itself as a “full-stream” business in the oil and gas industry.

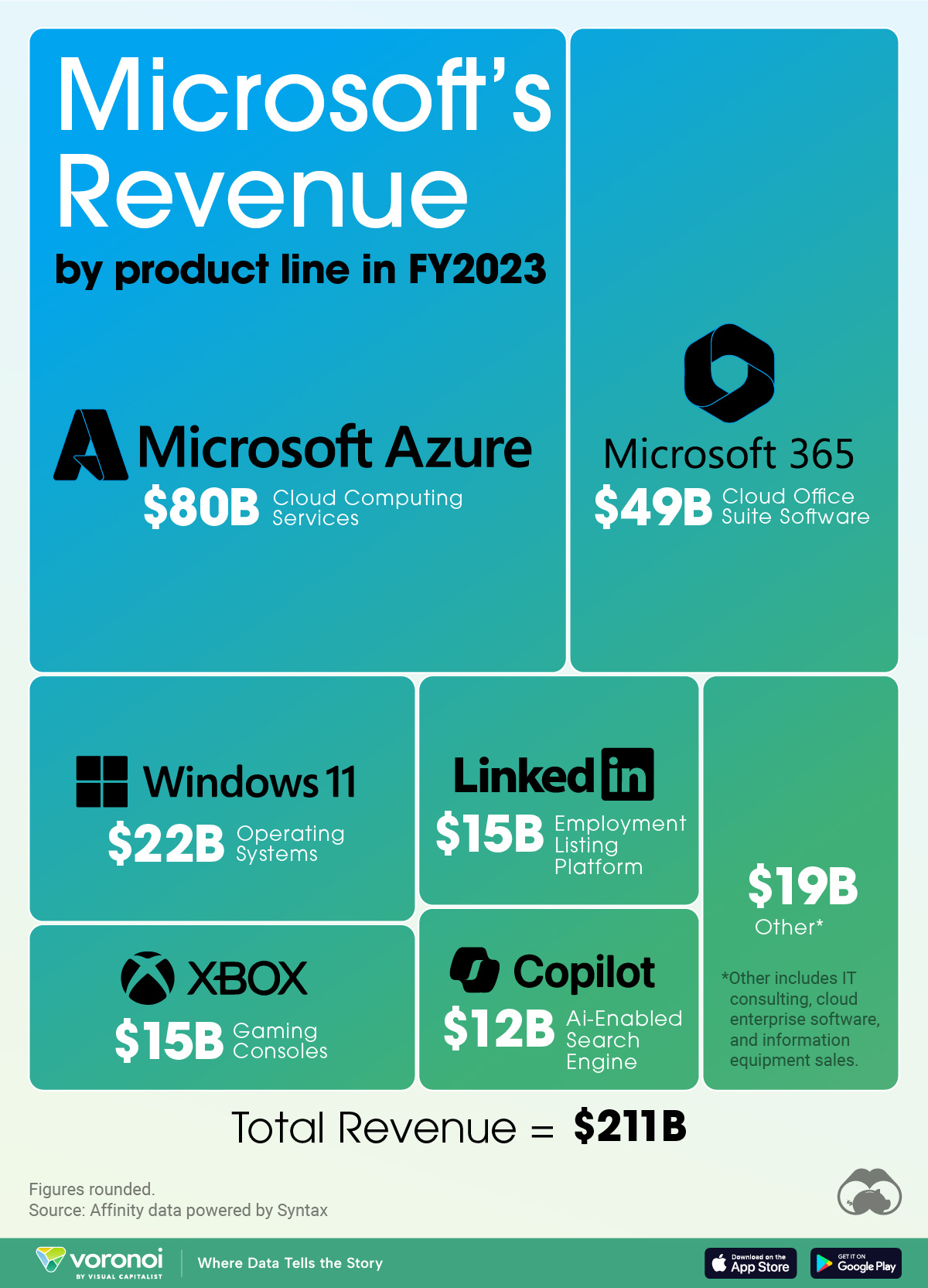

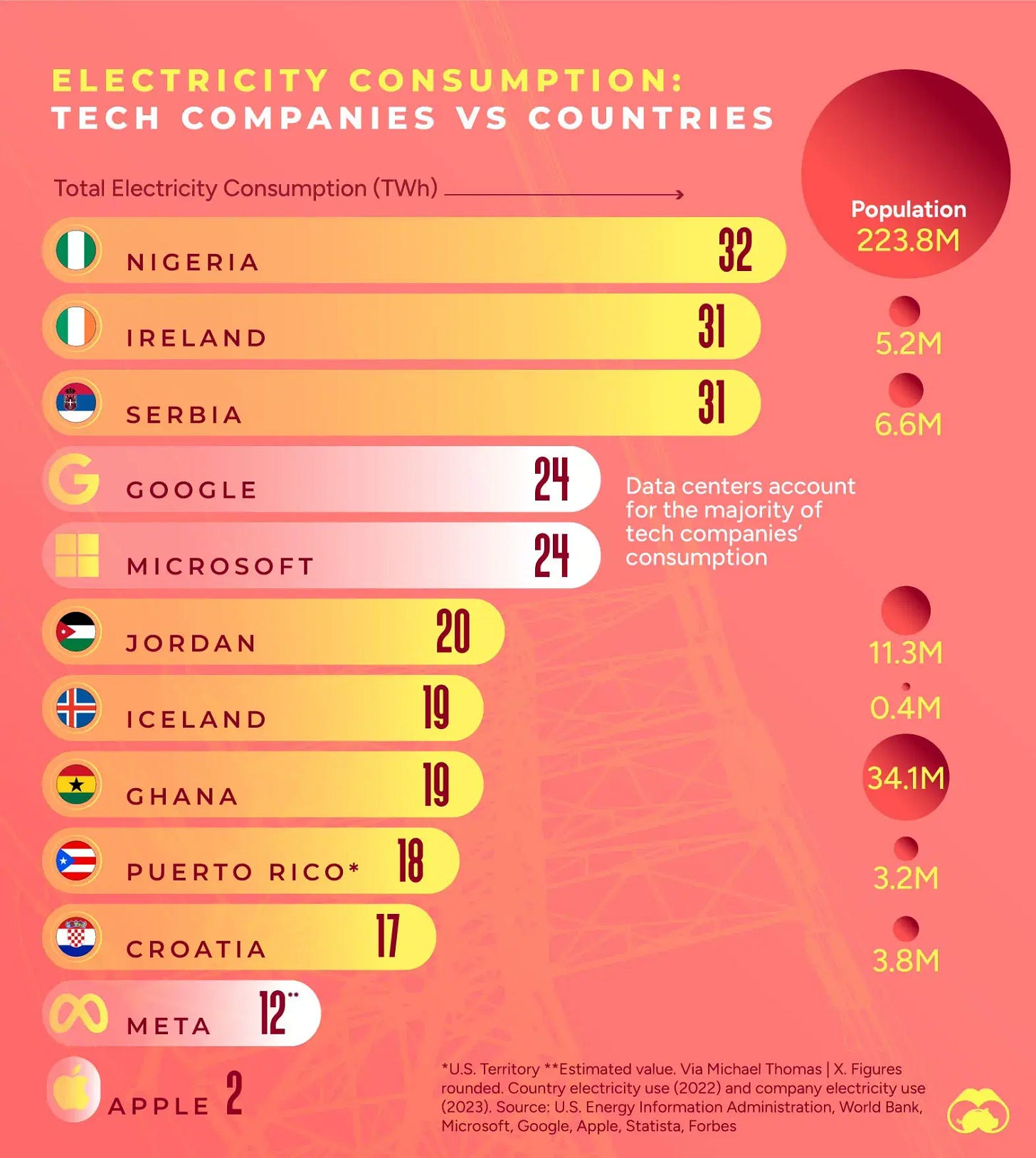

A few tech equivalents of these companies include Google, Microsoft, and Amazon.

They gather incremental user data with each search, click, or purchase. They store data with Google Cloud, Azure, and AWS. Data constantly improves their application layer offerings like Gmail, Teams, and Prime Video.

The old Golden Rule is “He who has the gold makes the rules.” The new Golden Rule is “He (or she) who has the data rules the world.”

Market Performance

Market Commentary

Stocks are like water, they seem to only boil when no one is watching them.

As many investors were relaxing at the beach, stocks decided to go on a tear enjoying the best week of the year.

NASDAQ moved up 5.3%, the S&P 500 advanced 3.9% and the Dow increased 2.9%. Since the August stock market kamikaze attack, NASDAQ has advanced 8% and the S&P 500 is up 6.5%.

Catalyst for the positive stock action included slighter softer inflation numbers than had been expected and economic data was slightly better than forecast. To wit, CPI came in at 2.2% annualized vs. the expected 2.3% and unemployment was 227K down from the 250K reported the previous month. Additionally, consumer sentiment was higher at 72.1% gauged by the University of Michigan Consumer Sentiment Index and retail sales were up 1%.

All this to say the conventional wisdom now is that the Fed will start lowering the discount rate when it gets together for its September 18th FOMC meeting. Fed trackers will be looking for clues coming out of the annual meeting of Fed officials in Jackson Hole this week.

Second Quarter Earnings Season is almost over with 93% of the S&P 500 having reported results. Currently, EPS has increased 10.9% which is the strongest growth since the Fourth Quarter of 2021. While 79% of companies “beat” EPS estimates (that’s normal and what you are supposed to do as a public company), just 60% beat revenue forecasts.

We remain BULLISH with our Market thesis playing out pretty much as we articulated in January. Look for an IPO Market to continue to perk up and a broadening of companies participating in the upside.

Need to Know

READ: Merit and Accountability Make Bureaucracy Less Dumb. | Joe Lonsdale

READ: The Great Services-To-Software Rotation | Clouded Judgement

READ: Palantir’s Alex Karp Talks About War, AI and America’s Future | The New York Times

WATCH: Peter Thiel \ Joe Rogan Experience #2190

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

#3: Interest Rates

#4: Inflation

Chart of the Week

Maggie Moe’s GSV Weekly Rap

Chuckle of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup….EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM