GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: 12 months – The period of time it took for Cursor to reach $100 million in annual recurring revenue. (AIM Research)

Innovation: >2x – The factor by which Amazon outsold every other retailer in apparel in 2023. (Wells Fargo)

Education: 26% – The percentage of U.S. tenth graders who say they love school. 65% of parents of U.S. tenth graders say their child loves school. (Harper’s)

Impact: 6,765 – The number of commercial ships delivered to China in the last 10 years, compared to 37 to the United States. (Bruce Mehlman)

Opportunity: 40% – The percentage of Saudi Arabia’s GDP made up by a single company, Saudi Aramco. (Sherwood)

“I promise you, in 10 years' time, you will look back and you will realize how AI has now integrated into everything. And in fact, we need AI everywhere… and in every region, every industry, every country, every company needs AI. And this infrastructure, just like the Internet, just like electricity, needs factories… and these data centers, if you will, are improperly described. They are, in fact, AI factories. You apply energy to it, and it provides something incredible.”

— Jensen Huang, CEO, NVIDIA“I should mention something amazing about (the new Duolingo curriculum in) chess that it really started with a team of two people, neither of whom knew how to program… and they basically made prototypes and did the whole curriculum of chess by using AI. Also, neither of them knew how to play chess.”

— Luis von Ahn, CEO, Duolingo“Success in creating AI could be the biggest event in the history of civilization. But it could also be the last… unless we learn to avoid the risk.”

— Stephen Hawking“Statistically speaking, the world doesn’t end that often.”

— Brian Rogers, CEO, T. Rowe Price

The AI Revolution is like a war we’ve never seen before.

Like past wars… it’s geographic. It’s technological. It’s philosophical. BUT, it’s also distributed. It’s changing at lightning speed. And friends and enemies are tough to distinguish—and often one and the same.

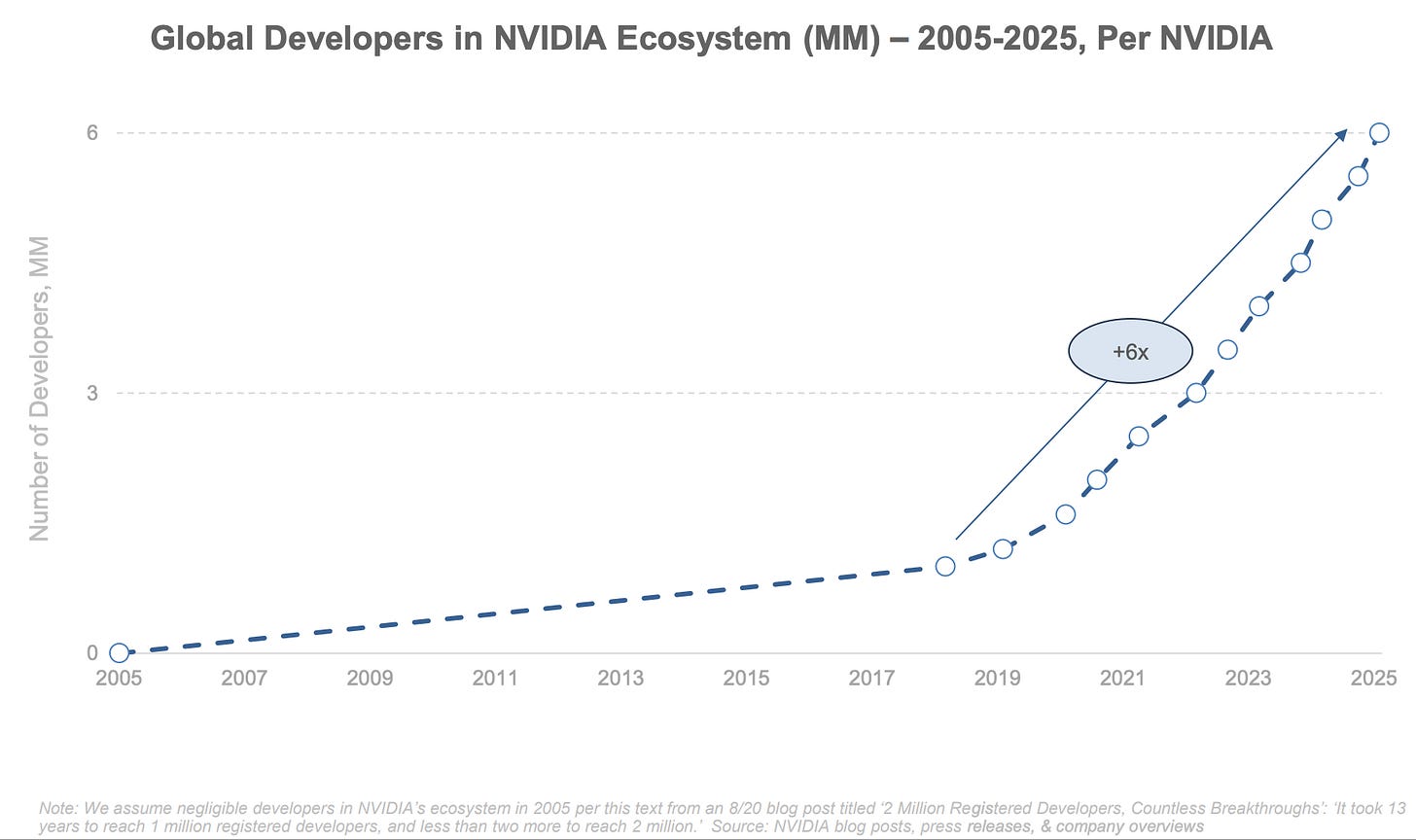

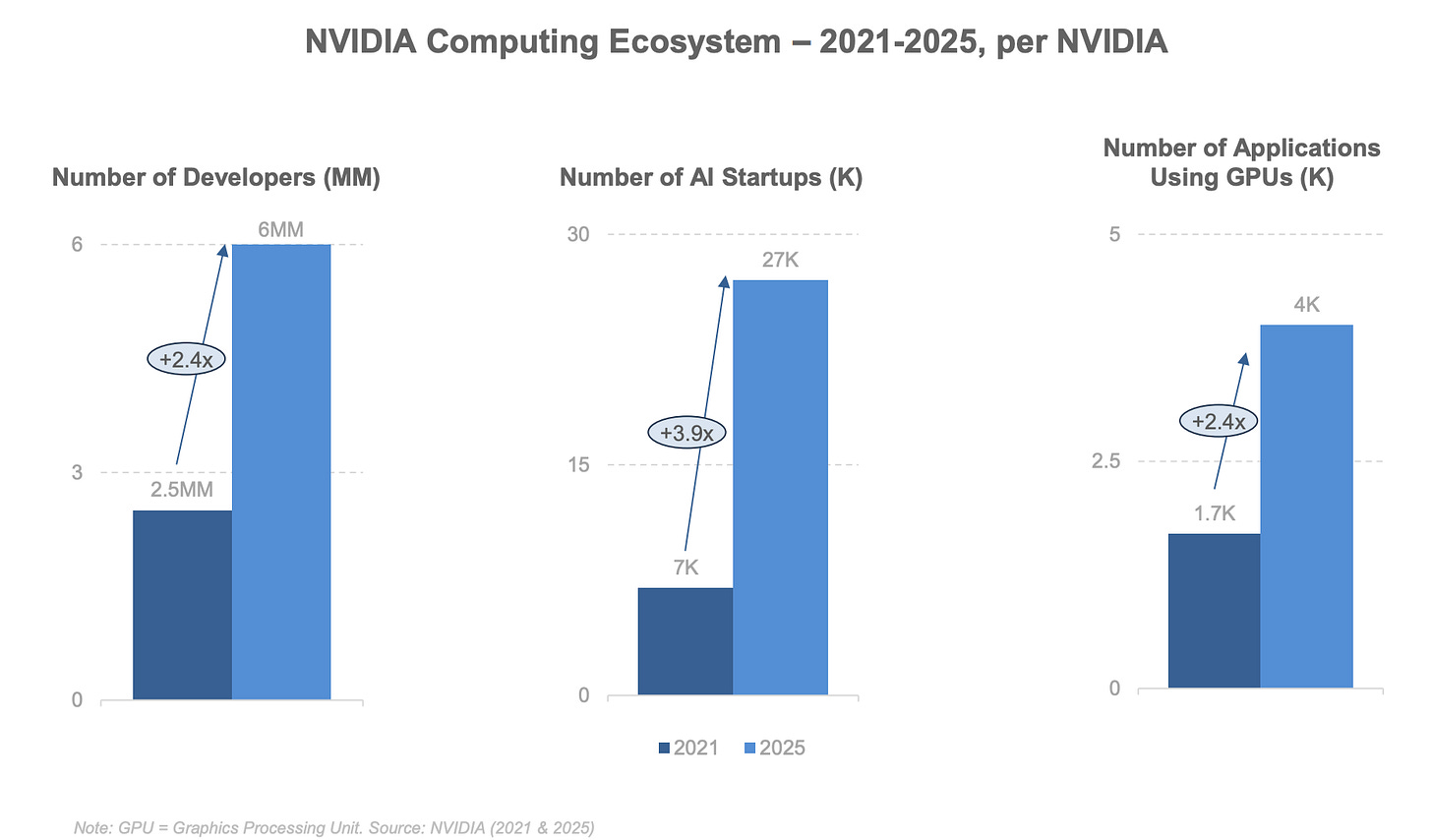

The undisputed superpower in the AI Revolution is NVIDIA, and it’s had its hands full in 2025. Trade wars. Intense competition. Deep Seek’s powerful LLM operating on a less advanced processor. “Liberation Day.” The banning of its H20 chip sales to China. Locusts, frogs, water turned to blood—the plagues have just kept coming.

Despite all of this, NVIDIA last week delivered some of the most remarkable financial results in the history of business.

For the quarter, overall revenues were up 69% to $44 billion. Data center revenues surged 73% to $39 billion. In kind, NVIDIA’s stock touched a $3.4 trillion market cap, briefly making it the most valuable company in the world.

More tailwinds: the so-called “hyperscalers”—Microsoft, Amazon, Alphabet, and Meta—are all upping the ante in their data center spending, now expected to reach $368 billion in 2025 and another $400 billion in 2026.

The compute needed for magical reasoning/inference AI is massive, and Agentic AI is starting to hit its stride. Hence, the demand for powerful chips will remain a megatrend, making NVIDIA shares, selling at 29x earnings, seem like a relative steal (compared to great companies we love but with huge valuations, such as Duolingo selling at 30x sales and Palantir at 100x sales).

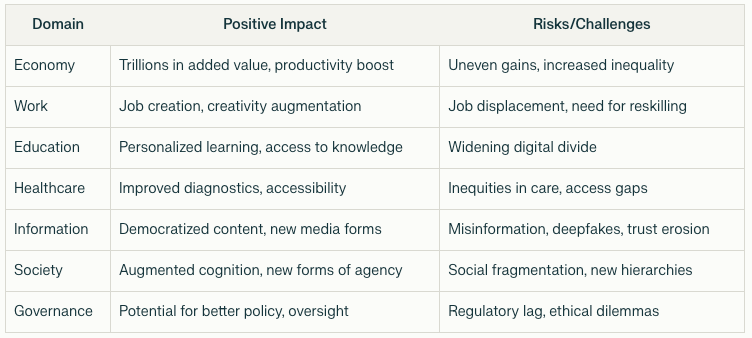

Last week, before his stop at the Bitcoin Conference, J.D. Vance said we are in an “arms race” with China in AI. While I agree that AI is of major strategic importance to both China and the USA, I think our strategies differ.

In the United States, it’s all about large language models (LLMs) and compute. In China, as articulated by its Politburo in April, the focus is on applications of AI for business and everyday life. The analogy used by President Xi was that AI is more like electricity than a nuclear weapon.

The history of electricity goes back to the Greeks in 600 B.C., who observed static electricity when rubbing amber against fur. Benjamin Franklin’s famous kite experiment in 1752 demonstrated that lightning was a form of electricity and laid the foundation for understanding electrical discharge.

The applications of electricity technology have obviously changed the world over the past two centuries—from electromagnets to the telegraph, electric lighting, home appliances like refrigeration, the telephone, radio, TV, and beyond. Coca-Cola, with its $300 billion market cap, was enabled by electricity and the application of refrigeration.

As the Internet made it possible for Amazon, Facebook, and Google to exist, we are now looking for how innovative entrepreneurs will piggyback on the disruptive technology of AI and transform industries like education, healthcare, real estate, transportation, and defense.

AI is like air. It’s invisible. It’s ubiquitous. And you’re going to need it to live.

Market Performance

Market Commentary

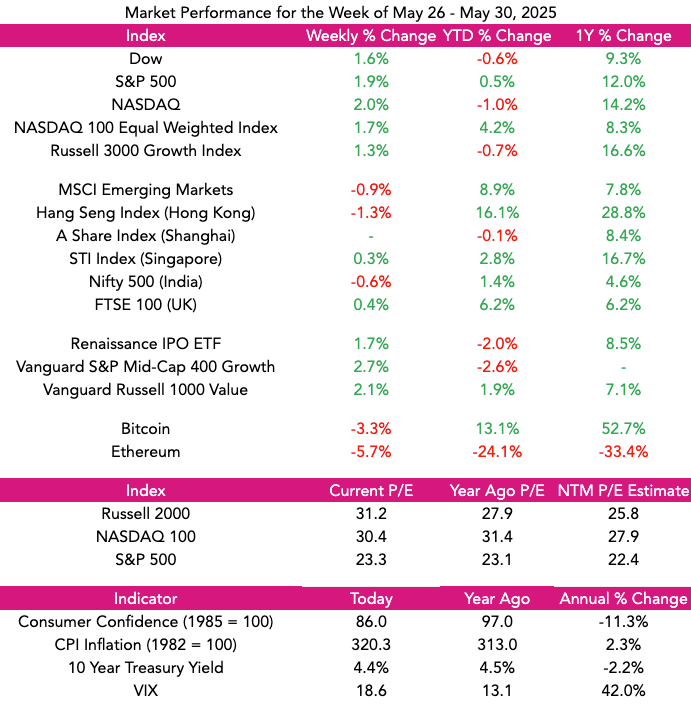

May was the best month for the stock market since 2023 and the best May in 35 years. To wit, the S&P was up 6%, and NASDAQ increased nearly 10%.

For the week, the NASDAQ advanced 2%, the S&P 500 was up 1.9%, and the Dow increased 1.6%.

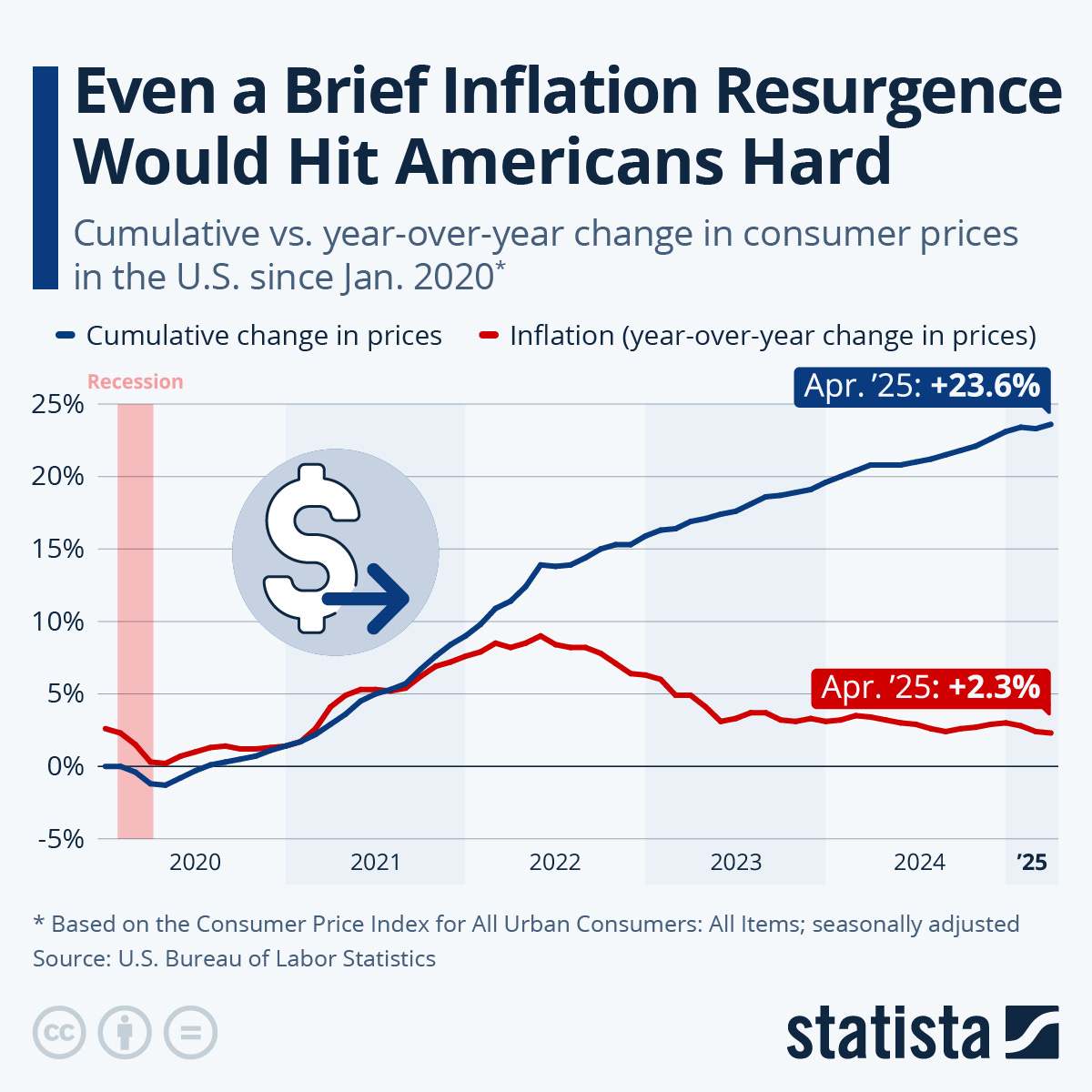

Obviously, the main catalyst behind the upward movement in the market was the tariff relief obsession. But contributing to the increased optimism was earnings that have come in strong—up 13% year-over-year—with 78% of companies beating analyst estimates. Moreover, the feared inflation that tariffs were supposed to materialize hasn’t, and in fact, the CPI was the lowest in four years.

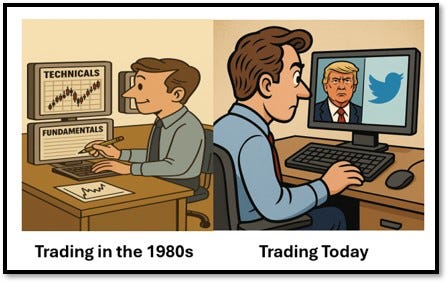

One of the clichés that have influenced traders for years is that you “sell in May and go away” for the summer. My sense is that we’ve entered a time where growth stock outperformance is likely. Hence, while I continue to expect high volatility, that’s actually the friend of the long-term investor.

Accordingly, I’d be looking at creating a list of the highest-quality and fastest-growing companies and look for any meaningful dips to increase the position in the leaders.

Need to Know

WATCH: OpenAI’s $6BN Jony Ive Deal & YC Is Both Chanel and Walmart, and Has Officially Won! | 20VC

READ: Trends in Artificial Intelligence | Bond

READ: Conviction-Led Contrarianism | Kyle Harrison

LISTEN: Graham Weaver - Building Alpine | Invest Like The Best

GSV’s Four I’s of Investor Sentiment

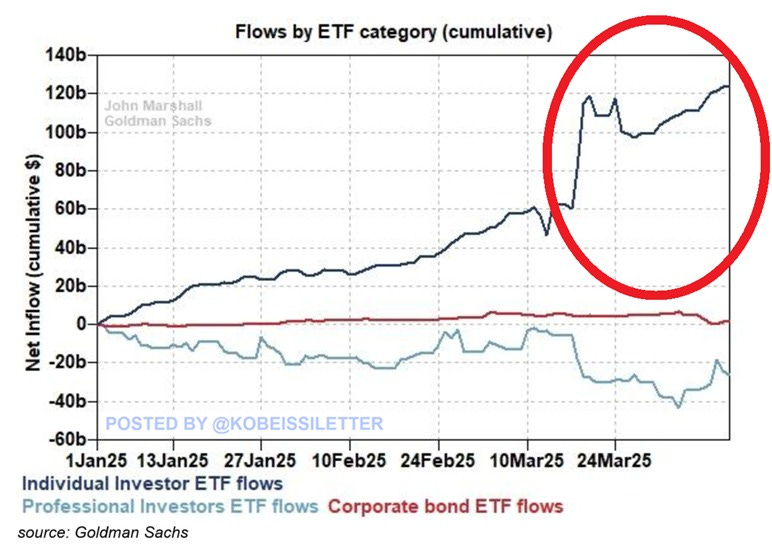

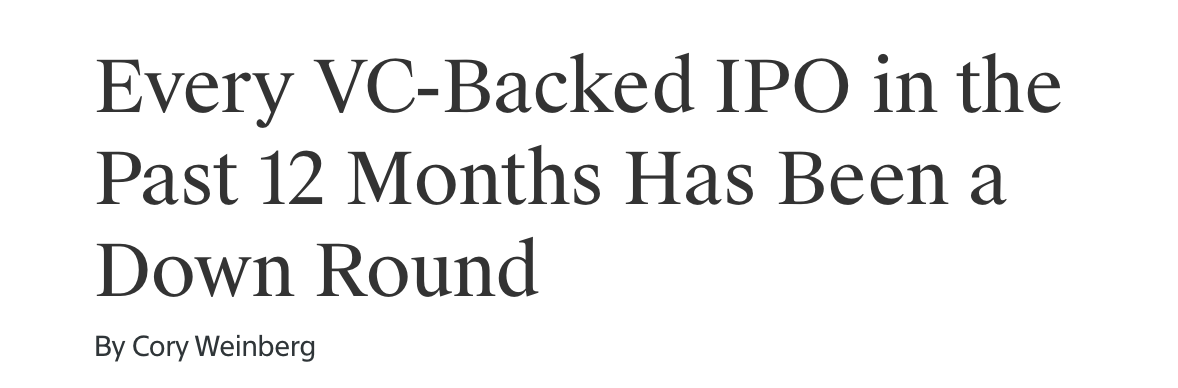

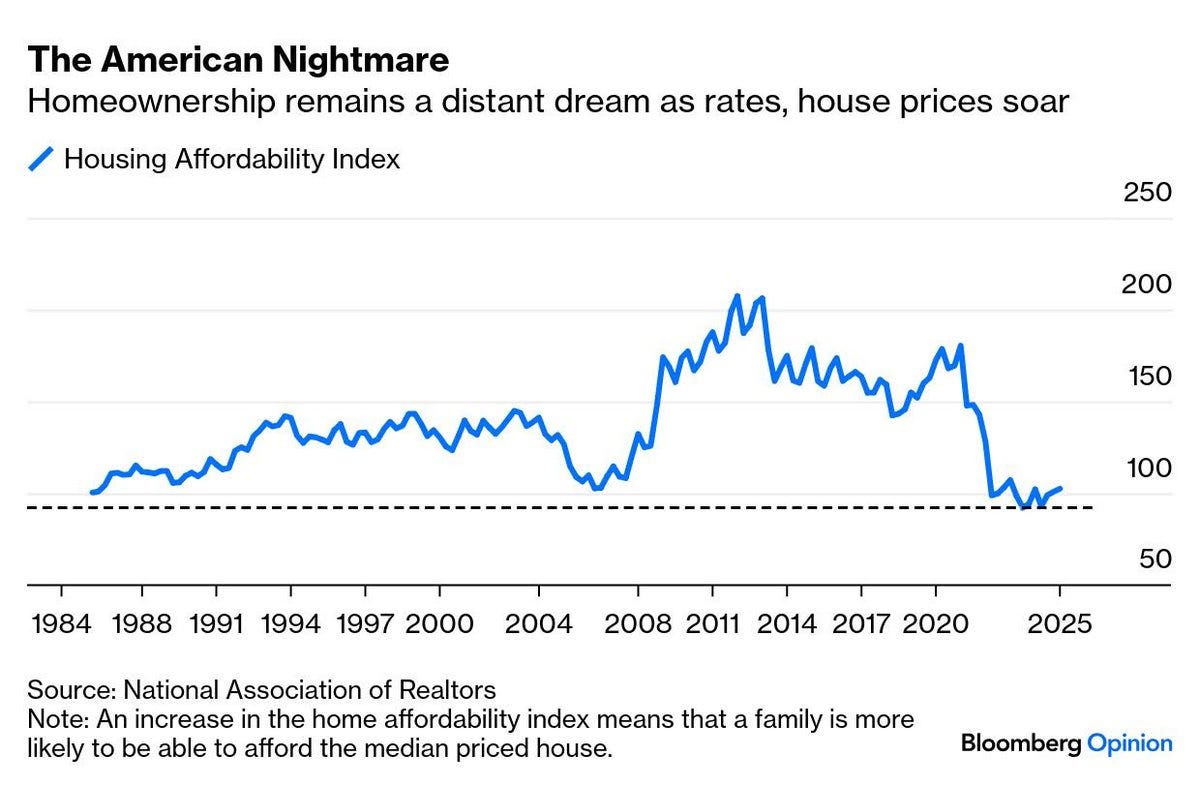

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

#3: Interest Rates

#4: Inflation

Charts of the Week

Maggie Moe’s GSV Weekly Rap

Chuckles of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM