GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

“There will be two kinds of companies by the end of this decade. Those fully utilizing AI…and those that are out of business.” – Peter Diamandis, X Prize Founder and Chairman of Singularity University

“AI will probably most likely lead to the end of the World but in the meantime, there’ll be great companies.” – Sam Altman, CEO of OpenAI

“AI is like AIR….It’s invisible. It’s ubiquitous. And you need it to live.” – Yours truly

It’s been a year since the first shot of the AI Revolution was fired with the launch of ChatGPT by OpenAI on November 30, 2022. Like many revolutions, the activity that led to that moment had been brewing, albeit on a simmer, for decades.

It has been breathtaking to see the changes in the techno-political landscape in the twelve months that have followed. AI funding is on pace to increase ~10X from 2022 to 2023, and OpenAI’s valuation skyrocketed from $14 billion in 2021 to $86 billion today. Adding drama to the hype, we saw the General of the OpenAI Army get fired, thwart a mutiny, and get reinstated…all in one long weekend.

The ChatGPT moment was similar to January 23, 1993, the day Mosaic came online and brought the Internet to peoples’ fingertips.

While only a few geeks in research labs knew much about the Internet before Mosiac’s launch, the notion of a “World Wireless System” had been conceptualized by Nikola Tesla in the early 1900’s.

By 1969, the Defense Advanced Research Projects Agency Network (DARPA), funded by the DoD, originated the first computer-to-computer message between the UCLA and Stanford campuses…which promptly crashed the entire network.

In 1989, Tim Berners Lee initiated the idea of the World Wide Web connecting hyperlink documents into an information system, accessible from any node on the network.

No one today would consider starting a business without at least some online presence. Leveraging the Internet is a given, and the same will be true with Artificial Intelligence. AI is like AIR….It’s invisible. It’s ubiquitous. And you need it to live.

Accordingly, calling yourself an “AI Company” is like calling yourself an “Internet Company”.

In the 1990s, Henry Blodget and Mary Meeker were the King and Queen of the Internet. By sprinkling their Dot-Com fairy dust on a company, the company was magically re-valued to stratospheric levels.

Sure, there were companies like Netscape and Cisco that literally made software and equipment that helped bring the Internet to business and consumers, but having a website doesn’t make you an “Internet Company.”

Over time, calling yourself an “Internet Company” became silly. It would be like calling yourself a “telecom company” because you sold products over the phone. Companies are defined by the products and services they provide, not the medium on which they conduct business.

Many people in the tech world try to make AI more mystical than it is.

AI is simply computers learning from data to complete tasks or make predictions, not magic. Generative AI (like ChatGPT) creates new content by training on vast datasets - whether writing stories, making art, or composing music.

What set the AI fire ablaze was ChatGPT. It allowed ordinary people to do the “magic trick” on their own in broad daylight…friction-free. Ask ChatGPT to write a speech, brainstorm a paper, or even have a therapeutic conversation, and it will come back with a lightning-fast response with confidence and vigor.

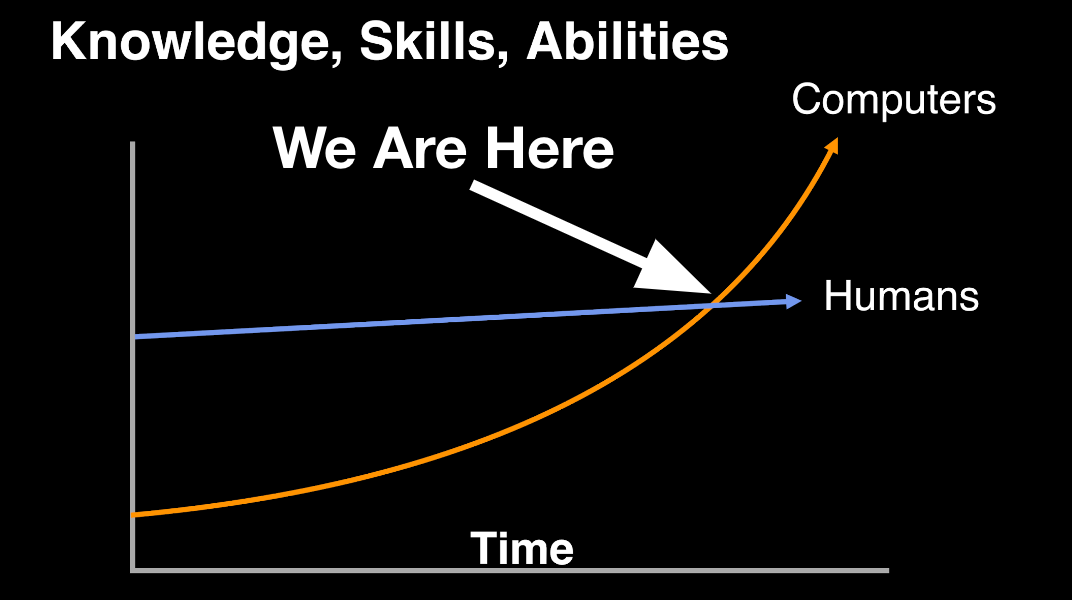

The humanness has both inspired people and wigged them out. We’ve been in a World where human capabilities are on a linear path and technological capabilities are growing exponentially.

What this means is pretty soon, technology will replace the technologist. It’s not just Blue Collar jobs that are at risk, or White Collar jobs….it’s also No Collar Jobs. Ironically, after years of being told to “learn to code”, many software programming jobs are getting the AI automation treatment.

While some feel defeated and view this as scary, we feel inspired. The AI Revolution has the opportunity to unleash human potential to a whole new level. Yes, many jobs that exist today will change or be eliminated, but humans always adapt and evolve. We wrote about the constant cycle of creative destruction in a March edition of the newsletter – EIEIO…The Circle of Life.

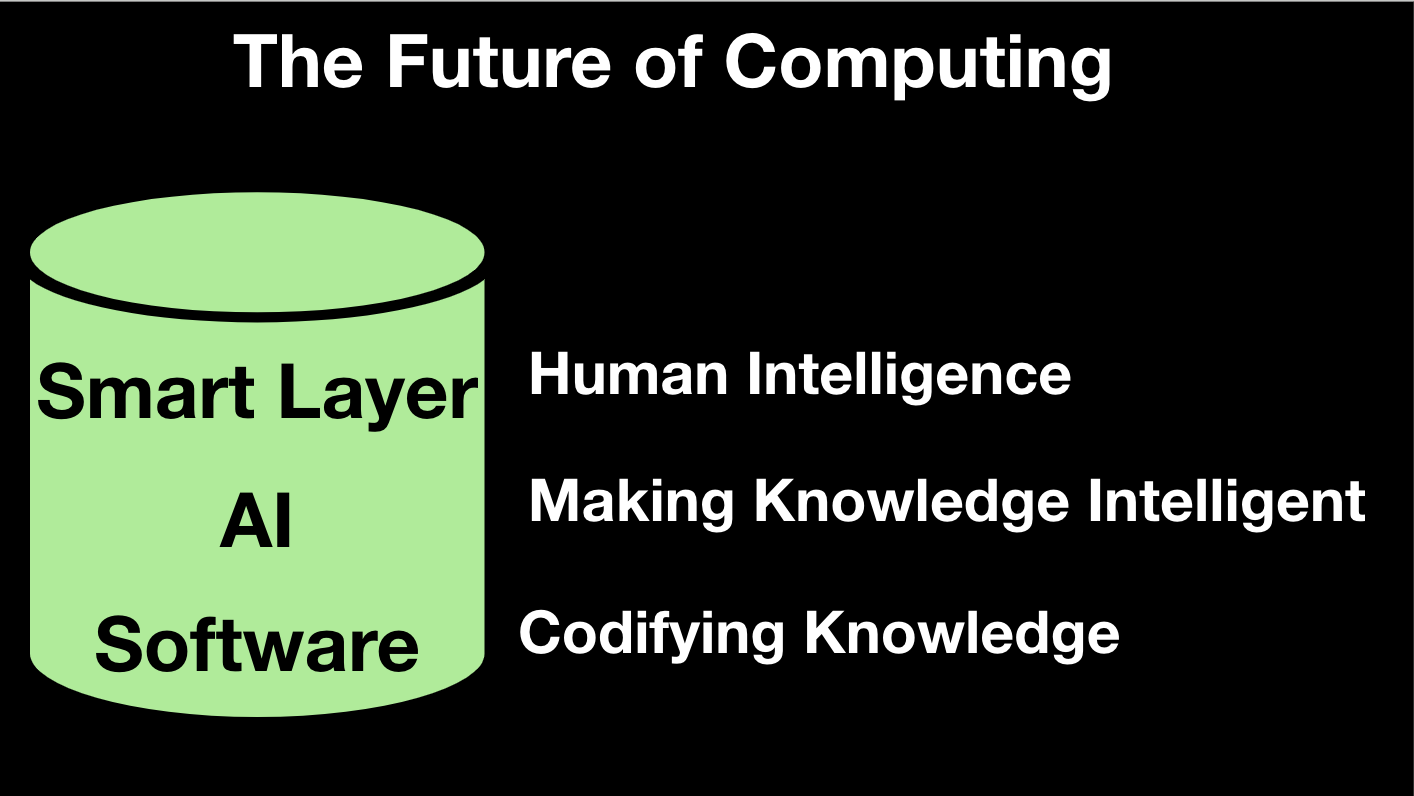

We see the future of computing being comprised of three layers. There is the Software Layer, which codifies knowledge. Then there is the AI Layer which makes that knowledge intelligent. On top of those is the Smart Layer where humans use reasoning and insights to make decisions.

As my friend Marc Andreessen famously said, “Software is Eating the World.” True, but AI is its teeth – and humans still decide what to eat!

Effectively, AI makes the World one gigantic Index fund. Which for many things is a faster, better, and cheaper way to do things. But the opportunity is always on the edge, which means there will be a super premium for real creators.

What’s clearly true is that it’s the end of average. Good is gone. Great isn’t enough. Excellence is the only option.

Read on for our Need to Know, AI Edition:

Public Companies To Know

AIR - Applications, Infrastructure, Resources

Private Companies To Know

10 Investment Firms To Know + Key Investments

Conviction | Seek, Harvey, Minion, Essential, Langchain, Mistral

a16z | Character.AI, OpenAI, Captions, Rewind, Descript, Mem, Equals, Pinecone, Replit

Khosla Ventures | OpenAI, ThoughtSpot, Moonhub, Arkifi, Limbic, Curai Health

Coatue |Tome, Weights & Biases, Jasper, Runway, AI21, Scale, Hugging Face, Canva, Databricks

Lux Capital | Hugging Face, Runway, MosaicML, TogetherAI

Lightspeed | Pika, Intenseye, Snorkel AI, Stability AI, Inworld AI, People.Ai

Greylock | Adept, Atomic AI, FERMÀT, Inflection, Neeva, Uplimit (formerly CoRise)

Benchmark | LangChain

Thrive | OpenAI, Adept

Sequoia | Hex, Harvey, Tavus, Dust, Replicate, Collaborative Robotics, Co:Helm

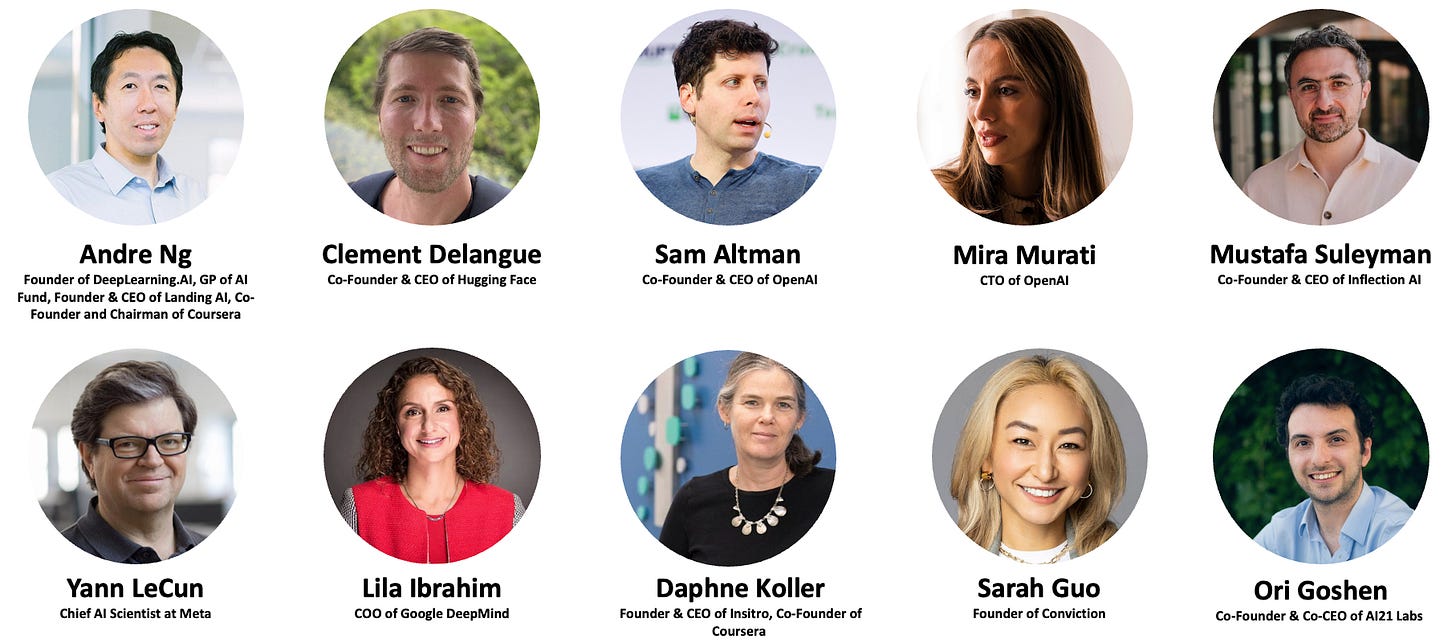

10 Thought Leaders To Follow

10 Reports To Read

State of AI Report 2023 | Air Street Capital

Generative AI Bible: The ultimate guide to genAI disruption | CB Insights

AI: The Coming Revolution | Coatue

Who Owns the Generative AI Platform? | Andreessen Horowitz

Generative AI: The Next Consumer Platform | Andreessen Horowitz

Generative AI’s Act Two | Sequoia Capital

The AI State of the Union | Rex Woodbury

AI Index Report 2023 | Stanford HAI

What Every Executive Needs To Know About AI | Bain & Company

The AI Bubble Playbook | Deepwater Asset Management

5 Videos To Watch

Mustafa Suleyman & Yuval Noah Harari -FULL DEBATE- What does the AI revolution mean for our future? | The Economist

Intro to Large Language Models | Andrej Karpathy

Alexandr Wang: 26-Year-Old Billionaire Powering the AI Industry | The Logan Bartlett Show

Andrew Ng: Opportunities in AI - 2023 | Stanford Online

Reid Hoffman on the future of artificial intelligence | Washington Post Live

5 Newsletters To Subscribe To

by by by Michael Spencer by by P.S. For a Window to the Future of AI, come to GSV’s inaugural AIR Show in San Diego on April 13 – 15, 2024! Hosted in conjunction with our 15th Annual ASU+GSV Summit, the AIR Show will be an immersive exposition of the landscape of AI and learning.

Market Performance

Despite the World going to Hell in a handbasket, stocks were up for the fifth week in a row. Climbing the proverbial “Wall of Worry”, the Dow was up 2.4%, the S&P 500 advanced .8% and NASDAQ inched up .4%.

Over the past month, NASDAQ is up over 10% and 36.7% year to date. To be immodest for a moment, GSV’s Growth Portfolio is up 45%.

Partially fueling the positive action in stocks was that Third Quarter GDP grew at a robust 5.2%. While prices of goods have skyrocketed over the past couple years (groceries up 25%, used cars up 33%, rent up 20%), inflation seems to be slowing down which has provided some optimism about future Fed activity.

Also, positive from a demand standpoint, Black Friday sales approached $10 billion which was an increase of 7.5% from last year. Shopify said its network activity was up 22%.

We remain optimistic for the outlook for stocks and believe we continue to have a good environment for growth stock pickers.

Maggie Moe’s GSV Weekly Rap

Need to Know

READ: Charlie Munger’s Life Was About Way More Than Money | WSJ

WATCH: Elon Musk on Power, Influence and the “Wild Storm” in His Mind | DealBook Summit

LISTEN: Peter Fenton & Victor Lazarte – Purpose and Partnership

READ: Early-stage investing: looking beyond rate hikes – Baillie Gifford

LISTEN: Visa: The Complete History and Strategy | Acquired

WATCH: Secrets of Being a Wartime CEO | Ben Horowitz, Andreessen Horowitz Cofounder

READ: Nvidia Envy: Understanding the GPU gold rush | John Luttig

LISTEN: The Marketing Formula that Propelled Duolingo to 500M Users | The Logan Bartlett Show

WATCH: Jensen Huang of Nvidia on the Future of A.I. | DealBook Summit 2023

READ: How Josh Kushner built Thrive Capital | Fortune

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

ETF flows into the Nasdaq 100 ETF, $QQQ, reached record highs for weekly flows the week of 11/13, at $7.54 billion. That’s greater than any weekly flow since 1999.

Source: Koyfin

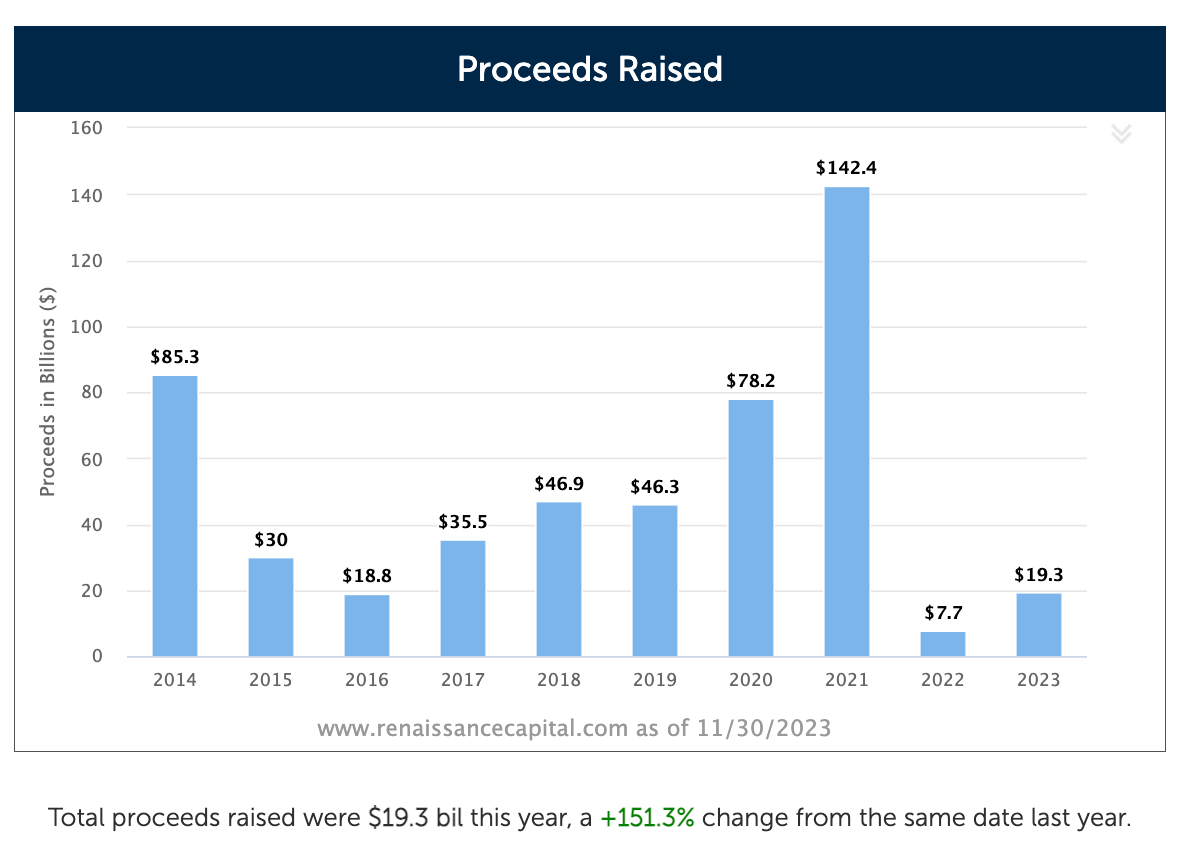

#2: IPO Market

Singapore-headquartered Shein filed confidentially for a US IPO this week, seeking a valuation as much as $90 billion. Meanwhile in MENA, Dubai Taxi got $41 billion in orders for a $315 million IPO, selling out in an hour.

Sources: Renaissance Capital, Bloomberg

#3: Interest Rates

As of Monday, interest rate futures indicated a 52% change that the Fed will lower rates by at least 25 basis points by its May 2024 policy meeting, up from 29% at the end of October.

Source: WSJ

#4: Inflation

The Fed's preferred measure of inflation (Core PCE) moved down to 3.5% in October, the lowest since April 2021.

Source: Charlie Bilello

Chart of the Week

Chuckle of the Week

EIEIO…Fast Facts

Entrepreneurship: 47% – decrease in new founder roles in 2023 vs. five year average

Innovation: 62% – percent of millennials who say they’re willing to pay $7 for a daily coffee because of the joy it brings (Forbes)

Education: 38% – percent of all AP test takers who scored a 1 or 2 on exams (Business Insider)

Impact: 59% – percent of Americans believe that money can buy happiness (Empower)

Opportunity: 36% – Americans who believe the American Dream still holds true (WSJ)

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup….EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM