EIEIO...The Circle of Life

By: Michael Moe, CFA, Brent Peus, Owen Ritz, Catherine Merrick

GSV’s weekly insights on the global growth economy. Join 22,000+ readers getting a window to the future by subscribing here:

“The World is not a meritocracy as much as we may pretend that it is.” – Malcolm Gladwell

“As long as poverty, injustice and gross inequity persist in our World, none of us can truly rest.” – Nelson Mandela

“What the World needs now, is love, sweet love.” – Burt Bacharach

Five hundred years ago, you lived and died within five miles of where you were born. Your future was your parents’ past. If they were royalty, you were royalty. If they were farmers, you were a farmer.

Technologies such as the Gutenberg Printing Press and Alexander Graham Bell’s telephone accelerated the spread of knowledge. Planes, trains and automobiles made Earth a smaller place.

Despite the World becoming everyone’s Oyster, it was conceptual for most with even today, nearly 10% of the planet’s population not having access to clean water, and 10 million people dying yearly to hunger.

Many people reading this will think, “yeah, but poverty is really relegated to some remote villages in Africa or South America….I feel bad it about it, but that’s why my Church has Mission Groups.”

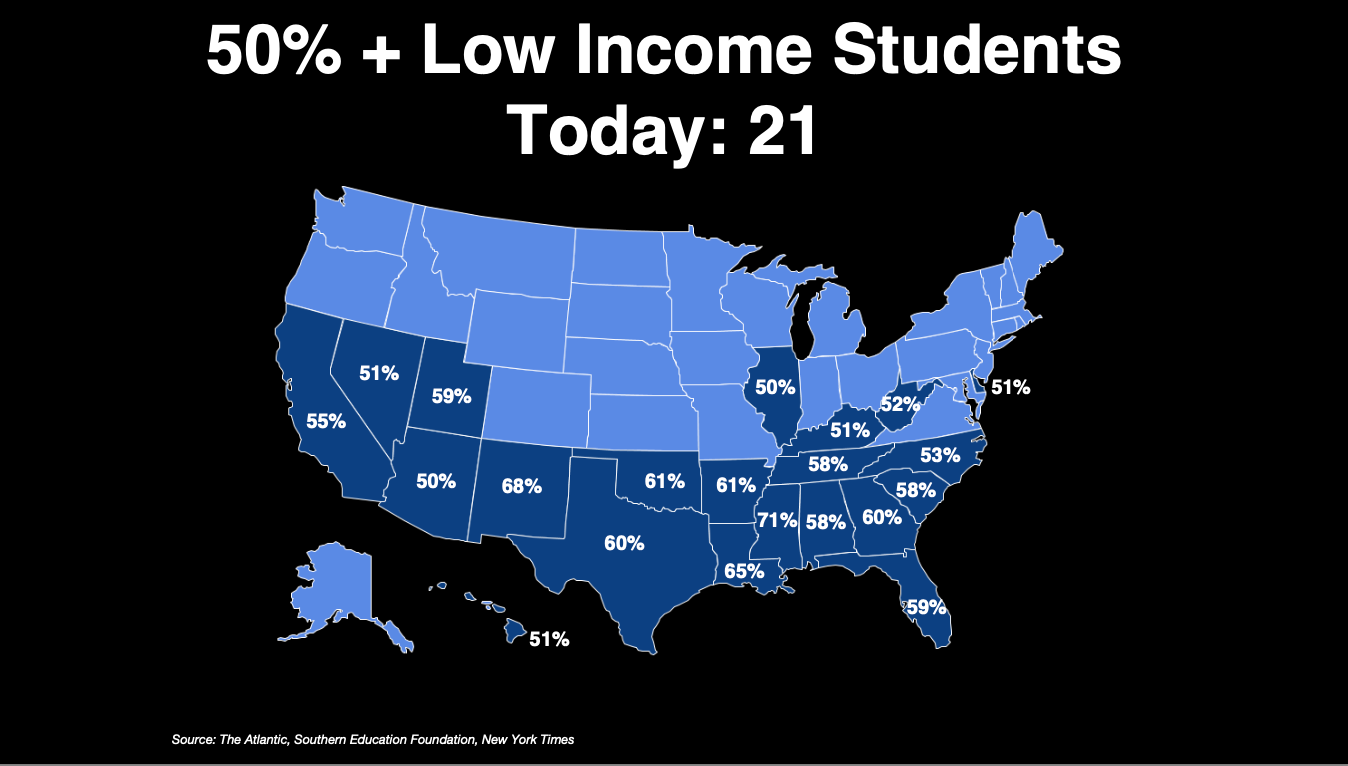

Factually, in 2000, four states in the U.S. had 50% or more of the student age children living in poverty. This is stunning, given that a Country as rich as America could have so many poor kids.

Today, it’s 21 states.

The American Dream was the powerful idea that it didn’t matter who your parents were, where you grew up, what the color of skin was or what gender you were….if you worked hard, kept your nose clean and kept persisting, there wasn’t anything you couldn't achieve.

In 1996, I wrote a white paper called “the Dawn of the Age of Knowledge”. In it, I forecast the emergence of the Knowledge Economy, how the Internet was going to change everything and how education was going to be at the heart of the Knowledge Economy.

The thesis was that in the Knowledge Economy in a Global Marketplace, your education, your knowledge was going to be the differentiator for an individual, for a Company and for that Matter a Country. Additionally, technology had the opportunity to “democratize” learning by increasing access, lowering the cost and improving the quality.

As a general matter, that prediction was right as rain. (I have plenty of predictions that haven’t been on the money, so it’s important to take credit when you can). The correlation between a person’s income and level of education is clear.

Moreover, there is a high correlation between a country’s level of education attainment, and GDP Per Capita…essentially a country’s populace quality of living.

The devil, of course, is in the details. Inequality has been exacerbated in the Knowledge Economy due to resources available to poor children and the schools they are assigned.

There is a 30 MILLION word gap between children from wealthy families and poor families by the time they are 4 year old. That’s obviously not because poor kids are born dumber, but because kids from affluent families are being read to, having the nanny bring to baby pre-school and grand parents active as well. Poor kids are often with one parent, who’s working two jobs and exhausted by the time they get home.

Not surprisingly, 52% of the poor children enter Kindergarten at a learning level below what is considered to be a base level. If you start from behind, it’s hard to ever catch up.

Not coincidently, if you are poor, you are 5X more likely to drop out of school. If you drop out of school, you are 8X more likely to go to prison. 80% of prisoners are made up of high school dropouts.

As an aside, we need to make prisons “prep schools” so when inmates become outmates, they have the skills to be effective in society.

Looking at the SAT Test, which is the Golden Ticket to most prestigious universities, there is a direct correlation between family income and the SAT Score. So what the SAT does the best job predicting is how wealthy your family is.

75% of the students at elite schools come from the top 25% of family household incomes. If you are from a bottom 25% household income, there is just a 15% probability of graduating from any college.

Historically, jobs were filtered by where you went to school, certainly in the most competitive industries. I realized how messed up this was when I was at Lehman Brothers in the early ‘90’s and couldn’t hire somebody to work for me that went to my alma mater (Go Gophers!). Effectively, the admissions officer at Harvard was the outsourced hiring director at Google.

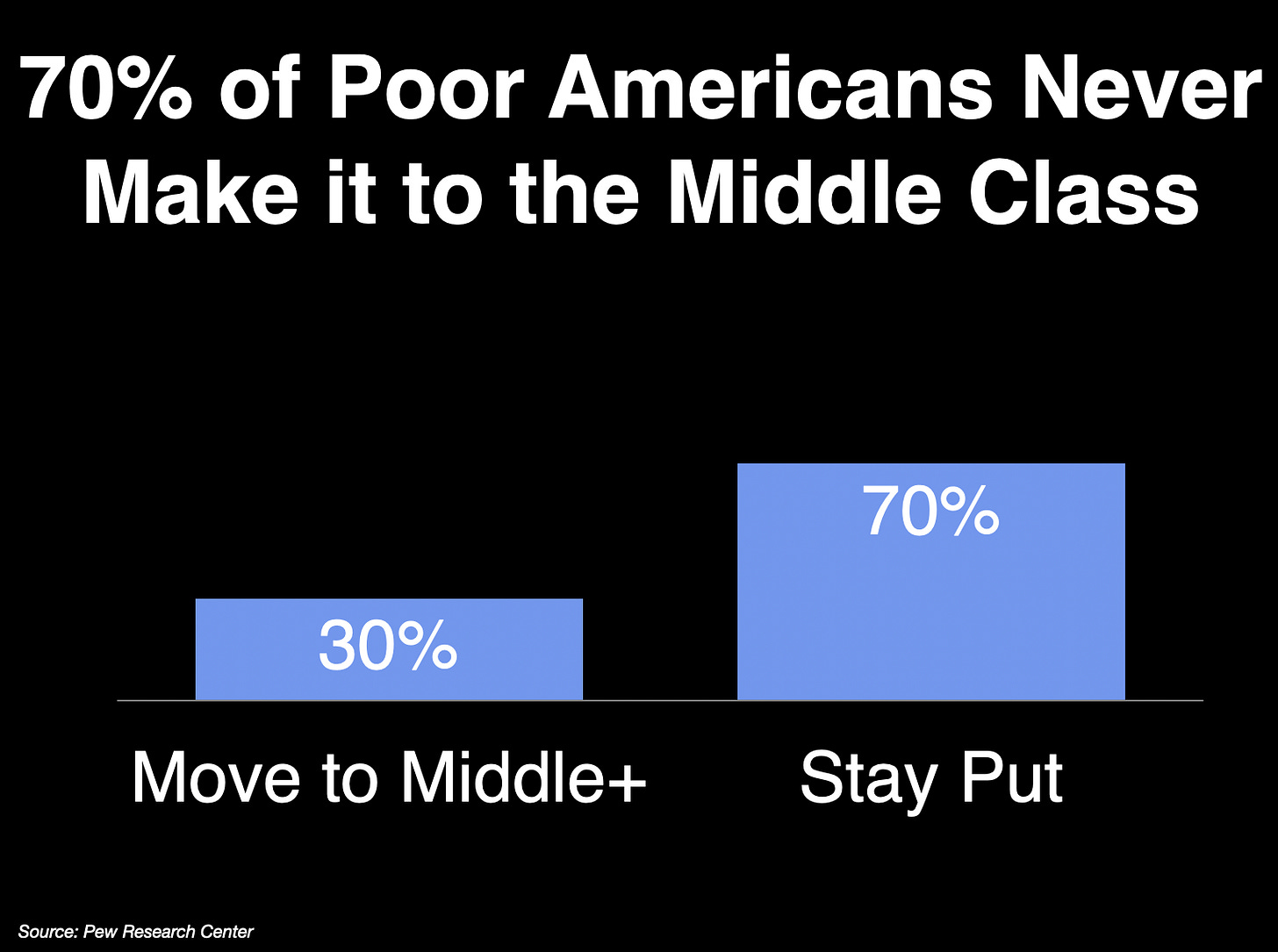

Add this up, and what it shows is that if you were born poor, you have a 70% chance of remaining poor. The American Dream has become a myth.

So, in five hundred years, we’ve come full circle, your success depends on how well you selected your parents.

If we were to end it there so I could go watch the Sunday NFL games, I appreciate it would be pretty much a downer. But I’m a believer in the entrepreneurial spirit and how obstacles create opportunities. (And alas, my Vikings already got beat by Philadelphia Thursday night.)

At GSV, our North Star has always been that everybody deserves an equal opportunity to participate in the future, the foundation of which is giving access to quality education and knowledge.

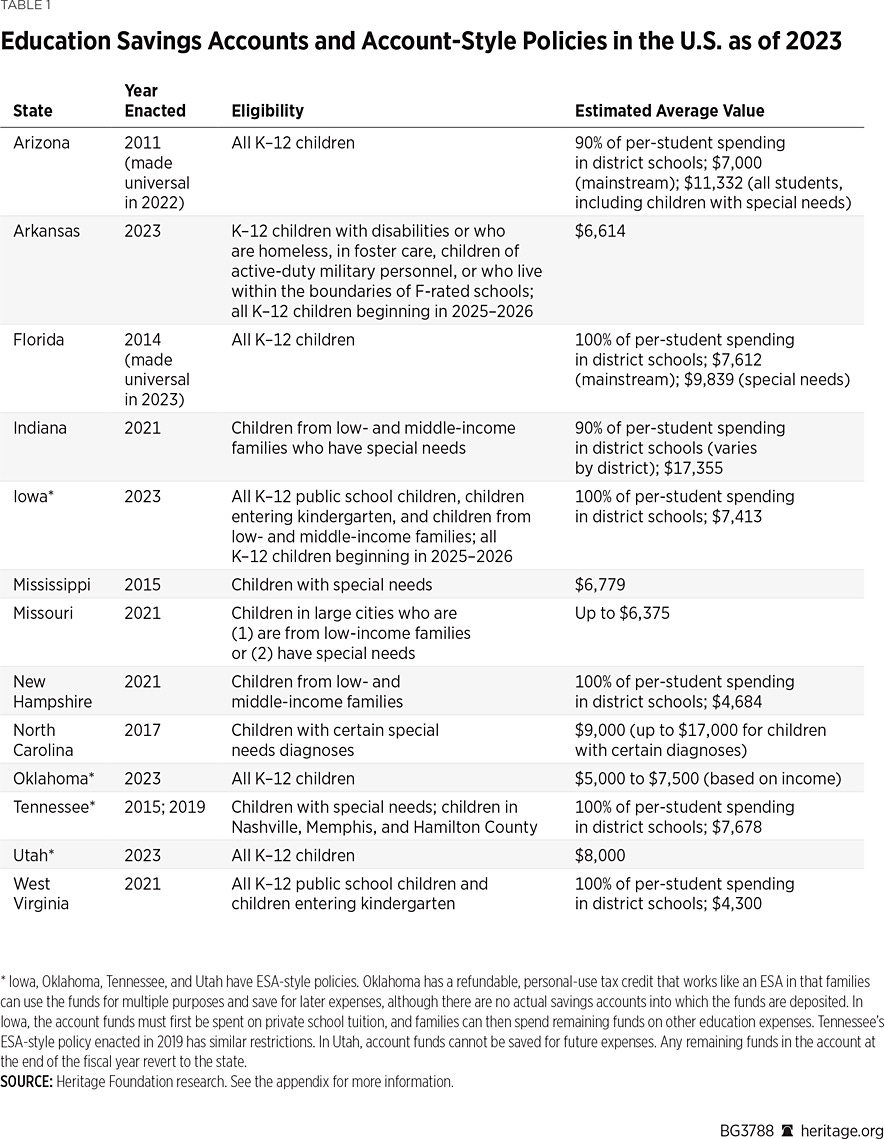

School choice isn’t a panacea for curing all the World’s unfairness but it’s a great start. The idea that children should be hostage to the school in their neighborhood is absurd. The good news that is choice of many forms is flourishing with charters, ESAs, vouchers and home schooling growing quickly.

Starting with the first charter school law in the Country in Minnesota in 1991, there are now 7800 charter schools with 3.7 million students.

Education Savings Accounts continue to grow, expanding educational opportunties for all families. In 2023 alone, seven states passed new education choice policies and eight states expanded existing choice policies.

We hear over and over again that there is no “Silver Bullet” to provide access to educational excellence for all. It’s like a Whack-o-Mole, you solve one problem and two more pop up.

But I actually do think there is a Silver Bullet…and it’s LOVE. Parents will do anything for their own child but when it’s the kid across the River, you may hope things get better but are you really going to try to do something about it?

If we loved our neighbor as we love ourselves (and our own family), we can change the World for Good. It’s not about Money, there is plenty of Money. It’s about intensity and resolution about giving everybody an equal opportunity to participate in the future.

Market Performance

Inflation unexpectedly reared its ugly head last week with the Consumer Price Index (CPI) up .6% month over month versus expectations of .2%.

Other not welcome news included the United Auto Workers (UAW) deciding to go on strike and Oil moving past $90 a barrel. Taiwan Semiconductors, which basically power the World, also said there would be delays in their shipments.

Interestingly to us, stocks mainly reacted to what could have resulted into a tailspin with a yawn. The Dow was actually up .1% for the week with the S & P and NASDAQ off .2% and .4%, respectively.

Other data points that reinforce our optimism is the much anticipated ARM IPO traded up a healthy 25% and the forthcoming Instacart IPO had its cover price raised.

Generally speaking when stocks don’t go down on bad news, it means they want to go up. Accordingly, that along with what good fundamentals for many growth companies has us remaining BULLISH.

Maggie Moe’s Weekly Rap

@maggiemoeyoWEEKLY RAP 9/16/23 #rap #news #trump #mccarthy #mila #ashton #hurricanelee #drewbarrymore #sagstrike #uwa #hunterbiden music by @Joshua Vranas | Music 🎶 ⭐️

Tiktok failed to load.

Enable 3rd party cookies or use another browser

Need to Know

READ: ‘Psychology of Money’ Author Morgan Housel on the Secret to Good Investing

LISTEN: WTT: The Real Yale Model

WATCH: Sequoia’s Roelof Botha on “Crucible Moments” and the state of VC

READ: Fewer Losers, or More Winners?

LISTEN: 3 lessons from a lifelong tech investor | Capital Ideas Investing Podcast

WATCH: All-In Summit: Bill Gurley presents 2,851 Miles

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: Yardeni

#2: IPO Market

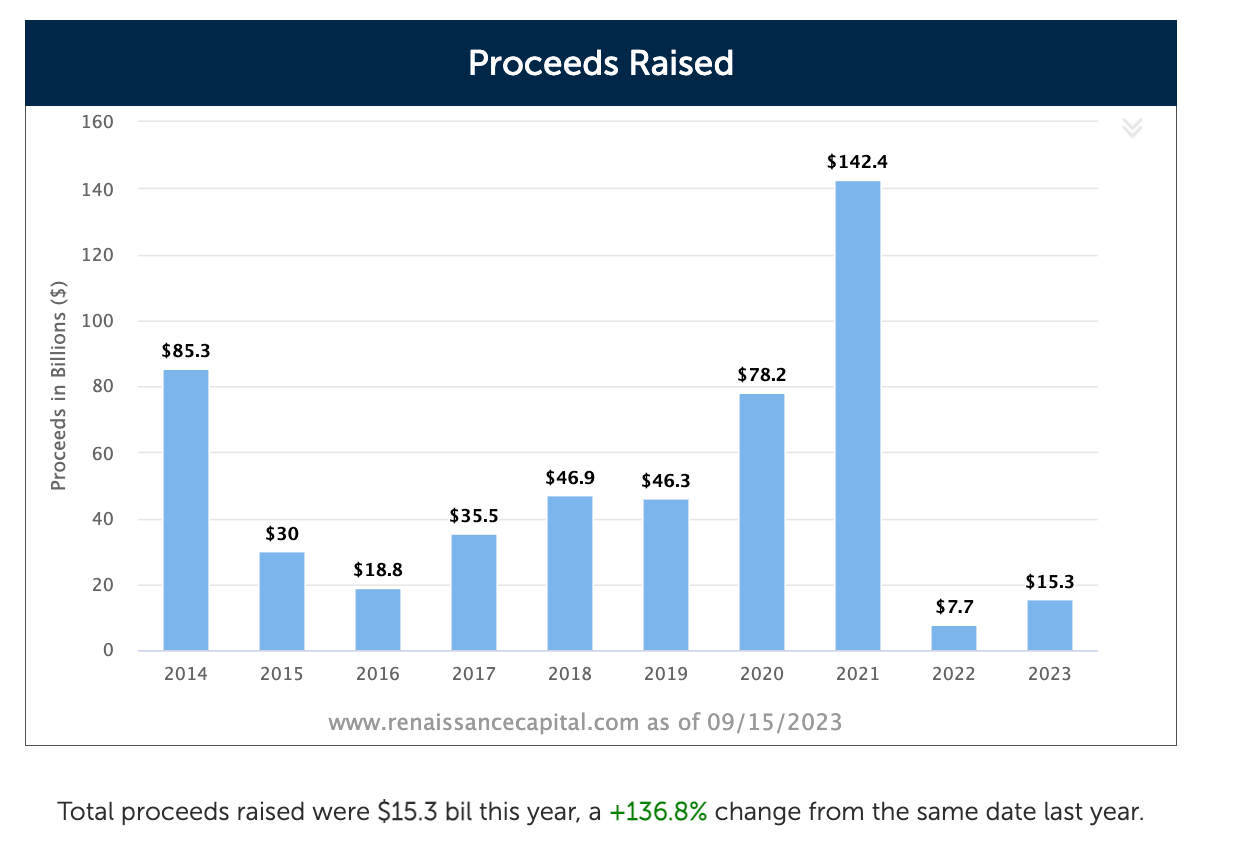

Arm’s stock soared nearly 25% in its market debut, hitting a market cap of $70 billion. Instacart, Klayivo, and Birkenstock will be the next companies to test the IPO market.

Source: Renaissance Capital

#3: Interest Rates

Source: Reuters

#4: Inflation

Source: Mike Konczal

Chart of the Week

Chuckles of the Week

EIEIO…Fast Facts

Entrepreneurship: 17% – percent of US funds that raised their first fund that managed to raise a fourth fund (Beezer Clarkson)

Innovation: 33% – percent of sales reps that hit their quotas in H1 2023 (Lightspeed)

Education: $29,726 – Norway’s public spending per child on early childhood care (NYT)

Impact: 530% – Starlink’s revenue increase over the past year (WSJ)

Opportunity: $228 million – annual cost of employee disengagement and attrition for a median-size S&P 500 Company (McKinsey)

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…. EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM