GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: 1.05 million – The number of businesses in the United States that were less than 1 year old as of 2023 (Statista)

Innovation: 48% – The percentage of Americans who believe that politeness matters when interacting with AI (Lifewire)

Education: 59% – The percentage of 2024 college graduates who worry about covering basic expenses (Handshake)

Impact: 6 years – The amount of time before the estimated ratio of pets to children under the age of 4 in China reaches 2:1 (Harper’s)

Opportunity: 8.7% – The percentage year-over-year increase in the costs of at-home care for ill and elderly people (BLS)

“Conformity is the jailer of the freedom and enemy of growth.” – John Kennedy

”There are no great limits to growth because there are no limits of human intelligence, imagination, and wonder." – Ronald Reagan

“The race might not always go to the swift, nor the battle to the strong, but that’s the way to bet.” – Damon Runyon

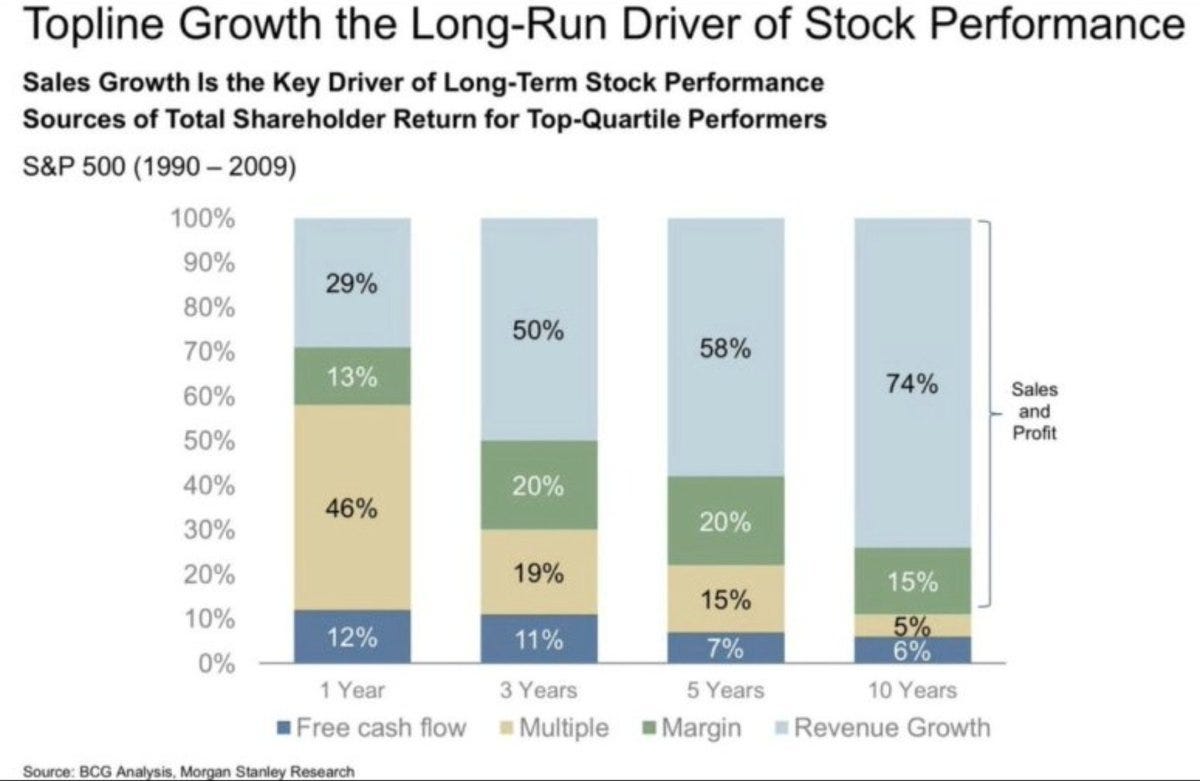

My investment philosophy for a long time has been that earnings and revenue growth drive stock price in the long run. Accordingly, to achieve the highest returns the right strategy would seem to identify companies with longest-term growth potential, take a deep breath, and hang on for the ride.

While that’s basically true, it gets better than that due to the magic of compound interest. Understanding what Albert Einstein called “The Eighth Wonder of the World” is key to why growth investing has such enormous potential.

High growth rates, compound interest, and time create a potent combination that can lead to spectacular returns. Even slight differences in growth rates can drive dramatically different returns over time.

To illustrate this, let me tell you a story about Peter Minuit who in 1626 bought the entire island of Manhattan from the Wappinger Tribe for $24 worth of trinkets. In other words, for what it costs to order a latte and a bagel at a midtown hotel today, Monsieur Minuit owned the entire Big Apple.

While there are some outside of Gotham who wouldn’t look at either as a bargain, my point is to demonstrate the power of compound interest over time. Using the HP 12C calculator, which I call “The Ninth Wonder of the World”, we can see what kind of deal Minuit got.

…Or not.

The real question is what kind of return the Wappinger People achieved versus the value of NYC today. So, if the Wappingers earned a 5% return over the last 398 years— essentially the long-term return on bonds — they’d have approximately $6.5 billion in the bank today. Not bad, but when you consider that the Hudson Yards development was worth $25 billion alone, it would seem Minuit got the better part of the trade.

BUT, if instead of receiving a 5% return and instead, the Wappingers achieved a 10% return — or an equity type of return — the total amount accumulated wouldn’t be double the 5% return ($13 billion), but $7.2 quadrillion.

That’s the magic of compound interest.

Suppose I was to hire you as a consultant and I gave you two compensation options.

Option #1: I’ll pay you $10K a week for a month — roughly $40K…

OR

Option #2: I’ll pay you a penny the first day and your comp will double every day for 31 days. On the second day, you would be paid two cents, the third day four cents, the fourth day eight cents, and so on.

Which one would you choose?

Well having done this exercise enough times, I know most people chose the second one because they assume it’s a trick question. But as you go through the calculation and you get to day 10 and it’s still only $5.12, people think they got played.

However, by the 31st day, it’s over $20 million!

So let me bring it back to our lifetime and practical application.

Over time, there is almost a 100% correlation between a company’s growth and its stock return.

Imagine we have to choose between investing $1,000 in Company A and Company B. We are highly confident that Company A will grow at 15% for 20 years. We think Company B could grow at 30%, but our confidence is just pretty good.

Let’s look at the difference in potential returns between these two companies.

The 15% grower’s $1K would be worth roughly $16K after 20 years…pretty good. But if the 30% grower was sustainable, that $1K would be worth over $190K.

I use our 5P formula to determine the companies we think can have the highest growth for the longest time, and hold on for the ride.

Giddy up!

Market Performance

Market Commentary

The beat goes on.

For the sixth week in a row, indices were higher with stocks rising over 12% since August. Last week, the Dow was up 1%, the S&P 500 advanced .9% and the NASDAQ increased .8%. Year to date, both the S&P 500 and NASDAQ are up over 23%.

It’s earnings season and Netflix pleased investors with a 15% increase in revenues and 41% increase in earnings. Shares of NFLX were up 11%. Taiwan Semiconductor had spectacular results with revenues increasing 36% and earnings increasing 54%…TSMC is the newest member of the trillion-dollar market cap club.

We’ve been BULLISH and remain BULLISH but believe for stocks to persist to go higher, we will need to see a continuation of the broadening of participation complimented by a robust IPO market.

Need to Know

READ: Podcaster Harry Stebbings raises one of Europe’s biggest venture funds | Financial Times

WATCH: Which Big Tech company's talent gets a new job fastest? | Jason Saltzman

LISTEN: How To Build A Successful Business | Keith Rabois & Mike Shebat | The Pomp Podcast

ICYMI: 🎙️ Ep 27 · Ben Nelson: Founder & CEO of Minerva | Ed on the Edge | Dash Media

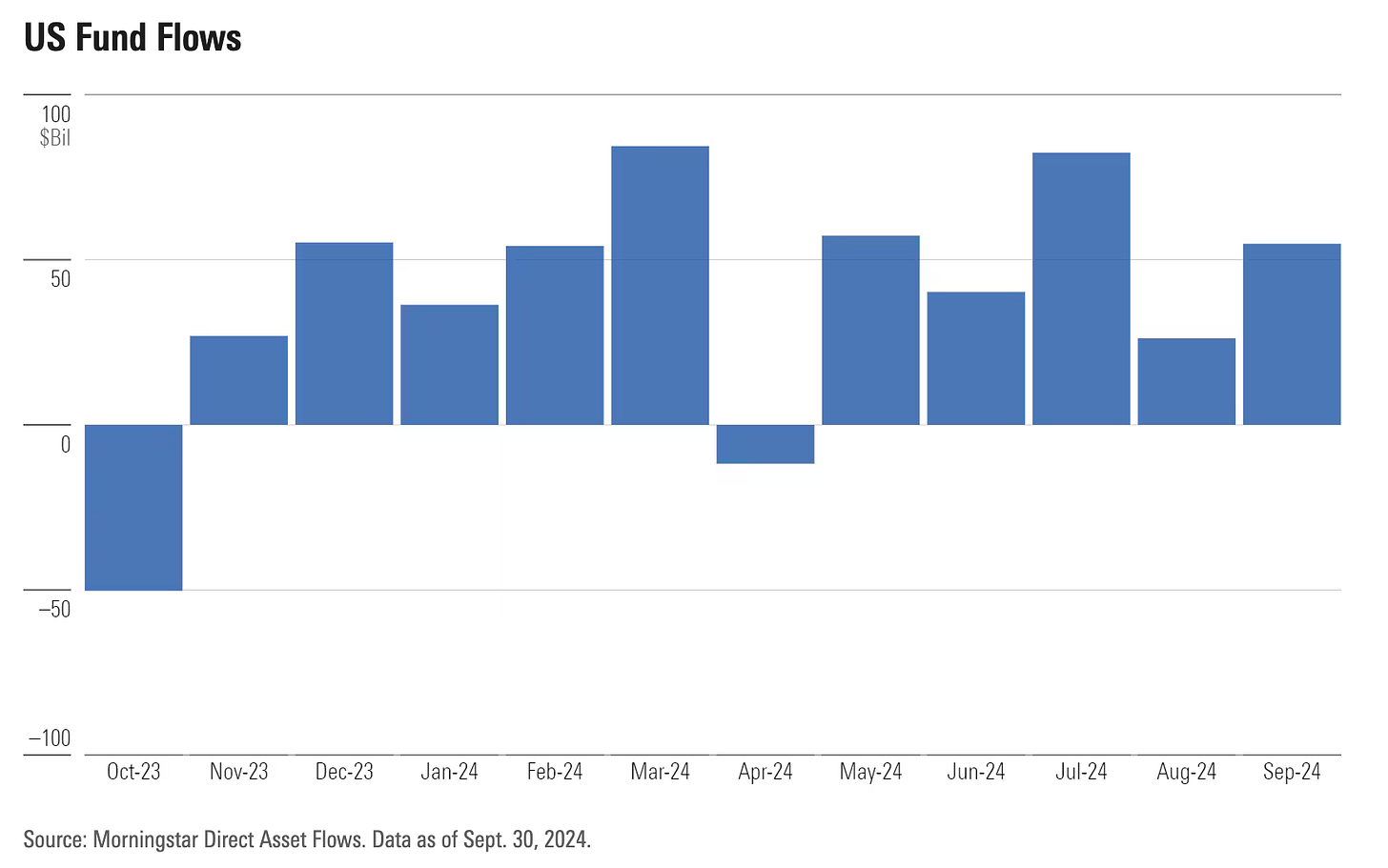

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

#3: Interest Rates

#4: Inflation

Chart of the Week

Maggie Moe’s GSV Weekly Rap

Chuckle of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup….EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM