EIEIO...There's No Place Like NEOM

By: Michael Moe, CFA, Brent Peus, Owen Ritz, Catherine Merrick

GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

“Is this heaven? No, it’s Iowa.” – Field of Dreams

“They say in the Middle East a pessimist is simply an optimist with experience.” – Ehud Barak

“Let me tell you something that Israelis have against Moses. He took us 40 years through the desert in order to bring us to the one spot in the Middle East that has no oil!” – Golda Meir

Human history began in the Middle East…hopefully it won’t end there.

It’s been two weeks since the shock of the murderous terrorist attacks on Israel by Hamas. In some ways, it seems like it was a lifetime ago, in others ways, it feels like we are still in the midst of a nightmare, hoping to wake up to realize it was only a bad dream.

Alas, the reality is that the after-effects of Israel’s 9/11 are only in the early innings and it's likely that the dramatic consequences in the Middle East will have a permanent impact (for more on the geopolitics, check out this overview from our friends at War On The Rocks).

To start, it was no coincidence Hamas, Iran and Co. staged their assault when they did. After the game-changing Abraham Accords between Israel and the United Arab Emirates, there was a pathway formed towards normalized relations with a number of Gulf States, with Saudi Arabia at the top of the list. Last year, Saudi decided to allow Israeli commercial flights to travel over the Kingdom and the stage had been set to consummate an agreement.

These would be extremely positive developments for most of MENA, Saudi, and the rest of the globe. However, these shifts towards normalized relations are not ideal for the terrorist groups that make a living off making Israel “the Little Satan” and America “the Big Satan”.

Mohammed Bin Salman a.k.a. “MBS” has been doing a delicate dance bringing Saudi to the Modern Era. Given Saudi’s deep historical roots, this is clearly easier said than done (for more on this, check out Scott Galloway’s interview with Fareed Zakaria).

Saudi leadership has made abundantly clear its plans to transition the country from an Industrial Economy based on oil to a Knowledge Economy based on education and technology.

On my first trip to Riyadh in 2007, we visited the U.S. Embassy where we met with Ambassador Ford Fraker. The security was like nothing I’ve ever seen and Ambassador Fraker said he hadn’t left the compound in two full months. If you saw a woman anywhere, they were covered from head to toe in a burqa. Women could not drive. Nobody could drink alcohol. And while I’m sure there were some places for people to hang out and have fun, it wasn’t obvious where those places might be. The 1 hour flight to Dubai was jam packed to get out of Riyadh for the weekend.

In a later trip where I met with the Stanford-educated CFO at ARAMCO (where he reminisced about burgers from the Dutch Goose), he said the biggest issue for the future of Saudi was young unemployed people who weren’t getting a balanced education. It wasn’t such a surprise when PIF made a $3.5 billion investment in Uber, partly to get young people working in the “Gig Economy.”

These are just a few vignettes to give a glimpse of the historical World MBS has been operating from. Though giving women the right to drive, travel and not be treated as subordinates might seem basic, it’s radically against the traditional cultural norms.

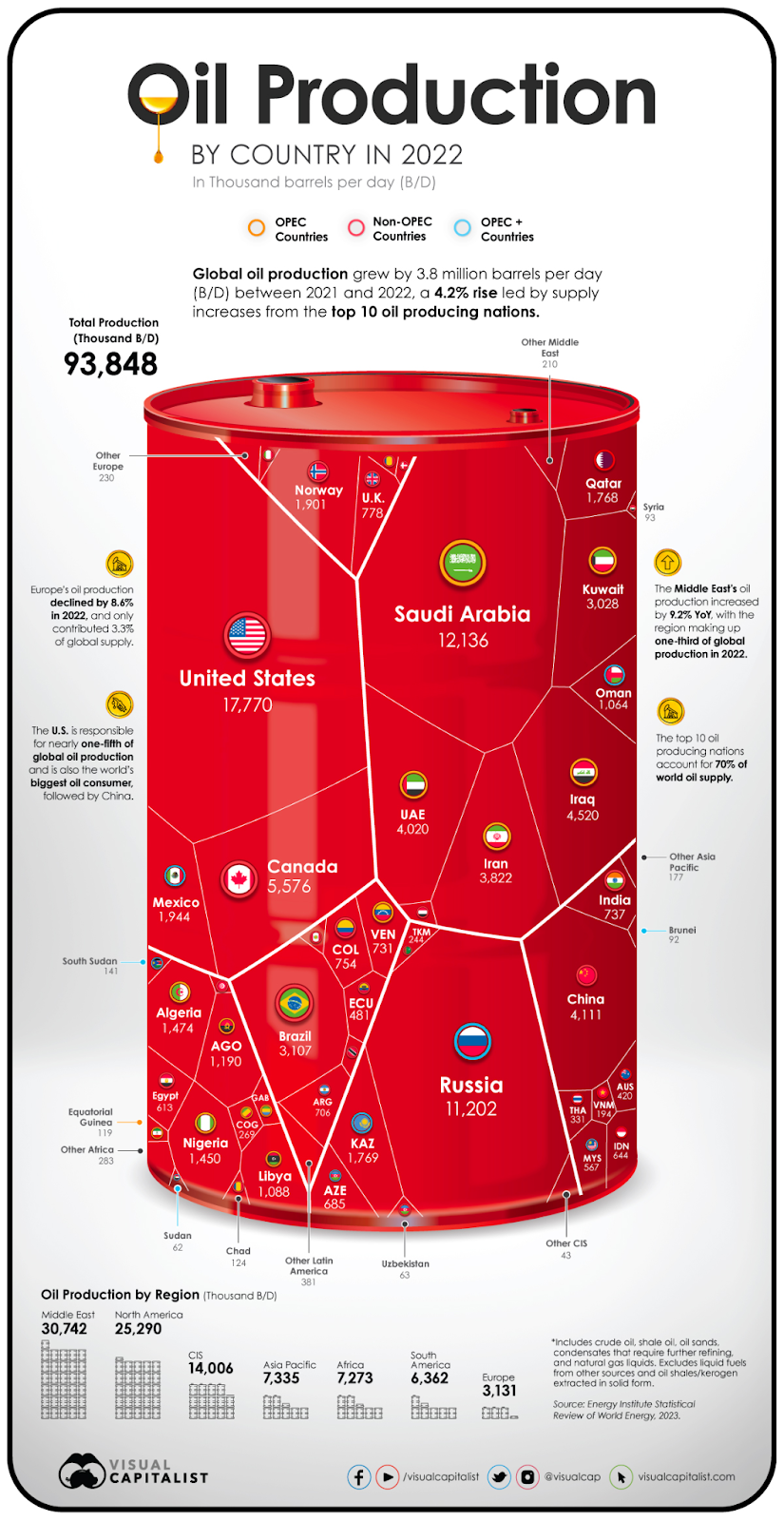

The Kingdom of Saudi Arabia has always been the most important country in the Gulf. The oil wealth and derivatives thereof, is staggering, with the House of Saud worth $1.4 trillion. It’s also the only Arab country to be part of the G20.

Before discovering oil and partnering with the Rockefeller Family and Standard Oil in 1938, Saudi’s claim to fame was that it was home to the two most holy sites for Islam, Mecca and Medina.

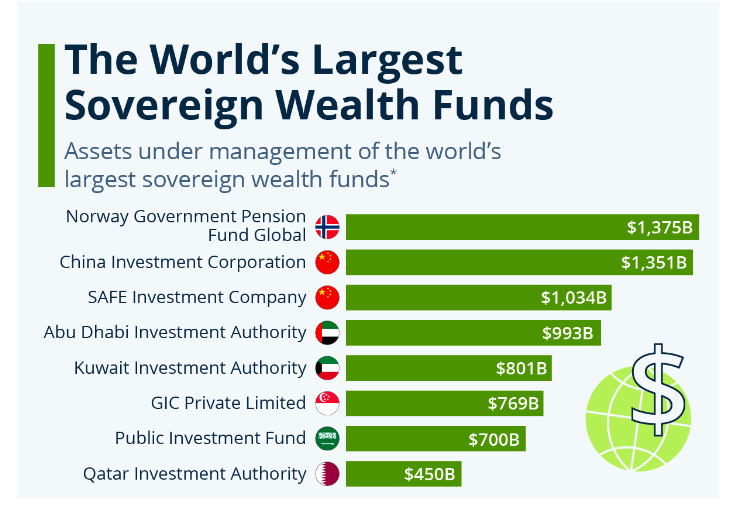

PIF was founded in 1971 and revamped by MBS in 2015. Today, it has $700 billion of assets (as of August 2023).

Most notably, PIF isn’t your normal sovereign fund as it’s been intentionally used as a strategic weapon for Saudi to advance its global aspirations. PIF’s investments have been made not only in hopes of driving financial returns, but also as a way to advertise Saudi’s intentions to become a dominant player on the world stage.

Sports has always had an outsized way of signaling ambition. Specifically, PIF has made a splash with trophy investments in LIV Golf, Formula 1, and Newcastle United FC, to name a few. It’s clear they aren’t messing around – they recently offered a 24 year old soccer star a $1.1 billion contract to play for Al-Hilal, a club that is majority owned by PIF. Just to underscore how important sports are for global credibility, after the Saudi national team upset Argentina in the World Cup, MBS declared a national holiday.

PIF’s Global Influence and Investments In Sports

In another PIF initiative, the 7th Annual Future Investment Initiative (FII) “Davos in the Desert” will take place in Riyadh this week. It’s expected there will be 5,000 attendees including JP Morgan’s Jamie Dimon, Bridgewater’s Ray Dalio, Goldman Sachs’ David Salomon, Blackrock’s Larry Fink and Carlyle’s David Rubenstein all to be part of this year’s Capitalist Club. Notably, while the first six years were free, this year tickets go for $15,000.

FII 7th Edition in Riyadh - FII Institute Overview

Perhaps nothing exemplifies the aspiration of MBS better than his vision for the innovation city of the future, NEOM. NEOM, situated in the Northwest Quadrant of Saudi Arabia on the Red Sea leapfrogs from “Bedrock” to “the Jetsons”.

NEOM aims to put the future of livability as its foundation, unprecedented in scope. The name "NEOM" is derived from two words. The first three letters from the Ancient Greek prefix neo-meaning "new". The fourth letter is from the abbreviation of Mostaqbal, an Arabic word meaning "future”.

It’s a $500 billion project, and the site covers an area of more than 10,000 square miles, about the same size as Massachusetts.

NEOM will be the first city in the World that is built on a “Cognitive Network” the foundation of which is digital infrastructure, mobility and green energy. Clearly a response to the success of Dubai as a “hub” for commerce, innovation and entertainment, NEOM has the leadership, blank canvas, and ambition to be a game-changer.

An unanticipated benefit is that NEOM has been a major inspiration to the young people in Saudi Arabia. Having the vision to create a “City of the Future” has captivated the imagination of Saudi’s creator community, who now can imagine staying local as opposed to moving to Dubai, London, or Silicon Valley.

Importantly, NEOM is a hop, skip, and a jump from Africa, Europe, and the Middle East, with 40% of the World’s population within a 6 hour flight.

It’s important to note from a geopolitical chessboard perspective that while NEOM is 1,000 kilometers from Riyadh, it’s just 100 kilometers from Israel.

The upside between linking NEOM to the current technological hub of the region (Israel) provides tremendous incentive for not letting the conflict prevent a long-term home run for Saudi.

Given the enormous progress the Kingdom of Saudi Arabia has made to advance its society and its opportunity to be the center of the World of the 21st century, we see the combination of the Invisible Hand and the Iron Fist coming together to bring peace and prosperity to the Middle East.

Market Performance

Tensions in Israel and Gaza, chaos in the House, comments by Fed Chairman Powell, and retail sales that were well above expectations all contributed to the 10 Year Treasury rising nearly 30 basis points sailing above 5% last week. That’s the first time the 10 Year note has gone above 5% in sixteen years…the last time being in July of 2007.

As interest rates go up, stocks typically go down. Accordingly, the Dow was down 1.6%, the S&P 500 declined 2.4% and NASDAQ was off 3.2%.

Earnings season kicked off in earnest last week with 86 of the S&P 500 reporting Third Quarter results. Notable were the mixed outcomes for banks…Bank of America’s results were strong, Goldman Sachs’ were mediocre and Morgan Stanley’s were bad. Netflix put up the best subscriber numbers in years with its stock surging 16%. Many of the other tech titans, including Microsoft, Alphabet, META, Amazon and Intel, report next week.

OpenAI continues on its path towards World domination with secondary shares being rumored to be valued north of $80 billion in a secondary purchase by Thrive Capital.

While last week was a definite pause from the healthy action by growth stocks for most of the year, taking a breather is healthy and should be expected with such a steep increase in interest rates. Fundamentals ultimately drive stock value and we remain optimistic on the outlook for many of the top growth companies we continue to highlight in our model portfolio.

GSV Weekly Rap

Need to Know

READ: Amazon’s Andy Jassy Plans to Crash the AI Party

WATCH: New Rule: Don't Go to College | Real Time with Bill Maher (HBO)

LISTEN: HubSpot — Brian Halligan & Dharmesh Shah | Crucible Moments

WATCH: NVIDIA CEO Jensen Huang | Acquired

READ: Macroeconomic Update: I remain significantly more bearish than consensus! - Fabrice Grinda

LISTEN: 20VC with Matthew Prince, Co-Founder @ Cloudflare

WATCH: The Ben & Marc Show: The Techno-Optimist Manifesto

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: Yardeni

#2: IPO Market

Source: Renaissance Capital

#3: Interest Rates

Source: Statista

#4: Inflation

Source: Charlie Biello

Charts of the Week

Chuckles of the Week

EIEIO…Fast Facts

Entrepreneurship: 53% – increase in new business applications in the South since 2019 (Bloomberg)

Innovation: 21% – increase in cancer survival rate from the 1970s to 2010s (CNN)

Education: 71% – percent of Americans who support School Choice (AFC)

Impact: 1.1 billion – number of middle class Africans by 2060 (Brookings)

Opportunity: 78% – percent of global middle class consumption from Asia by 2050 (Futures Platform)

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…. EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM