GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: ~10% – The percentage of Pre-Seed advisors who receive 1% or more equity. (Peter Walker)

Innovation: 24% – The estimated percentage of corporate press releases that were generated by AI last year. (Forbes)

Education: 129% – The percentage change since 2000 in the portion of U.S. kindergarten and preschool teachers who are men. (Harper’s)

Impact: 77 million - The number of Americans who held gym or fitness studio memberships in 2024, a record. (Fitt Insider)

Opportunity: 2.1 million - The number of U.S. manufacturing jobs that could go unfilled by 2030 due to a lack of skilled workers. (Manufacturing Institute + Deloitte)

“I think any self respecting educational institution ought to judge its policies by the best estimate of what their long-term consequences for students and for the society will be.” – Former Harvard President Derek Bok

“You get better or you get worse…you don’t stay the same.” – Lou Holtz

“To create a contagious movement, you often have to create many small movements first.” – Malcolm Gladwell

In Ernest Hemingway’s first novel, “The Sun Also Rises” one of the main characters Bill asked, “How do you go bankrupt?”

His friend Mike answered, “Slow. Then fast”.

Tipping points are moments when a critical threshold has been reached, where what could be seen as a small change or incident catalyzes changes in a system to undergo significant and often rapid transformation to radically new state. Inherent are the symptoms which lead to what seems like an overnight revolution had been in the works for years if not decades.

The Boston Tea Party and subsequent American Revolution was a result of years of unfair treatment by the British.

What seemed like shopping malls vanishing the minute Covid hit was really underway the minute Marc Andreessen helped commercialize the Internet through the Netscape browser. Mall-centric retailers such as JC Penny, Saks Fifth Avenue and Sears became dinosaurs faster than you can say Tyrannosaurus Rex.

Taxis were ripe for disruption after years of passengers living with dirty, unsafe, incompetent drivers, coupled with a system of bizarrely standing on a curb with your hand raised “fishing” for a driver to come by. Uber and Lyft instantaneously disrupted an industry that was begging for it.

Higher Education has had a remarkable run for centuries, where the leading academic institutions hundreds of years ago are still the leading academic institutions today. The premier brands of Oxford, Cambridge, Harvard and Yale were started in 1096, 1209, 1636 and 1701, respectively. Stanford would be considered an up and comer having launched 140 years ago.

Contrast that with the leading, most innovative and largest market cap companies in the World today, Apple, Microsoft, NVIDIA, Alphabet, and META, the oldest of which is Microsoft at 50 years old. META is barely 20.

I believe we are at that tipping point for higher education.

The symptoms are painful and obvious.

In 2011, 86% of college students thought their college education was worth it. By 2023, just 42% thought it was a good ROI.

And if you took on debt to get your degree…just 22% believed it was the right move.

Student debt has gone from $400 billion in 2005 to $1.8 trillion today. The mantra has gone from “College for all!” to “College at all?”

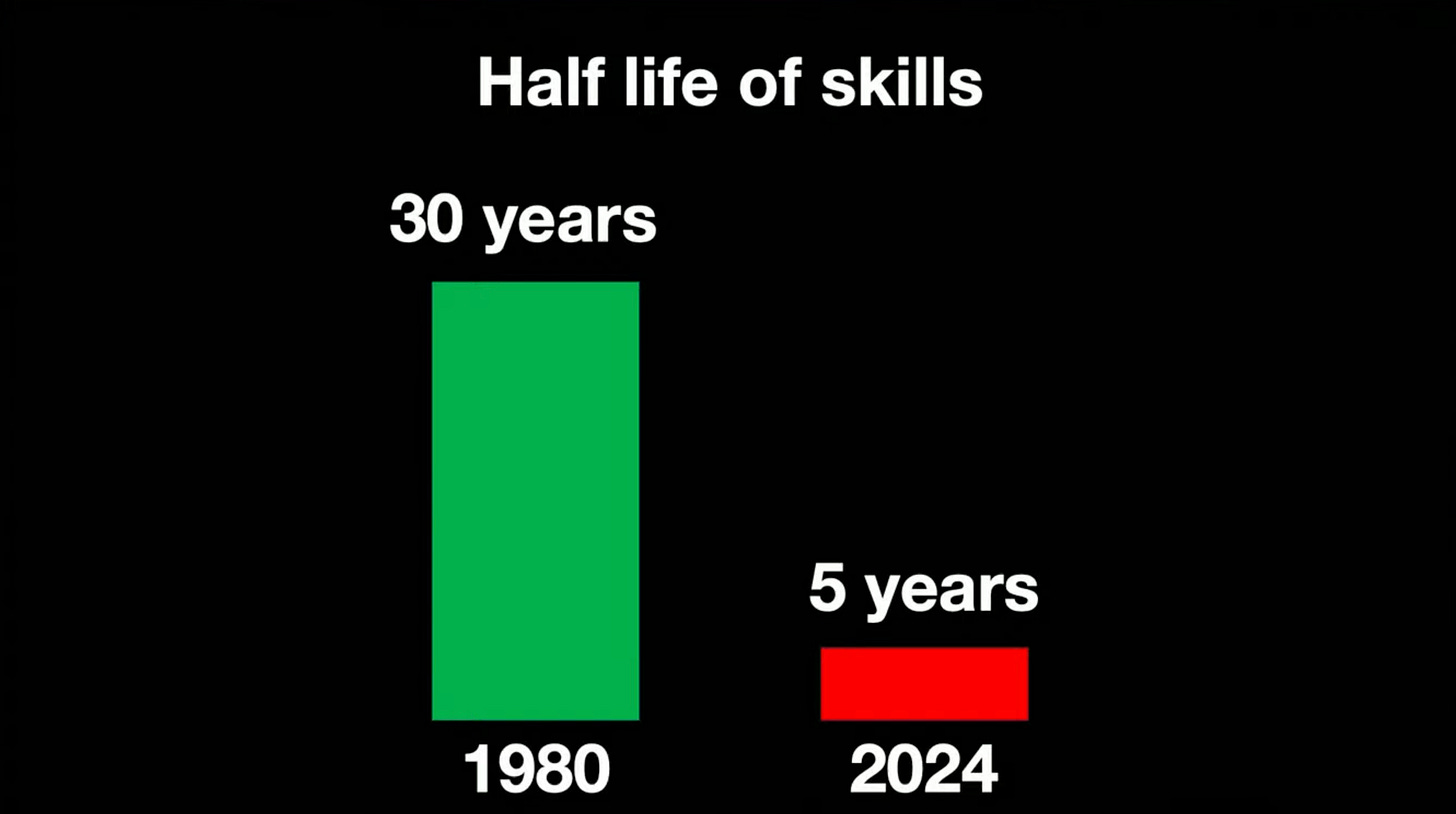

Part of this has been caused by the rapid changes in society. In 1980, the half life of knowledge or skills was 30 years. Today, it’s 5 years. If you have a technical degree, it’s 2.5 years.

As a real problem to anybody selling a high price degree, just over 50% of college graduates get jobs that require a degree. Another tough trend was that the number of employers that require a degree for a specified job dropped from 18% to 14% in a year.

Most everybody is aware of the insane cost of college which has increased at 3.5 times inflation the past 50 years.

That’s the headline. The rest of the story is that while the sticker price has continued to rise at levels that are unimaginable to the normal person, the net price to students has fallen 13% the past 5 years.

“Scholarships”—or in the non-academic world, “discounts”—are the norm. In 2024, the average freshman tuition was 54% of the listed price. The overall student body was provided an essential “50% off sale.”

Obviously, this wasn’t out of the goodness of the 4,000+ universities and colleges hearts…it’s because the market was demanding it.

A quiet fundamental has developed which is that the majority of college students are “non traditional”…meaning they aren’t in the 18-22 year old full time student category. Yet college and universities are set up for 18-22 year olds…classes during the day, semester system, dormitories, no parking, football team, marching band…all irrelevant to over 50% of the students. The University of Kentucky spent over $1 million dollars a day for a decade building facilities.

As another inconvenient truth, 30% of all college students in the United States are 100% online yet most online courses are essentially the same price as in person courses. While that’s worked historically due to online courses create access that otherwise wouldn’t exist, that’s an unsustainable dynamic. As Jeff Bezos said, “your margin is my opportunity.”

These issues would be problematic without any other issue present but that’s not the case. The Trump Administration has come on the scene and rightly or wrongly, fairly or unfairly, there is a new Sheriff in town.

Another wildcard for universities is the threatened excise tax on endowments that have $200K or more per student. Trump 1.0 had 1.4% tax on endowments with $500K or more per student. For example, Harvard with the largest college endowment paid $44 million of taxes in 2024. Clearly the targets for this are a pretty small but highly influential universe. More negotiating leverage in my view.

The research university was originally a German innovation in the early 1800s, combining teaching with research. United States universities borrowed the concept around the time of the Civil War with new institutions such as Cornell and John Hopkins University making research a core part of its model. The Morrill Act of 1862 established “Land Grant” Universities with part of their missions establishing research in agriculture and engineering foundational to their charter.

The Research University really came into its own during World War II with the Manhattan Project which created the Atomic Bomb that finished the War. Research Universities have been innovation machines and been at the forefront of discovering and inventing new technologies such as the Internet, radar, the Human Genome Project and Artificial Intelligence.

Under the Trump Administration, projected cuts for research from government agencies such as the NIH, NSF and DARPA would have a dramatic impact on funds received and obviously the research conducted. For example, the National Institute of Health spends $48.5 billion on research with 80% of that earmarked for university research…on the table right now is for that to decrease to $30 billion.

While studies such as the effect of alcohol on Zebra Finches vocalizations and how tokens impact pigeons behavior for gambling gain attention as evidence of the crazy things taxpayers are paying for at these out of control universities, our suspicion is the threat of the budget hammer is a weapon to get universities attention. For sure, every organization should reexamine how money is being spent and take out waste. More to the point, having leverage to accelerate the extermination of DEI policies, the woke virus and alarming antisemitism is the biggest target.

Thus, its my view that ultimately, the chainsaw research cuts that are feared will be significantly less and what comes out of this will actually result in a healthier system.

A less appreciated but significant risk facing the U.S. college and university economic model is attracting international students. Twenty years ago, there were 572,000 international students in U.S. college and universities. This represented about 2.5% of the student population and contributed approximately 3% of the revenue. Today, there is over 1.1 million international students which is 6% of student base but 12% of the revenue. At some public universities such as the University of Illinois, International students represent 30% of the overall revenue.

With all the other headwinds facing universities, any material decline of foreign students would be a huge problem. There are 277K Chinese students at U.S. universities with the Chinese Government recently telling students they should think twice about going to school in the United States. Traditional media and social media is full of warnings about hostility international students could face during the Trump Administration.

While I believe in actuality, the administration wants to bring the best and brightest from around the world, and then stay in the United States, the noise in the near term is most likely to result in many foreign students going elsewhere. International student demand for US postgraduate education (MA and PhD) is now down 44% since mid-January.

As Plato said, “Necessity is the Mother of invention” and what’s clear is the heretofore slow-changing university system is about to be disrupted. For some institutions, it will create enormous opportunities. For many others, it’s the beginning of the end.

You get better, or you get worse. You don’t stay the same.

Market Performance

Market Commentary

The market held its breath anxiously anticipating the meeting between U.S. Treasury Secretary Bessent with Chinese Vice Premier He Lifeng over trade issues. Word out of Geneva was the discussions were “productive”, which is likely to give stocks a lift Monday morning.

Last week, stocks treaded and took on some water, with the NASDAQ down .3%, the S&P 500 falling .5%, the Dow decreased .2% and the small cap Russell 2000 inched upwards .2%.

Leading growth names reported mainly solid results including Palantir which reported EPS growth of 62% alone with revenues increasing 39%. Other strong performers included Mercado Libre with 44% earnings growth and 37% revenue growth, more recent IPO Hims & Hers reported 111% revenue growth and Shopify had 27% revenue growth. Adtalem reported EPS soared 28% with the number of students reaching over 94K.

In the world of mobile services, DoorDash had solid results and also announced it acquired UK based Deliveroo for $3.9 billion and Seven Rooms for $1.9 billion. DoorDash reported 20% revenue growth and significant institutional buying. LYFT had 14% revenue growth but also an unexpected profit which resulted in shares gapping higher.

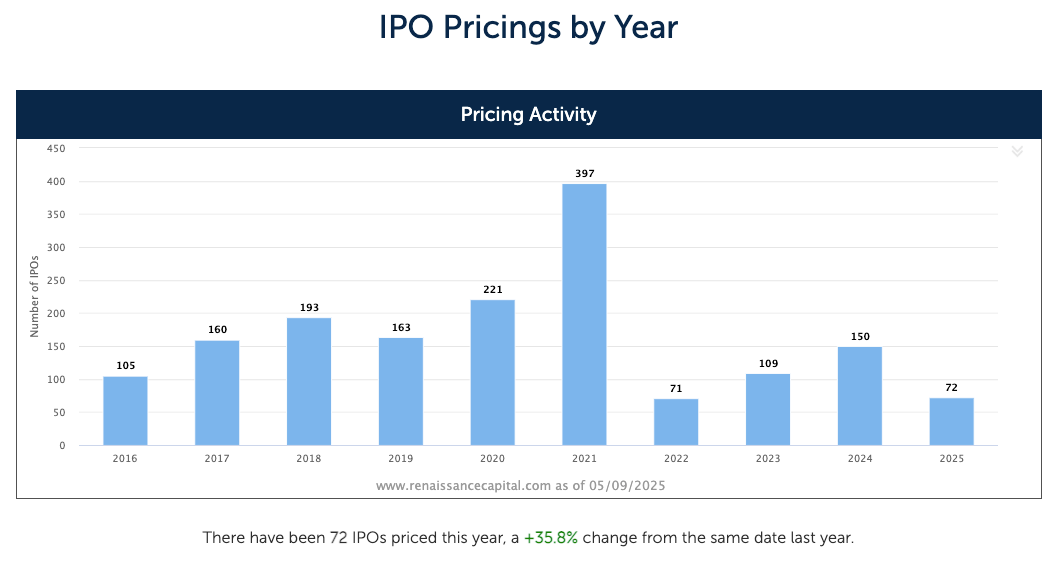

More evidence of investors/speculators embracing risk, Bitcoin blasted past $100K mark last week. Additionally, newer IPOs such as Rubrik, Bowhead Specialty, Loar Holdings and Mirex Group are acting well which is a good sign for fresh names from new issues.

While we’re not sure if we are out of the hyper volatile phase of the market we’ve been in for the past couple months, we are encouraged by the positive direction of change. Accordingly, for longer term investors, we’d look at weakness in leading growth names as a BUYING opportunity.

Need to Know

WATCH: At 82 years-old Domenic Stellato goes 16.02 (-1.0) to win the 80+ 100m at the Penn Relays | FloTrack

READ: Learning at the Speed of Light: A Conversation with Michael Moe | Educate AI

READ: Next | Jeff Selingo

LISTEN: David Senra · The Focused Few | Invest Like The Best

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

#3: Interest Rates

#4: Inflation

Charts of the Week

Maggie Moe’s GSV Weekly Rap

Chuckles of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM