“Far and away the best prize that life offers is the chance to work hard at work worth doing.” – Theodore Roosevelt

“Working hard for something we do not care about is called stress, working hard for something we love is called passion.” – Simon Sinek

“When you're surrounded by people who share a passionate commitment around a common purpose, anything is possible.” – Howard Schultz

Mission statements are ubiquitous in the corporate world, adorning office entryways, new hire welcome guides, and sales brochures. Unfortunately, that is where the “mission” ends for many.

Too often, companies seem more interested in projecting an image of virtue than actually living up to it. It would be impossible for an impartial third party to observe anything in the day to day operations of the business that reflects the mission statement. There is often a glaring disconnect between words and actions - Look at what I say, not at what I do.

We believe the most successful companies of the future will be those that are authentically values-based and mission-driven. These businesses will actively incorporate their values and mission across all elements of their operations - from the market they choose to service, to the way they treat their individual employees, to the way they actively impact their communities.

By doing so, they will create a culture that attracts top talent and motivates employees by fostering a sense of shared purpose and community among their employees. These Mission Corporations will create a virtuous cycle of success, where happy employees lead to happy customers, which in turn leads to business growth and long-term success.

The idea that companies that instill mission-driven values in their culture and operations are more successful is not a new one. In Built to Last, Jim Collins demonstrated through a six year research project that companies with a strong sense of purpose and values outperformed the overall stock market by a factor of 15 between 1926 and 1990.

My friend John Denniston, Chairman of Shared-X, talks about the concept of the “Triple Upshift” which is about using purpose as a driving force for growth and success.

The first "upshift" - companies that are driven by purpose and profits are attracting the best founders and employees.

The second "upshift" is that people want to buy from and associate with companies that are aligned with their values. In fact, many people will pay a premium for a product or service if they are mission-aligned.

The third "upshift" is that because this creates a better business due to more sustainable growth, investor capital flows into these types of companies at increased rates.

Modern enterprises’ competitive moats are its people and its proprietary data. Accordingly, at GSV, we believe that the balance sheet of the future will take into account not only physical assets like property, plant and equipment, but also proprietary data and human capital. On the human capital front, talent (including founders) will continue to flow to places that combine purpose and profits.

Consistent with the Triple Upshift thesis, recent findings from Linkedin show that 86 percent of millennials would take a pay cut in order to work at a company where they feel the values are in tune with their own. When the average person spends 90,000 hours at work over the course of their career, it's not surprising that individuals want to believe in what they are doing.

Moreover, for consumers, this applies to the way they spend as well. Reinforcing Upshift #2, according to 5WPR’s 2020 Consumer Culture Report, a whopping 83% of shoppers ages 18-34 want companies to align with their values.

Life is not a game of Monopoly, and a purely transactional model of employment is not sustainable (as my friend John Ortberg says, “When the Game is Over, It All Goes Back in the Box”). Despite unprecedented levels of employee perks and benefits, companies are facing a paradox: Gen Zers are projected to change jobs up to 10 times between the ages of 18 and 34.

This trend reflects a deeper shift in the way that people view work and career. The companies that effectively combine their purpose with profits will be the ones with the best employee retention. When employees do leave Mission Corps, it should be because they were inspired to start their own mission-driven venture.

For decades, GSV operated with the 4 Ps framework, but we recently added a 5th P - purpose. We saw the Four P’s - People, Product, Potential, Predictability - as the fundamental characteristics of the stars of tomorrow.

Over time, however, we found that emphasizing Purpose is so important that we added a 5th P. We did this because we believe that Purpose is a core element of businesses that will be the stars of tomorrow.

The 5 Ps

People:

By far the most important “P” when evaluating investment opportunities is “People”. There is no shortage of interesting ideas, but it’s always the team’s ability to execute against the opportunity that determines success or failure. Our experience is that “winners” find a way to win and attract other winners. When evaluating founders, we not only look at their experiences and strategic strengths, but we also look at the team that they are able to build around them including key partners, advisors, and early hires. At the end of the day, we bet on founders, because founders are what drive culture and their team around them.

Product:

The Second “P” stands for “Product.” We want to support companies that are leaders in what they do, have a proprietary product or service, or better yet, a “one-of-a-kind” type of business. Said another way, a company needs to have a claim to fame. We avoid “follower” companies, those that may be participating in the leader’s category, but due to market share, growth, and/or quality, are imitators rather than innovators. When looking at products, we try to find solutions that are differentiated and create 10X better user experiences than existing alternatives.

Technology, in general, and the Internet, in particular, are all about disproportionate gains to the leader in a category. We want to back businesses that not only survive, but thrive, during their corporate evolution.

Potential:

The Third “P” is for “Potential” — how big can this opportunity be? Determining the total future market potential is a pillar of our research. Megatrends influence our analysis as they provide “tailwinds” to accelerate growth. Often, the size of a market today doesn’t exist. As we connect dots, our analysis has shown us where there is tremendous opportunity for the future. The companies with the most potential are where the biggest problems are — the bigger the problem, the bigger the opportunity. Learning and talent is a multi-trillion dollar industry and thus, we look for companies addressing large as well as quickly-growing market segments within this broader investment focus.

Predictability:

The Fourth “P” is for “Predictability” — how visible is the company’s growth and what kind of operating leverage does it achieve with scale? For most new enterprises, having any degree of confidence in the forecast is a challenge. Instead, we are looking for business models that create predictability, whether it’s through recurring revenue or a clear articulation of operating metrics that drive the business. When evaluating companies, we analyze key signposts on the highway to see if the company is on track to reach its destination.

Purpose:

The last P is for “Purpose” — we think there is a fundamental shift taking place in the best businesses of tomorrow. There is a new “invisible hand” that is aligning economic incentives with purpose and meaning, where we believe the best, most long-term sustainable businesses will drive the highest returns. The greatest companies have equal alliances amongst employees, customers, shareholders, the environment, and the community.

Market Performance

Stocks were mainly dead to down last week with the S & P 500 losing 1.2%, the Dow down .8% and the NASDAQ up a smidgen .1%.

The Fed, as expected, raised rates for the 10th time in fifteen months, but said it’s almost done if not done. Not in time to save First Republic which was the third victim of the Fed’s botched response to “transitory” inflation.

In other macro news, New Farm payrolls were 253K crushing the expectation of 180K. Unemployment hit a fifty year low to 3.4%.

On the Company front, Apple did better than the bad expectations driven by robust iPhone sales. Uber had bookings up 40% with losses below expectations. And ChatGPT continued to cause havoc with Chegg falling 45% catalyzed by the impact it was having on bringing on new students.

This Market is not for the faint of heart but it is one for long term investors who are acting on knowledge not fear. Over time, the enterprise growth of a company will drive its stock price with many high growth businesses we follow attractively valued.

It’s a market of stocks.

Need to Know

LISTEN: Is AI the End of the World? Or the Dawn of a New One? | The Free Press

READ: Naval for Kids

LISTEN: Peter Thiel Says America Has Bigger Problems Than Wokeness - Honestly with Bari Weiss

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: Yardeni

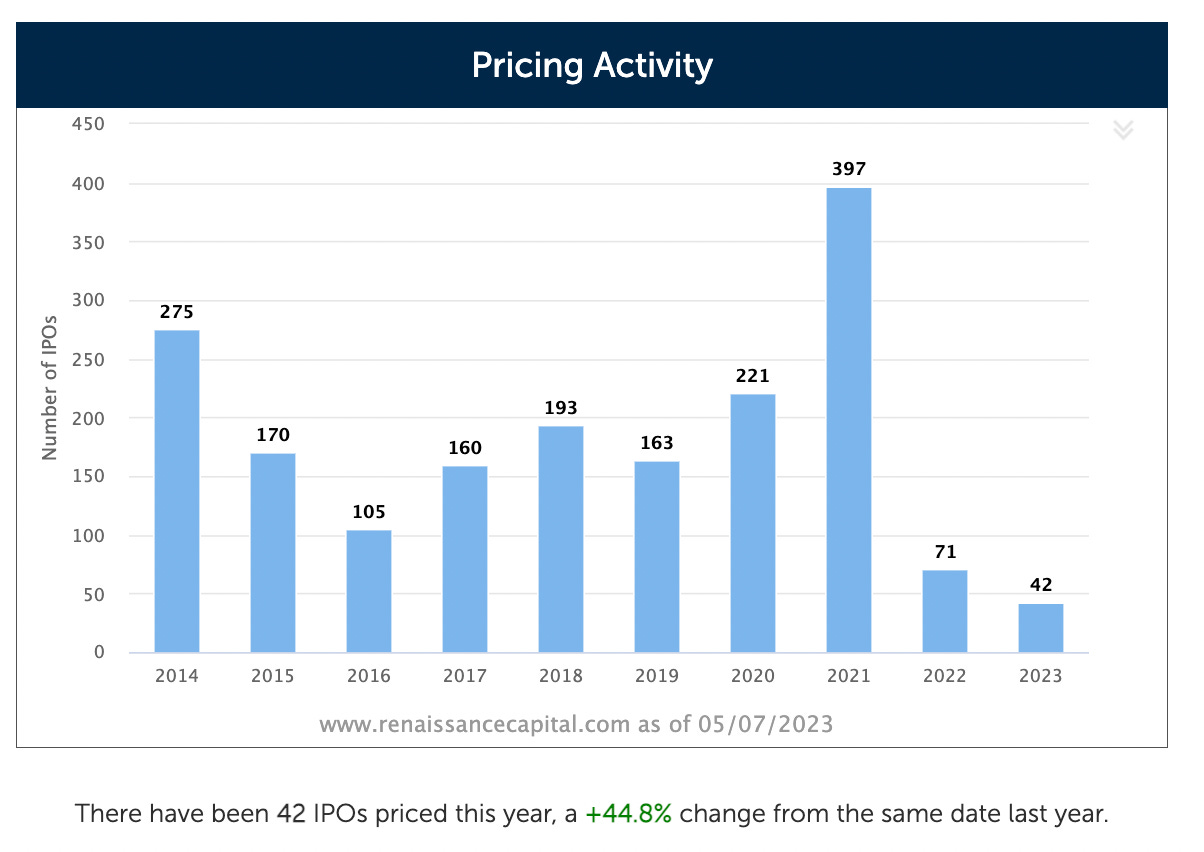

#2: IPO Market

This week, J&J spinoff Kenvue went public in the biggest IPO since Rivian in 2021. Kenvue sold 172.8 million shares in the IPO priced at $22 a share, at the higher end of the expected pricing range. Kenvue has over $2 billion in cash flow and a 3.7% dividend.

Source: Renaissance Capital

#3: Interest Rates

Last week, The Fed raised rates by 25 basis points, its 10th consecutive rate hike since March 2022. The Fed language indicated that a pause in rate hikes may be likely, but Fed Chair Powell noted that it “would not be appropriate to cut rates” yet.

Source: Edward Jones

#4: Inflation

On Wednesday, the Bureau of Labor Statics will release its latest US consumer price index report. Headline consumer price inflation is expected to be 5%. The rate has dropped every month since hitting 9.1% in June 2022.

Source: Bloomberg

Charts of the Week

Source: Kevin Smith

Chuckles of the Week

EIEIO…Fast Facts

Entrepreneurship: 0.96% – median equity grant for the first hire at a startup in 2022 (Source)

Innovation: $15.3 billion – China’s total investment in quantum technology to date (Source)

Education: 13% – percent of the nation’s eighth graders that were proficient in U.S. history last year (Source)

Impact: 90% – percent of consumers willing to spend an extra 10% or more for sustainable products, up from just 34% of consumers two years ago (Source)

Opportunity: 40% – percent of crony-capitalist wealth that derives from autocratic countries (Source)

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…. EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM