United States Secretary of Education Linda McMahon will speak at the 2025 ASU+GSV Summit. Click here to register.

GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: €10 million - The size of the new Harry Stebbings-led “Project Europe” fund, which will offer $200k checks to 18-25 year old entrepreneurs in Europe. (FT)

Innovation: –33% – The percentage drop in current software developer job listings compared to 2020 levels, marking the lowest point in five years. This follows a pandemic-driven surge that peaked in August 2022 at +93% above 2020 levels. (Visual Capitalist)

Education: 71% – The percentage of parents who think their children love school, compared to 41% of students who report they love school. (FutureEd)

Impact: ~60% – The percentage of all alcohol that is sold and consumed by the top 10% heaviest drinkers in the United States. (Newsweek)

Opportunity: >600 – The number of free online courses offered by Harvard. (Top Universities)

I spent last week in Thailand, so no EIEIO, but here's something from my last Asian adventure - my keynote from India last month. The topic: Where do BIG companies come from?

Market Performance

Market Commentary

The markets extended their losing streak to four consecutive weeks, with the Dow falling 3.1%, S&P 500 losing 2.3%, and Nasdaq dropping 2.4%. This pullback comes amid significant developments in both traditional and emerging sectors. The AI landscape saw major moves with Microsoft's MAI model development, ServiceNow's proposed $3B Moveworks acquisition, and CoreWeave's strategic partnership with OpenAI. Meanwhile, the crypto sector received a boost from Binance's $2B investment from Abu Dhabi's MGX fund.

On the macro front, inflation data showed signs of moderation, with February CPI rising 0.2% monthly (2.8% YoY) and Core CPI holding at 3.1% YoY. Notable market events included gold breaking $3,000 for the first time, Klarna's U.S. IPO filing, and Goldman Sachs revising their S&P 500 year-end target to 6,200. The upcoming Fed meeting next week is expected to maintain current rates, though market participants remain cautious given ongoing concerns about trade policy, government spending, and growth prospects. The technology sector continues to drive significant deal activity, highlighted by Intel's new CEO appointment and Databricks' strategic partnership with Palantir, suggesting continued innovation despite broader market uncertainty.

Need to Know

WATCH: #1: Sequoia’s Doug Leone: Trauma, Hardship, Purpose, and Silicon Valley’s Top Firm | Divot

READ: This Analysis Cost 27 Cents | Tomasz Tunguz

LISTEN: #89: America’s Crypto Reserve, Nvidia’s $600M Hit & Digg’s Comeback | More or Less

GSV’s Four I’s of Investor Sentiment

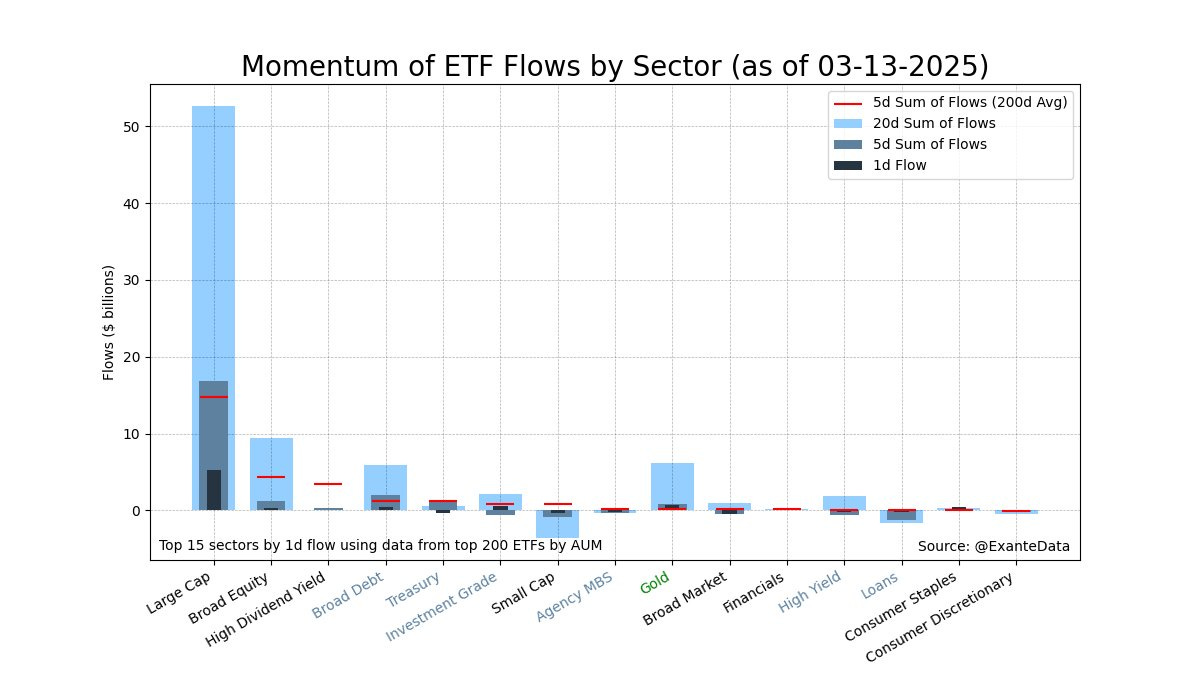

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

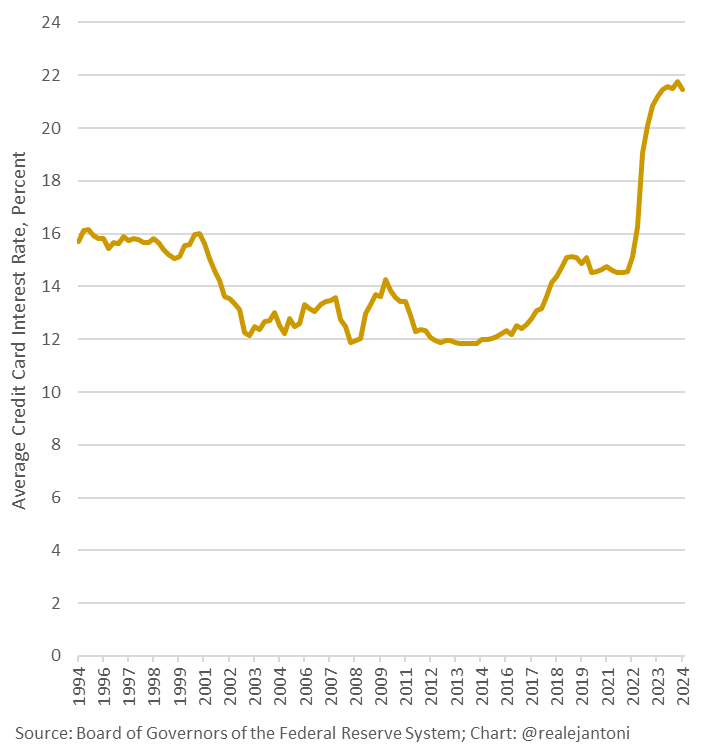

#3: Interest Rates

#4: Inflation

Chart of the Week

Maggie Moe’s GSV Weekly Rap

Chuckle of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM