“The trend is your friend.” – Martin Zweig

“Follow the trend lines, not the headlines.” – Bill Clinton

“In order to be irreplaceable, one must always be different.” – Coco Chanel

“I don’t set the trends. I just find out what they are and exploit them.” – Dick Clark

Megatrends are powerful technological, economic, and social forces that develop from a groundswell (early adoption), move into the mainstream (mass market), and disrupt the status quo (mature market), driving change, productivity, and ultimately growth opportunities for companies, industries, and entire economies.

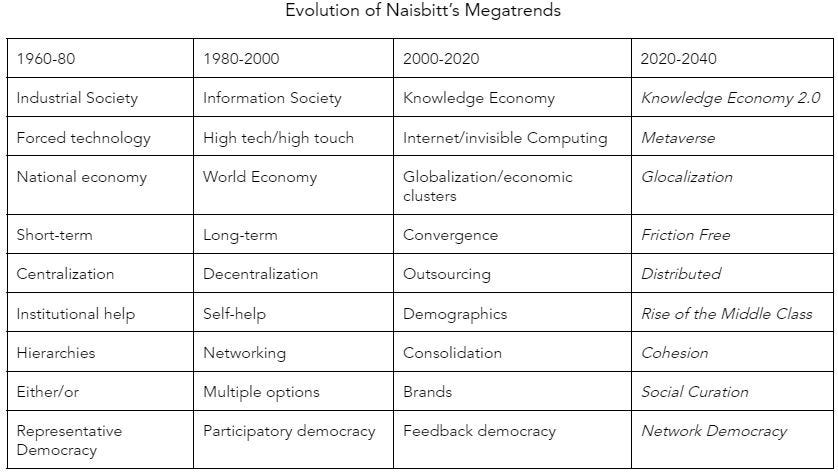

In his 1982 book Megatrends, John Naisbitt identified several trends, in various stages, within the restructuring of an industrial economy that was regionally concentrated and national in focus, with corporate America best characterized by industrial giants and extensive management hierarchies. Technological improvements were often feared, particularly by workers and unions. Politically, power remained concentrated, polarized by business, labor, and social issues, and focused on short-term solutions.

Amid this restructuring—which the consensus had yet to appreciate and fewer still wanted to embrace—Naisbitt anticipated what most feared: the continued decline of manufacturing and the rise of the information economy.

The trends he identified more than 40 years ago have steadily evolved. Aside from identifying the trends themselves, one of Naisbitt’s key insights was that the most powerful of the trends occurred independently, across geographies, and throughout communities, only later becoming a prominent collective trend.

What Naisbitt culled from these seemingly disparate trends were common factors catalyzing the restructuring of the past, present, and probable future.

Identifying new trends is always difficult. As the venture capital community notes, by the time something becomes a trend, it is too late for many investors to reap benefits. That said, only by continuing to look for the forces that shape the realms of businesses and consumers can we hope to understand and capitalize on emerging growth markets in today’s global economy.

It’s important to distinguish between a fad and a trend. As I asked in Finding the Next Starbucks, is it Krispy Kreme or Starbucks? Is it Beanie Babies or De Beers? Pet rocks or pet animals? How do you do it? Realistically understanding a trend’s predictability and long-term potential is key to identifying the real opportunity.

To identify the 10 megatrends, we used three following criteria:

Universal. Does the megatrend apply to each and all the major sectors of the economy (education, healthcare, finance, consumer, manufacturing, government)?

Transformational. Is the megatrend a game-changer in terms of large-scale change across society, politics, and business?

Long-term duration. Does the megatrend affect change over the long term (10-20 years), and is it future-looking?

In the coming years, these megatrends, as well as many new ones, will continue to create the most significant market opportunities, providing the fundamental catalysts to growing markets through their influence on consumer behavior and business processes. They will serve as the building blocks for the introduction of new products and services, as well as creating growth opportunities within more mature markets.

My view of current and future trends is that they are extensions of past megatrends. The Knowledge Economy, for example, may be considered a “megatrend of megatrends” or “metatrend” that has an extended duration and will continue to power the future.

In the years ahead, I anticipate that the dynamic changes that have taken place during the past bull market will serve as stepping stones for future growth opportunities. Below are the ten megatrends that will define the coming decade.

#1 Metaverse

What it is:

The short definition: the evolution of the internet with two major enhancements, real community and real ownership.

The long definition (from metaverse guru Matthew Ball): A massively-scaled and interoperable network of real-time-rendered 3D virtual worlds which can be experienced synchronously and persistently by an effectively unlimited number of users each with an individual sense of presence; while supporting continuity of data, such as history, identity, communications, payments, entitlements, and objects.

To translate both of these definitions, we see the metaverse unfolding in three ways:

The metaverse will integrate our physical and virtual worlds seamlessly and naturally.

This integration of physical and virtual worlds will empower people to have more meaningful community, ownership, and commerce on the internet.

Digital natives already feel more appreciated, creative, and like themselves “online” than “offline.” They will be the earliest adopters of the metaverse and start to work, live, and play in new ways.

Why it matters:

The metaverse is not a vertical trend; it’s a horizontal trend that will impact sectors ranging from healthcare, education, socialization, entertainment, commerce, and more.

Contrary to popular belief, the metaverse will make the internet feel more natural. Video calls will feel like someone is actually there, glasses will give you immediate translations of street signs in foreign languages, healthcare professionals will practice surgeries without risk to patients, and learning won’t be limited by geographical location.

As we discussed last week in Smoke Signals, the prior waves of computing (mainframe, personal, and mobile/cloud) made information, communication, and content globally accessible.

However, the current state of computing does not address three realities about today’s world:

Humans did not evolve to interact, learn, or communicate in 2D.

Prior waves of computing are designed to serve physical experiences, many of which are now virtual.

People are starting to value their “online” identities and capabilities more than their “offline” selves.

Source: New Consumer

These shifts will majorly affect how we work, play, and live. The metaverse will blend technology into the world to see it differently (mixed or augmented reality) or to see a different world altogether (virtual reality).

We think the first significant use case for the metaverse will be in the enterprise, as knowledge workers will use devices bought by employers to create a more effective and immersive way to work. This adoption curve mirrors the evolution of the PC and the mobile phone – both of which entered the consumer market after becoming “must have” tools in the enterprise.

Consumers, brands, and corporates are already excited about the metaverse opportunity: 59% of consumers are excited about transitioning their everyday activities to the metaverse. McKinseyestimates that the metaverse could generate $4-5 trillion of economic value:

Investment Implications:

We think the five categories are the most compelling opportunities in the metaverse:

Digital Experiences: Education, Work, Leisure, Sports

Digital Communities: Friendship, Socializing

Digital Commerce: Wallets, Currency, and Assets

Digital Infrastructure: 5G/6G

Digital Access: Hardware, Devices

Here are some companies to watch in those categories:

Digital Experiences: Dreamscape Learn, Vatom, Microsoft, Horizon Workrooms (Meta), Wave

Digital Communities: Epic Games, Yuga Labs, Vatom, Gather, Genies

Digital Commerce: Block, Metamask, PayPal, Etheruem, Solana

Digital Infrastructure: Nvidia, Qualcomm, Verizon, Azure, Condense Reality

Digital Access: Oculus (Meta), Apple, Microsoft, Samsung, Mojo Vision

#2 Thinking With Machines

What it is:

Although it’s been over 10 years since Marc Anderessen’s famous “Software is Eating the World'' piece, we’re still in the early innings of software and digitization.

Over the next 10 years, we think that an equally impactful shift will occur: while software will continue to take over segments of the economy, the way that software impacts our lives will evolve. We call this shift moving from working with machines to thinking with machines – and it's primarily driven by AI and data. If software is eating the world, then AI is its teeth.

Working with machines meant businesses digitized manual workflows and collected data: the primary insight was how you spend your time. Thinking with machines allows businesses to harvest insights and predictive analytics from this data. The primary insight will be how you should spend your time. If software and AI are the engines of Knowledge Economy 2.0, then data is the fuel that keeps it going.

One way to understand this trend is Billy Beane’s approach in Moneyball. While every team collected prescriptive data on their players and competitors, Billy Beane went one step further than his competitors by developing a predictive model to find the best players for his team.

While competitors were running their teams on gut feel and intuition, Beane crunched decades of data to develop analytics and insights on how to build an outperforming team. Moneyball fundamentally changed how coaches, fans, and players evaluated the game of baseball.

This shift from prescriptive to predictive software will dramatically increase the productivity of both our digital and physical lives. This shift has already unfolded in social media: TikTok’s recommendation engine brought AI to the masses. TikTok reinvented how we consume content: people spend over 90 minutes per day on TikTok – more than Snapchat, Facebook, and Instagram combined.

Why it matters:

AI-driven predictive analytics will not just be used for choosing funny videos – every industry will develop products and platforms to make our work, life, and play more productive. AI has been around for 50+ years, but it is becoming faster, better, and cheaper for two primary reasons: (1) a 94.4% improvement in training speed for AI models since 2018 and (2) the recent ability to create real-time predictive insights to optimize outcomes.

These innovations have created a tighter feedback loop that can create more predictable and positive outcomes across industries. AI will help doctors improve hospital operations and procedures, will help educators develop individually tailored offerings, and sports teams evaluate their talent and competition. The Denver Broncos have twice as many data scientists (6) as quarterbacks (3) on their roster.

Integrating AI will be a need to have – not a nice to have – for the companies, teams, and organizations that want to win over the coming years. There will be two concurrent “AI revolutions” that will be equally impactful: an applied AI and generative AI revolution.

Applied AI is bringing predictive and analytical decision making to automate activities, develop products, and make better decisions in the enterprise. Alexandr Wang, CEO of Scale, highlights the potential impact of applied AI as follows:

“If you spend all day in a Word Processor, all day in Excel, the actions that you take in those products are some of the most likely to be automated, frankly. And for the most part, I think a lot of that work is probably not very inspiring and so it will be this incredible enabler of leverage to think bigger about those kinds of jobs.”

“If your Turing test is a set of programming interviews to get a job at Google, you probably have a machine learning system now that can pass that Turing test [...] the machines are now better at a lot of that work than humans.”

ARK research suggests that by 2030, AI will increase the output of knowledge workers by 140%. The “AI ROI” is already becoming clear in a recent McKinsey survey:

79% of respondents report a cost decrease via AI adoption; 67% of respondents report a revenue increase via AI adoption

5.3% CAGR increase in 5-year revenue from companies adopting AI: 2.1x higher than non-AI companies

12.6% CAGR increase in 5-year total return to shareholders: 2.5x higher than non-AI companies

27% of respondents report at least 5% of EBIT being attributable to AI

Generative AI is nothing less than a creative revolution – machines are generating art and text that are indistinguishable from human creation. This is something new – not just collecting and analyzing data about what already exists. While applied AI harvests data to enhance enterprise decision-making, generative AI makes knowledge and creative workers more efficient and capable.

This is what the Stable Diffusion AI created when I asked it to produce art on “finding the stars of tomorrow”

As Patrick O’Shaughenessy puts it, generative AI such as Stable Diffusion and GPT-3 are more like search engines than creative tools. While the information we get from Google keyword search is an approximation of what we are interested in, generative AI tools return search results for the exact thing that you imagine.

AI is now winning art competitions and achieving passing grades writing college-level papers. Its works are created in minutes, not days.

The chart below from Sequoia’s recent piece “Generative AI: A Creative New World” highlights a potential timeline for the evolution of generative AI applications:

Investment Implications:

Applied and Generative AI will make people work more efficiently and creatively. This will reshape how workers in the Knowledge Economy write, code, make art, design, and make decisions.

Applied AI Companies

Palantir

C3.AI

Scale

DeepMind

Fatbrain AI

Generative AI Companies

OpenAI

Stability.AI

Runway

ByteDance

GitHub (Microsoft)

#3 Digital World

What it is:

We live in a digital world. 63% of the world’s population (5 billion people) are online… and it’s gaining a larger share of our attention. ARK Invest estimates in 2021, internet users spent 38% of their free time online and projects that by 2030, the majority of users’ free time will be spent online.

All firms and markets are affected by digital transformation with 58% of all customer interactions digitized and 55% of products and services that are partially or fully digitized. CPG and consumer companies are far along – global e-commerce has risen to a 22% of retail sales and is set to continue gaining traction.

eCommerce Penetration by Region

Source: Morgan Stanley

Digital Healthcare means an explosion of data from electronic medical records, image databases, self reports, health trackers and wearables, and the analytical tools to provide personalized treatments. Big data is being used in pharmaceutical R&D to discover targeted drug candidates and recruit eligible patients for clinical trials.

In financial services, advancements in fintech, cloud and blockchains have popularized online banking and boosted financial inclusion. Robo-advisors will automate the process of investing without human supervision. Digital payment solutions have emerged as the safest, quickest and most convenient option for financial services. Precise and efficient processes will continue to bring precision underwriting in insurance and lending.

Smart manufacturing is changing how products are designed, fabricated, used, operated and serviced. Intelligent devices allow machines across factory floors to talk to each other while collecting data on operations in real-time.

GE leverages sensors to monitor humidity conditions while vehicles are being painted and execute adjustments on the fly. HIROTEC has virtually eliminated the time needed for the manual inspection of production systems by using IoT technologies to visualize and generate reports on production lines.

The US government, which still relies on snail mail and requires you to take in-person trips to the DMV, still has a ways to go. But what if accessing public services could be as easy as online shopping? South Korea is rolling out AI-based chatbots and mobile IDs to replace plastic cards. $1T worldwide could be generated by digitizing public services, according to McKinsey.

Investment Implications

“Faster, better, cheaper” is the motto of the Digital World, and that value proposition still has several more decades to run. Digitization is getting faster with 5G and 6G connectivity, better with software and AI, and cheaper with dropping costs of hardware, cloud storage and vast libraries of open-source code.

In whatever their domain or industry, investors must continue to identify the firms with the strongest technology, processes, and talent powering digital transformation. Some of the companies on our radar with this megatrend include:

Alphabet

Alibaba

Pinduoduo

Protolabs

Flexport

Chewy

Opendoor

Twilio

Klarna

Block

#4 Friction Free

What it is:

Friction is the opposite of “better, cheaper, faster.” Innovators continue to remove friction in cost, geographies and social interactions. The biggest disruptors remove cost from a buying decision.

Just look at Google, YouTube, Spotify, Zoom, Robinhood. If you had to pay a penny to use their services, would they have gotten where they are today? I’d bet against it. By being friction-free, they created network effects and huge advantages over the competition. If you can get tens of millions of people to do anything, you can find a way to monetize it eventually.

Friction Free enables the superpower of network effects. Consider Zoom, whose one-click meetings reinforced network effects within a team and across companies. No more meeting codes and dialing numbers. With a killer experience that would get even better as more people used it, Eric Yuan knew he could create long-term monetization. As he explained in Andrew Chen’s “The Cold Start Problem”:

"I wanted Zoom to be free, at least for the basic experience, so that people could see why it was so much better. I first thought, maybe it should be limited based on participants. Maybe 3 attendees could join, but once there were 4, you’d have to pay. But that didn’t feel right. I studied Dropbox’s pricing strategy and wondered, why did they start charging at 2 gigabytes instead of 1? As I thought about it, I realized, it gave you time to use Dropbox more, and the more you used it, the more likely you will hit the cap and start paying. I wanted Zoom to be the same way, so I set the limit to be 40 minutes per meeting but you could get the full experience of the product. That way, if the quality was good and you liked it, then you’d eventually pay."

Why it matters:

Consider the frictions involved in everyday life: traffic congestion, a cluttered email inbox, or waiting for a package delivery. Businesses face friction hiring and training new people, teaching users how to use product features, and managing angry customers. Governments abound with administrative and legal friction.

With dozens if not hundreds of disruptors tackling these problems, these frictions will increasingly evaporate. Amazon Go (retail checkout), Zipcar (car rental), Zocdoc (doctor search), Convoy (truck freight), and Airtable (no code) are all indications of what’s to come.

Importantly in today’s Knowledge Economy, “cost” isn’t just counted in money and time, but also in attention and data. Just because you searched on a vacation website in West Virginia doesn’t mean you should be harassed by every other company in that market. If you’re creeped out by the data that free platforms are extracting from you, that’s friction.

The exploitation of users is a temporary strategy at best. The cost/benefit of handing over data will increasingly tilt in the favor of consumers as digital products become more transparent. People will be more empowered to get what they want and need more efficiently while owning their privacy and data.

Manuel Sevilla, chief digital officer of business services at Capgemini, provided five fundamentalsof creating a frictionless enterprise:

Hyperscale automation – touchless processes (e.g. ‘Invisible Learning’)

Cloud agility – scaling with cloud-native architectures, IoT, 5G and edge computing

Data fluidity – breaking down data silos and using AI to efficiently identify problems

Sustainability – empowering corporate responsibility and considering data design to reduce cognitive and emotional friction among employees and customers

Secure business - developing trust throughout the ecosystem, cybersecurity

Investment Implications:

Innovators and disruptors will leverage the above principles to make life easier and better for us all. We think the companies that continue to remove friction, while also incorporating sustainable practices around their mission and their data will thrive.

Some companies we’re watching in this trend include:

Amazon

Canva

Zocdoc

Airtable

Robinhood

Dropbox

Zoom

Lyft

Spotify

Instacart

#5 Glocalization

What it is:

Demographics are destiny – and there are region-specific themes that point toward the future destiny of the world. While we’re big believers in globalization (it’s gravity), counterforces spurred by COVID have underscored the importance of regional trends as realities of trade wars, nationalism, and tensions among superpowers have slowed the ongoing pull to bring the world closer together. We call this glocalization – the combination and tension between heightened regional dynamics in a hyperconnected world. There are a number of regions we have our eyes closely on.

The Rise of Asia – VCHIIPS (Vietnam, China, India, Indonesia, Philippines and Singapore)

Only 12% of the VCHIIPS population are older than 65, and 24% are below 15 years old. In contrast, the old economic engine for the World (U.S., Europe, Canada and Japan) is the exact opposite: 25% of the population is older than 65 and only 10% of the population is under 25.

Asia quadrupled in size over the last century and is forecast to grow to over 5 billion people by 2050. Its growth will be led by India, who will account for more than half of the increase in Asia’s workforce in the next decade.

Southeast Asian countries like Indonesia, the Philippines and Vietnam are on track to participate in similar growth trends. Young populations, proximity to China, foreign investments in manufacturing, an untapped consumer market, a digital boom, and economic collaboration all provide tailwinds for the region.

In 2022, the largest free trade area in the world – “By Asia, For Asia” – was ratified in the Regional Comprehensive Economic Partnership (RCEP). The agreement between the ASEAN countries and six partner countries (China, Japan, South Korea, Australia, New Zealand) covers a market of 3.4 billion people with a combined GDP of $49.5 trillion, and will accelerate trade throughout the region.

Meanwhile, Chinese technological leadership is leaving its mark. Projected to leapfrog the US as the world’s largest economy by 2035, China is now the leader in international patent applications, has overtaken the US in top-cited scientific publications, and has contributed the largest to the growth in R&D expenditures in the past 20 years.

MENA (Middle East and North Africa)

MENA consists of three regions accounting for 7.5% of the world’s population – North Africa, the Gulf Countries, and the Levant. These countries are experiencing rapid population growth and high fertility rates (2.8 births per woman vs. 1.6 in OECD countries) and over 30% of the population is under the age of 15:

The demographics of MENA present a huge opportunity to grow their labor force and economic prospects, provided that governments embrace reforms and increase incentives for private sector participation. The region has the highest rates of youth unemployment - between 23% and 27% – twice the global average.

That being the case, MENA is at the center of the world. Within an eight-hour flight, 2/3 of the World’s population is accessible from Dubai, home of the world’s most active International Airport. As governments speed up educational reforms to transition from an Oil Economy to a Knowledge Economy, MENA will flex an entrepreneurial muscle that has yet to be seen and break longstanding cycles of poverty and inequality.

Africa

Of the top ten fastest-growing economies, five of them are in Africa: Uganda (1), Tanzania (3), Mozambique (6), Egypt (8), and Madagascar (9). Of the top 20 countries with the fastest growing populations – all Africa. 41% of the African population is under the age of 15. As its population grows, so too will the African middle class, which will reach 1.1 billion by 2060.

Hence, part of the hyperglobal focus on being a friend to Africa. China is playing the long game with infrastructure investments through its Belt and Road Initiative (BRI), but not all Africans want to live in a communist system. That gives the United States an opening, one in which President Biden wants to take in his New Africa Policy.

Historically, Africa was a place where do-gooders were abundant. But with the ability to leapfrog pre-existing systems (because current systems don’t exist), plus massive demographic tailwinds, Africa is a very fertile environment whose potential can be reached faster than what people might suspect.

Globalization Countertrends:

As economic power shifts southeast, cracks are emerging in our global system. Global trade - which peaked in 2007 - shuddered under trade barriers and protectionism.

But the countertrend didn’t start with COVID. Beyond the recent US-China trade war, the number of restrictive trade measures has increased more than 200% between 2008 and 2018, compared to the previous decade. Foreign direct investments and the ratio of gross foreign assets to GDP have also slowed.

In the US, the one issue on which Biden hasn’t broken with his predecessor is trade with China. Leading the developing economies is Xi Jinping, whose “Made in China 2025” initiative seeks to make China dominant in high-tech manufacturing to rival Western enterprises and reduce dependence on foreign technology.

China’s new international institutions such as the BRI and the Asian Infrastructure Investment Bank (AIIB) highlight how regional economic development can be leveraged as a foreign policy tool as it seeks a dominant position in global markets.

Investment Implications:

The relative rise of China and decline of the United States is setting the stage for a great power conflict currently being waged in a techonomic cold war. Tariffs on $500 billion worth of imports. Delisting of Chinese companies from US stock exchanges. And the percent of Americans that favor using U.S. troops to defend Taiwan if China invades the island is at an all-time high (52%).

The implications of the new glocalization are massive and already being seen as China and others are developing more vertically integrated domestic industries and supply chains. Whether or not the cold war turns hot, it’s clear that the geopolitics and global economics of the future will be increasingly connected, virtually, while at the same time divided, politically.

Ten companies whose multinational and regional influence will have an impact:

Pinduoduo

Flexport

Faire

Modern Treasury

FourKites

Sourci

Balance

Stockarea

DocShipper

Arkestro

#6 Rise of the Middle Class

What it is:

Since 1980, 800 million Chinese have been lifted out of poverty. That was the first wave of China’s Middle Class. The second wave will be harder.

While tech giants like Alibaba and Tencent have enriched a small proportion of people and built a massive influence, they haven’t brought mass affluence. In a world of unequal tensions, the pressure to create a vibrant middle class only becomes more significant – especially across heavily populated countries like China, India, and Indonesia.

Recall that 60% of the world’s population lives in Asia. By 2030 China and India alone will represent ⅔ of the global middle class.

In the past decade, China nearly doubled its percentage of students attending higher education (30% in 2012 to 58% in 2021). In the next decade, India is projected to do the same, and in the process bring 80% of households to middle-income status. High-income and middle-income segments will grow from 1 in 4 in 2018 to 1 in 2 in 2030.

By the end of 2030, Chinese middle-class spending power will be equivalent to the middle classes of North America and Western Europe combined. Even so, their increase won’t be as dramatic as India’s, whose average of middle-class citizens (32) will be 10 years younger than the average age of a Chinese middle-class citizen (42).

Why it matters:

What do people do after they become middle class? They 2X their spend on essentials (housing, food, apparel, electronics) and 3-4X their spend on services (education, healthcare, entertainment, childcare). Half of that consumption will be buying more of the same; while the other half will be on upgrading to premium offerings and adding to new categories of consumption.

Source: World Economic Forum

India’s millennials and Gen Z will become major consumption pools and will pave the way for tech-forward products, services, and business models. Previously unaffordable ride-sharing and entertainment streaming companies will see big gains. Telemedicine will bring quality consultation from the 80% of doctors in India’s urban areas to the 60% of Indians living in rural areas. Similarly, EdTech will provide quality skilling, re-skilling and upskilling to India’s knowledge workers.

Indian companies won’t just copy western models at a lower cost. Entrepreneurs will look to Chinese business model innovations including mobile fintech, AI-powered ecommerce, and service ecosystems as a template for new models shaped according to the unique tastes and preferences of the Indian consumer. The market will become an inescapable target for new tech and service companies around the planet.

Investment Implications:

Here are ten companies to watch in markets with an emerging middle class:

Bombay Shaving Club

Amazon India

Grocery Pantry

Fab Bag

Byju’s

PhysicsWallah

Mattilda

Mercado Libre

Isaac

Neon

#7 Mission Corp

What it is:

Capitalism as articulated by Adam Smith in 1776 has been the greatest force of economic prosperity and standard of living improvements in the history of civilization. But capitalism needs a refresh, and that’s where Mission Corps comes in.

The great businesses of tomorrow combine the ambition of a for profit with the heart of a non-profit. Businesses need more than just profits to define them: they need a purpose and the “double bottom line.”

Mission Corps are governed by Seven Declarations:

The company will amend the articles of incorporation and have a stated mission or a “purpose of being” in the business formation documents, as well as on the company’s corporate website. The company will commit to utilize its business platform to impact society or their chosen market in a positive way.

The company will establish an equity or option grant plan of at least 10% whereby every full-time team member will have some form of equity compensation or stock to tie them to the success of the company and its mission.

The company promises to dedicate at least 3% of employee time to social/charitable causes, plus 2% of net income and 1% of revenue or equity to support at least 1 of the 17 United Nations Sustainable Development Goals.

The company commits to establishing a merit-based performance culture and establishes core values the team will be measured against for compensation, recognition, and advancement.

The company will commit that the CEO’s base salary will not be more than 20X the base salary of its lowest-paid full-time employee, and it will strive to create a diverse executive team that is blind to race, gender, and ethnicity.

The company has structured a board of directors with at least one outside director beyond the founders of the business and commits to diversity and inclusion.

The company will commit to investing in human capital and continuing education for all team members to improve their skills, as well as to help them develop as professionals and citizens to leave a positive impact on society.

Why it matters:

Adam Smith’s “Invisible Hand” of Capitalism is broken: 54% of Gen Z hold negative views of capitalism. It’s not that they are stupid – it’s that they see a system that today seems rigged. While innovation continues to grow, inequality is rising just as fast.

In 1965, a typical corporate CEO earned about twenty times that earned by a typical worker; by 2018, the ratio was 278:1, according to the Economic Policy Institute. Between 1978 and 2018, CEO compensation increased by more than 900 percent while worker compensation increased by just 11.9 percent.

B Corps have been one effort to meet this need of a new corporate entity for contemporary capitalism. B Corps’ goal is to “make business a force for good” that encourages leaders to build communities, not just profits. So far, the message is resonating: there are over 5,000 certified B Corps in 85 countries, employing 465,530 workers.

While the B Corp movement has made a positive impact, we think the Mission Corp is a more interesting (and impactful) form of capitalism because it is not driven by being self-serving “do gooders” or paying lip service. Instead, Mission Corps put their “money where their mouth is” by optimizing every part of their business around their mission.

The rise of Mission Corps will create a “triple upshift” in the way companies do business:

Mission Corps will attract the best people: talent has a broader interest than making money, and companies need talent that has a mission. 80% of Gen Z wants to work at an employer that has better alignment with interests and values.

Mission Corps will improve customer alignment: consumers want to align with companies whose values are the same as their own, and they will pay more for products that they believe in and support. Patagonia and Chick-Fil-A don’t just sell sweaters and sandwiches; they sell an aspirational lifestyle to their customers and stakeholders.

Mission Corps will enhance financial performance: investors are putting a premium on companies that have a mission. Mission Corps have sustainable growth and a protection of franchise that is impossible to fake. Companies that sell a product and a purpose outperform, as shown below in the Stengel 50:

Investment Implications:

Mission Corps will be the most sustainable and successful businesses in the coming decades. Here are 10 companies that we have our eyes on:

Nike

Starbucks

The Honest Company

Salesforce

Sweetgreen

Allbirds

Patagonia

Mezli

Toms

Bombas

#8 Everything is a Subscription

What it is:

Recurring revenues are the holy grail of predictable growth. Businesses and investors love subscriptions because it creates predictability. Consumers love a predictable cost that provides overwhelming value for what they pay.

With technology, it’s exciting to always have the latest and greatest product, as opposed to buying software that makes itself obsolete in six months. Take a leased Tesla for example. Unlike a typical car that gets less valuable the second you drive it off the lot, every 2 weeks, there’s an update that makes the Tesla perform better (and makes your lease more valuable).

Marc Benioff, the founder of Salesforce, was the most visible pioneer for turning the software model into an ongoing subscription. Software as a Service. Benioff’s vision was to make purchasing software easier, simpler, and more democratic. The customer would always have the latest and greatest with the cost of ownership being much lower and more high value.

Other industries have adopted this model and we now have seen Music as a Service (Spotify), Entertainment as a Service (Netflix), Education as a Service (Masterclass), and Wellness as a Service (Whoop) to name a few.

The data on subscription models backs up Benioff’s thesis that a subscription makes purchasing easier, simpler, and more democratic:

53% of all software revenue is generated from a subscription model

34% of US households won’t have a traditional TV subscription

The average subscription billing vendor is growing 30-50% annually

Why it matters:

This week, a thread on Reddit titled “In 50 years, what will people be nostalgic for?” went viral. The #1 answer?

While the above answer may be cynical, we’re believers in the Benioff model that subscription services make purchasing easier, simpler, and more democratic.

Take the fitness wearable company Whoop as an example. Whoop initially offered its device for $500, but pivoted to a membership model. Whoop’s fitness hardware is free, while they charge a $30/month subscription for unlimited access to data, coaching, and product updates.

This model differentiates Whoop from other wearable companies that charge hundreds (or even thousands) of dollars up front. Additionally, Whoop’s subscription encourages people to stay committed to exercise and wellness, rather than switching to the next gadget on a whim.

Investment Implications:

The “subscription economy” isn’t going anywhere; the shift from transactions to subscriptions is just beginning. We think that consumers will continue to want engaging and easy experiences with brands, while companies will want to build long-term relationships with customers.

Here are 10 companies to watch in this space:

Netflix

Whoop

Peloton

Salesforce

Masterclass

Mailchimp

Hello Fresh

YouTube

Snap

Coursera

#9 Women Power

What it is:

Education is the window to the future. Historically, women have not had the same leadership and growth opportunities in a male-centric world, but the playbook is different in today’s Knowledge Economy. Countries and companies who’ve prioritized educating and empowering have not only survived – they’ve thrived.

This shift has been gigantic. In 1970, women comprised 42% of the undergraduate college population. In 2022, women comprise nearly 60% of the undergraduate college population. Leaders the likes of Condoleezza Rice, Janica Arden, Rosalind Brewer, Indra Nooyi, and Cathie Wood have also come.

While women’s roles in society, business, and politics have increased dramatically over the last 50 years (and the last 15 years), there’s still much work to do in creating gender equity. This is a massive challenge for society, however, it is also a massive opportunity.

Why it matters:

The challenges are substantial:

A January Ventures study found that for every $1 men raise at the early stage, women raise an average of $0.37, with Black women raising an average of $0.02.

A Pew Research study found that in 1995, 7% of Congress members were women; today, 27% of Congress members are women.

According to PwC, it would take 63 years to close the gender pay gap and 33 years for women’s labor force participation rate to catch up to the men’s participation rate (80%)

But the opportunity and potential value creation are just as exciting:

PwC found that there’s an opportunity to boost OECD GDP by $6T by increasing the female employment rate to match Sweden (72%).

Women started 49% of new businesses in the US in 2021, up from 28% in 2019 (World Economic Forum).

Women are taking center stage as investors, controlling a third of U.S. household investable assets. By 2030, McKinsey predicts that much of the $30 trillion of baby boomer’s assets will be controlled by women – a wealth transfer larger than the annual US GDP.

According to a BCG analysis, businesses founded by women are better investments: for every dollar of funding, female-founded companies generate 78 cents, and male-founded companies generate 31 cents.

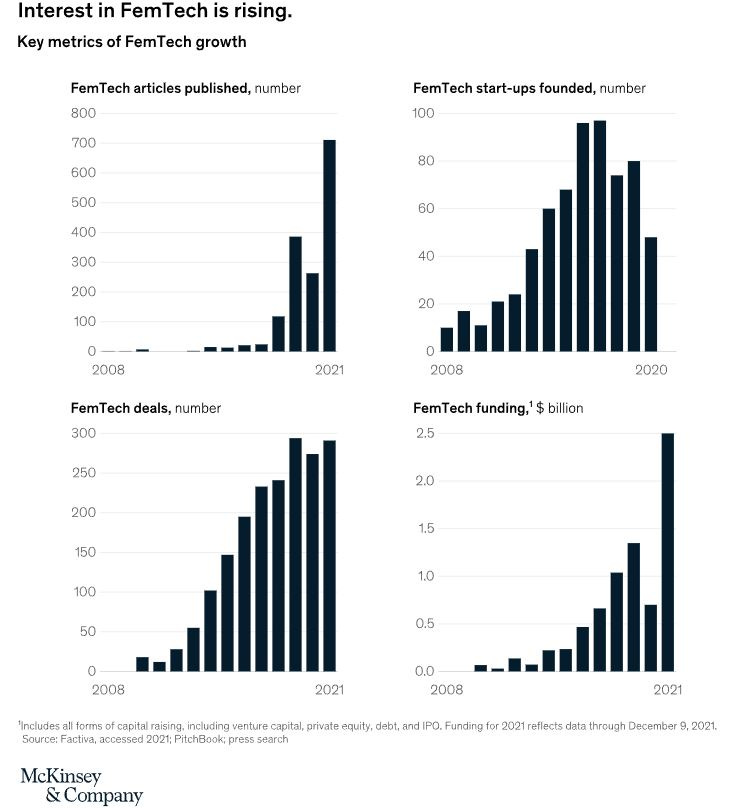

Over the last few years, FemTech has exploded to provide a wide range of female-specific conditions including, menstrual health, fertility, maternal health, menopause, and other conditions that affect women disproportionately.

Only in the early innings are the drivers underlying FemTech (public awareness, company formation, and funding) accelerating. Increasingly, women will flip the script as a new generation of female investors, entrepreneurs, and leaders are empowered in the workplace.

Source: McKinsey

Investment Implications:

The investment implications are clear: women are getting more higher education, starting just as many companies, and running businesses that generate greater revenue and returns. As leaders, they are more likely to commit to DEI initiatives. As investors, they will elevate ESG factors, promote sustainable investing, and lead Mission Corps (more on that later).

We expect that employers will increase spending on maternal benefits and family health as a function of retaining women in the workforce and see a variety of exciting opportunities from this megatrend:

Financial Services: Ellevest, Eko, Axio

Improved Care: Tia, Maven Clinic, Kindbody, Joylux, Elvie, Flo Health

Fertility: Ava, Clue, Kindbody, Carrot Fertility, Progyny

Motherhood: Bloomlife, Every Mother, The Honest Company

Apparel: Figs, Stitch Fix, Thinx

#10 Sustainability

What it is:

Waste not, want not. I don’t think anybody believes it’s good to support something that harms the planet and future generations. This isn’t a political comment on climate change - it’s sustainability, the fundamental obligation and intent to leave the planet better off than you found it. And it’s growing.

Look to younger demographics for the evidence. They reject plastic in favor of reusable water bottles, grocery bags, and metal straws. They use natural household cleaners instead of chemical sprays, and are becoming vegetarians. By failing to adapt to sustainability-minded GenZ, Forever 21 was pushed to bankruptcy.

Why it matters:

The opportunity is to play offense, not defense. A sustainable business approach creates long-term value in a “pay it forward” manner to the ecological, social, and economic environments. The question to ask is, what can be done that doesn’t just maintain or protect, but actively makes the world better than we found it?

Sustainably marketed products are growing 2.7 times faster than conventional products. Regulators are stepping up to the plate with car bans and lawsuits. Companies are seeing the importance of managing sustainability risks – a study showed that the number of appointed Chief Sustainability Officers tripled in 2021.

Patagonia’s Yvon Chouinard transferred 98% of the company’s stock to a non-profit to combat climate breakdown. Tesla cited ecological concerns as the reason for backing out of accepting Bitcoin payments. All major car and truck manufacturers have announced electrification plans.

As often the case, tech companies have been trend-forward. Google was the first company in the world to achieve net-zero emissions and the first to commit to operating on 24/7 renewable energy by 2030. Microsoft and Meta have made similar commitments.

Although digital technology is responsible for only 1.4% of global emissions, it could help reduce up to 15% of emissions through solutions in energy management, precision agriculture, manufacturing, and smart cities, plus an additional 35% in indirect influence. Recently, half of renewables purchase agreements came from tech firms operating large data centers.

Source: IEA

Tech giants aside, more than 2,200 companies, representing more than one third ($38 trillion USD) of global market capitalization, now have approved emissions reductions targets or commitments.

These moves are not just about virtue or virtue signaling, but common-sense incentives. Renewable energies are set to lead the global electricity sector and will supply ⅓ of the world’s electricityby 2025. Continued cost declines are changing the landscape as corporations increase their share of renewable energy consumption and investors join the party in green energy and greentech.

Investment Implications:

There’s a tectonic shift occurring in sustainable investing. Nearly half of investors are interested in sustainable investing and an estimated $30 trillion assets under management taking into account some form of ESG data. Millennials are champions of the ESG and will inherit over $30 trillion over the next two decades to invest in opportunities they believe will drive impact.

These investments will be pushed along by the tailwind of government regulation and funding. Subsidies in carbon capture tax credits, restrictions on power plant carbon emissions and fuel emissions, and even taxing corporations based on emissions are in the cards.

Renewable energies and greentech will mature. Funding for renewable energy tech startups surged 295% in 2021 compared to the previous year. We expect investments in wind, solar, next-generation batteries and infrastructure, climate software, and carbon removal technologies to continue to grow.

Companies are increasingly judged by their sustainability performance. Here are some we're watching:

Tesla

Intel

Ecolab

PVH

Xylem

American Water Works

BlackRock

NextEra Energy Partners

Air Products and Chemicals

First Solar

Market Performance

Stocks continued to slump, as the NASDAQ was off 5.1% and the S&P 500 fell 4.6%. Right now, the NASDAQ is about 5% above where it was in June lows, while the S&P 500 is only about 2% higher than where it was. With fall starting this past week, it’s looking like this summer’s bear market rally is officially over.

The main reason why investors are concerned is aggressive central bank tightening, led by the US Fed, who raised rates 75 bps this week. Chair Powell’s commentary was just as impactful as his actions, as he doubled down on his commitment to fighting inflation at all costs, regardless of the larger impact on the economy. As Chair Powell concluded his remarks, “restoring price stability is essential to set the stage for achieving maximum employment and stable prices over the longer run. We will keep at it until we are confident the job is done.”

The Fed’s forecast in June for the 2023 fed funds terminal rate was 3.8%; that has now increasedto 4.6%. The US Fed isn’t the only central bank that’s raising rates, as the central banks in Switzerland, England, and Norway all increased rates by at least 50 bps.

These challenges are slowing down the high growth companies that were the “stars of tomorrow” during the COVID bull market. The median cloud software P/S multiple is now 5.5x, which is the lowest multiple for the cloud software market since late 2016.

Furthermore, the fundamentals of these companies could be deteriorating: only 54% of companies raised guidance for Q3 2022, and the median guidance raise was only 0.1%. During normal ranges, the median guidance beat is usually ~3% with ~90% raising guidance.

On a brighter note, Costco announced this week that they aren’t raising membership fees after their earnings beat expectations, while Trip.com beat sales estimates by 10.5% and said that China hotel bookings are surpassing pre-pandemic levels.

As David Sacks puts it, “the market is back at June lows, except now the Fed’s forecast is worse, geopolitical risk is higher, and the administration shows no signs of changing course.” Time will tell if this is the end of a painful Q3 or if more trouble is ahead in the coming months.

GSV’s "Four I’s" of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. All of these signals point to the consensus among investors that we’re heading towards a recession, which is what 76% of Americans think.

#1: Inflows and Outflows for Mutual Funds & ETFs

Outflows continue to dominate inflows, especially in domestic equity funds. Investors are wary of market conditions and are “putting their money where their mouth is” by increasing outflows.

Source: Yardeni Research

#2: IPO Market

The IPO market continues to stay quiet this week as the market continues to wait for notable IPOs in Q4 2022. Here are a few companies to keep an eye on – Porsche, Chobani, and Instacart.

Source: Renaissance Capital

#3: Interest Rates

This week, the Fed hiked the fed funds rate by 75 bps as predicted. However, the forecast was new, as the Fed increased its rate hikes from 50 to 150 bps for the rest of the year. The market is now expecting higher rates for a longer time: the Nasdaq is only about 5% higher than its June lows.

#4: Inflation

Last week’s inflation report continues to send a “reality check” across markets. The Fed’s economic projections forecast that the nation’s unemployment rate will grow to 4.4% next year, meaning that 1.2 million more people will be unemployed.

EIEIO: Fast Facts

Entrepreneurship... 2 minutes 42 seconds – the amount of time spent by VCs on the average pre-seed pitch deck (Source)

Innovation... 78% – the % of factual questions that DeepMind’s new chatbot Sparrow can answer with plausible and evidence-based responses. (Source)

Education... 90% – the % of students and teachers with a school-issued computing device, up from 46% in 2015. (Source)

Impact... 130 million – the # of Americans between the ages of 16-74 who read below the equivalent of a sixth-grade level. (Source)

Opportunity... 1:1,456 – the doctor-population ratio in India. In the United States, that ratio is 1:384. (Source)

The GSV Big 10

This fall, we launched The GSV Big 10, synthesizing the news to bring you the top 10 stories and insights in Education and EdTech. In case you missed it, here are some of this week’s stories:

#1 The New Learning Economy: It’s Time To Build in Education

This piece from Anne Lee Skates at a16z captures the macro trends and opportunities driving the Learning Economy. We believe that learning will move from classrooms and online courses to being ubiquitous and invisible.

#2 Reflecting on Our Impact on K-12 Since 2015

Technology in the classroom isn’t the issue, nor is digital illiteracy. The percentage of students & teachers with a school computer increased from 46% in 2015 to 90%+ in 2022. Access to technology is getting there, but we still need better products and services.

#3 With Audiobooks Launching in the U.S. Today, Spotify Is the Home for All the Audio You Love

Spotify already became the largest podcast platform in the US: with audiobooks, they are becoming a major force in education. The category is growing 20% year over year and will provide learners of all ages a more accessible (and social) way to consume books.

... for more insights on the news, subscribe to N2K and The Big 10.

Last Week to Apply for the 2023 GSV Cup

The GSV Cup invites all EdTech startups, from "Pre-K to Gray" to apply to compete for up to $1 Million in non-dilutive cash and prizes. The deadline to apply to apply is Friday, September 30, 2022.

Get in front of the most prominent EdTech VC's and strategics as part of the 2023 GSV Cup! 190+ leading global judges will evaluate this year's pitch applicants, including Accel, Bessemer, Bain Capital, Owl Ventures, Pear VC, and Reach Capital.

START YOUR GSV CUP APPLICATION

Connecting the Dots & EIEIO...

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup.... EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM