GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

“I don’t set trends. I just find out what they are and exploit them.” ― Dick Clark

“I think women are afraid to say they don’t want to have kids because they’re going to get shunned. But I think that’s changing too now. I have more girlfriends who don’t have kids than those that do. And, honestly? We don’t need any more kids. We have plenty of people on the planet.” – Cameron Diaz

“Weather forecast tonight? Dark.” – George Carlin

One of my observations is that many of the great investors are also great demographers. Why? Because there are few clearer clues to the future.

Society at large and academia in particular is up in arms about using Artificial Intelligence to “cheat”…effectively getting the answer to something without having to do the hard work. Understanding demographics is kind of the same thing, but even better…it tells you the answer to the future.

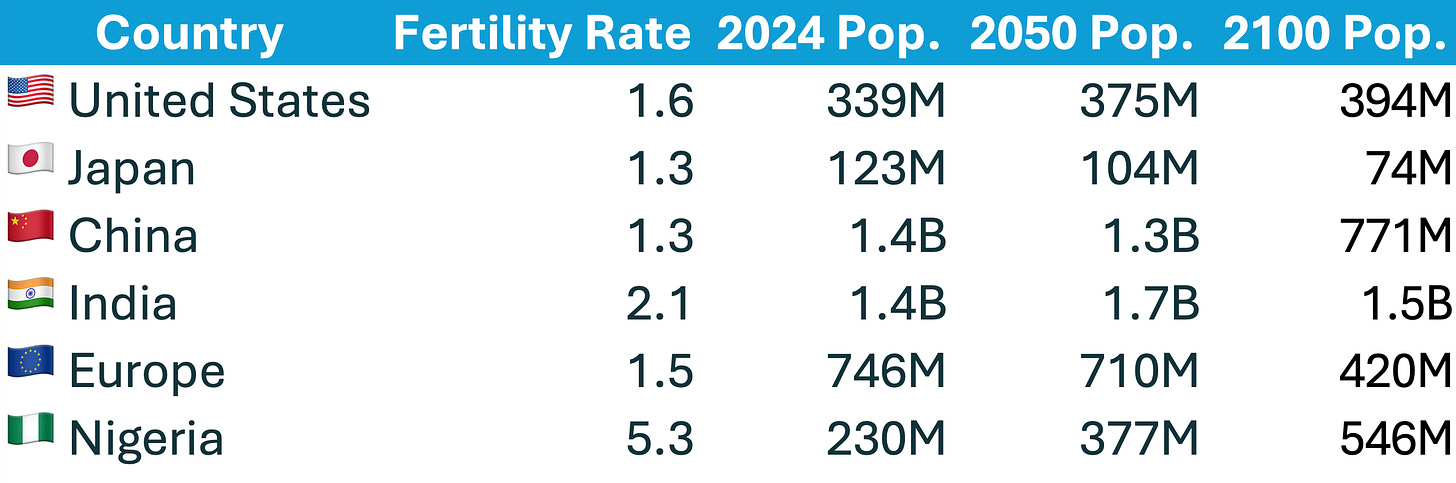

This week, we’re taking a deep dive into the demographics of Asia, Africa, Southeast Asia, and the US. Each region faces headwinds and tailwinds. Some of these are like a breeze providing wind at our sails while others are a gale in our face.

In some ways, demographics are the hand you're dealt, but the fate of a country is also the result of a combination of factors…some economic, some political, some cultural, and some psychological.

East Asia…A Cautionary Tale

Asia is shrinking, and it’s self-inflicted.

In Japan, two people die for every one that is born. There were more adult diapers sold in Japan last year than baby diapers.

China is now reporting a >70% drop in the birth rate since 2017. As demographer Peter Zeihan recently pointed out, that’s a faster decline than what was suffered by the Jews in Europe during the Holocaust.

China’s Total Fertility Rate: Children Per Woman

Combine this with China’s rapidly aging population - one that in 2035 will have more people over 60 than the United States has people – and you have yourself a sticky wicket.

China’s Shrinking Population

This demographic death is amplified by the fact that on the way up in the above chart, there was a credit-fueled construction boom. The incentive was to build, not be population planners.

Let’s just say the demand has not met the supply…China now has enough vacant residences for up to 3 billion people. Entire property developments are abandoned, creating ghost towns that look more like the country’s left-behind stadiums from the 2008 Olympics than the communities they were intended to be.

South Korea just broke its own record for the world’s lowest birth rate - with a minuscule 0.72 births per woman. As a reminder, the magic number to maintain a population (the replacement rate) is 2.1. In the nation’s capital, Seoul, the birth rate is 0.55.

When it comes to birth rate, there is a common theme that is true across the World. When a country industrializes, its birth rate declines. In a rural, agrarian society, kids are economic assets rather than liabilities. As free labor on the farm, parents want as many of them as they can possibly handle. More open spaces and less population density are conducive to households full of children.

Contrast that with industrialization and urbanization. When adults work in factories and live in cramped dwellings, children are no longer cheap “employees”, but they are certainly expenses. The average apartment in Hong Kong is 484 square feet. Its birth rate is 0.77.

The other factor here is that as cities such as Hong Kong became massive, it became harder and harder to raise children. As one Hong Kong resident said, “I didn’t want kids, not that I don’t like them, but I just feel like they would be miserable… or at least not so happy growing up in Hong Kong.”

The factors are both economic and psychological. The cost of raising a first child in China has soared to $76,629, 7X the country’s per capita GDP and over 15X per capita disposable income and far more than in the U.S. or Japan, according to Reuters.

And particularly after China’s handling of Covid, it makes sense why people may be hesitant to bring a child into the World…PTSD from multi-year lockdown and instances of the government welding peoples’ doors shut are still fresh. The sound of screaming voices out of the high rises in Shanghai wasn’t an aphrodisiac.

Meanwhile, as China develops and the population becomes more urban (and childless), there’s more disposable income to spend on a new type of companion…pets.

We’ve had a Pets are People theme for a decade with high-end pet products becoming a massive market. As Semafor recently reported, “China’s pet industry is booming as young people – nicknamed ‘the last generation’ over their reluctance to procreate – find cheaper, furrier companions.” One pet-owner told the South China Morning Post the responsibilities involved in raising a child were simply too daunting.

As the visual below illustrates, the industrialization = birth rate decline rule holds true everywhere. These charts start in 1950, and the industrialization that occurred in the decades post-World War II spurred declines across the world.

Charts that are relatively flat are in countries where industrialization began in the 19th century and happened much more gradually (US, UK, France, etc.) or has yet to really occur (DRC).

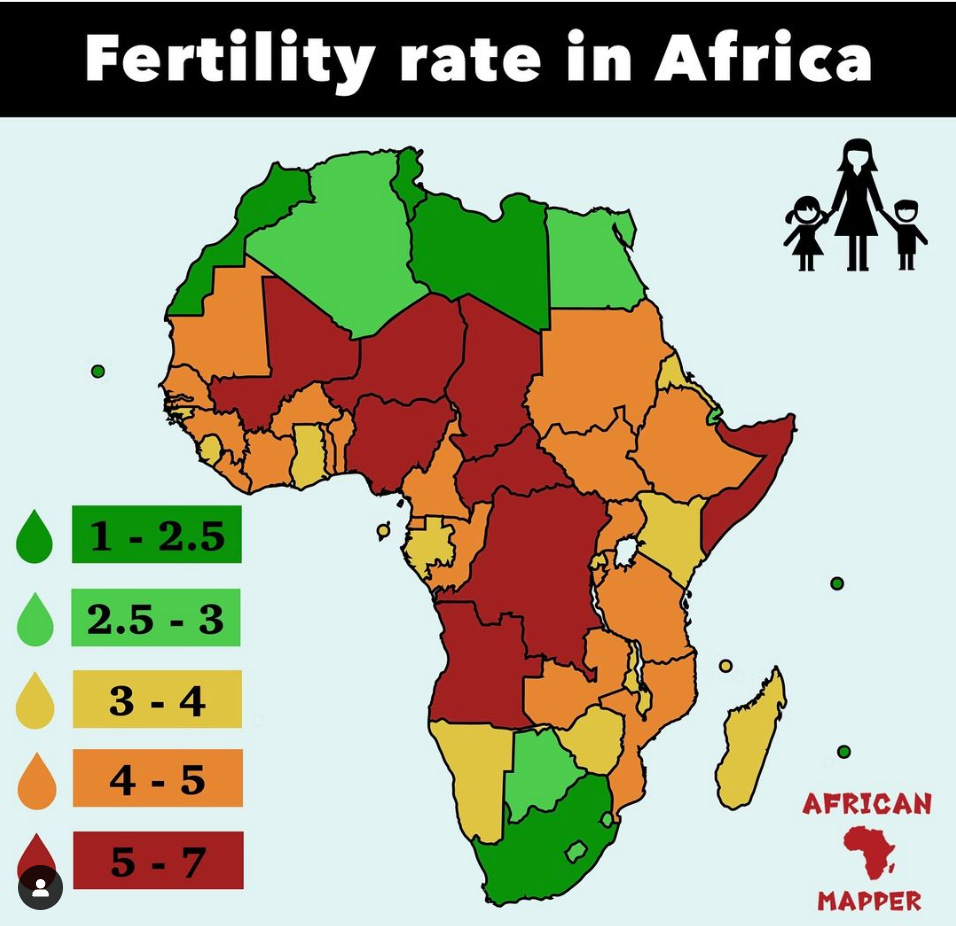

Africa…The Fountain Of Youth

While China, Japan, and Korea are becoming a facet of the past, Africa is the Fountain of Youth.

41% of Africa’s population is under the age of 15, and 8 of the 10 fastest growing countries in the World are in Africa. The top 10 cities in terms of population will look very different in 2100, with 5 of the top 10 and all of the top 3 in Africa.

10 Largest Cities In The World Over Time

Most of this growth is driven by Africa’s fertility rate of 4.1 births per woman, which is dramatically higher than its peers in Asia and Europe. The countries that are home to 2100’s 3 largest cities (Nigeria, DRC, and Tanzania) have fertility rates of 5.3, 6.2, and 4.8 respectively.

Africa will have 1.1 billion Middle Class people by 2060, up from 350 million in 2010. This population growth not only creates massive opportunities for Africa’s own development, but also its neighbors.

Abu Dhabi/Dubai are not just the “Capital of Capital”, but it has also emerged as the “Center of the World” due to the fact that it's an 8 hour flight from 5 billion people…and those people are from India, Africa, and MENA, with a huge portion moving into the Middle Class.

Predicted Distribution of the World’s Population in 2100

Another unexpected winner from Africa’s move to the Middle Class is China. The One Belt, One Road initiative was just as much about reasserting China’s global dominance in physical infrastructure as it was placing bets on how China could be a central link in Africa’s growth.

Two million Africans were working in China as of 2017, and China has a positive perception among African countries. China has bought its way to being beloved in Africa and is placing more chips on its bet.

In addition to geopolitics, one other Megatrend that could be wind at Africa’s back is the democratization of advancements in longevity. While Africa is leading the World in terms of fertility rates, Africa’s life expectancy (64) is still 12% below the global average (73)...but up 10 years per person over the past 25 years.

Global advancements in longevity and resource provision will help power Africa’s Middle Class to participate in the global knowledge economy. Companies such as Zipline have pioneered partnerships with local governments and NGOs to deliver supplies by drone.

While Zipline delivers physical goods to improve Africa’s physical infrastructure, there’s an even more massive opportunity to empower Africa’s digital infrastructure and knowledge economy grows as 800M+ people enter the global Middle Class. In 2022, only 36 percent of Africa's population had broadband internet access.

Another company to watch is Jambo, whose mission is to onboard the next billion African people to the Web with a “Web3 WeChat”. Web3 may sound disconnected from Africa’s other development goals, but given that our digital and physical lives are increasingly connected, building the infrastructure to connect Africa to the World is a massive opportunity.

Jambo’s go-to-market is two-fold: first, it’s building a “Super App” called JamboApp to educate, bank, and entertain the continent. Second, it launched a $99 Android phone called the JamboPhone that is tailored for emerging markets and has been bought in 100+ countries. The combination of the smartphone, the Internet, and the app store was the killer app for China and India’s development, and Jambo is trying to run a similar playbook in Africa.

Southeast Asia…A Window To The Future

India and Southeast Asia are a marriage of China’s population strength and Africa’s rapid growth. India recently surpassed China as the World’s largest country by population, and is on track to double down on its lead over the coming decades.

India vs. China Population Growth

In many ways, India is 25 years behind China in its development as it shifts from a rural to a knowledge economy and unlocks the value of its 1.4 billion people. 10% more of India’s population is working in agriculture than China’s…10% might not sound like a lot, but that’s 140M people (larger than the United Kingdom and France combined).

“Act 1” of India’s transition to the Knowledge Economy was its offshore services business, which stood at $250B in 2022. But as Daniel Gross points out, the “ChatGPT Magic” could be an existential risk to this business model, so India will need to find a compelling “Act 2” to drive its economic growth and place in the global marketplace.

Regardless, India’s physical and digital infrastructure has made tremendous progress over the past decade, but it's Digital Public Infrastructure (DPI), not India’s roads and airports, which are ready to be exported to the World. PM Modi is betting the farm (literally) that India can make the transition to power its own growth and empower the Global Knowledge Economy.

For more on India’s massive opportunities, check out our recent piece EIEIO…Amrit Kaal and my opening keynote at the ASU+GSV & Emeritus Summit.

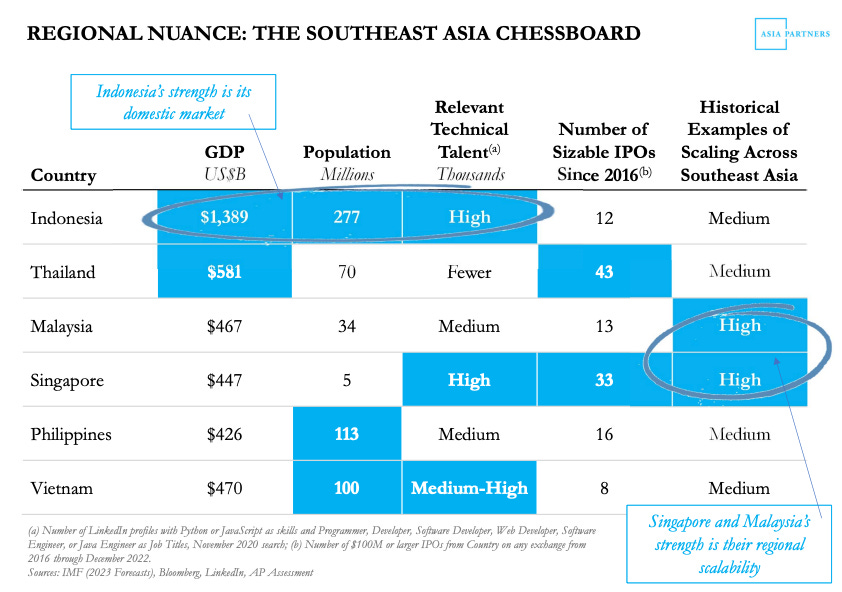

Just across the Bay of Bengal, Southeast Asia has a similar combination of demographic tailwinds, a shift to manufacturing growth due to the “China Plus One” strategy, and a culture that prioritizes education above all else.

Just like China and India, Southeast Asia leads in terms of prioritizing education as the highest priority for every child and family. As a % of Household Budget, Asian families spend over 7X more on Education than American families.

Singapore has emerged as the Hub of the region, with top-down investment from the government combined with the bottom-up pull of entrepreneurs and capital into the region. It’s not a coincidence that Jack Ma’s wife, Zhang Lei of Hillhouse, and Neil Shen of Hongshan are all spending more time in Singapore than Shanghai these days (h/t Ivy Yang ).

Two excellent research reports that lay out Southeast Asia’s prospects are Baillie Gifford’s report on South-east Asia’s rising export stars and Asia Partners’ annual Southeast Asia Internet Report…a nod to Mary Meeker’s old Internet reports.

While Singapore is the Hub of the Far East, it’s neighbors are rapidly investing their resources in both the physical and knowledge economy.

Vietnam, Indonesia, and Thailand are increasingly challenging China's long-standing dominance as the world's manufacturing hub. The combination of rising labor costs in China, geopolitical tensions, and a tougher business environment are causing companies to diversify their manufacturing bases to neighboring countries that offer cheaper labor and business-friendly policies.

Vietnam appears to be leading the pack, with its exports rising nearly 8X over the past 15 years, aided by relatively low wages and an impressive education system. Indonesia is also emerging by leveraging its natural resources and implementing policies to move up the value chain by processing raw materials domestically rather than just exporting them. Thailand's strengths in manufacturing electronic components and a growing consumer market are also highlighted.

US…A New Look

The US faces both headwinds and tailwinds. The aging Baby Boomer Generation will put significant strain on entitlement programs like Social Security and Medicare over the coming decades. The US faces a debt crisis like no other in the decades to come.

However, immigration done right could help offset some of these headwinds. The US faces a massive backlog of legal immigration cases, with many of them total All-Stars in their fields looking to make their mark in America. Unlike countries in Asia, the US has a long history given that it was founded as a country of immigrants.

The US will become a Majority-Minority country sometime between 2041 and 2046, depending on both immigration and fertility rates. Texas turned majority-minority in 2023…. 40% of Texans are Hispanic and 39% are White.

As our friend Michael Milken said in his recent podcast with Ted Seides, the best way to assess the future of any nation is to visit schools and study young people. And what’s exciting about this is that a majority-minority America is younger and hungrier than ever.

The average Hispanic American is age 11, and 27% of all k-12 students in the United States are Hispanic. A lot of this growth is happening in the Sunbelt region, which is seeing tremendous inflows of both human and investment capital as people look for better (and cheaper) places to raise their families.

From 2000-2020, the proportion of Latinos in the US with a bachelor's degree or higher doubled, from 10% to 20%.

The combination of immigration, geographic isolation, and more wide-open space (“elbow room”) than many countries is a winning combo for US growth. Additionally, the US has had a more gradual transition to industrialization over a longer time period (rural farms > small towns > suburbs > cities)...unlike countries like Japan where rural land in Tokyo is now selling for pennies on the dollar because you have to live in the city to have economic opportunity.

Visualization of Land Price Changes in Tokyo (Red = More Expensive, Blue = Less Expensive)

Additionally, the US’s sizable workforce will be able to work longer than ever before thanks to the intersecting megatrends of Autonomous Everything, Longevity, and Mission Corporations. Who wouldn’t want to work as long as they could if they’re healthy, happy, and working at a place whose mission is tied to the impact they want to make in the World? Take all this together, we live in a Global Silicon Valley, but we’re just as BULLISH on the United States as ever before.

Demographics are the key to the future, and changes in generations are the way these Megatrends become reality. Next week, we’ll offer our takes on the cultural and generational changes that are unfolding before our eyes…which are often hiding in plain sight. What’s Hot and What’s Not, Trend vs. Fad, and companies and themes to invest in…stay tuned for more next weekend.

Market Performance

Stocks took a breather last week using a mixed job report as its excuse for the pause.

While 275K new jobs were created in February above the 200K forecast, unemployment moved up to 3.9%.

The NASDAQ slid the most declining 1.2%, followed by the Dow being down .9%, with the S & P falling a modest .3%. The GSV Growth Model Portfolio was off 2.3% but is still up over 15% for the year and 70% since 2023.

Interesting to us, is while the so called “Magnificent 7” have been languishing as of late, we’ve seen a broadening of participation. Moreover, Bitcoin was up 8.5% last week and has advanced 55% ytd showing the speculative juices are starting to flow again.

Our thesis has been and continues to be, that emerging growth companies are coming back in fashion and by the Spring, IPO’s will reappear bringing much appreciated fresh oxygen for investors. We remain BULLISH.

Maggie Moe’s GSV Weekly Rap

Need to Know

READ: Halfway Bertween Kyoto And 2050: Zero Carbon Is A Highly Unlikely Outcome

LISTEN: Aravind Srinivas – Building An Answer Engine

WATCH: Frank Quattrone: Lessons from 650 M&A Deals Worth Over $1TRN & Taking Amazon and Cisco Public| E1121

READ: What’s right with the world? | Capital Group

WATCH: How To Find Your Edge As A Writer | Michael Mauboussin

READ: The Journey From Monetary Shock To An Innovation-Led Economic Boom

WATCH: Ep4. Tesla FSD 12, Imitation AI Models, Open vs Closed AI Models, Delaware vs Elon, & Market Update

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: A Wealth of Common Sense

#2: IPO Market

#3: Interest Rates

Actual Interest Rates Vs. Predictions Over Time

Source: X

#4: Inflation

Source: Charlie Bilello

Chart of the Week

The Front Lines of the Attention Economy…time spent per day for Instagram, TikTok, Facebook, YouTube, Snapchat, and Pinterest

Chuckles of the Week

EIEIO…Fast Facts

Entrepreneurship: 58% – unicorns that don’t have a founder with a Computer Science degree (Forbes)

Innovation: 96% – Chinese children who believe that humans will eventually live in outer space or on another planet (CNBC)

Education: 67 – schools in Illinois where not a single child is proficient in math (Wirepoints)

Impact: 47% – Americans who are “very satisfied” with their personal life, down from 65% in 2020 (Gallup)

Opportunity: 87% – American businesses that are family-owned or controlled (Fortune)

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup….EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM