EIEIO...CAC Hack

Tap into content-to-commerce, negative customer acquisition cost through media

GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: 91% – The percentage of 16 to 24-year-olds in the US who have purchased creator-founded products and services. (Billion Dollar Boy)

Innovation: $77 billion – The global market size for the weight-loss drug market by 2030 according to Morgan Stanley, up from $15 billion in 2024. (Visual Capitalist)

Education: >1.1 million – The number of international students at U.S. colleges in the 2023-24 academic year, an all-time high. (Higher Ed Dive)

Impact: $191 billion – The amount fraudsters cost the American taxpayer by taking advantage of the federal government’s unemployment system and exploiting individuals’ personally identifiable information during the COVID-19 pandemic. (Committee on Oversight and Accountability)

Opportunity: 2.7% – Argentina’s inflation rate for the month of October, down from 25.5% when Javier Milei took office in December 2023. (Charlie Bilello)

“Marketing is a contest for people’s attention.” – Seth Godin

“If people believe they share values with a company, they will stay loyal to the brand.” – Howard Schultz

“I would rather entertain and hope people learned something than educate people and hope they were entertained.” – Walt Disney

Imagine starting a daily newsletter as a simple side hustle and selling it to a ~$40 billion company 500 days later.

That’s what happened to Adam Biddlecombe when he sold Mindstream to HubSpot earlier this fall. It’s hard to even imagine the corporate development team at the marketing technology juggernaut seriously pursuing a blog run by a three-person team.

In Biddlecombe’s own words:

In June 2023 I decided to create an AI newsletter with my best friend Matt.

It worked. In October I quit my job. In December we reached 100k subs.

In October 2024, we sent our 500th edition of Mindstream to 150,000 subscribers and were acquired by HubSpot.

Mindstream now takes pride of place alongside the incredible brands and creators in the HubSpot Media Network.

Commerce Seeking Content 📢

It wasn’t HubSpot’s first M&A activity in the media world, either. The company purchased The Hustle from Sam Parr for a reported $27 million in 2021. The Hustle was a publication that covered business ideas and entrepreneurship broadly – it had a newsletter with 1.5 million subscribers, a subscription offering called Trends (featuring charts, data, and visualizations around trending topics that could feasibly lead to business opportunities), and a podcast called My First Million.

Some have pursued a build-rather-than-buy approach to getting into the media game. Stripe, the $70 billion payment processing behemoth, has produced podcasts, made movies, and sold hundreds of thousands of books so far this year via Stripe Press.

The common theme between these businesses is that they sell big-ticket, high LTV (lifetime value) products (CRMs and payment processors) with high switching costs. The problem they have historically faced, however, is that this strong LTV has been accompanied by steep CAC (customer acquisition cost).

These businesses can spend all the money they want on traditional advertising via commercials, billboards, or boosted social media content. The more they spend on acquiring customers, the longer the payback period (and thus required LTV) of their offering grows. This is because they are pleading with rented audiences to become patrons of their goods or services. Paying for a commercial slot during an NFL game is a classic example of this – those eyeballs are there to watch football, not to learn about your SaaS product.

However, the person who goes to Sherwood News (the media business launched by Robinhood in April) to find “News for the next generation about markets, business, technology, and the culture of money” 1) is there voluntarily and 2) has likely self-selected into Robinhood’s target customer demographic. Sherwood is supported by ad sales and has plans to add an events revenue stream. It could (and should) become a self-sustaining business on its own given this model, while simultaneously funneling its readers towards Robinhood’s financial services offerings. They are serving their product to their owned audience – one that is much more likely to be hungry for what they’re serving.

Making money off of the funnel itself before you’ve even fed the audience the big meal (i.e., 5, 6, or even 7-figure per year software contracts, for example) allows companies to achieve something truly incredible…negative CAC.

The king of this negative CAC model is Freightwaves founder & CEO Craig Fuller. Craig founded Freightwaves as a Data-as-a-Service provider for the freight and logistics industry. Struggling to generate leads and unable to afford outsourcing to an agency, he started a blog with content from industry insiders. The network grew, the content was consistently strong, and before long, he had stumbled into having a successful media company on his hands. It was a must-read for those in the industry that just so happened to direct readers toward paying 5-figures for the freight data he was selling.

Life is good when you own the billboard company and many of the businesses the billboards point to.

This model was so successful that earlier this year, Fuller divested Freightwaves (the media entity) from SONAR (the DaaS offering) and rolled it into a new holding company, Firecrown. He wants to replicate the playbook beyond supply chain into aviation, maritime, and space.

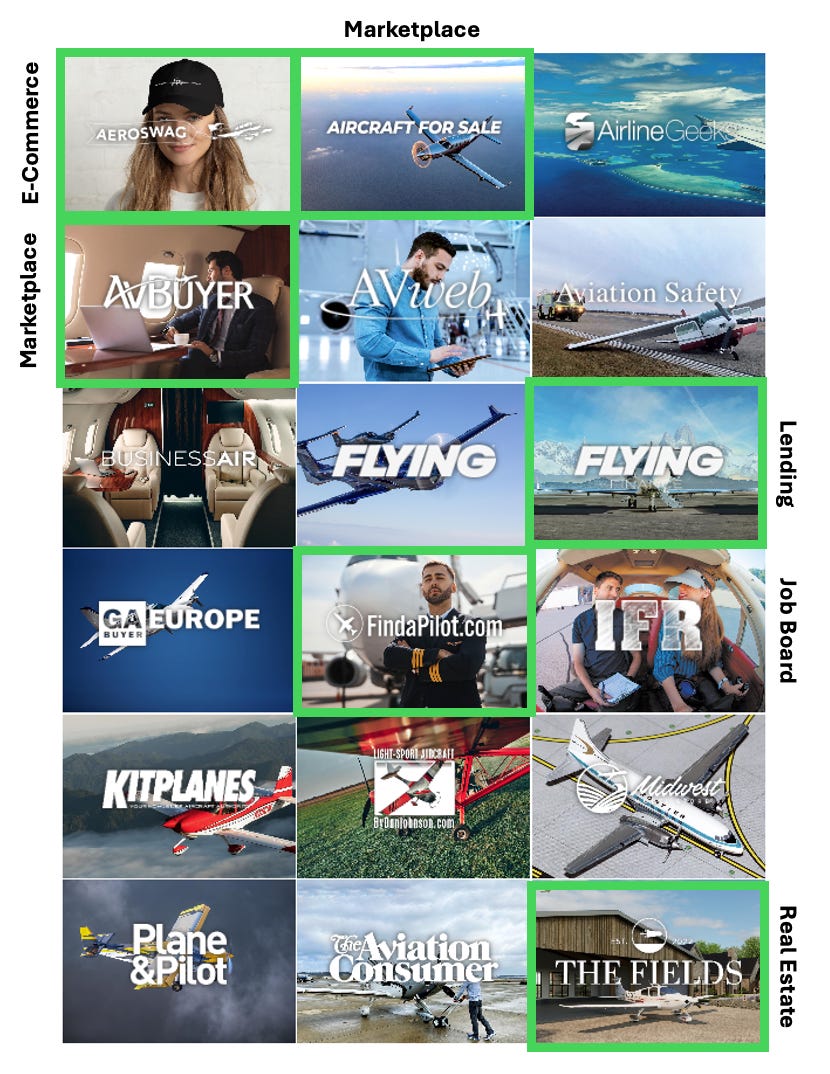

Firecrown: The Category King in Affluent Enthusiast Media and Commerce

“Firecrown reigns supreme as the category king in the affluent enthusiast community, setting the standard for how luxury hobbies and lifestyles are enhanced through an innovative content-to-commerce model.”

Firecrown has made dozens of acquisitions in the past year alone across aviation (Plane & Pilot, AV Buyer, etc.), maritime (Yachting, Sailing World, etc.), and space (Astronomy Magazine, the Space Store). In one interview, Fuller talked about buying Flying Magazine, improving the stock of its paper, and almost quadrupling the subscription price. He watched as his subscriber count plummeted, but the outcome was powerful – all of the “tourist” readers had bailed, while the serious enthusiasts had held on.

These are people who own aircraft, charter flights, or are learning how to fly…they are power users who don’t care that the price went up. They’re the people who are in the market for things like Find a Pilot and Flying Finance.

I would not be surprised to see Firecrown expand into automotive, equine, high-end hunting, or collectors categories (whether it’s wine, watches, or art). If it ain’t broke, don’t fix it…no pun intended.

Content Seeking Commerce 🛒

We started this piece with businesses (commerce) in search of improved distribution (content). Trailblazer Craig Fuller is working on both ends of the space with Firecrown. Now, let’s take a look at creators who are positioned to better capitalize on their distribution channels via commerce. The demand has been proven: 91% of 16-24 year old and 84% of 25-34 year old US consumers have bought a creator-founded product or service.

The best creators have built their respective followings by earning the trust of their audience through authenticity and consistency.

Dude Perfect started as a group of Texas A&M roommates making trick-shot videos in their backyard. Today, the Dude Perfect YouTube channel boasts over 60 million subscribers – that’s more than the NFL, NBA, UFC, and F1 combined. Their audience trusts them to deliver family-friendly, highly entertaining videos that might even feature their favorite athlete in the event that the dudes visit Steph Curry or if Tom Brady drops by the DP HQ in Frisco.

Up to this point, their business has been built on ads with corporations like GMC, product partnerships with companies like Nerf, and collaborations with things like Thursday Night Football.

The creator-adjacent to businesses “renting audiences” is running ads that promote other companies. These make for nice one-off checks (particularly when you generate tens of millions of views for national brands), but won’t be grand slams financially. Neither will brand collaborations or corporate partnerships – they too are ultimately campaigns with expiration dates. I’m not at all arguing creators should turn away from these steady revenue streams (they shouldn’t) – it does, however, raise the question around earners vs. owners – real wealth is accumulated through equity.

Speaking of equity, Dude Perfect already owns stakes in Burnley F.C. (soccer) and the Frisco Pandas (pickleball). The Dudes have a chance to build a full-blown empire by continuing to develop and/or acquire new business lines and properties that fit within the hard-earned ethos of the DP brand. If they can execute strategically, they will reap the benefits of a wonderful content-to-commerce flywheel.

Other companies have set the precedent for this approach.

In January, we wrote about another creator, Steve Rinella, in EIEIO…NOW Media. Rinella is the face of Meateater, an outdoor lifestyle company that offers multimedia content, guides, and gear for hunting and fishing enthusiasts.

[Rinella] built a media empire around hunting and outdoors starting with his Netflix show, where he gained credibility and legitimacy with his audience over the course of a decade. This earned trust allowed him to expand into guides, podcasts, gear, recipes, and more. The company is backed by The Chernin Group and is shooting for 9-figure revenue.

Rinella & Co. now own several properties underneath the Meateater umbrella, including First Lite (technical apparel), FHF Gear (hunting gear), Phelps (game calls), and Dave Smith Decoys (decoys). If you can own the audience and over time assemble a full suite of offerings to your captive, enthusiastic followers, you’ll have yourself one hell of a business.

We’ve watched as creators have started to shift into holding companies via acquisitions or by co-founding new businesses. Mr. Beast, who according to Forbes earned $85 million this year, has written venture checks as an angel investor in fintech firms, events businesses, and creator infrastructure companies.

The next frontier for the creator economy should be inspired by a 186-year-old newspaper in India.

You read that right.

The Times of India is a proud investor in Uber, Airbnb, Coursera, and Flipkart...among hundreds of other businesses. Their innovative model allowed them to join these cap tables without “traditionally” investing in them – no checks were written.

Instead, the Times pioneered a “media-for-equity” model, providing startups with advertising in exchange for a small piece of ownership in the businesses. This allows early-stage businesses to experiment with the Times’ advertising channel and establish a relationship with them. Here’s an excerpt from a 2015 Bloomberg piece about the Uber deal:

Uber Technologies Inc. said the publisher of India’s most-read English newspaper has taken a small stake in the ride-hailing application company as part of a strategic partnership to support its expansion.

The deal with Times Internet Ltd. will help increase the marketing and distribution of Uber’s services to more than 200 million consumers in India.

The Times pays for the investment by giving away otherwise costly ad inventory, making it easy to assign a dollar value to each strategic investment. US consumer startups allocate up to 50% of their budget to advertising costs, making the value proposition (freeing up cash for use elsewhere, gaining exposure from an established and far-reaching brand, adding a strategic partner to the cap table) quite compelling.

This is how groups like Dude Perfect can establish a built-in fund strategy without outwardly changing much of anything in their content. How many young CPG brands/apparel businesses/gaming companies would kill to tap into the DP universe and receive a stamp of approval from the Dudes? Our guess would be quite a few.

It’s critical that those who pursue this strategy remember what earned them their following in the first piece…trust. They will have to be hyper-selective and thoughtful about what businesses they involve themselves with – they must fit their specific ethos.

If not, they will look like sell-outs and risk watching even their most loyal followers turn on them, having decided that their favorite creators have turned into shills. Done properly, however, the value of these brands will swell astronomically, with longevity that will far outlive the original creators themselves.

Top Investors Funding Creators

Investments include Barstool Sports, Meateater, and Epic Gardening

Investments include Pearpop, Marina Mogilko, and Bookshelved

Lead investor in Dude Perfect’s $100m+ round

Investments include Fourthwall, Feastables, and Riverside

Not a traditional fund, Spotter provides growth capital upfront in exchange for licensing rights to backlogs of long-form videos on YouTube

Investments include Outtake, Scenery, and Riverside

Content-to-Commerce Businesses to Watch

Accessible family-friendly entertainment

Affluent enthusiast media and commerce

Production agency, lifestyle brand, and social media holding company

An omnichannel entertainment platform designed to share the game of golf with everyone

Financial humor and an inside look at life & cultural trends on Wall Street

Gardening advice for all experience levels

Growing collective of industry experts

Outdoor lifestyle media and commerce company founded by Steven Rinella.

An ongoing education on the frontiers of business and investing

Bringing unparalleled insights and diving deep into business technology & venture capital

The leading brand for the next generation of sports fans

The team behind Professor Scott Galloway's Prof G Show, Prof G Pod, and No Mercy No Malice

For the curious creator & the mischief maker

Your AI-powered social learning platform

A tech-infused, 3-on-3 golf league

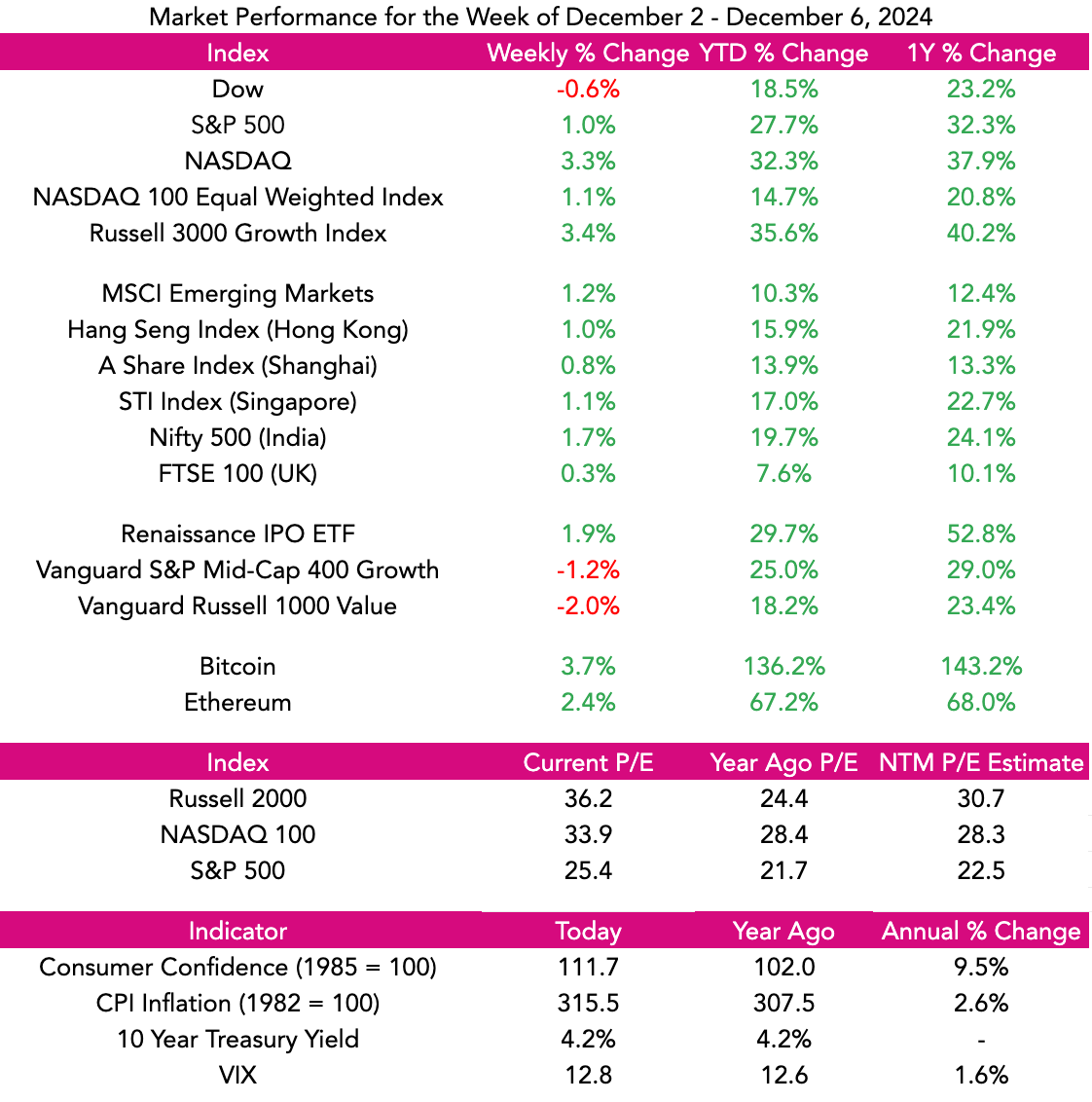

Market Performance

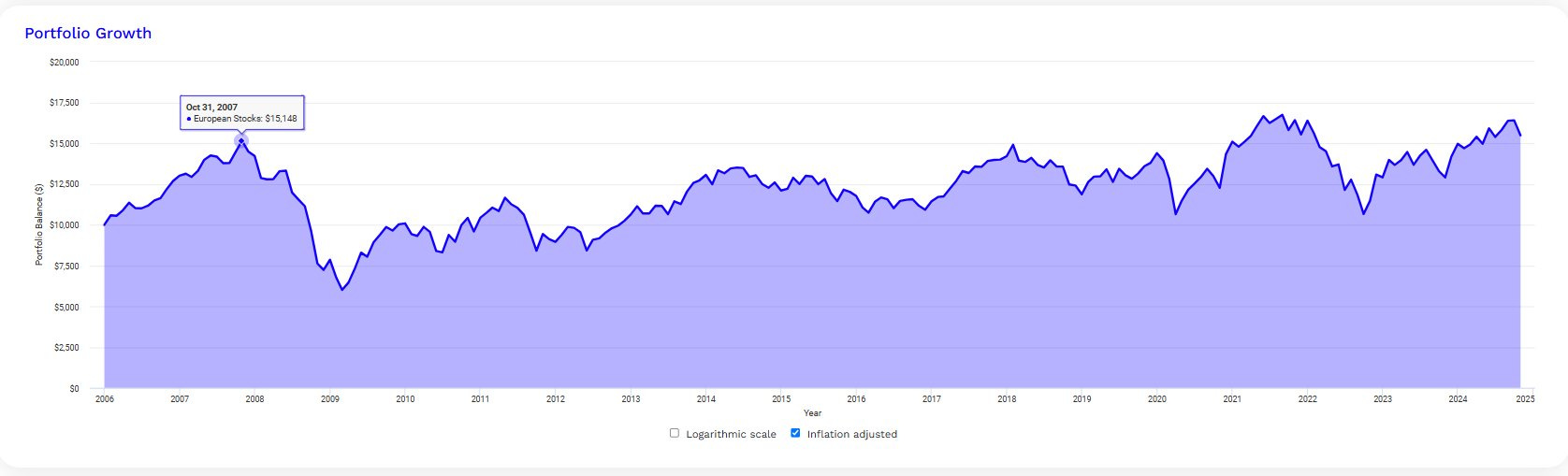

Market Commentary

It was a bad week to be a sovereign government and a good week to be a non-sovereign cryptocurrency.

In South Korea, the President declared martial law which within hours was reversed by its National Assembly…now it’s not super clear who is running the government. Bashar Al-Assad fled Dodge a.k.a. Damascus upon rebels reaching the outskirts of the City. The French Government was toppled faster than you can say s’il vous plait.

On the other side of the mountain, inspired by the incoming Trump administration’s support of cryptocurrency, Bitcoin went over $100K last week and ether had record inflows of $1.1 billion.

Overall, stocks moved higher last week led by NASDAQ surging 3.3%. The S&P 500 was up 1% and the 30-company Dow was down .6%.

Consumers are feeling good with online Black Friday sales reaching a record $10.1 billion. Additionally, the Michigan Consumer Sentiment Index had its 5th up month in a row reaching 74.

We’ve been very positive on stocks for several years and what we are seeing only ups our enthusiasm. Market participation is rising and the IPO Market is warming up.

Need to Know

READ: 10 Charts That Capture How the World Is Changing (Part I) | Digital Native

WATCH: A Billionaire's Guide To Going From $4/hour to $1 Billion Net Worth - HubSpot Co-Founder & CTO Dharmesh Shah | My First Million

LISTEN: Craig Fuller - Acquiring Flying Magazine and Building a Media Playbook | Think Like an Owner

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

#3: Interest Rates

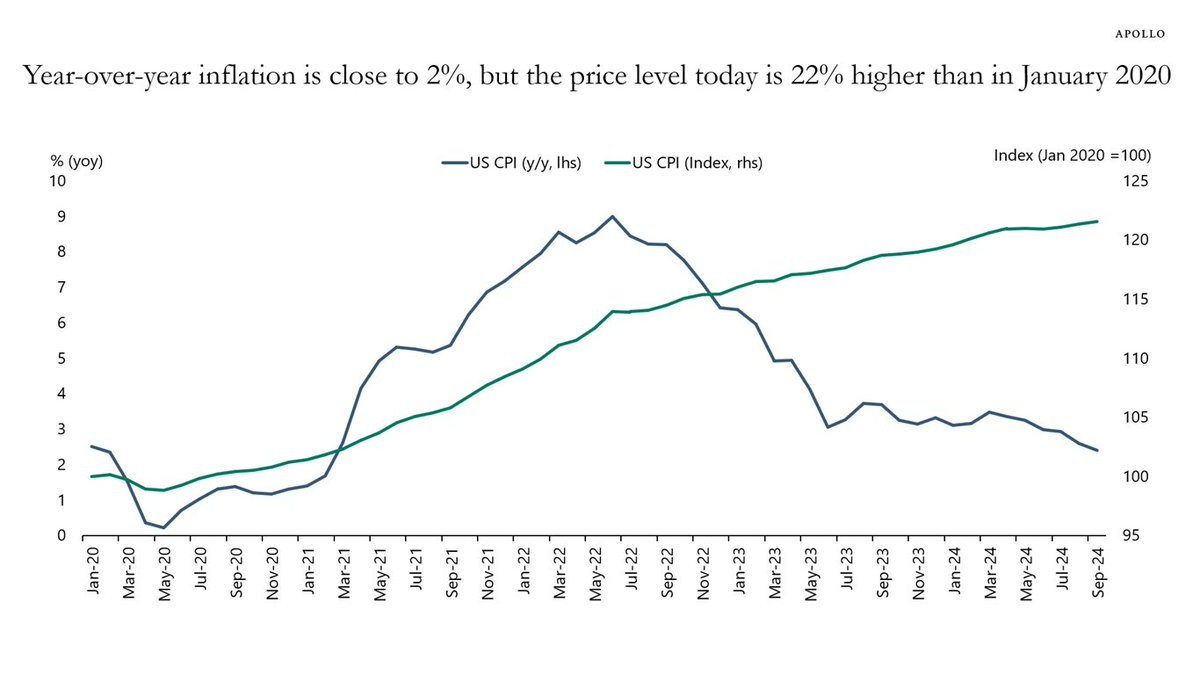

#4: Inflation

Charts of the Week

Maggie Moe’s GSV Weekly Rap

Chuckle of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM