GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

“How did he go bankrupt? Two ways. Gradually and then suddenly.” - Ernest Hemingway

“It’s the greatest arbitrage play of this decade. If you own an audience, you can sell them practically anything.” - Craig Fuller

"Whoever controls the media controls the mind." - Jim Morrison

There were signs.

It went from the must-read publication that you couldn't wait to get every Friday to being published bi-monthly. Then in 2020, it cut to once a month.

The annual Swimsuit Edition, which reliably got irate cancellations and made a week’s worth of news, could barely get anyone to care, even as it tried desperately to stir the pot.

It was announced Friday that Sports Illustrated was firing its entire staff, and even though it shouldn’t have been surprising to anyone paying attention, it still felt shocking. After 70 years of being the "must-read" for all who cared about sports, the iconic publication was gone in a blink.

While its no secret that traditional media has been struggling for a while (in fact, Sports Illustrated reached its peak circulation a full 30 years ago), what makes SI's demise even more puzzling is that sports are booming around the World. The most watched shows on TV last year were all live sports (and news broke just last week that the NFL is looking to buy a slug of ESPN).

SI's implosion is reminiscent of when Kodak went bankrupt in 2011. Kodak, which was one of the five largest market cap companies in the United States in the 70s and whose name was synonymous with photography, became extinct at the exact time everybody became a photographer with their smartphone. Ironically, Kodak even had the patent for digital photography but couldn't position itself for the tsunami that was to come. Instagram, started in 2011 the same year Kodak filed for bankruptcy, sold to Facebook for $1 billion with 13 employees and now is estimated to be worth $100 billion.

You get better or you get worse, you don't stay the same.

New technology and media have gone hand in hand since the Gutenberg Printing Press was invented in the 15th Century. Media has played a key role in shaping society in four main areas:

Providing a Public Forum for Important Issues

Acting as a Watchdog for Government, Business and other Institutions

Educating and Informing

Entertaining

The proliferation of media platforms, infobesity, and the growing distrust of the integrity of media information have resulted in a dramatic decline in traditional media's relevance in our lives. At the same time, when you add it all up, we are spending more than 13 hours a day interacting with all forms of media.

From a trust perspective, legacy news sources have fallen dramatically amongst all political parties. A far cry from the days when Walter Cronkite was the "most trusted person in America" – only 11% of Republicans trust news organizations today.

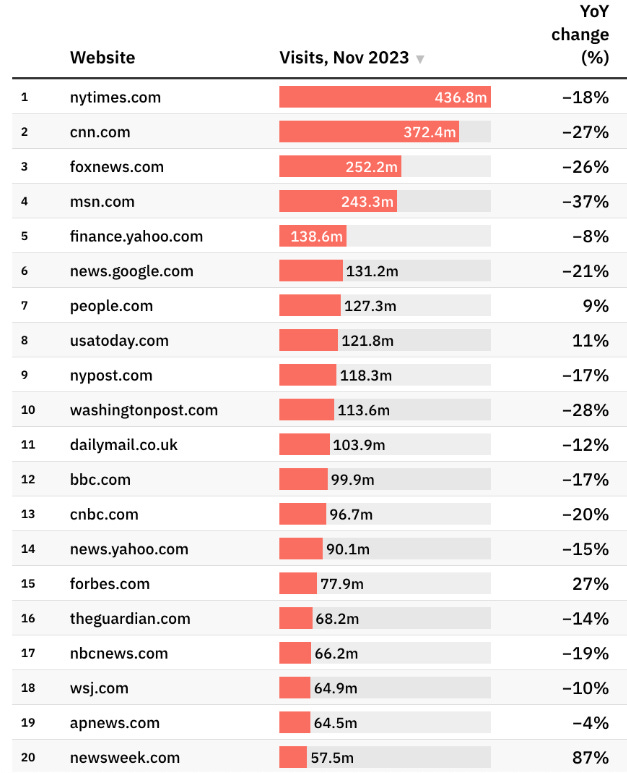

Among the top 20 media properties in terms of viewership, only Forbes, USA Today, People, and Newsweek showed increases in page views, while the rest faced negative YoY changes.

On the other side of the mountain, 33% of people under 30 get their news from TikTok. 37% of consumers trust social influencers more than brands or organizations.

Old Media has several paths it can take. One route is M&A, with the rumored combination of Paramount and Warner as an example. To us, that one seems like two aging nursing home patients getting married so they won’t have to die alone.

Another strategy is to leverage the brand equity, audience, and content to extend the spectrum on which the business can operate. One theme we like is the “News to Knowledge" Continuum.

In a Knowledge Economy, people are going to have to get smarter on an ongoing basis to participate in the future. This won’t be done in the traditional way of taking a class. Education will be gained through a variety of media and mediums. Articles and blogs are short-form education. Podcasts are lectures in your AirPods. The continuum goes on and includes documentaries, conferences, seminars, online courses, degrees, and executive education.

For example, The New York Times has podcasts, conferences, and a journalism program. Forbes has all of the above plus the Forbes Business School with nearly 20K students. It's mEDia – education is the center of the future of media.

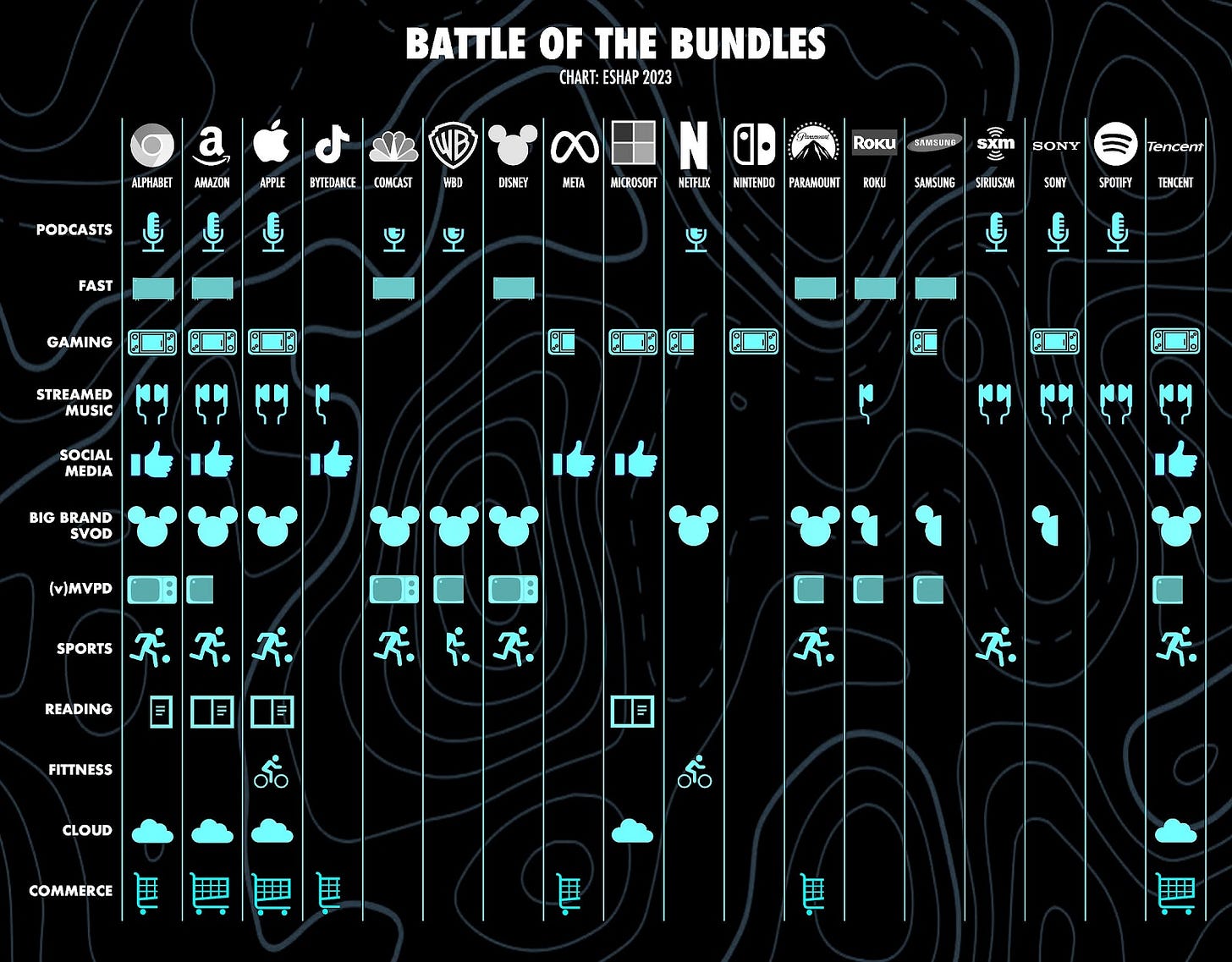

Technology platforms are becoming increasingly involved in the media game as a natural way to extend their customer relationships. Apple has Apple TV, Apple Music, and Apple News and will be looking to fill in the remainder of its "media stack". Ditto for Amazon, Google and Microsoft. Amazon has added live sports into their Prime Video offering with Thursday Night Football and more regional broadcasts in the future. Google has quietly turned YouTube TV into the 4th largest live TV service in the country, and arguably the World’s largest education channel.

h/t Evan Shapiro

The commercialization of the Internet 30 years ago provided the catalyst for new media platforms like AOL, Yahoo, and Facebook to achieve exponential growth by piggybacking on the explosion of this new medium. The fundamentals were to get "eyeballs" and create network effects. The three most important metrics were #1) engagement #2) engagement #3) engagement.

AI, mobile phones, and the emerging web 3.0 are creating the environment for the next wave of media which we call NOW Media.

As we wrote in EIEIO…Under the Influence, people are the platforms and while eyeballs and engagement are still important fundamentals, the foundation of NOW Media is trust and affinity and the monetization is from data and insights. The revenue streams that come from owning a 6, 7, or even 8-figure audience are massive.

h/t Erik Torenberg on a great podcast with Greg Isenberg

From EIEIO…Under the Influence:

As the Forbes Top Creators List 2023 shows, there are dozens of vloggers, podcasters, and streamers raking in tens of millions of dollars annually.

Whether it's 25-year-old YouTube king MrBeast (187 million subscribers and over 33 billion total views) or 29-year-old podcaster Alex Cooper (currently entering the final year of her 3-year, $60 million Spotify contract), these people are certified powerhouses. Their reach, distribution, and of course influence have made them money-printing machines.

Persona and affinity-driven content is the future for both news and entertainment. We can expect persona-led production companies to steal significant market share from older, established agencies. High-profile figures like LeBron James (Springhill), Peyton Manning (Omaha Productions), Barack Obama (Higher Ground), Beyoncé (Parkwood Entertainment), and Drake (Dreamcrew Entertainment) have all turned themselves into platforms and media companies.

Similar things are happening in news. Tucker Carlson, Megyn Kelly, Don Lemon, Tulsi Gabbard, and others have decided to go independent and build their own media brands. Upstart costs are the lowest they’ve ever been, especially with distribution platforms like X, where a single piece of content can get 267 million impressions.

The Internet offers programmatic, global-scale content distribution at no marginal cost. Many well-known creators don’t want to sign with larger media entities – they can reach a tremendous number of people without them and do not want to risk eroding trust with their audiences.

The heartbeat of any community is a shared passion, and it sometimes takes a trusted persona to lead it. The OG audience + affinity + community builder was Oprah Winfrey. She built a passionate audience that trusted her and she reached them across channels – The Oprah Winfrey Show, Oprah Magazine, the Oprah Winfrey Network, Oprah’s Book Club, and more. Not to mention, she has authored books, signed radio deals, and created buyer’s guides.

Modern-day renaissance man Joe Rogan, with his audience of 11 million listeners per podcast episode, is well-positioned to follow the Oprah playbook. He is someone who could be a horizontal influencer with a multi-billion dollar business empire.

From EIEIO…2024 in Review

Joe Rogan leveraged the value of his enormous reach (15 million subscribers) to launch the JRE Network. He introduced an array of specialized podcasts, exclusive video series, and engaging digital experiences, alongside an e-commerce venture featuring branded merchandise, supplements, and fitness programs.

Leading life coach Tony Robbins is a one-man media machine. This year, his free virtual seminar will have over 1 million participants. He consistently gets 15,000 attendees to his in-person conferences. He’s able to charge $100,000 per day in one-on-one coaching sessions. This goes along with his books, videos, and personal interests in over a hundred businesses with an aggregate of $7 billion in revenue.

It’s easier to build and monetize a community vertically. With the internet, being “niche” does not mean small. A great case study of this is Steve Rinella of Meateater. He built a media empire around hunting and outdoors starting with his Netflix show, where he gained credibility and legitimacy with his audience over the course of a decade. This earned trust allowed him to expand into guides, podcasts, gear, recipes, and more. The company is backed by the Chernin Group and is shooting for 9-figure revenue.

Another example of a successful affinity-driven media business that has expanded across multimedia, products, and experiences is The Daily Wire. Ben Shapiro and Jeremy Boreing rallied a group around a common theme (politically conservative principles) and built out a roster of recognizable faces who garner viewership and engagement. Founded 2015, the company was quickly able to earn the trust of its ever-growing audience (many of whom are paying subscribers) and has ventured beyond just articles and podcasts into documentaries, films, e-commerce, and a full-blown children’s content network (Bentkey). These revenue streams have allowed the company to achieve sales well into the hundreds of millions.

Hot Media Businesses

Sports media for Gen Z with over 85 million followers across all platforms. 9 out of 10 people under the age of 25 who like sports know about Overtime.

Crowdfunded studio behind The Chosen and Sound of Freedom (which has surpassed The Godfather at the box office and had only a $14.5 million budget).

Only 20 full-time employees, 540,000 subscribers, deals with Netflix, plans for more in-person events.

"The E-Mail Newsletter for the Mogul Set”. Recently raised a $10 million series B.

#1 technology podcast in the world. Expect All-in to expand into a full-blown media business in the coming years.

#1 most subscribed sports channel on YouTube with 115M total social media followers. Began with a huge following of 12 to 30-year-old men, but becoming a family-focused media empire. Recently launched the Dude Perfect app.

“Pro-tech, expert-led media” – Launched 13 shows, reached nearly 3 million downloads after only formally launching in June of 2023.

“Smart Brevity” - concise, often bulleted-format news stories. The business has been profitable since its inception and was acquired by Cox Enterprises for $525 million in August 2022.

Founded by media veterans Ben Smith (former editor-in-chief of BuzzFeed News and media columnist at The New York Times) and Justin B. Smith (Former CEO of Bloomberg Media Group), the company is seeking to make their journalists into influencers

Smart, insider insight on Silicon Valley, founded by former WSJ reporter Jessica Lessin. Hit 45,000 paid subscribers as of 2022, with a mission to build “the next Wall Street Journal over the next 50 years.”

Today’s creators have the opportunity to achieve unprecedented reach but face fierce competition. While producing and distributing content is easier than ever, standing out is extremely hard. However, market forces will elevate the best creators who can truly connect with audiences through quality work. Those who successfully break through will strike gold.

Market Performance

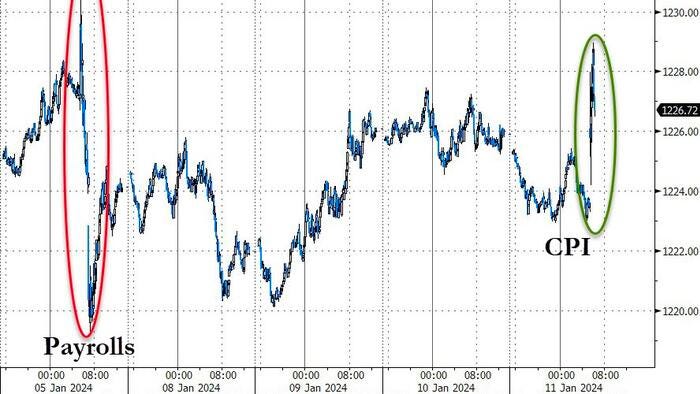

Stocks moved higher last week boosted by expectations of falling inflation and a reduction in interest rates. The S&P 500 rose to 1.2% reaching an all-time high, while NASDAQ increased 2.3% and the Dow was up .7%.

Microsoft moved past Apple last week to be the highest-valued company in the World with a market cap of $2.96 trillion. This happened despite Apple's iPhone becoming the top-selling smart phone in the market for the first time ever.

Also encouraging was the University of Michigan (Go Blue!) Sentiment Index reached a 2.5-year high at 78.8. Earning season is about to kick off with the expected overall EPS growth for the next 12 months around 11%.

Entering its 52nd year, the World Economic Forum (a.k.a. Davos) was last week, with focuses on AI, the Ukraine War, Climate Change, and Trump. JP Morgan CEO Jamie Dimon turned heads saying it was a mistake to demonize the Trump supporters and that Trump actually did some good things as President.

Japan's Stock Market reached a 34-year high and is threatening to have positive interest rates in recent memory. A little further West, China said its economic growth achieved its 5.2% target to the surprise of nobody.

Coinbase made the novel argument to the SEC that the cryptocurrencies it traded weren't securities but more like Beanie Babies. Also of interest, Reddit looks like it's going to go Public in March.

My view is we continue to be in a constructive environment for stock pickers (see our model portfolio) and as the year progresses, a continued broadening of the participation in positive performance.

Maggie Moe’s GSV Weekly Rap

Need to Know

READ: Asset-Light Software Businesses: The New Paradigm for Startups | Every

READ: Demographics in Motion | White Star Capital

READ: Sarah Tavel Compilation

LISTEN: Michael Ovitz – Knowledge Is Power

WATCH: Ed Sim & Jamin Ball: Did Figma Kill M&A Markets & 3 Requirements to IPO in 2024 | E1101

READ: AI in 2024: From Big Bang to Primordial Soup | Sequoia Capital

LISTEN: Daniel Ek – CEO and Founder of Spotify | In Good Company | Norges Bank Investment Management

WATCH: NFX Longevity Documentary

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: WSJ

#2: IPO Market

$USDC stablecoin issuer Circle confidentially filed for a US IPO this week.

Source: Axios

#3: Interest Rates

Source: Charlie Bilello

#4: Inflation

Source: ZeroHedge

Chart of the Week

Source: Gallup

Chuckle of the Week

EIEIO…Fast Facts

Entrepreneurship: 30% – percent of IPOs over the past five years that by founder-led companies (Schroders)

Innovation: $4.6B – inflows into Bitcoin ETFs on first day of trading (Reuters)

Education: $29,307 – spending per student at Chicago Public Schools (Wirepoints)

Impact: 80% – percent of Gen Z and millennial workers that are stressed out (Fortune)

Opportunity: 10.5% – outperformance of woman-owned hedge funds over the last 16 years (BlackRock)

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup….EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM