EIEIO...F.R.E.E. Is the Key

Thirty Plus Years in the Making...The Dam Finally Breaks

GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: 2,368 – The number of businesses sold in the US in the first quarter of 2025. (Entrepreneur)

Innovation: >500 million – The total number of lives estimated to have been saved by penicillin. (Sir William Dunn School of Pathology)

Education: 90% – The percentage of U.S. college seniors who regard schedule flexibility as “very important” in a first job. (Harper’s)

Impact: 3x – Alaska residents spent three times more on energy than Florida residents in 2023. (EIA)

Opportunity: ~10 Years – The amount of time it took for Sundar Pichai to rise from a mid-level Product Manager to CEO of Google. (Signüll)

“These overnight successes take a hell of a long time.” – Steve Jobs

“But in the free market system, you are forced to change.” – Roy Romer

“The Pioneers get all the arrows, but the ones that survive get all the land.” – MM

You are who you are based on the people you meet and the books you read.

As I was trying to make my way into the investment business, I was lucky enough to gain the intrigue of Richard Perkins. Initially, it was from my persistence and, ultimately, my hunger to learn from him.

“Perk” was a legend in the Minneapolis investment community. He had run money for the Mayo Clinic and, following that, started up the institutional capital markets business for Piper Jaffray. In those days, Minneapolis was a hotbed for innovative, fast-growing companies such as Medtronic, Control Data, St. Jude Medical, Cray Research, Best Buy, United Health Care, and on and on.

Perk would scout out local emerging growth companies in the afternoon, write up a research report in the evening, and call up institutional funds the next morning. Perk had a nose for big ideas, and small-cap fund managers were eager to hear what Perk was excited about.

After Perk finally relented and let me into his office to meet, he was amazingly generous, sharing his time and advice—how to analyze a company and, more importantly, a management team. How to pour through reports, spot trends, and swing for the fence. Perk told me not to get an MBA but to do the CFA Program (great advice) and to read six newspapers a day (New York Times, Wall Street Journal, Financial Times, USA Today, Minneapolis Star Tribune, and the most important, the Investors Daily).

Naturally, when I started as a rookie research analyst at Dain Bosworth, charged with identifying small companies with big potential between Minneapolis and Seattle, Perk was my stock whisperer.

A company Perk was hot on was a local company that had spun some IP out of Control Data called Education Alternatives. Education Alternatives’ business was to privately manage public schools—or, at least, that was their aspiration.

My sheltered world view didn’t really get it when Perk excitedly told me what a big idea this was. After all, I had grown up in Minneapolis, which was the inspiration for Garrison Keillor’s Lake Wobegon, and the public schools pretty much worked. Why would a public school need to be managed by a private company?

Given my deep respect for Perk, I decided I’d dig deep to understand why he loved this concept so much. First on the list was to meet the CEO of EAI, John Golle, who rapidly filled me in on what a desperate state public education was in across the country (I hadn’t heard of A Nation at Risk) and how Minnesota passed the country’s first Charter School Law in 1991.

Intrigued, I flew to Baltimore, Maryland, where EAI’s first contract was to manage several of Baltimore’s most desperate schools. From Baltimore’s perspective, they had nothing to lose, and EAI needed to actually run a school to prove their innovative model worked with live students.

When I got to the first school, I couldn’t believe my eyes. In the courtyard were dead animals the neighbors had shot for sport. When I got into the actual building, it was abysmal, chaotic, and scary. The bathrooms didn’t have partitions in them, and the teachers were doing their best but were clearly overmatched.

I couldn’t believe schools like this existed in the United States of America. It was no longer a mystery to me why 50% of students in urban public high schools dropped out.

Armed with real-time information from the front lines, I put out a report on EAI with a “speculative BUY.” My thesis was pretty simple: the best investment opportunities are where there is a problem, and companies that can solve that problem have enormous opportunity.

I couldn’t imagine a much bigger problem, and at $4 a share, it seemed like a good risk-versus-reward scenario. Within a year, the stock went to $48 a share, and in between, the company became a target for the opposition, and I, as a lowly research analyst, had received personal threats.

Around that same time, a whiz-bang media entrepreneur had been studying the issues facing public education and how this new Charter School legislation opened up this potentially massive new category of privately running public schools. Founder Chris Whittle made headlines when he somehow recruited the President of Yale University, Benno Schmidt, to leave New Haven and join the fledgling Edison Project as its first President.

Initially, the Edison Project did incredibly well and had smartly spread its contracts across different geographies so as not to become a sitting duck for the forces against change. Given Edison was “awarded” the most challenging schools, its success was impressive.

In fact, Edison’s success was so impressive that then-Pennsylvania Governor Tom Ridge decided on a scale solution in Philadelphia’s notoriously failing schools and brought the company in to run 30 of its absolute worst ones.

The good news for Edison: a massive contract. The bad news for Edison—and ultimately its demise: it created a massive target for the opposition to wreak havoc, and indeed, that’s what happened.

To wit, the project manager of the Philadelphia schools, Richard Barth, who later became the CEO of KIPP, had to wear a flak jacket and have bodyguards to enter his schools. Obviously, not a great environment to obtain academic achievement.

Alas, both EAI and Edison became prime examples that the “pioneers get all the arrows.”

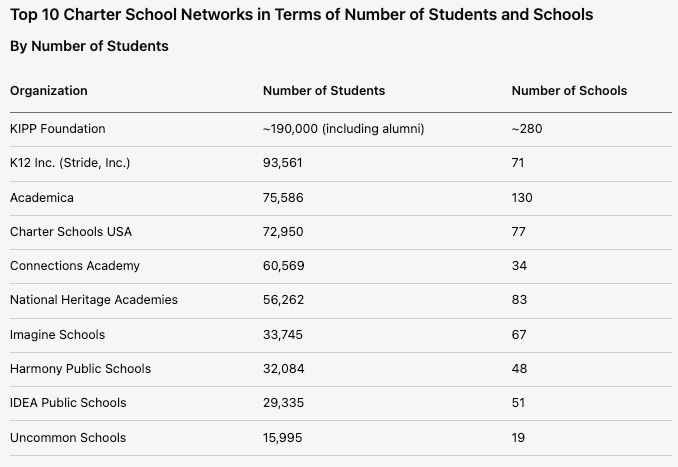

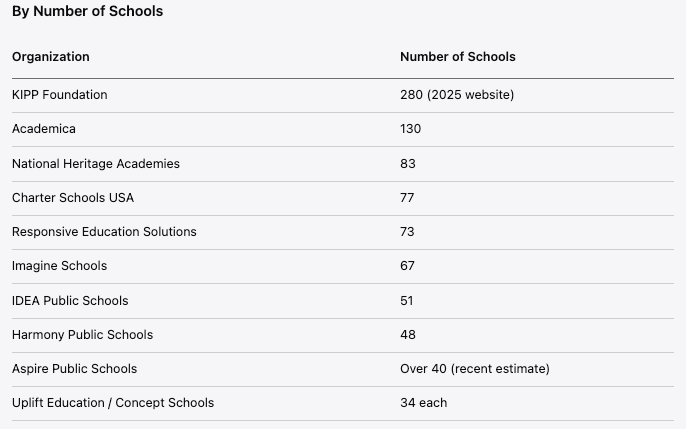

Fortunately, and relatively quietly, a number of Charter School operators have taken some of the lessons learned and created successful schools across the country. Now there are over 8,000 schools and 3.8 million students. Networks such as John Hage’s Charter Schools USA and Fern Zulueta’s Academica (both of whom took their experience working for Jeb Bush) have created some of the most impressive schools in the nation.

Charter students now comprise 8% of all K–12 students. So my addendum to the “pioneers get all the arrows” is “but the ones that survive get all the land.”

Moreover, there are scaled school networks that aren’t in the ten largest, such as Eva Moskowitz’s Success Academy in NYC and Peter & Patti Bezanson’s BASIS Charter Schools, that have achieved remarkable academic success. Basis has consistently had a number of its schools as the very best in the country. Part of its secret sauce? Pay teachers for how well their students learn.

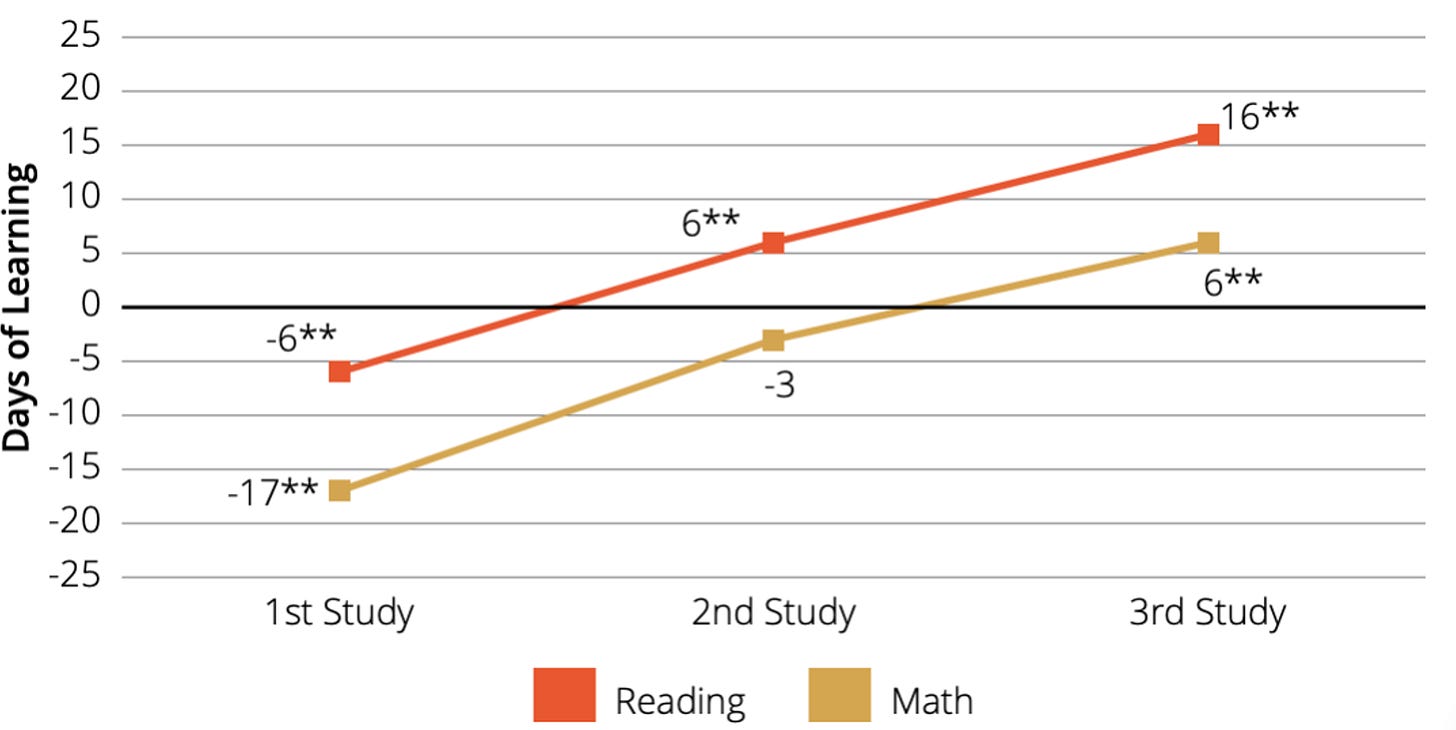

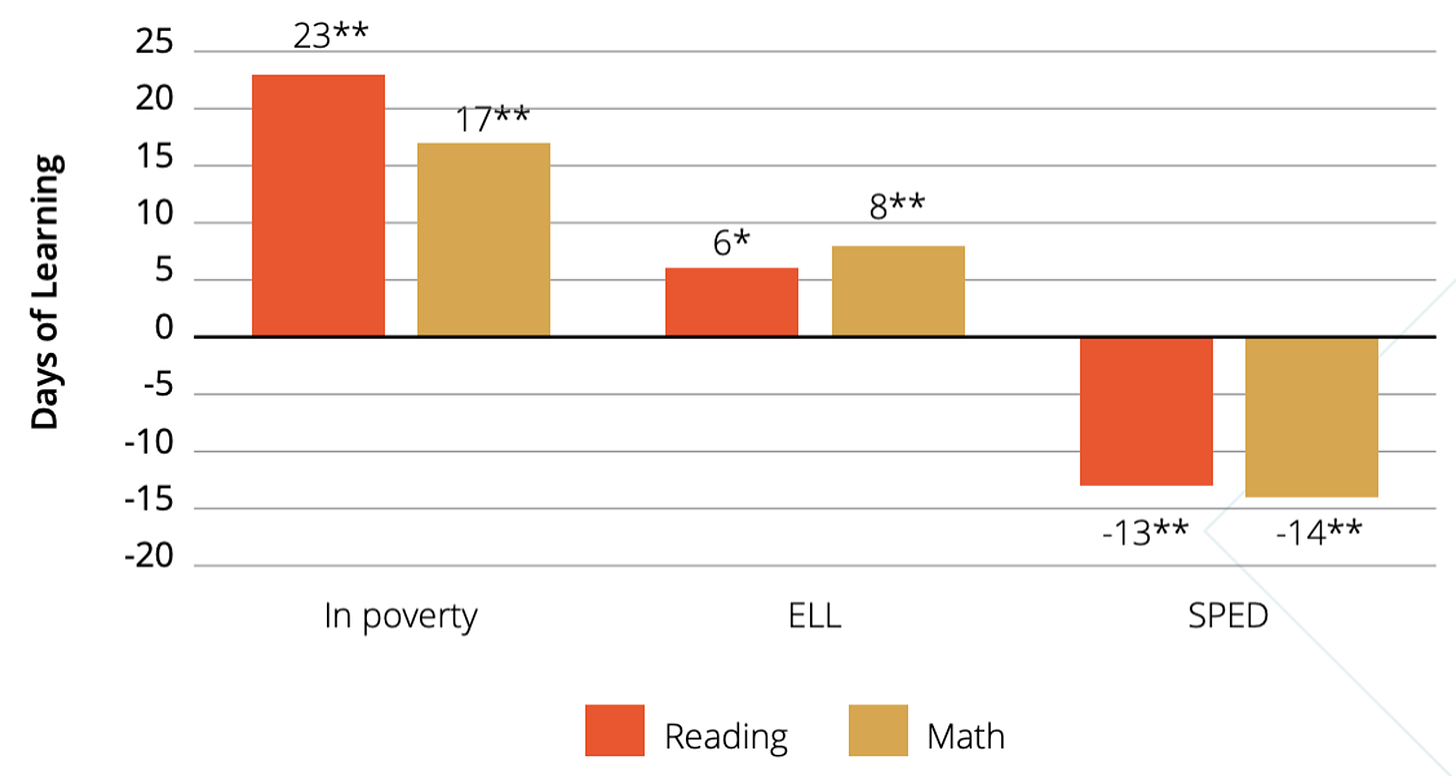

In a country where we can’t even agree on what day of the week it is, 75% of all adults support school choice and Charter Schools. Why? Because overall, they work, and they are working especially well for the kids who are the most disadvantaged.

In addition to charters, “choice” of many flavors is thriving.

Education Savings Accounts (ESAs) are booming, which can be applied for a variety of educational services, including private schools, tutoring, and supplementary material. Eighteen states now have ESAs, with approximately 400K children as potential beneficiaries.

There are now 95,000 micro-schools in the United States with 1.5 million students in them. A number of micro-school providers are popping up, with leaders such as Primer (GSV Ventures investment) and Prenda showing huge traction.

Home school, once thought to be the place for religious fanatics or recluses, now has 3.8 million students and famous alumni such as Tim Tebow, Thomas Edison, and Emma Watson.

Last week, I had the opportunity to interview one of the heroes of the school choice movement, Ian Rowe, from Vertex Partnership Academies. Ian’s philosophy of embedding virtues in the overall academic experience is impressive, and his F.R.E.E. Model (Family, Religion, Education, and Entrepreneurship) kind of nails it for me. Please check out my interview with him when it comes out later this week.

As we enter a new school year, the education options for our children have never been more robust. The progress made over the past 34 years is real. That said, we are a long way from our aspirational goal of giving every student an equal opportunity to participate in the future, the foundation of which is access to quality education.

Today, coming together, we have businesses that say they can’t hire students coming out of our schools because they can’t read and they can’t write. You have parents who are scared and angered by studies showing that this generation of children will be less educated than themselves for the first time in our country’s history and are demanding change and choices. You have politicians who are sticking their fingers in the air and seeing that it’s an issue that is a winner from polls. Against that, you have the entrenched status quo who says, “Give us more time and more money.” The good news—the American people are saying, “250 years is long enough, we need change now!”

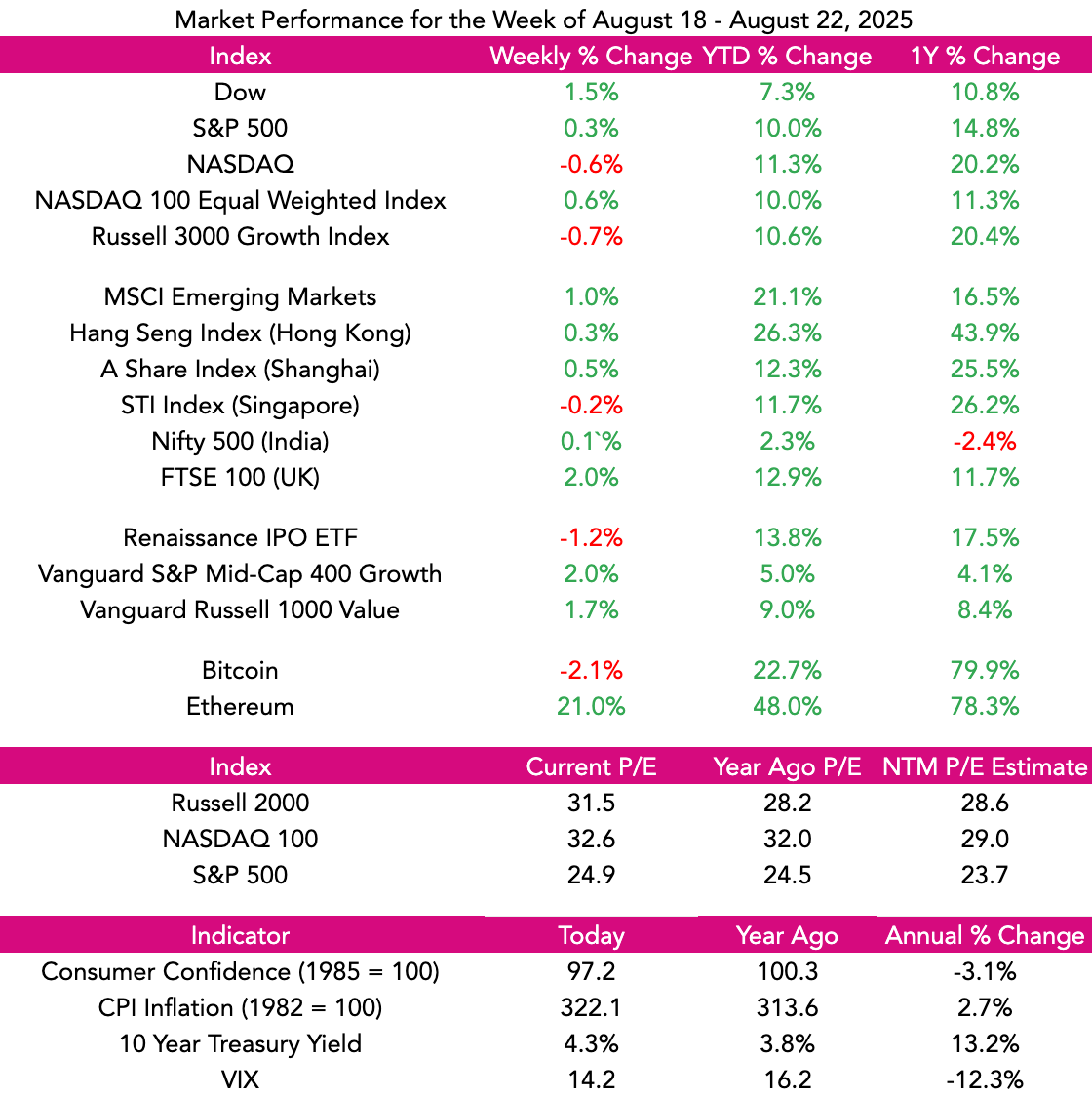

Market Performance

Market Commentary

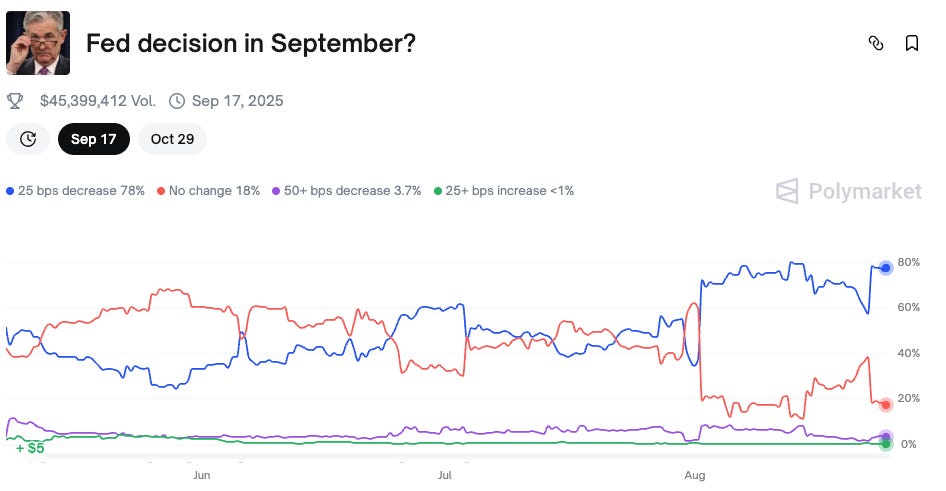

Against the backdrop of the stunning Teton Mountains, Fed Chair Jerome Powell’s comments at the annual Fed meeting in Jackson Hole sent stocks surging Friday.

Powell’s hyper-scripted remarks are always closely listened to by Wall Street, with the interpretation being that the Fed finally seems ready to start lowering interest rates.

For the week, the Dow rose 1.5%, the S&P 500 inched up 0.3%, and the NASDAQ fell 0.6%.

Since the April 8th low, the S&P has rocketed upwards over 30%, and the NASDAQ has doubled, boosting almost 41%.

Two online education companies were highlights for the week, with both Stride and Grand Canyon reaching record highs. Stride gapped up 15% following a 36% increase in its quarterly EPS. Grand Canyon gained 13% on 20% EPS growth and word that Uncle Sam was going back in the attic.

Also of intrigue last week was the attempted takeover of OpenAI by Elon Musk and Mark Zuckerberg. The price they were trying to wrangle was just a shade under $100 billion, which is one-fifth of the $500 billion shares have recently traded hands for.

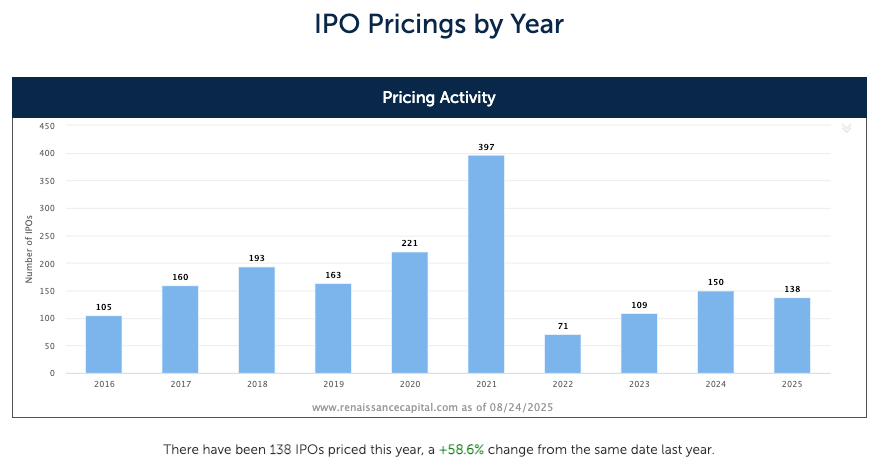

We remain BULLISH on the outlook for growth equities, with the likely commencement of lower rates making future earnings more valuable. We expect a vibrant IPO market to provide fresh oxygen for investors. 🐂

Need to Know

READ: Workflows Are the New Databases | Clouded Judgement

WATCH: Brent Richard & Drew Weatherford: Expanding College Sports with Project Add More Athletes" | Profluence

LISTEN: Steve Jobs In His Own Words | Founders

GSV’s Four I’s of Investor Sentiment

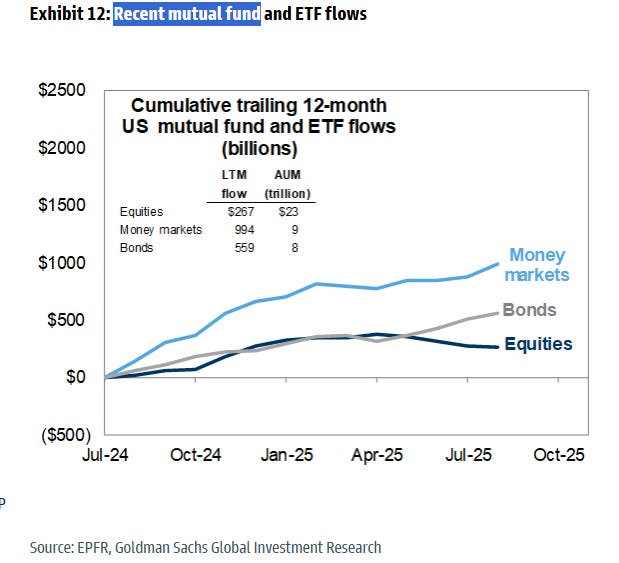

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

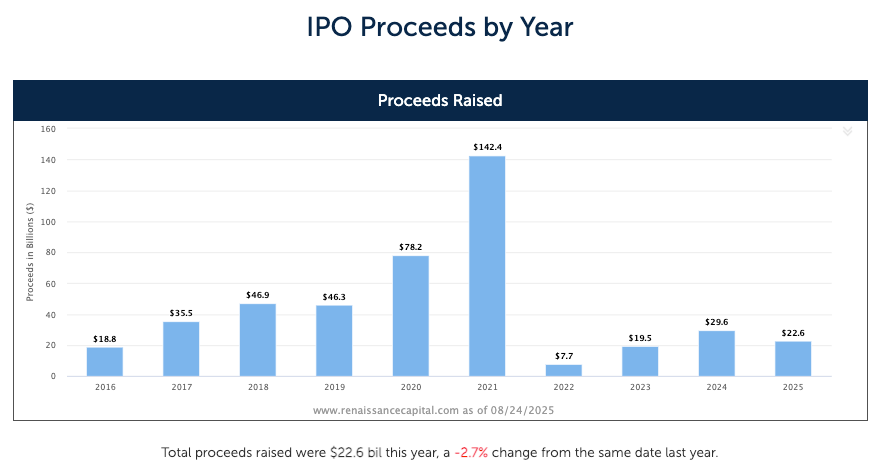

#2: IPO Market

#3: Interest Rates

#4: Inflation

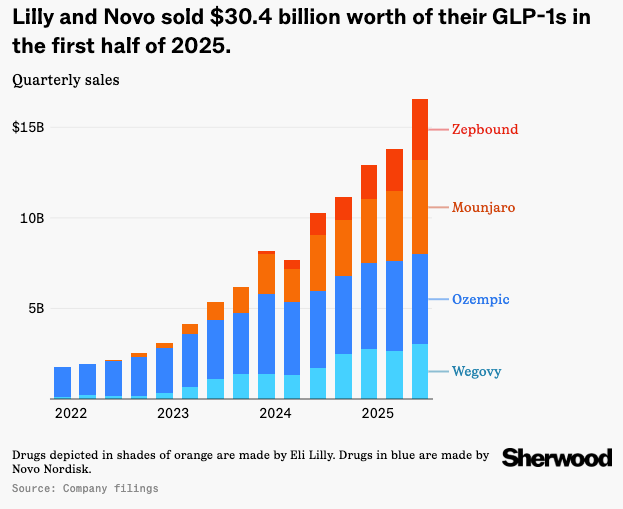

Chart of the Week

Maggie Moe’s GSV Weekly Rap

Chuckles of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM