GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: Nearly 200,000 – The number of businesses in the US that are worth between $10 million and $100 million (Financial Times)

Innovation: 58:2 – The ratio of employee arrivals (hires) to departures at Anthropic over the past 8 weeks (Live Data Technologies)

Education: 14,448 – The number of non-teaching employees at Stanford University in 2018, compared to 7,800 undergraduate students (Stanford Review)

Impact: $10 billion – The total profits from Vinod Khosla’s VC investments between 1988 and 1998, which included a 2,500x return on his investment in Juniper Networks (Mario Gabrielle / The Generalist)

Opportunity: Nearly 1/3 – the fraction of all startup capital that came from family offices in 2022 (PwC)

“The amount of education you need to get a job really has risen more than the amount of education you need to do a job.” – Bryan Caplan

“Academics used to be the upward mobility of the middle class in America. We’ve now become the caste system as we’ve become drunk on exclusivity, failing to realize we’re public servants, not luxury brands.” – Scott Galloway

“I think the best move now is just to get admitted to a Stanford or an MIT, drop out, and put the admission letter on your wall.” – Naval Ravikant

“When everyone has a degree, the signal loses its strength.” – Rob Henderson

There are subtle signals…and there are obnoxious signals.

A guy I used to work with was a young, very successful investment banker. He was not, however, a model. Short, chubby, and prematurely bald, his looks weren’t going to make him a top draft pick at Friday night’s Happy Hour.

Resourceful and determined, he used to bring his W-2 statement with him to the bar. Perhaps as another signal that he had been over-served, he’d eventually attach it to his forehead.

Dumb & Dumber (1994)

Hopefully, few of us engage in such overt signaling.

But nearly everyone is guilty of some form of signaling in their lives. From the cars in our driveways to the jewelry on our wrists to the framed diplomas on our office walls.

We do this to signal. To signal that we have wealth, taste, smarts…

The badge of elite academia is one hell of a signal. It’s a way of letting others know that we are ambitious and competent – after all, we have the official credential to prove it. The more elite the institution and the greater the number of degrees, the stronger the signal.

Signals change over time. It wasn’t all that long ago that powdered wigs demonstrated status and being overweight was a symbol of wealth. Amidst the AI Revolution, a strange sign of the times is the phenomenon of “billionaires increasingly flexing on each other by bragging about the size of their AI superclusters instead of the size of their yachts.” I didn’t have data centers on my signals bingo card, but here we are.

However, as many high-signal trends have come and gone, the badge of elite education has stood the test of time as perhaps the greatest of them all.

Studies have shown that educated dictators achieve higher FDI [Foreign Direct Investment]. By contrast, the leader’s age and political experience have no relationship with FDI.

The Winklevoss Brothers started the company (initially called The Harvard Connection) that morphed into Facebook on the sole premise that people wanted to “connect” with people who went to Harvard. The @harvard.edu email address was a golden ticket.

The world’s most elite schools have the the strongest brands on the planet. Harvard, Stanford, Yale…the heraldry of these institutions do all the talking. These schools were able to continue to charge over $50,000 per year when they went fully online during COVID with few questions asked.

I know CEOs who only set out to hire from elite schools – schools I would consider “Ivy+”. You know, the schools that have 1% of American college students and ~45% of the total endowment pool.

When these CEOs have a job posting for junior roles (for example, “business analyst”), their bias directly impacts the company’s hiring process. They’ll receive resumés from applicants who earned a business/economics/finance degree from a mid-tier school, and these resumés will get thrown out in place of a Classics major from Princeton. Grossly unfair, but true nevertheless. The shield takes you places.

However, the same CEOs could receive a resumé from that states:

Education: Yale

Major: History (Dropped out senior year, did not complete degree)

…And they would bar that applicant from consideration.

Why?

Due to the Sheepskin Effect: People with academic degrees earn higher incomes than people who don’t have an academic degree but possess the same amount of knowledge and skills.

Rex Woodbury described this phenomenon on episode 19 of Ed on the Edge ⬇️

As author Rob Henderson points out, “A college degree is often perceived as a signal of ability. A decent proxy of a person’s ability to think and learn and conform.”

He notes, “In the 1970s, only 13% of Americans had bachelor’s degrees. Today more than 30% of Americans are college graduates. This has led to an educational signaling race.”

Given this trend, it shouldn’t be shocking that more than half of college graduates are working in jobs that don't require degrees.

Chamath Palihapitiya ranted about the need for increased focus on skill development over degree prestige on a recent episode of All-In.

“If you are a great creative thinker/designer/architect, you should be at RISD. . .If you are a great musician you should be a Julliard. . .You should not be going to MIT because you think it's a checkmark.

You should be going there because you think that there are professors in organic chemistry, in physics, in these disciplines that are really important, who are experts in their fields that you can learn from and become an expert yourself.

I think the problem with all of this other stuff is once you make it a credential there are some folks that are only going to MIT because they could get in and because it's a great credential in their minds…and they shouldn't go there either.”

He continues lobbying on behalf of schools with specializations in hard skills, labeling colleges like Harvard as more of a “pure credential”:

“Harvard is more of a pure credential. MIT. . .you go there for certain kinds of specializations. Caltech – you go there for certain specializations. If you're really into wine you go to UC Davis. My point is, these schools exist for reasons other than just as a collector coin.”

Imagine your dog was critically ill and you needed to look up your city’s best veterinarians. You find one local vet who went to Cornell and one who went to Colorado State. You’ll instinctively call the Ivy-educated doc first, right?

Program-specific rankings suggest otherwise – CSU tops Cornell when it comes to vet school.

Fair or not, there is no denying that degree holders from “pure credential” schools have a considerable leg up in the working world. Headhunters have them on speed dial.

However, for the 99% of college students who don’t attend these “pure credential” Ivy+ universities, hard-skill development is paramount.

Teaching in the “hard disciplines” (engineering, math, computer science, etc.) is commoditized to a large extent. The laws of quantum mechanics do not change whether you’re sitting in a lecture hall at Stanford or at Florida State.

Interestingly, in these disciplines, the distribution of income across college rankings is relatively flat. Obtaining a degree in fields like electrical engineering or computer science generally results in similar earnings over time, regardless of the prestige of the institution. While graduates from higher-ranked schools might initially earn slightly more, income levels tend to converge.

In January, we talked with the President of Western Governors University, Scott Pulsipher, about the school’s approach to competency-based education.

“I don’t really care where the individual learned to fly. I don’t care necessarily how many hours. I really care about whether the individual is a competent pilot.”

AngelList founder and Investor Naval Ravikant invoked the Sheepskin Effect in a recent interview in which he railed on college as a whole. Despite its flaws, have a far more optimistic view on the institution of higher ed than Ravikant.

However, he makes a strong argument regarding skill acquisition in the modern age, pointing out that the means for learning are now abundant. This is certainly true – YouTube is the largest education company in the world and we are massive proponents of learning outside the box.

There are still plenty of positives to campus life and it remains a key to producing flourishing, ambitious, and equipped young adults.

We find ourselves more in line with Marc Andreessen’s school of thought when characterizing higher education. He describes the “overt purpose” of college as a bundle comprised of skills training, a 4-year adventure, a dating service, and (in classic Andreessen fashion) a “giant sports complex generally attached to a hedge fund.”

The implicit purpose, he points out, is to conduct IQ and personality testing on behalf of employers (who can no longer legally do this themselves). He argues that the college system can be boiled down to a barometer for conscientiousness, which he describes as a combination of industriousness and attention to detail.

Plus, Andreessen says, it proves that you can finish something. If you can finish a 4-year degree, you ought to be able to complete a task as an employee.

College is also a place where people learn how to learn. It serves as a critical environment for developing key skills beyond specialized knowledge. Over the course of four years, college students engage extensively in problem-solving, reading, writing, communicating, comprehending, and analyzing. This experience often goes beyond what you'd typically learn outside of college during the same time.

Higher education is an institution that is filled with gatekeeping. Academic counselors, professors, and students have long gatekept information to their benefit. For centuries, academic material was literally kept under lock and key behind the physical gates of campus.

The Internet significantly democratized access to knowledge, a trend supercharged by the AI Revolution. The friction has been diminished even further – we now have personalized tutors (trained on all of the data in the world) accessible at our fingertips, for free. This ease of access is enabling learning at the speed of light, fostering skill development like never before.

In this new era, your knowledge portfolio will matter far more than the prestige of your degree…it’ll be about what you know, not where you go.

Market Performance

Market Commentary

From worst to first…after suffering the biggest decline in 2024 for weekly stock performance, last week had the best results.

NASDAQ advanced a whopping 6%, the S&P 500 was up 4% and the Dow increased 2.6%.

Investors decided to focus on continued calming of inflation and now expected 50 bips lowering of the Fed’s Discount Rate this week. Ignored were some signs of an economy that was losing steam.

AI and India are the two continued themes that have captured attention. Last week, the leaders of NVIDIA, Microsoft, Amazon Web Services and OpenAI met with the Secretaries of Energy and Commerce to discuss the growing energy needs to power the AI Revolution. Speaking of OpenAI, it’s reported they are in the process of raising an additional $6.5 billion at $150 billion valuation.

The Indian IPO Market continues to be where the action is at with Bajaj Housing Finance in the process of being floated at nearly a $40 billion valuation. YTD, $7.5 billion has been raised in Indian new issues with the average IPO “pop” of roughly 30%.

We continue to have a positive outlook for growth stocks and are particularly optimistic for smaller emerging companies and IPO’s. Accordingly, we remain BULLISH.

Need to Know

READ: Signals 📡 - A Window To The Future | Dash Media

READ: Why Generalists Own The Future | Every

WATCH: Anthropic’s Claude Creates a Bill-Splitting App in <30 seconds | Eric Vyacheslav

WATCH / LISTEN: EP. 1 At The Helm | Glue Guys

READ: Family offices are making more startup bets as venture capital shakes out. Here's what founders need to know. | Business Insider

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

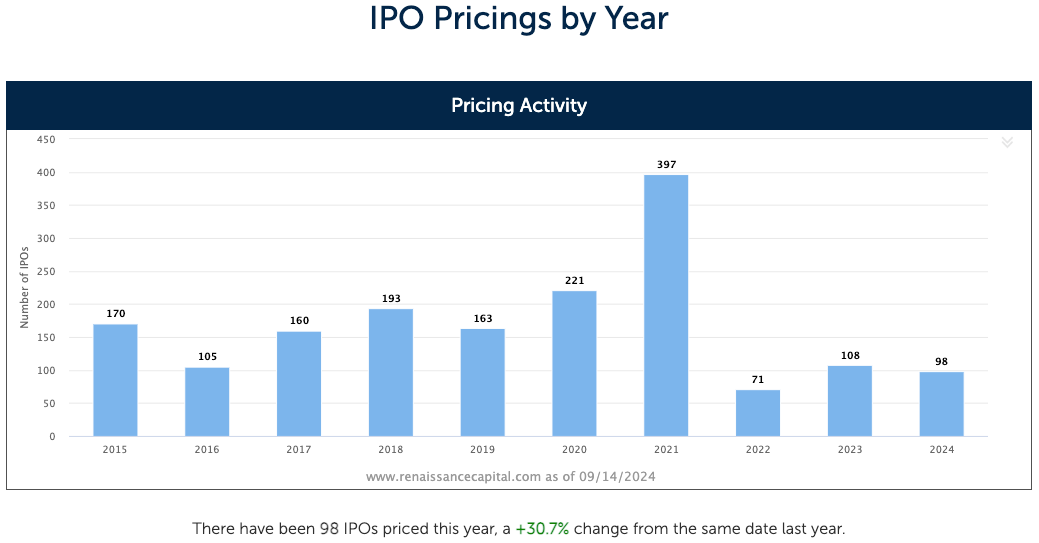

#2: IPO Market

#3: Interest Rates

#4: Inflation

Charts of the Week

The world’s biggest oil reserves by country, visualized:

Maggie Moe’s GSV Weekly Rap

Chuckles of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup….EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM