GSV’s weekly insights on the global growth economy. Join 22,000+ readers getting a window to the future by subscribing here:

“The speed of business is the speed of trust.” – Stephen Covey

“Trust, but verify.” – Ronald Reagan

“I’m so much cooler online.” – Brad Paisley

Meet Ryan Kaji. Ryan is 11 years old. He has twin sisters, Emma and Kate. Oh, and Ryan made $35 million last year doing toy reviews on YouTube.

That’s $5 million more than the Kansas City Chiefs paid Patrick Mahomes last year and 3x the total annual compensation of the CEO of Mattel.

When it comes to online creators who are swimming in cash, Ryan is not alone these days. As the Forbes Top Creators List 2023 shows, there are dozens of vloggers, podcasters, streamers raking in tens of millions of dollars annually.

Whether it's 25-year-old YouTube king MrBeast (187 million subscribers and over 33 billion total views) or 29-year old podcaster Alex Cooper (currently entering the final year of her 3-year, $60 million Spotify contract), these people are certified powerhouses. Their reach, distribution, and of course influence has made them money printing machines.

The evolution of media over the past several decades has been remarkable. There are people alive today who were born before the television was invented…and these same people can now access 114 million YouTube channels, 3 million podcasts, and 800 million daily tweets on demand, usually at zero cost to them.

It wasn’t all that long ago that television stations (of which there were three) signed off for the night. For better or for worse, there was no way to spend the night binging shows on Netflix or going down rabbit holes on YouTube.

As with the evolution of all technology cycles, the media landscape has been transformed by things becoming cheaper, faster, and better. This goes for both hardware and software. It used to be that unless you got a job at a TV station, radio station, or newspaper (national or local), your opinion would not be heard beyond your friends, family and coworkers.

Hardware was prohibitively expensive – the average person could not set up an in-home studio with microphones, speakers, computers, monitors, headsets, etc. More importantly, even for those who could afford to assemble something like this, there were no distribution platforms. If you were a musician, you had to sign with a record label to end up on the airways.

Source: Digital Native

Today, if you can buy a $35 microphone and use some free software, you can become the next big musical artist after posting on SoundCloud, or the next famous political commentator with your own show on Substack, or the next renowned investigative journalist by publishing your findings on X.

Thanks to the internet, the gatekeepers (record labels, TV stations, universities, and publishing companies) became largely unnecessary middlemen.

Can you name the record labels behind Drake, Ed Sheeran, or Taylor Swift? I can’t. And it doesn’t matter, because the individual is the brand, and the producers and agencies need the artists much more than the artists need them.

The artist formerly known as Prince began the assault on “the man” when he changed his name to escape the chains of Warner Bros. Records.

The same trend is happening in education. The 250 Most Popular Online Courses of All Time account for 117M enrollments (468K on average), and 249 of them are free. Top online teachers such as Andrew Ng, Aswath Damodaran, and Laurie Santos have taught millions of students around their areas of expertise (AI, Finance, and Happiness) that go beyond the limitations of a traditional classroom or campus.

While the old-school record label and university models may be relatively obsolete, there are many other elements of the creator economy value chain that have emerged.

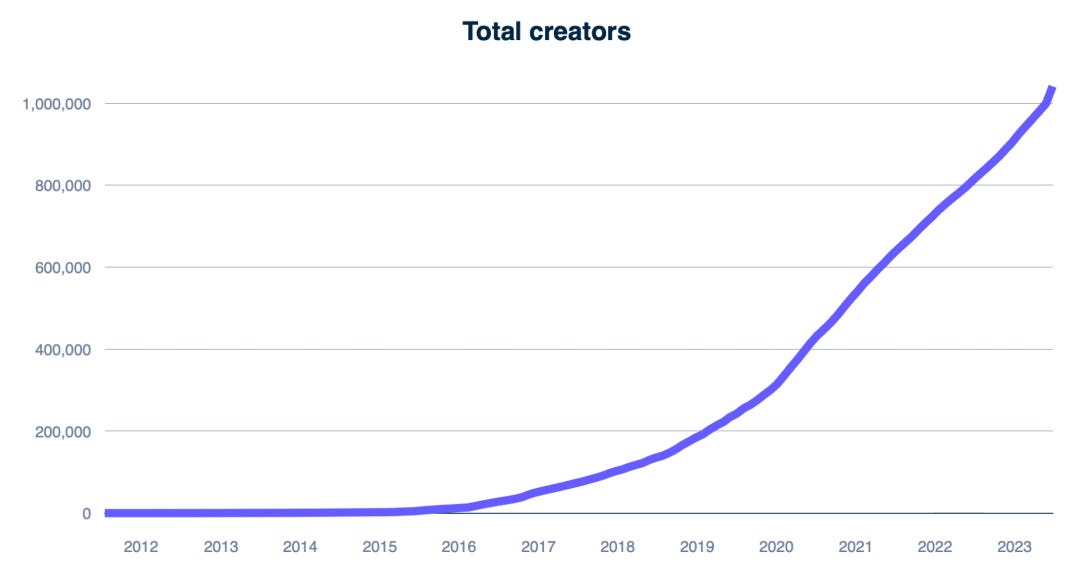

Source: Number of Creators on Top 50 Creator Platforms on Stripe

There are creator talent agencies (i.e., Night Talent), venture firms dedicated to the creator economy (i.e., Slow Ventures Creator Fund), fintech businesses (e.g. Karat) specifically built for creators – these have all emerged because they are genuinely value-additive to the individuals pursuing the careers as creators.

There are new business models where a creator in the early phases of their career can sign with a firm, agreeing to profit sharing in exchange for the enhanced distribution that the firm can provide. Morning Brew co-founder Alex Lieberman talked about this strategy on a recent episode of the Media Empires podcast.

Workweek is also pursuing this business model, and venture firms are getting in the business of backing people too. Slow Ventures has backed creators such as Marina Mogilko and The Libermans, while Chamath Palihapitiya’s Social Capital has backed Jimmy Donaldson aka MrBeast.

Goldman Sachs Research expects the 50 million global creators to grow at a 10-20% compound annual growth rate during the next five years, which would mean a TAM of nearly $500 billion by 2027 (and a world with 100 million creators).

Modern networks that emerge that can best curate content for specific audiences will take the lead. These networks do the heavy lifting of identifying the stars for you, which is otherwise impossible in a world of infobesity.

For example, in sports, Barstool Sports and The Ringer have created networks for top voices to publish their work and build engaged communities.

Erik Torenberg has recently launched Turpentine Media, which he wants to become “The Ringer” for tech.

The extreme ease of content production and distribution has created a crowded field for creators. However, the ones who successfully break through can strike gold.

Many emerging leaders in the creator economy are leveraging their reach and distribution to construct empires with diverse revenue streams, as they rightfully should.

Take Logan Paul for instance. Ten years ago, he was making goofy videos on Vine. He amassed a following and was able to make money from brand deals and meet and greets, but this was only the beginning.

Today, his revenue streams include his YouTube Channel, his podcast, his personally-branded merchandise, his WWE contract, his NFT and crypto ventures, and of course, his beverage company. The drink, Prime, did a cool $250 million in sales in its first year alone.

In yet another example of these creators putting incumbent businesses on notice, Gatorade has had to release its new drink “Gatorade Fast Twitch” in a clear attempt to fend off Prime, which has taken a considerable share (5.8%) of the sports drink market.

The influencer-as-cofounder trend has been picking up steam for the past decade. Many great operating teams have been paired with the ideal celebrity in order to strategically market, message, and distribute to the perfect target audience.

Casamigos (George Clooney), 818 Tequila (Kendall Jenner), Feastables (MrBeast), Teramana Tequila (Dwayne the Rock Johnson), and Skims (Kim Kardashian), have been incredible success stories, with rapid adoption by attracting not just supportive consumers, but crazed fans.

Of course, businesses have linked with famous people for decades in the form of endorsement deals to better promote their products. However, this new model is endorsements on STEROIDS - these people are not merely endorsers, but true cofounders with significant skin in the game.

Once a certain level of distribution has been achieved by an individual, the list of possible business ventures becomes infinite. No one is just a musician, streamer, actor, or supermodel anymore. That would be a huge waste of distribution and influence. Take The Chainsmokers: why be just a DJ when you can also have revenue streams as a venture capitalist (Mantis VC) and tequila magnate (Jaja)?

MrBeast has put Hershey’s on notice [h/t toEdwin Dorsey] by launching Feastables, which is on track to grow its store count by 10x next year to 50,000 stores.

MrBeast could open an in-person arcade (like fellow YouTube Hall of Famers Dude Perfect). He could start an upstart e-sports league. He could start a shoe company.

Any of the above would gain significant traction (if not turn into massive businesses) because at the end of the day, when MrBeast says jump, his followers ask how high.

Why? Audiences give trust where they feel like their provider (the creator) knows them and hears their voice. It was always a one-way conversation when three big networks dominated the news - this gave people a false sense of “truth” because no one could say anything otherwise.

Now, if ABC reports one thing, an investigative independent journalist can counter it and post to X and get 100 million impressions (and have to defend their argument in the town square).

The old-guard institutions – record labels, TV channels, universities, and even the government – used to have a monopoly on talent, truth, and trust.

That’s clearly no longer the case. Incumbents are getting crushed, and people no longer believe what they once trusted and took comfort in.

People used to watch Late Night TV and Sunday Morning talk shows to get a perspective on where the world is going…now they watch Joe Rogan, Lex Fridman, Andrew Huberman, and Tucker Carlson.

The takeaways are clear. The choice is now all in the hands of the consumer, and internet culture is now culture. Just look at the growth of the Streamy Awards vs. the decline of the Oscars:

It’s on creators and independent networks to build community and engagement. The ones that do this best will become the media empires of the future. Digital natives are voting with their eyes, ears, and clicks…it’s Ryan’s World and we’re all living in it.

Market Performance

The Market had a solid week as it looks to stage a fourth-quarter comeback. For the week, NASDAQ was up 0.1%, the S & P was off 0.7% and the Dow was down 1.3%. The VIX fell 4.3% this week and remains below 20, which is the benchmark for IPOs to be “in the clear.”

The major regulatory story of the week was that the Government shutdown was averted on Saturday night, as the House passed a 45-day spending bill. Meanwhile, Lina Khan and the FTC launched an antitrust suit against Amazon for “illegally maintaining monopoly power.”

On the company front, Lululemon announced a five-year global content, clothing, and community partnership for both with Peloton, as Softbank-backed rival Vuori is rumored to be planning an IPO next year.

Jony Ive, Sam Altman, and Masayoshi Son are rumored to be collaborating on the “iPhone for AI”, as OpenAI is talking to investors about raising a tender offer at a $90 billion valuation. Lastly, The Sphere Las Vegas launched on Friday night with an “utterly astonishing” concert by U2.

We remain BULLISH on our outlook for high quality growth companies but recognize that investors will be in a holding pattern until there is more conviction that rates will stabilize and inflation is tamed.

Maggie Moe’s GSV Weekly Rap

@maggiemoeyoWeekly Rap 10/1/23 #taylorswift #kelce #traviskelce #chiefs #government #shutdown #dianefienstein #amazon #monopoly #flooding #flood music by @Joshua Vranas | Music 🎶 ⭐️

Tiktok failed to load.

Enable 3rd party cookies or use another browser

Need to Know

READ: The Tea on Gen Z | Redpoint Ventures

LISTEN: E147: TED goes woke, Canada's Nazi blunder, AI adds vision, plus: who owns OpenAI?

WATCH: Life Extension Innovations, Moonshots & Snake Oil (with Celine Halioua & James Peyer)

READ: The Value Chain of Capital

LISTEN: Matthew Prince: Untold Stories Behind the $20B Business That Runs the Internet

WATCH: Mark Zuckerberg: First Interview in the Metaverse | Lex Fridman Podcast

READ: The Future Is Starting to Look Like the Future by

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: Yardeni

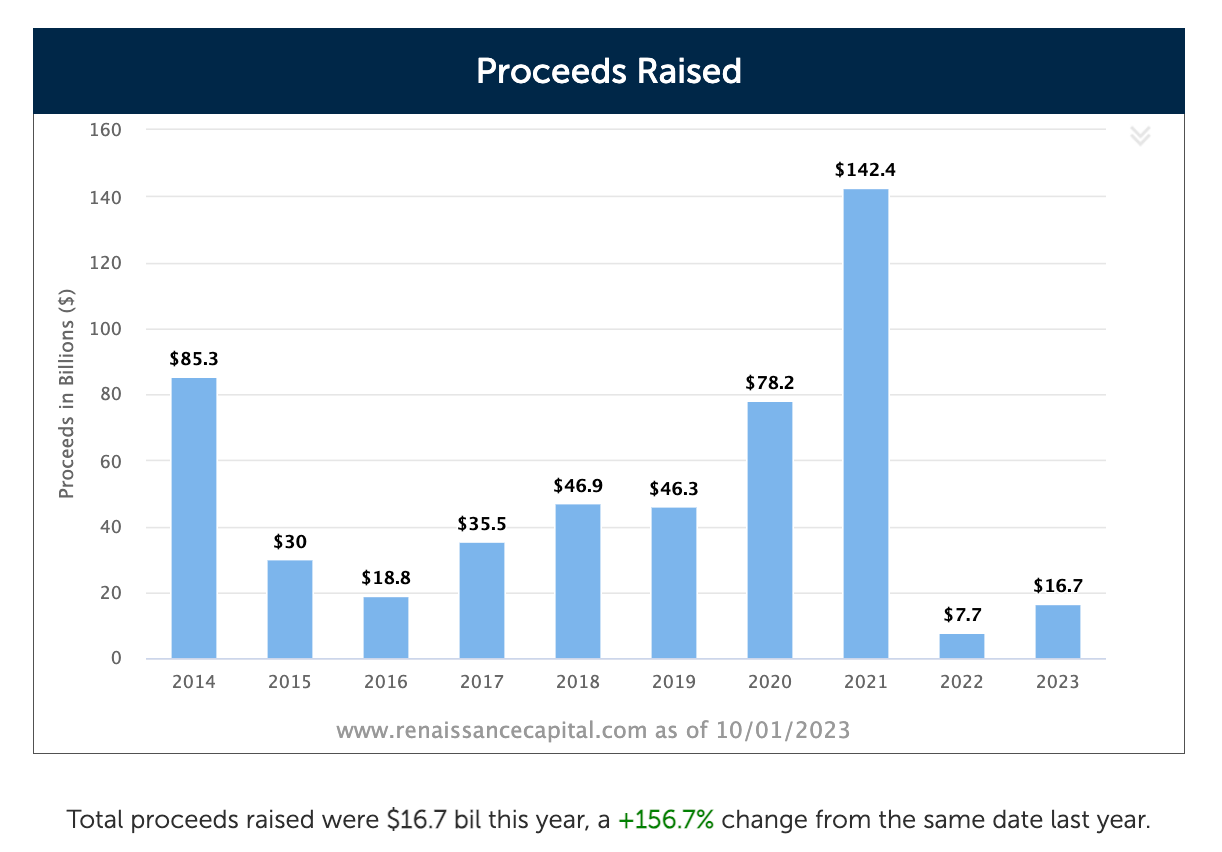

#2: IPO Market

Source: Renaissance Capital

#3: Interest Rates

Source: Bloomberg

#4: Inflation

Source: Jason Furman

Charts of the Week

Chuckles of the Week

EIEIO…Fast Facts

Entrepreneurship: 31% – increase in weekly business applications since 2019 (Hubspot)

Innovation: 33% – decrease in US cancer death rate since 1991 (NIH)

Education: 53% – US student loan borrowers who owe less than $20k (Emma Camp)

Impact: 80% – Americans who experienced at least one travel-related problem in the first half of 2023 (McKinsey)

Opportunity: 8 years – difference in life expectancy between Americans with and without a BA (Noah Smith)

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…. EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM