GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: $78.9 billion – Global late-stage venture dollar volume in Q1 2025, up from $27.8 billion in Q1 2024. (Crunchbase News)

Innovation: $50 billion – The amount that major Swiss pharmaceutical player Roche is investing in the U.S. over the next five years, creating more than 12,000 new jobs in Pennsylvania, Indiana, Massachusetts and California. (Linkedin News)

Education: $60 billion – The amount in federal funding American universities spent in 2023, >30x what they spent in 1952, accounting for inflation. (New York Times)

Impact: 60% – The percentage of general admission ticket buyers at Coachella who used Buy-Now-Pay-Later to finance their tickets. (Unusual Whales)

Opportunity: 0 – The number of Chipotle (“Mexican Grill”) locations in Mexico. The company announced it plans to expand into the country in 2026. (Sherwood)

“Necessity is the mother of invention.” – Plato

“The big joke in the college world is NIL stands for ‘Now It’s Legal.’” – Chris Petersen

“You may hate gravity but gravity doesn’t care.” – Clayton Christensen

On Thursday night, 13.6 million people watched the NFL Draft from Green Bay, Wisconsin…not the Super Bowl, the draft.

For comparison purposes, that’s more than double the number of people who watch 60 minutes and 4x the number who tune in to Fox News—the top watched cable channel.

While the twice-transferred QB Cam Ward was the top pick to the Tennessee Titans (along with a $50 million, four-year contract), the story of the night was the snubbing of Shedeur Sanders, who wouldn’t be selected until the fifth round by Cleveland.

Conspiracy theories aside, what’s instructive to us isn’t whether the chip on Prime Time Jr.’s shoulder will translate into a Hall of Fame career, but how upside down college football has become and the implications for higher education.

As the 144th player selected, and the sixth quarterback, Sanders’ NFL contract will be about $4.5 million over four years (just over $1 million a year) which includes a $450K signing bonus. This is actually a huge pay cut from the $6.5 million he made last year as the Colorado Buffaloes starting quarterback. His Name, Image and Likeness (NIL) deals with Nike, Gatorade and Beats by Dre, and of course the Colorado booster “collective” (5430 Alliance) were the source of his outsized collegiate income.

The combination of NIL and the transfer portal has completely changed the game for college football. In Division 1 Football this year, of the 11,000 scholarship players, 3,200 are in the transfer portal.

The most famous player in the transfer portal right now is former Tennessee Quarterback Nico Iamaleava who was “holding out” to get his collective deal upped from $2 million per year to $4 million, and he also wanted to change the offense the Volunteers ran to make it more about him. Tennessee Head Coach Josh Heupel told him to pound sand. Go Vols!

The concept of the student athlete has been blown up, with the victim really being the player. Of the 80,000 college football players, .2% will get an opportunity to play professional football. Thus, losing credits with each transfer, taking all online classes with sole goal of staying eligible, not developing a relationship with the broader university community (students, faculty, alumni, and businesses) is a huge missed opportunity for the vast, vast majority of the college players.

Sadly enough, the college football players who don’t make the NFL might actually be the lucky ones. To wit, the average NFL career is 3.5 years with 78% of former professional players going bankrupt or becoming financially distressed within two years of retirement.

Sports, and football in particular, have become a marketing strategy for many large schools (analogous to Emirates sponsoring Manchester United), which historically had negative cost associated with it. Scholarships cost X, coaches salaries cost Y, and other expenses were Z, BUT the direct revenue from tickets sales and TV was several times greater. Not to mention the multiplier of alumni donations and increased applications accompanying a winning TEAM.

For example, the direct revenue for an average Big 10 athletic department was $177 million and for the SEC, $122 million. Texas A&M’s revenue alone was $280 million and Ohio State was $251 million (Prediction: the BIG 10 and the SEC merge to form a “Super Conference” that will be private equity-backed). As evidence of how dominant those two conferences are, 58% of this years draft came from the SEC and Big 10.

In the good old days, the surplus money could be directed back to the school to fund other academic programs and facilities, in the New World it’s going to look increasingly like a revenue share.

This shift alone in college sports would be difficult enough for many universities navigate but it’s just one of the mega forces impacting the traditional college structure.

Peyton Manning, a former winner of the Campbell Trophy (a.k.a. “the Academic Heisman”), famously hollered out “Omaha! Omaha!” at the line of scrimmage when he wanted to audible to another play based what he saw going on in the field. Sometimes it was to avoid a disaster, sometimes it was to take advantage of what the other team doing.

In higher education today, both peril and potential exist for the future of sports and the student athlete.

Next week, we’ll write about the major forces at work disrupting the traditional university model.

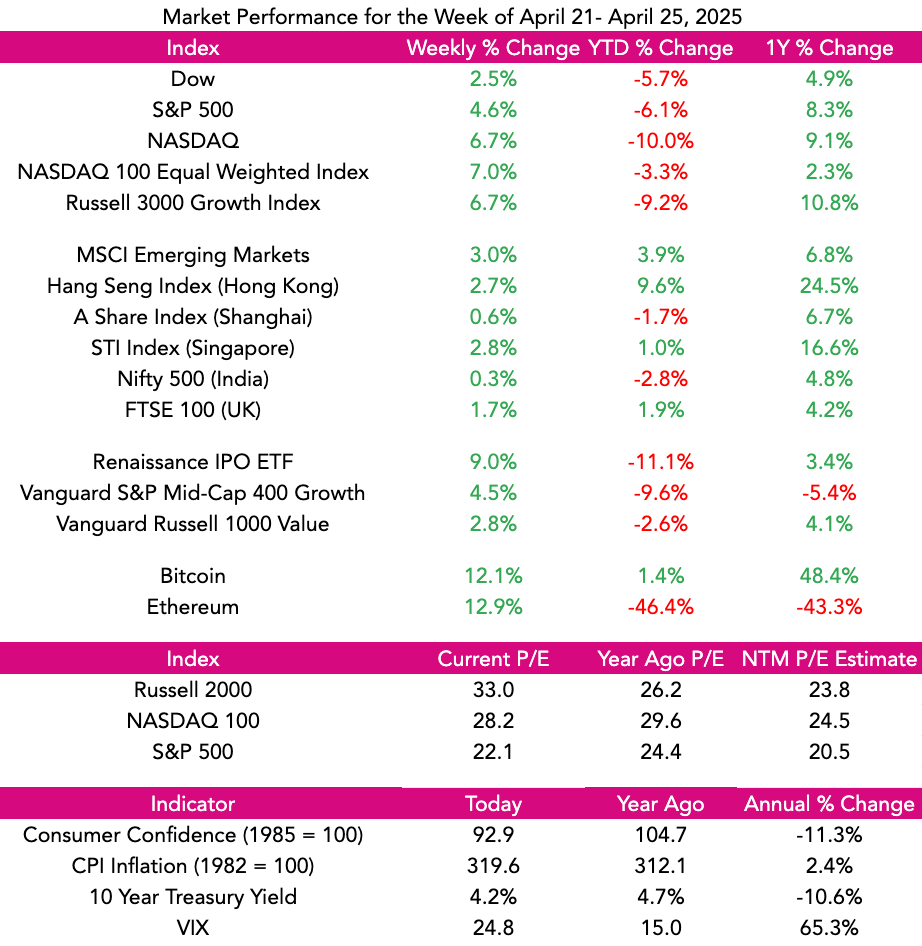

Market Performance

Market Commentary

A relief rally lifted stocks significantly higher last week as Tariff War fears and Fed firing fears subsided. NASDAQ roared 6.7% for the week, followed by the S&P 500 rising 4.6% and the Dow advancing 2.5%.

Since the April 9th bottom, the S&P is up 10%, but is still 10% down from its high on February 19th. Between April 20th and May 2nd, 60% of the S&P will have reported earnings. So far, 75% of companies have beat analyst estimates which is about normal.

As the S&P 500 and Nasdaq faced the pressures of a bear market, with major Magnificent Seven stocks like Nvidia, Alphabet, and Tesla experiencing sell-offs, Wall Street redirected investments toward more traditional sectors.

However, last week marked a return to the tech-focused Nasdaq, as growth stocks began to recover. The upcoming earnings reports from tech giants Meta, Microsoft, Apple, and Amazon.com are expected to provide a clearer signal on whether it's time to confidently re-enter the Big Tech arena.

While we are long term BULLISH on growth stocks, we do expect continued volatility which we view as an opportunity investors with longer time horizons to own high quality companies that go on “SALE”.

Need to Know

WATCH: 🎙️ Ep. 42 · OpenAI CFO Sarah Friar | Ed on the Edge | Dash Media

READ: AI Horseless Carriages | Pete Koomen

LISTEN: OpenAI’s $3BN Acquisition of Windsurf: The Breakdown | Are Endowments F*****? | 20VC

GSV’s Four I’s of Investor Sentiment

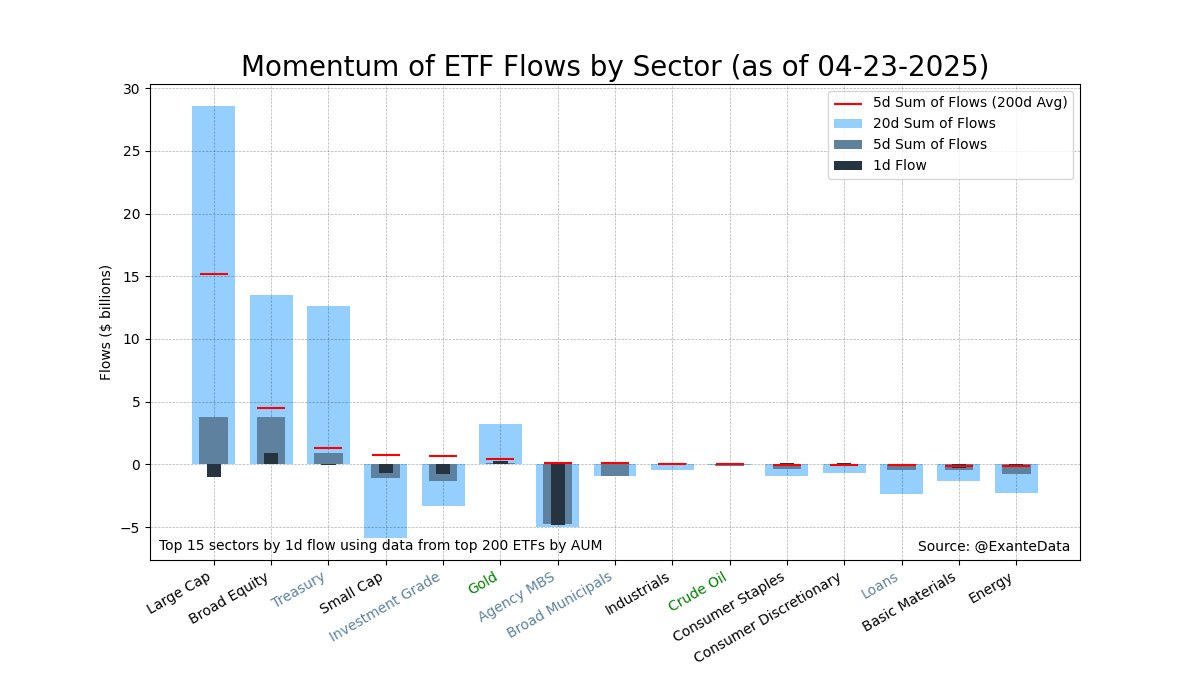

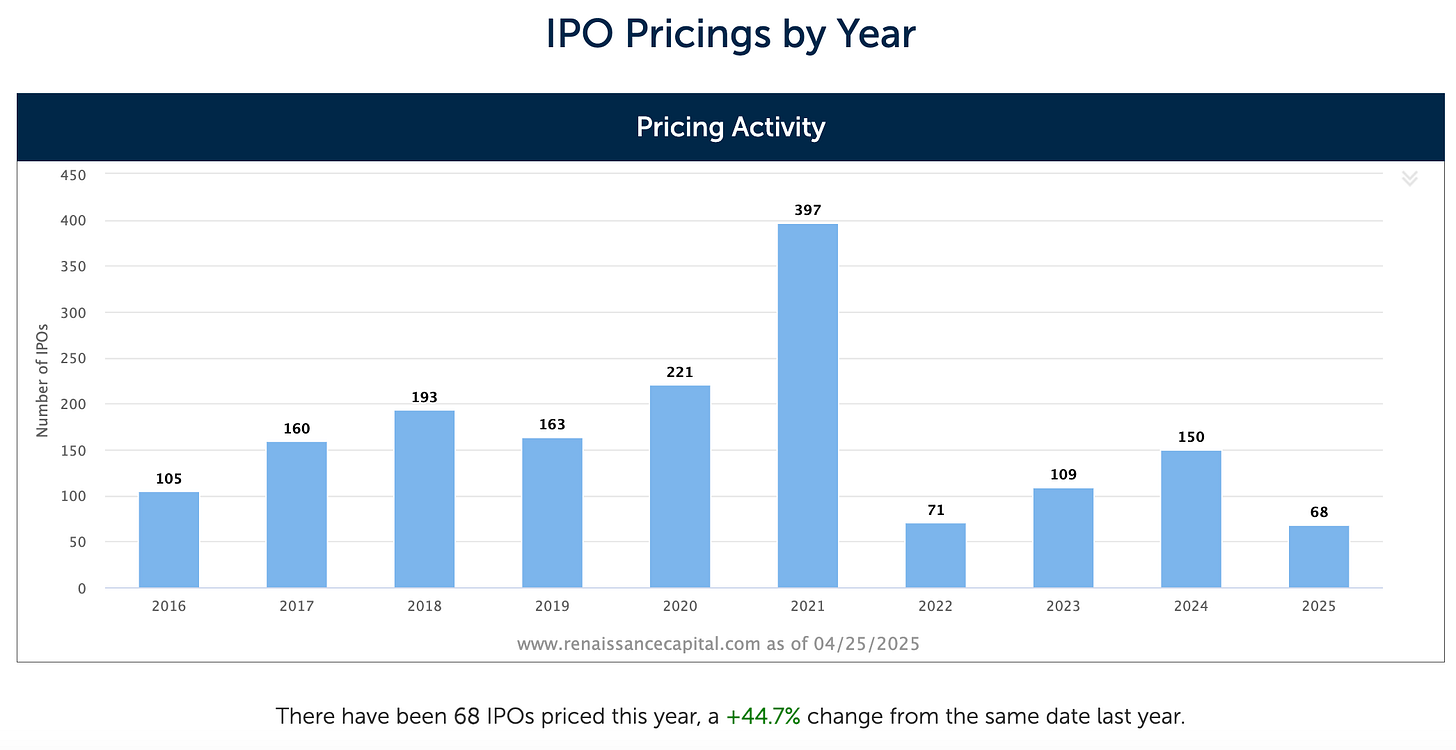

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

#3: Interest Rates

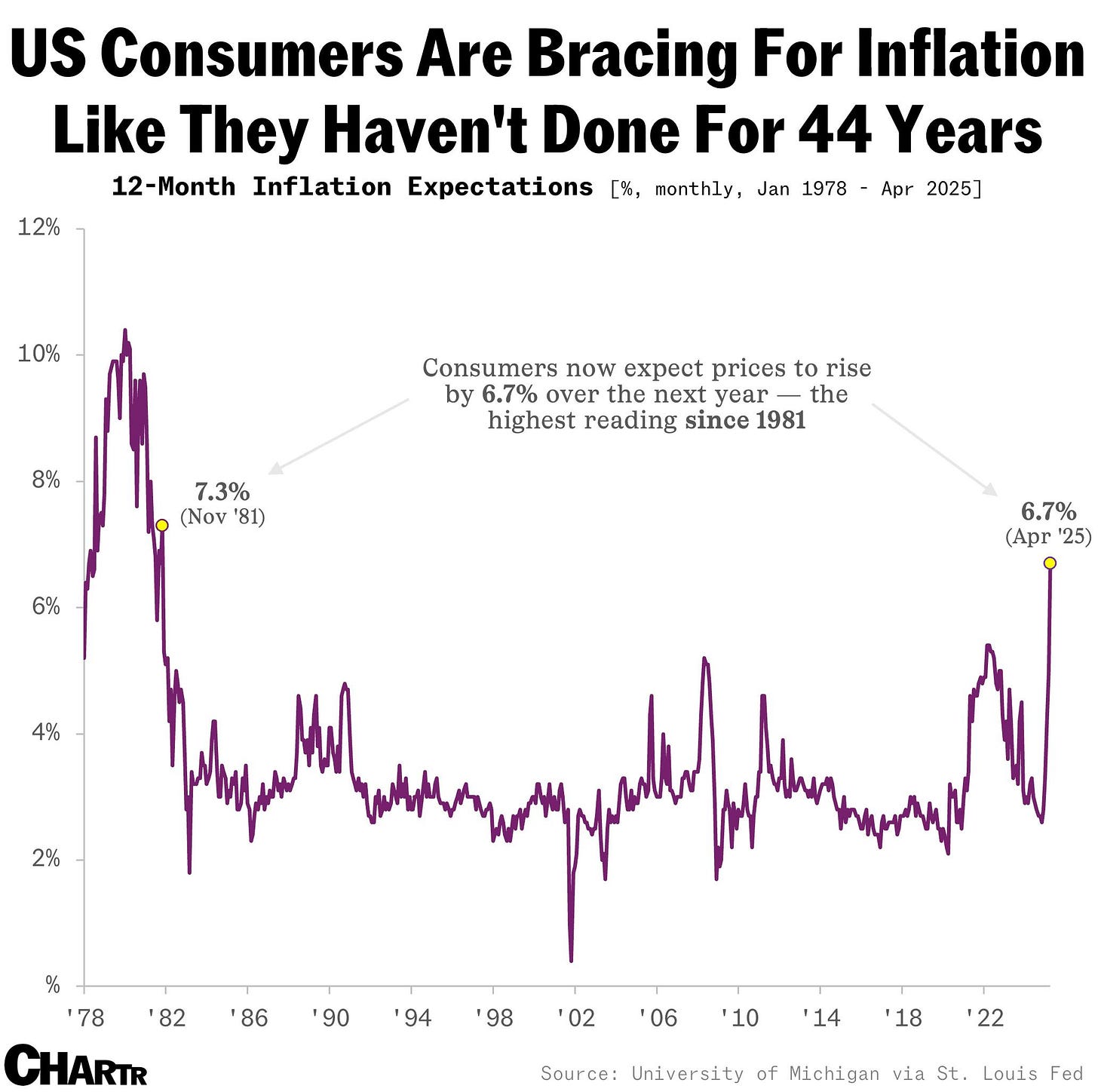

#4: Inflation

Charts of the Week

Maggie Moe’s GSV Weekly Rap

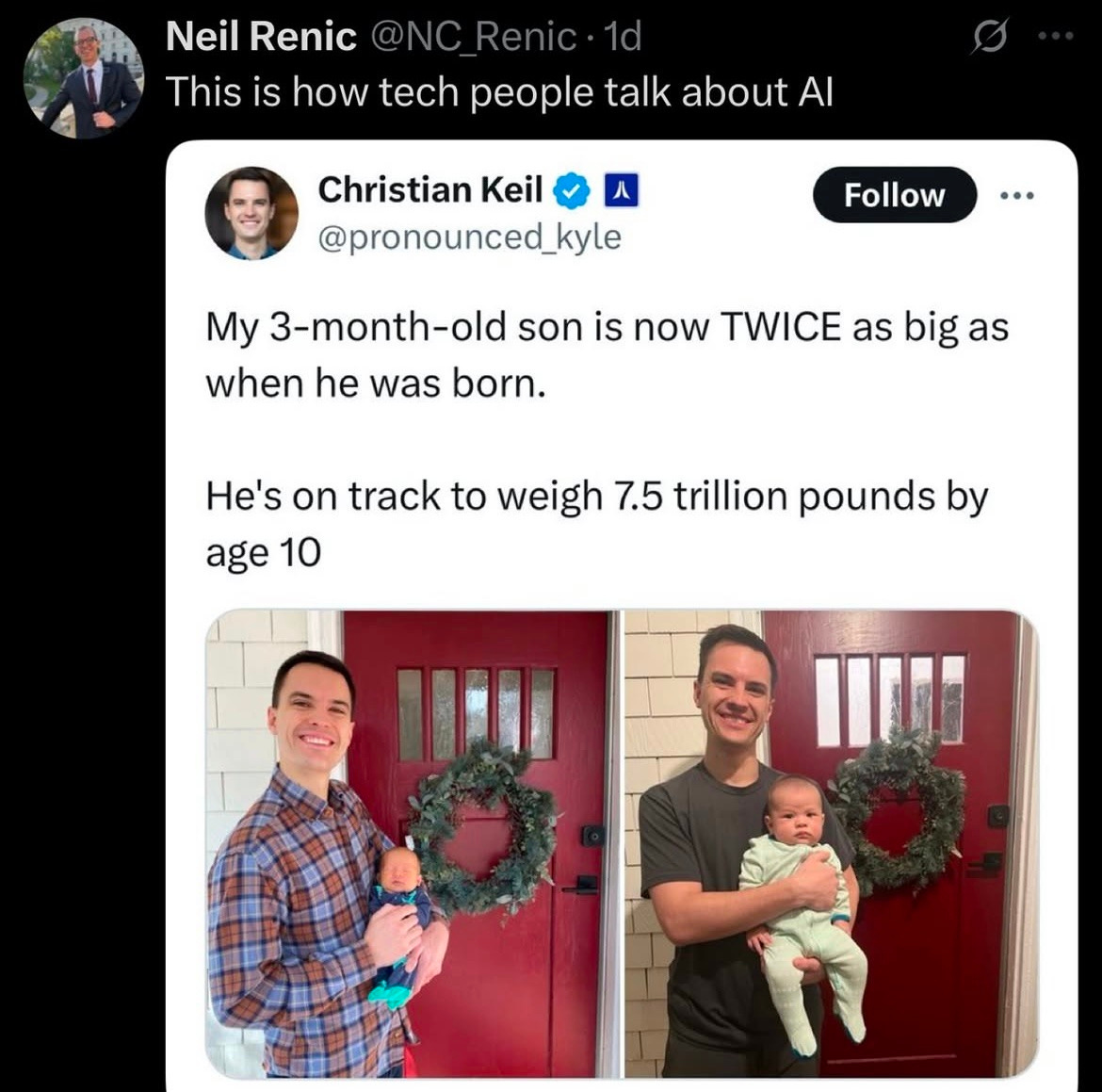

Chuckles of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM