GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: $14.8 million – The median pre-money valuation for seed rounds in Q2 2024, just under the all-time high of $15.0 million in Q2 2022. (Carta)

Innovation: 2,500 – The number of airplanes Starlink has under contract (CNBC)

Education: 43% – The percentage of U.S. adults who don’t know what a 401(k) is (Talker)

Impact: 0 – The number of people connected to the Internet 1,049 days after the Infrastructure Investment and Jobs Act was signed, which provided $42.45 billion to provide broadband access to unserved communities, particularly those in rural areas. (Brendan Carr)

Opportunity: >3,000 – The number of current and former Home Depot employees who started “pushing carts back into the store from the parking lot” who are now millionaires. (Forbes)

The first anniversary of Dash Media is fast approaching. We’ve compiled a list of the top ten EIEIO newsletter editions of the past year, ranked by reader engagement.

1️⃣ Shift Happens

From living at work, to booze breaks, to dopamine culture…”Shift Happens” is our Gen Z deep dive.

We covered 10 themes that define a generation and the companies that will reap the most rewards.

“Gen Z is overstimulated and overmedicated. Among people ages 20 to 39, prescriptions of A.D.H.D. Schedule II stimulants, which include Ritalin and Adderall, rose 30 percent during the pandemic. The rate of antidepressant use among 12-25-year-olds increased 66% from 2016-2022.”

2️⃣ Land of Opportunity

You can’t use an old map in a new world. An alternative name for this piece could have simply been “The Global Silicon Valley.” We took a look at where the talent is going, which cities are emerging as leading hubs, and who is benefitting most from a reshuffling of the checkerboard thanks to an innovative mindset that is spreading like wildfire - across the US and the globe.

“Despite DFW making up 2% of the nation’s population, the area has scored 10% of the net jobs created in the U.S. since February 2020.”

3️⃣ Speed Thrills

Anybody who says the public markets are “efficient” hasn’t operated in the public markets. In the short term, stocks ebb and flow, driven by perceptions and emotions. In the long term, a stock’s performance is essentially 100% correlated with its actual enterprise growth. Punch line: to have the highest returns in the long run, invest in companies that grow at the highest rates for the longest time.

“Fear and greed dominate the moment-by-moment movements of the stock market. FOMO affects the voting machine. Human nature does not change - everyone is trying to minimize pain and maximize pleasure.

There are always things that tickle the nervous system, for example:

‘AI companies are going to the moon.’

‘AI companies are going to be legislated away.’

‘The war is going to make the economy crash.’

‘The war is going to make the economy boom.’

In the long term, however, the Market is a ‘weighing machine’ and what it measures is cash flow and earnings growth. Accordingly, to be a long-term winner in the stock market, the key is to invest in companies that generate the highest earnings and revenue growth over time.”

4️⃣ NOW Media

It feels like they’re running out of plots in the traditional media graveyard. The old model has been turned on its head, and the legacy operators are rightfully shaking in their boots. This piece aims to help you understand who will win, who will lose, and the companies (+ influencers) to watch.

“The heartbeat of any community is a shared passion, and it sometimes takes a trusted persona to lead it. The OG audience + affinity + community builder was Oprah Winfrey. She built a passionate audience that trusted her and she reached them across channels – The Oprah Winfrey Show, Oprah Magazine, the Oprah Winfrey Network, Oprah’s Book Club, and more. Not to mention, she has authored books, signed radio deals, and created buyer’s guides.”

5️⃣ Chips Ahoy!

Chips are unmatched instruments of progress. They power our lives and will continue to drive the AI Revolution. At the same time, TSMC has a 90% market share in advanced semiconductors globally while operating a mere 81 miles off the coast of China. We delved into the chip industry's history, examining its potential and the risks it faces.

“It’s 1777 in the AI Revolution. The question is, who is going to arm it?”

6️⃣ Answers to the Test

Our most comprehensive breakdown of demographic and birth rate trends. Spoiler alert: we’ve got work to do.

“In Japan, two people die for every one that is born. There were more adult diapers sold in Japan last year than baby diapers.”

7️⃣ Up Schitt’s Creek?

Higher education faces a well-deserved PR crisis. The system feels rigged, the faculty looks out of touch, and many students seem more focused on activism than academics. Confused parents, disillusioned prospective students, and disgruntled enrollees create a perfect storm of discontent. However, the bigger the problem, the bigger the opportunity…

“If your parents went to an elite school (making you a “legacy”) and they are in the 50th percentile of income earners, you’re more than twice as likely to get in compared to non-legacy applicants with the same test scores. If they’re extremely wealthy (top 0.1% of all earners) you’re 7x more likely to gain admission to that school.”

8️⃣ Learning at the Speed of Light

Brace yourselves for an era of abundance that has the potential to make it the greatest time ever to be alive.

Just-in-case learning ➡️ Just-in-time learning ➡️ Learning at the speed of light

🧠 Knowledge Proliferation + ⏰ TIme Dividend = 🚀 Innovation Explosion

“We are heading into an era of innovation and abundance that has the potential to make it the greatest time ever to be alive. To participate in that scenario, we as a country, enterprise, and as individuals need to be learning at the speed of light.”

9️⃣ Multiplication by Division

Adam Smith would have marveled at the AI Revolution. AI will exponentially accelerate skill acquisition while simultaneously taking over mundane, repetitive tasks. What once took decades will be achievable in years; years will shrink to months, months to weeks, weeks to days, and days to mere hours. This is multiplication by division, a paradigm shift in human productivity and potential.

“The time dividend that is created by AI and the division of labor will not create a lazier society where people sit around and eat cheese and drink wine (don’t get me started on the terrible idea that is UBI), but will instead be a catalyst for human flourishing like we’ve never seen before. Acquiring new knowledge and skills through invisible learning will be a defining aspect of the future, and the advancement of humankind will make it the most exciting era in history.”

🔟 Moneyballing Motherhood

The impact of AI on parenting will be massive. Rather than replacing the essential role of parents, AI will enhance and augment their abilities. The era of relying on anecdotal evidence and old wives' tales will come to an end. Raising children is the most crucial responsibility we have, and with the power of data and personalized insights readily available, we will be better prepared to make informed decisions. Our innate parental instincts will remain intact, and human nature will endure, but AI will empower us to reach unprecedented levels of informed decision-making in the realm of parenting.

“As we’ve pointed out before, the AI Revolution is not about man vs. machine, but man and machine. A motherly instinct will never be replaced. The difference is that a mother with strong instincts who is also equipped with comprehensive, personalized data and tailored insights about their child will be that much more powerful.”

Market Performance

Market Commentary

Stocks continued to march higher driven by optimism regarding the Fed and optimization regarding Artificial Intelligence.

For six of the past seven weeks, stocks have been higher and continue to reach new records. Last week, the Dow and the S&P 500 advanced .6%, and NASDAQ was up 1%. Tesla shares were nearly 10% higher, and NVIDIA shares increased 5%.

In the biggest move in fifteen years, Chinese stocks increased approximately 15% last week. The catalyst for this huge increase was Chinese authorities dropping interest rates, lowering mortgage payments, and encouraging Chinese companies to buy back shares from borrowed funds from the bank.

Also notable is the huge move Bitcoin has made over the past 12 months, advancing over 144% and 56.7% YTD. Last week was more of the same, with Bitcoin increasing 4%.

We remain BULLISH on growth stocks and see continued positive action in shares, accelerating earnings, and a broadening of stock participation as confirmation of our thesis.

Need to Know

READ: Beyond Bots: How AI Agents Are Driving the Next Wave of Enterprise Automation | Menlo Ventures

WATCH: Mako, “The world’s first AI Investment Associate” emerges from stealth | Mako AI

LISTEN: Oil Explains the Entire 20th Century | Dwarkesh Podcast

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

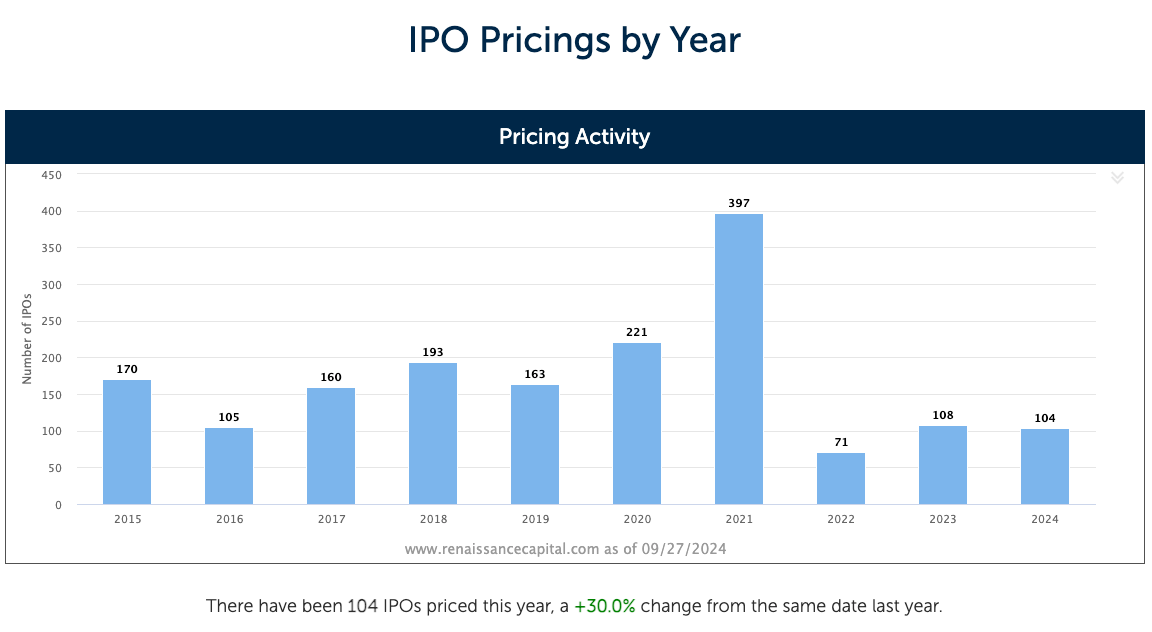

#2: IPO Market

#3: Interest Rates

#4: Inflation

Chart of the Week

Maggie Moe’s GSV Weekly Rap

Chuckle of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup….EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM